Is AsiaFXI safe?

Business

License

Is AsiaFXI Safe or a Scam?

Introduction

AsiaFXI is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market since its inception. As traders increasingly seek platforms to engage in currency trading, the importance of assessing the credibility and safety of brokers like AsiaFXI cannot be overstated. With numerous reports of scams and fraudulent activities in the financial sector, traders must exercise caution and conduct thorough evaluations before entrusting their funds to any broker. This article aims to provide an objective analysis of AsiaFXI, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The assessment is based on a comprehensive review of various online sources, including user reviews, regulatory filings, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety. AsiaFXI claims to operate under a fully licensed and regulated environment; however, the specifics of its regulatory oversight are ambiguous. The broker is reportedly based in the British Virgin Islands, a jurisdiction known for its lenient regulatory framework. This raises significant concerns regarding the safety of client funds and the broker's accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | British Virgin Islands | Unverified |

The lack of a valid regulatory license is a red flag for potential investors. Reliable brokers typically operate under stringent regulations that mandate transparency and accountability. The absence of such oversight with AsiaFXI suggests that traders may be exposed to higher risks, including the potential loss of funds without recourse. Furthermore, historical compliance issues have been noted with companies associated with AsiaFXI, further compounding concerns about its legitimacy.

Company Background Investigation

AsiaFXI was established in 2016, and while it claims to have extensive experience in the forex market, details about its ownership structure and management team are scarce. The lack of transparency regarding the company's history and the identities of its executives raises questions about its operational integrity. A thorough investigation reveals that the company is linked to IFX Investment House Ltd., which has faced scrutiny for overdue filings and regulatory warnings in the past.

The management teams background is crucial for assessing the company's reliability. However, the absence of publicly available information regarding their qualifications and experience in the financial sector is concerning. This opacity can lead to uncertainty among traders regarding the company's operational practices and overall trustworthiness.

Trading Conditions Analysis

When evaluating whether AsiaFXI is safe, it is essential to consider its trading conditions, including fees and spreads. AsiaFXI offers a variety of account types, but the specifics of its fees and commissions are not transparently disclosed on its website.

| Fee Type | AsiaFXI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The lack of clarity in the fee structure can be a significant disadvantage for traders. Unusual or hidden fees can erode profits and lead to unexpected losses. Furthermore, the absence of a clear commission model may indicate potential issues with pricing transparency, which is vital for traders looking to optimize their trading strategies.

Customer Funds Security

The security of customer funds is paramount when assessing the safety of a broker. AsiaFXI claims to implement various measures to protect client funds, including segregated accounts. However, the effectiveness of these measures is questionable given the broker's lack of regulatory oversight.

Traders should be aware that without robust investor protection schemes, such as those offered by regulated brokers, their funds may not be secure. Additionally, historical complaints indicate that AsiaFXI has faced issues with fund withdrawals, further highlighting concerns about its financial integrity.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether AsiaFXI is safe. A review of user experiences reveals a pattern of complaints regarding withdrawal difficulties and poor customer service. Many users report that once they request withdrawals, communication from the broker ceases, and their funds remain inaccessible.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Issues | High | Poor |

Two notable cases illustrate these concerns. One user reported investing $20,000 only to find that their withdrawal requests were ignored, leading to significant financial distress. Another user described being pressured to deposit additional funds under the promise of higher returns, which never materialized. These experiences indicate a troubling trend that suggests AsiaFXI may not prioritize customer satisfaction or transparency.

Platform and Trade Execution

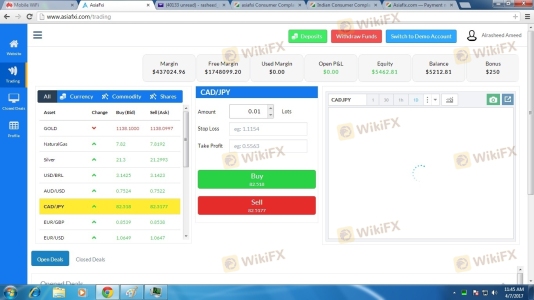

The performance of the trading platform is another critical factor in assessing whether AsiaFXI is safe. Users have reported mixed experiences regarding platform stability and order execution quality. Issues such as slippage and order rejections have been noted, which can significantly impact trading outcomes.

A reliable trading platform should offer seamless execution and minimal latency. However, the feedback from AsiaFXI users indicates that there may be underlying issues that could affect trading efficiency. This raises concerns about the overall reliability of the trading environment provided by AsiaFXI.

Risk Assessment

Using AsiaFXI presents several risks that potential traders should consider. The absence of regulatory oversight, combined with a lack of transparency and a history of customer complaints, suggests a high-risk trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory license |

| Financial Risk | High | Difficulty in withdrawing funds |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that offer greater security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that AsiaFXI presents significant risks to potential investors. The lack of regulatory oversight, combined with numerous customer complaints and a lack of transparency, raises serious concerns about the broker's legitimacy.

For traders seeking reliable options, it is advisable to consider regulated alternatives with proven track records, such as XM, eToro, or Forex.com. These brokers not only offer robust regulatory protections but also prioritize customer service and transparency.

In summary, while AsiaFXI may offer trading opportunities, the associated risks and lack of safety measures make it a questionable choice for serious traders. Proceed with caution and prioritize the security of your investments when navigating the forex market.

Is AsiaFXI a scam, or is it legit?

The latest exposure and evaluation content of AsiaFXI brokers.

AsiaFXI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AsiaFXI latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.