Executive Summary

SPRING FX CRYPTO TRADING presents itself as an online investment platform offering forex, stock market, and cryptocurrency trading services. However, this spring fx crypto trading review reveals significant concerns about the broker's regulatory status and overall reliability. The company is registered in Romania but operates without proper oversight from any recognized financial regulatory authority. This raises substantial red flags for potential investors.

The platform attracts traders seeking diversified trading opportunities across multiple asset classes, including foreign exchange, equities, and digital currencies. User feedback presents a mixed picture. Both positive and negative experiences have been reported by clients. While some users appreciate the variety of trading instruments available, others have raised concerns about the company's business practices and customer service quality.

The lack of valid regulatory certificates represents the most significant weakness in SPRING FX CRYPTO TRADING's offering. Without proper regulatory oversight, traders face increased risks regarding fund security and dispute resolution. Additionally, the absence of detailed information about trading conditions, spreads, commissions, and minimum deposit requirements makes it difficult for potential clients to make informed decisions. This creates uncertainty about whether this platform suits their trading needs.

Important Notice

SPRING FX CRYPTO TRADING claims to be a US-registered entity but operates without supervision from any recognized financial regulatory institution. This creates a significant regulatory gap that potential clients should carefully consider before engaging with the platform. The company's actual operational base appears to be in Romania, despite claims of US registration. This adds another layer of complexity to its regulatory status.

This review is based on comprehensive analysis of available public information and user feedback collected from various sources. Due to the limited transparency provided by the broker itself, some aspects of their service offering remain unclear. Traders should exercise extreme caution when considering this platform. They should conduct their own due diligence before making any financial commitments.

Rating Framework

Broker Overview

SPRING FX CRYPTO TRADING operates as an online investment platform that claims to provide access to multiple financial markets. The company's background information remains somewhat unclear. Limited details are available about its founding date or specific headquarters location. While the broker claims US registration, its actual operational base appears to be in Romania. This creates confusion about its true jurisdictional status.

The platform positions itself as a comprehensive trading solution for investors seeking exposure to diverse asset classes. The broker's business model centers around providing online trading services across forex markets, stock exchanges, and cryptocurrency platforms. However, the lack of detailed information about the company's history, management team, and operational structure raises questions about its legitimacy and long-term viability.

This spring fx crypto trading review finds that the broker operates without clear regulatory framework. This significantly impacts its credibility in the competitive online trading space. The absence of proper licensing from established financial authorities like the FCA, CySEC, or ASIC means that clients have limited recourse in case of disputes or issues with the platform. This regulatory gap represents a fundamental weakness that potential traders must carefully consider.

The company's asset offerings include foreign exchange pairs, stock market instruments, and various cryptocurrencies. This suggests an attempt to cater to different trader preferences and strategies. However, without detailed information about trading conditions, execution quality, or platform specifications, it becomes challenging to assess the true value proposition offered by SPRING FX CRYPTO TRADING.

Regulatory Status

SPRING FX CRYPTO TRADING operates without oversight from any recognized financial regulatory authority. While registered in Romania, the company lacks proper licensing from established regulators. This creates significant risks for client fund protection and dispute resolution.

