tgx markets 2025 review: All You Need to Know

Abstract

In this tgx markets review, we examine a broker that has gotten a lot of bad attention from users. TGX Markets is an unregulated forex and CFD broker that operates without proper oversight, which means users have raised many concerns about withdrawal problems and keeping their money safe. Despite having a low entry barrier with just a $10 minimum deposit and offering high leverage up to 1:1000, the platform lacks regulatory oversight that raises serious questions about whether it's legitimate. The broker seems to target beginners and small investors who might like the low deposit and the chance to trade with more power than their money would normally allow.

However, problems like poor customer service and bad user experiences show up in a low WikiFX score of 1.43 and 21 negative reviews that have been documented. This review uses market data, user feedback, and standard industry measures to give you an informed view of the broker's risks and features. We want to help you understand what you're getting into before you make any decisions about using this platform.

Important Considerations

TGX Markets does not hold any valid regulatory license, which makes its legal standing questionable. This means you should be extremely careful if you're thinking about investing with them. This review looks at user feedback, market data, and industry standards to give you the full picture of what to expect.

You should know that there are serious risks when you work with a company that isn't regulated by proper authorities. The information we're sharing comes directly from available sources, but some key details are still missing or unclear. You need to do your own research before you put any money into TGX Markets, because once you commit financially, you might face problems that are hard to solve.

Rating Framework

Broker Overview

TGX Markets started in 2020 and has its headquarters in St. Vincent and the Grenadines. As an unregulated broker, TGX Markets works in the competitive world of forex and CFD trading without backing from any recognized regulatory authority, which has led to multiple negative reviews about fund withdrawals and customer support. Even with these problems, TGX Markets offers a low entry barrier with a small minimum deposit and tempting leverage up to 1:1000.

These features might appeal to beginning traders and people who want high-risk, high-reward trading opportunities. For technology, TGX Markets only provides the MetaTrader 4 platform, which is well-known in the forex industry for being versatile and widely used. The assets you can trade include forex pairs and various CFDs, but detailed information about specific offerings is limited.

No clear details about regulatory oversight have been provided in the available information. While the platform's basic setup might appeal to some traders, the lack of a regulatory framework and credibility issues should make you think twice before choosing TGX Markets for your trading activities.

TGX Markets operates without any valid regulatory licenses, which raises major red flags about the broker's legitimacy. The lack of regulatory oversight means investors don't have the protection that stricter jurisdictions usually provide. This should be your main concern when evaluating the platform, because without regulation, you have fewer options if something goes wrong.

The available information doesn't detail deposit methods, which leaves potential clients without crucial information about transaction ease or security. For people interested in starting with TGX Markets, the minimum deposit is notably low at $10 for a basic account, while the more advanced ECN account requires $500 to cater to both small and more established traders. No information exists about bonus promotions or special offers, so it's unclear whether any incentives exist beyond standard trading conditions.

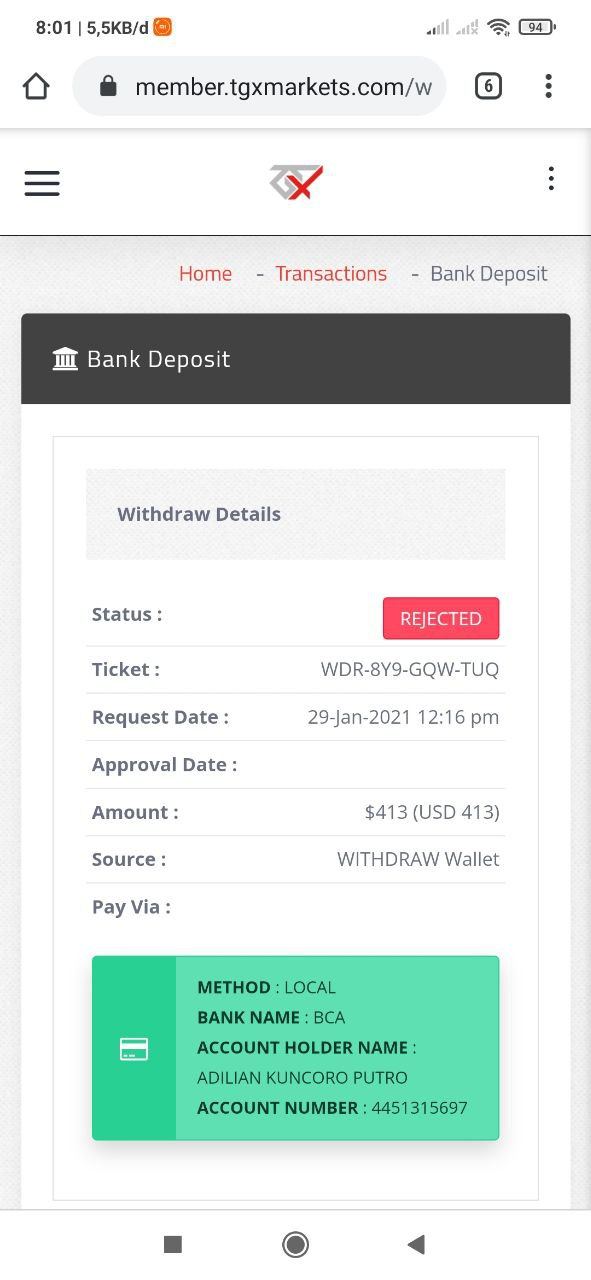

The tradable assets include forex pairs and CFDs, but specific details about available instruments aren't mentioned. Trading costs like spreads and commission rates aren't clearly outlined, but user feedback consistently cites problems with fund withdrawals that suggest potential hidden costs or operational problems. Leverage ratios vary by account type, with micro and standard accounts providing leverage up to 1:1000 while ECN accounts are limited to 1:100.

TGX Markets only supports MetaTrader 4 , which is a widely recognized trading platform. Details about regional trading restrictions are missing, and no information about customer service languages is provided, which creates significant gaps in operational transparency that require caution when considering TGX Markets.

Detailed Rating Analysis

1. Account Conditions Analysis

TGX Markets offers three different account types, but the exact features of each type aren't detailed enough. While the low minimum deposit of $10 for the basic account might look attractive to beginners, the ECN account requires a much higher deposit of $500, which creates confusion and raises questions about account flexibility. You should also consider the reported difficulties in opening accounts and the ongoing problems with fund withdrawals that multiple user reviews mention.

These issues point to potential hidden limitations or operational problems in managing account funds that can seriously hurt trading performance and confidence in the broker. Compared to other well-regulated brokers that offer clear and competitive account conditions, TGX Markets lacks transparency. The available information doesn't detail important account features like commission structures, account verification processes, or special functions that might reduce these risks.

With these concerns, the low deposit requirement only looks like a surface benefit. While the low barrier might attract beginners, the lack of detailed account information and widespread negative feedback significantly hurt the overall appeal, which confirms the concerns in this tgx markets review.

TGX Markets uses the widely recognized MetaTrader 4 platform, which many forex traders know for its strength and flexibility. Beyond providing the MT4 interface, there's a clear lack of additional trading tools and resources that could help both new and experienced traders. The available documentation doesn't mention features like advanced charting tools, technical analysis modules, or automated trading systems that are increasingly important in today's competitive trading environment.

There's no mention of educational resources or market research reports that could help traders make informed decisions. The lack of these extra tools means traders must rely heavily on outside sources for market analysis or risk management strategies, which has been a common criticism among users in multiple reviews that show the platform falls short in providing a complete trading ecosystem. The overall efficiency and effectiveness of trading on TGX Markets may be seriously compromised without access to comprehensive resources.

This makes it particularly challenging for new traders who depend on strong educational support. The limited scope of tools is a critical drawback that reinforces the caution advised in this tgx markets review.

