TM Inversiones 2025 Review: Everything You Need to Know

Executive Summary

TM Inversiones is an Argentina-based forex and securities broker that operates in the local market without regulatory oversight from recognized financial authorities. This tm inversiones review reveals a company that focuses primarily on serving Argentine investors seeking exposure to domestic markets. The broker offers trading in stocks, options, bonds, and futures. It positions itself as a comprehensive platform for local market participants.

The company distinguishes itself by providing customer training programs and educational courses designed to enhance investor knowledge and trading capabilities. However, the absence of regulatory supervision from established financial authorities raises significant concerns about investor protection and operational transparency. TM Inversiones appears to target local investors who are specifically interested in Argentine market opportunities. This narrow focus may limit its appeal to international traders.

While the broker provides access to multiple asset classes and educational resources, potential clients should carefully consider the regulatory limitations before committing funds. The lack of oversight from recognized financial regulators represents a substantial risk factor. This distinguishes TM Inversiones from internationally regulated brokers operating in the forex and securities markets.

Important Notice

TM Inversiones operates as a local Argentine broker without supervision from internationally recognized financial regulatory bodies. This review is based on publicly available information and user feedback, as comprehensive regulatory documentation is not available. Potential investors should exercise heightened caution when considering this broker. This is particularly true for those accustomed to the protections offered by regulated financial institutions. The absence of regulatory oversight means that standard investor protection measures may not apply to client funds or trading activities.

Rating Framework

Broker Overview

TM Inversiones operates as an Argentina-based financial services provider specializing in domestic market access for local investors. The company has established itself within the Argentine financial landscape by focusing on providing comprehensive trading services across multiple asset classes. These include equities, derivatives, and fixed-income securities. This tm inversiones review indicates that the broker's primary business model revolves around facilitating access to Argentine financial markets rather than international forex trading.

The broker's approach to client service includes educational components, with regular training programs and courses designed to enhance investor understanding of market dynamics and trading strategies. This educational focus suggests an attempt to build long-term client relationships through knowledge transfer rather than purely transactional services. However, the company's operational framework lacks the regulatory foundation typically associated with internationally recognized brokers.

TM Inversiones offers trading access to stocks, options, bonds, and futures, providing a relatively comprehensive suite of investment instruments for clients interested in Argentine market exposure. The broker's asset coverage spans traditional equity investments, derivative products for hedging and speculation, and fixed-income securities for more conservative investment strategies. Despite this broad offering, the absence of regulatory supervision from established financial authorities remains a significant consideration. Potential clients must evaluate the broker's credibility and operational security carefully.

Regulatory Status: TM Inversiones operates without oversight from recognized financial regulatory authorities. This represents a significant departure from industry standards for broker regulation and client protection.