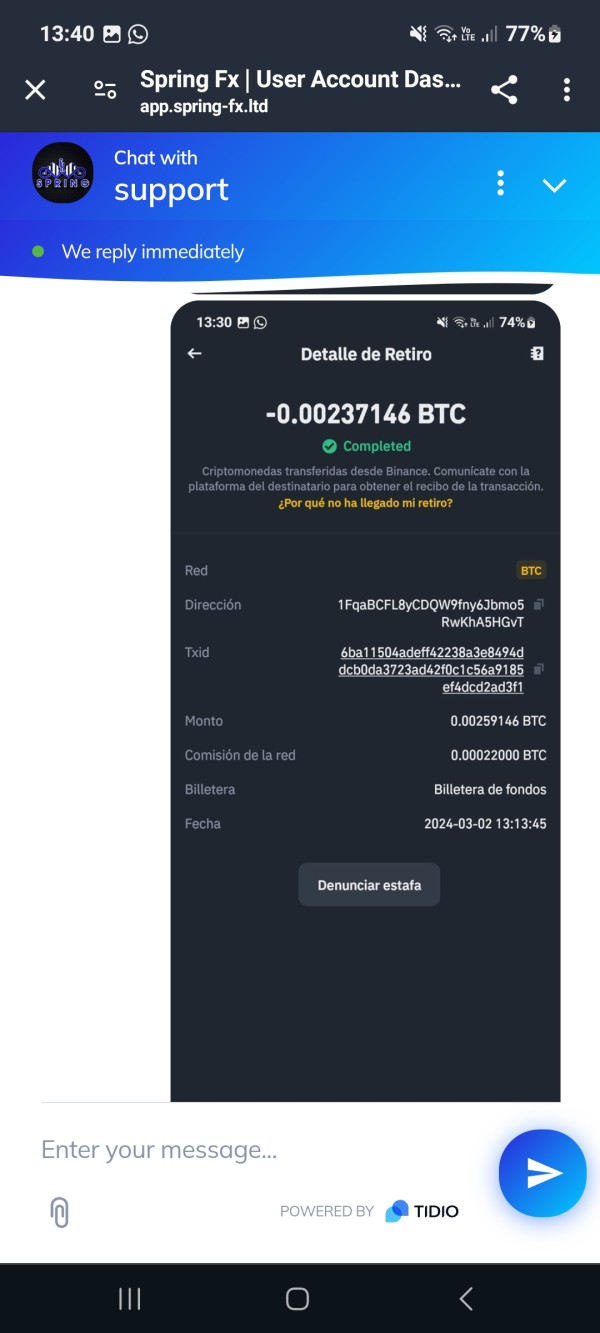

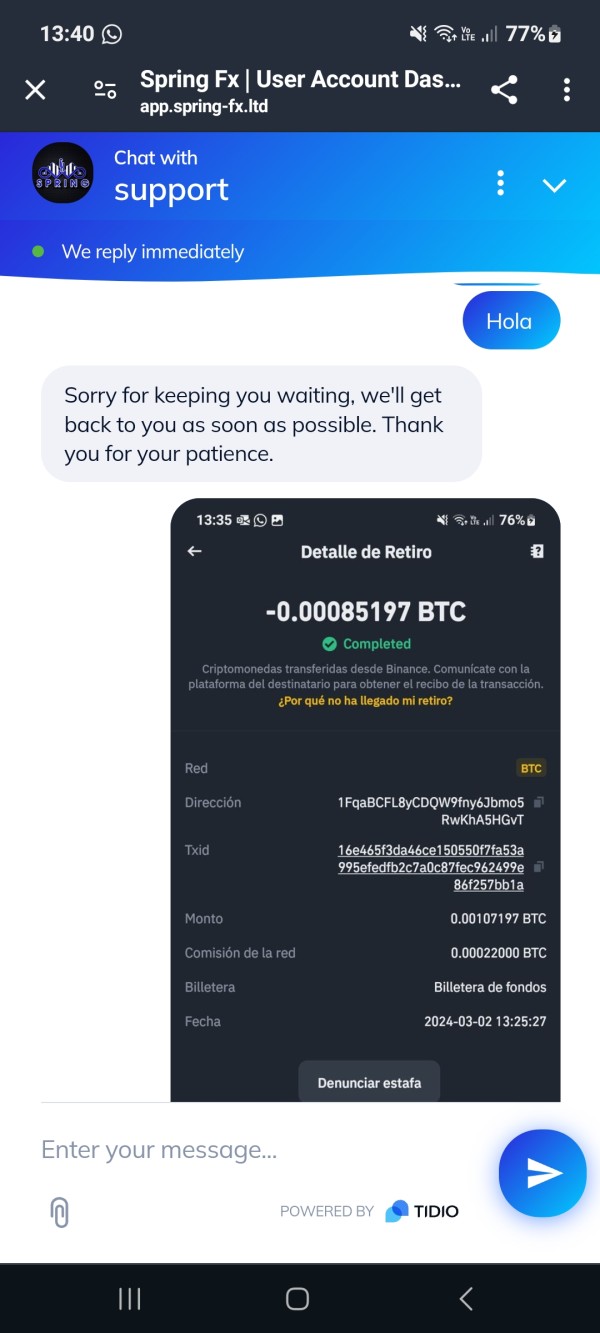

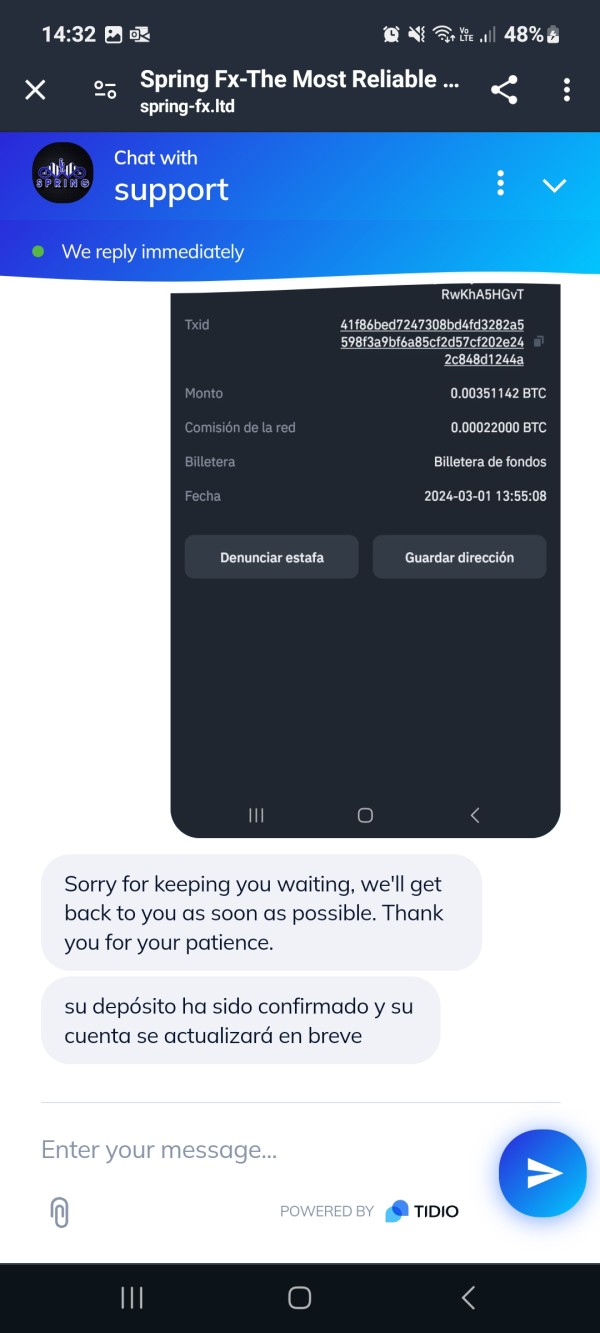

