WEEX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive WEEX review examines an unregulated cryptocurrency exchange that has received mixed feedback in the digital asset trading community. WEEX was established in 2021 and is registered in Hong Kong, positioning itself as a platform that offers spot and futures trading for over 100 cryptocurrencies, including popular assets like Bitcoin, Ethereum, Dogecoin, XRP, SHIB, and PEPE.

The platform's most notable feature is its high no-KYC limits. This appeals to traders who want privacy in their cryptocurrency transactions. However, according to available user feedback and market analysis, WEEX receives an overall rating of 2 out of 10, which shows significant concerns about its operations and user satisfaction.

The platform primarily attracts users interested in cryptocurrency trading, particularly those willing to accept higher risk levels that come with unregulated exchanges. Despite offering a wide range of digital assets and supporting both spot and futures trading, WEEX faces criticism about customer service quality, platform reliability, and the risks that come with its unregulated status.

Users considering this platform should carefully weigh the convenience of high no-KYC limits against the potential risks of trading with an unregulated entity.

Important Notice

Regional Entity Differences: As WEEX operates without regulatory oversight, investors should exercise extreme caution. This is particularly important considering the varying legal protections and regulatory frameworks across different jurisdictions. The absence of regulatory supervision means users may have limited recourse in case of disputes or platform issues.

Review Methodology: This evaluation is based on available customer feedback, market data, and publicly accessible information. Due to the limited transparency typical of unregulated exchanges, this assessment may be subject to information constraints and should be considered alongside other due diligence efforts.

Rating Framework

Broker Overview

WEEX entered the cryptocurrency exchange market in 2021. The company established itself as a Hong Kong-registered trading platform focused on digital asset transactions. The company operates as an unregulated broker, which significantly impacts its credibility and user protection measures.

According to information from the platform's official sources, WEEX has positioned itself to serve the growing demand for cryptocurrency trading by offering access to a diverse range of digital assets. The platform's business model centers around providing both spot and futures trading services for cryptocurrency enthusiasts. WEEX supports trading in over 100 different cryptocurrencies, making it attractive to users seeking variety in their digital asset portfolios.

The exchange emphasizes its high no-KYC limits as a key differentiator, allowing users to trade larger amounts without extensive identity verification procedures. However, this WEEX review must highlight that the platform's unregulated status raises significant concerns about user protection, fund security, and operational transparency.

The company's Hong Kong registration does not provide the same level of regulatory oversight that users might expect from exchanges operating under stricter financial supervision in other jurisdictions.