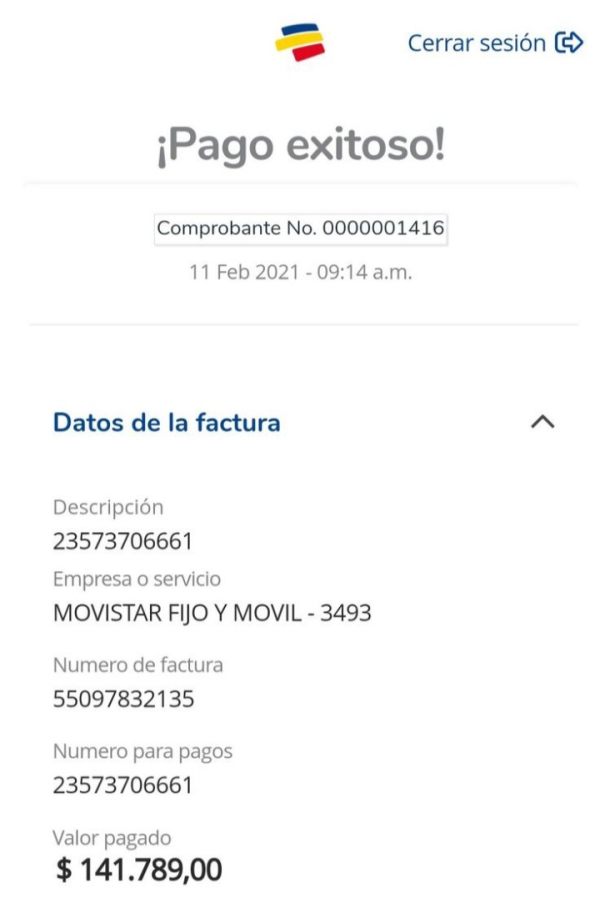

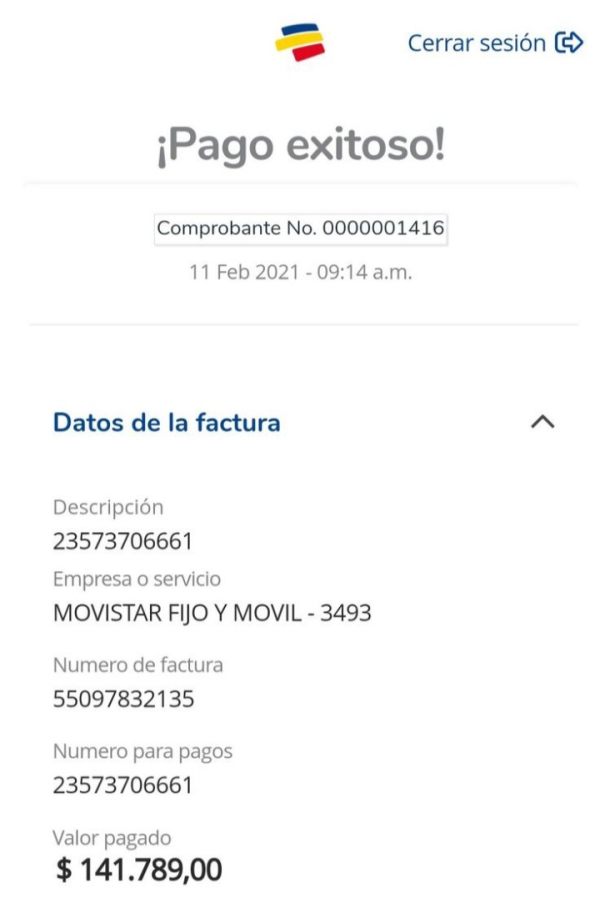

Deposit and Withdrawal Methods: Specific information regarding funding methods and withdrawal procedures is not detailed in available source materials. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The minimum deposit threshold for account opening is not specified in publicly available information about TM Inversiones.

Promotional Offers: Details regarding bonus structures or promotional incentives are not mentioned in the source materials reviewed for this evaluation.

Tradeable Assets: The broker provides access to stocks, options, bonds, and futures. It offers a diverse range of investment instruments primarily focused on Argentine market opportunities.

