Executive Summary

This comprehensive reynold international securities ltd. review reveals concerning findings about this forex broker. The findings demand immediate attention from potential traders who might consider using their services. Established in March 2024, Reynold International Securities Ltd. has quickly gained significant negative attention within the trading community. The company has earned an alarming overall rating of 1.00 out of 10 from WikiBit's assessment platform.

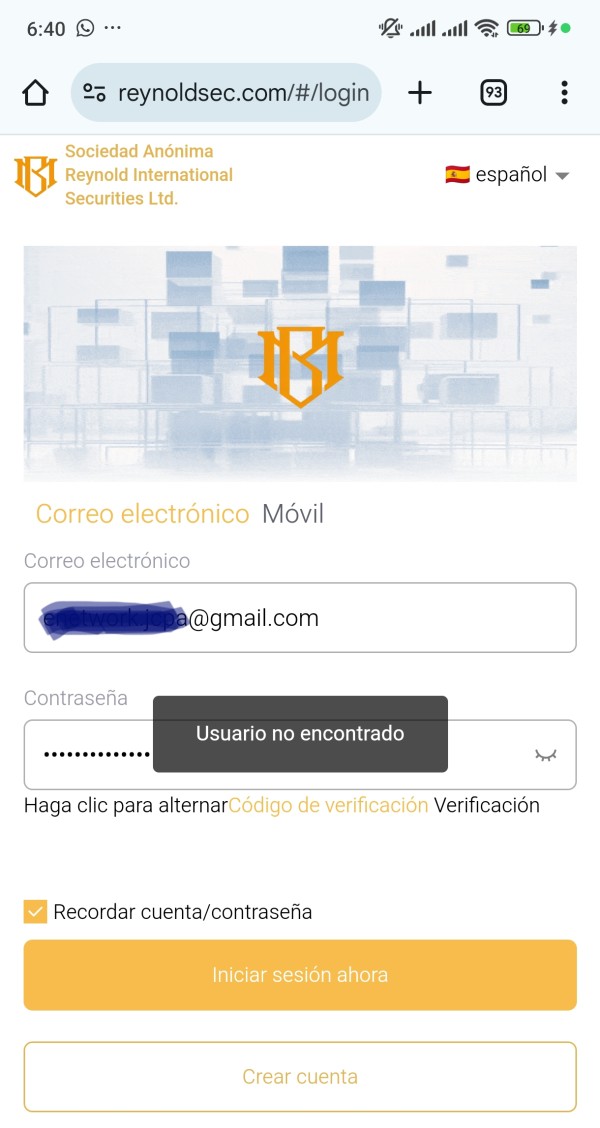

The broker claims to hold operational licenses from the U.S. Securities and Exchange Commission (SEC). However, multiple user reports and industry analyses have flagged serious concerns about its legitimacy and actual regulatory compliance. TraderKnows and other review platforms have documented numerous user complaints characterizing the company as a fraudulent operation. While the company maintains "Good Standing" status with company ID number 20241937004, this administrative status does not reflect the reality of user experiences or operational integrity that traders actually encounter.

Targeted primarily at forex market newcomers and experienced traders seeking new opportunities, Reynold International Securities Ltd. presents significant red flags. These warning signs are ones that potential clients must carefully consider before making any financial commitments. The overwhelmingly negative user feedback, combined with the lack of transparent operational information, creates a concerning picture for anyone considering this broker. This situation should make traders think twice about using their trading services.

Important Notice

This review is based on comprehensive analysis of available user feedback, industry reports, and market information. The information was gathered from multiple sources including WikiBit, TraderKnows, and other industry platforms that monitor broker performance. The evaluation methodology incorporates user testimonials, regulatory status verification, and comparative analysis with established industry standards.

Readers should note that the forex industry involves significant risks. Broker selection requires careful due diligence and thorough research before making any financial commitments. This assessment reflects information available at the time of writing and may be subject to changes in the broker's operational status or regulatory standing.

Rating Framework

Based on available information and user feedback, here are our ratings for Reynold International Securities Ltd.:

Broker Overview

Reynold International Securities Ltd. emerged in the forex market on March 13, 2024. The company represents one of the newest entrants in the competitive online trading space that serves retail investors. According to official records, the company maintains "Good Standing" status with company identification number 20241937004. This status suggests compliance with basic administrative requirements that companies must meet to operate legally.

