EE TRADE Review 5

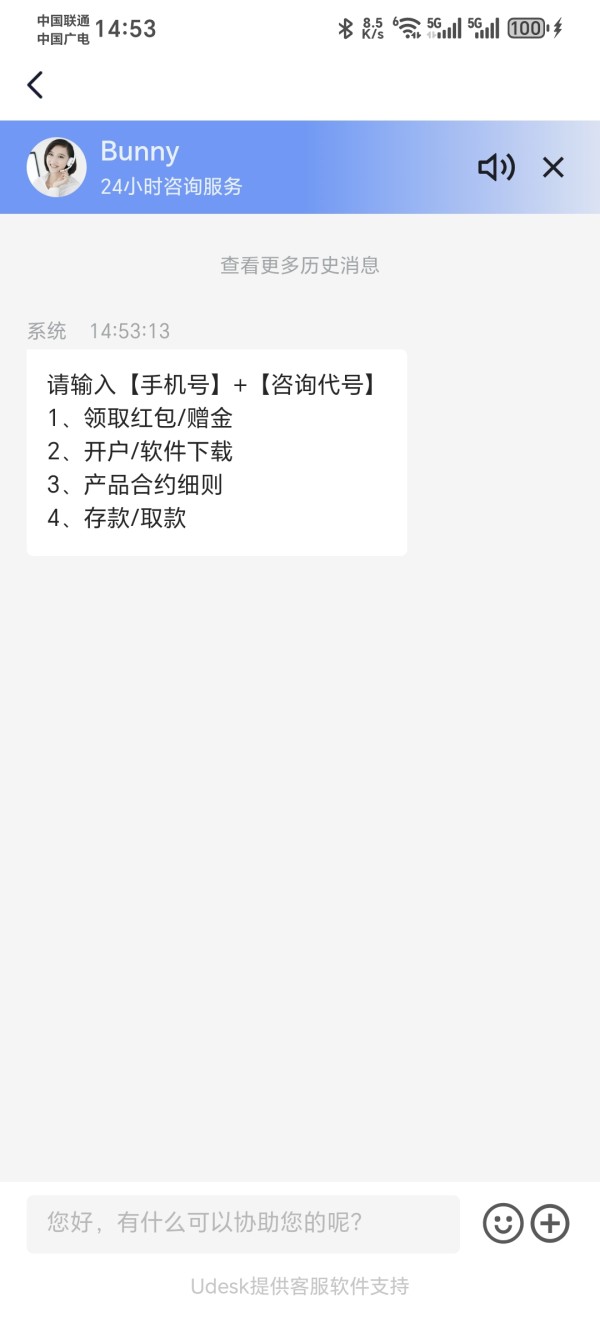

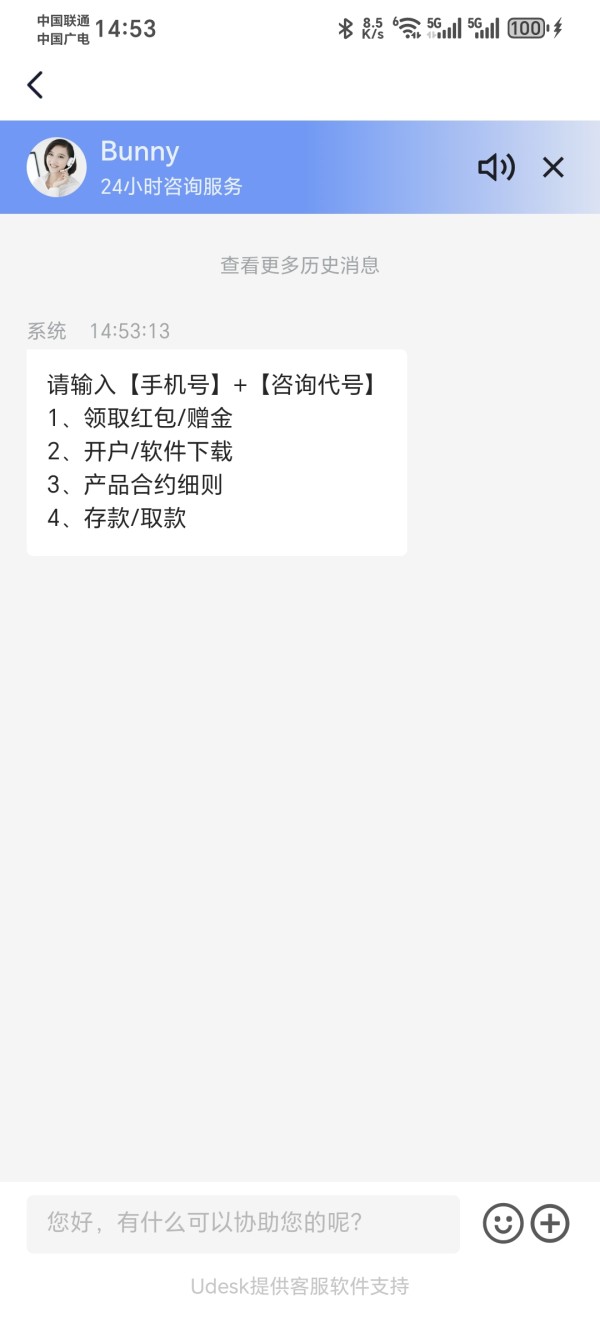

EE TRADE is a scam platform—be cautious. They operate under multiple trading names. Previously, I downloaded an app called “Gold” after searching for ‘gold’ or “precious metals” on Tencent's App Store. Now they've launched another one called “Yitong Gold Industry.” 😓 I downloaded it, registered, and entered my phone number, only to be told my account had been deactivated. It instructed me to contact customer service for reactivation. That's when I realized they're all the same operation—same old, same old. They keep deceiving the public. This is a classic scam platform—stay away!!