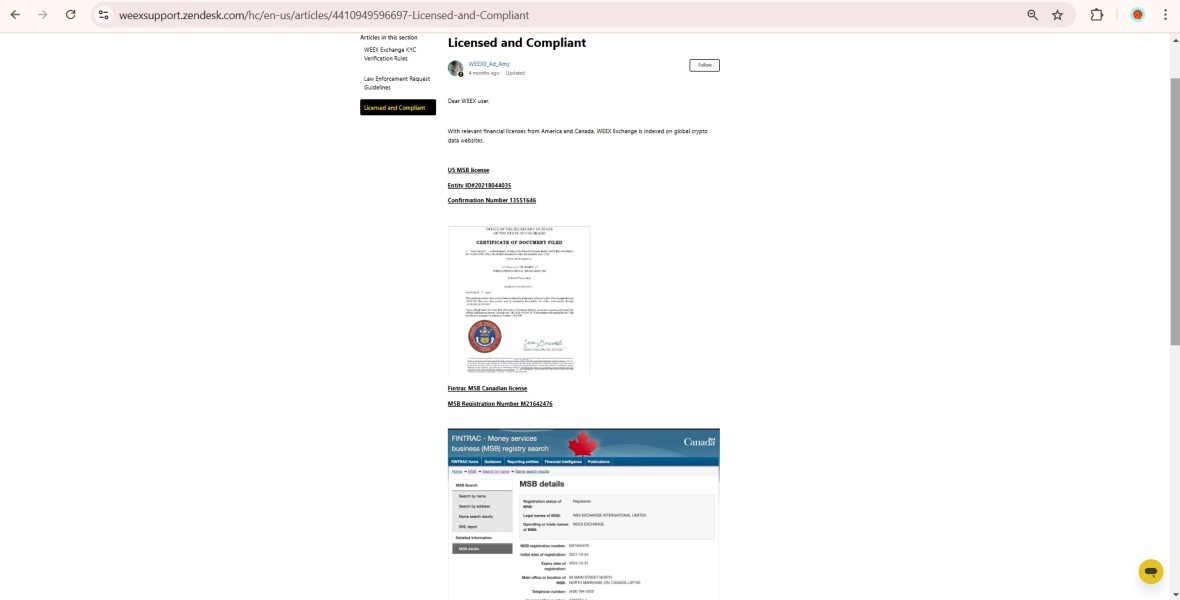

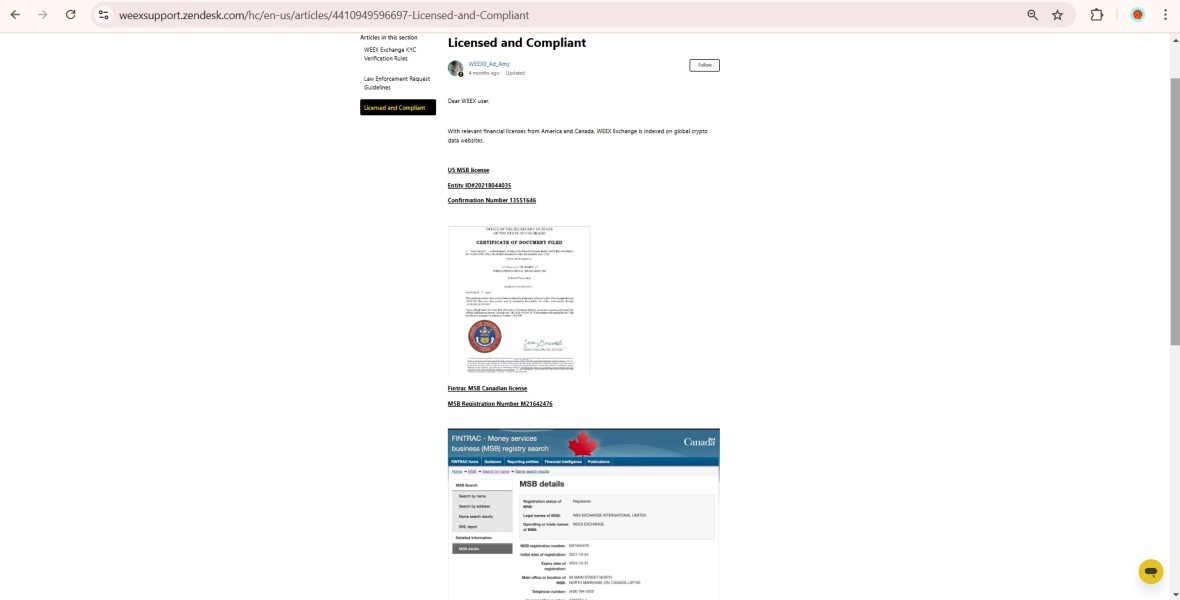

Regulatory Status: WEEX operates as an unregulated cryptocurrency exchange registered in Hong Kong. The platform does not hold licenses from major financial regulatory authorities, which presents inherent risks for users regarding fund protection and dispute resolution.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources. As a cryptocurrency exchange, the platform likely supports various digital asset transfers.

Minimum Deposit Requirements: Available sources do not specify minimum deposit amounts required to begin trading on the WEEX platform.