The broker positions itself as a forex trading service provider. The company focuses specifically on foreign exchange market access for retail and potentially institutional clients who want to trade currencies. Despite its recent establishment, the company has already attracted significant attention within the trading community. Unfortunately, this attention has been largely negative due to various operational and service issues that users have reported.

The second concerning aspect of this reynold international securities ltd. review involves the broker's regulatory claims and actual market performance. While the company states it has obtained operational licenses from the U.S. Securities and Exchange Commission (SEC), the practical implementation of regulated services remains questionable. The protection this supposedly provides to clients is also unclear given the negative user feedback that continues to accumulate. The rapid accumulation of negative reviews and fraud allegations within months of operation suggests significant operational issues. These problems are ones that potential clients must carefully consider before engaging with this broker for their trading activities.

Regulatory Regions: Specific regulatory jurisdiction details are not clearly outlined in available source materials. SEC licensing is claimed by the company but verification remains problematic.

Deposit and Withdrawal Methods: Information regarding accepted payment methods and withdrawal processes is not detailed in available documentation. This lack of transparency raises additional concerns about fund management.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in the source materials reviewed. Most legitimate brokers clearly state these requirements upfront.

Bonuses and Promotions: No information about promotional offers or bonus structures is available in current source materials. This absence of detail makes it difficult to assess value propositions.

Tradeable Assets: Details about available trading instruments and asset classes are not specified in available information. Traders need this information to make informed decisions.

Cost Structure: Comprehensive information about spreads, commissions, and fee structures is not provided in source materials. This lack of transparency is particularly concerning in this reynold international securities ltd. review.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation. Leverage information is crucial for risk management planning.

Platform Options: Trading platform specifications and options are not mentioned in source materials. Platform quality directly affects trading success.

Regional Restrictions: Geographic limitations on service availability are not specified in available information. This creates uncertainty for international traders.

Customer Support Languages: Supported languages for customer service are not detailed in source materials. Language support affects accessibility for global users.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Reynold International Securities Ltd. present a significant information void. This void immediately raises concerns for potential traders who need clear account details before making decisions. Despite conducting a thorough review of available materials, no specific details about account types, their distinctive features, or the benefits they might offer to different trader categories could be identified. This lack of transparency regarding fundamental account structure represents a major red flag in the forex industry.

Reputable brokers typically provide comprehensive details about their account offerings. The absence of information regarding minimum deposit requirements further compounds these concerns about transparency and legitimacy. Established brokers in the forex market typically offer clear, tiered account structures with varying minimum deposit levels. These structures accommodate different trader experience levels and capital availability for various client needs.

The failure to provide such basic information suggests either poor communication practices or deliberate obscuration of terms. Terms that might not favor clients are often hidden or made deliberately unclear by problematic brokers. Account opening processes and verification procedures remain equally mysterious, with no user experience feedback available regarding the ease or difficulty of establishing trading accounts. The lack of information about special account features, such as Islamic accounts for Muslim traders or demo accounts for practice trading, further demonstrates the broker's failure to meet basic industry transparency standards. This comprehensive absence of account-related information significantly contributes to the negative assessment in this reynold international securities ltd. review.

The trading tools and resources landscape at Reynold International Securities Ltd. reveals another area of significant concern. Virtually no information is available about the technological infrastructure or analytical support provided to clients who need these tools for successful trading. Modern forex trading requires sophisticated tools, real-time market analysis, and comprehensive educational resources to enable traders to make informed decisions. The complete absence of details about these crucial elements suggests either inadequate service provision or poor communication of available resources.

Research and analysis capabilities represent fundamental requirements for serious forex trading operations. Reputable brokers typically provide market analysis, economic calendars, technical analysis tools, and expert commentary to support their clients' trading decisions effectively. The lack of any mention of such resources in available materials indicates a significant deficiency in service offerings. This deficiency could severely impact trader success rates and overall trading outcomes.

