CJC Markets 2025 Review: Everything You Need to Know

CJC Markets has garnered mixed reviews in the forex trading community, with significant concerns regarding its legitimacy and user experience. While it offers a variety of trading instruments and utilizes the popular MetaTrader 4 platform, numerous reports suggest potential issues with withdrawals and customer support. Notably, the broker's regulatory claims have been questioned, raising red flags for prospective traders.

Note: It is essential to consider the broker's various regional entities, as these can impact regulatory oversight and user experience. Our analysis aims for fairness and accuracy by incorporating diverse sources.

Rating Overview

We assess brokers based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

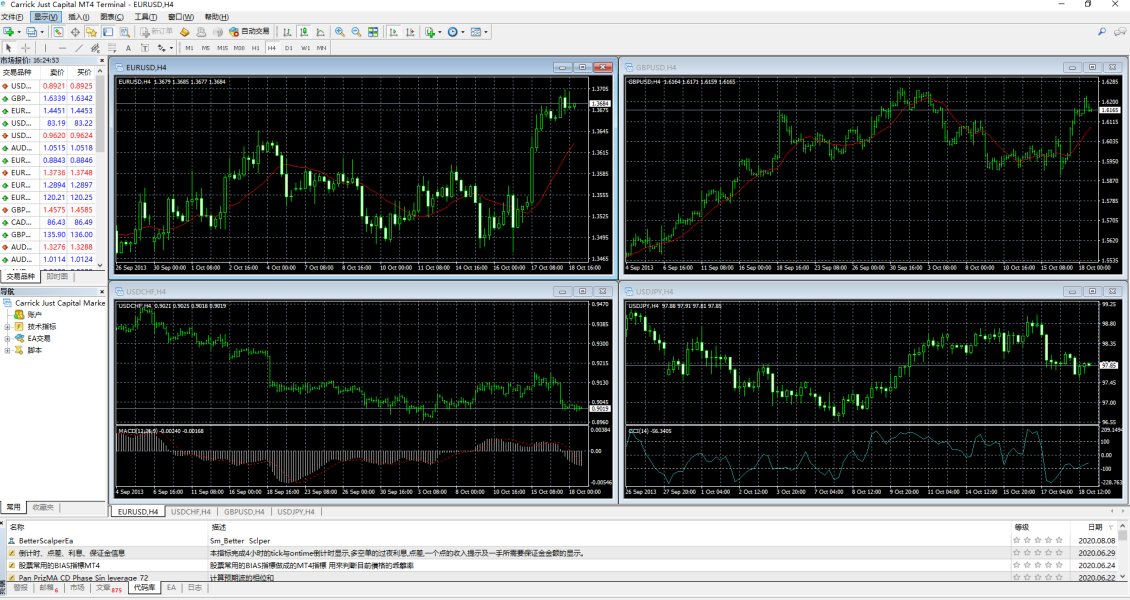

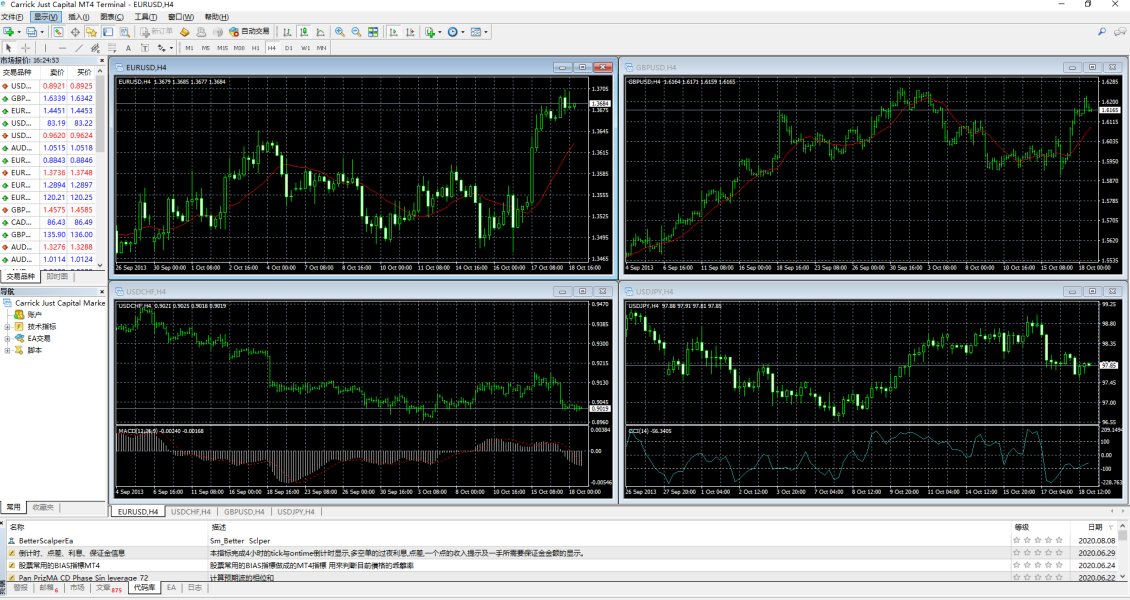

Founded in 2012, CJC Markets, also known as Carrick Just Capital Markets Limited, is an online forex and CFD broker based in Auckland, New Zealand. The broker claims to provide access to a wide range of trading instruments, including forex, commodities, cryptocurrencies, and equity indices. It primarily operates on the MetaTrader 4 platform, which is favored for its user-friendly interface and robust trading tools. However, the broker's regulatory status is ambiguous, with claims of licenses from multiple jurisdictions that may not be entirely valid.

Detailed Breakdown

-

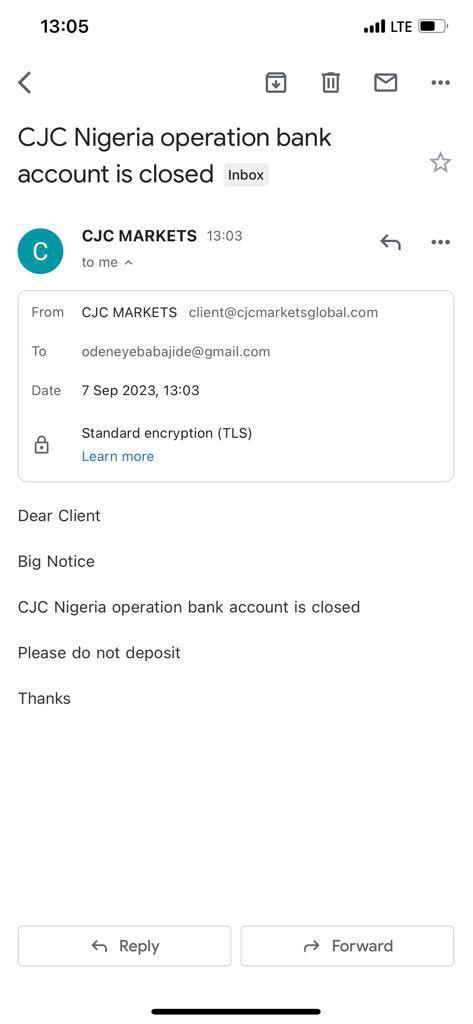

Regulatory Areas: CJC Markets claims to hold licenses from the Financial Markets Authority (FMA) in New Zealand, the Australian Securities and Investments Commission (ASIC), and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, multiple sources indicate that these claims may not be substantiated, with warnings issued by the FMA regarding the broker's operations.

