Is AstarFX Trading safe?

Business

License

Is AstarFX Trading Safe or a Scam?

Introduction

AstarFX Trading positions itself as a player in the forex market, claiming to offer a range of trading services and investment opportunities. However, in an industry rife with scams and unregulated brokers, traders must exercise caution when selecting a brokerage. The importance of due diligence cannot be overstated, as the choice of a broker can significantly impact the safety of ones investments and the overall trading experience. This article aims to investigate the legitimacy of AstarFX Trading by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis is based on a thorough review of various credible sources, including regulatory databases, customer reviews, and expert opinions.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. AstarFX Trading has been scrutinized for its lack of regulation by a recognized financial authority. Without proper oversight, brokers can operate without adhering to industry standards, putting traders at significant risk.

Here is a summary of AstarFX Tradings regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license from a top-tier authority raises serious concerns about AstarFX Trading's operations. Brokers regulated by reputable authorities, such as the U.S. Securities and Exchange Commission (SEC) or the UK Financial Conduct Authority (FCA), are subject to strict rules and regular audits, which provide a level of security to traders. In contrast, AstarFX Trading's lack of regulation indicates that it may not be held accountable for its actions, making it a risky option for traders seeking a safe trading environment.

Company Background Investigation

AstarFX Trading's company background is another area of concern. The broker claims to have a solid operational history, but information about its ownership and management team is sparse. Reliable brokers typically disclose their ownership structure and provide details about their management teams, including their qualifications and experience in the financial industry.

Unfortunately, AstarFX Trading does not meet these transparency standards. The lack of accessible information about its management raises questions about the broker's credibility and intentions. Traders looking for a trustworthy broker should prioritize those that openly share their company history and management credentials, as this is often a sign of a reputable operation.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. AstarFX Trading presents various investment plans and trading options, but the specifics of its fee structure are not clearly outlined. Hidden fees can significantly affect a trader's profitability, and brokers should be transparent about their costs.

Here‘s a comparison of AstarFX Trading’s core trading costs against industry averages:

| Cost Type | AstarFX Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unavailable | 1.0 - 2.0 pips |

| Commission Model | Unavailable | Varies |

| Overnight Interest Range | Unavailable | 0.5% - 2.5% |

The absence of detailed information regarding spreads, commissions, and overnight interest rates makes it difficult for traders to assess the true cost of trading with AstarFX Trading. This lack of clarity is a red flag, as reputable brokers typically provide comprehensive information about their fee structures to help traders make informed decisions.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker. AstarFX Trading's approach to safeguarding client funds is unclear. Trusted brokers generally implement measures such as segregating client funds from company funds, offering investor protection schemes, and providing negative balance protection.

Without clear information on these critical security measures, traders may face significant risks. If AstarFX Trading lacks robust security protocols, clients could potentially lose their investments without any recourse. Historical incidents involving fund mismanagement or disputes can further exacerbate concerns about a broker's reliability.

Customer Experience and Complaints

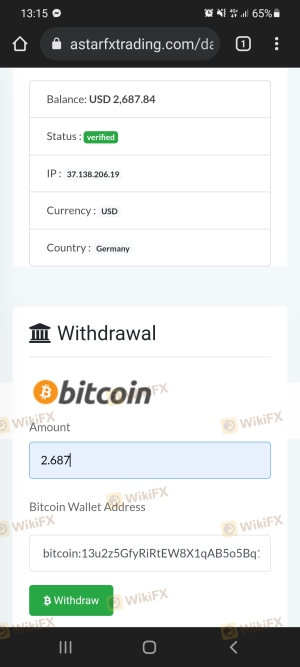

Customer feedback is an invaluable resource for assessing a broker's reputation. AstarFX Trading has received mixed reviews from users, with many highlighting issues related to withdrawal difficulties and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| High-Pressure Sales Tactics | Medium | Limited Communication |

One notable case involved a trader who reported being unable to withdraw their funds after repeated attempts to contact customer support, which remained unresponsive. Such experiences contribute to a growing sentiment that AstarFX Trading may not prioritize customer satisfaction or ethical business practices.

Platform and Execution

The trading platform's performance is crucial for a seamless trading experience. AstarFX Trading claims to offer a user-friendly platform, but reports of execution issues, including slippage and order rejections, have surfaced. Traders need a reliable platform that executes trades promptly and accurately to avoid potential losses.

Indicators of platform manipulation, such as frequent slippage or sudden price spikes, can also be concerning. If AstarFX Trading's platform fails to deliver on these fronts, it could significantly impact traders' ability to execute their strategies effectively.

Risk Assessment

The overall risk associated with AstarFX Trading is substantial. The absence of regulation, unclear trading conditions, and negative customer experiences contribute to a high-risk profile for potential investors. Here is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud |

| Financial Security Risk | High | Lack of clear fund protection measures |

| Customer Service Risk | Medium | Unresponsiveness to client inquiries |

To mitigate these risks, traders should consider choosing regulated brokers with transparent practices and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that AstarFX Trading exhibits several characteristics commonly associated with untrustworthy brokers. The lack of regulation, unclear trading conditions, and negative customer experiences raise significant red flags. For traders seeking a safe and reliable trading environment, it is advisable to avoid AstarFX Trading.

Instead, consider alternative brokers that are regulated by reputable authorities and offer transparent trading conditions. Trusted platforms typically provide comprehensive information about their fees, security measures, and customer support, ensuring a safer trading experience. In the ever-evolving forex market, prioritizing safety and transparency is essential for long-term success.

Is AstarFX Trading a scam, or is it legit?

The latest exposure and evaluation content of AstarFX Trading brokers.

AstarFX Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AstarFX Trading latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.