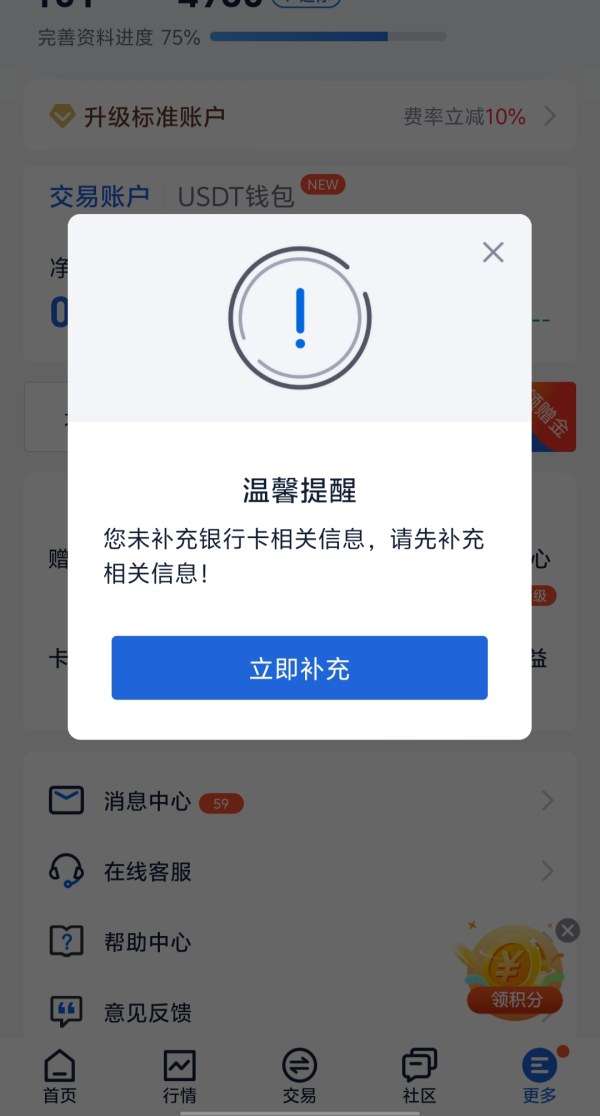

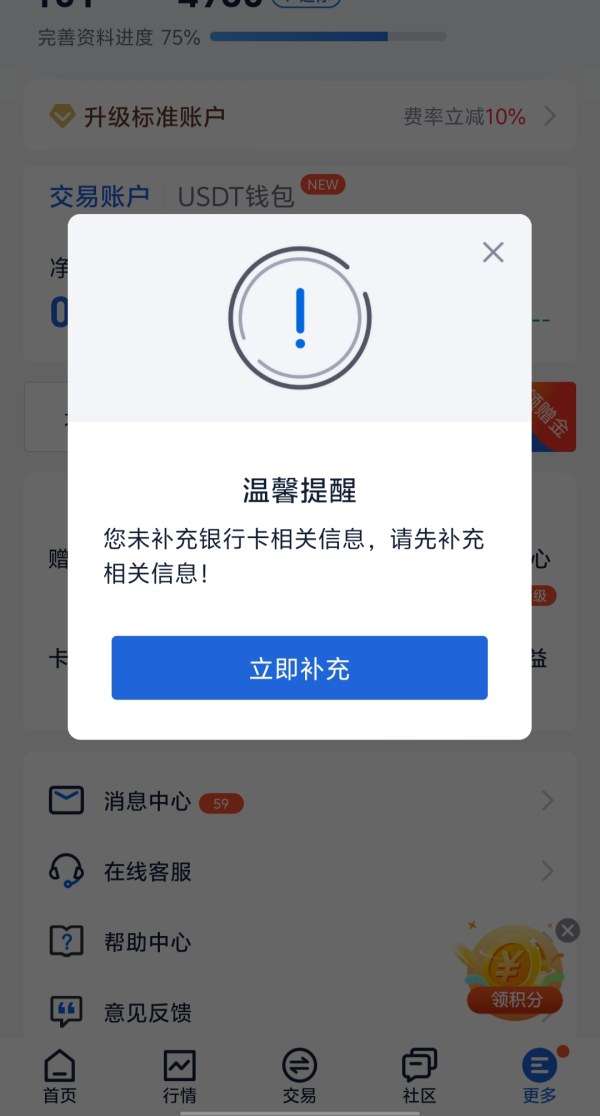

When depositing funds, they called me three or four times to explain the process. But when I tried to withdraw, they claimed I couldn't because I was participating in a promotion. I requested settlement for the promotion, yet they kept delaying day after day. The issue remains unresolved to this day, and my withdrawal interface is still stuck in restricted status. I can't reach customer service, the official phone line is dead, and there are multiple official websites. I now suspect it's a scam platform.

