Summary

This madden markets limited review shows major problems with this Chinese forex trading platform. Based on information we found and user feedback, Madden Markets Limited works without proper rules from big financial authorities, which makes us question if it's real and safe for traders. The platform says it has licenses in Canada and the United States, but our research shows these claims are false. User reviews always doubt the platform's trustworthiness, with many calling it a high-risk operation. The broker offers forex and CFD trading services, but it hides how it works, has unclear fees, and gives no regulatory protection, making it wrong for most traders. This review gives potential investors important information to make smart choices about whether to use this platform.

Important Notice

Regional Entity Differences: Madden Markets Limited says it works with licenses in many places, including Canada and the United States. But when we checked regulatory databases, we found no valid registrations with major oversight bodies like the Investment Industry Regulatory Organization of Canada or the National Futures Association. The company's claims about following regulations lack transparency and proof documents.

Review Methodology: This assessment uses available user feedback, regulatory database searches, and market information from multiple sources. Since the broker provides limited official documents, some parts of this review use third-party reports and user experiences.

Rating Framework

Broker Overview

Madden Markets Limited shows itself as a Chinese forex trading platform that offers services in foreign exchange and CFD trading. According to TraderKnows reports from 2024, the platform has been called high-risk with suspected scam features. The company's start date and detailed corporate background stay unclear in available documents, which raises transparency concerns for potential traders.

The platform claims to give forex and CFD trading services to international clients, positioning itself as a complete trading solution. But the lack of clear information about its founding, corporate structure, and operational history creates uncertainty about whether it's legitimate. This madden markets limited review finds that the broker's business model seems to focus on attracting traders through unverified regulatory claims while working without proper oversight.

According to available information, Madden Markets Limited works mainly in the forex and CFD space, though specific details about asset offerings, trading platforms, and service features are not clearly documented. The broker's main regulatory status shows no authorization from major financial supervisory bodies, including the FCA, IIROC, or NFA, despite claims suggesting otherwise.

Regulatory Status: Madden Markets Limited is not regulated by any major financial authority. Despite claims of holding licenses in Canada and the United States, checking with the IIROC database confirms the broker is not among authorized entities. Similarly, NFA register checks show no valid membership or oversight status.

Deposit and Withdrawal Methods: Specific information about funding options is not detailed in available sources, creating uncertainty about transaction processes and potential restrictions.

Minimum Deposit Requirements: The broker's minimum deposit amounts are not specified in accessible documentation, making it difficult for potential traders to assess entry requirements.

Bonuses and Promotions: No specific information about promotional offers or bonus structures is available in current sources.

Tradeable Assets: The platform focuses on forex and CFD trading, though detailed information about specific currency pairs, indices, or other instruments is not clearly documented.