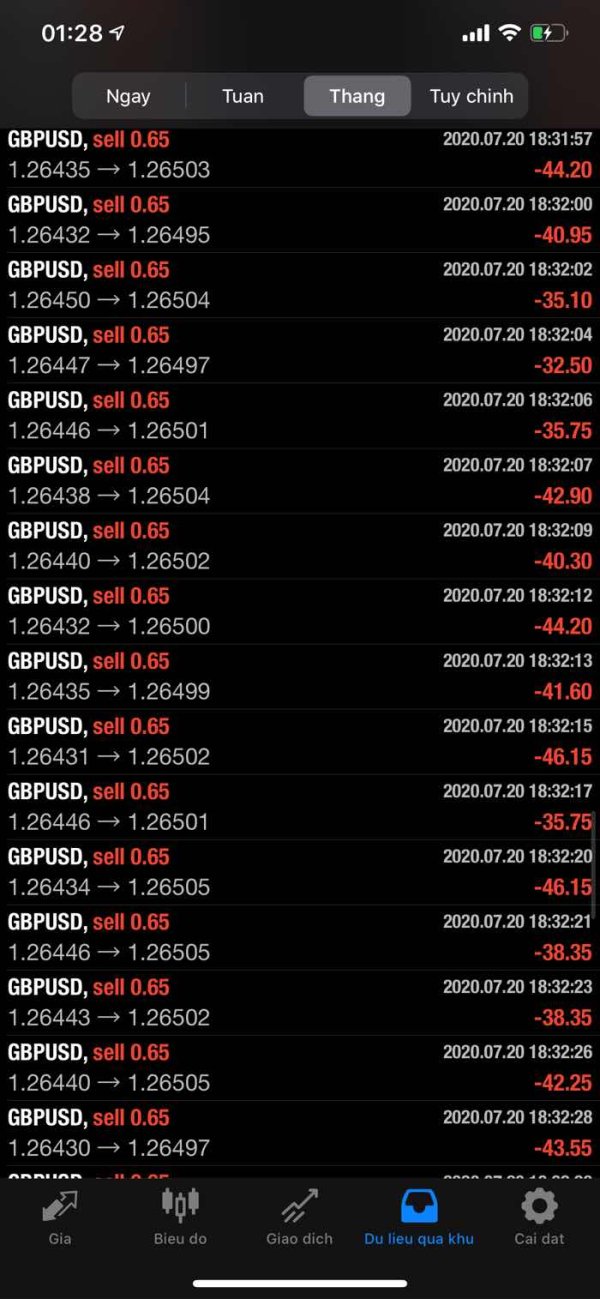

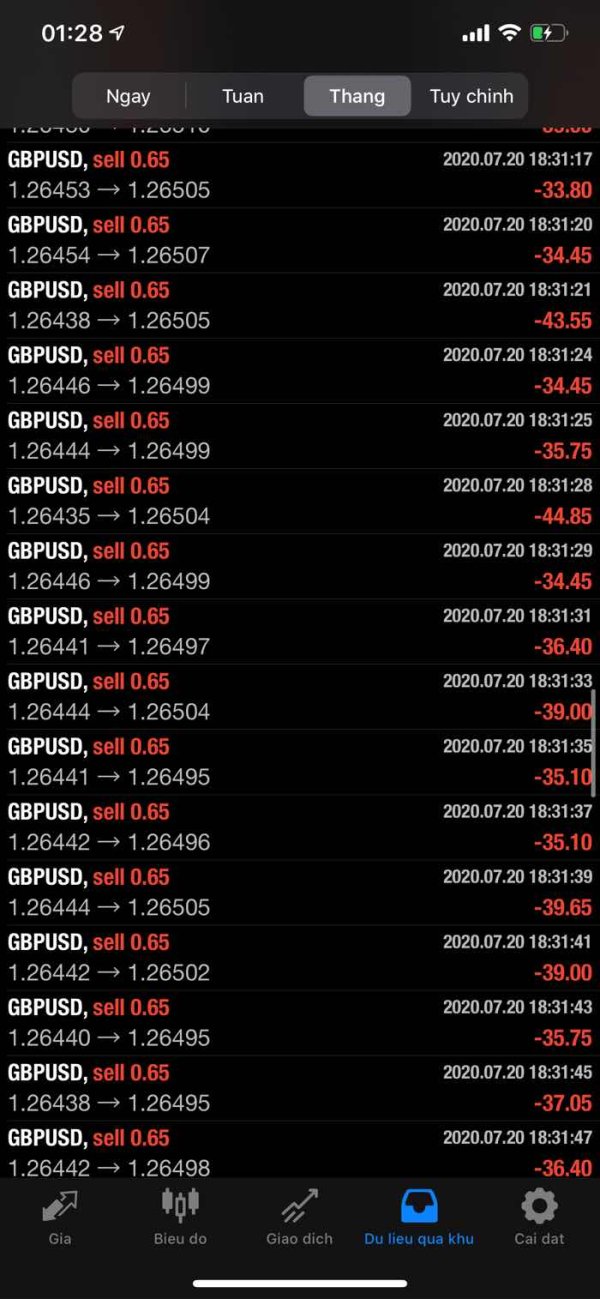

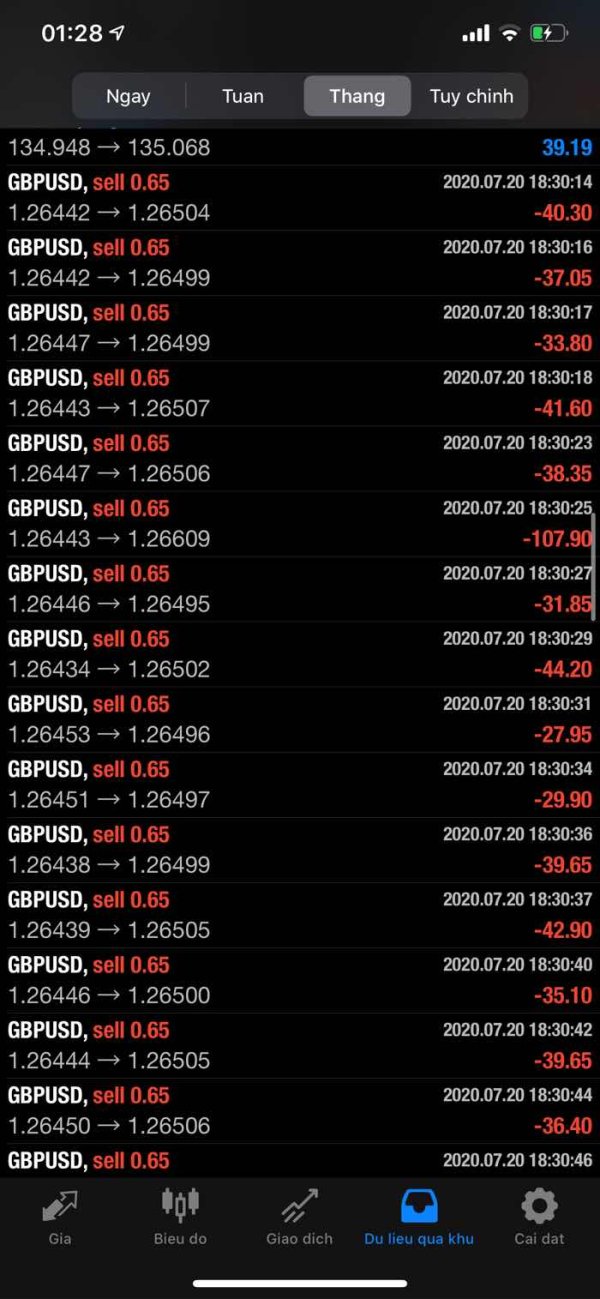

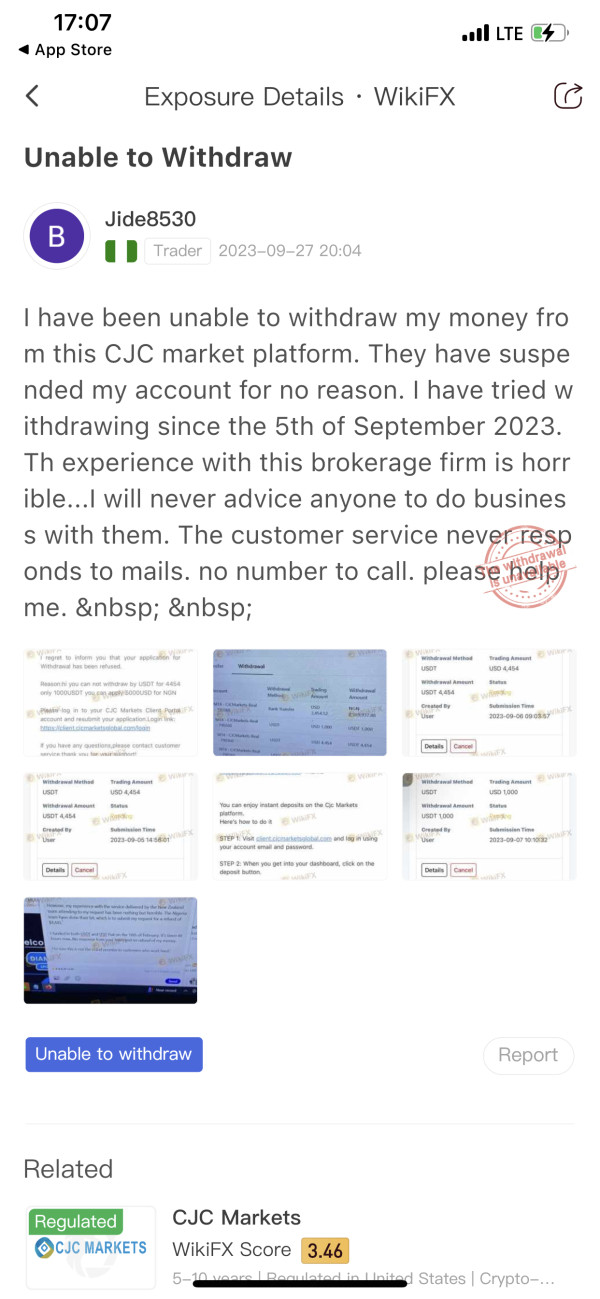

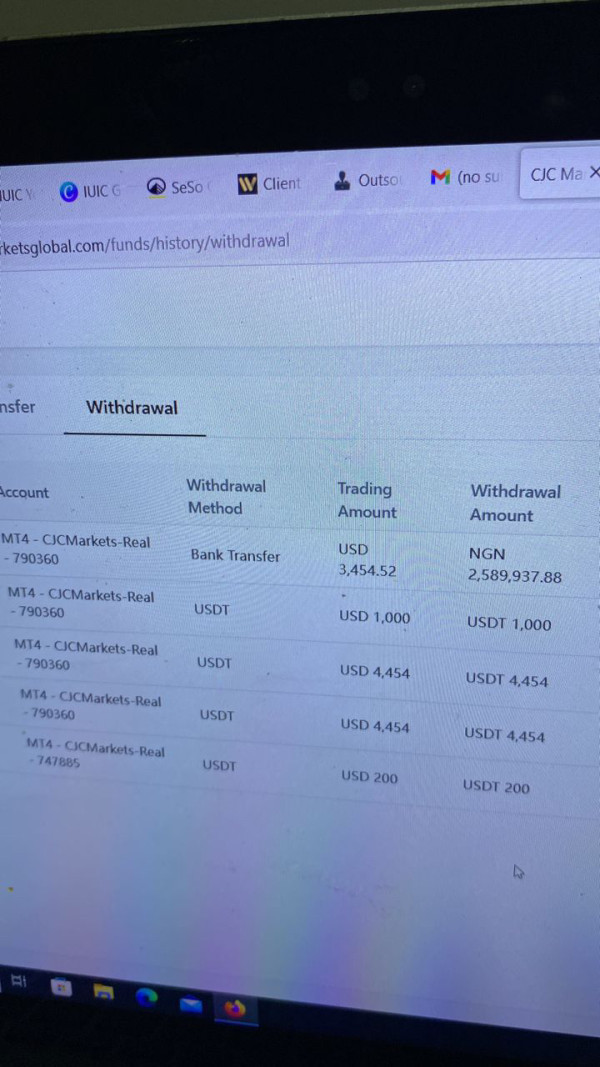

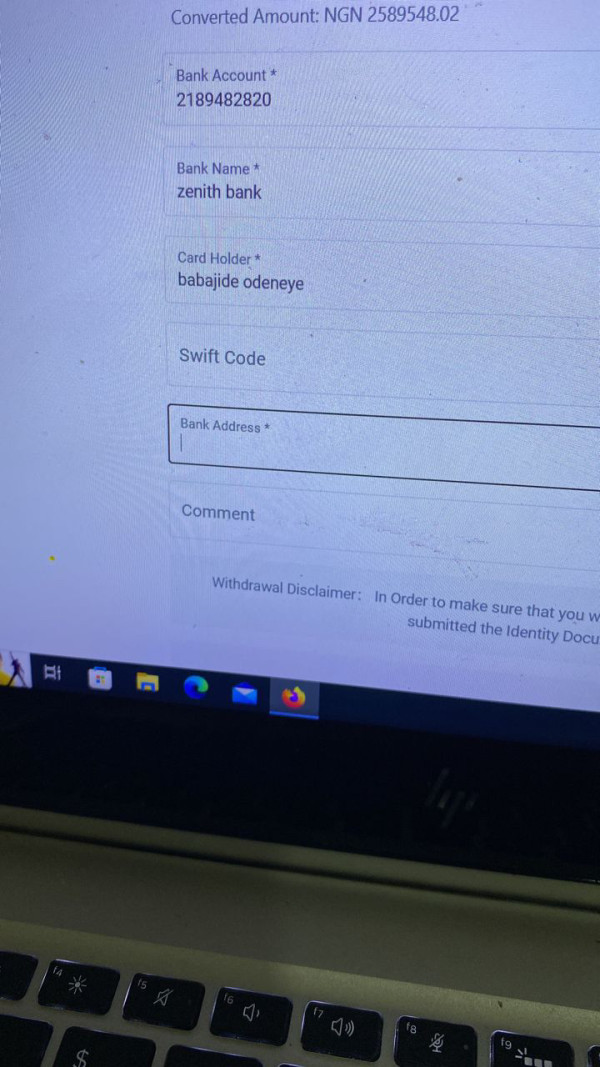

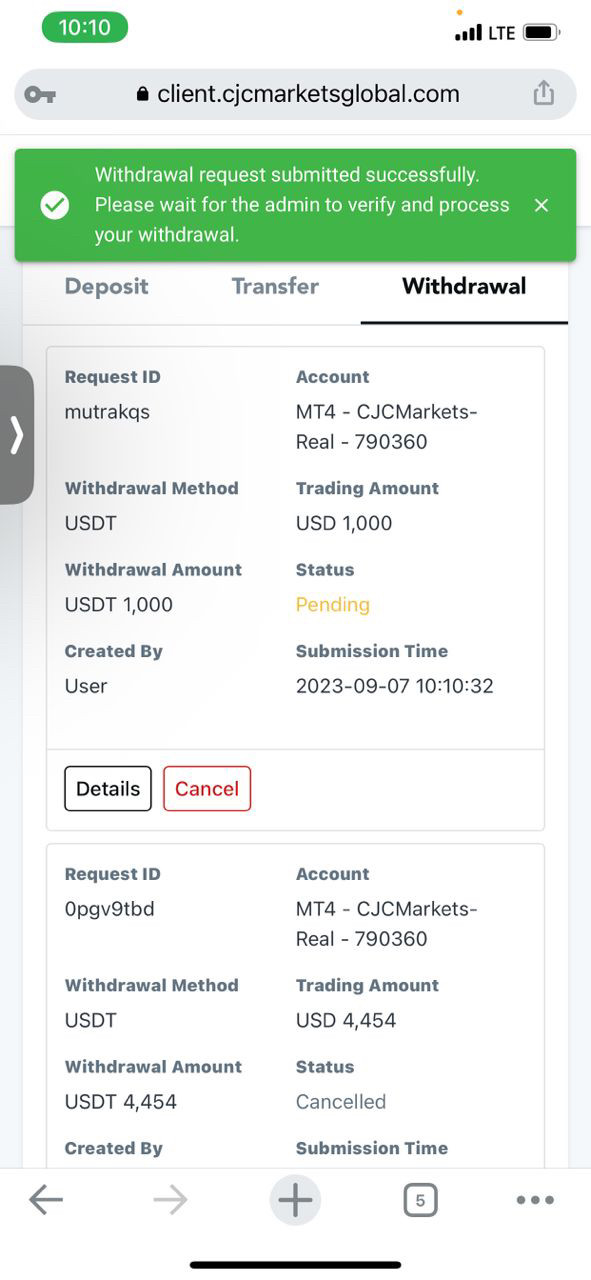

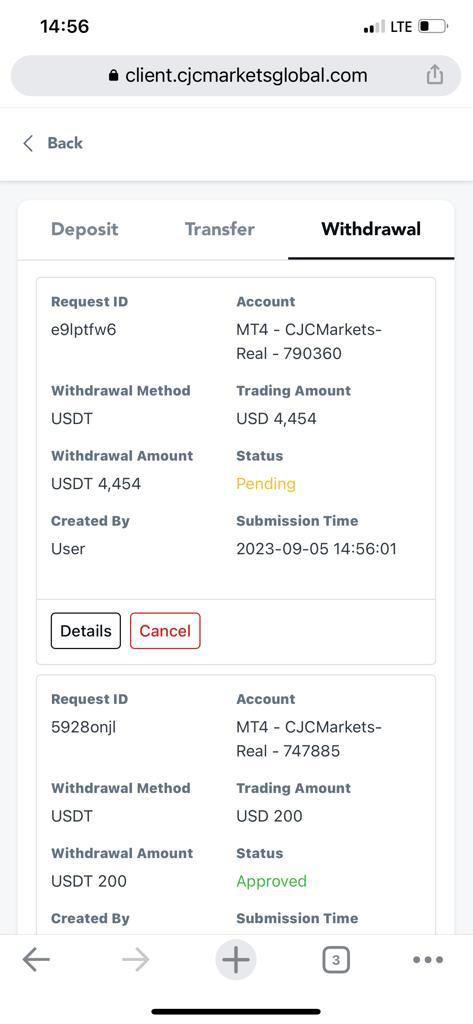

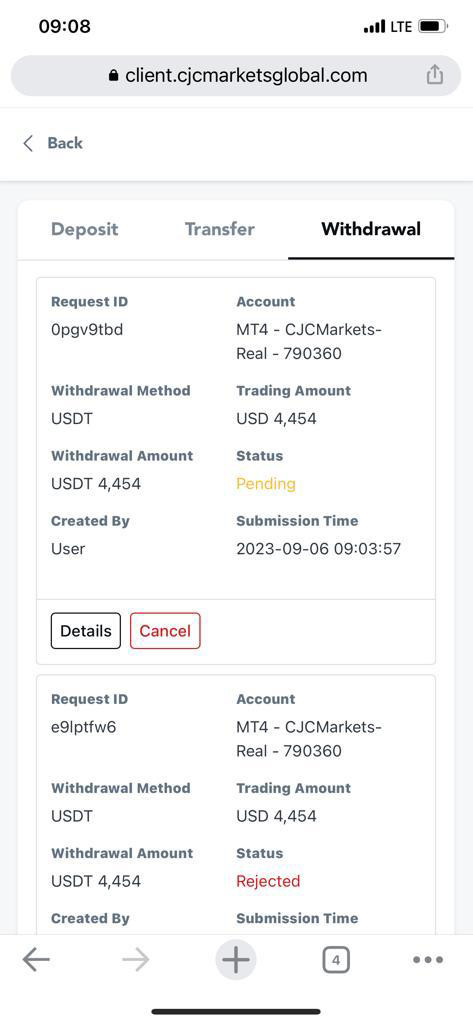

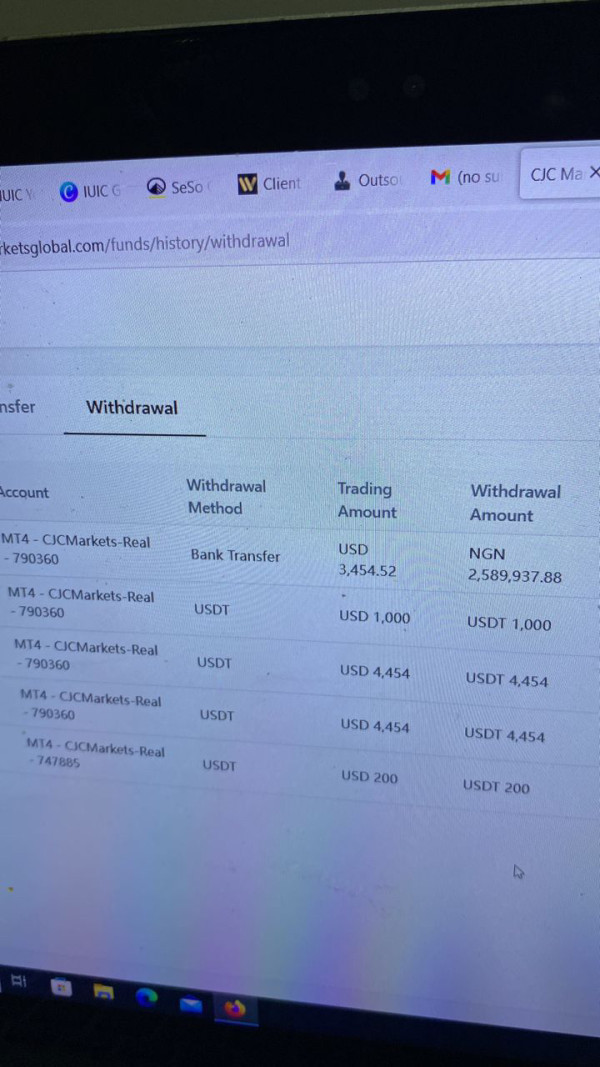