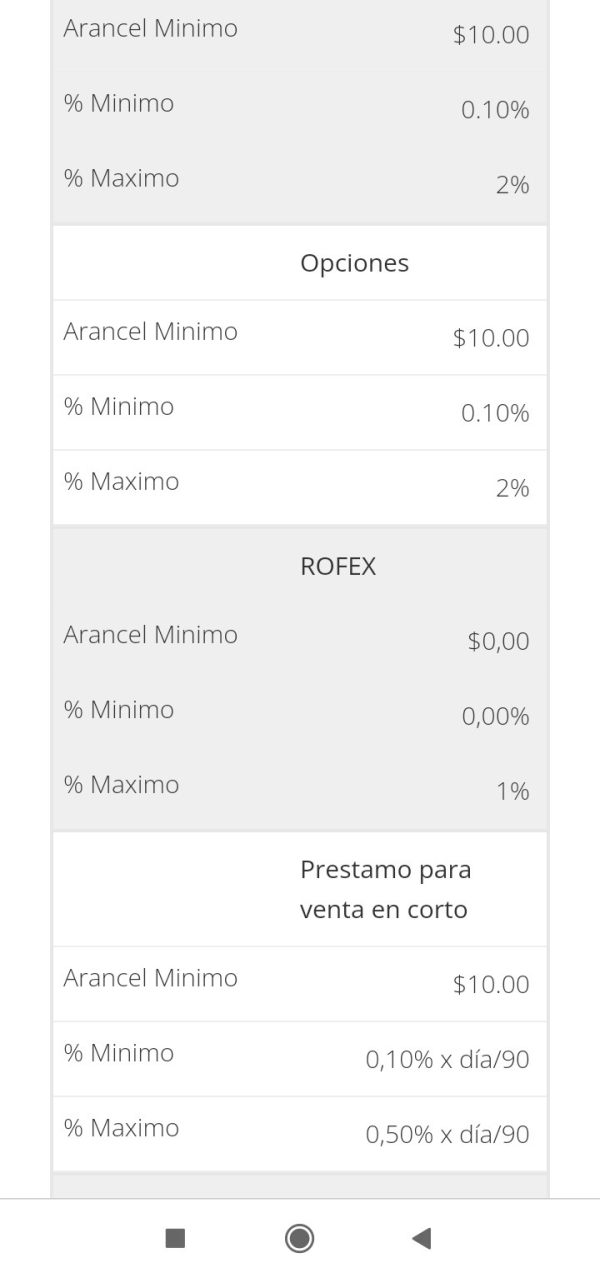

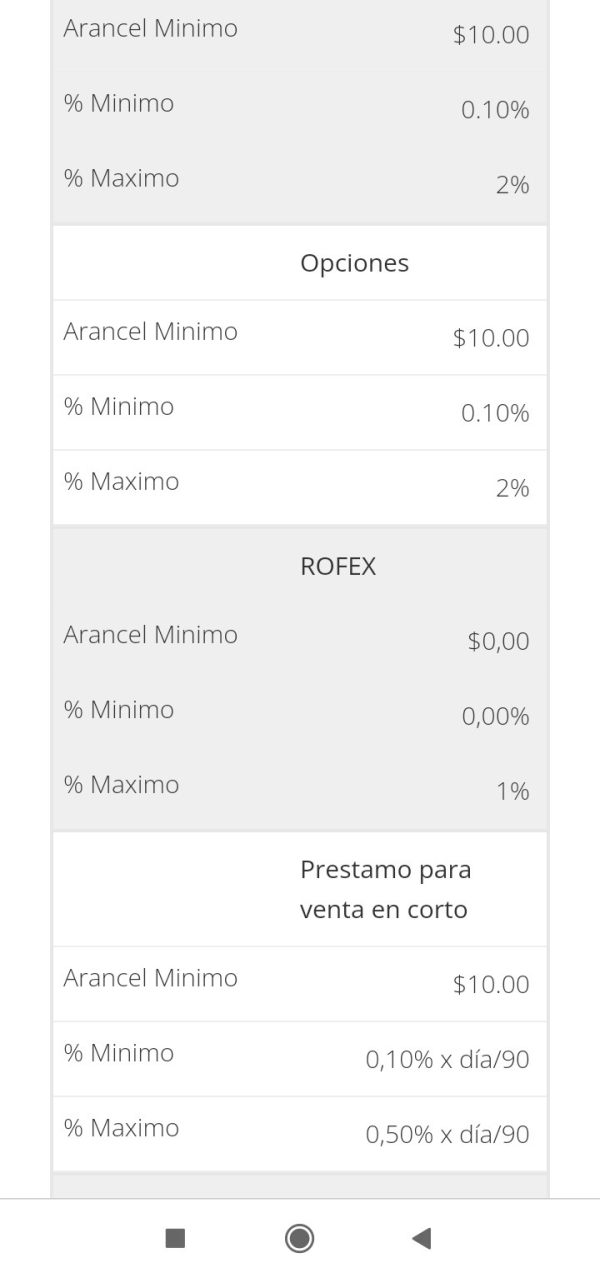

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in the available source materials. This necessitates direct contact with the broker for pricing details.

