Swan Bullion 2025 Review: Everything You Need to Know

Swan Bullion, an Australian-based precious metals company, has garnered mixed reviews from users and experts alike. While the firm offers a transparent fee structure and a range of services, including buying and loaning precious metals, its lack of regulation raises significant concerns. This review aims to provide a comprehensive overview of Swan Bullion, highlighting both its strengths and weaknesses.

Note: It's important to understand that the operations of Swan Bullion may differ across regions, and the absence of regulatory oversight adds a layer of risk for potential investors. This review synthesizes information from various sources to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Ratings are derived from a comprehensive analysis of user feedback, expert opinions, and factual data.

Broker Overview

Founded in 2004, Swan Bullion is a prominent player in the precious metals market, specializing in the buying, selling, and loaning of gold, silver, platinum, and collectible coins. The firm operates without a verified regulatory authority, which raises questions about its credibility. Swan Bullion does not offer a specific trading platform like MT4 or MT5, as it primarily functions as a retail outlet for precious metals. The company provides various payment methods, including credit cards and bank transfers, but lacks a robust online trading interface.

Detailed Section

Regulated Regions: Swan Bullion operates out of Australia but has no valid regulatory licenses, which is a significant red flag for potential investors. The absence of oversight means that consumer protection measures are lacking, leading to higher risks for clients engaging in transactions.