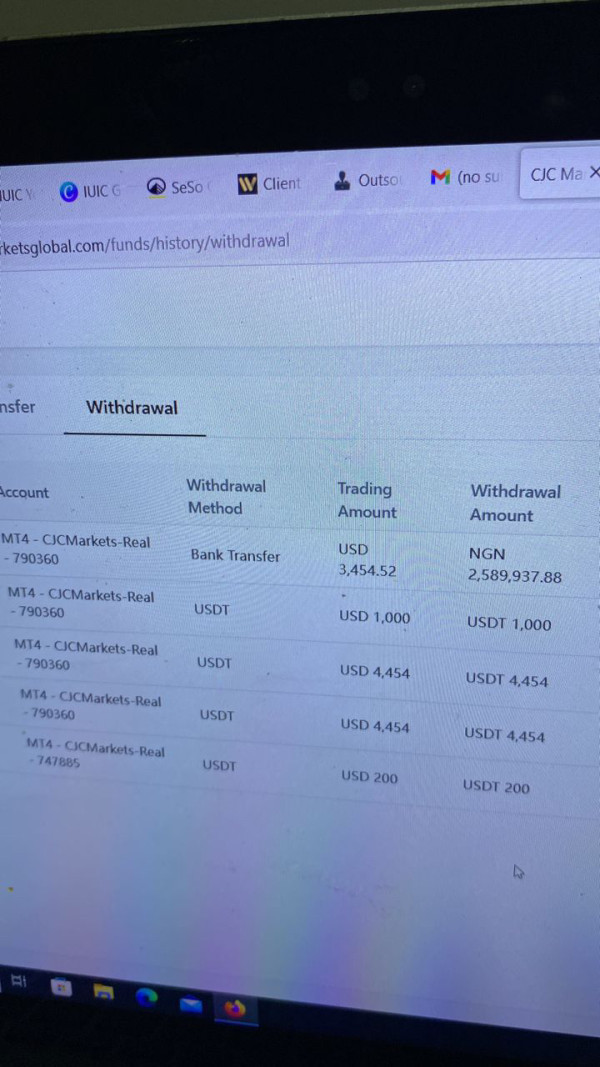

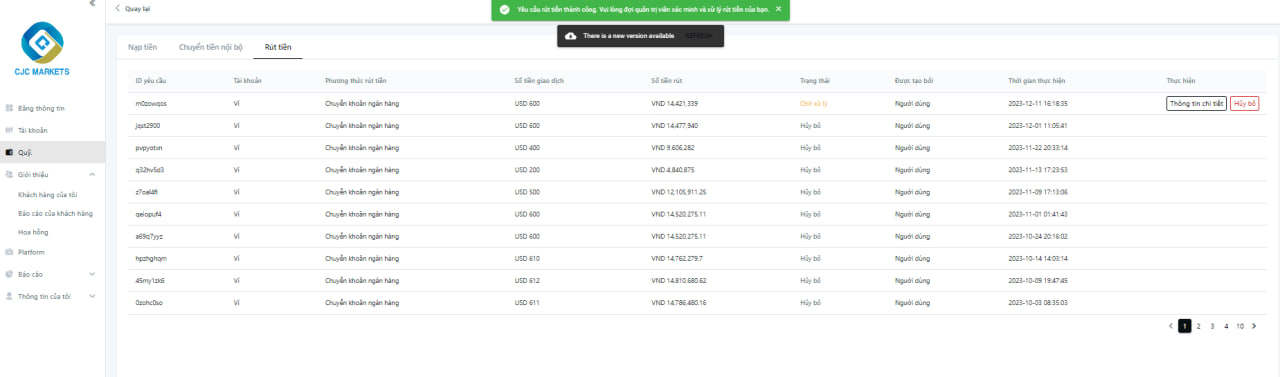

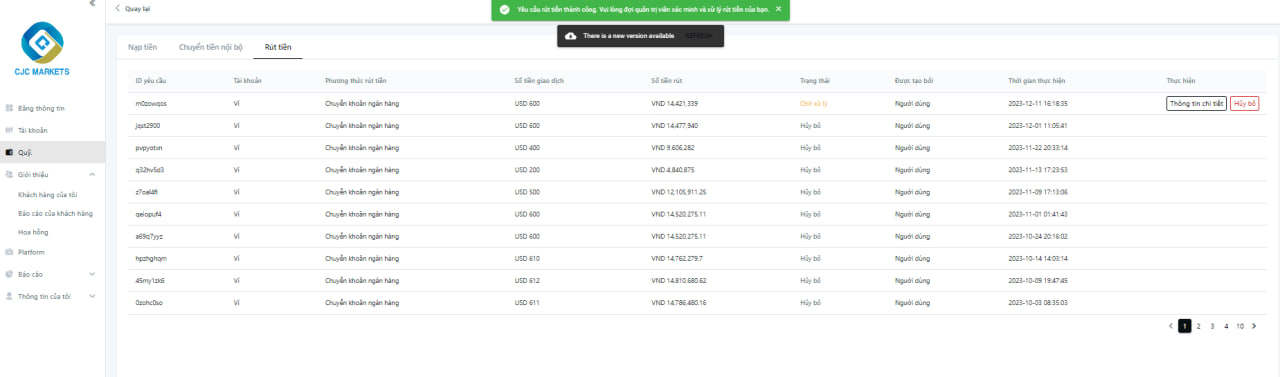

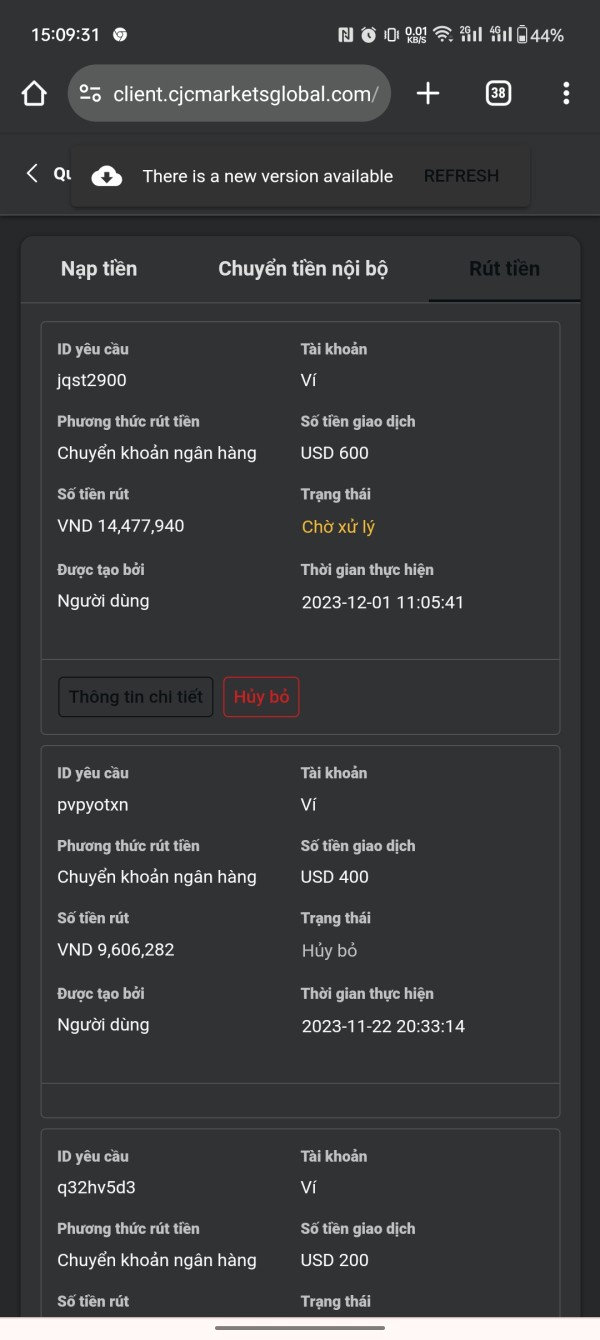

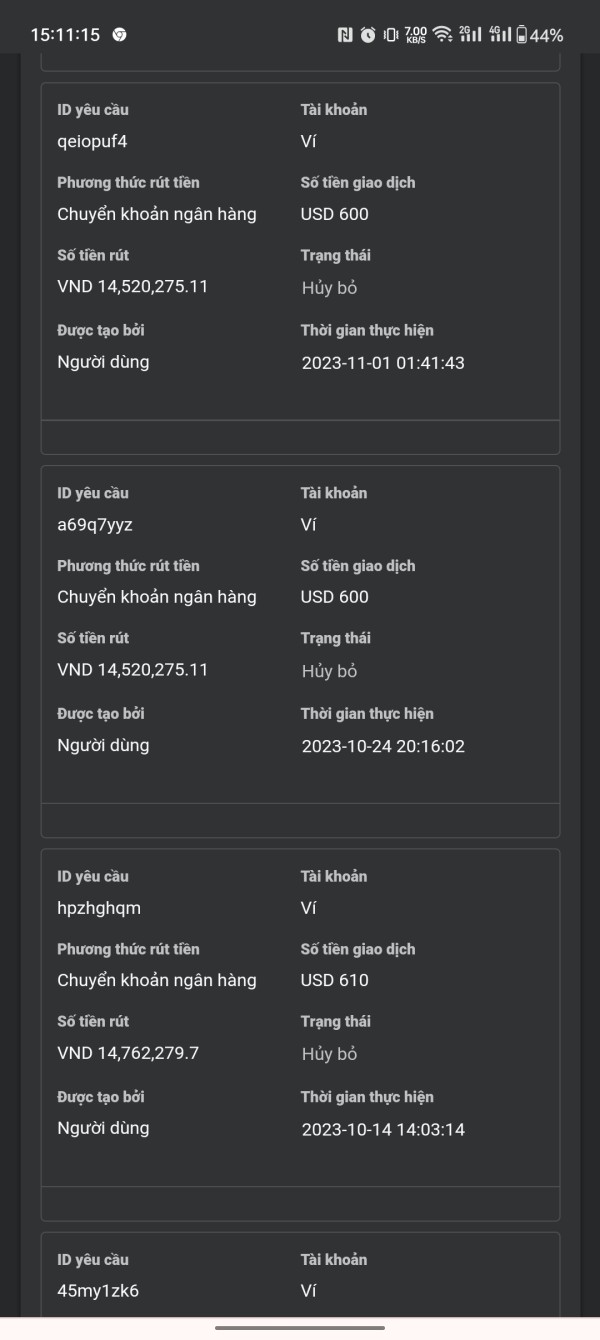

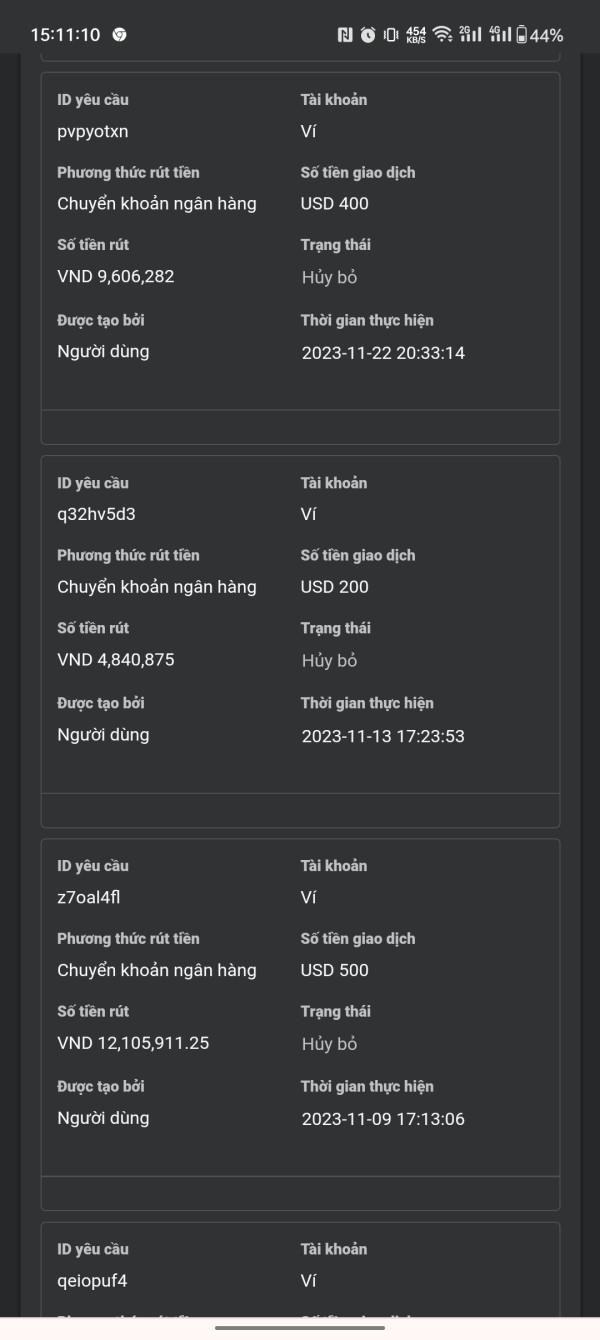

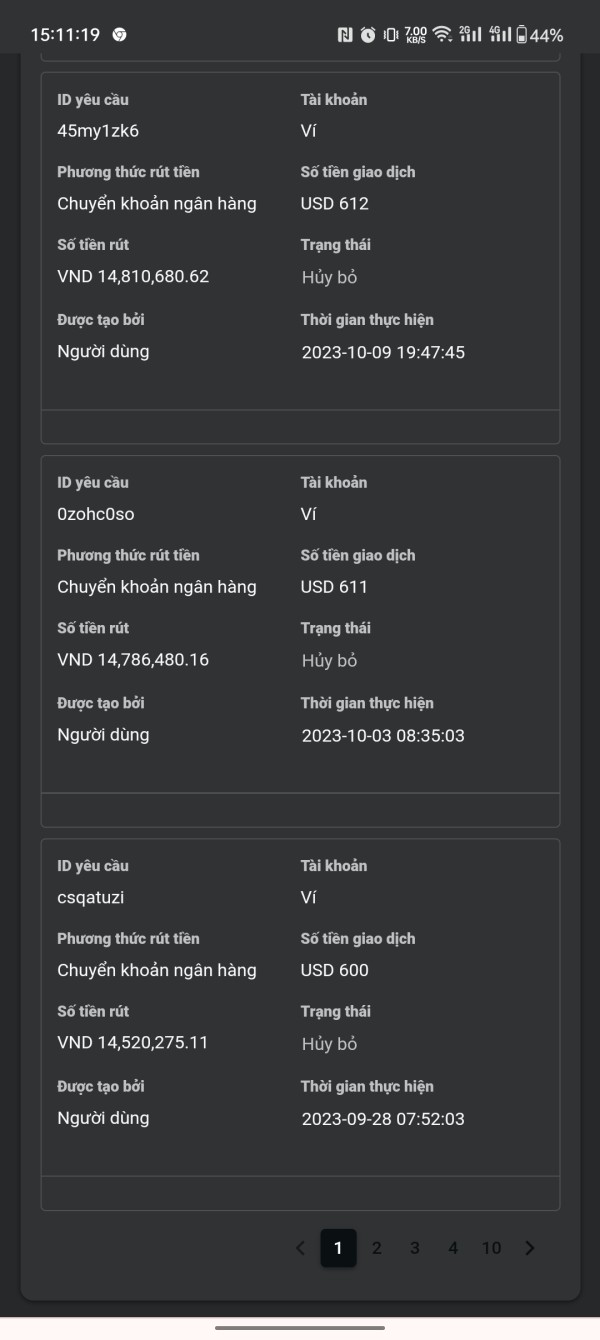

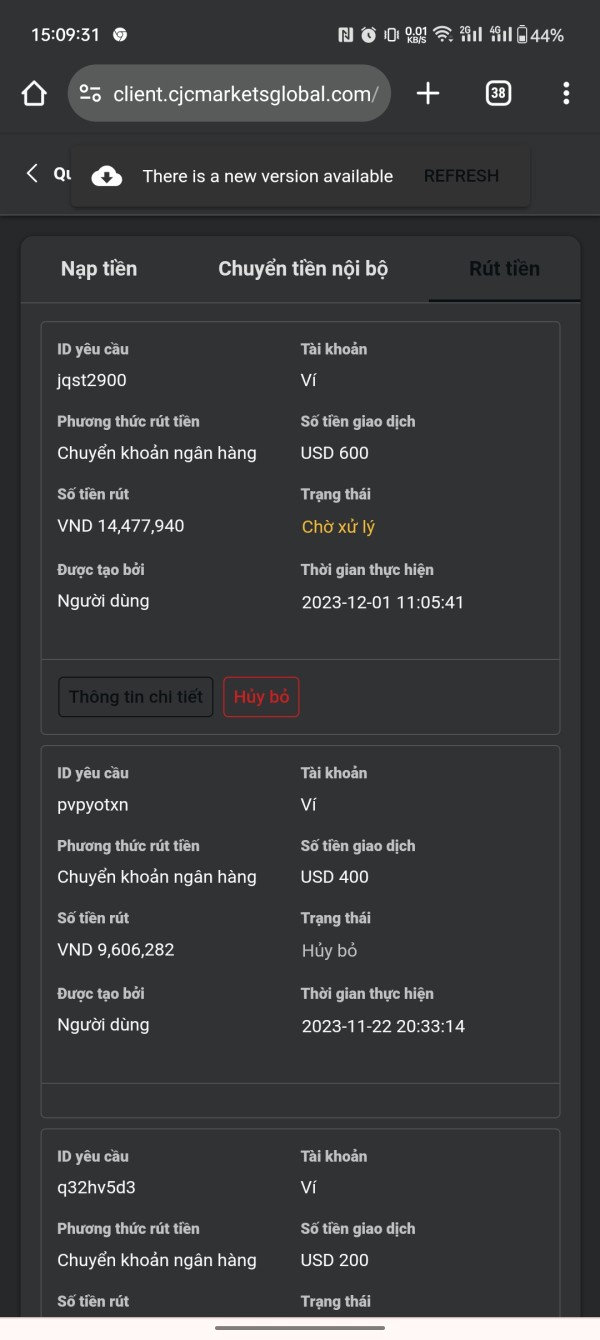

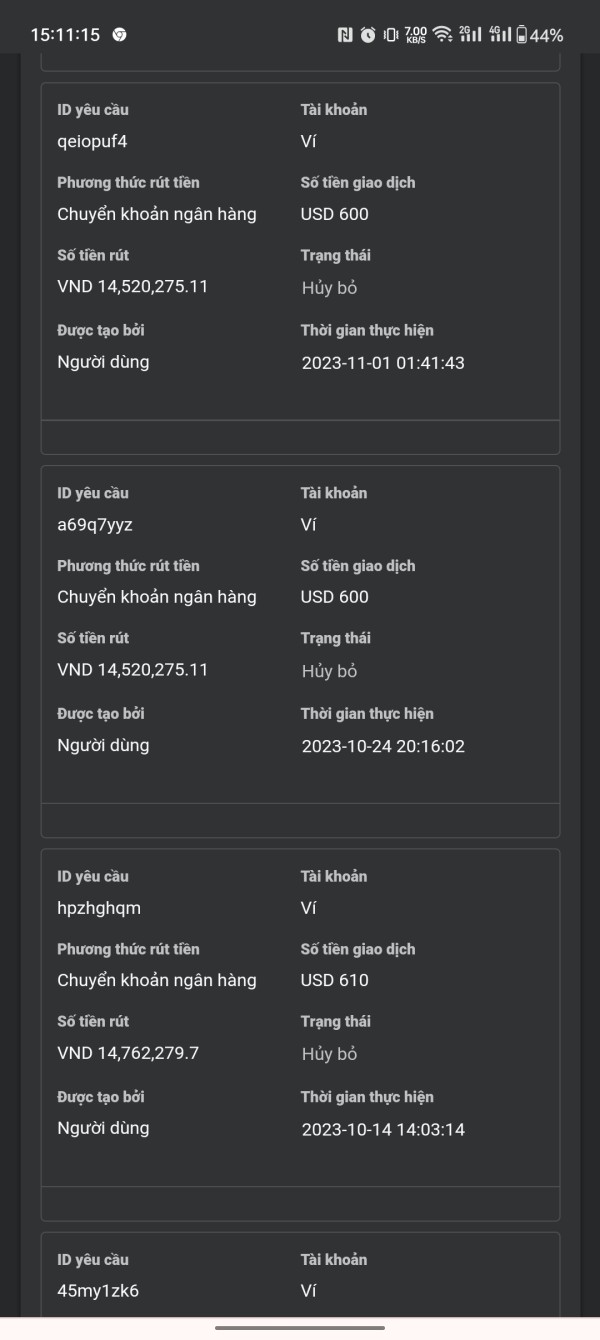