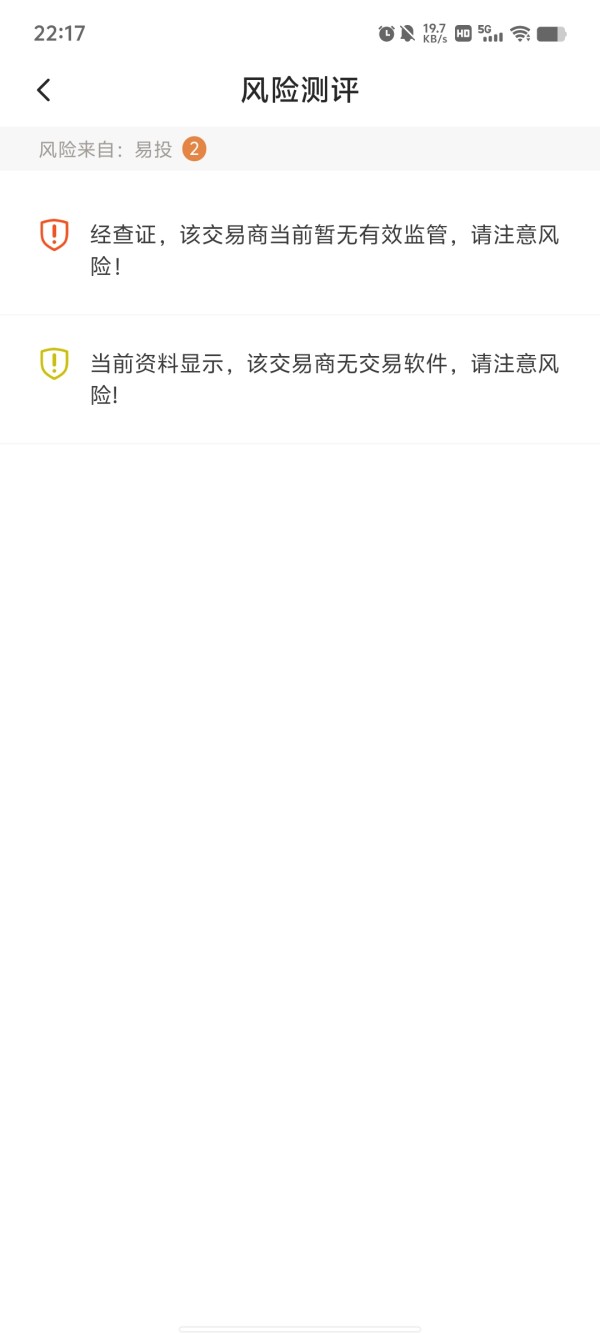

Initially, I was trading on the Sanjia Jin Ye platform where I consistently faced losses. The platform forcibly closed my positions, and when I threatened to report them to the authorities to recover my principal, they stated it was impossible to refund my money. Subsequently, I left the platform. To my dismay, the same operators deceitfully registered me on another platform called Yitou using different software. They enticed me back with promotional bonuses and persuaded me to deposit again in hopes of recovering my previous losses. Unfortunately, this led to an additional total loss of $2133 USD. I am now seeking assistance to recover my principal. Thank you!