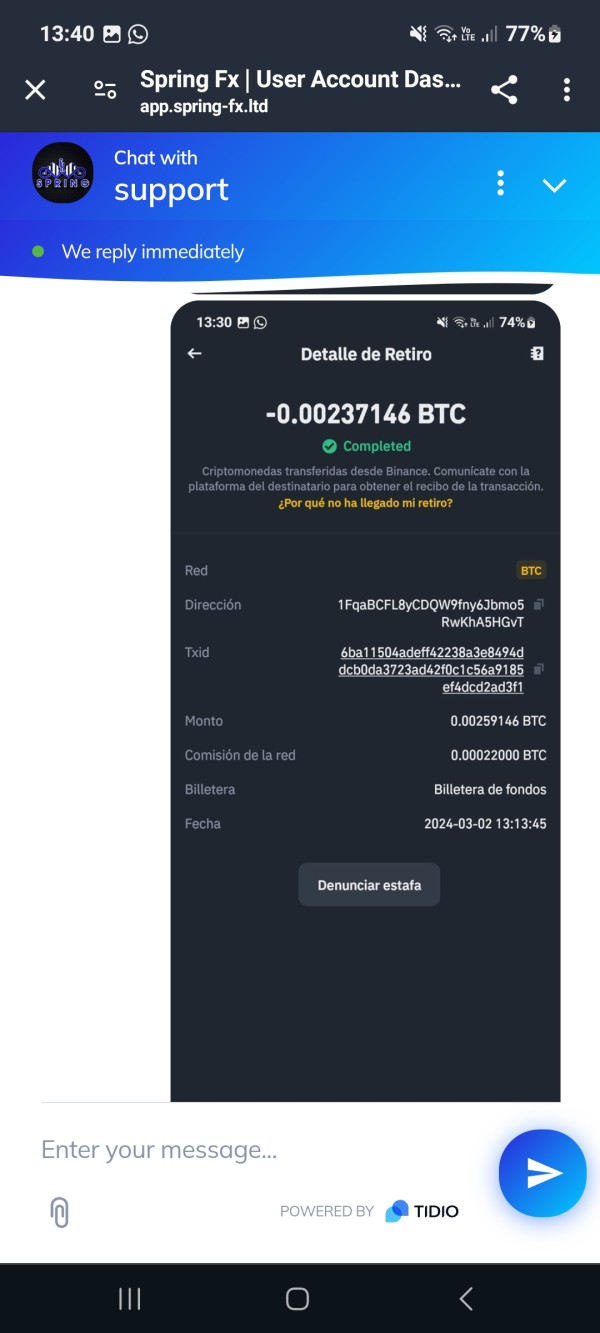

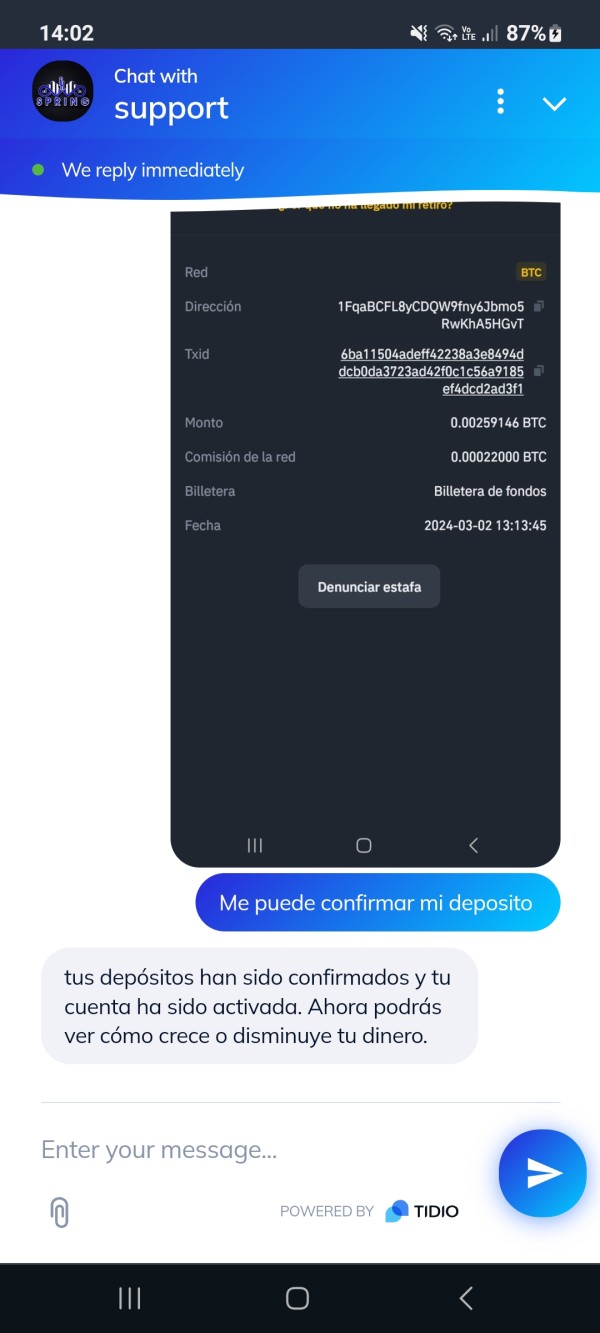

Deposit and Withdrawal Methods

Specific information about available deposit and withdrawal methods has not been disclosed in available materials. This makes it difficult for potential clients to understand funding options.