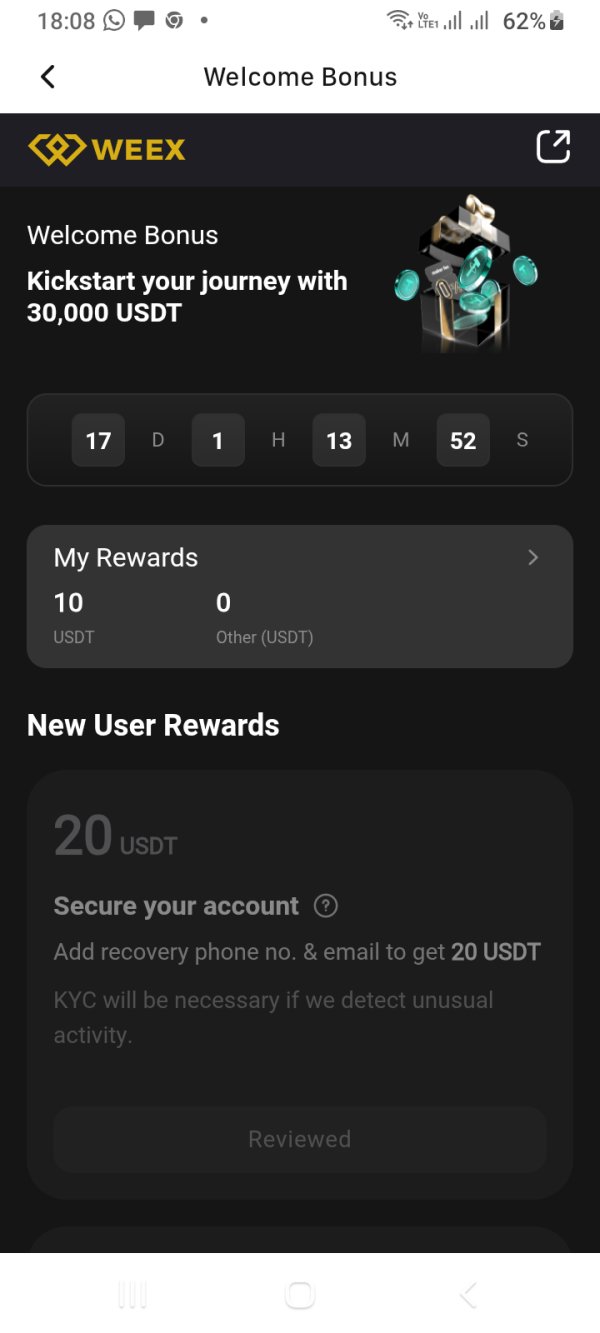

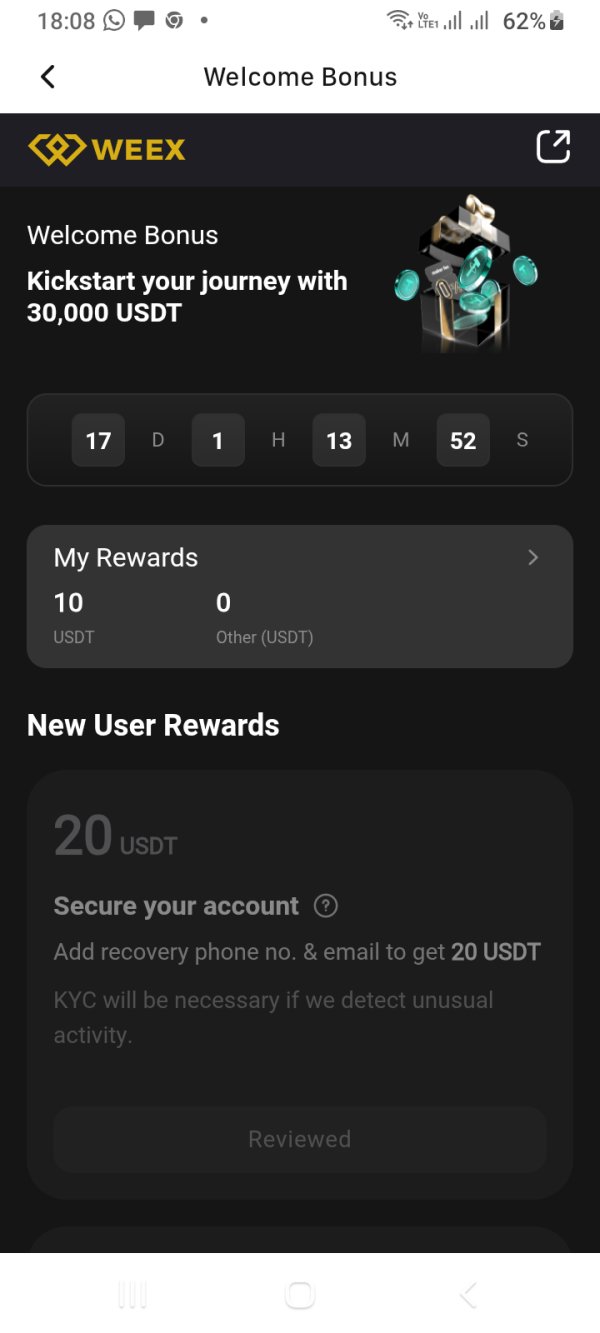

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in the available information sources.

Tradeable Assets: WEEX supports trading in over 100 cryptocurrencies, including major digital assets such as Bitcoin, Ethereum, Dogecoin, XRP, Shiba Inu, and PEPE. The platform offers both spot and futures trading options for these digital assets.

Cost Structure: Specific information regarding spreads, commissions, and fee structures was not provided in available sources. This is concerning for potential users trying to assess trading costs.

Leverage Ratios: Available sources do not specify the maximum leverage ratios offered for futures trading on the platform.

Platform Options: Detailed information about specific trading platforms or software used by WEEX was not mentioned in available sources.

Geographic Restrictions: Specific regional restrictions or availability limitations were not detailed in the source materials.

Customer Service Languages: Information about supported languages for customer service was not specified in available sources.

This WEEX review notes that the lack of detailed information about many operational aspects raises additional concerns about the platform's transparency and user support infrastructure.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