Leverage Ratios: Leverage offerings and margin requirements are not specified in the publicly available information about TM Inversiones' trading conditions.

Platform Options: The specific trading platforms utilized by TM Inversiones are not detailed in the source materials. However, the broker appears to facilitate multi-asset trading capabilities.

Geographic Restrictions: Regional limitations and service availability are not explicitly outlined in the available information about the broker's operations.

Customer Support Languages: Language support options for customer service are not specified in the source materials reviewed for this tm inversiones review.

Account Conditions Analysis

The account conditions offered by TM Inversiones remain largely undisclosed in publicly available information. This creates uncertainty for potential clients seeking to understand the broker's service parameters. Without detailed documentation of account types, minimum deposit requirements, or account-specific features, prospective traders cannot adequately assess whether the broker's offerings align with their trading objectives and financial capabilities.

The absence of clear account condition information suggests either limited transparency in the broker's marketing approach or a preference for direct client consultation to discuss individual requirements. This lack of readily available information contrasts with industry standards. Regulated brokers typically provide comprehensive account specifications to facilitate informed decision-making.

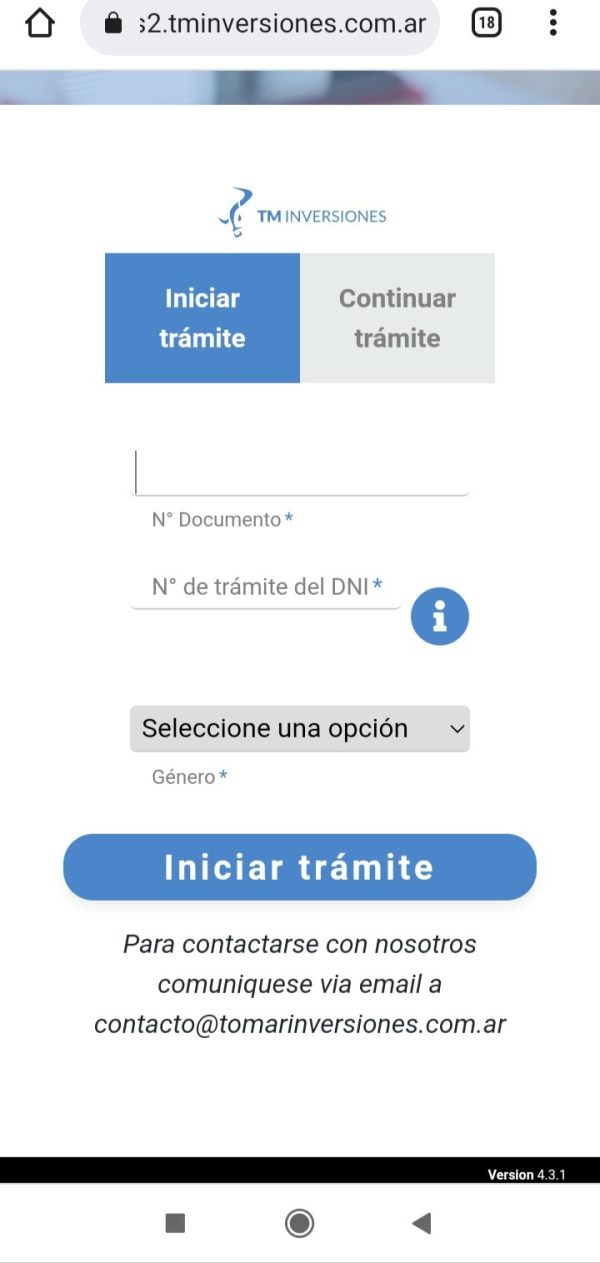

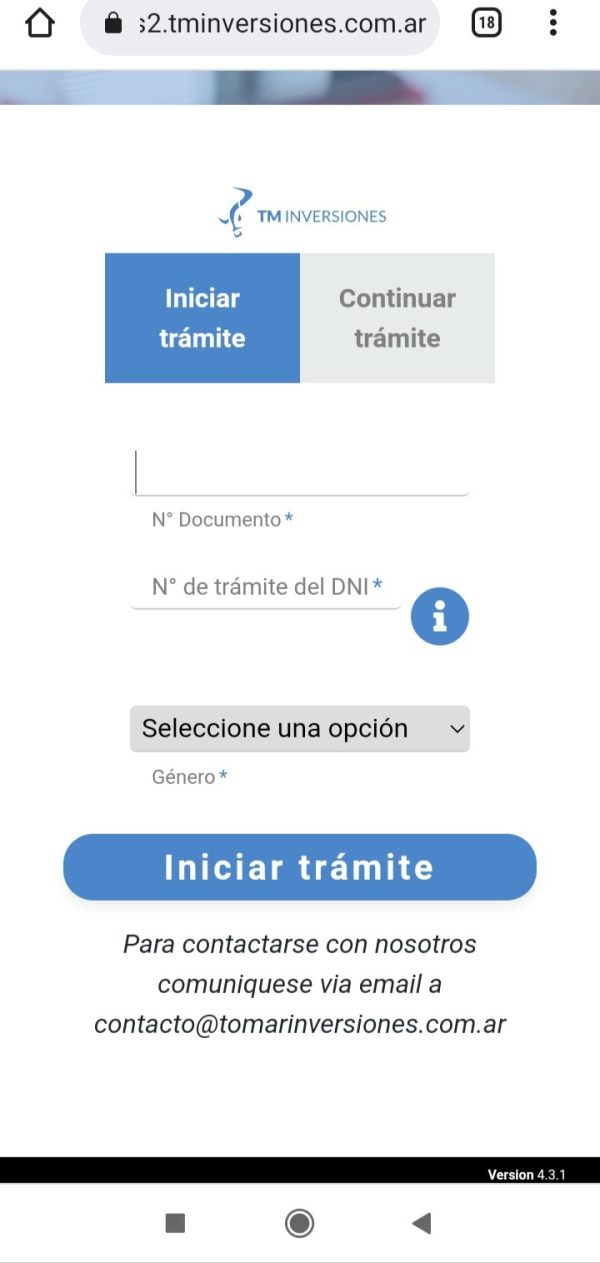

The evaluation of account opening procedures, verification requirements, and ongoing account maintenance conditions cannot be completed based on available source materials. Potential clients would need to engage directly with TM Inversiones to obtain specific details about account structures, funding requirements, and any special account features that may be available. This tm inversiones review cannot provide definitive guidance on account conditions due to insufficient publicly available information about these critical service parameters.

