BitDelta Pro 2025 Review: Everything You Need to Know

Executive Summary

BitDelta Pro is a multi-asset trading platform. It offers access to forex, stocks, commodities, indices, and cryptocurrencies through the MT5 trading platform. This BitDelta Pro review examines a broker that claims to provide competitive spreads, fast execution speeds, and comprehensive customer support for retail traders.

The platform markets itself as "Your Gateway to Seamless and Efficient Trading." It targets forex traders as well as investors interested in CFD trading across multiple asset classes. According to available information, BitDelta Pro offers demo accounts and swap-free options to accommodate different trading preferences and religious requirements.

However, our analysis reveals significant information gaps. These gaps concern regulatory oversight, company background, and specific trading conditions. While the broker claims legitimacy and emphasizes cutting-edge trading technology, detailed regulatory information and transparent fee structures remain unclear in available public materials.

For potential users considering this platform, it's essential to conduct thorough due diligence. This is particularly important regarding regulatory compliance and fund safety measures, before committing capital to any trading activities.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Traders should note that specific regulatory details and company registration information were not comprehensively detailed in available materials at the time of this analysis.

Our evaluation methodology combines public information analysis, user feedback assessment, and comparison with industry standards. Given the limited availability of detailed regulatory and operational information, potential users are strongly advised to verify all trading conditions and regulatory compliance independently before opening accounts.

Rating Framework

Broker Overview

BitDelta Pro operates as a multi-asset trading platform. Specific information about its establishment date and detailed company background remains limited in available public materials. The broker positions itself as providing "cutting-edge trading" services with emphasis on seamless and efficient trading experiences for retail investors.

The platform's primary business model centers around CFD trading across multiple asset classes. These include forex pairs, individual stocks, commodities, market indices, and cryptocurrencies. According to available information, the broker aims to serve both novice and experienced traders through its technological infrastructure and customer support framework.

BitDelta Pro utilizes the MetaTrader 5 platform as its primary trading interface. This provides access to various financial instruments through a single platform. The broker markets itself as offering competitive spreads and fast execution speeds, though detailed specifications about trading conditions require further verification. Specific information about primary regulatory oversight and licensing jurisdictions was not comprehensively detailed in available materials, representing a significant information gap for potential users conducting due diligence.

Regulatory Jurisdiction: Specific regulatory information and licensing details were not comprehensively provided in available materials. This requires independent verification by potential users.

