Is BEL safe?

Pros

Cons

Is Bel FX A Scam?

Introduction

Bel FX is a forex broker that has garnered attention in the trading community for its offerings and trading conditions. Positioned as a platform for both novice and experienced traders, it claims to provide access to a wide range of financial instruments, including forex pairs, commodities, and indices. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. It is crucial to evaluate the legitimacy and safety of a trading platform before committing any funds. This article aims to provide an objective assessment of Bel FX by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on extensive research, including data from industry reviews and regulatory bodies.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing whether it is safe to trade with them. Bel FX claims to be regulated by the International Financial Services Commission (IFSC) in Belize. However, the IFSC is known for its lenient regulatory framework, which raises questions about the effectiveness of its oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000127/404 | Belize | Verified |

The importance of regulation cannot be overstated, as it serves to protect traders from potential fraud and malpractice. However, the IFSC does not impose stringent requirements on its licensed brokers, which can lead to a lack of investor protection. Furthermore, there have been no significant reports of compliance issues for Bel FX, but the historical context of its regulatory environment suggests that traders should approach with caution. Thus, while Bel FX is technically regulated, the quality of that regulation is questionable, leading to concerns about the overall safety of trading on this platform.

Company Background Investigation

Bel FX was established in Belize, a popular offshore jurisdiction for financial services. The company operates under the ownership of Bel FX Limited, which has raised some eyebrows due to the lack of transparency regarding its ownership structure and management team. A thorough background check reveals that the management team consists of individuals with varying degrees of experience in the financial sector; however, specific details about their qualifications and prior experience remain scant.

The company's transparency is further called into question by its limited disclosure of operational practices and financial health. This lack of information can be concerning for potential investors who are looking for a broker that demonstrates accountability and openness. The absence of a detailed company history and an unclear management structure might lead traders to question whether Bel FX is a trustworthy platform.

Trading Conditions Analysis

Bel FX offers a range of trading conditions that are typical for many forex brokers, including various account types, leverage options, and spreads. However, the overall fee structure has raised some concerns among traders.

| Fee Type | Bel FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.3 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% - 1.5% | 0.2% - 1.0% |

The spreads offered by Bel FX are notably higher than the industry average, which may impact trading profitability. Additionally, the absence of a clear commission structure raises questions about potential hidden fees that could affect traders adversely. The overnight interest rates also appear to be on the higher end, which could lead to increased costs for traders holding positions overnight. Overall, while Bel FX presents itself as a competitive option, the trading conditions may not be as favorable as they initially appear, warranting further scrutiny.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Bel FX claims to implement various security measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent on the broker's regulatory framework.

The company does not provide extensive information about its investor protection schemes, which is a significant red flag. In the event of financial difficulties, clients may find themselves vulnerable without adequate safety nets. Historically, there have been no significant reports of fund mismanagement or security breaches associated with Bel FX, but the lack of transparency regarding fund safety protocols is concerning. Traders should remain vigilant and consider the potential risks associated with entrusting their capital to this broker.

Customer Experience and Complaints

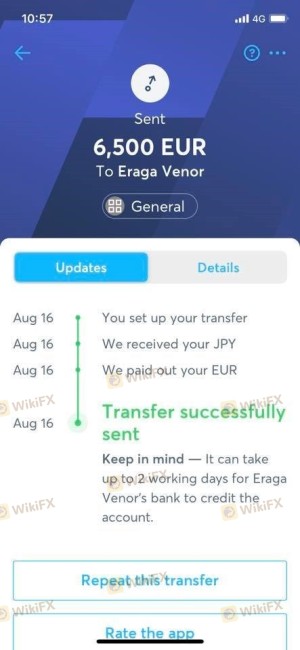

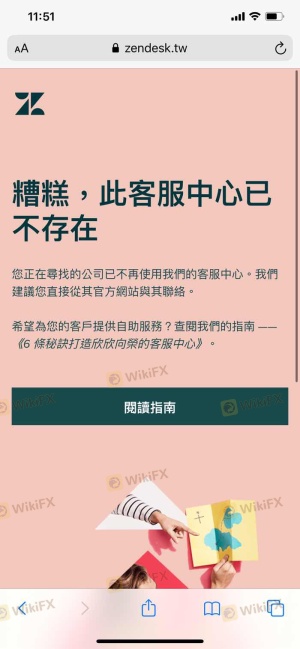

User experiences with Bel FX have been mixed, with some traders reporting satisfactory trading conditions while others have expressed serious concerns. Common complaints include difficulties in withdrawing funds, slow customer service responses, and issues with order execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Delays | Medium | Inconsistent |

| Order Execution Problems | High | Inconsistent |

A notable case involved a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and distrust in the platform. Another user highlighted the slow response times from customer support when issues arose. These complaints suggest that while some traders may have positive experiences, significant issues remain that could deter potential clients.

Platform and Trade Execution

Bel FX utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and robust trading features. However, the platform's performance has been a point of contention among users. Reports of slippage and order rejections have surfaced, indicating potential issues with trade execution quality.

Traders have noted that during high volatility periods, the platform may struggle to execute orders efficiently, which can lead to missed opportunities and financial losses. Additionally, there are concerns about the potential for platform manipulation, although concrete evidence remains elusive. Overall, while the platform itself is widely regarded, Bel FX's execution quality may not meet the expectations of all traders.

Risk Assessment

Using Bel FX presents several risks that traders should be aware of before engaging with the broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulation in Belize. |

| Withdrawal Risk | Medium | Complaints about withdrawal issues. |

| Execution Risk | High | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to start with a small investment and thoroughly test the platform's functionality before committing larger sums. Additionally, it is crucial to maintain a clear understanding of all trading conditions and fees associated with the account.

Conclusion and Recommendations

In conclusion, is Bel FX safe? While it is technically regulated, the quality of that regulation raises significant concerns about the safety and legitimacy of the broker. The lack of transparency in company operations, coupled with mixed user experiences and high trading costs, suggests that traders should approach Bel FX with caution.

For those seeking a reliable trading environment, it may be prudent to consider alternative brokers with stronger regulatory oversight and better customer service records. Recommendations include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer more robust investor protection and transparency. Overall, while Bel FX may appeal to some traders, the potential risks and concerns surrounding its operations warrant careful consideration.

Is BEL a scam, or is it legit?

The latest exposure and evaluation content of BEL brokers.

BEL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BEL latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.