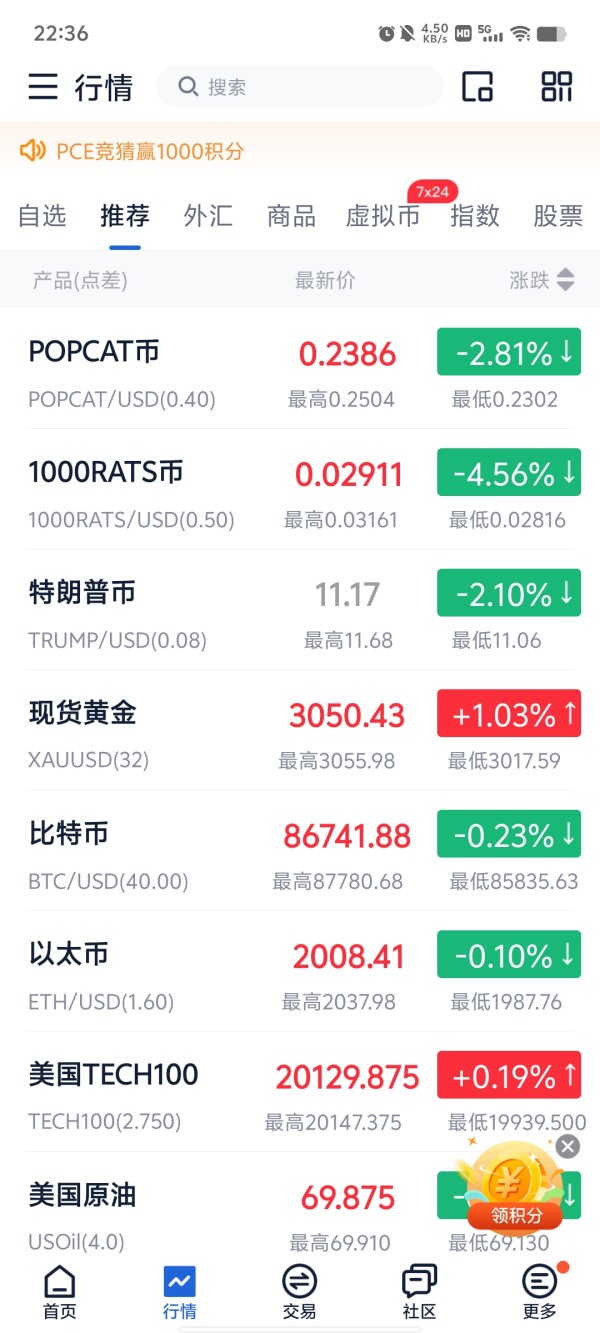

My name is Chen Yanyong. My trading account on EE TRADE is 13210700688, my ID number is 372321198706070036, and my email is 632770238@qq.com. In October 2024, with the intention of investing and managing finances, I downloaded an app called Anxin to start trading. Following a mandatory platform upgrade, without any notification, the Anxin app was replaced by the EE TRADE app. The customer service of EE TRADE frequently called me under the pretext of offering bonus funds on deposits to induce me to make deposits. They also enticed frequent trading by promising gift packs for trading activities. However, the EE TRADE app is very unstable, often freezes, and experiences slippage. Most critically, the deposit channels are unstable, not allowing timely deposits which led to insufficient margins and consequently caused my account to be liquidated. To date, I have incurred a loss of 13,000 yuan. Later on realizing through research that this is a virtual platform where funds are deposited into private accounts and never enter the international market; essentially they profit from customer losses. EE TRADE is undeniably a fake platform engaging in illegal activities. Below are the illegal practices carried out by this company: 1. The company operates virtual currency and stock index futures without proper qualifications for trading cryptocurrencies and stock indices—this constitutes illegal operation. Evidence includes my trading records which mainly consist of cryptocurrency and stock index transactions. The platform cunningly only displays these transactions after registration and login. 