QFX 2025 Review: Everything You Need to Know

Executive Summary

QFX operates as a foreign exchange prime brokerage firm. It offers diverse trading options across multiple asset classes including forex, cryptocurrencies, stocks, commodities, and indices. However, this qfx review reveals significant concerns about the broker's overall service quality and user satisfaction. Based on available user feedback and market analysis, QFX receives an overall rating of 3 out of 10 stars. This indicates substantial room for improvement in service delivery.

The broker's primary strength lies in its comprehensive asset selection. It provides traders with access to various financial instruments under one platform. Additionally, QFX Software Corporation has developed QFX KeyScrambler, which industry experts recommend as an essential tool for enhancing online security during trading activities. However, these positive aspects are overshadowed by consistently negative user reviews regarding service quality, customer support, and overall trading experience.

QFX primarily targets traders seeking diversified trading opportunities across multiple asset classes. However, potential clients should exercise significant caution given the widespread user dissatisfaction and lack of transparent regulatory information. The broker may appeal to experienced traders who can navigate potential service limitations. But novice traders should consider more established alternatives with stronger regulatory oversight and better customer satisfaction records.

Important Notice

Regional Entity Differences: QFX's regulatory status varies significantly across different jurisdictions. Specific regulatory information was not clearly detailed in available sources. Traders should independently verify the regulatory status of QFX entities in their respective regions before opening accounts, as regulatory protections may differ substantially between locations.

Review Methodology: This evaluation is based on available user feedback, industry reports, and publicly accessible information about QFX's services. The analysis may not encompass all aspects of the broker's operations. Prospective clients should conduct additional due diligence before making trading decisions.

