UEZ Markets 2025 Review: Everything You Need to Know

Executive Summary

UEZ Markets is a new forex and cryptocurrency broker. The company has received good feedback from users who have tried their services. User reviews show the broker has a solid reputation with ratings of 4/5 and a 3.61/5 TrustScore on different review platforms, which means users are generally happy with their experience. The platform mainly helps traders who want to trade both regular forex markets and the growing cryptocurrency sector.

The broker's main features include the MT5 trading platform and support for multiple types of assets, focusing specifically on forex and cryptocurrency trading. This approach makes UEZ Markets a good choice for traders who want to trade both regular currency pairs and digital assets in one place. The broker works well for traders who want simple and easy-to-use trading tools.

Users have praised the platform for its simple interface and easy trading environment. This makes it attractive for both new traders and experienced traders who want a simple approach. This uez markets review shows that the broker successfully helps traders who want easy access to different financial markets.

Important Notice

UEZ Markets operates as an offshore broker with limited regulatory transparency. Specific regulatory information is not clear from available sources. The broker's regulatory status and oversight are not clearly explained in public documents, which may lead to different trading experiences for users in different countries.

Offshore brokers may operate under different rules compared to traditional regulated companies. This review uses information from public sources, user feedback, and platform assessments. All ratings come from observable data and user reviews gathered from various review platforms and industry sources.

Rating Framework

Broker Overview

UEZ Markets started in 2020 and operates as an offshore financial services provider based in the Cayman Islands. The company focuses on forex and cryptocurrency investment opportunities for traders who want exposure to both traditional currency markets and new digital asset sectors. As a relatively new broker in the competitive market, UEZ Markets has built its business around providing easy trading solutions for retail investors who want to participate in different markets.

The broker emphasizes simplicity and user accessibility. This appeals to traders who prefer straightforward market access without complex trading structures. UEZ Markets has designed its services for both new traders seeking their first market experience and experienced traders looking for efficient execution across multiple asset classes.

The company's offshore structure allows it to serve international clients while maintaining operational flexibility in various locations. UEZ Markets operates mainly through the MetaTrader 5 platform, giving traders access to forex pairs and cryptocurrency markets. The broker's asset selection focuses on major and minor currency pairs alongside popular digital currencies, though specific regulatory oversight information remains limited in available documents.

This uez markets review shows that while the broker offers modern trading infrastructure, transparency about regulatory compliance could be better.

Regulatory Jurisdiction: Available information does not specify which regulatory authorities oversee UEZ Markets operations. This is common among offshore brokers but may concern traders who want regulatory oversight.