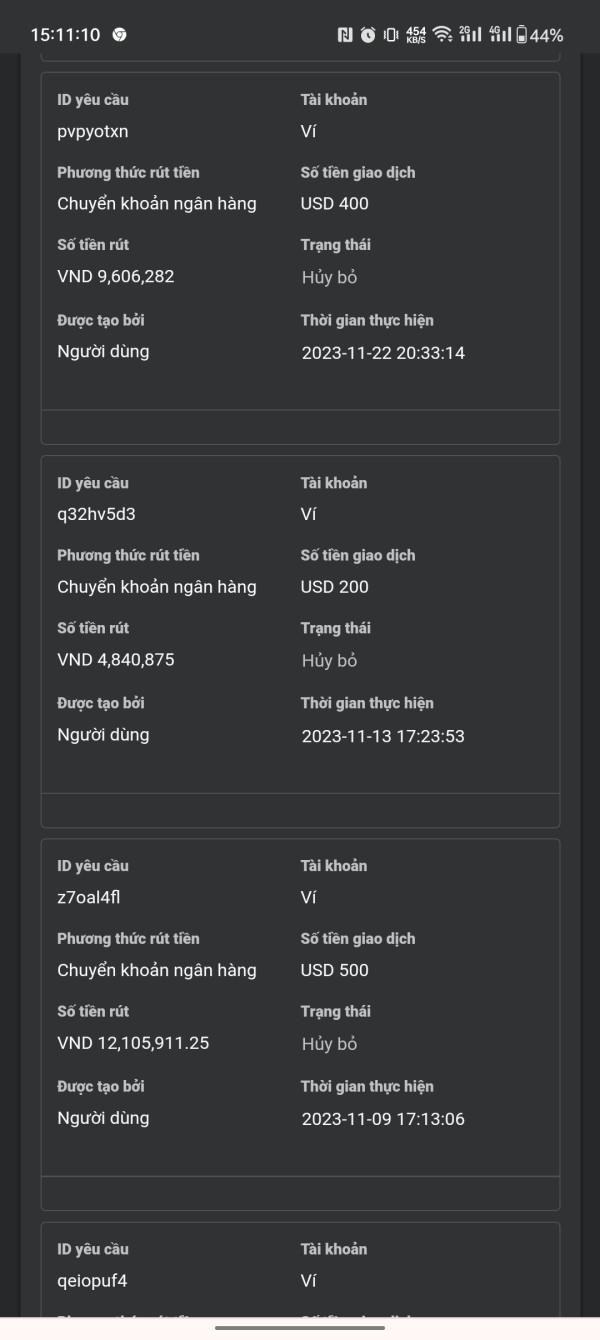

Deposit/Withdrawal Methods: The broker supports various deposit methods, including bank transfers, credit/debit cards, and cryptocurrencies like Bitcoin and Tether. However, user reviews highlight issues with withdrawals, with many customers reporting difficulties in accessing their funds.

Minimum Deposit: The minimum deposit requirement is set at $1,000, which is considered high compared to other brokers that allow starting with significantly lower amounts.

Bonuses/Promotions: There are no notable bonuses or promotions mentioned in the available reviews, which is not uncommon in the industry.

Asset Classes: CJC Markets offers access to over 500 trading instruments, including more than 100 currency pairs, precious metals, equity indices, and cryptocurrencies.

Costs: The spreads start from 1.5 pips for the standard account, with no commissions on this account type. However, there are reports of hidden fees and high withdrawal costs, starting from $25, raising concerns about the overall cost-effectiveness of trading with this broker.

Leverage: Maximum leverage is advertised at up to 1:400, which is significantly higher than what is permitted by many regulatory bodies, including ASIC, where the maximum is typically 1:30.

Trading Platforms: CJC Markets primarily offers the MetaTrader 4 platform, which is widely regarded for its advanced charting capabilities and customizability.

Restricted Regions: The broker does not accept clients from the United States or China, which is a common practice among many forex brokers to comply with regulatory restrictions.