Educational resources appear to be entirely absent from the broker's service portfolio. These resources are particularly crucial for novice traders who need guidance and training. The forex market's complexity demands comprehensive educational support, including tutorials, webinars, market analysis training, and risk management guidance for all skill levels. The failure to provide or adequately communicate such resources suggests an approach that may not prioritize client success or long-term trading relationships.

Customer Service and Support Analysis (Score: 1/10)

Customer service capabilities at Reynold International Securities Ltd. remain completely undocumented in available source materials. This creates serious concerns about the broker's commitment to client support and problem resolution when issues arise. Effective customer service represents a cornerstone of legitimate forex brokerage operations, where traders require reliable access to support personnel for account issues, technical problems, and trading-related inquiries. The absence of information regarding available customer service channels creates significant uncertainty for potential clients.

Whether support is available through phone, email, live chat, or other communication methods remains unknown. This suggests either inadequate support infrastructure or poor communication of available services to potential clients. Response time expectations, service quality standards, and support availability hours remain completely unknown, leaving potential clients without crucial information. This information is needed to assess the broker's service reliability and commitment to client satisfaction.

Multilingual support capabilities are increasingly important in the global forex market. Professional forex brokers typically provide support in multiple languages to serve their international client base effectively and professionally. The failure to communicate language capabilities or support availability further reinforces concerns about the broker's commitment to comprehensive client service. This lack of information also raises questions about global market accessibility and international client support standards.

Trading Experience Analysis (Score: 1/10)

The trading experience offered by Reynold International Securities Ltd. cannot be adequately assessed. This is due to the complete absence of relevant information in available source materials that would help evaluate platform quality. Platform stability, execution speed, and overall trading environment quality represent crucial factors that directly impact trader success and satisfaction. The lack of user feedback or technical specifications regarding these fundamental aspects creates significant uncertainty for potential clients.

Order execution quality remains entirely undocumented. This includes speed, accuracy, and price consistency that traders depend on for successful operations. Professional forex trading demands reliable order execution with minimal slippage and consistent pricing across all market conditions. The absence of information about execution protocols, server locations, or technology infrastructure suggests potential inadequacies. These inadequacies could significantly impact trading outcomes and overall client satisfaction.

Mobile trading capabilities and cross-platform functionality are essential features in modern forex trading. Today's traders require seamless access across desktop, mobile, and web-based platforms to manage positions effectively throughout the day. The failure to provide information about platform options or mobile trading capabilities further reinforces the concerning lack of transparency. This transparency issue has been identified throughout this reynold international securities ltd. review.

Trust and Security Analysis (Score: 1/10)

Trust and security concerns represent the most critical issues identified in this evaluation of Reynold International Securities Ltd. While the broker claims to hold operational licenses from the U.S. Securities and Exchange Commission (SEC), the practical implementation and verification of these regulatory protections remain questionable. The overwhelmingly negative user feedback and fraud allegations documented across multiple review platforms create serious doubts about actual regulatory compliance.

The broker's overall rating of 1.00 from WikiBit represents an extremely concerning assessment. This rating reflects serious operational and trustworthiness issues that pose significant risks to traders and their funds. Such ratings typically indicate fundamental problems with broker operations, client fund safety, or service delivery that experienced traders recognize as major warning signs. The consistency of negative feedback across multiple platforms suggests systemic issues rather than isolated incidents that might be resolved easily.

User reports characterizing the broker as fraudulent create additional serious concerns about fund safety and operational integrity. When multiple independent sources report similar negative experiences, it typically indicates genuine operational problems that potential clients must consider carefully before risking their money. The rapid accumulation of such feedback within months of the broker's establishment suggests immediate and ongoing issues. These issues have not been adequately addressed by management despite their severity and frequency.