TM Inversiones demonstrates strength in its asset coverage, offering access to stocks, options, bonds, and futures trading. This multi-asset approach provides clients with diversified investment opportunities across different risk profiles and market sectors. The inclusion of derivative instruments like options and futures suggests the broker caters to both conservative investors and those seeking more sophisticated trading strategies.

The broker's commitment to client education represents a notable feature, with regular training programs and courses designed to enhance investor knowledge and market understanding. This educational focus indicates an investment in long-term client development rather than purely transactional relationships. The training programs may cover market analysis, trading strategies, and risk management concepts relevant to the Argentine financial markets.

However, specific details about research resources, analytical tools, or automated trading capabilities are not detailed in available source materials. The quality and depth of market analysis, technical indicators, or fundamental research support cannot be assessed without additional information from the broker directly. While the educational component appears robust, the broader spectrum of trading tools and resources remains unclear in this evaluation.

Customer Service and Support Analysis

Customer service capabilities and support structures for TM Inversiones are not detailed in the available source materials. This prevents a comprehensive assessment of the broker's client support quality. The absence of information regarding communication channels, response times, and service availability represents a significant gap in publicly available broker information.

Standard customer service metrics such as telephone support hours, email response times, and live chat availability cannot be evaluated based on current information sources. The quality of customer service representatives, their expertise in addressing technical and account-related issues, and the overall client support experience remain undocumented in accessible materials.