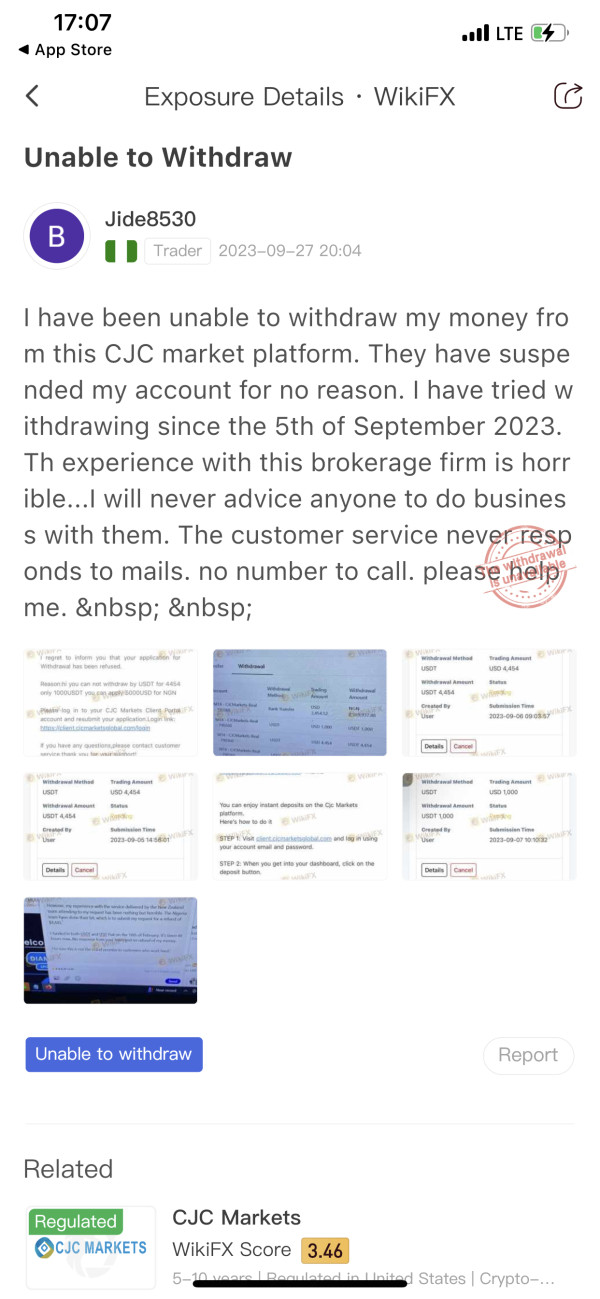

Customer Service Languages: Support is available in multiple languages, but user reviews consistently point to a lack of effective customer service, with many clients reporting long response times or no replies at all.

Rating Breakdown

Account Conditions: 5/10

CJC Markets offers three account types: Standard, VIP, and ECN, with minimum deposits ranging from $1,000 to $50,000. However, the high minimum deposit for the standard account may deter new traders, and the lack of transparency regarding account features raises concerns.

While the broker provides access to the MetaTrader 4 platform, the educational resources available on the website are limited. This lack of support may hinder novice traders seeking to enhance their trading knowledge.

Customer Service & Support: 3/10

User feedback highlights significant issues with customer support, including unresponsiveness and a lack of clarity regarding withdrawal processes. This can lead to frustration and a sense of insecurity among traders.

Trading Experience: 5/10

The trading experience on the MetaTrader 4 platform is generally positive, but issues with execution speed and reliability have been reported. Additionally, the presence of hidden fees can impact overall trading satisfaction.

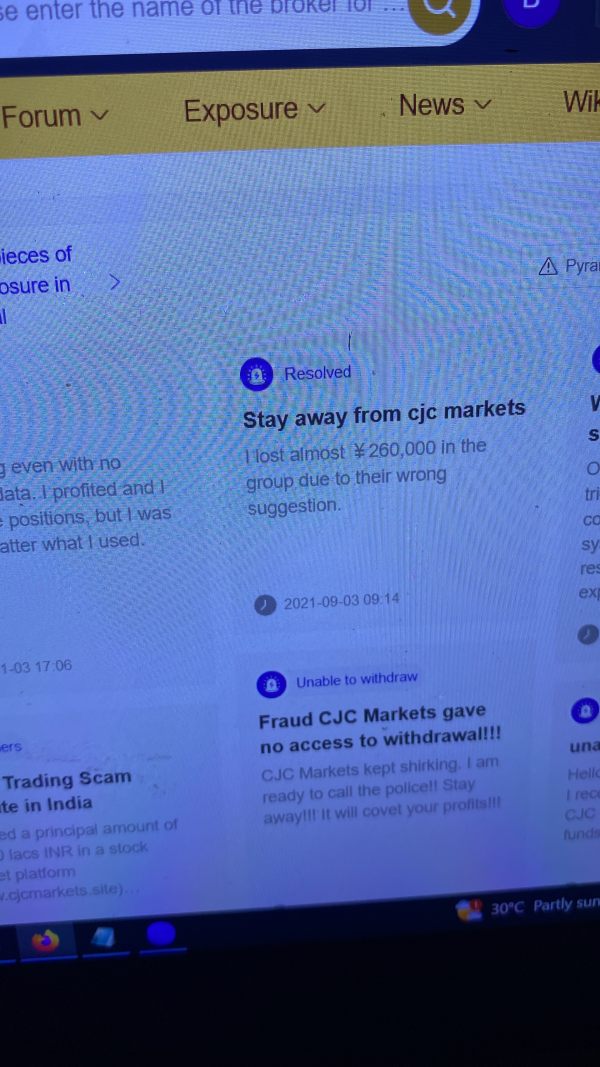

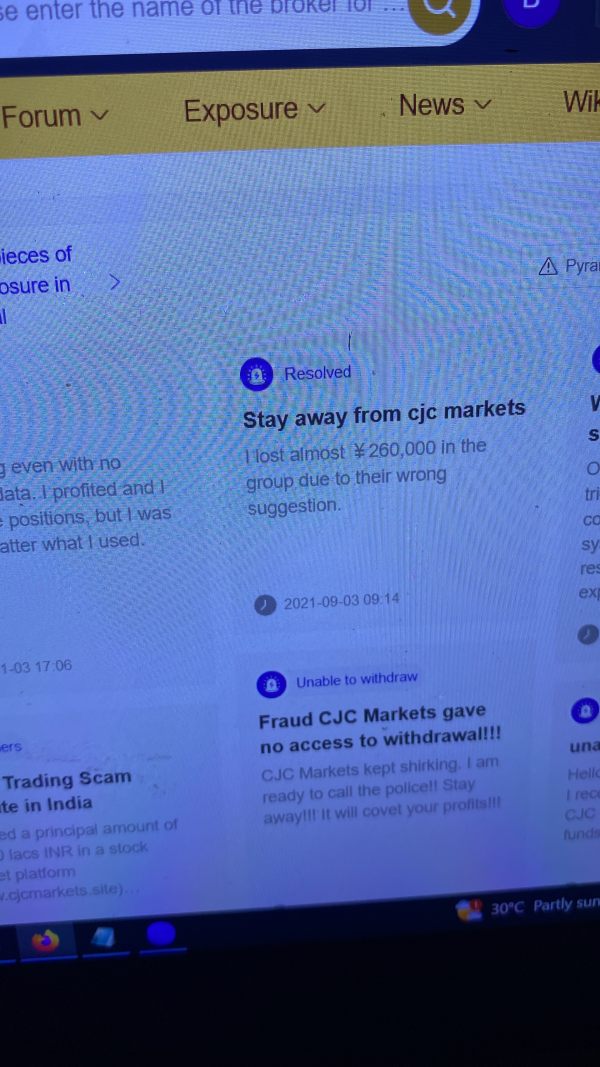

Trustworthiness: 3/10

Given the mixed reviews and questions surrounding its regulatory status, CJC Markets scores low on trustworthiness. The presence of warnings from regulatory bodies further compounds these concerns.

User Experience: 4/10

While some users report positive experiences, the overall sentiment is marred by complaints regarding withdrawal issues and customer service. This disparity indicates a lack of consistency in user experience.

Conclusion

In summary, CJC Markets presents a mixed picture for prospective traders. While it offers a range of trading instruments and utilizes a reputable trading platform, significant concerns about regulatory legitimacy, customer service, and withdrawal issues cannot be overlooked. Traders should exercise caution and thoroughly research before committing any funds to this broker.

For those considering trading with CJC Markets, it is advisable to weigh the potential risks against the benefits and to remain vigilant regarding the broker's practices.