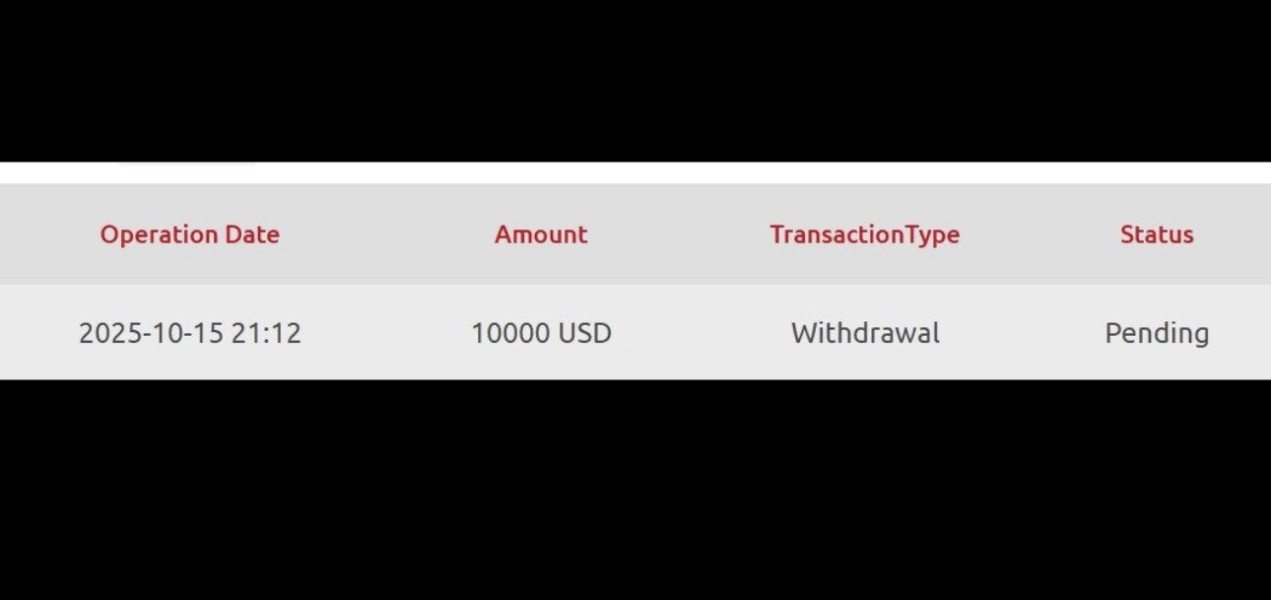

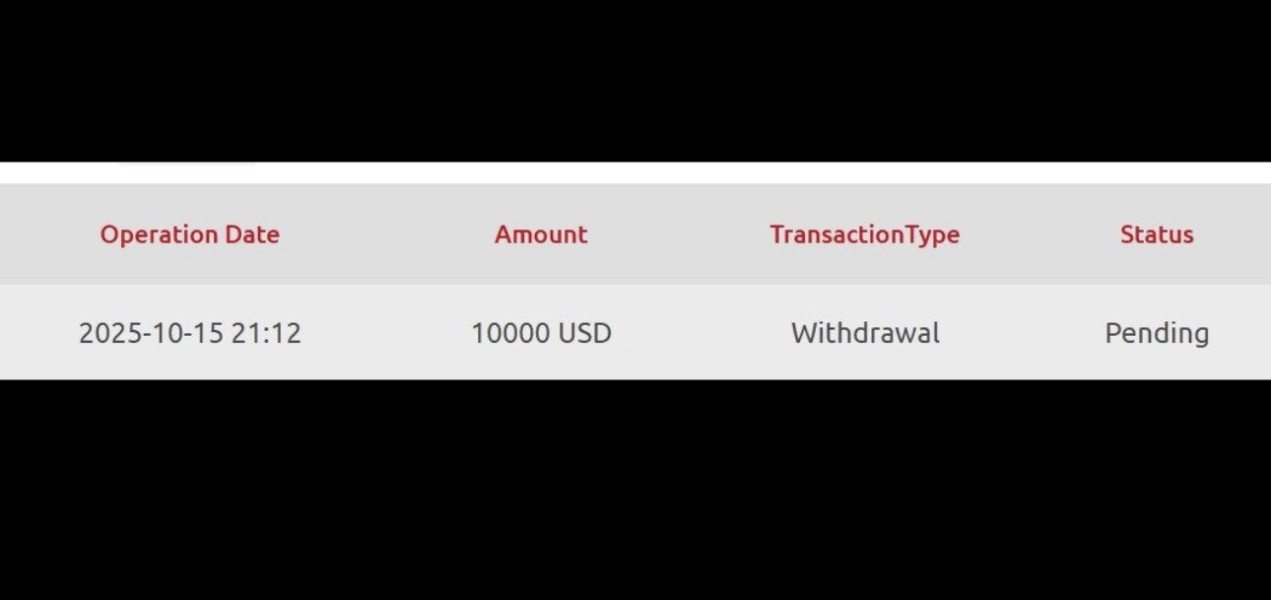

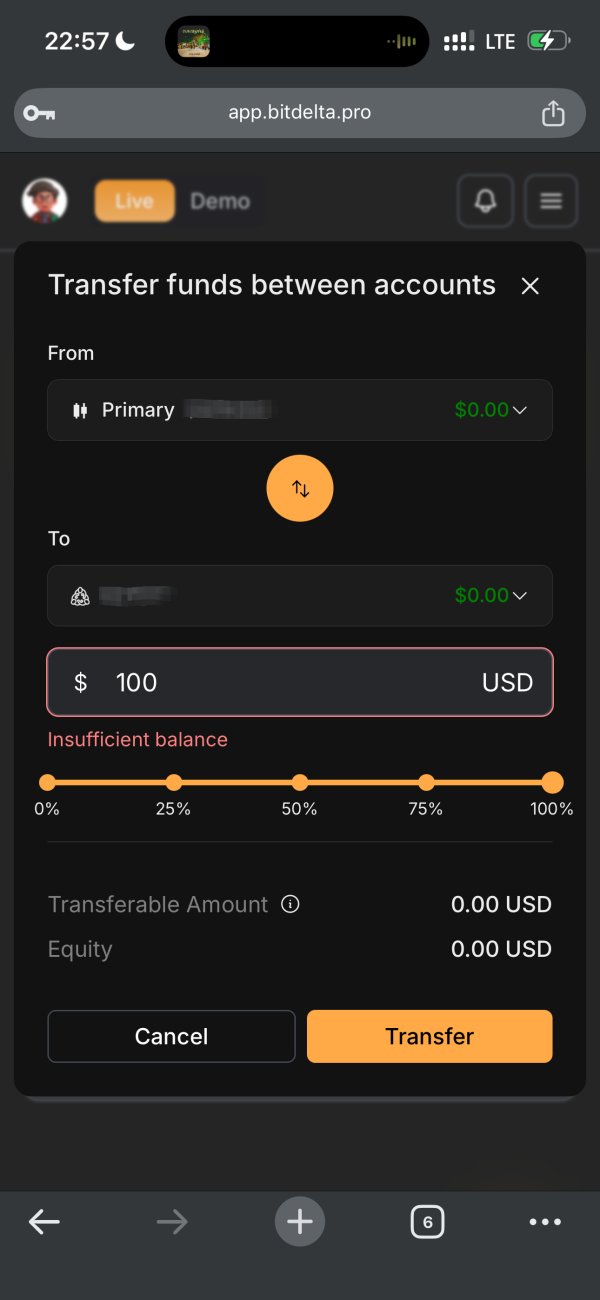

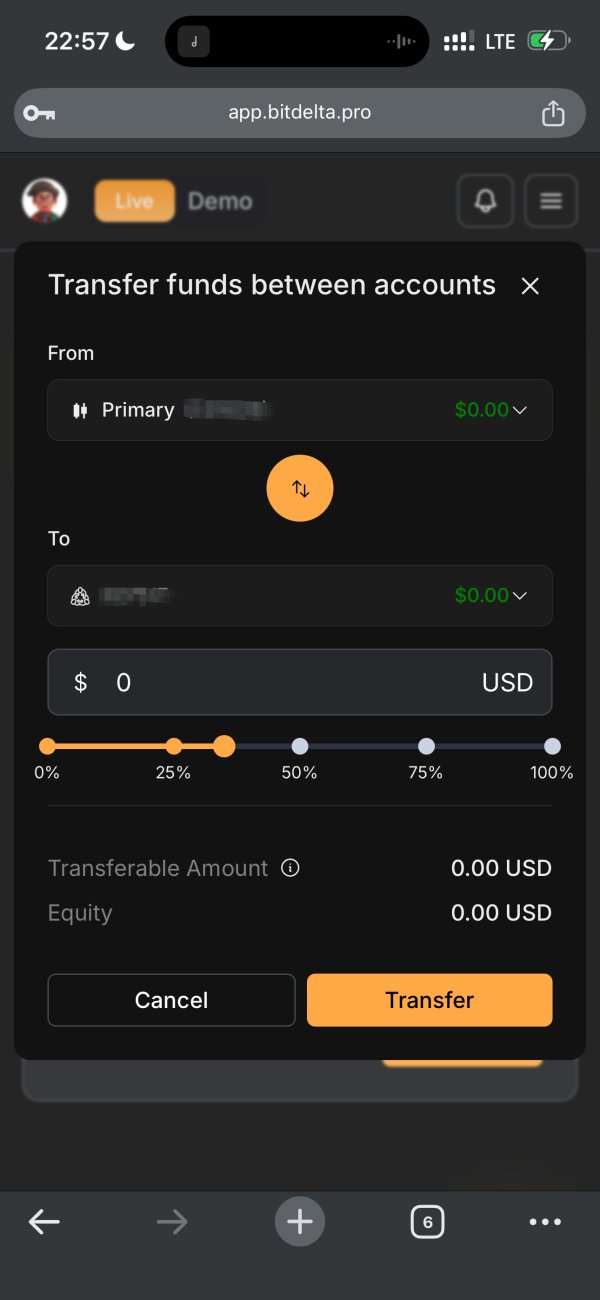

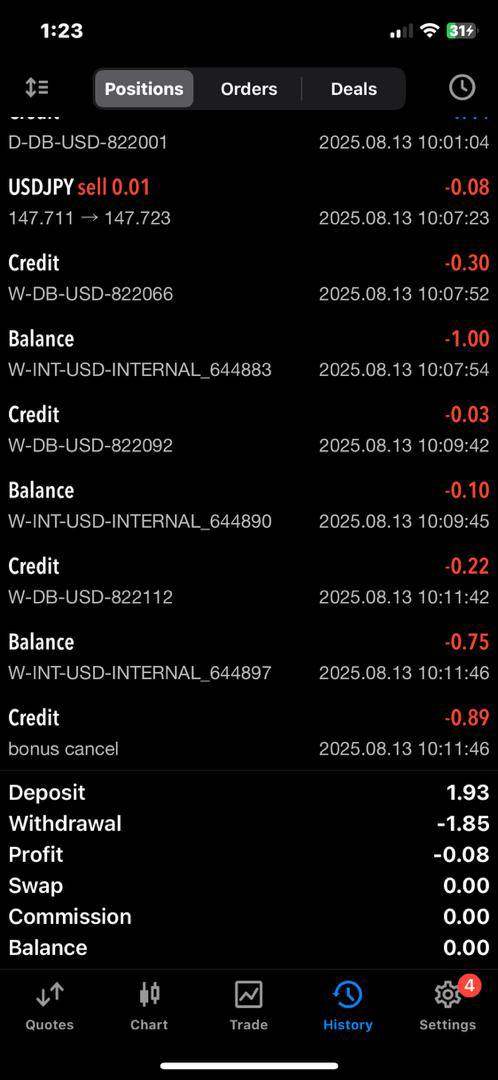

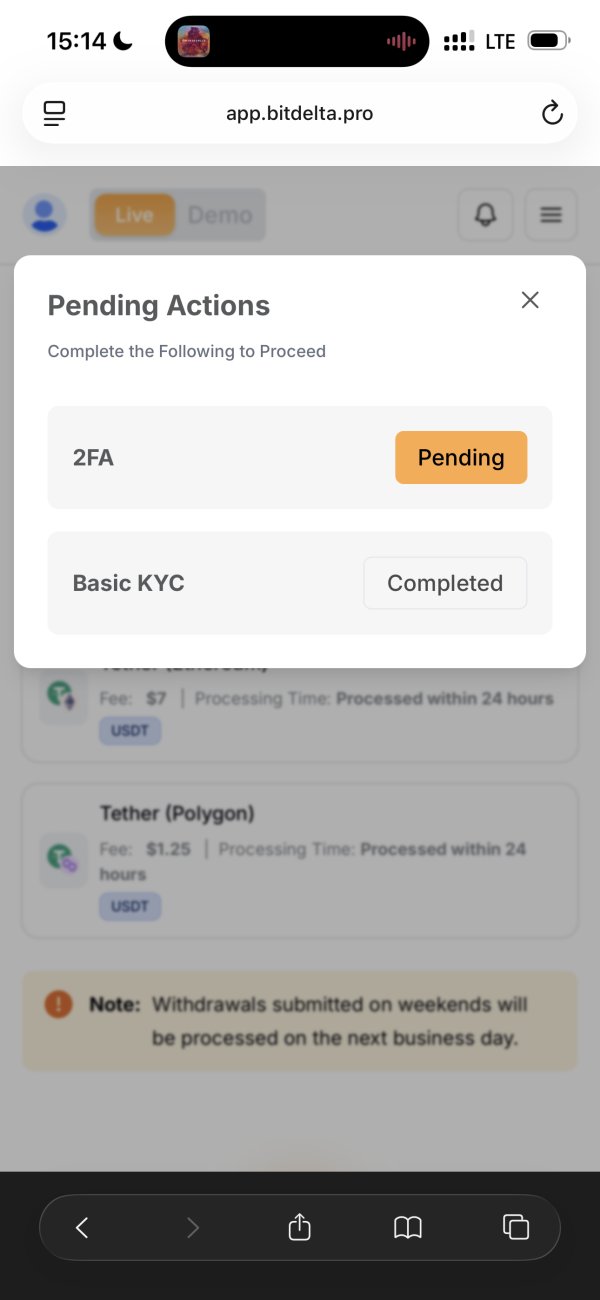

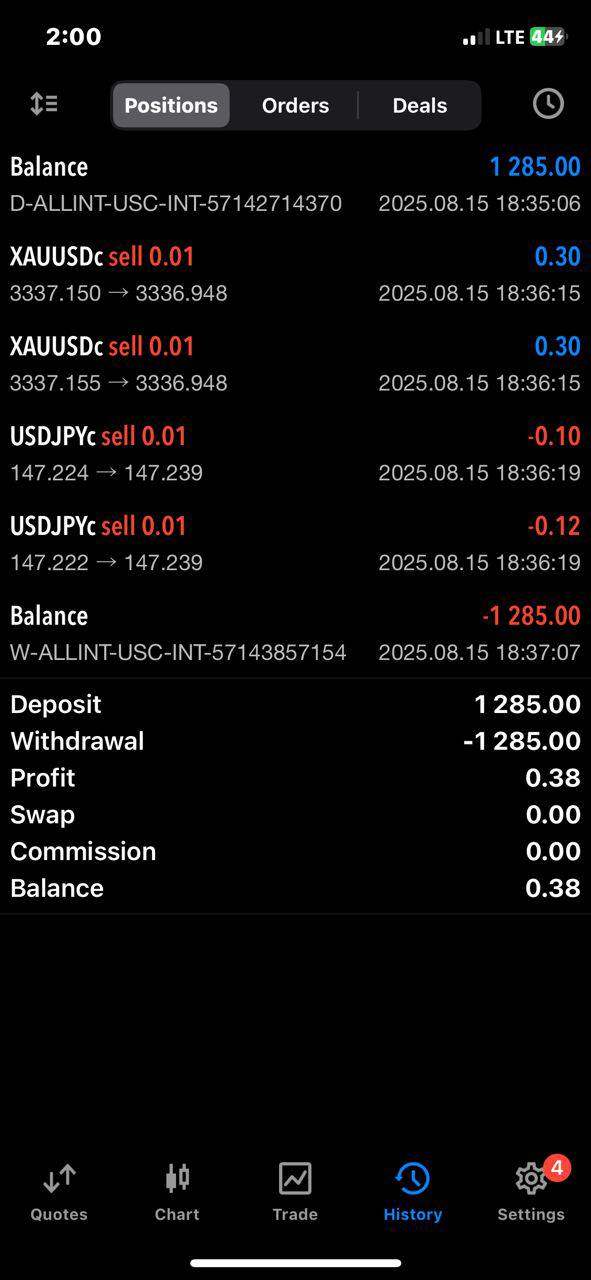

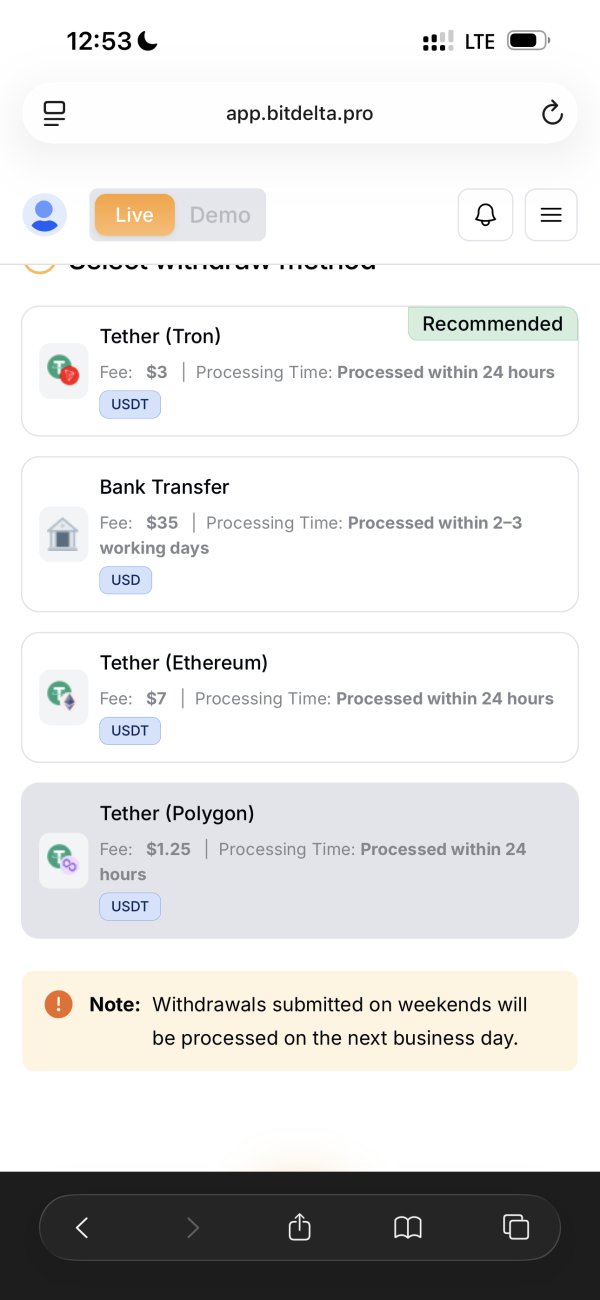

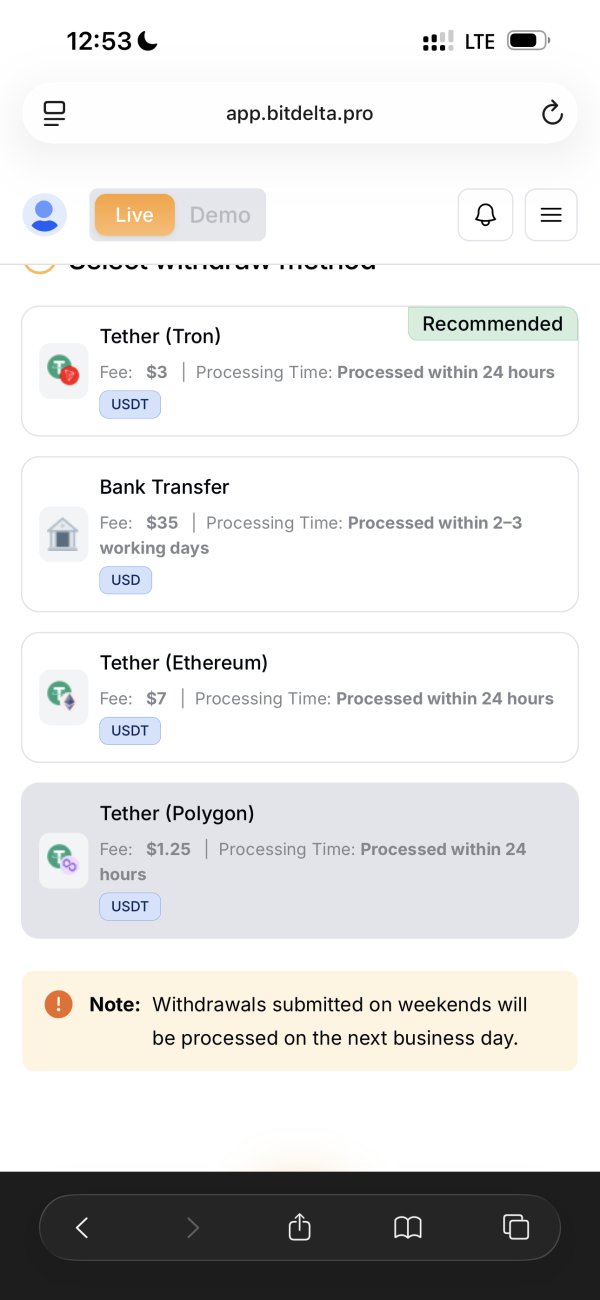

Deposit and Withdrawal Methods: Available payment methods and processing procedures for deposits and withdrawals were not detailed in accessible public information.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types were not clearly specified in available materials.

Bonus and Promotions: Information about promotional offers, welcome bonuses, or ongoing trading incentives was not detailed in public materials.