Rating Framework

Broker Overview

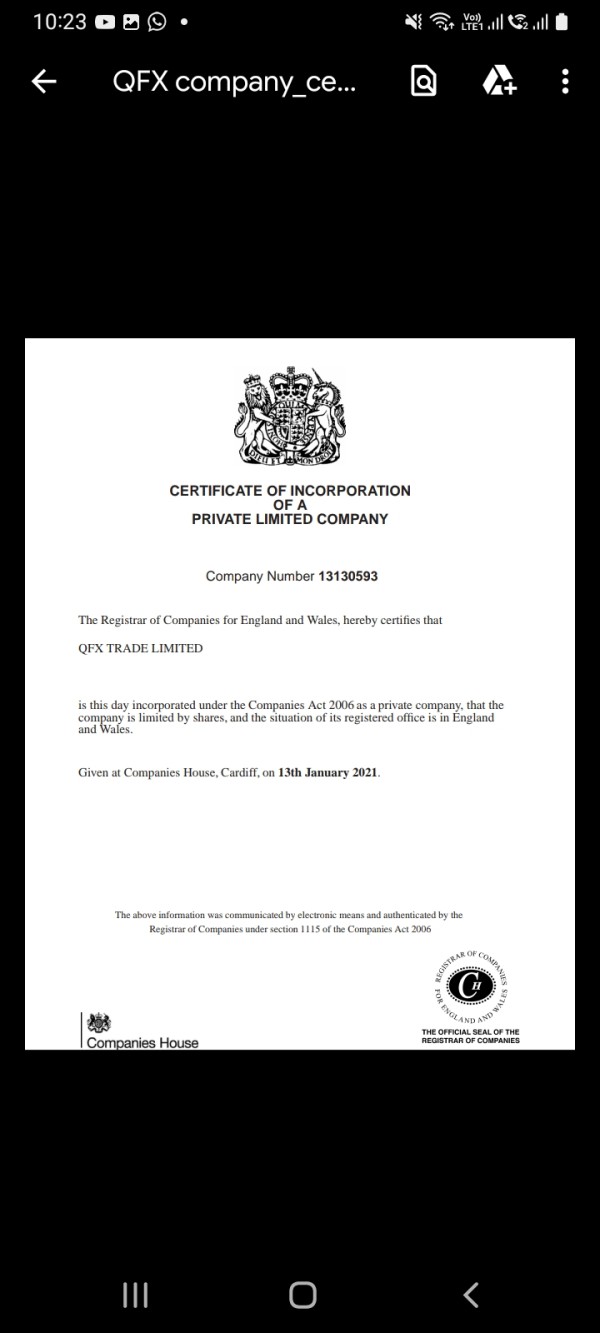

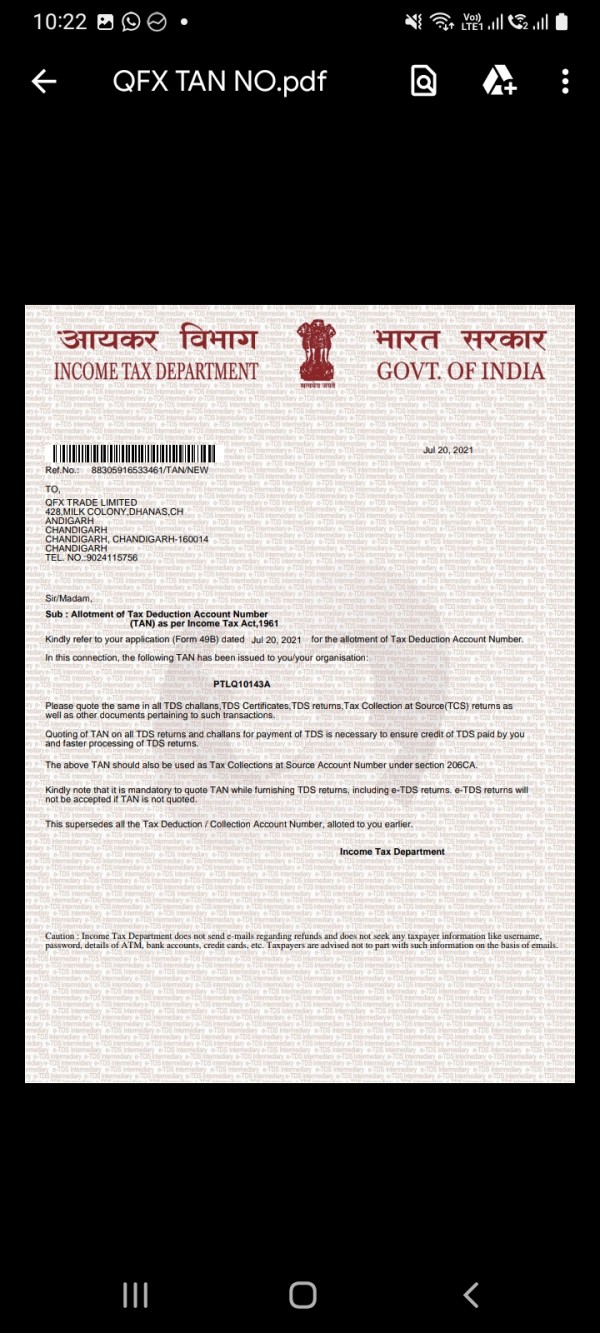

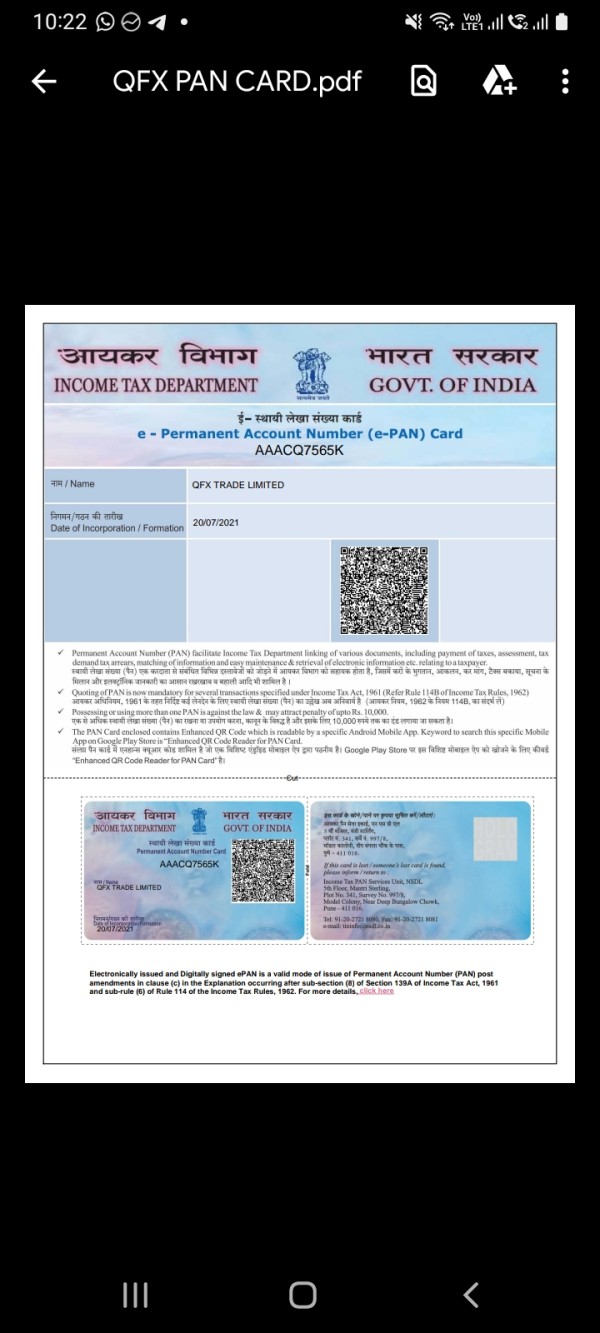

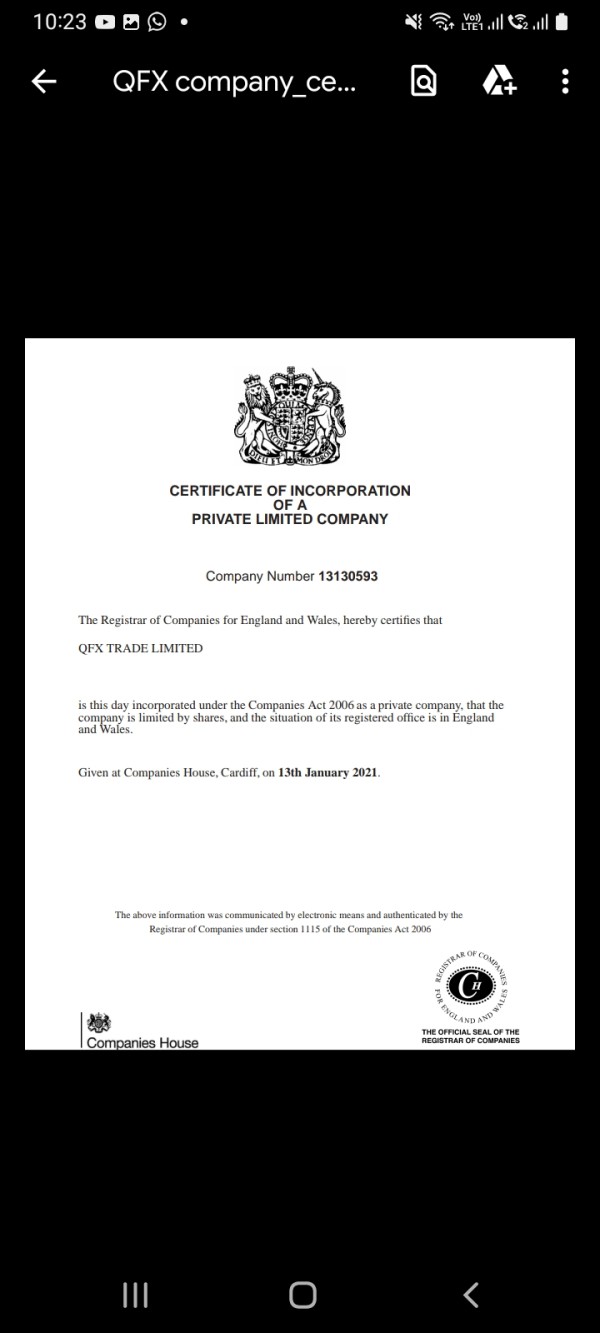

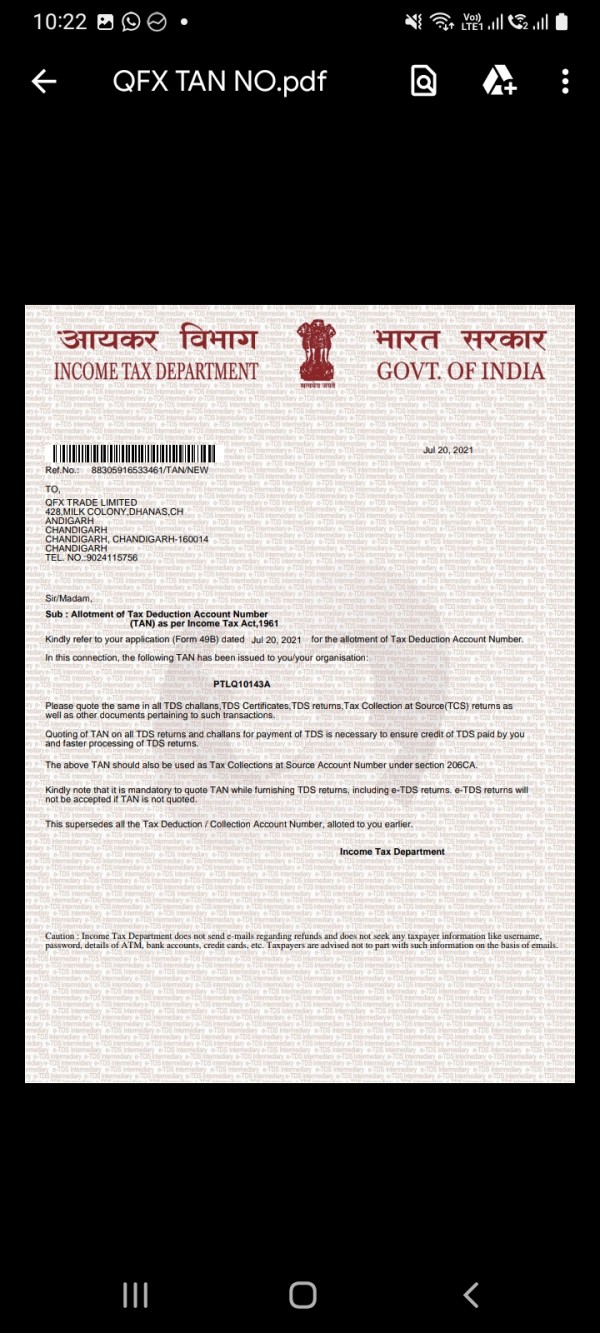

QFX Trade Limited positions itself as a leading foreign exchange prime brokerage firm. Specific establishment details and founding year information were not clearly documented in available sources. The company operates through multiple entities, including QFX Software Corporation, which has developed specialized security software products. According to industry reports, QFX has attempted to establish itself in the competitive forex brokerage market by offering comprehensive trading solutions across various financial instruments.

The broker's business model centers on providing multi-asset trading capabilities. It encompasses traditional forex pairs, emerging cryptocurrency markets, equity instruments, commodities, and major stock indices. However, the company's market reputation has been significantly impacted by user complaints and service quality issues that have persisted across multiple review platforms and industry assessments.

QFX's platform infrastructure supports trading across forex, cryptocurrencies, stocks, commodities, and indices. This positions the broker as a one-stop solution for diversified investment strategies. The company has also ventured into cybersecurity solutions through its QFX KeyScrambler