Is AFFIX FINANCE safe?

Business

License

Is Affix Finance Safe or a Scam?

Introduction

Affix Finance is a relatively new player in the forex market, presenting itself as a brokerage firm that offers trading services primarily through a proprietary trading platform. As the forex market continues to attract traders from around the globe, the need for cautious evaluation of forex brokers becomes paramount. With the potential for significant financial loss, traders must ensure that the brokers they choose are legitimate and operate under sound regulatory frameworks. This article aims to investigate the credibility of Affix Finance by assessing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. By employing a comprehensive research methodology, including analysis of online reviews and regulatory databases, we aim to provide a balanced view of whether Affix Finance is safe or poses risks to traders.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Regulation provides an essential layer of protection for traders, ensuring that brokers adhere to industry standards and practices. In the case of Affix Finance, the broker claims to be registered with the National Futures Association (NFA) in the United States. However, this registration has raised concerns, as it is classified as a "suspicious clone," suggesting that it may not be operating legitimately under the NFAs oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0553518 | United States | Suspicious Clone |

The lack of valid regulation is a significant red flag. Traders should be wary of brokers that operate without proper oversight, as it exposes them to potential fraud and financial loss. Furthermore, the absence of a robust regulatory framework means that traders have limited recourse in the event of disputes or financial issues. Therefore, it is crucial for potential clients to consider these factors carefully and evaluate whether Affix Finance is safe for their trading activities.

Company Background Investigation

Affix Finance is a newly established brokerage firm, reportedly operating for less than five years. The company operates out of the United States but has not provided detailed information regarding its ownership structure or history. This lack of transparency raises questions about the firm's legitimacy and operational practices. The absence of a well-documented history can be alarming for potential traders, as it makes it difficult to gauge the broker's reliability and trustworthiness.

The management team behind Affix Finance has not been prominently featured in available resources, which further obscures the firm's credibility. A brokerage's management team typically plays a crucial role in its operational integrity, and the absence of information regarding their backgrounds and qualifications is concerning. Transparency in leadership is essential for building trust with clients, and the lack of it may indicate potential issues within the organization. Therefore, the question of whether Affix Finance is safe to trade with remains open, pending further investigation into its management and operational practices.

Trading Conditions Analysis

When considering whether Affix Finance is safe, traders must also evaluate the trading conditions offered by the broker. Affix Finance presents a trading model that claims to provide competitive fees and a range of trading instruments, including cryptocurrencies. However, the specifics of its fee structure are not readily available, which can lead to confusion and uncertainty for potential clients.

| Fee Type | Affix Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies by broker |

| Commission Structure | N/A | Typically between $0 - $10 per lot |

| Overnight Interest Range | N/A | Varies by broker |

The absence of clear information regarding spreads, commissions, and overnight fees is troubling. Traders should be cautious of brokers that do not disclose their fee structures, as hidden fees can significantly impact profitability. Moreover, the lack of a demo account for potential clients to test the trading conditions raises additional concerns about the broker's transparency. Traders are advised to fully understand the costs involved before committing to a broker, especially one with questionable regulatory status like Affix Finance.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Affix Finance's approach to safeguarding client funds is unclear, which poses a risk to potential investors. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to ensure that client funds are secure.

Unfortunately, there is no available information on whether Affix Finance utilizes these safety measures. The lack of transparency regarding fund security protocols is a significant concern for traders. Historical issues related to fund safety, such as reports of withdrawal difficulties, further compound these worries. Traders should be especially cautious when dealing with brokers that lack clear security protocols, as this can lead to significant financial loss. Therefore, the question of whether Affix Finance is safe is increasingly pertinent in light of its opaque policies regarding customer fund protection.

Customer Experience and Complaints

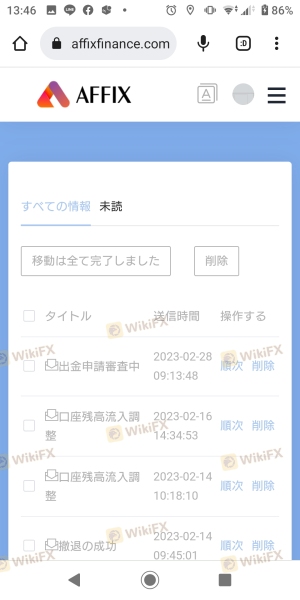

User feedback and experiences are invaluable when assessing a broker's reliability. Reports from current and former clients of Affix Finance indicate a pattern of complaints, particularly concerning withdrawal issues. Many users have reported difficulties in accessing their funds after making withdrawal requests, which is a serious red flag in the forex trading industry.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Transparency Concerns | High | Unresponsive |

One notable case involved a trader who reported a lengthy delay in processing a withdrawal request, leading to frustration and distrust in the broker's operations. Such complaints highlight the importance of evaluating a broker's responsiveness and customer service quality. A broker with a history of unresolved complaints may not be a safe choice for traders, raising further concerns about whether Affix Finance is safe for investment.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. Affix Finance does not provide access to popular platforms like MetaTrader 4 or MetaTrader 5, opting instead for a proprietary trading software that is reportedly available on mobile devices. The performance, stability, and user experience of this platform are crucial for effective trading.

Concerns have been raised regarding order execution quality, including issues related to slippage and order rejections. Traders have reported instances where their orders were not executed at the desired price, potentially leading to losses. Such experiences can indicate underlying problems with the broker's trading infrastructure and raise questions about market manipulation. As a result, assessing the reliability of Affix Finance's trading platform is essential in determining whether Affix Finance is safe.

Risk Assessment

Engaging with a broker like Affix Finance carries inherent risks that traders must consider. The lack of regulation, transparency issues, and customer complaints contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Operational Risk | Medium | Lack of transparency regarding operations. |

| Customer Trust Risk | High | Numerous complaints regarding withdrawals. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with any broker. This includes verifying regulatory status, understanding the fee structure, and assessing customer feedback. Additionally, traders should consider diversifying their investments and not committing substantial funds to brokers with questionable practices.

Conclusion and Recommendations

In conclusion, the investigation into Affix Finance raises several red flags regarding its legitimacy and safety as a forex broker. The lack of valid regulation, transparency issues, and a history of customer complaints indicate that potential clients should exercise caution. While there may be opportunities for trading with this broker, the associated risks are significant.

For traders seeking safer alternatives, it is advisable to consider brokers that are well-regulated by reputable authorities, have transparent fee structures, and demonstrate a commitment to customer service. Brokers like Plus500, RoboForex, and XTB present more reliable options for those looking to engage in forex trading without the heightened risks associated with unregulated entities. Ultimately, the question of whether Affix Finance is safe should lead traders to carefully weigh their options and choose wisely.

Is AFFIX FINANCE a scam, or is it legit?

The latest exposure and evaluation content of AFFIX FINANCE brokers.

AFFIX FINANCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AFFIX FINANCE latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.