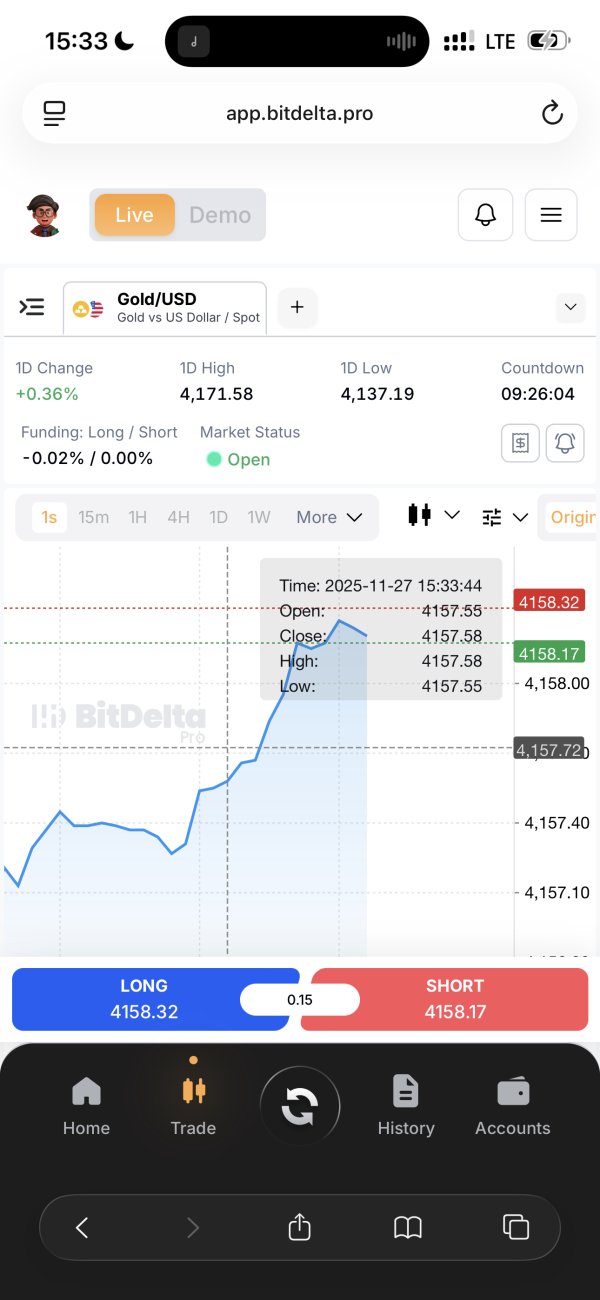

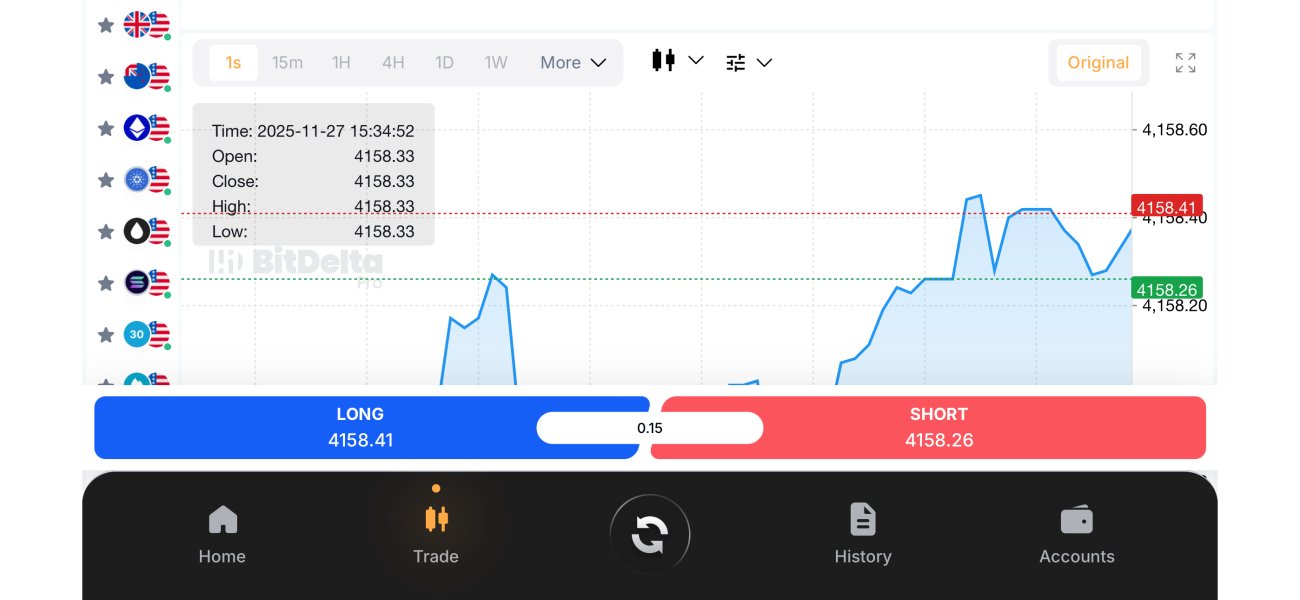

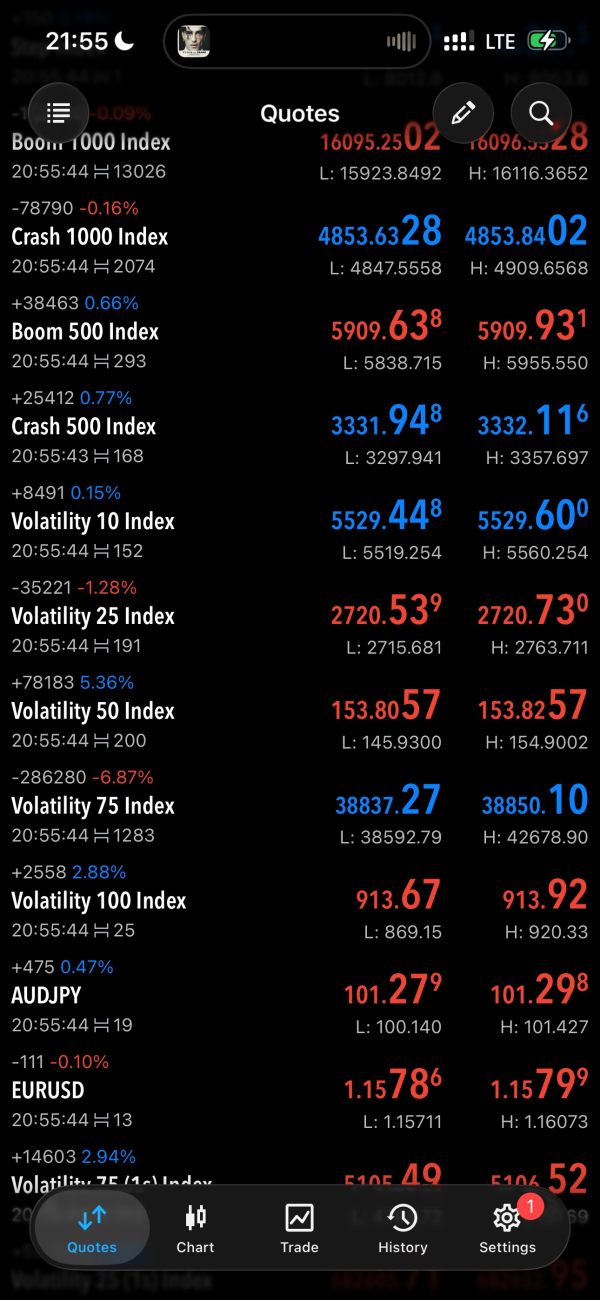

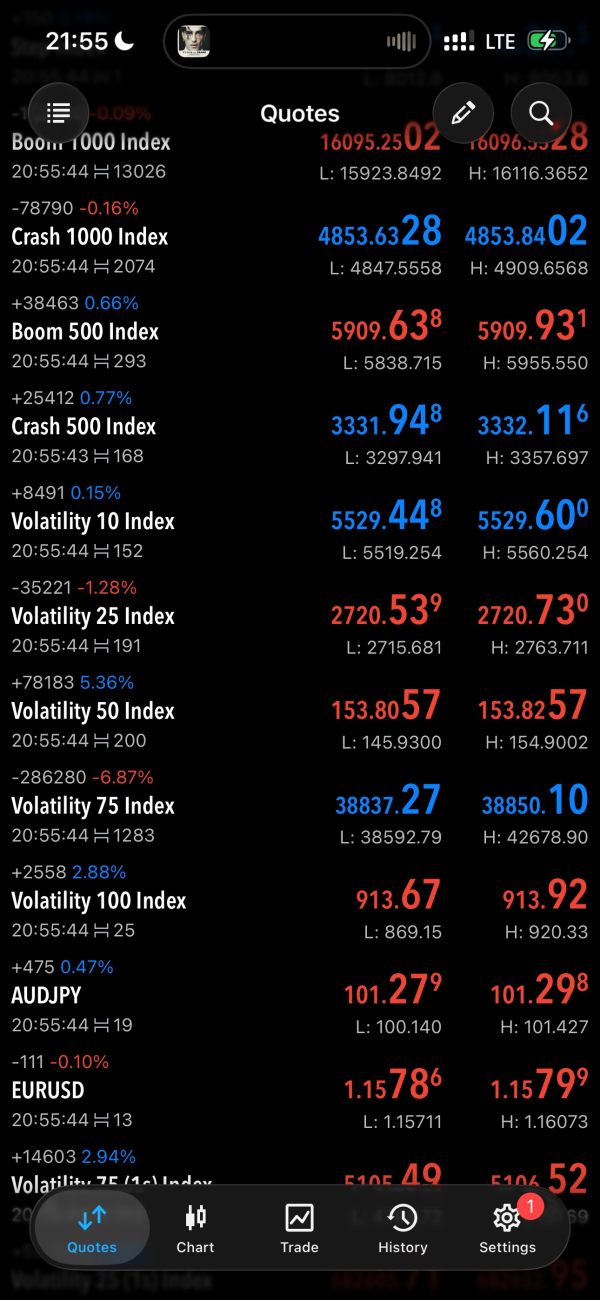

Tradable Assets: The platform provides access to forex pairs, individual stocks, commodities, market indices, and cryptocurrencies through CFD trading arrangements.

