ThreeTrader 2025 Review: Everything You Need to Know

Summary

This comprehensive threetrader review evaluates a high-leverage offshore forex broker. The broker has gotten mixed reactions from the trading community. ThreeTrader positions itself as a competitive option for traders seeking ultra-low spreads and substantial leverage ratios up to 1:1000. The broker operates under Vanuatu Financial Services Commission (VFSC) regulation. It offers trading across multiple asset classes including forex, cryptocurrencies, indices, commodities, and CFDs.

The platform's primary appeal lies in its Raw Zero account structure with commissions of just $4 per lot. It also provides access to both MetaTrader 4 and MetaTrader 5 platforms. However, user feedback reveals a polarized experience, with some traders praising the competitive trading conditions while others express concerns about service reliability and overall trustworthiness. This review aims to provide potential clients with a balanced assessment of ThreeTrader's offerings. We examine both the advantages of low-cost trading and the considerations surrounding its offshore regulatory status.

Important Disclaimers

Regional Entity Differences: ThreeTrader operates under the regulatory framework of the Vanuatu Financial Services Commission (VFSC). This differs significantly from major financial jurisdictions such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC. Traders should understand that VFSC regulation may offer different levels of investor protection compared to these established regulatory bodies.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and official broker documentation. Some aspects of the broker's services may not be fully covered due to limited disclosure of certain operational details in available sources.

Rating Framework

Broker Overview

ThreeTrader operates as a specialized forex and CFD broker. The company focuses on delivering competitive trading conditions through high leverage offerings and reduced transaction costs. According to available information, the company has positioned itself within the offshore brokerage sector, specifically targeting traders who prioritize low spreads and substantial leverage capabilities over traditional regulatory protections.

The broker's business model centers on providing institutional-grade trading conditions to retail clients. It places particular emphasis on their Raw Zero account structure that features commission-based pricing rather than spread markups. This approach appeals to experienced traders who prefer transparent cost structures and are comfortable with the regulatory environment provided by Vanuatu's financial oversight.