3. Customer Service and Support Analysis

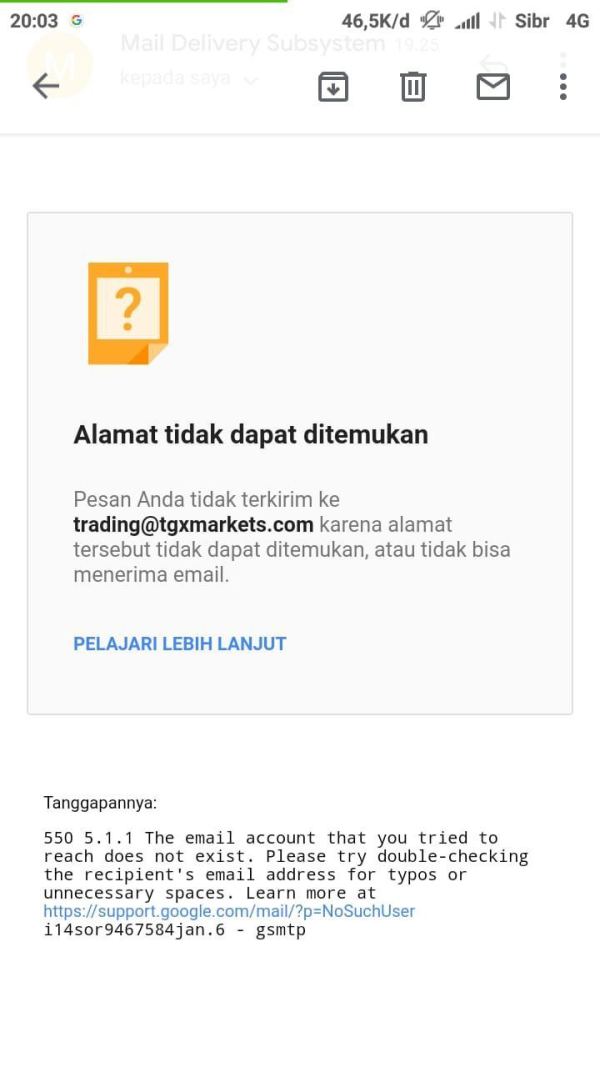

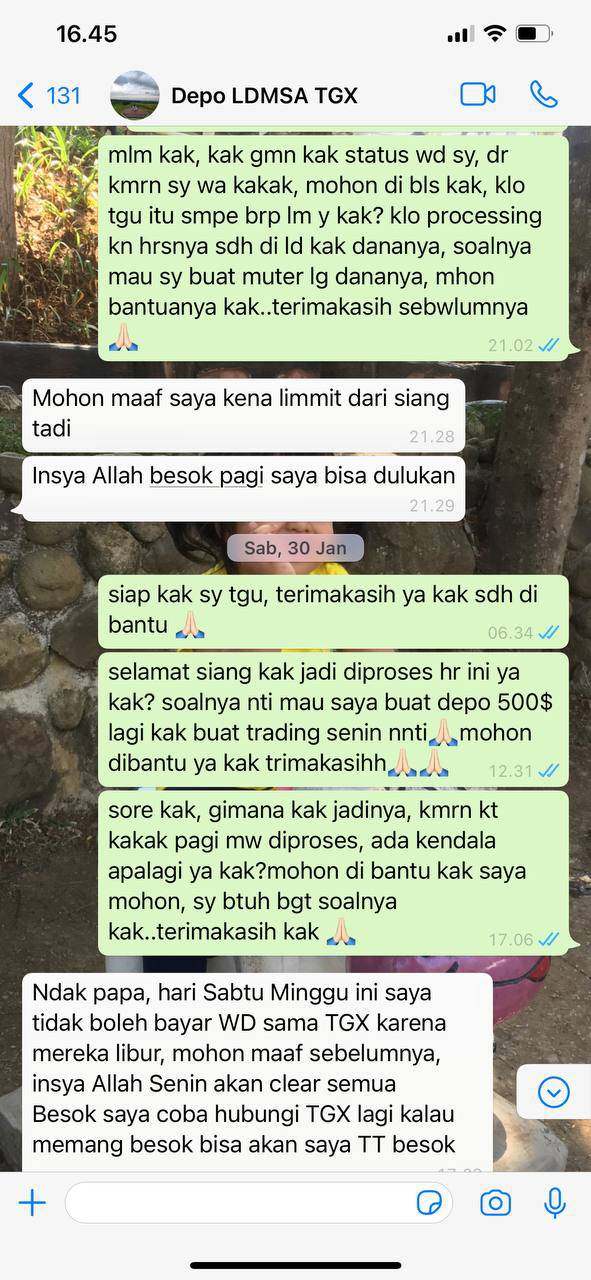

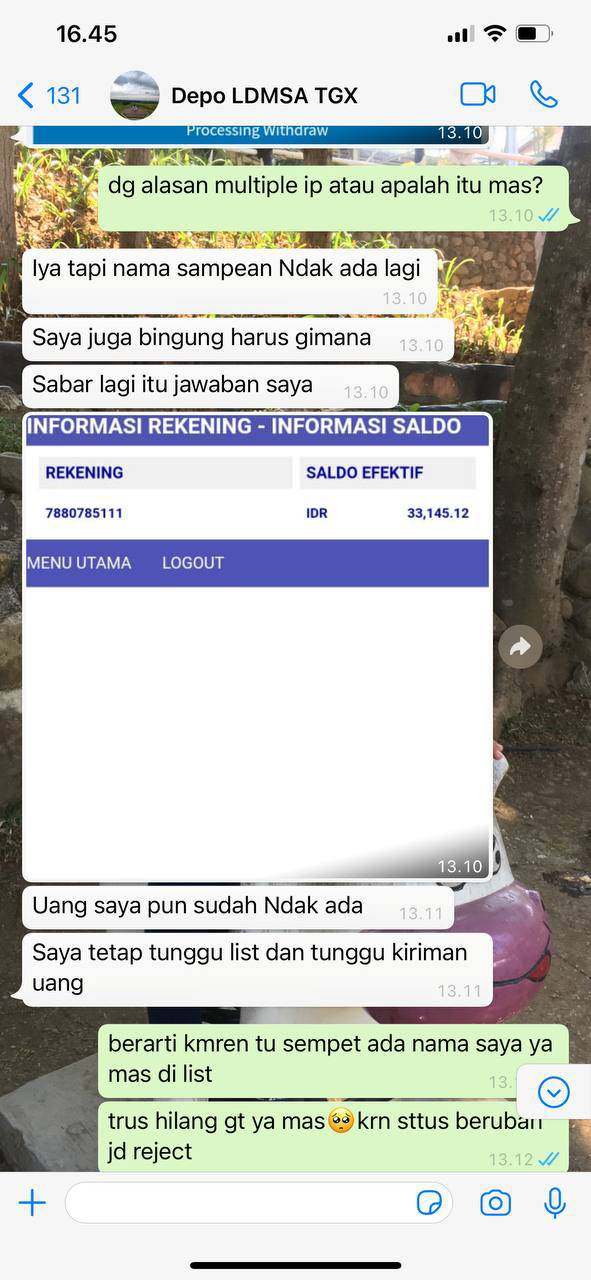

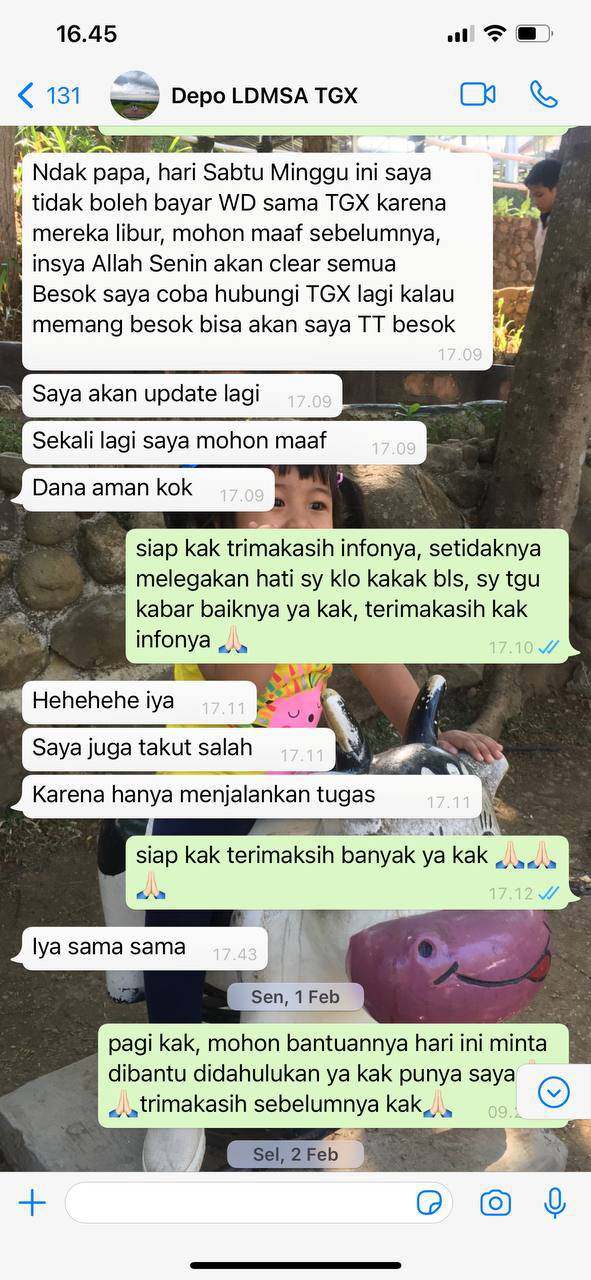

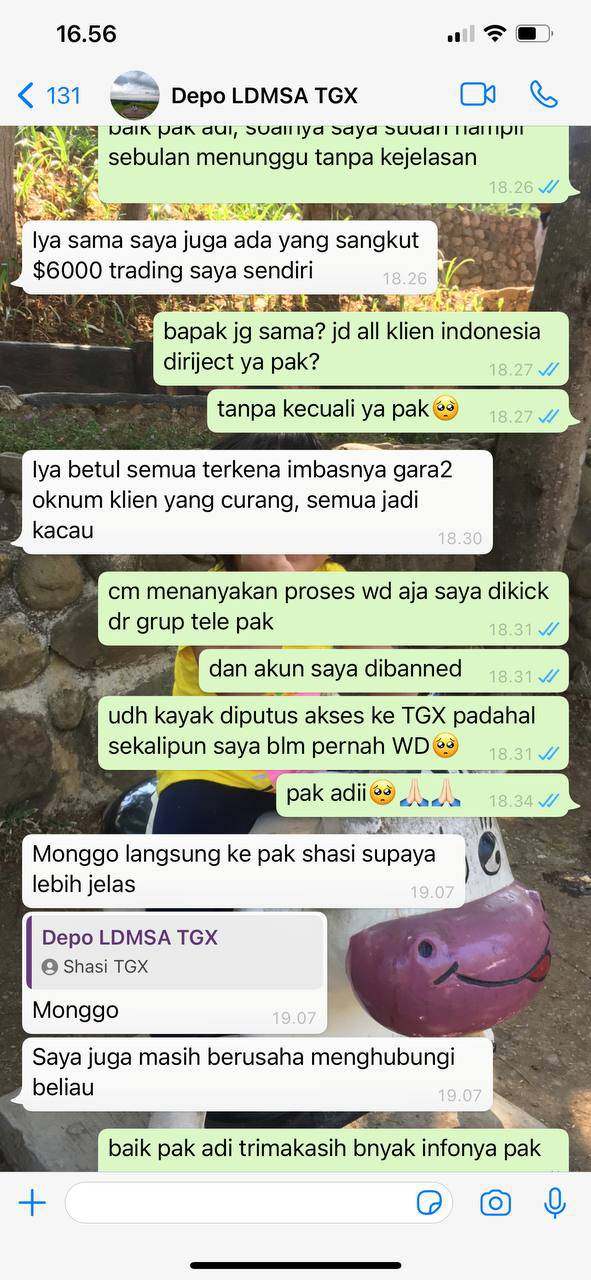

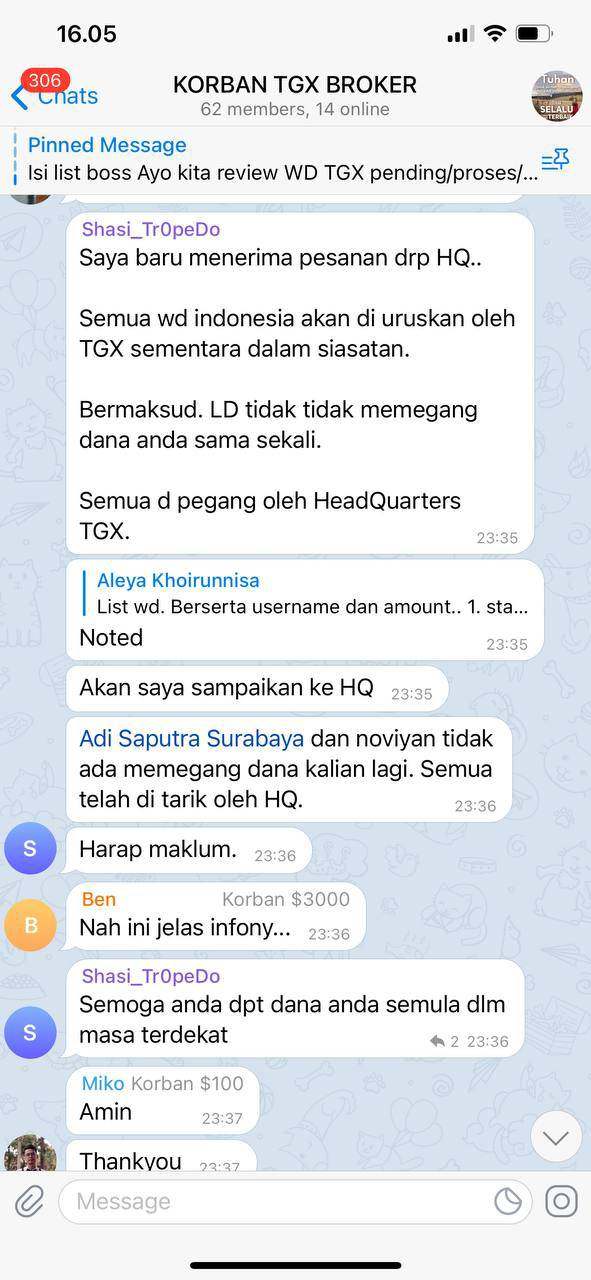

Customer service is crucial for any trading platform, yet TGX Markets appears to fall short here. User reviews consistently report slow response times and insufficient problem resolution when trying to contact support. Specific complaints highlight difficulties in reaching knowledgeable representatives, especially when urgent issues like fund withdrawal complications happen.

This lack of effective communication not only makes traders more frustrated but also undermines confidence in the broker's overall operations. The summary doesn't provide details about available customer support channels like live chat, telephone, or email, which adds to the uncertainty. There's also no information about multilingual support availability, which potentially disadvantages non-native English speakers.