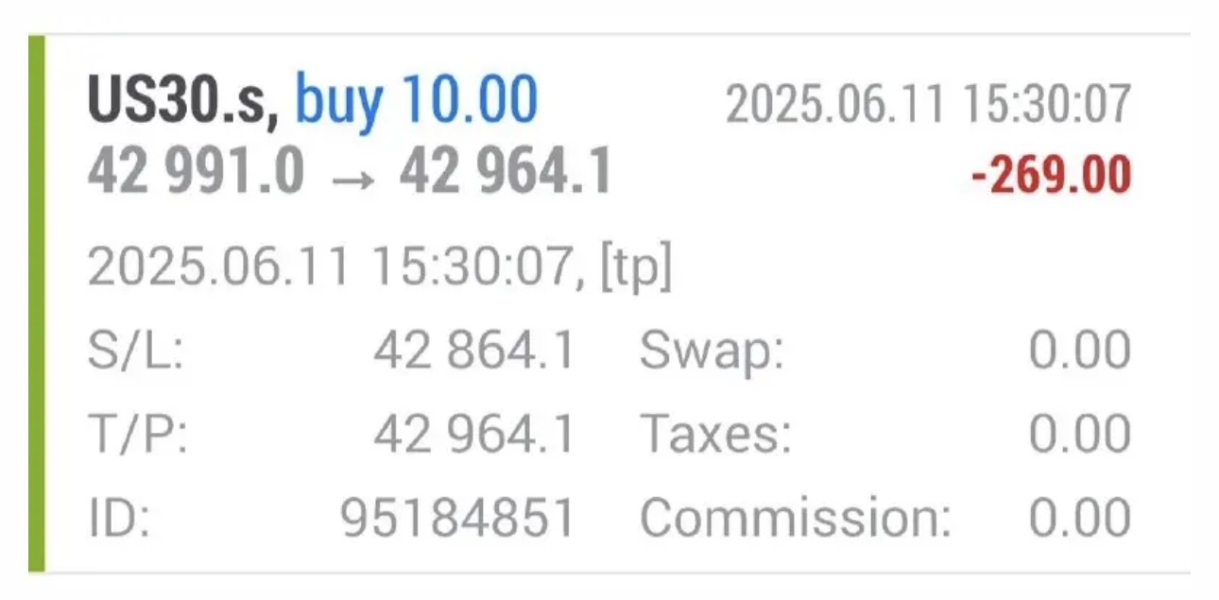

Cost Structure: BitDelta Pro advertises competitive spreads. However, specific commission structures, overnight fees, and other trading costs require clarification through direct inquiry.

Leverage Ratios: Maximum leverage available and leverage restrictions by asset class were not specified in available materials.

Platform Options: The broker primarily utilizes the MetaTrader 5 trading platform for client trading activities.

Geographic Restrictions: Specific information about restricted jurisdictions and regional limitations was not detailed in accessible materials.

Customer Service Languages: Available language support for customer service was not specified in public information.

This comprehensive BitDelta Pro review continues with detailed analysis of each evaluation criterion. It provides thorough assessment guidance.

Account Conditions Analysis

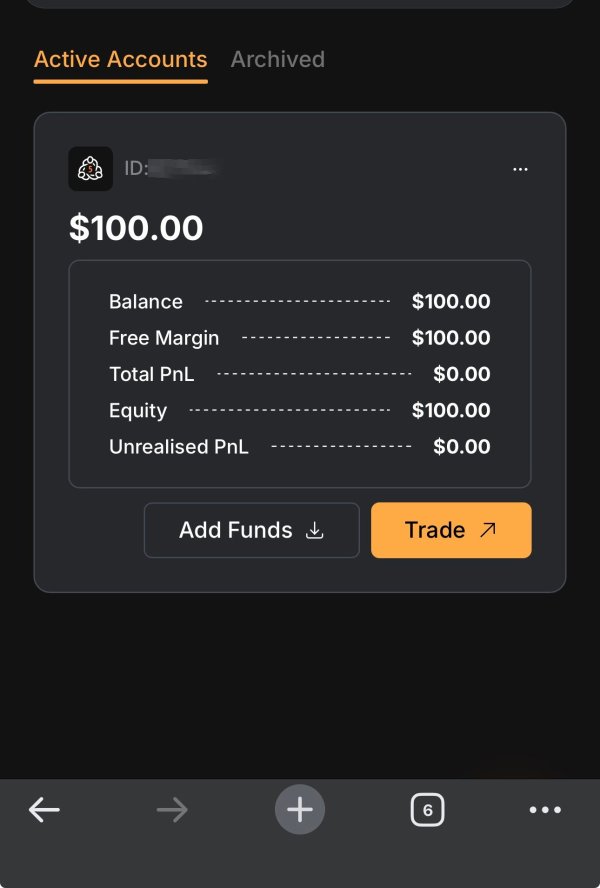

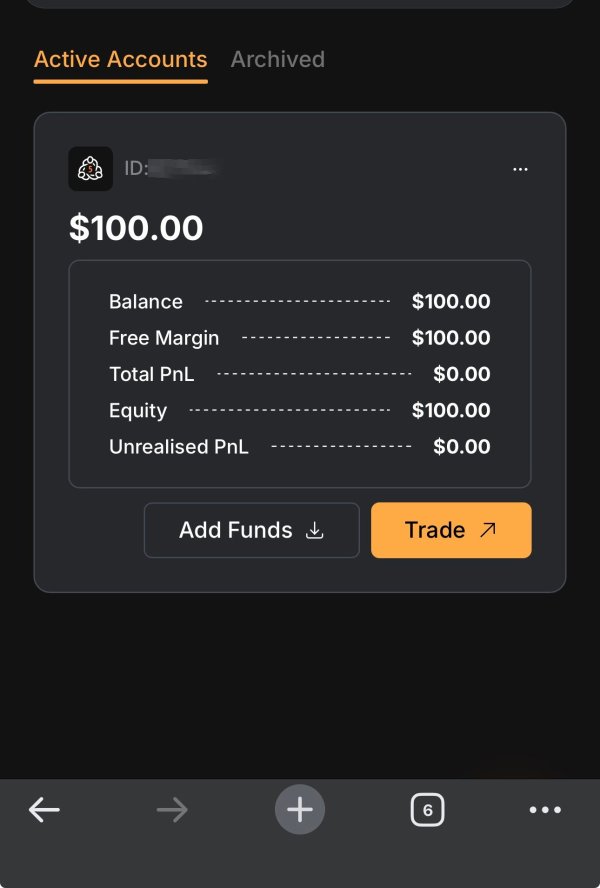

BitDelta Pro offers demo accounts. This allows potential clients to test trading strategies and platform functionality without risking real capital. The availability of swap-free accounts demonstrates consideration for traders with religious restrictions on interest-based transactions, particularly appealing to Islamic traders seeking Sharia-compliant trading options.

