Regarding the legitimacy of Bedafx forex brokers, it provides VFSC and WikiBit, .

Is Bedafx safe?

Business

License

Is Bedafx markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Bedafx Limited

Effective Date:

2017-06-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is BedaFX Safe or a Scam?

Introduction

BedaFX is a forex brokerage that positions itself within the competitive landscape of online trading, primarily targeting traders interested in currency pairs and CFDs. As the forex market continues to grow, the importance of selecting a trustworthy broker cannot be overstated. Traders must be vigilant in assessing the credibility of their chosen trading platform to avoid potential pitfalls, including scams and mismanagement of funds. This article aims to provide a comprehensive evaluation of BedaFX, focusing on its regulatory status, company background, trading conditions, and overall safety. Our investigation is based on various online reviews and reports, providing a structured analysis to help traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is crucial for ensuring the safety of traders' funds and the integrity of trading practices. BedaFX claims to be licensed in Vanuatu, but the reality is more complex. The Vanuatu Financial Services Commission (VFSC) has revoked its license, leaving BedaFX without valid regulation. This lack of oversight raises significant concerns about the broker's legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | Revoked | Vanuatu | Not Verified |

The absence of a robust regulatory framework means that BedaFX is not subject to the stringent compliance requirements that reputable brokers face. Offshore brokers like BedaFX often operate under minimal regulatory scrutiny, which can lead to questionable practices. The lack of a regulatory body overseeing BedaFX's operations makes it difficult to ascertain the broker's reliability and trustworthiness.

Company Background Investigation

BedaFX's history and ownership structure are essential in evaluating its credibility. The broker appears to be relatively new in the market, with limited information available regarding its founding and development. This obscurity raises red flags, as potential investors may find it challenging to gauge the broker's track record.

The management team behind BedaFX is another critical aspect to consider. A lack of transparency regarding the qualifications and experience of the management can lead to concerns about the broker's operational integrity. Furthermore, the information available on BedaFX's website is not comprehensive, making it difficult for potential clients to assess the company's transparency and commitment to ethical trading practices.

Trading Conditions Analysis

BedaFX offers a range of trading conditions that include competitive spreads and high leverage options. However, it is essential to scrutinize these conditions closely. The broker advertises spreads starting from 0 pips, but real-world testing revealed spreads around 3.3 pips for major currency pairs, which is significantly higher than industry standards.

| Fee Type | BedaFX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3.3 pips | 1.0 - 1.5 pips |

| Commission Model | Not specified | Varies by broker |

| Overnight Interest Range | Not disclosed | Typically 0.5% - 2% |

The high initial deposit requirement of $500 is another point of concern. Many well-regulated brokers allow traders to start with deposits as low as $100, making BedaFX's entry barrier relatively high. Such conditions may deter novice traders and suggest that the broker is not fully aligned with the needs of retail clients.

Client Fund Security

When it comes to client fund security, BedaFX's practices are less than reassuring. The broker's offshore registration means that there is no requirement for the segregation of client funds, which poses a significant risk. Without proper fund segregation, clients' money may be at risk if the broker faces financial difficulties.

Additionally, BedaFX does not provide clear information about investor protection schemes or negative balance protection, which are standard features among reputable brokers. The absence of these safety nets raises concerns about the potential for significant losses, particularly in volatile market conditions.

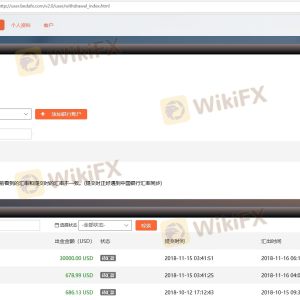

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Numerous reports on BedaFX indicate a pattern of complaints related to withdrawal issues and unresponsive customer service. Many users have expressed frustration over their inability to access funds, which is a significant red flag when evaluating the broker's trustworthiness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

For instance, several clients have reported delays in processing withdrawal requests, leading to suspicions about the broker's operational integrity. Such issues not only undermine trust but also suggest potential financial instability within the brokerage.

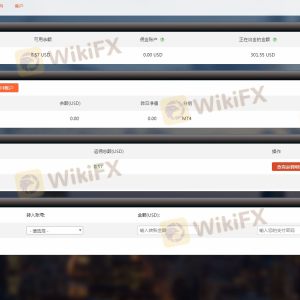

Platform and Trade Execution

BedaFX provides access to the widely-used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading tools. However, the broker's execution quality has been called into question. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The potential for platform manipulation is another concern. While there is no concrete evidence to suggest that BedaFX engages in such practices, the lack of regulatory oversight makes it challenging to trust the integrity of trade execution.

Risk Assessment

The overall risk of trading with BedaFX is considerable, given the lack of regulation, high trading costs, and troubling customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Potential withdrawal issues |

| Operational Risk | Medium | Complaints about service quality |

To mitigate risks, traders should consider starting with a small deposit, thoroughly researching the broker, and exploring alternative options with better regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that BedaFX poses significant risks to potential traders. The lack of valid regulation, high trading costs, and troubling customer feedback raise serious concerns about the broker's legitimacy. While BedaFX may offer some appealing features, the potential for fraud and mismanagement cannot be overlooked.

Traders are advised to exercise extreme caution when considering involvement with BedaFX. For those seeking alternative options, well-regulated brokers with positive reviews and transparent practices are recommended. Always prioritize safety and due diligence when selecting a forex broker.

In summary, Is BedaFX safe? The answer is a resounding no, and traders should be wary of engaging with this broker.

Is Bedafx a scam, or is it legit?

The latest exposure and evaluation content of Bedafx brokers.

Bedafx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bedafx latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.