Is Ahead safe?

Pros

Cons

Is Ahead Safe or a Scam?

Introduction

Ahead (HK) Limited positions itself as a forex broker operating primarily in the foreign exchange market. With its base in Hong Kong, it aims to attract traders seeking a platform for forex trading. However, the increasing number of scams in the forex industry necessitates that traders perform diligent evaluations of brokers before committing their funds. In a market where unregulated brokers can easily defraud unsuspecting traders, understanding the safety and legitimacy of a broker like Ahead is crucial.

This article employs a comprehensive investigative approach, utilizing data from various credible sources, including regulatory bodies, user reviews, and financial assessments. By analyzing the regulatory framework, company background, trading conditions, client feedback, and overall risk factors, we aim to provide a clear picture of whether Ahead is safe or if it exhibits characteristics of a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a fundamental aspect that determines its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to strict operational standards and protect clients' funds. Unfortunately, Ahead operates without any valid regulatory licenses, raising significant concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unregulated |

The absence of regulation means that Ahead is not bound by any legal requirements to safeguard client funds or provide transparency. This lack of oversight is a red flag, as it exposes traders to heightened risks, including potential fraud and mismanagement of funds. Moreover, the historical compliance of a broker is essential; in this case, the absence of any regulatory history is a cause for concern. Therefore, when questioning Is Ahead Safe, the unregulated status is a significant factor that cannot be overlooked.

Company Background Investigation

Ahead (HK) Limited was established within the last five years and claims to focus exclusively on forex trading. However, limited information about its ownership structure and management team raises questions about its operational transparency. A thorough investigation reveals that the company's details are sparse, with no substantial history or credibility in the forex market.

The management team lacks publicly available information regarding their professional backgrounds or experience in the financial sector. This absence of information can lead to concerns about the broker's legitimacy, as reputable firms typically provide detailed profiles of their management teams. The lack of transparency in this area further complicates the assessment of Is Ahead Safe.

Additionally, the company does not appear to maintain a robust information disclosure policy. Potential clients may find it challenging to obtain vital information about the broker's operational practices, which is essential for making informed trading decisions. The combination of limited background information and a lack of transparency raises alarms about the broker's trustworthiness.

Trading Conditions Analysis

Examining the trading conditions offered by Ahead is crucial in assessing its overall reliability. The broker claims to provide a competitive trading environment; however, the absence of clear information regarding fees and spreads can be a cause for concern.

| Fee Type | Ahead | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 2-3 pips |

| Commission Structure | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of clarity surrounding trading costs can lead to unexpected expenses for traders. Furthermore, the absence of a transparent commission structure might suggest hidden fees, which could significantly impact profitability. Such practices are often associated with unregulated brokers, raising doubts about whether Is Ahead Safe for traders looking to invest their money.

Moreover, the broker's limited offerings, focusing solely on forex trading, may restrict traders seeking a diversified portfolio. While specializing in a specific market can be beneficial for some, it can also be a limiting factor for those looking to explore various asset classes. This narrow focus may not align with the investment strategies of all traders, further complicating the evaluation of Ahead's safety.

Client Fund Security

Ensuring the safety of client funds is paramount when evaluating any forex broker. Ahead claims to prioritize client security; however, the lack of regulatory oversight raises concerns about the effectiveness of its security measures.

The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies. The absence of these critical safeguards exposes traders to the risk of losing their entire investment without any recourse. Furthermore, if Ahead encounters financial difficulties or operational issues, traders may find themselves with little to no protection for their funds.

Historically, unregulated brokers have been known to mismanage client funds, leading to significant losses for traders. Therefore, when assessing whether Is Ahead Safe, the lack of clear policies regarding fund security is a major red flag that potential clients should consider.

Customer Experience and Complaints

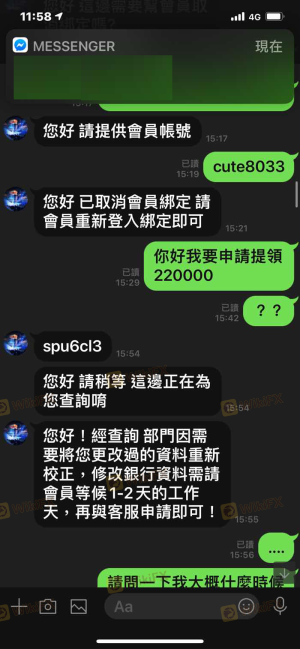

Analyzing customer feedback is vital in understanding the overall experience with a broker. User reviews for Ahead reveal a mixed bag of experiences, with several complaints highlighting issues such as withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

Common complaints include difficulties in withdrawing funds, which is a serious concern for any trader. The lack of responsiveness from customer support exacerbates these issues, leading to frustration among clients. For a broker to be deemed safe, it must demonstrate a commitment to addressing client concerns promptly and effectively. The negative feedback surrounding Ahead raises questions about its reliability and overall safety.

Several users have reported feeling pressured to invest more funds without clear explanations of the associated risks. This type of high-pressure sales tactic is commonly associated with fraudulent brokers, further contributing to the skepticism surrounding Ahead. When considering whether Is Ahead Safe, the patterns of complaints and the company's response quality are critical factors that cannot be ignored.

Platform and Trade Execution

The performance and stability of a trading platform are crucial for a positive trading experience. Ahead offers the MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools. However, the effectiveness of this platform is contingent upon the broker's execution quality.

Traders have reported mixed experiences regarding order execution, with some noting delays and slippage during volatile market conditions. Such issues can significantly impact trading outcomes and raise concerns about the broker's reliability. Furthermore, the lack of transparency regarding execution policies and potential manipulation raises questions about the integrity of the trading environment.

When evaluating Is Ahead Safe, it is essential to consider the quality of trade execution and any indications of platform manipulation. A broker that fails to provide a stable and fair trading environment may not be a safe choice for traders looking to engage in forex markets.

Risk Assessment

Engaging with any broker carries inherent risks, and Ahead is no exception. The absence of regulation, combined with the various red flags identified in this analysis, suggests a higher risk profile for traders considering this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Fund Security Risk | High | Lack of clear security measures for client funds. |

| Customer Service Risk | Medium | Poor response to client complaints may lead to unresolved issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Ahead. Seeking alternative brokers with established regulatory frameworks and positive user reviews can provide a safer trading environment. Additionally, maintaining only a portion of funds in trading accounts and employing risk management strategies can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the investigation into Ahead (HK) Limited raises significant concerns regarding its legitimacy and safety. The broker's unregulated status, lack of transparency, and negative customer feedback suggest that it may not be a safe choice for traders. Therefore, when questioning Is Ahead Safe, the evidence points towards potential risks that should not be overlooked.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that emphasize regulatory compliance, transparent fee structures, and strong customer support. Brokers with a proven track record and positive user experiences are likely to provide a safer trading environment. In light of the findings, potential clients are encouraged to exercise caution and conduct thorough due diligence before committing any funds to Ahead.

Is Ahead a scam, or is it legit?

The latest exposure and evaluation content of Ahead brokers.

Ahead Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ahead latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.