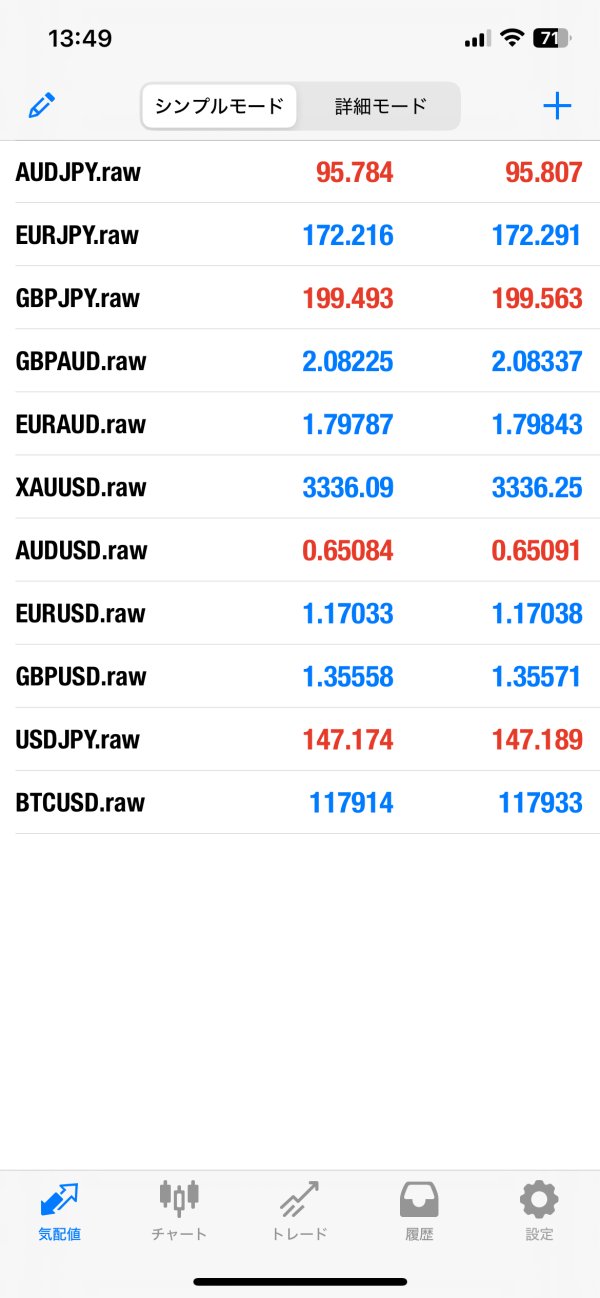

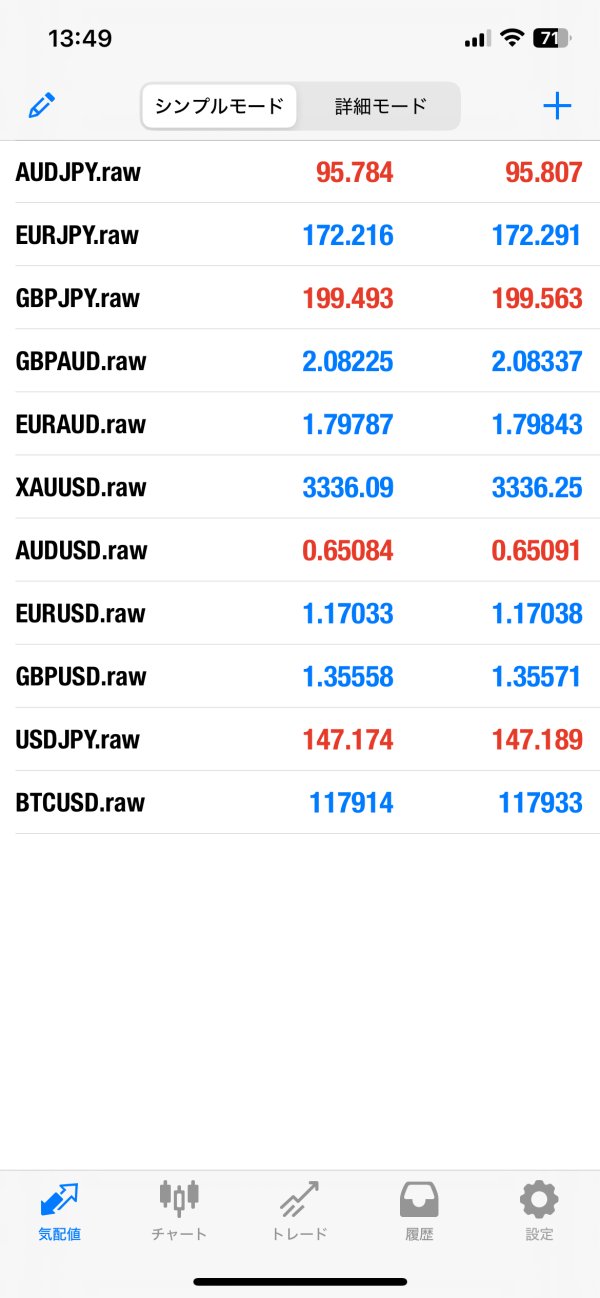

ThreeTrader supports both MetaTrader 4 and MetaTrader 5 platforms. The broker offers access to a diverse range of tradeable assets including major and minor currency pairs, cryptocurrency CFDs, stock indices, precious metals, energy commodities, and individual equity CFDs. The broker operates under license number 40430 from the Vanuatu Financial Services Commission, which provides the regulatory foundation for its international operations. This threetrader review finds that while the broker offers attractive trading conditions, potential clients should carefully consider the implications of offshore regulation.

Regulatory Jurisdiction: ThreeTrader holds regulatory authorization from the Vanuatu Financial Services Commission (VFSC) under license number 40430. This offshore regulatory framework provides operational flexibility but may offer limited investor protection compared to major financial centers.

Deposit and Withdrawal Methods: Specific information regarding funding methods was not detailed in available sources. This requires potential clients to contact the broker directly for comprehensive payment option details.

Minimum Deposit Requirements: Available documentation does not specify minimum deposit thresholds for account opening. This suggests this information may vary based on account type and individual circumstances.

Bonus and Promotional Offers: Current promotional structures and bonus programs were not detailed in accessible materials. This indicates either absence of such programs or limited public disclosure.

Tradeable Assets: The broker provides access to multiple asset classes including foreign exchange pairs, cryptocurrency contracts for difference, major global indices, precious metals (gold, silver), energy commodities (crude oil, natural gas), and individual stock CFDs across various markets.

Cost Structure: ThreeTrader's Raw Zero account features ultra-low spreads with commission charges of $4 per standard lot (or equivalent in other currencies). This transparent pricing model allows traders to calculate transaction costs precisely without hidden spread markups.