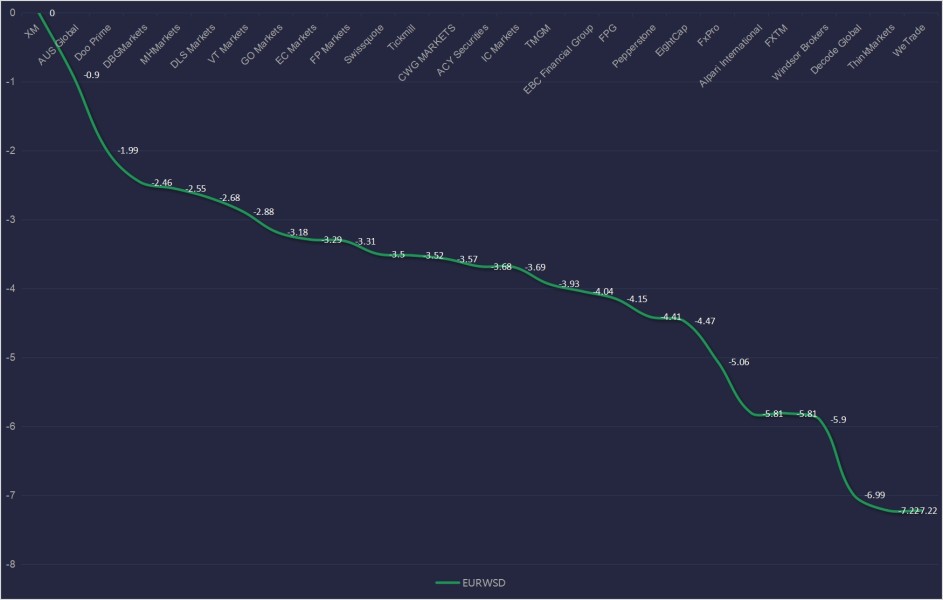

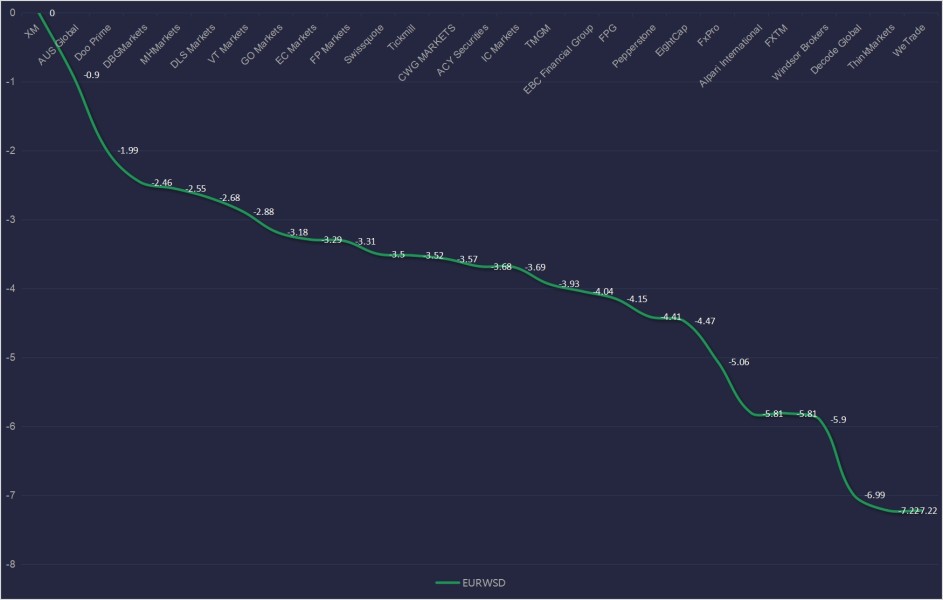

Cost Structure: Spreads, commissions, and other trading costs are not transparently disclosed in available materials, raising concerns about hidden fees and unfavorable trading conditions.

Leverage Ratios: Specific leverage offerings are not mentioned in accessible documentation.

Platform Options: The trading platforms available through Madden Markets Limited are not clearly specified in current sources.

Regional Restrictions: Information about geographical limitations or restricted jurisdictions is not detailed in available materials.

Customer Service Languages: Supported languages for customer support are not specified in accessible documentation. This comprehensive madden markets limited review highlights the concerning lack of transparent information across multiple operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Madden Markets Limited get a poor rating because there's no transparency about account types, features, and requirements. Available sources give no specific information about different account tiers, minimum deposit amounts, or special account features that traders typically expect from legitimate brokers. This absence of clear account information makes it impossible for potential clients to make informed decisions about their trading setup.

The account opening process is not documented in available materials, creating uncertainty about verification requirements, documentation needs, and approval timelines. Without clear information about account conditions, traders cannot assess whether the broker meets their specific needs or trading strategies. User feedback suggests general concerns about the platform's legitimacy, which extends to uncertainties about account safety and fund protection.

The lack of information about special account types, such as Islamic accounts for Sharia-compliant trading, further demonstrates the broker's limited transparency. This madden markets limited review finds that the absence of clear account condition details represents a significant red flag for potential traders seeking reliable and transparent trading environments.

Madden Markets Limited gets a very poor rating for tools and resources because there's no information about trading tools, analytical resources, or educational materials. The platform fails to provide clear details about chart analysis capabilities, technical indicators, or market research resources that traders typically rely on for informed decision-making.

Educational resources, which are essential for both novice and experienced traders, are not mentioned in available documentation. The lack of learning materials, webinars, or market analysis content suggests the platform does not prioritize trader development or market education. This absence of educational support is particularly concerning for newer traders who depend on broker-provided resources to improve their trading skills.