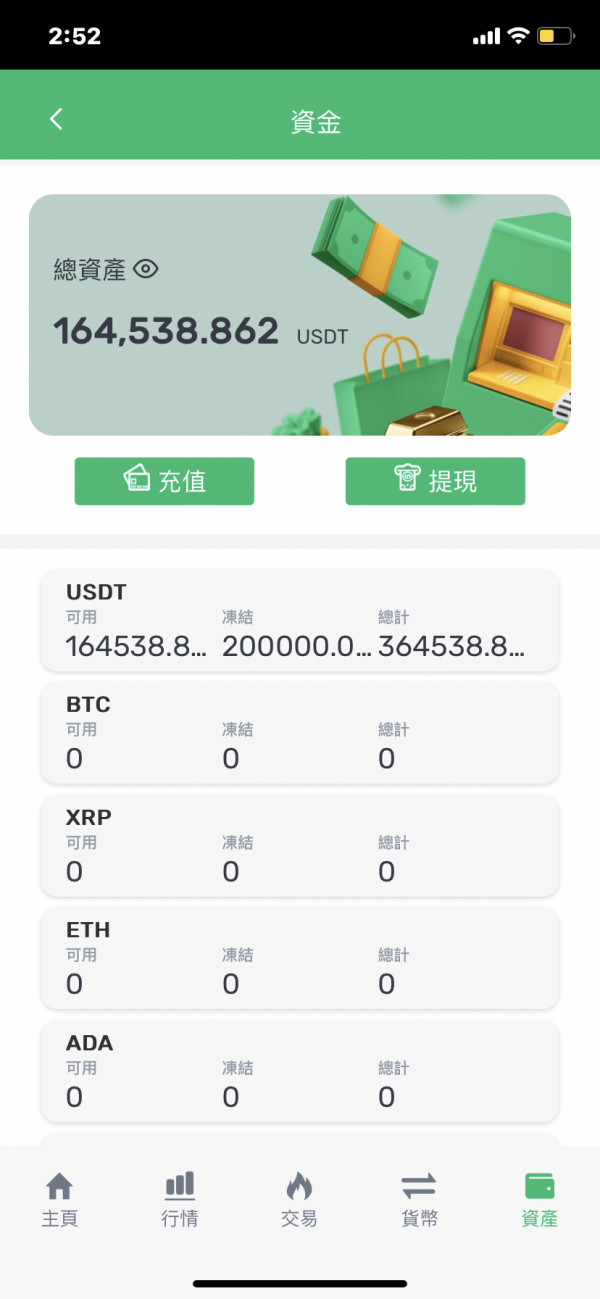

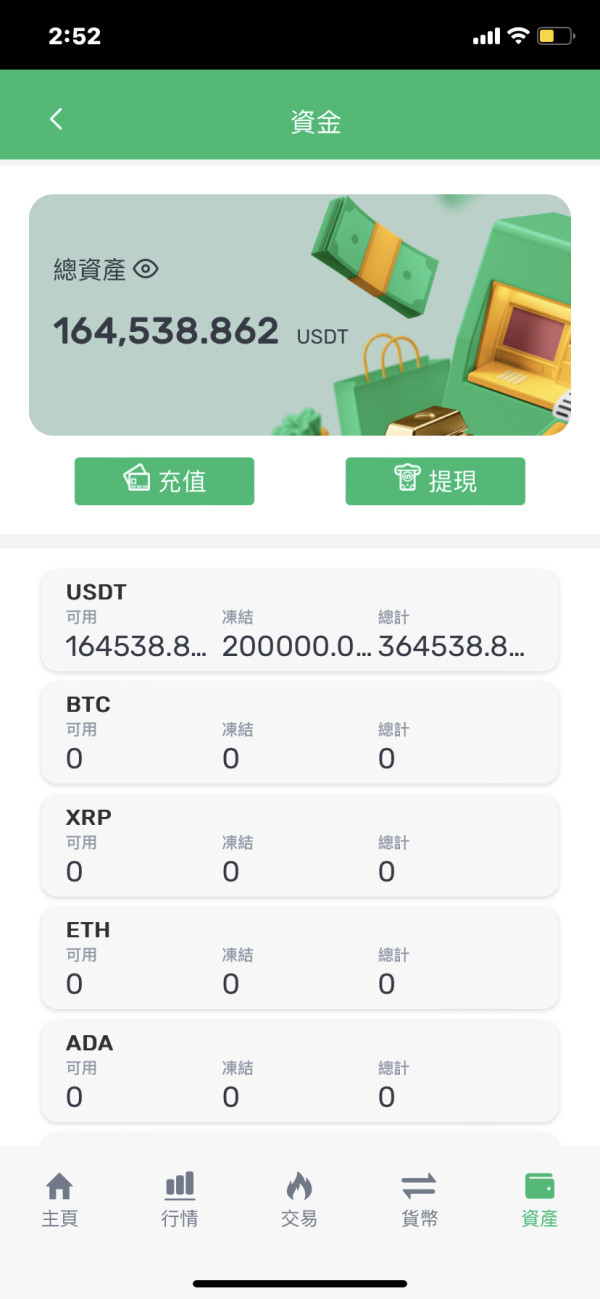

The account conditions at WEEX receive a poor rating due to limited transparency about account types, requirements, and features. Available sources do not provide specific information about different account tiers, minimum deposit requirements, or account opening procedures, which creates uncertainty for potential users.

The platform's emphasis on high no-KYC limits may appeal to privacy-conscious traders. However, this approach also raises questions about compliance with international anti-money laundering standards. User feedback suggests that account-related experiences have been generally unsatisfactory, contributing to the low overall rating.

Without clear information about account features, fee structures, or special account benefits, users cannot make informed decisions about whether WEEX meets their trading needs. The lack of detailed account documentation also suggests limited customer support infrastructure, which further impacts the user experience.

This WEEX review finds that the absence of transparent account condition information significantly undermines user confidence and represents a major weakness in the platform's offering. Potential users should seek clarification on all account-related terms before engaging with the platform.

WEEX receives a fair rating for tools and resources primarily due to its extensive cryptocurrency selection and trading options. The platform supports over 100 different cryptocurrencies, providing users with significant variety in their trading choices. The availability of both spot and futures trading options adds flexibility for different trading strategies.

However, available sources do not detail specific research tools, analytical resources, or educational materials that might support traders in making informed decisions. The absence of information about trading tools, charting capabilities, or market analysis resources limits the platform's appeal to serious traders who require comprehensive trading infrastructure.

The platform's focus on high no-KYC limits represents a unique feature that some users value. However, this does not compensate for the apparent lack of sophisticated trading tools and educational resources. User feedback suggests that while the cryptocurrency selection is adequate, the overall trading environment lacks the depth expected from modern exchanges.

Without detailed information about automated trading support, API access, or advanced order types, it's difficult to assess whether WEEX provides the technical tools required by experienced cryptocurrency traders.

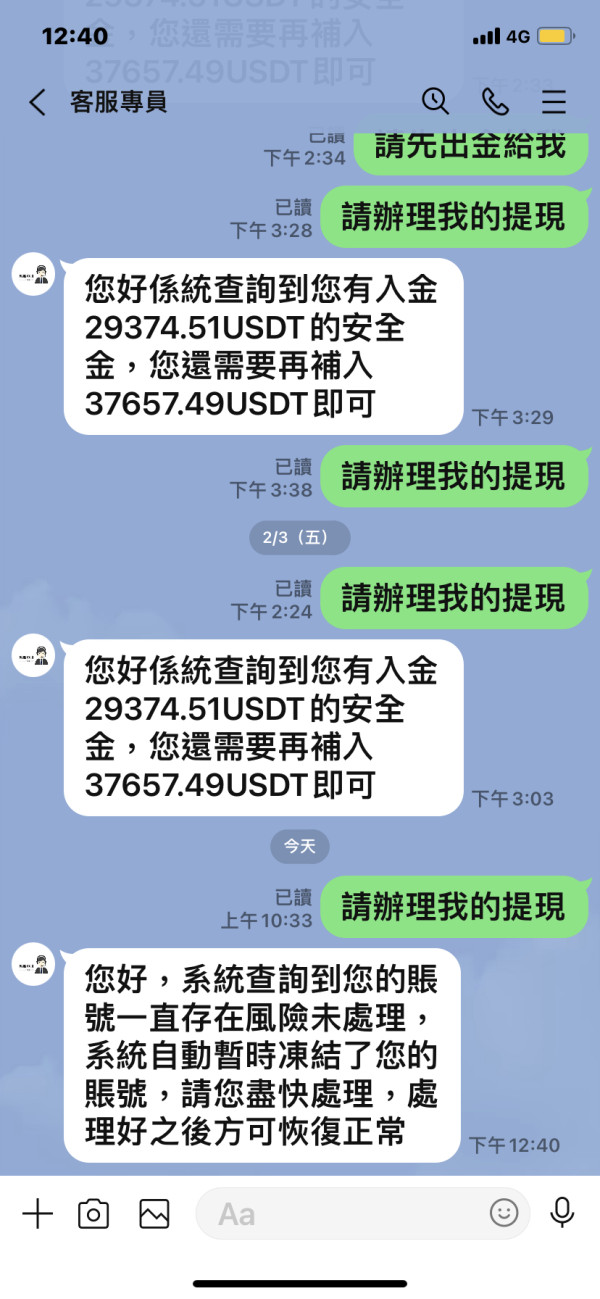

Customer Service and Support Analysis (Score: 4/10)