Leverage Ratios: Maximum leverage reaches 1:1000 across major currency pairs. This provides substantial capital efficiency for experienced traders while requiring careful risk management due to amplified exposure.

Platform Options: Trading infrastructure includes both MetaTrader 4 and MetaTrader 5 platforms. These offer comprehensive charting tools, automated trading capabilities, and advanced order management features.

Geographic Restrictions: Specific jurisdictional limitations were not detailed in available sources. However, offshore brokers typically restrict services in certain regulated markets.

Customer Support Languages: Available documentation does not specify the range of supported languages for customer service interactions. This threetrader review notes this as an area requiring direct inquiry with the broker.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

ThreeTrader's account structure demonstrates competitive elements that attract cost-conscious traders. This particularly applies through their Raw Zero account offering. The commission-based model of $4 per standard lot provides transparency that many traders prefer over spread-based pricing, as it allows for precise cost calculation and potentially lower overall trading expenses on higher-volume strategies.

However, the absence of clearly stated minimum deposit requirements in available documentation creates uncertainty for potential clients planning their initial investment. This lack of transparency regarding entry-level funding may deter smaller traders or those seeking to test the platform with minimal capital exposure.

User feedback indicates general satisfaction with the commission structure. Several traders note competitive advantages compared to other brokers in similar market segments. The account opening process specifics were not detailed in available sources, though user experiences suggest a relatively straightforward procedure.

The absence of information regarding Islamic account options or other specialized account types limits appeal to certain trader demographics. Additionally, without clear details on account maintenance fees or inactivity charges, traders cannot fully assess the long-term cost implications of maintaining positions with ThreeTrader. This threetrader review finds that while the core commission structure is attractive, greater transparency in account terms would enhance overall appeal.

ThreeTrader's platform infrastructure demonstrates strong technical capabilities through its support of both MetaTrader 4 and MetaTrader 5 platforms. These industry-standard platforms provide comprehensive charting packages, technical analysis tools, and automated trading capabilities that meet the requirements of both novice and experienced traders.

The availability of multiple asset classes through a single platform interface enhances trading efficiency. This allows users to manage diverse portfolios without switching between different systems. MT4 and MT5 support includes expert advisor functionality, custom indicator installation, and advanced order types that facilitate sophisticated trading strategies.

However, available sources do not detail proprietary research resources, market analysis tools, or educational materials that might supplement the basic platform offerings. The absence of mentioned economic calendars, news feeds, or analyst commentary represents a potential limitation compared to full-service brokers.

User feedback suggests satisfaction with platform stability and functionality, particularly regarding the speed and reliability of trade execution. The technical infrastructure appears robust enough to handle high-frequency trading strategies and multiple simultaneous positions across various asset classes.

The lack of detailed information about mobile platform capabilities, web-based trading options, or additional analytical tools limits the complete assessment of ThreeTrader's technological offerings. Nevertheless, the solid foundation of MT4 and MT5 support provides essential functionality that meets most traders' operational requirements.

Customer Service and Support Analysis (6/10)

Customer service quality emerges as a mixed aspect of ThreeTrader's operations based on available user feedback. While some clients report satisfactory interactions with support staff, others express concerns about response times and service consistency, creating an uneven experience across the user base.

The specific channels for customer contact, including phone support, live chat availability, or email response timeframes, were not detailed in accessible documentation. This lack of clarity regarding support accessibility may contribute to user frustration, particularly during urgent trading situations or technical difficulties.

User testimonials reveal divided opinions on support quality. Some praise knowledgeable assistance while others question the professionalism and reliability of service interactions. The absence of clearly defined support hours or multilingual capabilities further complicates the service picture for international clients.

Response time concerns appear in multiple user reviews, suggesting potential understaffing or inefficient support processes during peak periods. However, positive feedback indicates that when support is accessible, technical issues and account-related inquiries can be resolved satisfactorily.

The lack of comprehensive self-service resources, FAQ sections, or detailed documentation may increase reliance on direct support contact. This potentially overwhelms available staff and contributes to longer response times. Improvement in support infrastructure and response consistency would significantly enhance the overall client experience.

Trading Experience Analysis (8/10)

The core trading experience with ThreeTrader receives generally positive feedback from users, particularly regarding platform stability and execution speed. The integration of MT4 and MT5 platforms provides familiar interfaces for experienced traders while offering comprehensive functionality for strategy implementation and portfolio management.

Ultra-low spreads combined with high leverage ratios create attractive conditions for active traders. This particularly benefits those employing scalping strategies or requiring significant position sizing capabilities. The 1:1000 leverage option provides substantial capital efficiency, though it demands sophisticated risk management approaches due to amplified exposure potential.