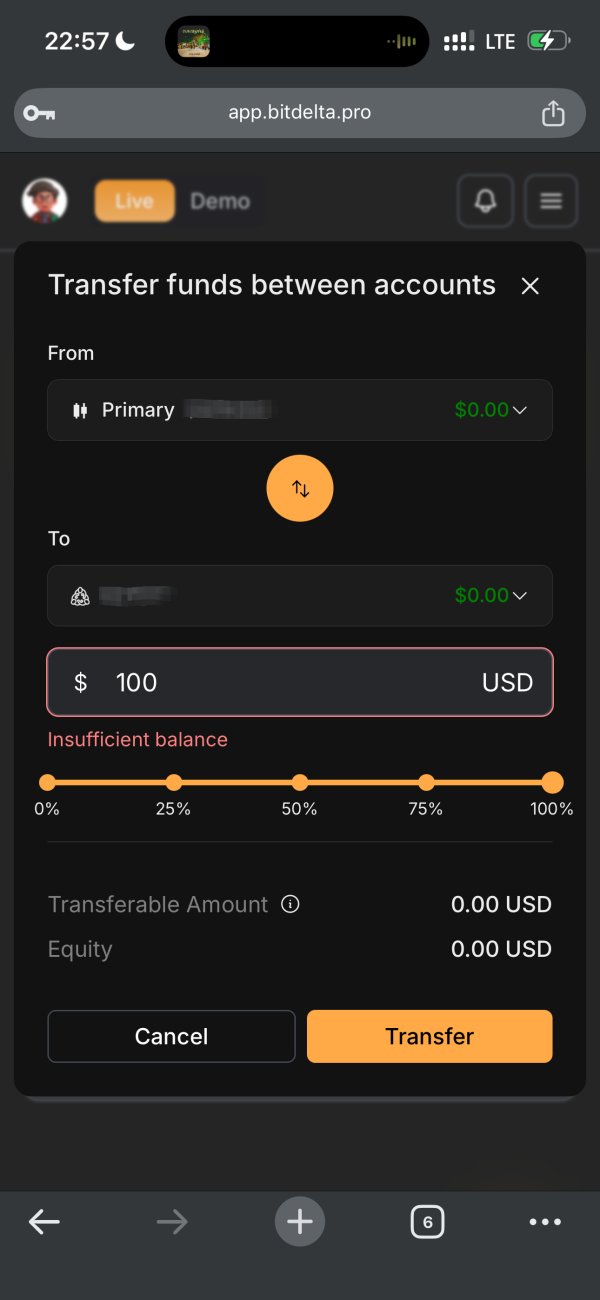

However, crucial account details were not clearly outlined in available public materials. These include minimum deposit requirements, available leverage ratios, and specific account tier structures. This lack of transparency regarding basic account conditions represents a significant concern for traders attempting to evaluate whether the broker's offerings align with their capital requirements and trading objectives.

The absence of detailed information creates uncertainty for potential clients. This information includes account opening procedures, verification requirements, and funding timeframes. Most established brokers provide clear documentation about account types, associated benefits, and qualification criteria, making the limited available information about BitDelta Pro's account structure notable.

Without comprehensive details, traders cannot effectively assess the total cost of trading with this platform. These details include trading conditions, commission structures, and account maintenance requirements. This BitDelta Pro review emphasizes the importance of obtaining detailed account information directly from the broker before proceeding with account opening procedures.