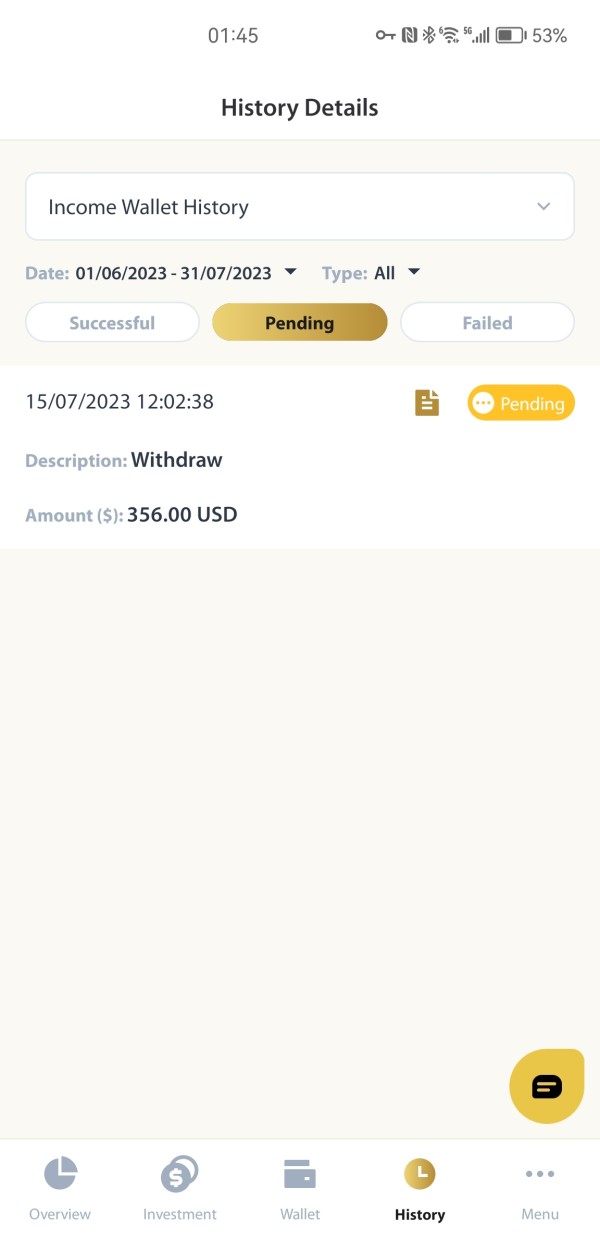

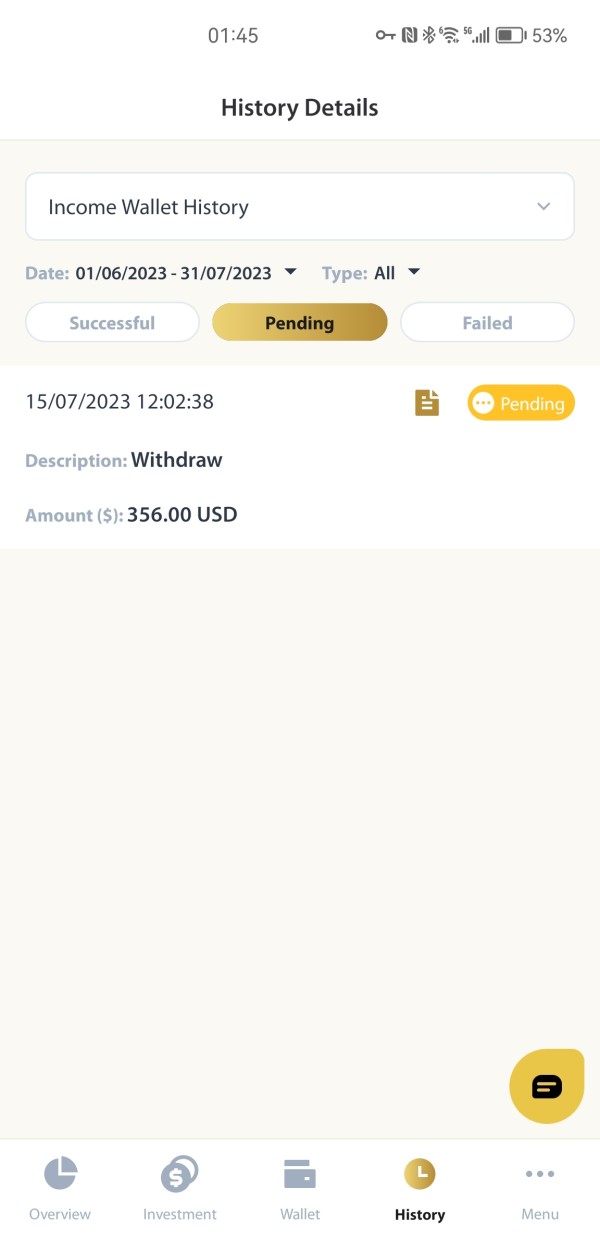

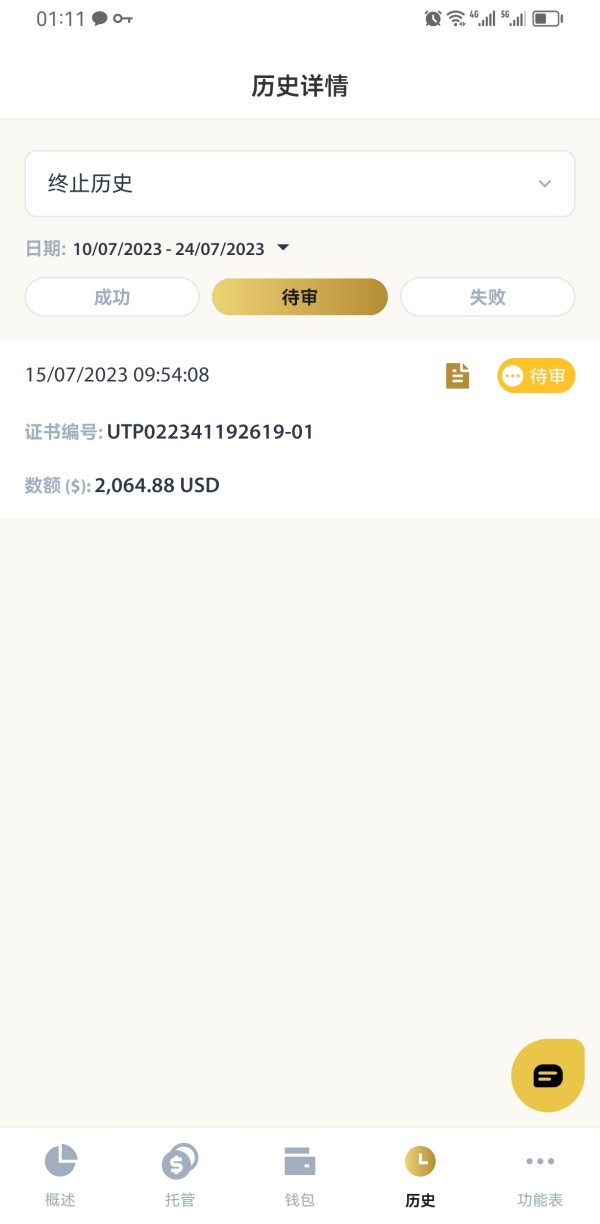