User Experience Analysis (Score: 1/10)

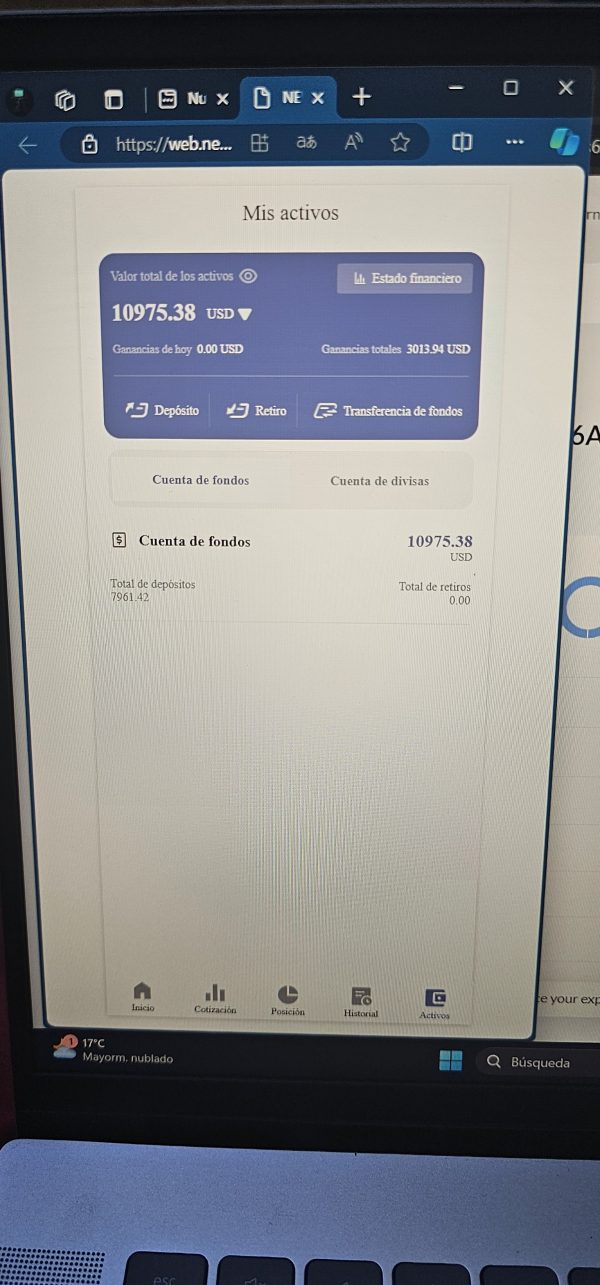

User experience feedback for Reynold International Securities Ltd. presents an overwhelmingly negative picture. This negative feedback should serve as a significant warning to potential clients who might consider using their services. The consistently low ratings and fraud allegations documented across multiple review platforms indicate serious problems with the broker's service delivery and client satisfaction. Such uniformly negative feedback patterns typically emerge when brokers fail to meet basic service standards or engage in practices that harm client interests.

The absence of positive user testimonials or balanced feedback creates additional concerns about the broker's operational approach. This also raises questions about client relationship management and overall service quality standards. Legitimate brokers typically maintain mixed but generally positive user feedback, with satisfied clients sharing positive experiences alongside any negative reviews. The apparent absence of positive feedback suggests either very poor service delivery or potential issues with the broker's business practices.

Common user complaints focusing on fraudulent behavior represent the most serious concerns identified in this analysis. When multiple users independently report similar negative experiences, particularly involving fraud allegations, it indicates systemic problems that extend beyond typical service quality issues. Such patterns typically suggest fundamental problems with broker operations that pose significant risks to client funds and trading success.

Conclusion

This comprehensive reynold international securities ltd. review reveals serious concerns that strongly advise against engaging with this broker. The recommendation applies to all types of forex trading activities regardless of trader experience level. The combination of extremely low ratings (1.00 from WikiBit), multiple fraud allegations from users, and complete lack of transparency regarding basic operational details creates a risk profile that is unacceptable. This risk level is too high for any type of trader, whether novice or experienced.

The broker cannot be recommended to any trader category due to the significant red flags identified throughout this analysis. The absence of detailed information about account conditions, trading tools, customer service, and user experiences creates serious concerns about operational legitimacy. Combined with consistently negative feedback, this suggests operational deficiencies that could result in financial losses for clients who choose to use their services.

Primary concerns include lack of operational transparency, extremely low industry ratings, multiple fraud allegations from users, and absence of verifiable positive client experiences. Potential traders should consider established, well-regulated brokers with proven track records and positive user feedback rather than risking their capital with operations that demonstrate such significant warning signs. The forex market offers many legitimate alternatives that provide better protection and service quality for traders at all experience levels.