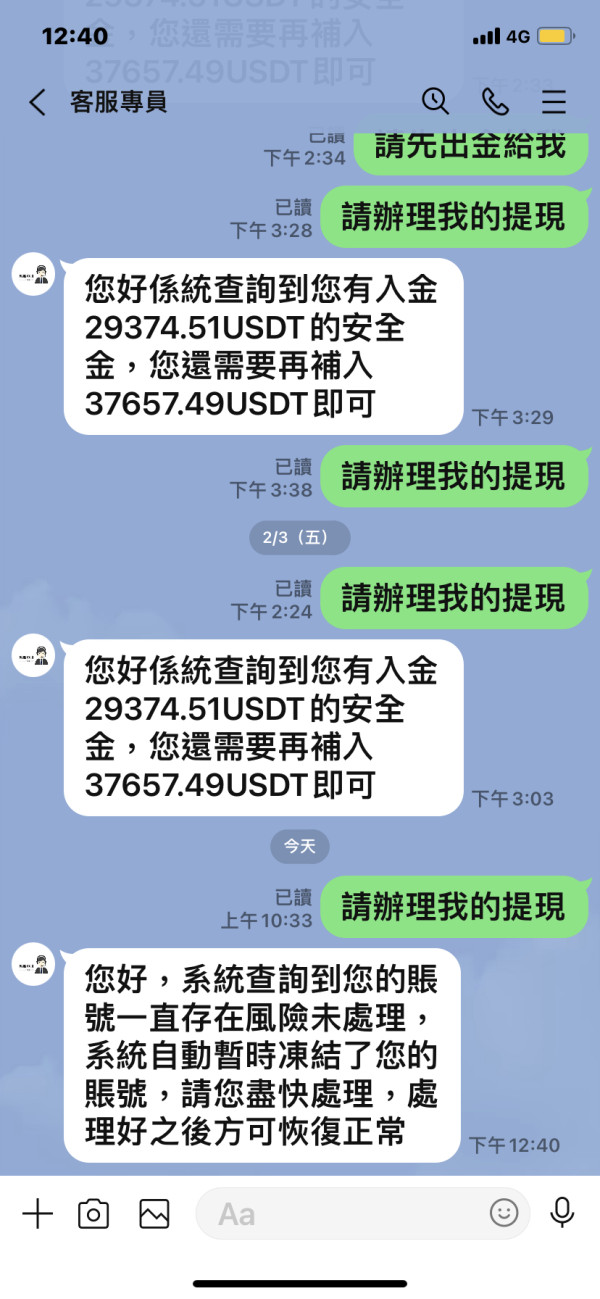

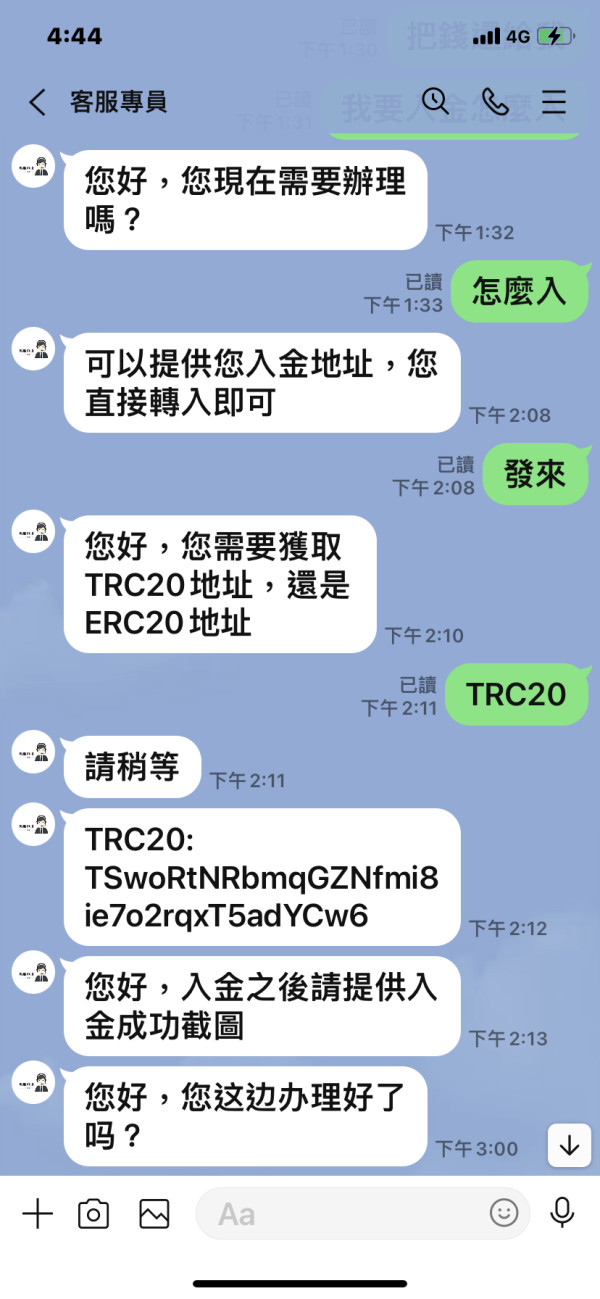

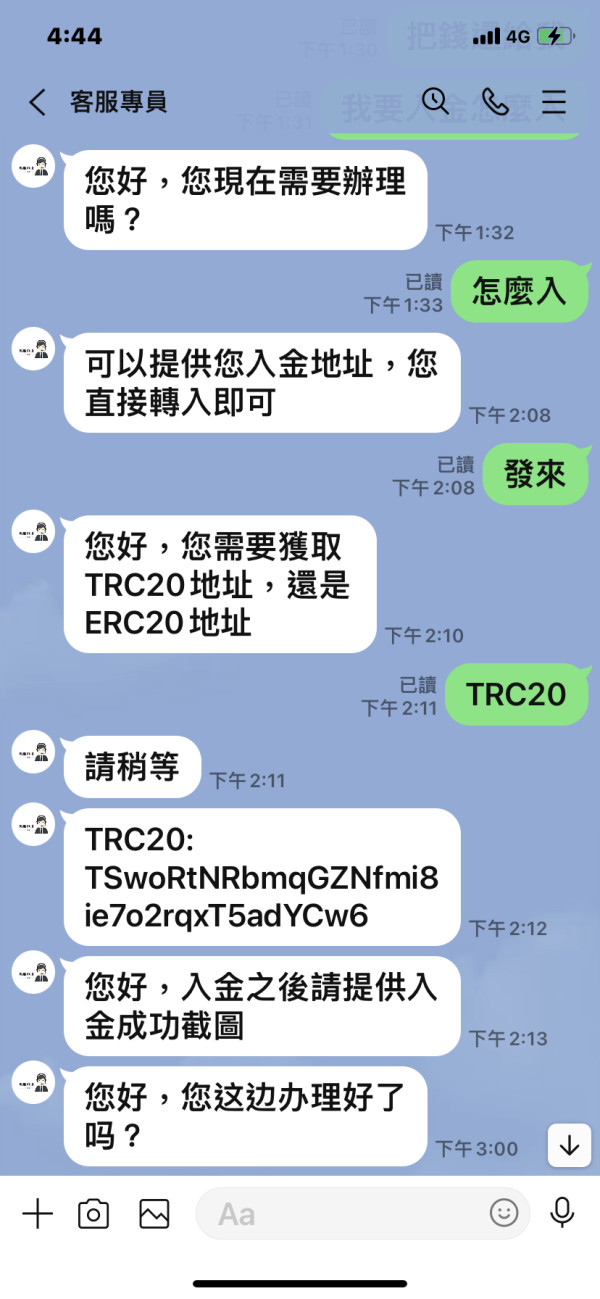

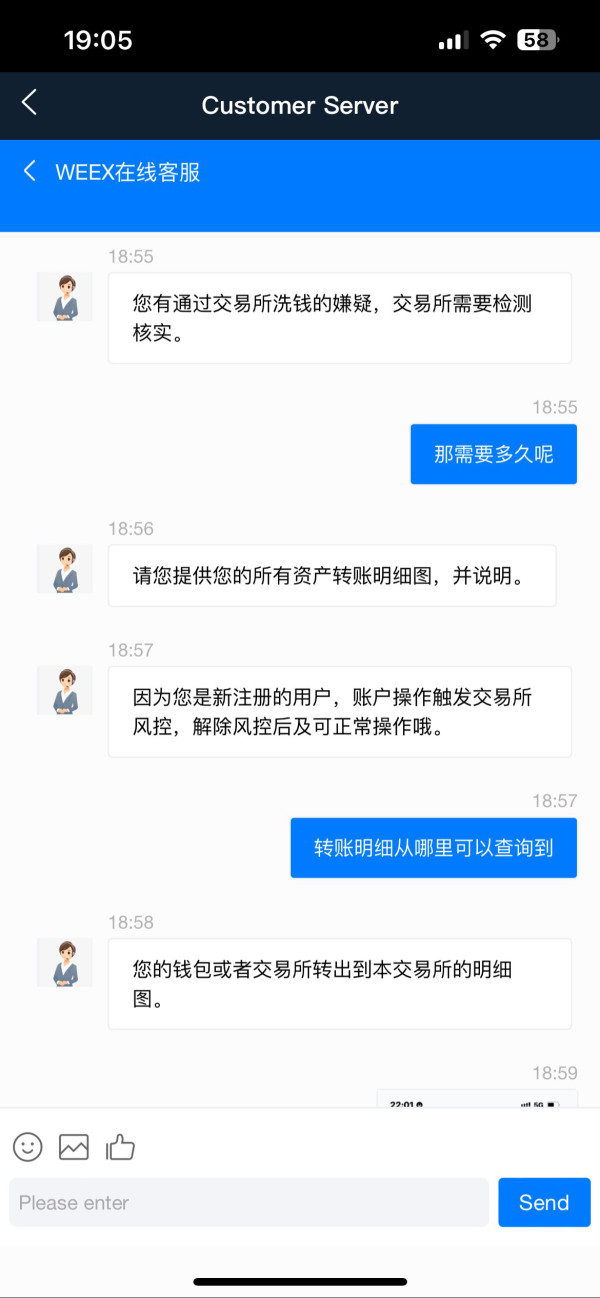

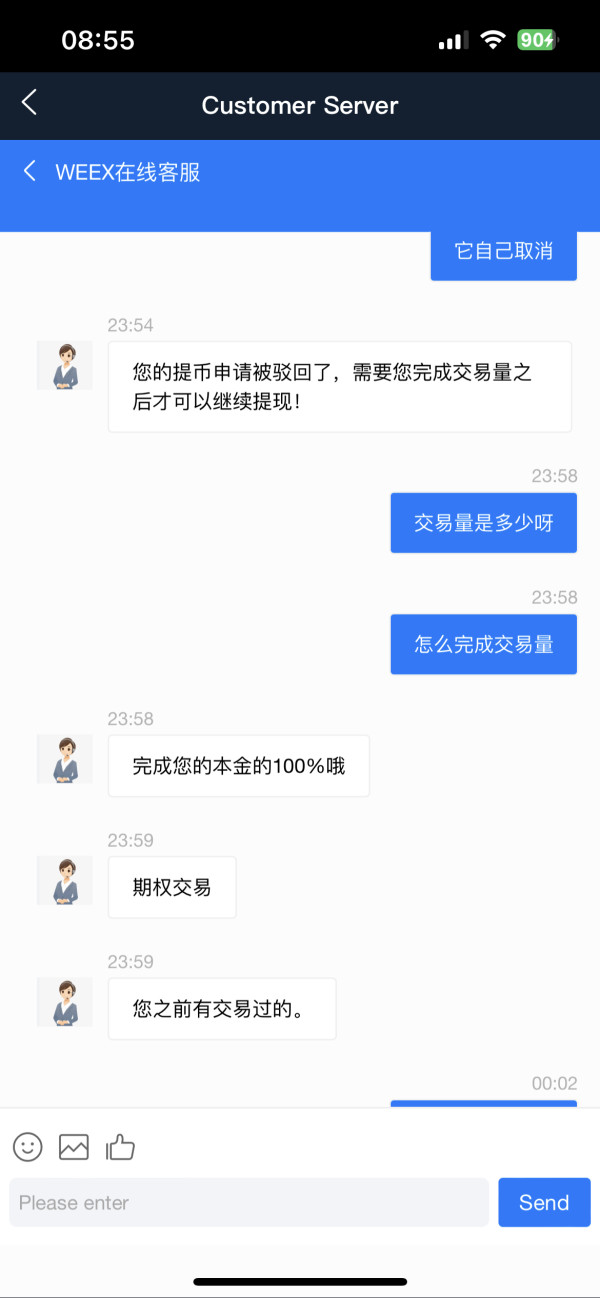

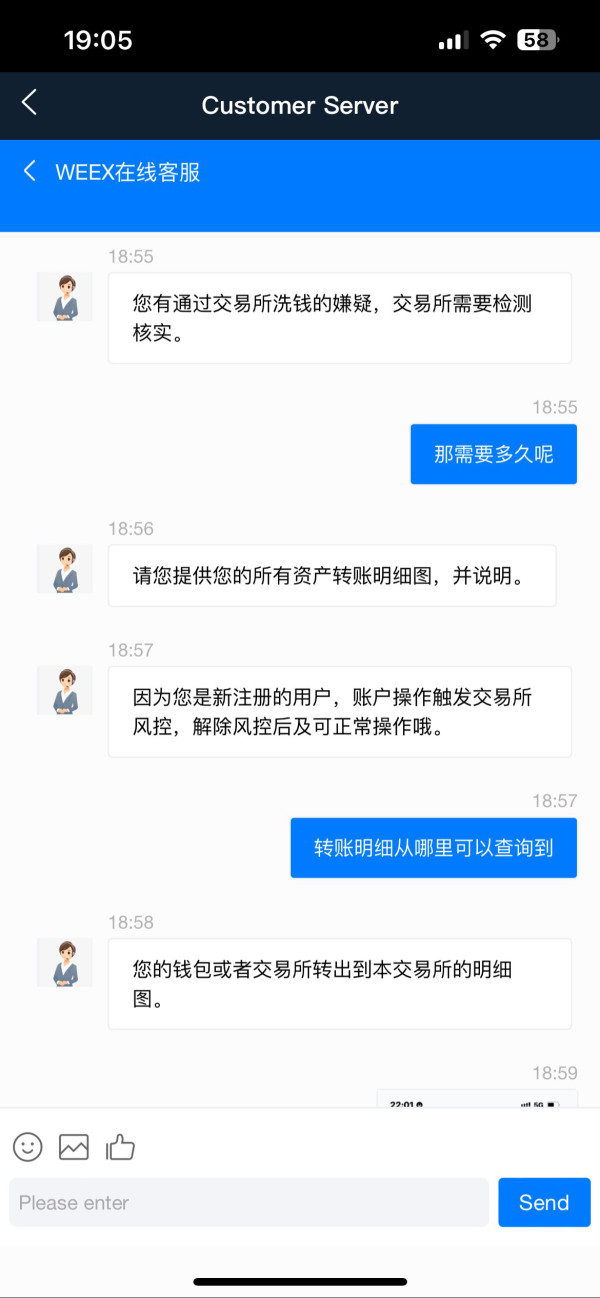

Customer service and support at WEEX receive a below-average rating based on available user feedback. Users have reported poor experiences with customer service responsiveness and problem-solving capabilities. The lack of detailed information about available support channels, response times, and service quality standards raises concerns about the platform's commitment to user support.

Available sources do not specify the customer service channels offered, such as live chat, email support, or phone assistance. The absence of clear information about support availability hours and multilingual support options further impacts the user experience, particularly for international users.

User feedback indicates that when issues arise, the resolution process is often lengthy and unsatisfactory. This is particularly concerning for a financial platform where timely support can be crucial for addressing trading issues or account problems.

The limited transparency about customer service standards and the negative user feedback suggest that WEEX has significant room for improvement in this area. For users considering this platform, the weak customer support infrastructure represents a notable risk factor.