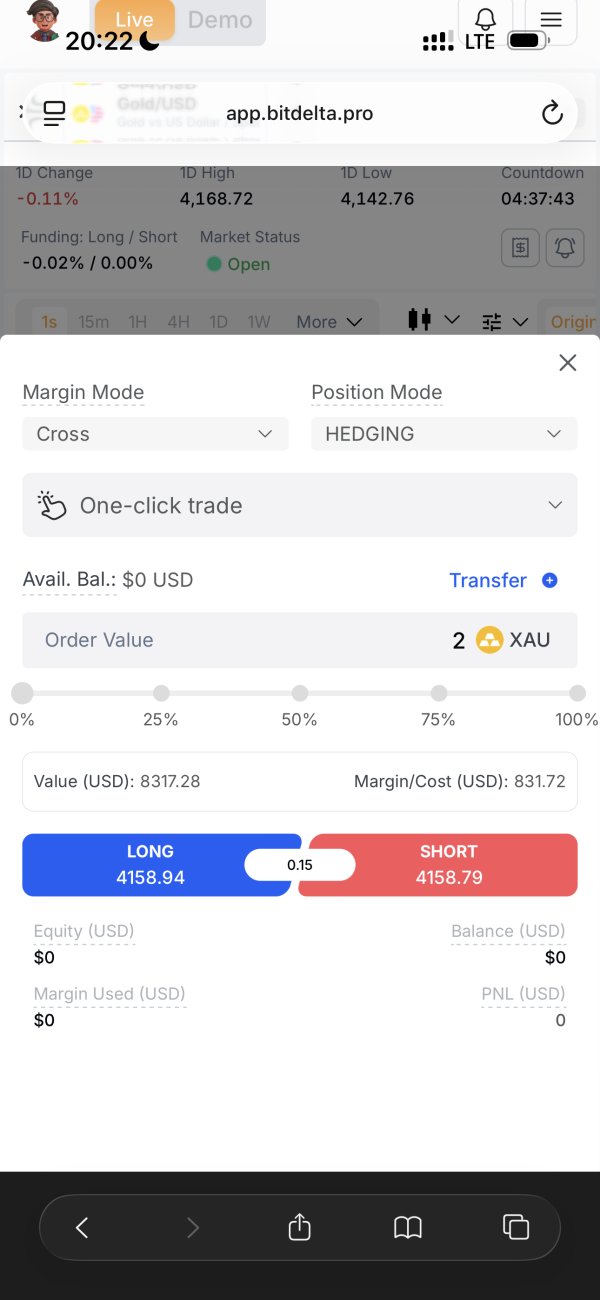

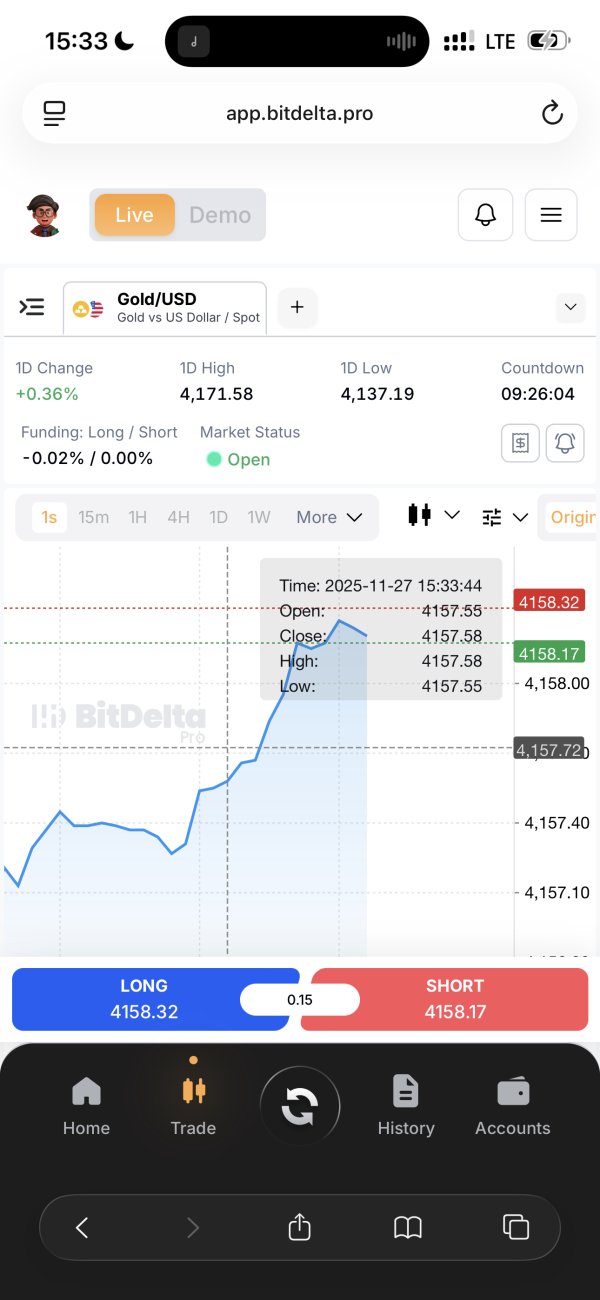

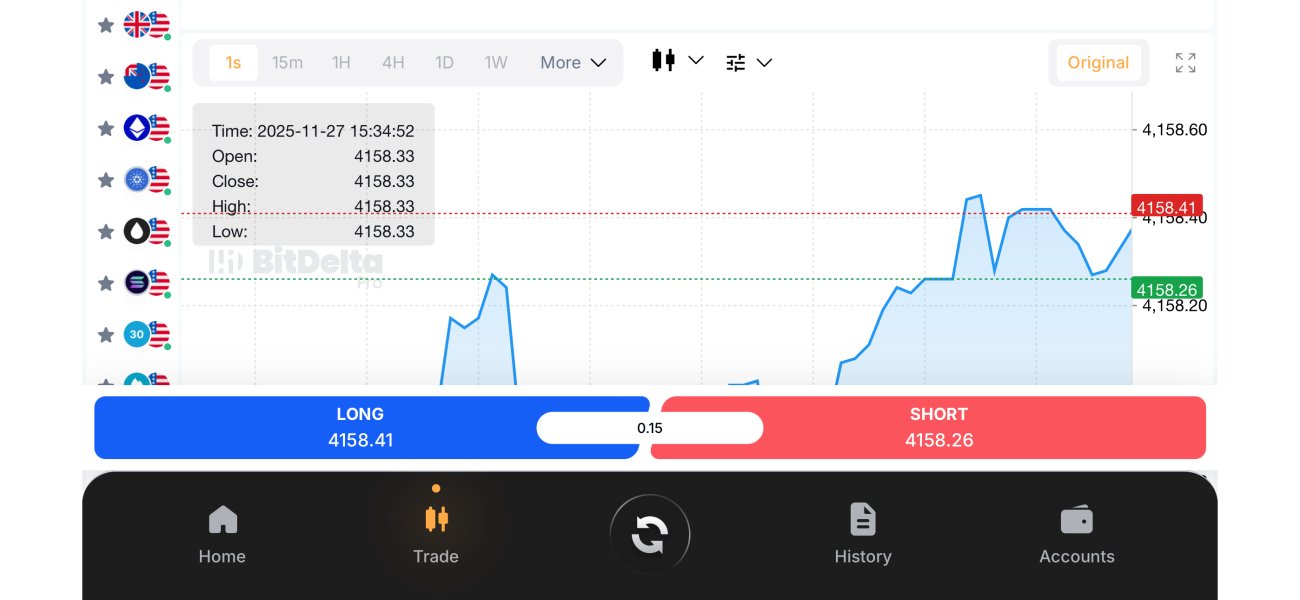

The MetaTrader 5 platform serves as BitDelta Pro's primary trading interface. It provides access to advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors. MT5's multi-asset functionality aligns with the broker's offering of forex, stocks, commodities, indices, and cryptocurrencies through a single platform interface.

However, information about additional trading tools, market research resources, and educational materials was not comprehensively detailed in available materials. Many competitive brokers provide economic calendars, market analysis, trading signals, and educational content to support trader development and decision-making processes.

The absence of detailed information about research and analysis resources represents a potential limitation. This affects traders who rely on broker-provided market insights and educational content. Advanced traders may find sufficient value in MT5's built-in capabilities, but novice traders often benefit from comprehensive educational resources and market analysis.

Without clear documentation about additional tools, traders cannot fully assess the platform's capability. This includes mobile trading applications and supplementary resources to support their trading strategies and learning objectives. The limited available information suggests potential users should inquire directly about available tools and resources beyond the standard MT5 platform offering.

Customer Service and Support Analysis

BitDelta Pro emphasizes excellent customer support as one of its key service features. However, specific details about support channels, response times, and service quality metrics were not extensively documented in available materials. Quality customer service represents a crucial factor for traders, particularly when dealing with technical issues, account problems, or urgent trading concerns.

The absence of detailed information makes it difficult to assess the actual quality and accessibility of customer service. This includes available support channels, operating hours, and multilingual support capabilities. Most reputable brokers provide 24/5 support during market hours with multiple contact methods and qualified support staff.

Without documented user feedback, potential clients cannot reliably evaluate the customer service quality. This feedback would cover support experiences, response times for different inquiry types, and problem resolution effectiveness. Professional trading environments require responsive, knowledgeable support teams capable of addressing both technical and account-related issues promptly.

The claimed excellence in customer support requires verification through direct interaction or documented user experiences. This BitDelta Pro review recommends testing support responsiveness and expertise through initial inquiries before committing significant capital to the platform.

Trading Experience Analysis

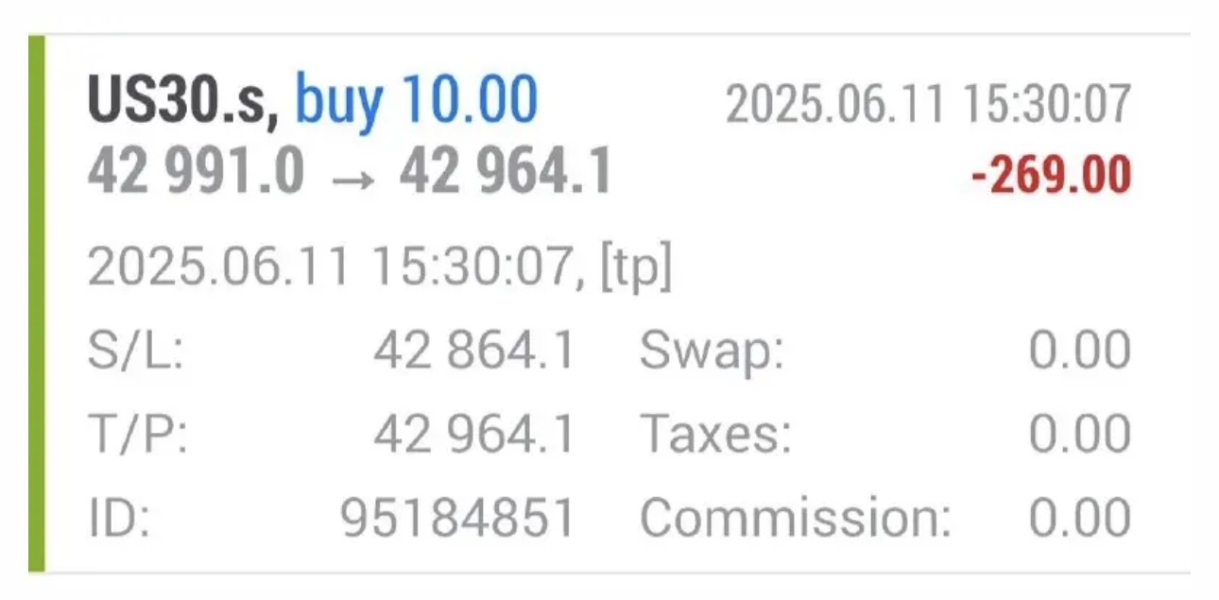

BitDelta Pro advertises fast execution speeds as a key feature of its trading environment. This represents an important factor for traders implementing time-sensitive strategies or trading volatile markets. However, specific performance metrics, average execution times, and slippage data were not provided in available materials.

The MT5 platform generally provides reliable order execution and advanced trading functionality. However, the overall trading experience depends significantly on the broker's technological infrastructure, liquidity providers, and order routing systems. Without detailed information about execution quality, spreads during different market conditions, and platform stability records, traders cannot fully assess the trading environment quality.

Platform functionality extends beyond execution speed. It includes features like one-click trading, advanced order types, mobile accessibility, and real-time market data quality. The absence of comprehensive information about these trading experience factors represents a limitation for traders evaluating platform suitability for their trading styles.

Market conditions often reveal the true quality of a broker's trading infrastructure, especially during high volatility periods. Without documented performance data or user experiences during challenging market conditions, this BitDelta Pro review cannot provide definitive assessment of the actual trading experience quality.