Minimum Deposit Requirements

The platform has not provided clear information about minimum deposit requirements across different account types.

Details about promotional offers, welcome bonuses, or ongoing incentive programs are not mentioned in available documentation.

Tradeable Assets

SPRING FX CRYPTO TRADING offers access to forex markets, stock market instruments, and cryptocurrency trading opportunities. This provides diversification across multiple asset classes.

Cost Structure

Specific information about spreads, commissions, overnight fees, and other trading costs has not been clearly disclosed. This makes cost comparison difficult.

Leverage Ratios

Available leverage ratios for different asset classes and account types are not specified in accessible materials.

The specific trading platforms supported by the broker, such as MetaTrader 4 or 5, proprietary platforms, or web-based solutions, are not detailed in available information.

This spring fx crypto trading review highlights the significant information gaps that potential clients face when evaluating this broker's offerings.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by SPRING FX CRYPTO TRADING present several concerns that contribute to the low rating in this category. The broker has not provided transparent information about the different account types available to traders. This makes it impossible to compare features and benefits across different client segments. This lack of clarity extends to fundamental aspects such as minimum deposit requirements. These remain unspecified across all account categories.

The absence of detailed information about account opening procedures represents another significant weakness. Potential clients cannot easily understand the documentation requirements, verification processes, or timeframes involved in establishing a trading account. This opacity creates uncertainty and may deter serious traders who require clear information before committing to a platform.

User feedback regarding account conditions shows mixed experiences. Some clients report satisfactory account setup processes while others express frustration with unclear terms and conditions. The lack of information about special account features, such as Islamic accounts for Muslim traders or managed account options, further limits the platform's appeal to diverse client bases.

When compared to established brokers in the market, SPRING FX CRYPTO TRADING's account conditions transparency falls significantly short of industry standards. This spring fx crypto trading review emphasizes that the absence of clear account specifications creates unnecessary barriers for potential clients seeking to make informed decisions about their trading platform choice.

SPRING FX CRYPTO TRADING's tools and resources receive a moderate rating based on the diversity of asset classes offered. However, specific details about tool quality remain limited. The platform provides access to forex, stock market, and cryptocurrency trading. This suggests an attempt to serve traders with varying interests and strategies. However, the absence of detailed information about specific trading tools, analytical resources, and educational materials limits the assessment of their actual value.

The broker has not disclosed information about research and analysis resources that might be available to clients. Modern traders typically expect access to market news, technical analysis tools, economic calendars, and expert commentary to support their decision-making processes. Without clear information about these resources, it becomes difficult to evaluate whether the platform meets contemporary trading requirements.

Educational resources represent another area where information is lacking. Successful brokers typically provide comprehensive educational materials including webinars, tutorials, trading guides, and market analysis to help clients improve their trading skills. The absence of detailed information about such resources suggests either their non-existence or poor communication about available offerings.

User feedback regarding platform tools shows varied experiences. Some traders find adequate functionality while others report limitations in available features. The lack of information about automated trading support, API access, or advanced order types further restricts the platform's appeal to sophisticated traders who require comprehensive tool sets.