Multi-language support capabilities, which are particularly relevant for brokers operating in diverse markets, are not specified for TM Inversiones. The broker's ability to serve international clients or provide support in languages beyond Spanish cannot be confirmed through available documentation. This lack of customer service information requires potential clients to conduct direct inquiries to assess whether the broker's support capabilities meet their specific requirements and expectations.

Trading Experience Analysis

The trading experience offered by TM Inversiones cannot be comprehensively evaluated due to limited information about platform performance, execution quality, and technical capabilities. Without specific details about trading platforms, order execution speeds, or system reliability, potential clients cannot assess the quality of the trading environment provided by the broker.

Platform stability, which is crucial for active traders, remains undocumented in available source materials. The broker's ability to handle high-volume trading periods, maintain consistent platform uptime, and provide reliable order execution cannot be verified through publicly available information. Mobile trading capabilities, which are increasingly important for modern traders, are not mentioned in the broker's available documentation.

The overall trading environment, including features such as advanced charting tools, technical analysis capabilities, and order management systems, cannot be evaluated without additional information from TM Inversiones directly. This tm inversiones review cannot provide definitive guidance on trading experience quality due to insufficient technical and performance data in accessible source materials.

Trust and Safety Analysis

The trust and safety profile of TM Inversiones is significantly impacted by the absence of regulatory oversight from recognized financial authorities. Operating without supervision from established regulatory bodies means that standard investor protection measures may not be in place or guaranteed. These measures include segregated client funds, compensation schemes, and regulatory compliance monitoring.

The lack of regulatory registration with bodies such as securities commissions or financial conduct authorities represents a substantial risk factor for potential clients. Regulated brokers typically must maintain specific capital requirements, undergo regular audits, and adhere to strict operational standards designed to protect client interests. Without such oversight, clients cannot rely on regulatory protections that are standard in the international brokerage industry.

Company transparency regarding ownership structure, financial stability, and operational procedures cannot be verified through regulatory filings or official documentation. The absence of third-party regulatory validation means that clients must rely solely on the broker's own representations regarding business practices and financial security. This limitation significantly affects the overall trust profile and may deter investors who prioritize regulatory protection and operational transparency in their broker selection criteria.

User Experience Analysis

User experience evaluation for TM Inversiones is limited by the absence of detailed user feedback and interface information in available source materials. The overall satisfaction levels of current clients, ease of platform navigation, and general usability cannot be assessed without access to comprehensive user reviews or detailed platform demonstrations.

Registration and account verification processes, which significantly impact initial user experience, are not documented in publicly available information. The efficiency of onboarding procedures, required documentation, and timeline for account activation cannot be evaluated based on current source materials. These factors are crucial for potential clients seeking to understand the practical aspects of beginning a relationship with the broker.

Common user concerns, platform functionality feedback, and suggestions for improvement are not available through accessible channels. The broker's responsiveness to user feedback and commitment to platform enhancement cannot be assessed without direct user testimonials or detailed service reviews. This limitation prevents a comprehensive evaluation of the day-to-day user experience and client satisfaction levels with TM Inversiones' services.

Conclusion

TM Inversiones presents a mixed profile as an Argentine-focused broker offering multi-asset trading capabilities and educational resources. While the broker provides access to stocks, options, bonds, and futures along with client training programs, the absence of regulatory oversight from recognized financial authorities represents a significant limitation. This may affect investor confidence and protection.

The broker appears most suitable for local Argentine investors seeking domestic market exposure and educational support for their trading activities. However, the lack of regulatory supervision, limited publicly available information about trading conditions, and absence of detailed user feedback create substantial uncertainties for potential clients.

The primary advantages include diverse asset offerings and educational focus, while the main disadvantages center on regulatory gaps and limited transparency in operational details. Potential clients should carefully weigh these factors against their risk tolerance and regulatory protection requirements before considering TM Inversiones for their trading activities.