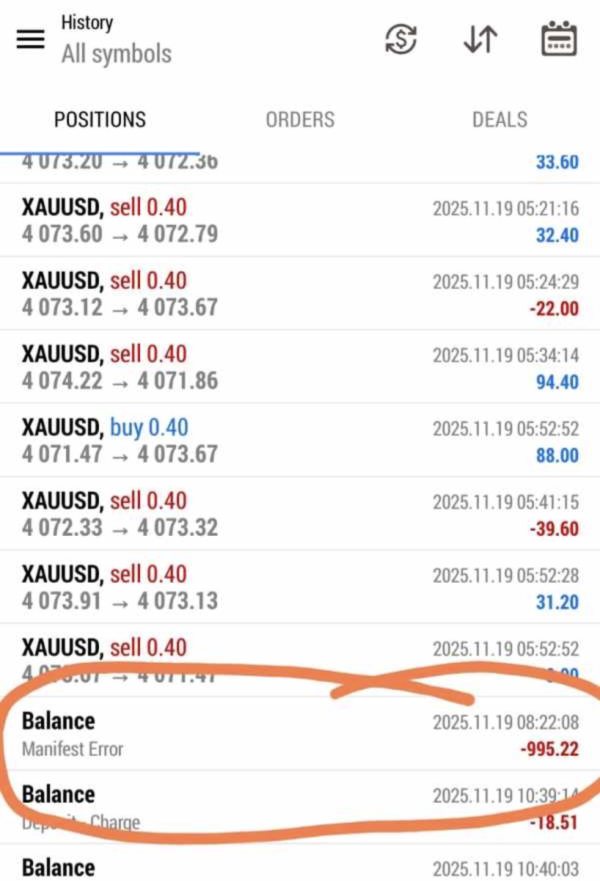

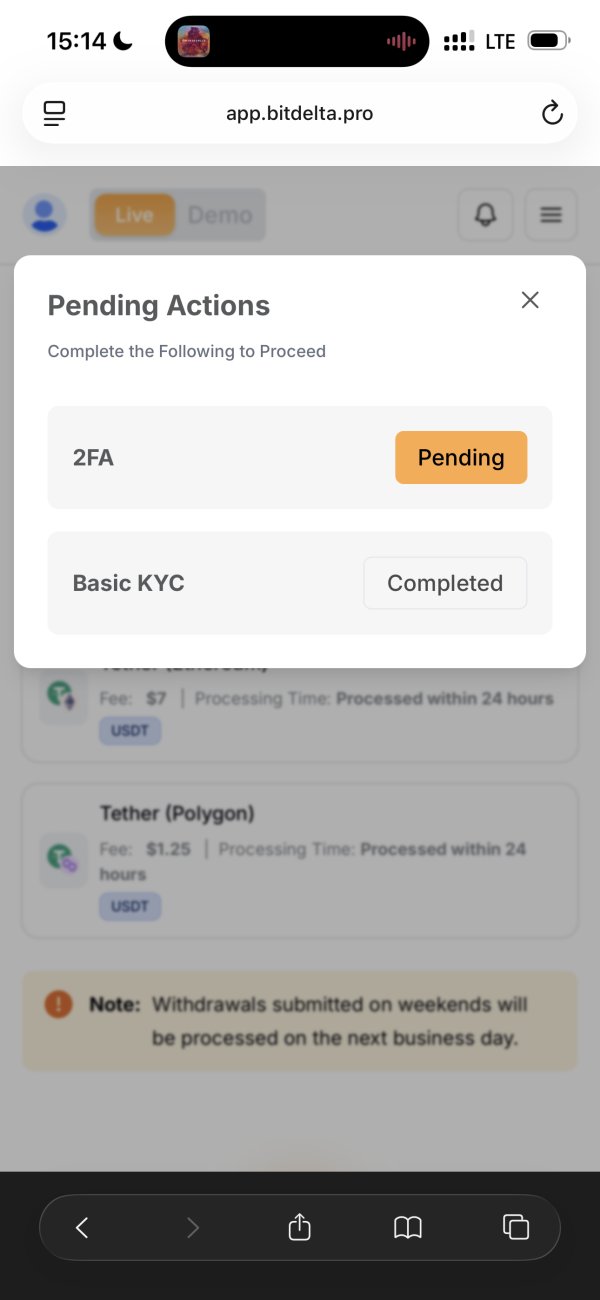

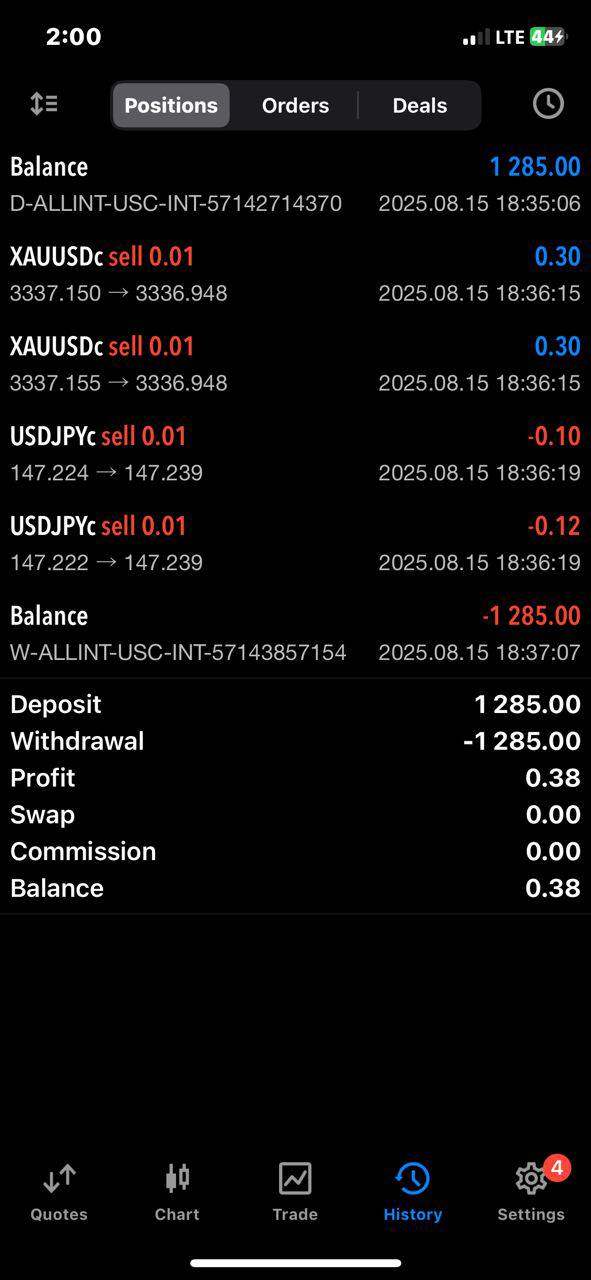

Trust and Safety Analysis

The evaluation of BitDelta Pro's trustworthiness faces significant challenges. This is due to limited available information about regulatory oversight, company registration details, and fund safety measures. Regulatory compliance represents the foundation of broker trustworthiness, providing legal framework for dispute resolution and fund protection.

Without clear documentation of regulatory licenses, potential clients cannot adequately assess the legal protections available. This includes supervisory authorities and compliance frameworks for their funds and trading activities. Established brokers typically provide detailed regulatory information, segregated account arrangements, and investor compensation scheme participation.

The absence of detailed information creates uncertainty about operational transparency and fund safety measures. This includes fund segregation, bank partnerships, audit procedures, and financial reporting. Professional traders generally require clear understanding of how their funds are protected and what legal recourse exists in case of disputes.

Company background information was not comprehensively available in public materials. This includes ownership structure, operational history, and management team details. This lack of transparency regarding corporate structure and operational history represents a significant concern for traders conducting due diligence before selecting a trading platform.

User Experience Analysis

Information about overall user satisfaction was not extensively detailed in available materials. This includes platform usability and client feedback, though Trustpilot presence was mentioned without specific ratings or review content. User experiences typically provide valuable insights into platform performance, customer service quality, and overall satisfaction levels.

The registration and account verification process details were not clearly outlined. This makes it difficult to assess the ease of account opening and time requirements for becoming operational. Streamlined onboarding processes generally indicate professional operational standards and user-focused service design.

Interface design, navigation ease, and platform accessibility across different devices represent important user experience factors. These were not comprehensively addressed in available materials. Modern traders expect intuitive interfaces, responsive design, and consistent functionality across desktop and mobile platforms.

Without documented user feedback, potential clients cannot benefit from existing user experiences when making platform selection decisions. This feedback would cover common issues, platform reliability, and overall satisfaction levels. The limited available information about user experiences represents a notable gap in this comprehensive evaluation.

Conclusion

This BitDelta Pro review reveals a trading platform with several attractive features. These include MT5 platform access, multiple asset classes, and claimed competitive trading conditions. However, significant information gaps regarding regulatory oversight, detailed trading conditions, and comprehensive user feedback create uncertainty for potential clients conducting thorough due diligence.

The broker appears suitable for traders seeking multi-asset CFD trading capabilities through the established MT5 platform. This particularly applies to those interested in forex and cryptocurrency trading. However, the limited transparency regarding regulatory compliance, fee structures, and operational details suggests careful consideration before committing significant capital.

Primary advantages include the diverse asset selection and professional trading platform. Notable concerns center on limited regulatory transparency and insufficient detailed information about trading conditions. Potential users should prioritize obtaining comprehensive information about regulatory status, fund safety measures, and detailed trading terms before proceeding with account opening procedures.