Loyal Trust Market 2025 Review: Everything You Need to Know

Loyal Trust Market has emerged as a controversial player in the forex brokerage landscape, primarily due to its lack of regulation and mixed user experiences. While it offers a broad range of trading instruments and the popular MetaTrader platforms, concerns regarding its legitimacy and customer service persist. Notably, the absence of a regulatory authority overseeing its operations raises significant red flags for potential investors.

Note: It is essential to consider that different entities operate under the same name across various regions. This review aims to provide a fair and accurate assessment based on available information.

Ratings Overview

How We Rate Brokers: Ratings are based on user experiences, expert opinions, and factual data from multiple sources.

Broker Overview

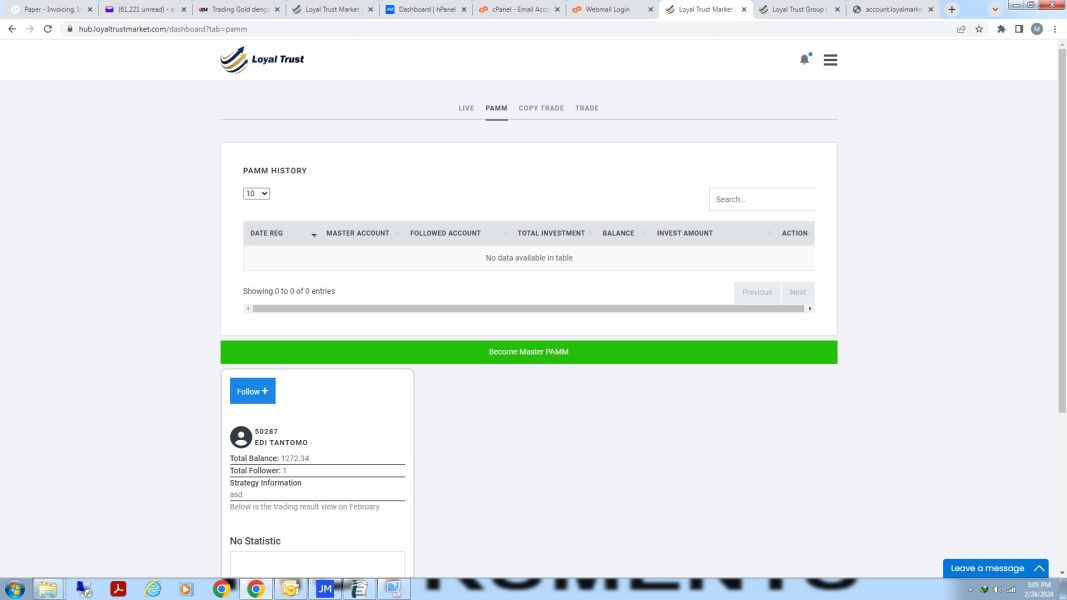

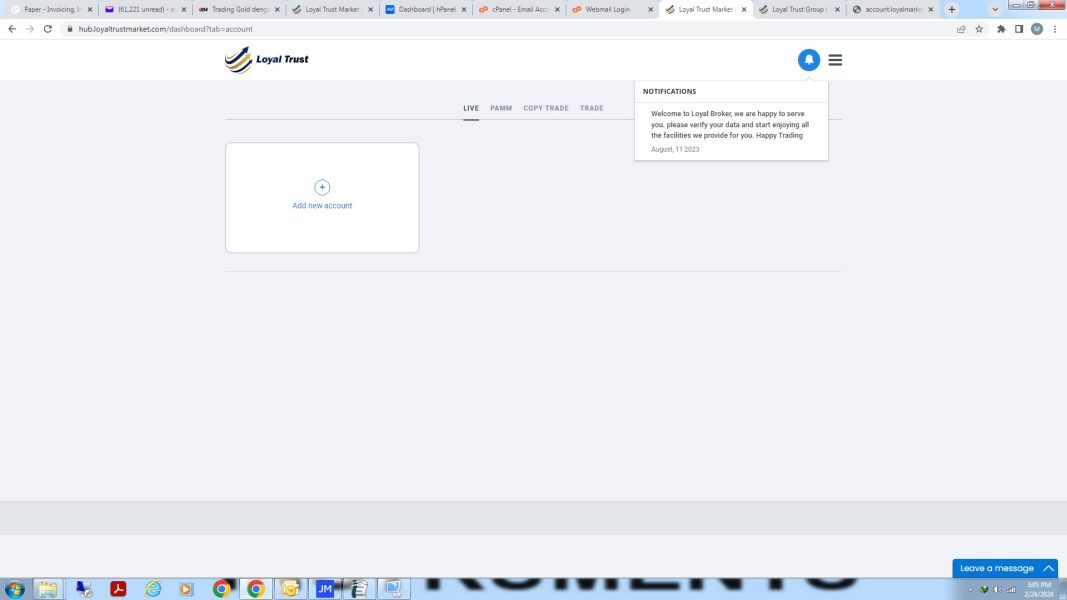

Founded recently, Loyal Trust Market operates out of the United Arab Emirates. It offers trading on the widely used MetaTrader 4 and MetaTrader 5 platforms, catering to both novice and experienced traders. The broker claims to provide access to over 350 trading instruments, including forex, CFDs, commodities, and indices. However, it lacks any valid regulatory oversight, which is a significant concern for potential clients.

Detailed Breakdown

Regulatory Status

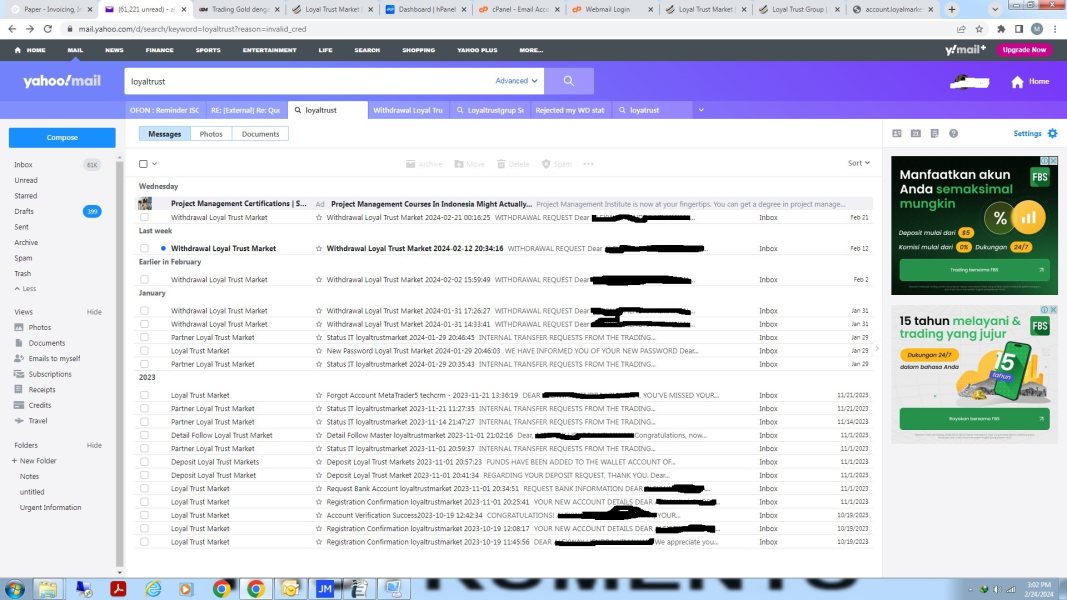

Loyal Trust Market is not regulated by any recognized financial authority, which poses a considerable risk to clients. According to WikiFX, there is no valid regulatory information available, indicating that traders may not have any recourse in the event of disputes or issues with fund withdrawals.