Automated trading support and third-party tool integration capabilities are not documented, limiting traders' ability to implement sophisticated trading strategies. The platform's failure to clearly communicate its technological capabilities and resource offerings indicates a significant deficiency in meeting modern trading requirements.

Customer Service and Support Analysis (Score: 3/10)

Customer service gets a poor rating based on user feedback expressing concerns about support effectiveness and the general lack of transparency about service channels. Available information does not specify customer support methods, response times, or service quality standards, making it difficult for traders to understand what level of assistance they can expect.

User reviews suggest doubts about the platform's reliability, which extends to concerns about customer service capabilities. Without clear information about support hours, available languages, or contact methods, traders face uncertainty about accessing help when needed. This lack of transparency about customer service represents a significant operational concern.

The absence of documented customer service policies or service level commitments further undermines confidence in the platform's support capabilities. According to user feedback patterns, concerns about the platform's legitimacy naturally extend to questions about whether adequate customer support would be available during critical trading situations or account issues.

Trading Experience Analysis (Score: 4/10)

The trading experience gets a below-average rating because there's limited information about platform stability, execution quality, and overall trading environment. Available sources do not provide specific details about order execution speeds, platform reliability, or trading technology infrastructure, making it difficult to assess the actual trading conditions traders would experience.

User feedback suggests mixed experiences with the trading environment, with some expressing concerns about the platform's overall legitimacy affecting their confidence in trading operations. Without clear information about platform features, mobile trading capabilities, or execution quality, potential traders cannot adequately evaluate whether the platform meets their trading requirements.

The lack of detailed information about trading conditions, including execution methods, slippage policies, or platform stability measures, creates uncertainty about the actual trading experience. This madden markets limited review notes that the absence of transparent trading condition information represents a significant limitation for traders seeking reliable execution environments.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability get a very poor rating because the broker lacks regulatory oversight and has transparency issues. Investigations confirm that Madden Markets Limited is not authorized by major regulatory bodies including IIROC and NFA, despite claims suggesting regulatory compliance in Canada and the United States. This difference between claims and verified regulatory status represents a fundamental trust issue.

The absence of proper regulatory oversight means traders lack essential protections typically provided by licensed brokers, including segregated fund protection, dispute resolution mechanisms, and regulatory oversight of business practices. User feedback consistently expresses concerns about the platform's legitimacy, with many sources flagging it as high-risk or potentially fraudulent.

The company's lack of transparency regarding corporate structure, operational details, and regulatory status further undermines trustworthiness. Without proper regulatory backing and transparent operations, traders face significant risks regarding fund safety and fair treatment. The platform's inability to provide verifiable regulatory credentials represents a critical trust deficit.

User Experience Analysis (Score: 3/10)

User experience gets a poor rating based on available feedback indicating general dissatisfaction and concerns about the platform's legitimacy. User reviews consistently express doubts about the broker's credibility, with many questioning whether it represents a legitimate trading operation or potential scam.

The overall user satisfaction appears low, with feedback suggesting that traders harbor significant concerns about engaging with the platform. Without clear information about interface design, registration processes, or user-friendly features, it's difficult to assess the technical aspects of user experience beyond the fundamental trust issues.

User complaints appear to center on questions about the platform's legitimacy rather than specific operational issues, suggesting that trust concerns overshadow other user experience factors. The pattern of user feedback indicates that potential traders should exercise extreme caution when considering this platform for their trading activities.

Conclusion

This comprehensive madden markets limited review reveals significant concerns that make this broker unsuitable for most traders. The platform's lack of regulatory oversight, absence of transparency in operations, and consistent user concerns about legitimacy create an unacceptably high-risk trading environment. The broker's claims of regulatory compliance in Canada and the United States have been proven false through verification with official regulatory databases.

The platform may only be considered by traders specifically seeking high-risk investment opportunities and who fully understand the potential for complete loss of funds. However, even risk-tolerant traders should exercise extreme caution given the fundamental trust and regulatory issues identified in this review. The absence of proper oversight, transparent operations, and clear trading conditions makes Madden Markets Limited a poor choice for serious trading activities.

The main disadvantages include lack of regulatory protection, operational transparency issues, and widespread user trust concerns. While some sources suggest limited positive feedback exists, these are significantly outweighed by the fundamental structural problems with the broker's regulatory status and operational transparency.