When prompt customer support is critical, the reported delays can turn minor issues into significant operational risks. The consistently negative feedback about handling withdrawal issues further emphasizes the need for strong and responsive customer service, which questions the overall quality and reliability of TGX Markets' customer support as one of the least favorable aspects according to this tgx markets review.

4. Trading Experience Analysis

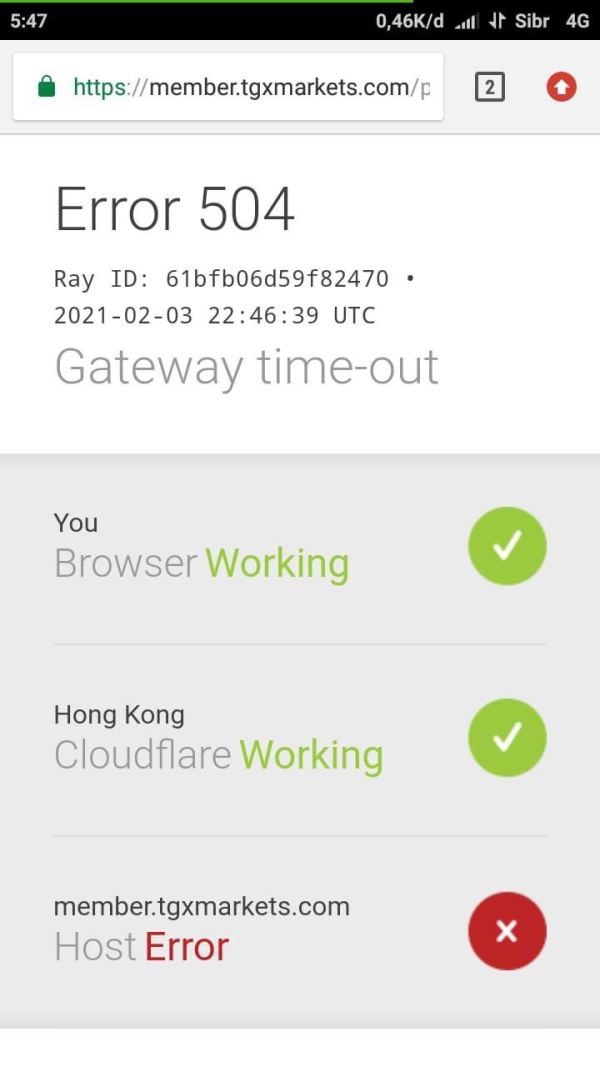

The trading experience on TGX Markets is one of the most important things to consider, and unfortunately, it's full of concerns. While the MT4 platform is known for its comprehensive features and user-friendly interface, traders have reported inconsistencies in platform stability and execution quality on TGX Markets. There are numerous accounts of difficulties accessing trading accounts and executing orders efficiently, particularly during volatile market periods.

