Is Reynold International Securities Ltd. safe?

Business

License

Is Reynold International Securities Ltd. Safe or a Scam?

Introduction

Reynold International Securities Ltd. is a forex broker that positions itself as a provider of foreign exchange trading services. In the fast-paced and often volatile world of forex trading, traders must exercise caution when selecting a broker. The potential for scams and fraudulent practices is a significant concern, especially for those who may be new to the market. Therefore, it is essential for traders to conduct thorough evaluations of any broker, focusing on regulatory compliance, company background, trading conditions, and customer experiences. This article aims to provide an objective analysis of Reynold International Securities Ltd. by examining its regulatory status, company history, trading conditions, customer fund security, and overall reputation within the trading community.

Regulatory and Legality

The regulatory status of a broker is crucial in determining its legitimacy and trustworthiness. Reynold International Securities Ltd. claims to be registered in the United States and is said to be regulated by the Financial Crimes Enforcement Network (FinCEN). However, the nature of its regulatory oversight raises questions about the effectiveness of the protection offered to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | N/A | United States | Verified |

While being registered with FinCEN is a positive sign, it is important to note that FinCEN does not provide the same level of investor protection as other financial regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). The lack of comprehensive regulatory oversight may expose traders to risks, particularly in the event of disputes or financial misconduct. Furthermore, reports of account eliminations and fund misappropriation associated with Reynold International Securities Ltd. have surfaced, indicating a potential history of non-compliance with industry standards. This raises red flags regarding the broker's operational integrity.

Company Background Investigation

Reynold International Securities Ltd. is a relatively new entrant in the forex market. Information about its history and ownership structure is limited, which can be a cause for concern. The absence of a well-documented company history often leads to a lack of transparency, making it difficult for traders to assess the reliability of the broker.

The management team's background is another critical area for evaluation. A strong and experienced management team can significantly impact a broker's performance and reputation. However, details regarding the qualifications and professional experiences of the leadership at Reynold International Securities Ltd. are scarce. This lack of information may indicate a lack of accountability and transparency within the organization.

Moreover, the company's information disclosure practices are not up to par with industry standards. Traders typically expect brokers to provide comprehensive details about their operations, including financial statements, regulatory compliance records, and operational practices. The limited information available about Reynold International Securities Ltd. may deter potential clients and raise suspicions about the broker's legitimacy.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Reynold International Securities Ltd. presents a range of trading options, but the overall fee structure and trading conditions appear to be less favorable compared to industry standards.

| Fee Type | Reynold International Securities Ltd. | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2.0 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is notably higher than the industry average, which may cut into potential profits for traders. Additionally, the variable commission model raises concerns, as traders may face unexpected costs that could affect their overall trading profitability. It is essential for traders to be aware of these costs upfront to make informed decisions about their trading strategies.

Customer Fund Security

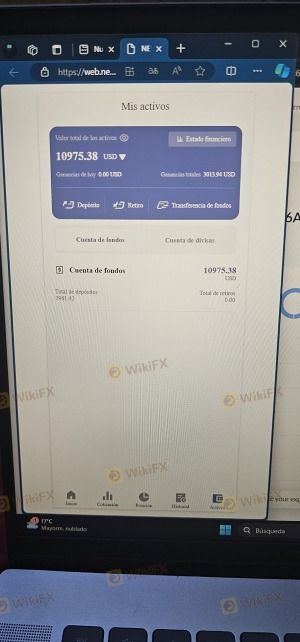

The safety of customer funds is paramount when selecting a forex broker. Reynold International Securities Ltd. claims to implement various measures to secure client funds; however, the specifics of these measures remain ambiguous.

Traders should look for brokers that offer segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, there is limited information available regarding Reynold International Securities Ltd.'s practices in these areas. Reports of account eliminations and fund misappropriation suggest that there may have been issues with fund security in the past, further raising concerns about the broker's reliability.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's performance and reputation. Reviews of Reynold International Securities Ltd. reveal a mixed bag of experiences, with several users reporting issues related to account management and withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Eliminations | High | Poor |

| Withdrawal Delays | Medium | Average |

| Unresponsive Support | High | Poor |

Common complaints include account eliminations, withdrawal delays, and unresponsive customer support. The severity of these complaints can significantly affect a trader's experience and overall satisfaction. For instance, several users have reported their accounts being closed without prior notice, leading to concerns about the broker's operational transparency and ethics.

Platform and Trade Execution

The trading platform provided by a broker plays a critical role in the trading experience. Users of Reynold International Securities Ltd. have expressed concerns regarding the platform's performance and stability. Reports of slippage and rejected orders have surfaced, indicating potential issues with trade execution quality.

A reliable trading platform should offer fast execution times, minimal slippage, and high uptime. However, the experiences reported by users suggest that Reynold International Securities Ltd. may not meet these expectations. Such issues can lead to frustration and financial losses for traders, further undermining confidence in the broker.

Risk Assessment

Engaging with any forex broker comes with inherent risks. For Reynold International Securities Ltd., these risks appear to be elevated due to the broker's regulatory status, customer feedback, and operational transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Limited oversight and potential non-compliance. |

| Fund Security | High | Reports of fund misappropriation and account issues. |

| Customer Support | Medium | Mixed reviews regarding responsiveness and support. |

To mitigate these risks, traders should conduct thorough research, consider using a demo account, and only invest funds they can afford to lose. Additionally, diversifying trading activities across multiple brokers can help reduce risk exposure.

Conclusion and Recommendations

Based on the evidence gathered, it is prudent to approach Reynold International Securities Ltd. with caution. The broker's regulatory status, mixed customer experiences, and reports of fund security issues raise significant concerns about its trustworthiness. While it may offer certain trading opportunities, the potential risks associated with this broker may outweigh the benefits.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of transparency, robust customer support, and positive user experiences. Brokers regulated by the CFTC or NFA, for instance, typically offer a higher level of investor protection and operational integrity.

In conclusion, while Reynold International Securities Ltd. may not be overtly classified as a scam, the numerous warning signs suggest that traders should exercise extreme caution and seek more reputable alternatives for their trading needs.

Is Reynold International Securities Ltd. a scam, or is it legit?

The latest exposure and evaluation content of Reynold International Securities Ltd. brokers.

Reynold International Securities Ltd. Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Reynold International Securities Ltd. latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.