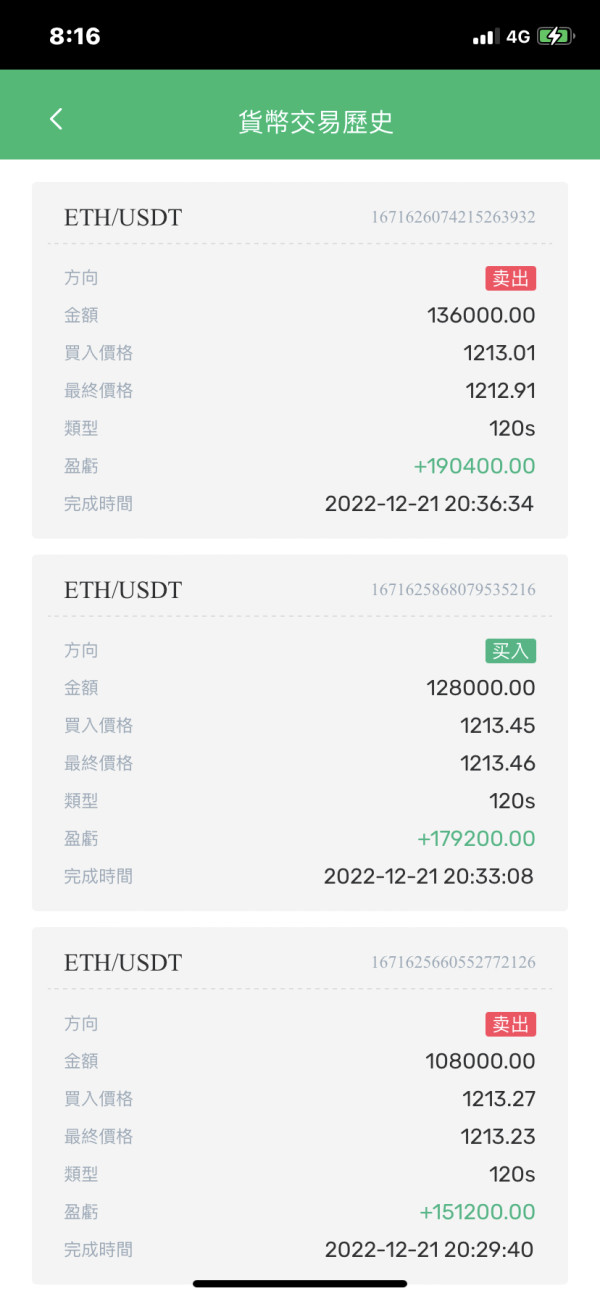

Trading Experience Analysis (Score: 5/10)

The trading experience at WEEX receives an average rating, reflecting mixed user feedback about platform performance and functionality. While the platform offers access to a wide range of cryptocurrencies and supports both spot and futures trading, users report varying levels of satisfaction with the actual trading environment.

Available sources do not provide detailed information about platform stability, order execution speed, or trading interface quality. The lack of specific technical performance data makes it difficult to assess whether WEEX can handle high-volume trading periods or provide reliable execution during market volatility.

User feedback suggests that the trading experience is generally functional but lacks the sophistication and reliability that traders expect from modern cryptocurrency exchanges. Issues with platform stability and order execution have been reported, though specific details about these problems are not extensively documented.

The absence of detailed information about mobile trading capabilities, advanced order types, or trading tools further impacts the overall trading experience assessment. Users seeking a comprehensive trading environment may find WEEX's offerings insufficient for their needs.

Trust and Safety Analysis (Score: 2/10)

Trust and safety receive the lowest rating in this WEEX review, primarily due to the platform's unregulated status and lack of transparency about security measures. Operating without regulatory oversight means users have limited protection in case of platform issues, fund security breaches, or operational problems.

The absence of regulatory supervision from recognized financial authorities represents a significant risk factor for users. Without regulatory oversight, there are no mandated security standards, fund protection requirements, or operational transparency obligations that regulated exchanges must meet.

Available sources do not detail specific security measures, fund storage practices, or insurance coverage that might protect user assets. The lack of information about cold storage practices, security audits, or compliance procedures raises serious concerns about the safety of user funds.

User feedback reflects concerns about the platform's trustworthiness, with the overall rating of 2 out of 10 indicating widespread dissatisfaction with the platform's reliability and safety measures. The combination of unregulated status and negative user feedback creates a high-risk environment for potential users.

User Experience Analysis (Score: 3/10)

The user experience at WEEX receives a poor rating based on the overall user satisfaction score of 2 out of 10 and consistent negative feedback from users. While specific details about interface design and usability are not extensively documented, user reports suggest significant issues with the overall platform experience.

The registration and verification process, while featuring high no-KYC limits, appears to lack the clarity and user-friendliness that modern traders expect. Available sources do not provide detailed information about the platform's interface design, navigation structure, or mobile accessibility, which are crucial factors in user experience assessment.

Common user complaints appear to focus on customer service quality, platform reliability, and overall satisfaction with the trading environment. The lack of detailed information about user onboarding, educational resources, and platform tutorials suggests limited attention to user experience optimization.

The combination of negative user feedback, limited transparency about platform features, and poor customer service creates an overall user experience that falls well below industry standards. Users considering WEEX should be prepared for potential frustrations and limitations in platform usability.

Conclusion

This comprehensive WEEX review reveals a cryptocurrency exchange with significant limitations and risks that potential users must carefully consider. While WEEX offers access to over 100 cryptocurrencies and features high no-KYC limits that may appeal to privacy-conscious traders, these benefits are overshadowed by substantial concerns about safety, reliability, and user satisfaction.

The platform's unregulated status represents its most significant weakness, leaving users without the protections typically associated with licensed financial institutions. Combined with poor user feedback, limited transparency about operational procedures, and inadequate customer service, WEEX presents a high-risk trading environment that may only be suitable for experienced cryptocurrency traders who fully understand and accept these risks.

For users specifically interested in cryptocurrency trading with minimal identity verification requirements, WEEX may offer some utility, but the overall risk-to-benefit ratio appears unfavorable compared to regulated alternatives in the cryptocurrency exchange market.