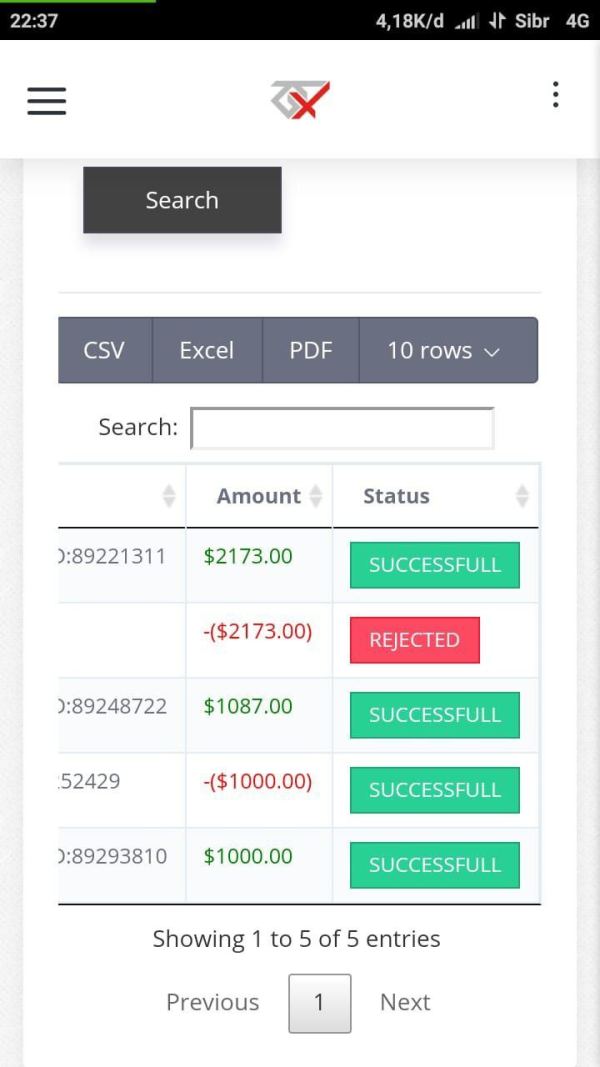

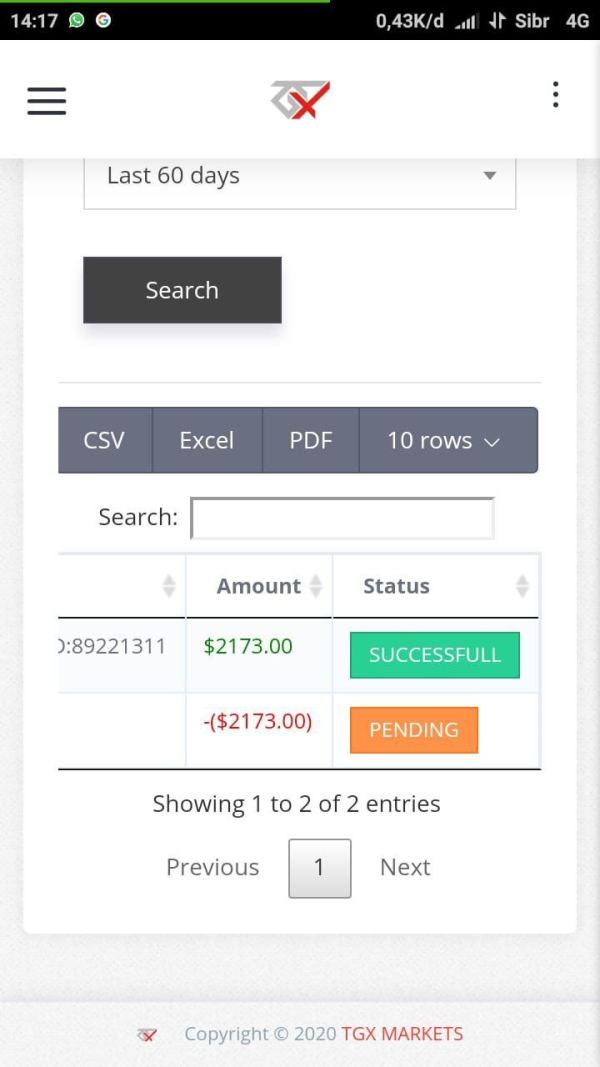

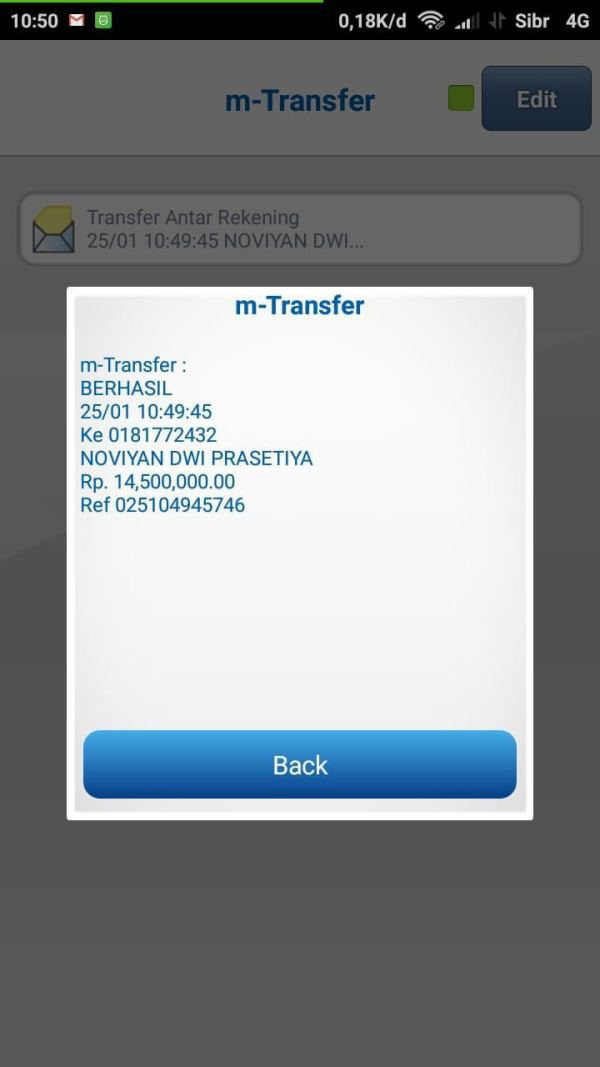

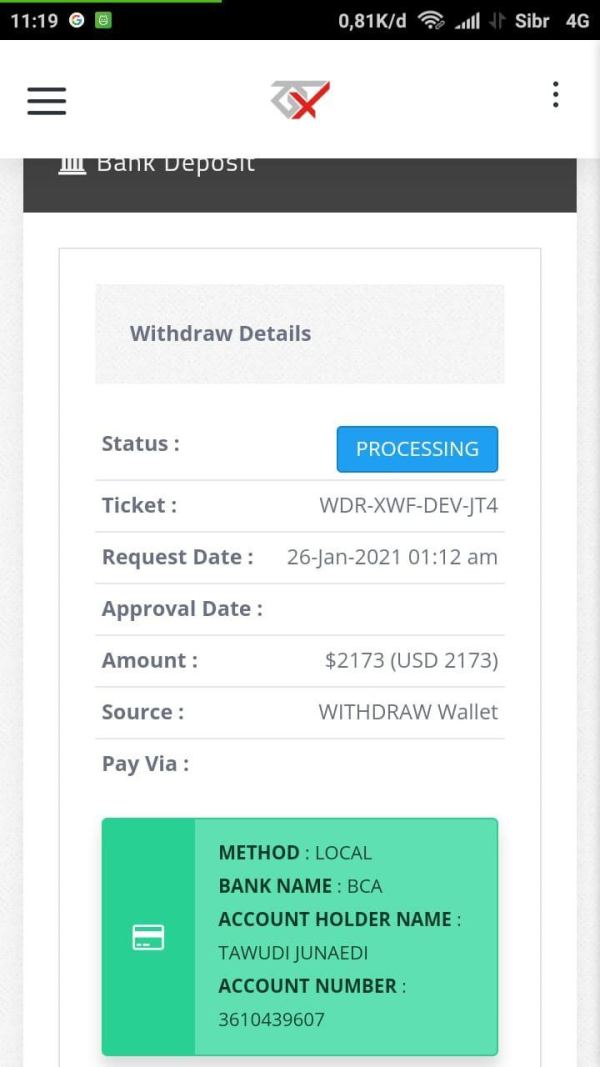

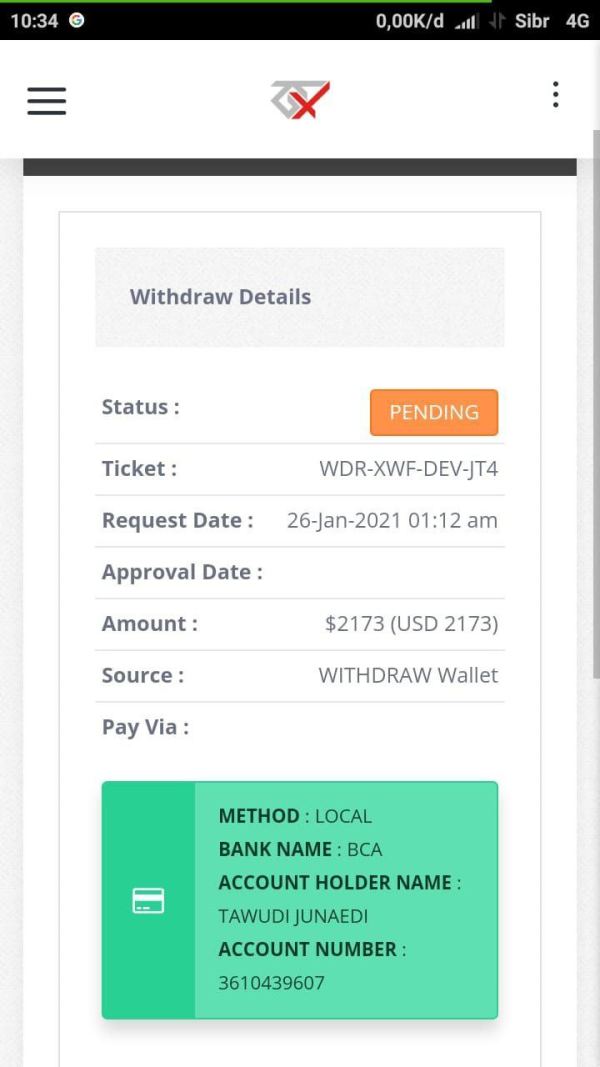

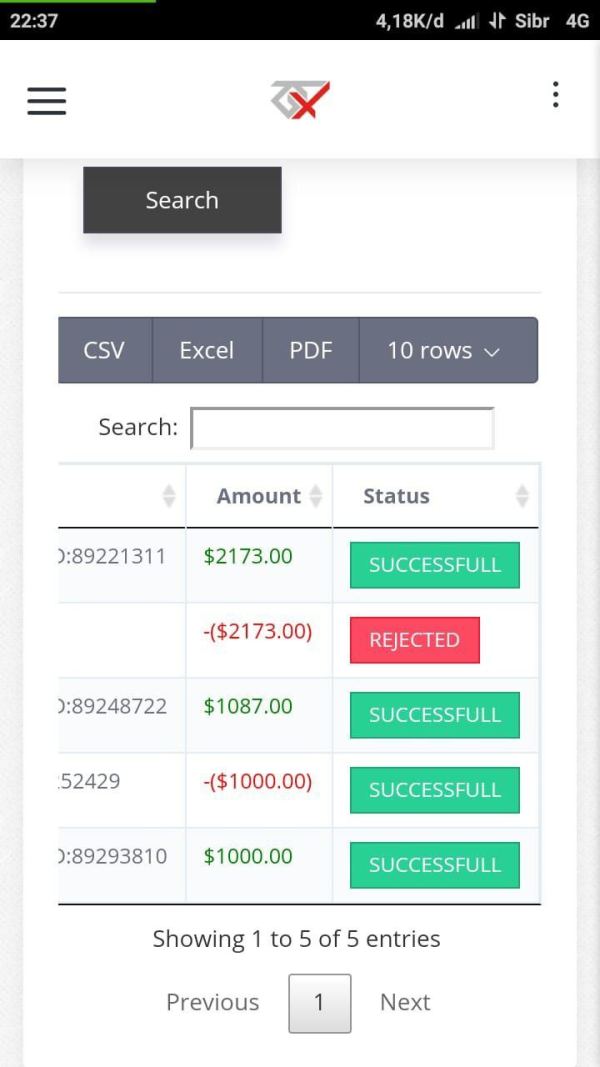

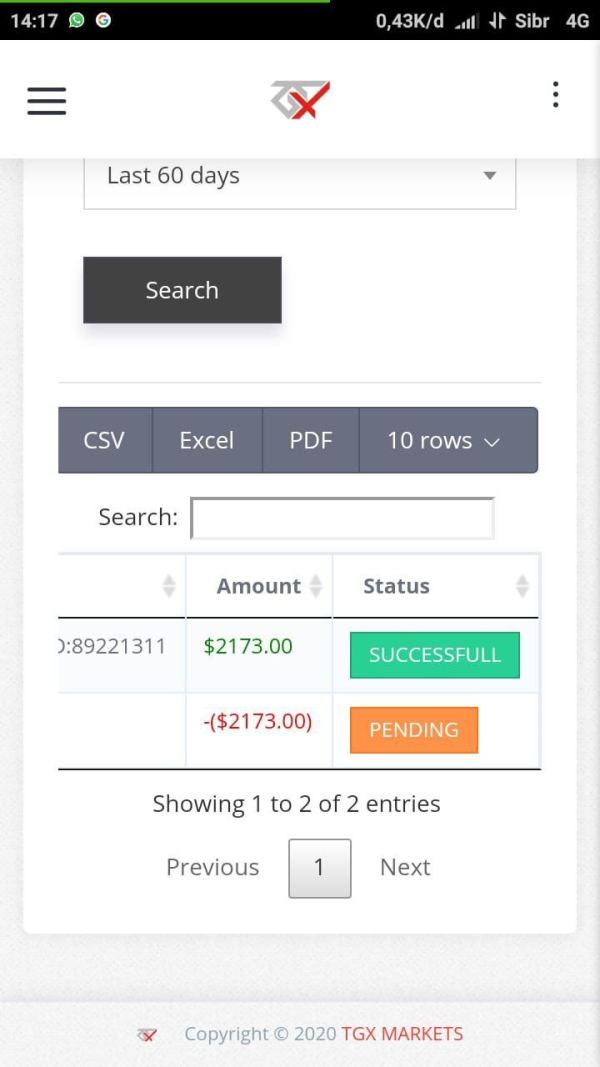

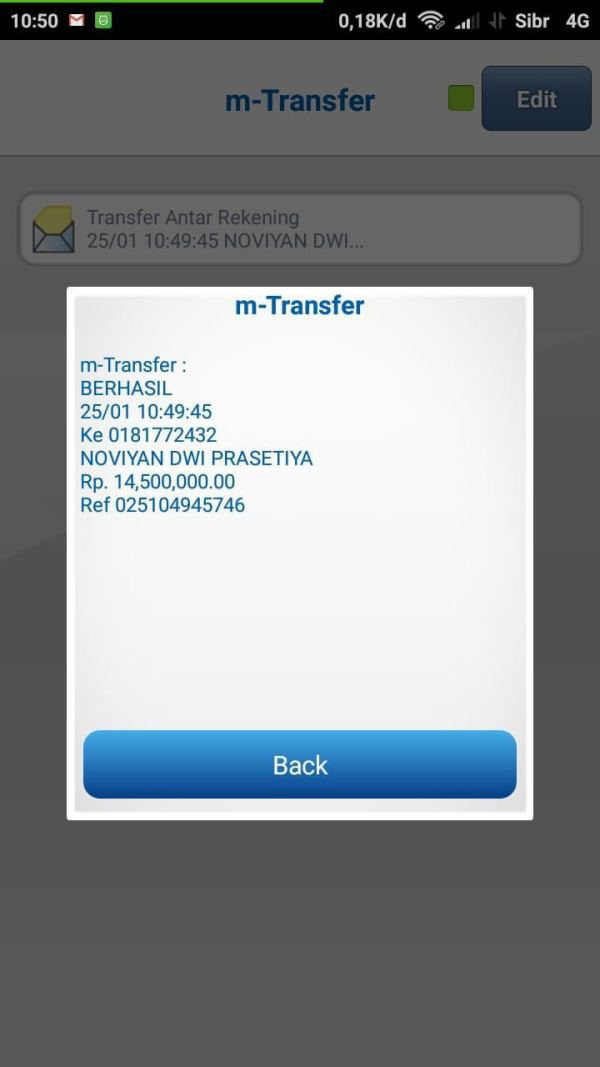

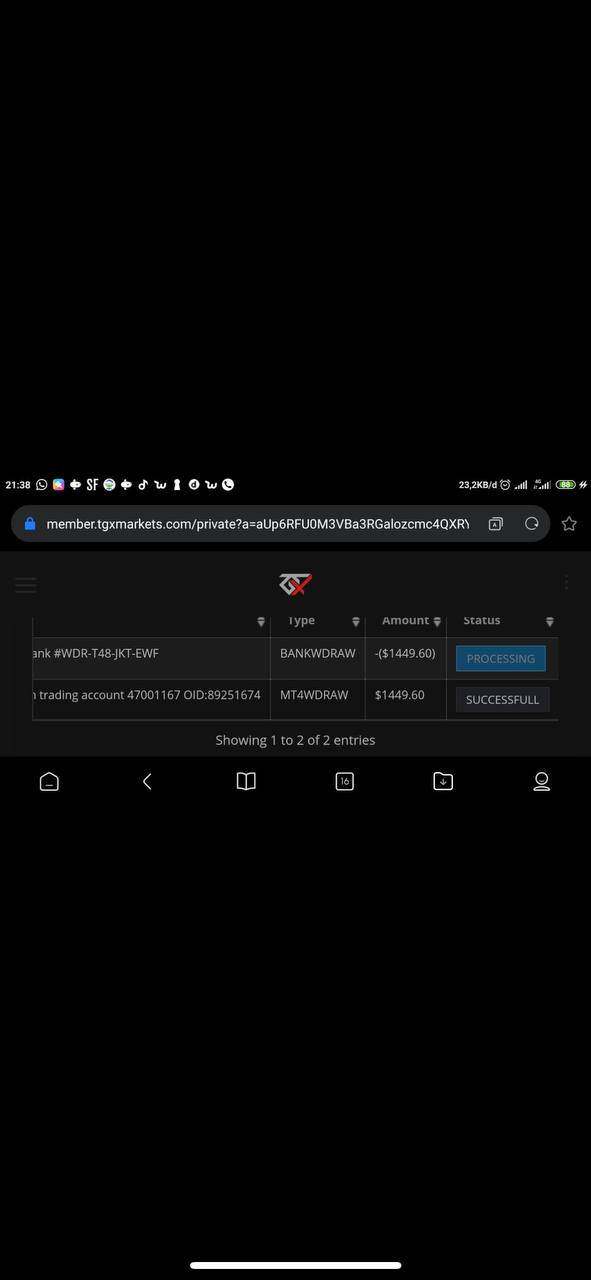

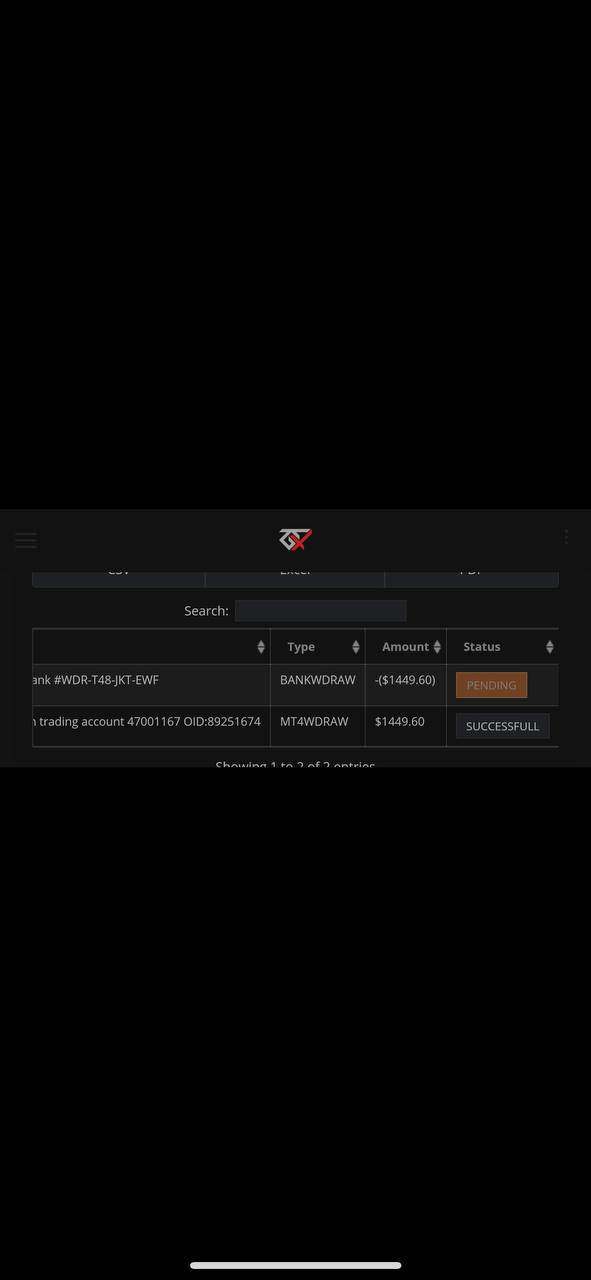

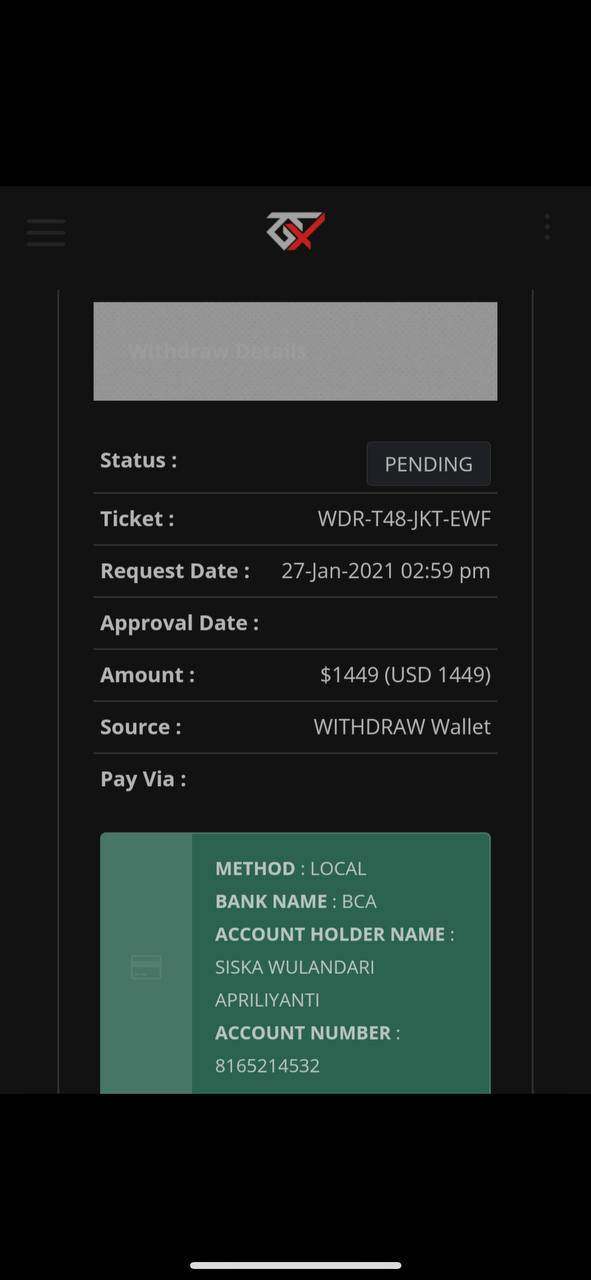

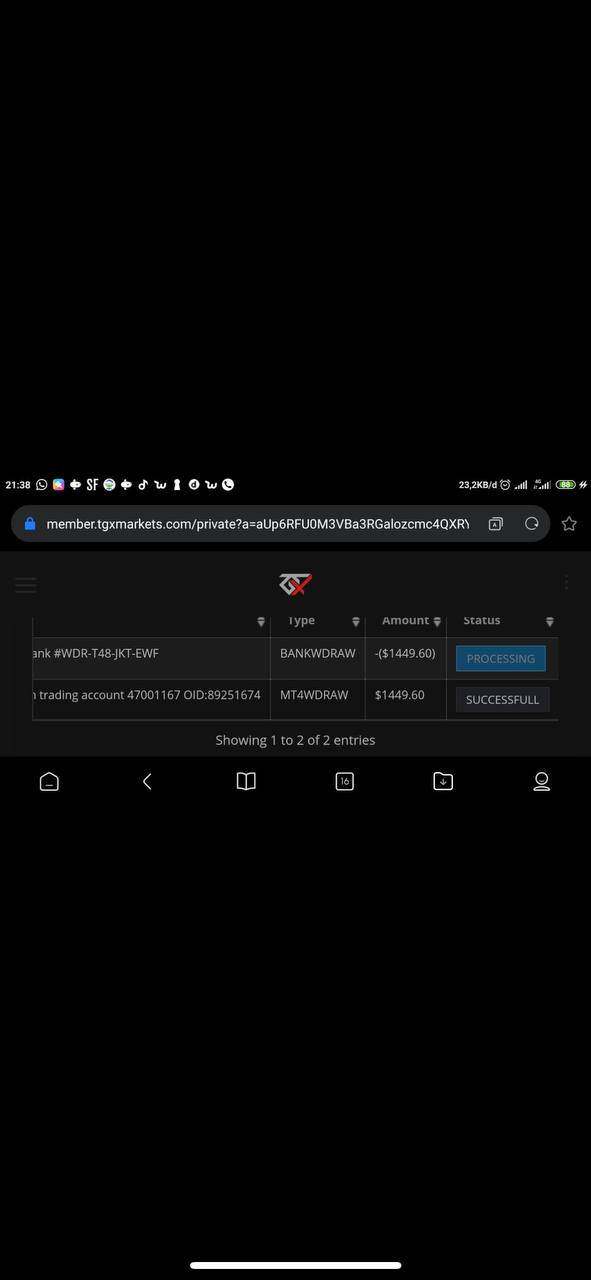

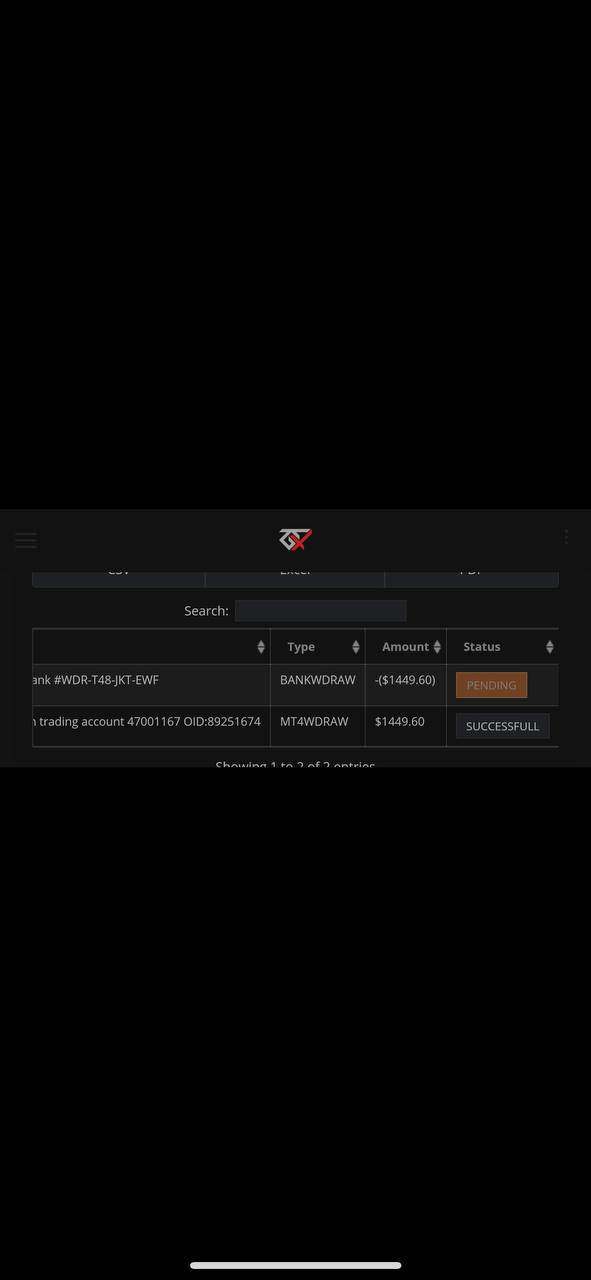

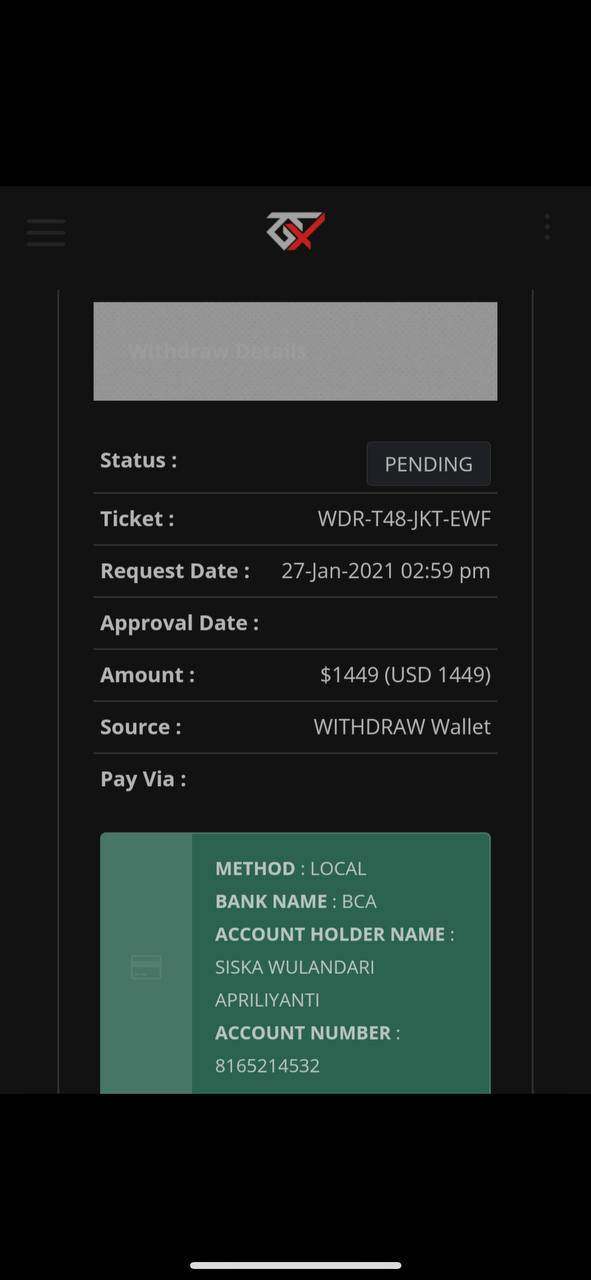

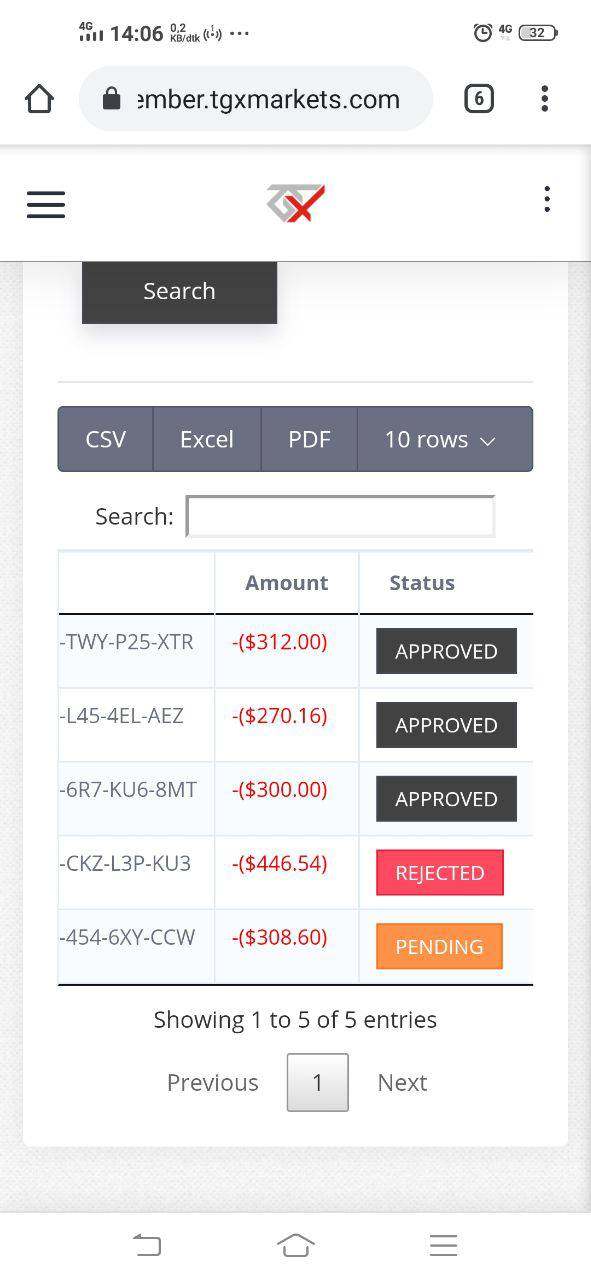

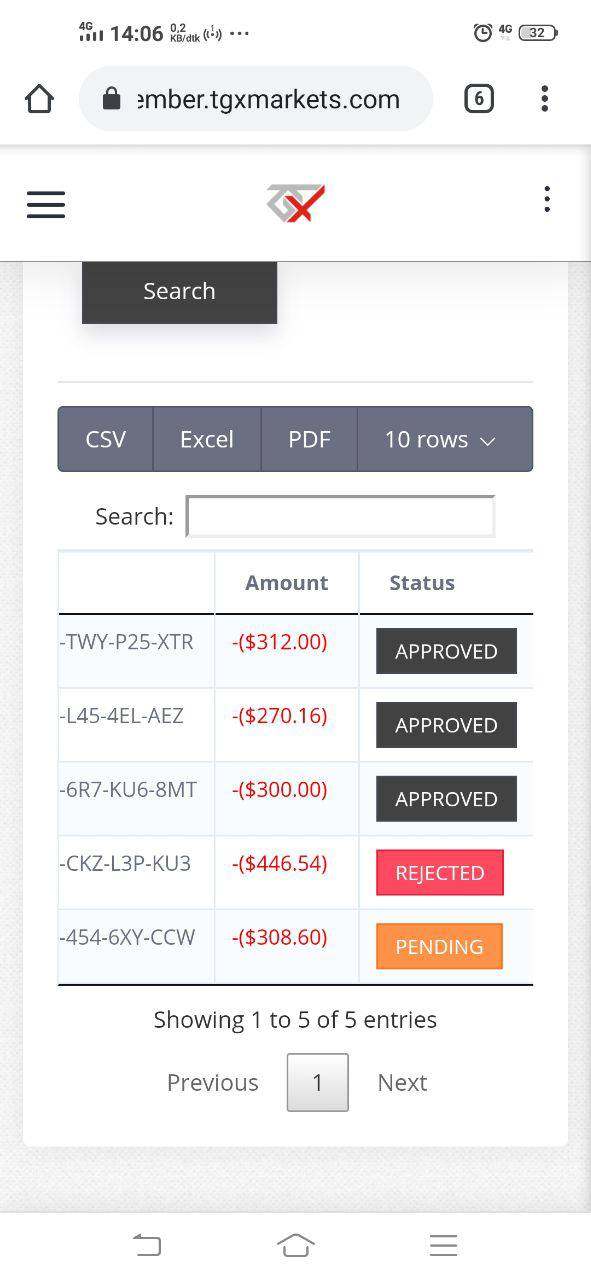

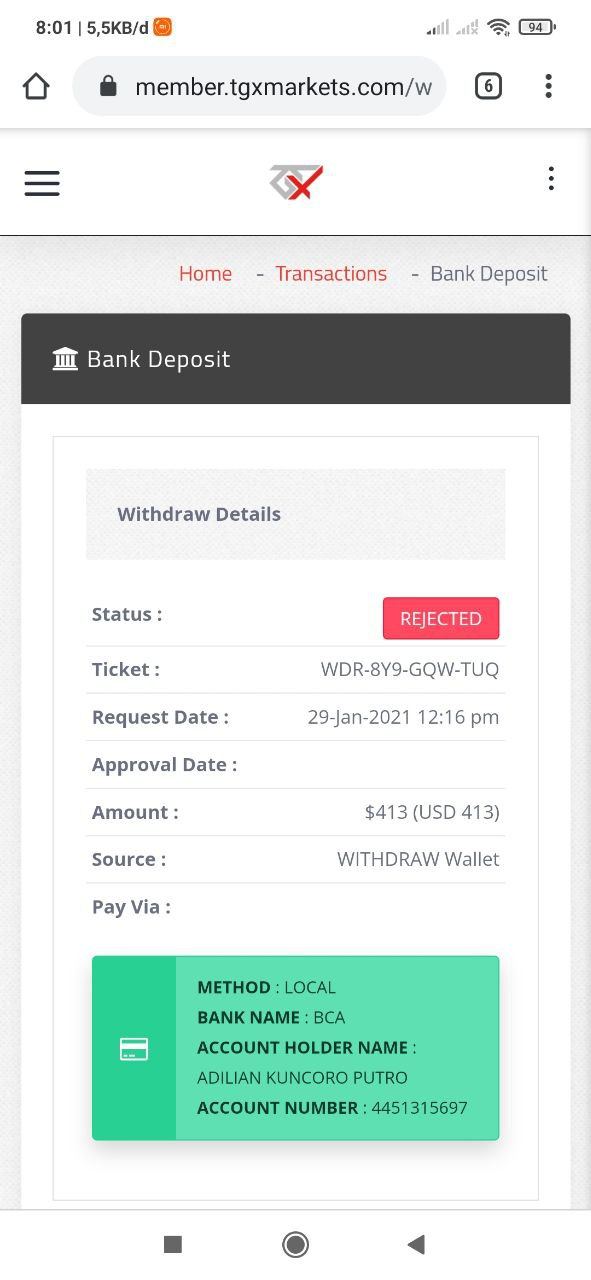

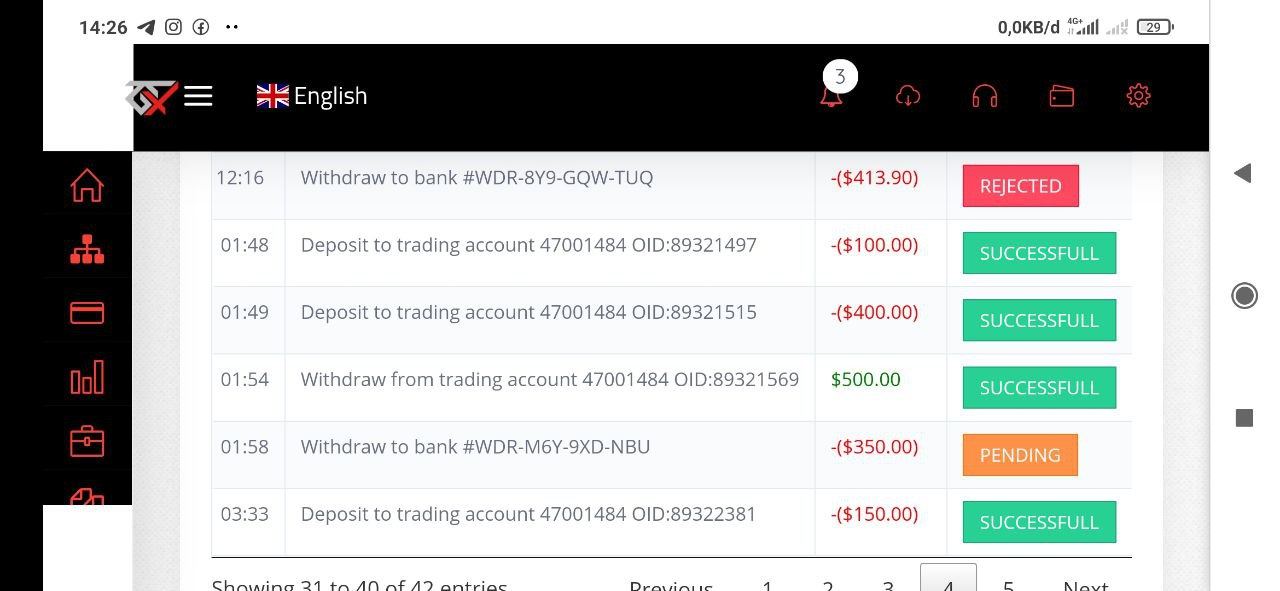

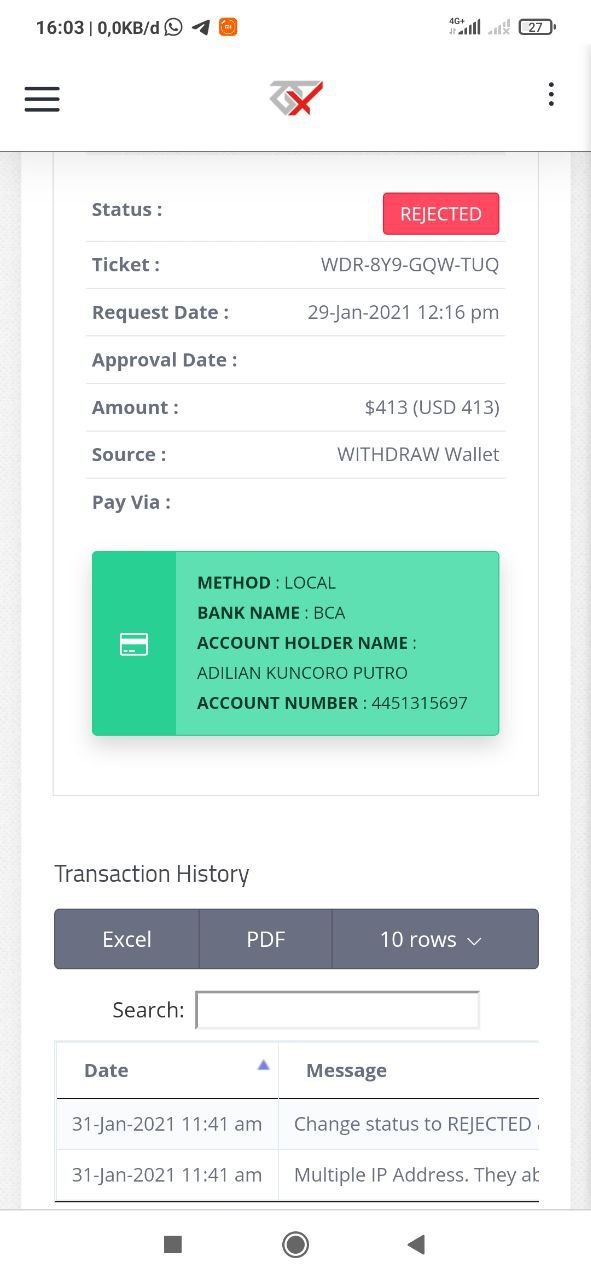

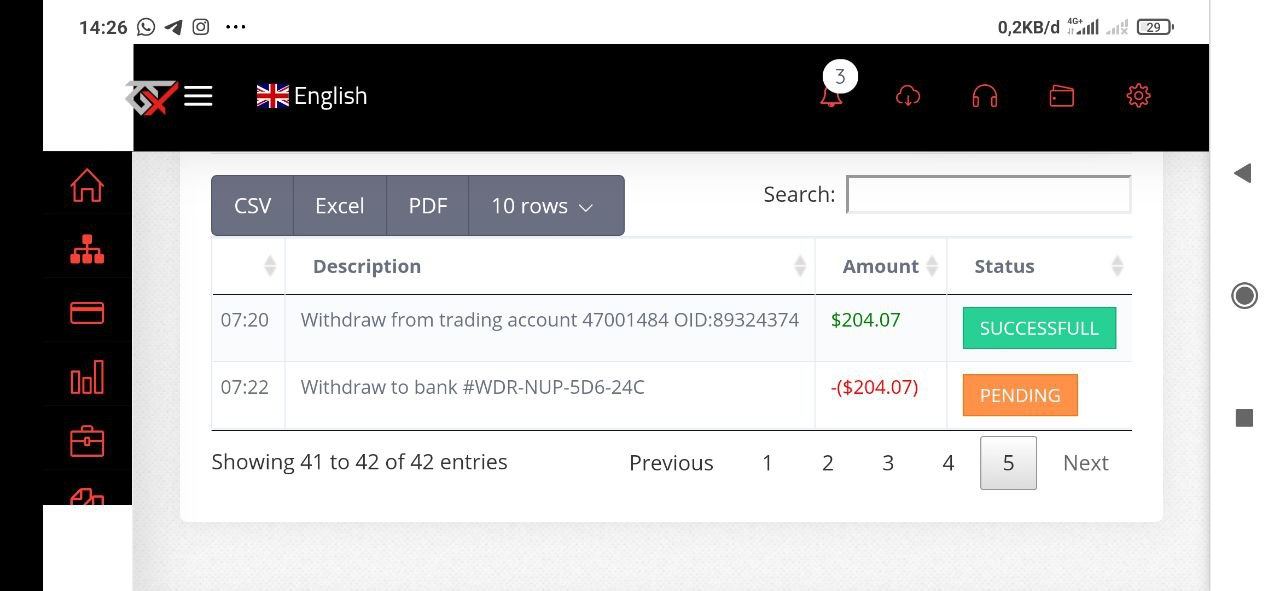

A major point of disagreement has been the fund withdrawal issue, which user feedback shows is marked with delays and procedural complications. These problems not only affect trading efficiency but also reduce overall confidence in the broker's