2. The money deposited into this company does not flow into international markets during trading but remains in personal accounts. The deposit interface involves transferring money into personal accounts before the platform shows that the deposit has been successful. 3. Engages in money laundering; investigations show that this platform buys bank cards in mainland China for investors to transfer money for laundering purposes before funneling it into their platform. 4. Induces deposits through deceptive practices by frequently calling about deposit bonuses and trading activity gift packs, only highlighting potential profits without mentioning risks or considering my financial capacity. I am currently facing severe financial difficulties; coming from a financially constrained family background at 39 years old, I am unmarried with elderly parents over 70 years old—my mother suffers from heart disease and chronic nephritis requiring ongoing medication treatment. Already burdened with debts, being scammed has worsened my situation significantly. I earnestly request your platform's assistance once again in recovering my lost 13,000 yuan; your help would be immensely appreciated.

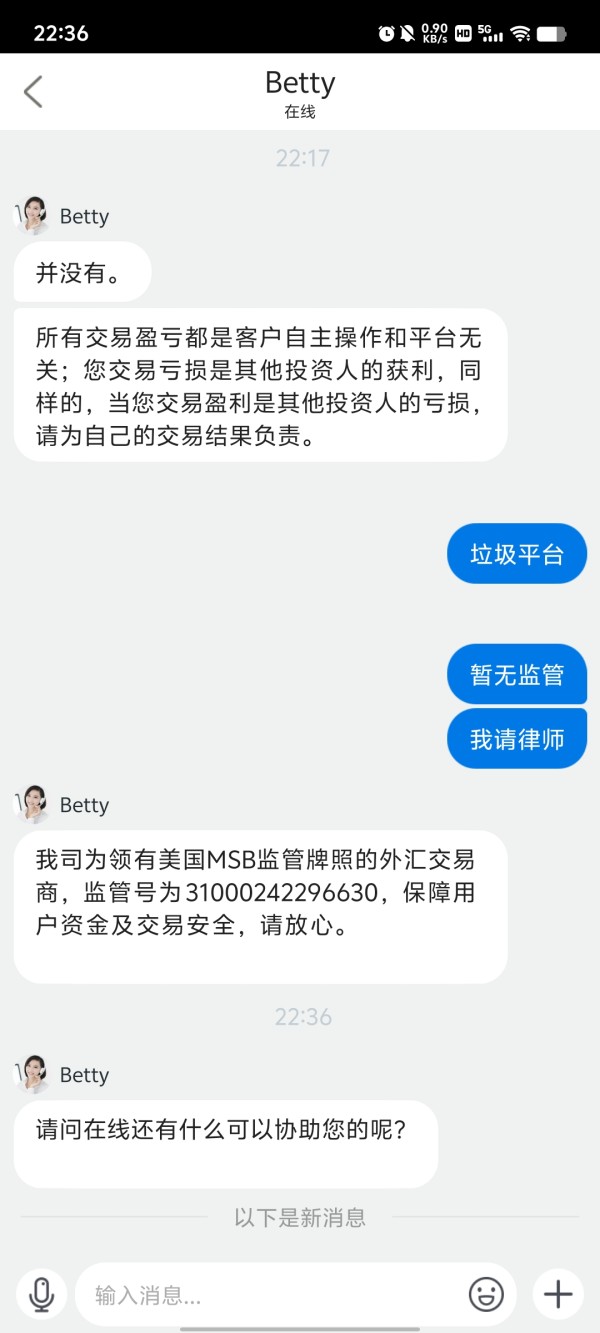

My withdrawal request was denied due to alleged "abnormal trading." When I asked for specifics about what was abnormal, they couldn't provide any details. Customer service only mentioned that the relevant department was reviewing the abnormal trading. I pressed further to understand the issue, but they still couldn't specify what was wrong. I asked if I could directly contact their relevant department to clarify the situation, but they said that wasn't possible.