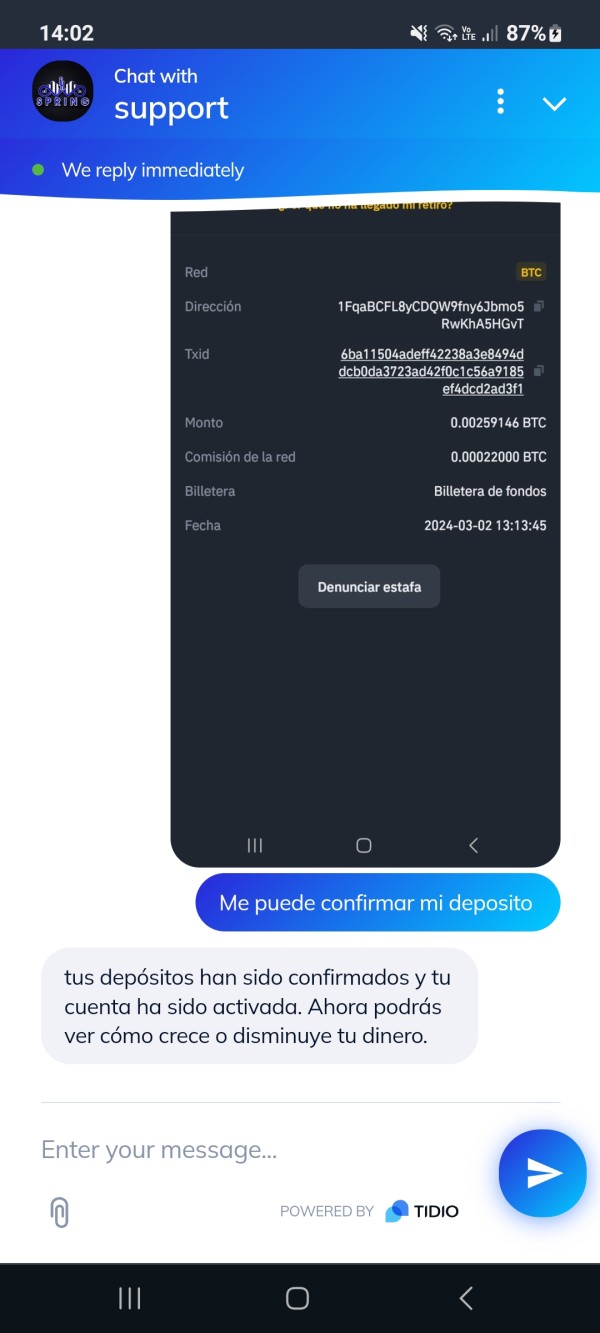

Customer Service and Support Analysis (5/10)

Customer service quality at SPRING FX CRYPTO TRADING receives a mixed rating based on polarized user feedback and limited information about support infrastructure. The broker has not provided clear details about available customer service channels. This makes it difficult for potential clients to understand how they can access support when needed.

Response times appear to vary significantly based on user reports. Some clients experience prompt assistance while others report delays in receiving support. This inconsistency in service delivery creates uncertainty about the reliability of customer support when urgent assistance is required. The absence of guaranteed response time commitments further complicates expectations management.

Service quality feedback from users presents a divided picture. Some clients praise helpful support staff while others express frustration with inadequate problem resolution. This polarization suggests potential issues with staff training, resource allocation, or support process standardization that could impact client satisfaction levels.

The broker has not disclosed information about multilingual support capabilities. This could limit accessibility for international clients. Similarly, details about customer service operating hours, holiday schedules, and emergency contact procedures are not readily available. This creates additional uncertainty about support availability when needed.

Trading Experience Analysis (5/10)

The trading experience provided by SPRING FX CRYPTO TRADING shows mixed results based on available user feedback. This contributes to a moderate rating in this category. User reports indicate varying levels of satisfaction with platform stability and execution quality. This suggests inconsistent performance that could impact trading outcomes.

Platform stability and speed appear to fluctuate according to user experiences. Some traders report smooth operation while others encounter technical difficulties. This variability in platform performance creates uncertainty about system reliability during critical trading periods. This becomes particularly important during high market volatility when consistent execution becomes crucial.

Order execution quality information is not specifically detailed in available materials. This makes it difficult to assess slippage rates, rejection frequencies, or execution speed benchmarks. These factors significantly impact trading profitability and should be clearly communicated to potential clients considering the platform.

The absence of detailed information about platform functionality completeness, including advanced order types, charting capabilities, and analytical tools, limits the assessment of overall trading experience quality. Mobile trading experience details are also not provided. This is increasingly important for modern traders who require flexible access to markets.

This spring fx crypto trading review finds that the inconsistent user feedback regarding trading experience quality raises concerns about platform reliability and suitability for serious trading activities.