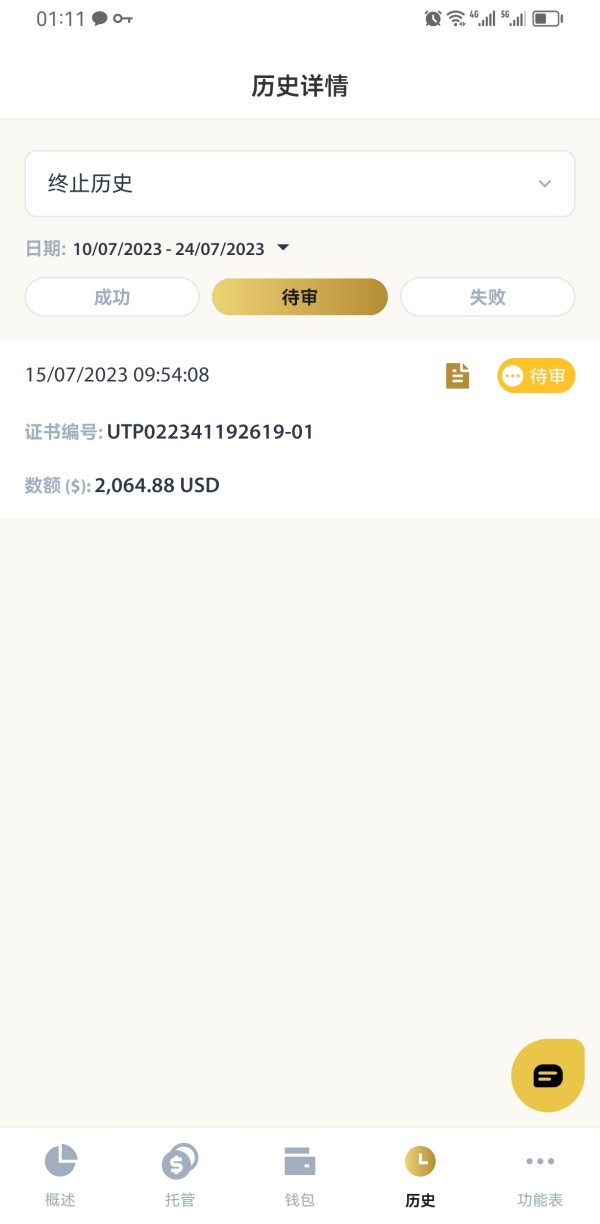

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees is not detailed in available sources.