operational reliability. Important components like exact spread details and liquidity conditions haven't been transparently provided, which leaves traders uncertain about potential hidden costs or slippages.

The lack of detailed information about mobile trading experiences further contributes to a poor trading environment. Together, these factors create a challenging trading context for both new and seasoned traders, and the negative perceptions expressed by users, particularly around withdrawal issues and order execution, are significant disadvantages that are central to this tgx markets review.

5. Trust Analysis

Trust is extremely important when selecting a trading broker, and TGX Markets falls notably short in this area. The broker's failure to secure any valid regulatory licenses immediately questions its legitimacy. The absence of a regulatory framework means there are no protective mechanisms for traders, which is a major red flag that should concern anyone thinking about using their services.

Users have expressed significant worries about fund safety, especially when combined with the low WikiFX rating of 1.43, which shows broader industry skepticism. Transparency is another critical factor in building trust, yet TGX Markets provides limited insight into its operational practices and safety measures, which makes it hard for potential users to feel confident about their decision. The large volume of negative feedback related to unresolved withdrawal issues further erodes confidence.

Without rigorous external oversight, the potential for fraudulent practices increases, which is a concern echoed in numerous user complaints and independent reviews. The lack of publicly accessible financial reports or detailed disclosures makes uncertainty worse. In light of these issues, potential traders should approach with extreme caution, because the combined impact of unregulated status and consistent negative user experiences severely undermines trust, which is a fundamental aspect central to this tgx markets review.

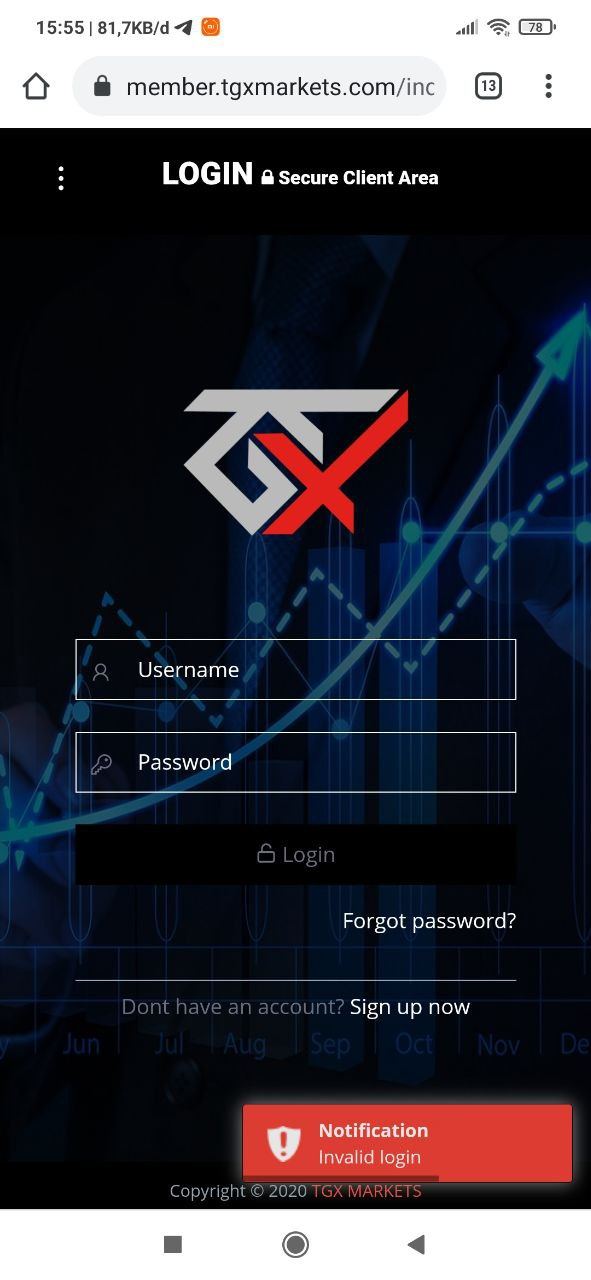

6. User Experience Analysis