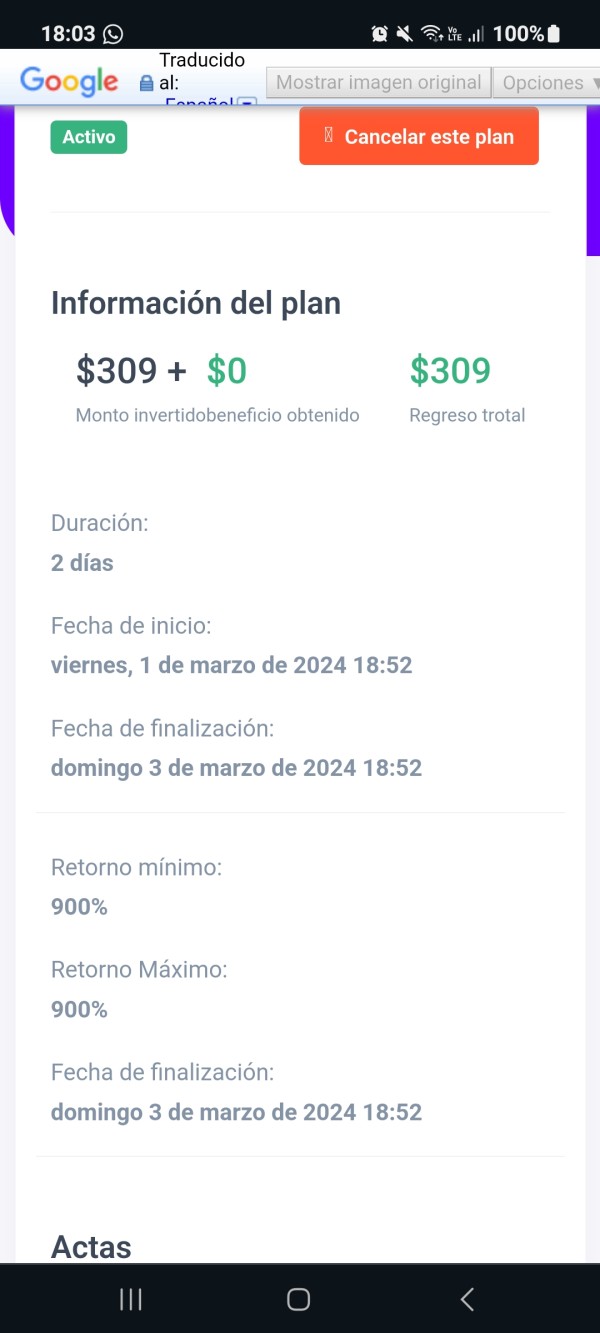

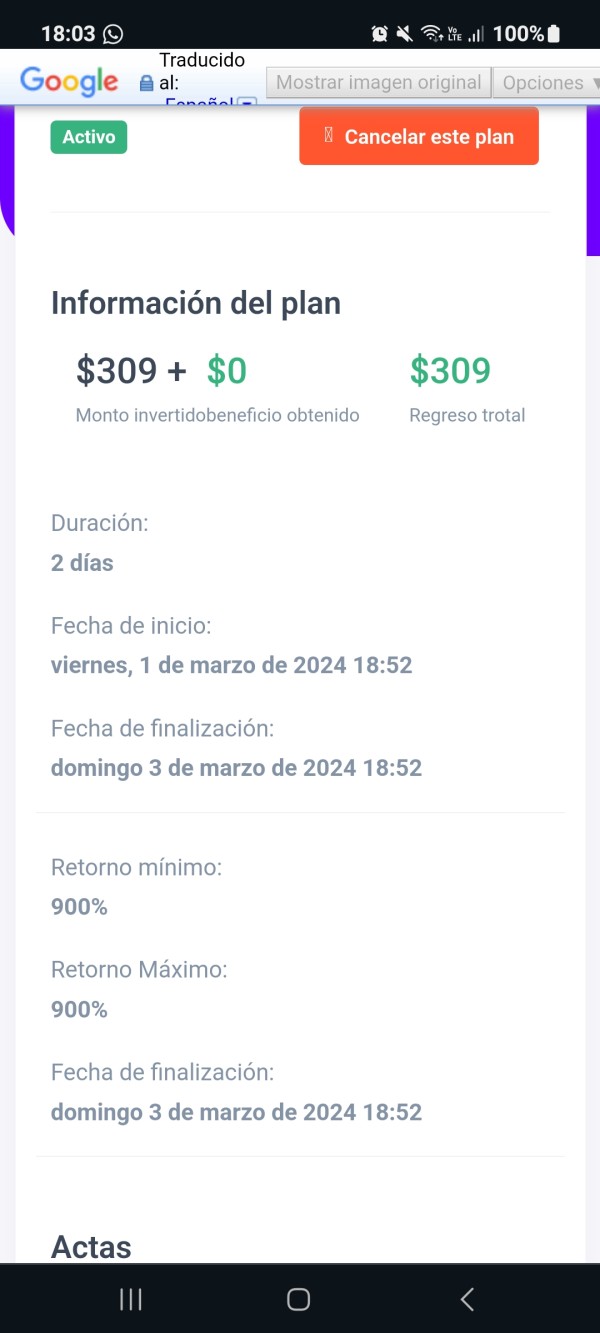

Trust and Security Analysis (3/10)

Trust and security represent the most significant concerns for SPRING FX CRYPTO TRADING. This results in the lowest rating among all evaluation categories. The broker's operation without oversight from any recognized financial regulatory authority creates fundamental trust issues that impact all aspects of client relationships.

The absence of proper regulatory licensing means that client funds lack the protection typically provided by established regulatory frameworks. Reputable financial authorities implement strict requirements for client fund segregation, capital adequacy, and operational standards that help protect trader interests. Without such oversight, clients face increased risks regarding fund security and recovery in case of operational difficulties.

Company transparency issues further compound trust concerns. Limited information is available about management structure, financial statements, or operational procedures. Established brokers typically provide comprehensive information about their corporate governance, regulatory compliance, and risk management practices to build client confidence.

User feedback includes reports of concerning experiences that raise questions about business practices and ethical standards. Some clients have reported interactions with individuals they describe as dishonest. This suggests potential issues with staff conduct or business integrity that require careful consideration by prospective clients.

The absence of industry recognition, awards, or third-party certifications further limits the broker's credibility in the competitive online trading market. Reputable brokers typically accumulate recognition from industry organizations and maintain positive relationships with financial technology providers and liquidity sources.

User Experience Analysis (5/10)

Overall user satisfaction with SPRING FX CRYPTO TRADING shows significant polarization. Experiences range from positive to highly negative, resulting in a moderate rating for user experience. This wide variation in satisfaction levels suggests inconsistent service delivery that may depend on individual circumstances or timing of engagement with the platform.