Minimum Deposit Requirements: The broker's minimum deposit amount for opening an account is not specified in accessible documents.

Bonus and Promotional Offers: Current promotional campaigns or welcome bonuses are not mentioned in available materials. This suggests either no such programs exist or limited marketing disclosure.

Tradeable Assets: UEZ Markets supports forex trading across major, minor, and exotic currency pairs, alongside cryptocurrency trading opportunities including popular digital assets like Bitcoin, Ethereum, and other altcoins.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not available in public sources. This may require direct consultation with the broker.

Leverage Ratios: Maximum leverage offerings for different asset classes are not specified in available documents.

Platform Options: The broker primarily operates through MetaTrader 5. This provides traders with advanced charting tools, technical analysis capabilities, and automated trading support.

Geographic Restrictions: Specific countries or regions where services are restricted are not clearly outlined in available information.

Customer Support Languages: Supported languages for customer service are not mentioned in accessible sources. This uez markets review highlights the need for more comprehensive public information disclosure.

Detailed Rating Analysis

Account Conditions Analysis

UEZ Markets' account structure information remains limited in publicly available sources. This makes comprehensive evaluation challenging. The broker does not provide detailed specifications about different account types, their features, or minimum balance requirements across various trading levels.

This lack of transparency about account conditions represents a significant information gap for potential traders. Traders need to understand their options before committing to the platform. The absence of clear minimum deposit requirements makes it difficult for traders to plan their initial investment strategy effectively.

Most established brokers provide tiered account structures with varying minimum deposits, spread levels, and additional benefits. Such information is not readily accessible for UEZ Markets. This limitation particularly affects new traders who need to understand entry-level requirements and progression opportunities within the platform.

Account opening procedures and verification processes are not detailed in available documents. This leaves potential clients uncertain about required documentation, processing timeframes, and compliance procedures. Additionally, specialized account features such as Islamic accounts for Muslim traders, corporate accounts for institutional clients, or demo accounts for practice trading are not specifically mentioned in accessible sources.

The overall assessment of account conditions receives a lower rating due to insufficient publicly available information rather than poor service quality. This uez markets review emphasizes the importance of direct broker consultation to obtain comprehensive account details before making trading decisions.

UEZ Markets provides access to the MetaTrader 5 platform. This represents a significant strength in their tool offering. MT5 is widely recognized as an advanced trading platform that supports sophisticated technical analysis, automated trading through Expert Advisors, and comprehensive market monitoring capabilities.

The platform's native support for both forex and cryptocurrency markets aligns well with UEZ Markets' dual-market focus. This provides traders with integrated access to diverse asset classes. However, beyond the MT5 platform provision, specific additional trading tools and resources are not extensively documented in available sources.

Many competitive brokers supplement their platform offerings with proprietary research tools, market analysis reports, economic calendars, and educational resources. Such supplementary tools are not clearly outlined for UEZ Markets. User feedback indicates satisfaction with the platform's simplicity and ease of use, suggesting that the MT5 implementation is well-configured and user-friendly.

This positive user experience indicates effective platform optimization and reliable technical infrastructure. These are crucial factors for successful trading operations. The absence of detailed information about research resources, educational materials, and advanced trading tools represents a potential area for improvement.

Comprehensive broker offerings typically include market analysis, trading signals, and educational content to support trader development and decision-making processes.

Customer Service and Support Analysis

Customer service evaluation for UEZ Markets faces limitations due to insufficient detailed feedback about support quality, response times, and service accessibility. While user reviews indicate general satisfaction with the broker's services, specific experiences with customer support interactions are not comprehensively documented in available sources. The availability of customer service channels, including live chat, email support, phone assistance, and help desk hours, is not clearly specified in accessible information.

Modern traders typically expect multiple communication options with reasonable response times. This is particularly important for urgent trading-related inquiries or technical issues requiring immediate attention. Multi-language support capabilities, which are essential for international brokers serving diverse client bases, are not explicitly mentioned in available documentation.