product, which provides additional security layers for online trading activities. Despite these technological offerings, the broker's overall market position remains challenged by regulatory transparency concerns and consistently negative user experiences that have affected its industry standing and credibility among retail traders.

Regulatory Jurisdictions: Specific regulatory information was not comprehensively detailed in available sources. This raises concerns about the broker's compliance status across different jurisdictions. Traders should independently verify regulatory standing before account opening.

Deposit and Withdrawal Methods: Available sources did not provide detailed information about supported payment methods, processing times, or associated fees for funding and withdrawal operations.

Minimum Deposit Requirements: Specific minimum deposit thresholds were not clearly outlined in accessible documentation. This requires direct inquiry with the broker for accurate information.

Bonus and Promotional Offers: Current promotional structures and bonus offerings were not detailed in available sources. This suggests either limited promotional activities or lack of transparent marketing communication.

Tradeable Assets: QFX offers access to multiple asset classes including major and minor forex currency pairs, popular cryptocurrencies, international stocks, precious metals, energy commodities, and global stock indices across various markets.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs was not comprehensively available in reviewed sources. This makes cost comparison challenging for potential clients.

Leverage Ratios: Specific leverage offerings and maximum leverage limits were not clearly documented. This requires direct verification with the broker based on account type and regulatory jurisdiction.

Platform Options: Available trading platform options and their specific features were not detailed in accessible sources. The broker appears to offer web-based and potentially mobile trading solutions.

Geographic Restrictions: Specific country restrictions and regulatory limitations were not clearly outlined in available documentation.

Customer Support Languages: Supported languages for customer service were not specifically mentioned in reviewed sources.

This comprehensive qfx review highlights the significant information gaps that potential traders may encounter when evaluating the broker's services.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

QFX's account conditions present several areas of concern for potential traders. The broker's lack of transparent information regarding account types, minimum deposit requirements, and specific account features creates uncertainty for prospective clients. Available sources suggest that the broker offers multiple account categories. However, detailed specifications about each tier's benefits, trading conditions, and eligibility requirements remain unclear.