The overall user experience on TGX Markets has been overwhelmingly negative, as shown by recurring complaints on multiple feedback platforms. Users repeatedly express frustrations over many issues, from complex and non-intuitive account management processes to difficult fund withdrawal procedures. The platform's interface, while built on the MT4 system, appears to be less optimized for ease of use compared to other modern trading platforms that prioritize user experience.

Many traders have reported that navigating account registration and verification processes is unnecessarily complicated, which leads to delays in beginning actual trading. The negative experiences are made worse by inadequate customer support that fails to provide timely assistance when technical or financial issues arise, which significantly hurts overall satisfaction and confidence. Although TGX Markets may still attract those interested in a low minimum deposit, the consistently unfavorable reviews about irregular platform performance and withdrawal-related issues show a fundamentally poor user experience.

Users seeking a streamlined and transparent trading environment are likely to be disappointed. This highlights the essential need for improvements across all user interaction channels, as emphasized in this tgx markets review.

Conclusion

TGX Markets shows significant drawbacks that overshadow its appealing low entry barrier and high leverage options. The broker's unregulated status, combined with consistent negative user feedback about fund withdrawal and customer service, puts it at a considerable disadvantage in the competitive trading market. TGX Markets may seem attractive to beginners because of its low minimum deposit, but the severe operational and transparency issues demand extreme caution from anyone considering using their services.

Potential traders should weigh these risks carefully and consider more reputable, regulated alternatives before engaging in trading activities with TGX Markets. This tgx markets review clearly advises caution and further research before any financial commitments are made, because the risks may outweigh any potential benefits for most traders.