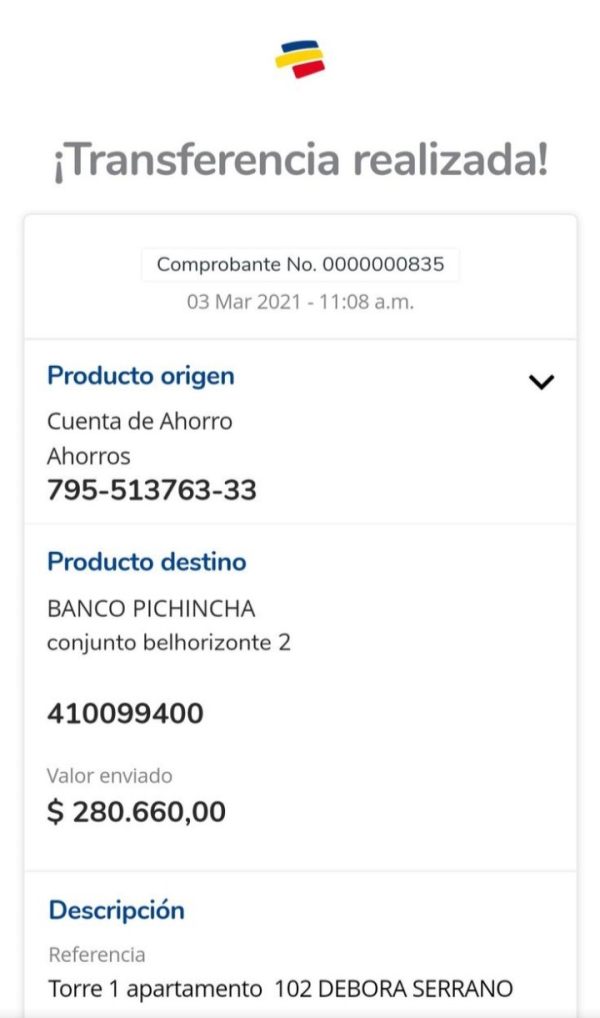

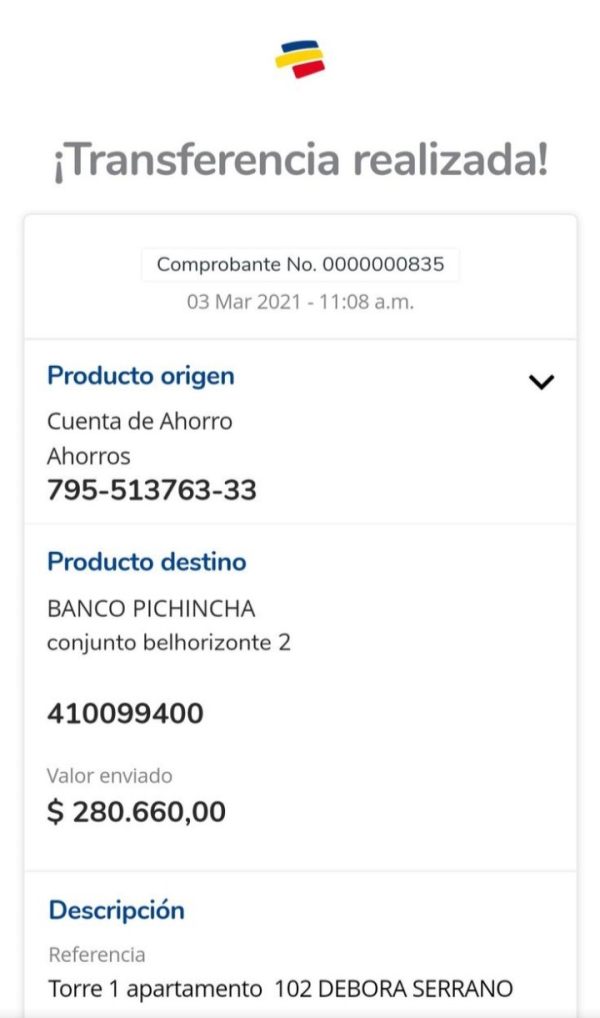

Deposit/Withdrawal Currencies: The firm accepts various payment methods, including credit cards and bank transfers. However, the lack of cryptocurrency options may deter some tech-savvy investors.

Minimum Deposit: Specific information regarding the minimum deposit required by Swan Bullion is not readily available, which could be a concern for potential clients looking for transparency.

Bonuses/Promotions: There are no current promotions or bonuses mentioned in the sources reviewed, which may be a drawback for those seeking incentives to invest.