Given UEZ Markets' offshore structure and international focus, comprehensive language support would be expected but cannot be verified through available sources. Problem resolution procedures, escalation processes, and customer satisfaction metrics are not detailed in accessible materials. These elements are crucial for assessing the overall quality and effectiveness of customer support operations, particularly for traders who may encounter technical difficulties or account-related issues requiring professional assistance.

Trading Experience Analysis

User feedback about trading experience with UEZ Markets indicates general satisfaction with platform stability and ease of use. Traders have reported positive experiences with the platform's interface design and navigation, suggesting effective user experience optimization and intuitive platform configuration. The emphasis on simplicity appears to resonate well with users who prefer straightforward trading environments without unnecessary complexity.

However, specific technical performance metrics such as order execution speeds, slippage rates, server uptime statistics, and latency measurements are not available in public sources. These technical specifications are crucial for evaluating trading quality, particularly for active traders who require reliable and fast order processing for optimal trading outcomes. The platform's support for both forex and cryptocurrency markets provides traders with diversified trading opportunities within a single environment.

This integrated approach can enhance trading efficiency by eliminating the need for multiple platforms or accounts across different brokers for various asset classes. Mobile trading capabilities and cross-device synchronization features are not specifically addressed in available information, which represents a significant consideration for modern traders who require flexible trading access across multiple devices and locations. This uez markets review notes that comprehensive trading experience evaluation requires additional technical specifications.

Trust and Security Analysis

Trust assessment for UEZ Markets faces significant challenges due to limited regulatory transparency and unclear oversight mechanisms. The absence of specific regulatory authority information, license numbers, and compliance documentation raises concerns about the broker's regulatory standing and oversight accountability. Most established brokers provide clear regulatory information, including specific license numbers, regulatory authority details, and compliance certifications that allow traders to verify their legitimacy and regulatory status.

UEZ Markets' limited disclosure in this area represents a notable transparency gap that may concern security-conscious traders. Fund security measures, including client fund segregation, deposit protection schemes, and insurance coverage, are not detailed in available sources. These security features are fundamental for trader confidence and financial protection, particularly when dealing with offshore brokers that may operate under different regulatory frameworks.

Despite regulatory transparency concerns, user feedback regarding asset security has been relatively positive. Traders have expressed satisfaction with their fund safety experiences. However, the absence of detailed security protocols and regulatory oversight information limits the comprehensive assessment of trust factors.

User Experience Analysis

Overall user satisfaction with UEZ Markets appears positive based on available ratings. Users have awarded the broker 4/5 stars and a 3.61/5 TrustScore across various review platforms. These ratings suggest that traders generally find value in the broker's services and experience satisfactory outcomes with their trading activities.

The platform's emphasis on simplicity and ease of use has been well-received by users who appreciate straightforward trading interfaces without unnecessary complexity. This user-friendly approach appears particularly beneficial for traders who prioritize efficient market access over advanced feature complexity. Registration and account verification procedures are not specifically detailed in available sources, making it difficult to assess the onboarding experience quality.

Streamlined registration processes are important for user satisfaction and can significantly impact initial impressions of broker services. Common user complaints or recurring issues are not extensively documented in accessible sources, which could indicate either limited negative experiences or insufficient feedback collection. Comprehensive user experience assessment typically requires analysis of both positive feedback and common complaint patterns to provide balanced evaluation perspectives.

Conclusion

UEZ Markets presents itself as an emerging forex and cryptocurrency broker with generally positive user satisfaction ratings. However, significant information gaps limit comprehensive evaluation. The broker's strength lies in its MT5 platform provision and dual-market focus, appealing to traders seeking straightforward access to both traditional forex and cryptocurrency markets within a single trading environment.

The broker appears most suitable for traders who prioritize simplicity and ease of use over extensive feature sets or comprehensive regulatory transparency. Users seeking uncomplicated trading experiences with basic platform functionality may find UEZ Markets aligned with their requirements, particularly those interested in both forex and cryptocurrency market exposure. However, potential traders should carefully consider the limited regulatory transparency and insufficient public information disclosure before committing to the platform.

The absence of detailed account conditions, cost structures, and comprehensive service specifications represents notable limitations that may require direct broker consultation for informed decision-making.