Interface design and usability information is not detailed in available materials. This makes it difficult to assess whether the platform provides intuitive navigation and efficient workflow for different types of traders. Modern trading platforms require sophisticated design that balances comprehensive functionality with user-friendly operation. This becomes particularly important for less experienced traders.

Registration and verification process details are not clearly specified. This creates uncertainty about account opening requirements and timeframes. Efficient onboarding processes are crucial for positive initial user experiences and can significantly impact long-term client satisfaction and retention rates.

User feedback compilation reveals that negative experiences often center around trust and reliability concerns. Positive feedback tends to focus on asset variety and basic platform functionality. This pattern suggests that while the broker may provide adequate basic services, fundamental trust issues prevent many clients from achieving satisfactory overall experiences.

The absence of detailed user testimonials, case studies, or comprehensive satisfaction surveys limits the ability to identify specific areas where user experience could be improved. Established brokers typically collect and analyze user feedback systematically to drive continuous improvement in service delivery and platform functionality.

Conclusion

This comprehensive spring fx crypto trading review reveals a broker that operates with significant limitations and risks that potential clients must carefully consider. While SPRING FX CRYPTO TRADING offers access to diverse trading assets including forex, stocks, and cryptocurrencies, the fundamental lack of regulatory oversight creates substantial concerns about fund security and business practices.

The platform may appeal to traders seeking diversified investment opportunities across multiple asset classes. However, the absence of proper licensing and mixed user feedback suggest that extreme caution is warranted. The broker's failure to provide transparent information about trading conditions, costs, and operational procedures further compounds the risks associated with choosing this platform.

Key advantages include asset diversity and accessibility to multiple markets. Significant disadvantages encompass regulatory gaps, limited transparency, and polarized user experiences. Potential clients should carefully weigh these factors against their risk tolerance and trading requirements before making any commitment to this platform.