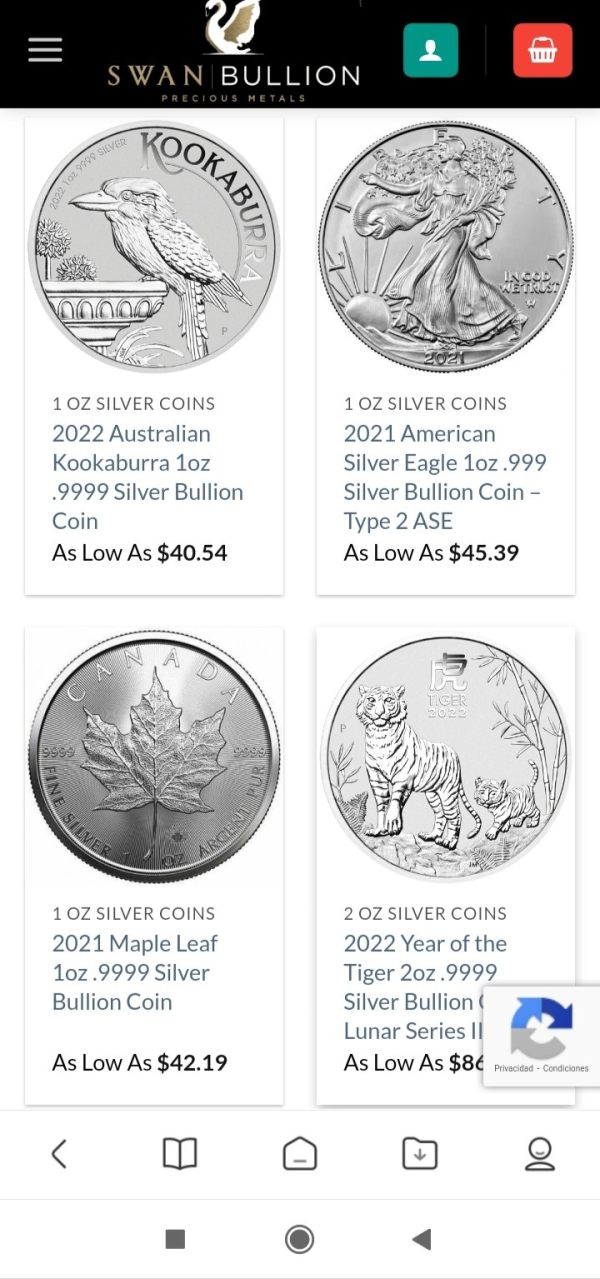

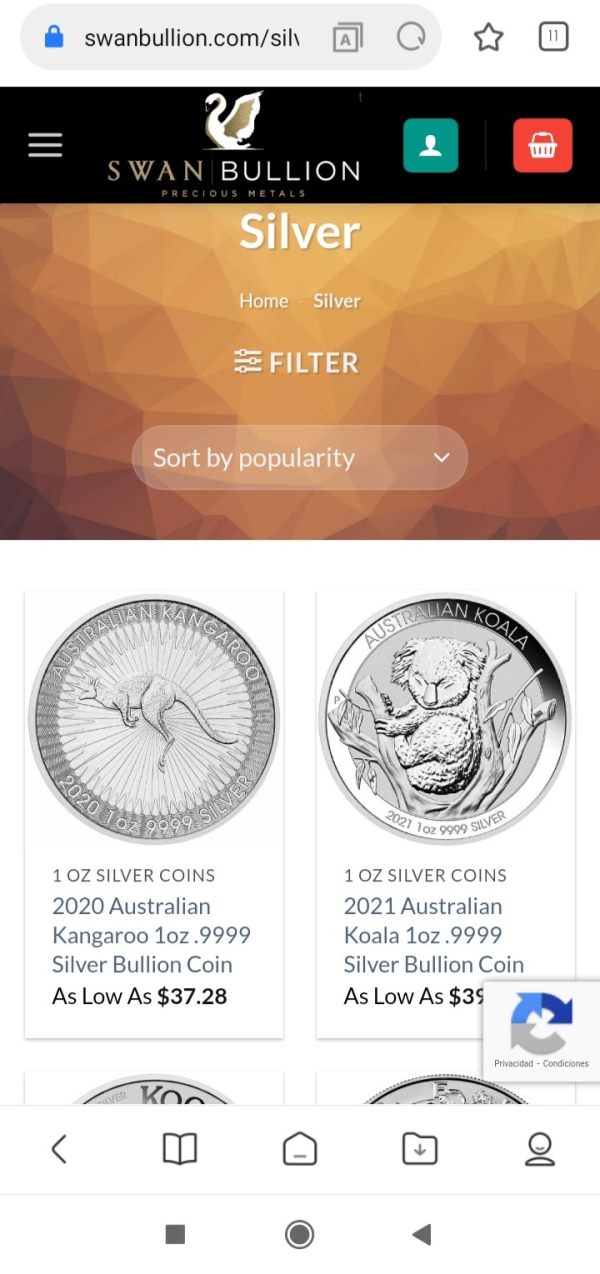

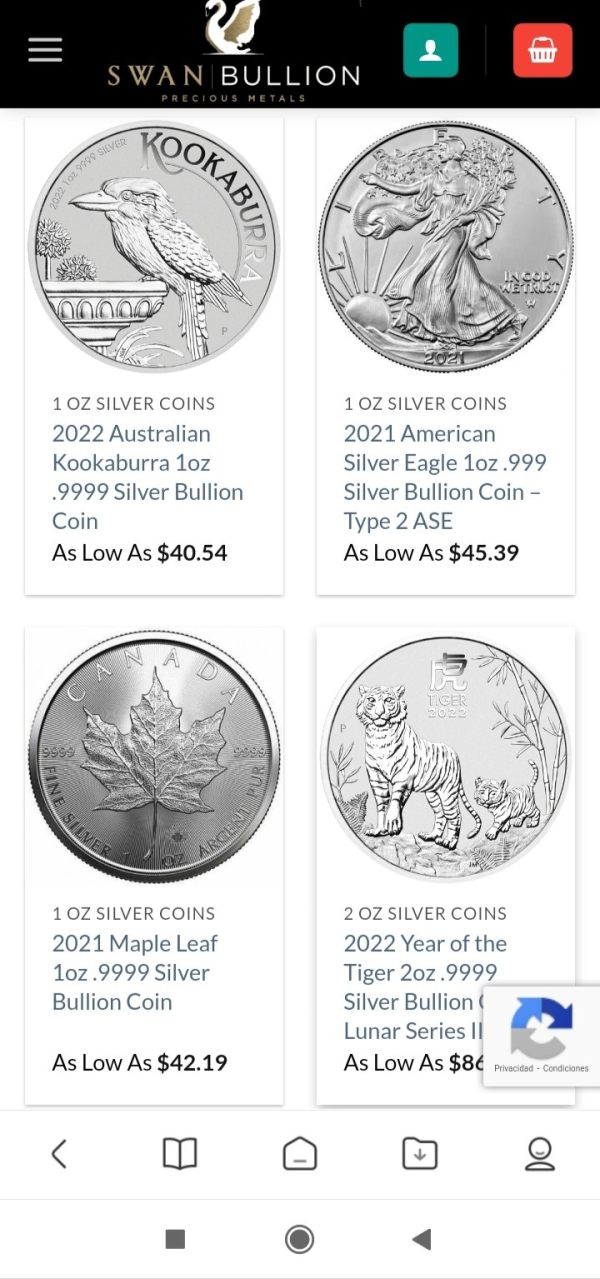

Tradeable Asset Classes: Swan Bullion primarily focuses on precious metals, including gold, silver, platinum, and collectible coins. This narrow focus may limit diversification opportunities for investors.

Costs (Spreads, Fees, Commissions): The firm maintains a transparent fee structure, with specific buy and loan rates based on the purity of the metals. For instance, gold rates range from AUD 30.82 to AUD 94.64 per gram, depending on purity. However, the lack of clarity around other potential fees could be a concern.

Leverage: The review sources did not provide specific information about leverage options offered by Swan Bullion, which could be a significant factor for traders.

Allowed Trading Platforms: Swan Bullion does not appear to offer traditional trading platforms, as it focuses on in-person and online retail transactions for precious metals.

Restricted Regions: While Swan Bullion operates primarily in Australia, the absence of regulatory oversight may limit its appeal in other jurisdictions.

Available Customer Service Languages: The primary language for customer service appears to be English, which could be a limitation for non-English speaking clients.

Ratings Revisited

Detailed Breakdown

-

Account Conditions: The lack of regulatory oversight significantly impacts the trustworthiness of Swan Bullion. Potential investors should be cautious, as the absence of regulation can lead to higher risks.

Tools and Resources: Swan Bullion does not provide a sophisticated trading platform, which may limit the trading experience for users accustomed to more advanced tools.

Customer Service and Support: The firm offers multiple channels for customer support, including email and phone contact. However, the effectiveness and responsiveness of these services remain uncertain, especially given the negative reviews highlighting issues with fund withdrawals.

Trading Experience: The absence of a dedicated trading platform and the focus on physical transactions may not meet the expectations of modern traders looking for online trading capabilities.

Trustworthiness: With a lack of regulatory oversight and reports of potential scams, Swan Bullion's trustworthiness is significantly compromised. Users are advised to conduct thorough research before engaging with the company.

User Experience: While some users appreciate the transparent fee structure, the overall experience is marred by concerns over security and the potential for scams, as highlighted in various reviews.

In conclusion, while Swan Bullion offers a range of services in the precious metals market, the absence of regulation and concerns about trustworthiness make it a risky choice for potential investors. Users should weigh the pros and cons carefully and consider alternative options that provide better regulatory oversight and customer protection. For those interested in precious metals, conducting thorough research and seeking regulated alternatives is strongly advised.