The account opening process appears to lack the streamlined efficiency that modern traders expect from established brokers. User feedback indicates frustration with verification procedures and account setup timelines. This suggests that QFX's onboarding systems may require significant improvements. Additionally, the absence of clear information about specialized account options, such as Islamic accounts for Sharia-compliant trading, limits the broker's appeal to diverse trading communities.

Account maintenance fees, inactivity charges, and other account-related costs were not transparently disclosed in available sources. This creates potential surprise expenses for traders. The lack of detailed account condition documentation raises questions about the broker's commitment to transparency and regulatory compliance standards that are typically expected in the forex industry.

This qfx review reveals that account conditions represent a significant weakness in QFX's service offering. Substantial improvements are needed in transparency, documentation, and user experience to meet industry standards and trader expectations.

QFX's trading tools and resources present a mixed picture of capabilities and limitations. While the broker offers access to diverse asset classes, the quality and comprehensiveness of analytical tools, research resources, and educational materials remain questionable based on available information. The platform appears to provide basic trading functionality. However, advanced analytical capabilities and professional-grade tools seem limited compared to industry leaders.

Research and market analysis resources were not extensively documented in available sources. This suggests that traders may need to rely on third-party providers for comprehensive market insights. The absence of detailed information about economic calendars, market news feeds, technical analysis tools, and fundamental research capabilities indicates potential gaps in the broker's analytical infrastructure.

Educational resources, including trading guides, webinars, video tutorials, and market education materials, were not prominently featured in available documentation. This limitation could significantly impact novice traders who rely on broker-provided educational content to develop their trading skills and market understanding.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, and API access for institutional clients, was not clearly outlined in reviewed sources. The lack of detailed information about these advanced features may limit QFX's appeal to sophisticated traders and institutional clients who require robust technological infrastructure for their trading strategies.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of QFX's most significant operational weaknesses. Consistently negative user feedback highlights serious deficiencies in support quality and responsiveness. Available reviews and user testimonials indicate widespread dissatisfaction with the broker's customer support capabilities, creating substantial concerns about service reliability and problem resolution effectiveness.

Response times for customer inquiries appear to be considerably longer than industry standards. Users report delays in receiving assistance for urgent trading-related issues. The lack of comprehensive 24/7 support coverage may particularly impact traders in different time zones who require immediate assistance during active trading sessions.

Service quality issues extend beyond response times to include inadequate problem-solving capabilities and limited technical expertise among support staff. User feedback suggests that many customer service representatives lack the necessary knowledge to address complex trading platform issues, account problems, or technical difficulties effectively.

Communication channels and multilingual support capabilities were not clearly documented in available sources. This potentially limits accessibility for international clients. The absence of detailed information about live chat availability, phone support hours, and email response guarantees further compounds concerns about the broker's commitment to customer service excellence and client satisfaction standards.

Trading Experience Analysis (Score: 4/10)

The trading experience with QFX appears to fall short of industry standards based on available user feedback and platform assessments. Platform stability and execution quality concerns have been raised by multiple users. This suggests potential technical infrastructure limitations that could impact trading performance during critical market conditions.

Order execution quality and speed appear inconsistent. Some users report slippage issues and delayed order processing during volatile market periods. These execution problems can significantly impact trading profitability and create frustration for active traders who require reliable and fast order processing capabilities.

Platform functionality and user interface design were not comprehensively detailed in available sources. However, user feedback suggests that the trading environment may lack the sophistication and intuitive design that modern traders expect. Navigation difficulties and limited customization options appear to contribute to overall user dissatisfaction with the trading experience.

Mobile trading capabilities and cross-device synchronization features were not extensively documented. This potentially limits trading flexibility for users who require seamless access across multiple devices. The absence of detailed information about mobile app features, offline capabilities, and real-time data synchronization raises questions about the broker's technological infrastructure and commitment to modern trading convenience standards.

This qfx review indicates that significant improvements in platform technology, execution quality, and user interface design are necessary to meet competitive trading experience standards in the current forex market environment.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent QFX's most critical weaknesses. Significant concerns exist about regulatory transparency and financial security measures. The absence of clear regulatory information in available sources raises serious questions about the broker's compliance status and regulatory oversight, creating substantial risks for potential clients considering account opening.