Platform performance appears consistent across different market conditions. Users report reliable connectivity and minimal downtime during active trading sessions. The execution quality, while not extensively documented regarding slippage or requote frequency, receives generally favorable mentions in user feedback.

The variety of tradeable assets enhances strategy diversification opportunities. This allows traders to implement cross-market approaches or hedge positions across different asset classes. This flexibility particularly benefits those seeking to capitalize on correlations between forex, commodities, and equity markets.

Mobile trading capabilities and advanced order management features support active trading styles. However, specific details about mobile platform functionality were not comprehensively covered in available sources. The overall trading environment appears well-suited to both manual and automated trading approaches. This threetrader review finds the core trading experience to be a significant strength despite some documentation gaps.

Trust Factor Analysis (5/10)

Trust considerations represent a significant concern area for ThreeTrader, primarily due to its offshore regulatory status and mixed user testimonials regarding reliability. The Vanuatu Financial Services Commission (VFSC) regulation, while legitimate, provides different investor protections compared to major financial centers, potentially affecting client fund security and dispute resolution processes.

License number 40430 from VFSC can be verified through official channels, confirming the broker's authorized status within Vanuatu's regulatory framework. However, offshore regulation typically involves less stringent capital requirements and oversight compared to established financial jurisdictions, which may influence institutional and sophisticated investor confidence.

User feedback reveals polarized opinions regarding ThreeTrader's trustworthiness. Some clients express satisfaction with fund security and withdrawal processes while others report concerns about business practices and long-term reliability. This division in user experience suggests inconsistent service delivery or varying client expectations.

The absence of detailed information about fund segregation practices, insurance coverage, or dispute resolution mechanisms limits transparency regarding client protection measures. Additionally, the lack of clear information about company ownership, operational history, or financial backing creates uncertainty about long-term stability.

Third-party reviews and industry discussions reflect ongoing debates about ThreeTrader's legitimacy and operational reliability. Opinions range from cautious acceptance to serious skepticism. This mixed reputation requires potential clients to conduct thorough due diligence before committing significant capital to the platform.

User Experience Analysis (6/10)

Overall user satisfaction with ThreeTrader demonstrates significant variation across different client segments and experience levels. The platform interface, built on established MT4 and MT5 foundations, provides familiar navigation and functionality that experienced traders appreciate, though newcomers may require additional learning resources.

Account registration and verification processes were not detailed in available sources, limiting assessment of onboarding efficiency and user-friendliness. This information gap may indicate either streamlined procedures that require minimal documentation or complex processes that lack clear public explanation.

Fund management experiences, including deposit and withdrawal procedures, receive mixed feedback from users. While some report smooth transactions, others mention delays or complications that suggest inconsistent operational procedures or varying processing criteria based on transaction size or payment method.

The absence of comprehensive educational resources or user guides may disadvantage newer traders seeking to maximize platform capabilities or understand available features. This limitation particularly affects user experience for those transitioning from other brokers or trading platforms.

User interface design appears functional rather than innovative. It focuses on essential trading capabilities rather than enhanced visual appeal or advanced customization options. While this approach satisfies experienced traders seeking efficiency, it may not meet expectations of users accustomed to more modern platform designs.

Common complaints center on customer service accessibility and response quality, which directly impacts overall user satisfaction. Improvements in support infrastructure and user communication would significantly enhance the general experience for ThreeTrader clients.

Conclusion

This comprehensive threetrader review reveals a broker offering competitive trading conditions through low spreads and high leverage. The broker is positioned primarily for experienced traders comfortable with offshore regulatory environments. While ThreeTrader's cost structure and platform access present attractive features for active trading strategies, significant concerns regarding trust factors and service consistency require careful consideration.

The broker best suits high-risk tolerance traders who prioritize trading cost efficiency over regulatory protection levels. This particularly applies to those experienced with MT4/MT5 platforms and sophisticated risk management techniques. The ultra-low spreads and substantial leverage capabilities provide genuine advantages for specific trading approaches, though these benefits come with elevated counterparty and operational risks.

Primary advantages include competitive commission structures, substantial leverage availability, and reliable platform performance. Notable disadvantages encompass offshore regulatory limitations, inconsistent customer service quality, and mixed user testimonials regarding overall reliability. Potential clients should conduct thorough due diligence and consider starting with minimal capital exposure while evaluating service quality and operational reliability firsthand.