Regulatory licensing and compliance verification were not comprehensively documented. This makes it difficult for traders to assess the level of regulatory protection and dispute resolution mechanisms available. The lack of transparent regulatory information contradicts industry best practices and creates uncertainty about fund security and client protection measures.

Fund security measures, including segregated account policies, deposit insurance coverage, and client money protection protocols, were not clearly outlined in available documentation. This transparency gap creates significant concerns about financial security and regulatory compliance standards that are essential for building trader confidence and trust.

Company transparency regarding ownership structure, financial statements, regulatory filings, and corporate governance practices appears limited based on available sources. The absence of detailed corporate information and regulatory disclosures further undermines confidence in the broker's operational integrity and long-term stability.

Industry reputation and third-party assessments consistently highlight concerns about QFX's reliability and trustworthiness. Multiple review platforms and industry observers note significant weaknesses in regulatory compliance and operational transparency that potential clients should carefully consider before account opening.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with QFX remains consistently poor across multiple review platforms and feedback sources. This indicates systemic issues with service delivery and client experience management. User testimonials and reviews consistently highlight frustrations with various aspects of the broker's operations, from account opening procedures to ongoing customer support interactions.

Interface design and platform usability appear to create significant challenges for users. Feedback suggests that navigation difficulties and limited customization options impact daily trading activities. The absence of intuitive design elements and user-friendly features that are standard in modern trading platforms contributes to overall user dissatisfaction and operational inefficiency.

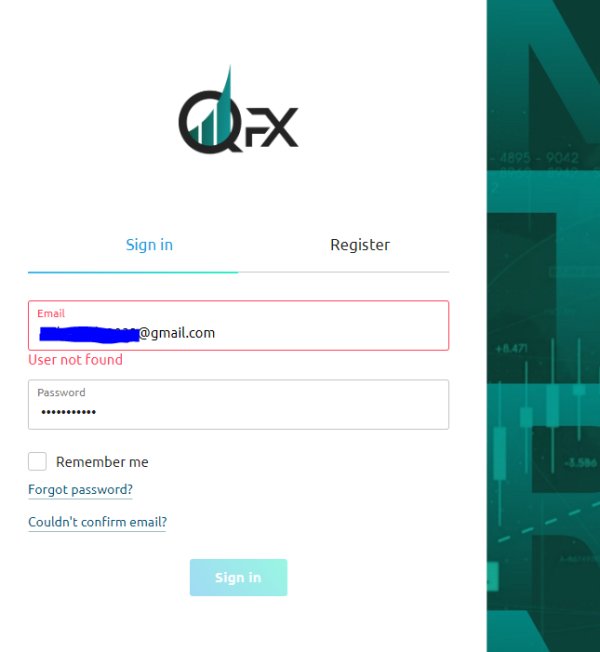

Registration and account verification processes receive criticism for complexity and extended processing times. This creates barriers to entry that discourage potential clients and frustrate existing users. The lack of streamlined onboarding procedures and clear verification requirements adds unnecessary complexity to the client acquisition process.

Funding and withdrawal experiences appear problematic based on user feedback. Concerns about processing delays, limited payment options, and unclear fee structures create additional friction in the client experience. These operational issues significantly impact user satisfaction and contribute to negative perceptions about the broker's reliability and professionalism.

Common user complaints center on service quality, platform limitations, customer support deficiencies, and transparency issues that collectively create a challenging user experience. The broker would benefit from comprehensive service improvements across all user touchpoints to address these widespread satisfaction concerns and rebuild client confidence in their service delivery capabilities.

Conclusion

This comprehensive qfx review reveals that QFX operates as a multi-asset broker with significant operational and service quality challenges that substantially impact its market position and user satisfaction. While the broker offers access to diverse trading instruments including forex, cryptocurrencies, stocks, and commodities, these advantages are overshadowed by consistent user dissatisfaction and transparency concerns.

QFX may appeal to experienced traders seeking diversified asset exposure who can navigate potential service limitations. However, the broker's current operational standards make it unsuitable for novice traders or those requiring reliable customer support and transparent regulatory protection. The lack of clear regulatory information and consistently poor user feedback create substantial risks that potential clients should carefully evaluate.

The broker's primary advantages include diverse asset class availability and security software offerings through QFX KeyScrambler. But these positives are significantly outweighed by poor customer service, limited transparency, questionable regulatory compliance, and widespread user dissatisfaction that collectively result in a below-average overall rating requiring substantial improvements across all operational areas.