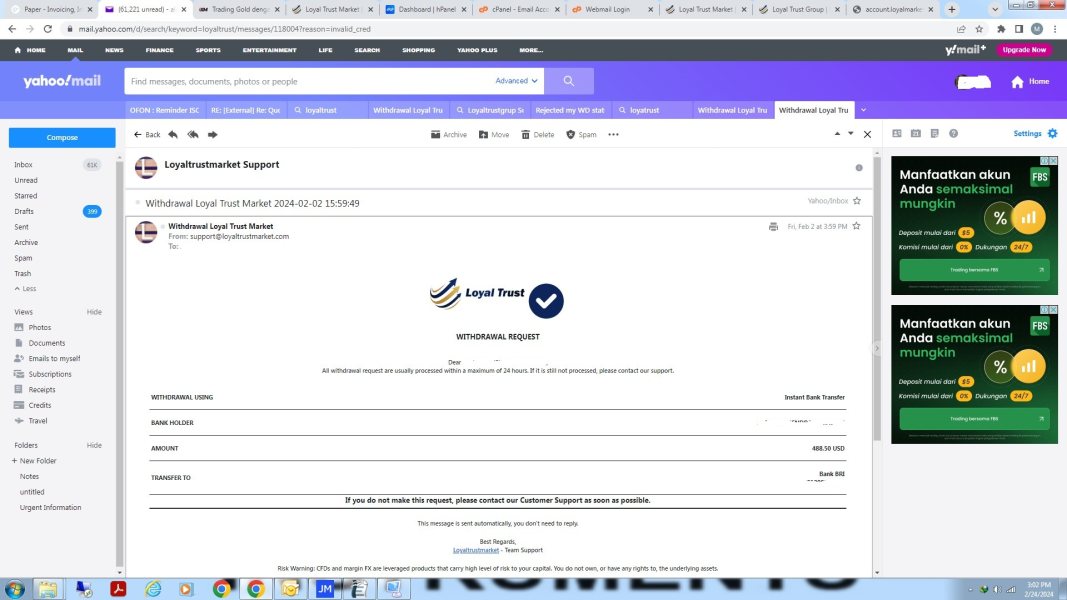

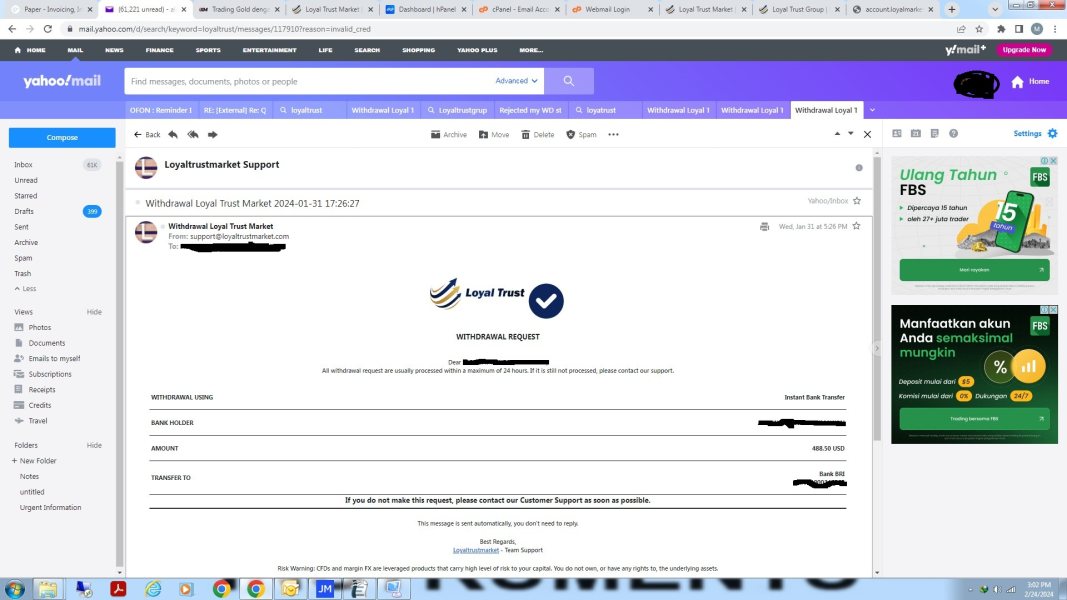

Deposit and Withdrawal Currencies

The broker supports various currencies for deposits and withdrawals, but specific details are scarce. Users have reported challenges with fund withdrawals, a common issue among unregulated brokers.

Minimum Deposit

The minimum deposit requirement is reportedly $0, which may attract new traders. However, the lack of regulatory oversight raises questions about the safety of even minimal investments.

Loyal Trust Market does not appear to offer any significant bonuses or promotional incentives, which could be a drawback for traders looking for additional value.

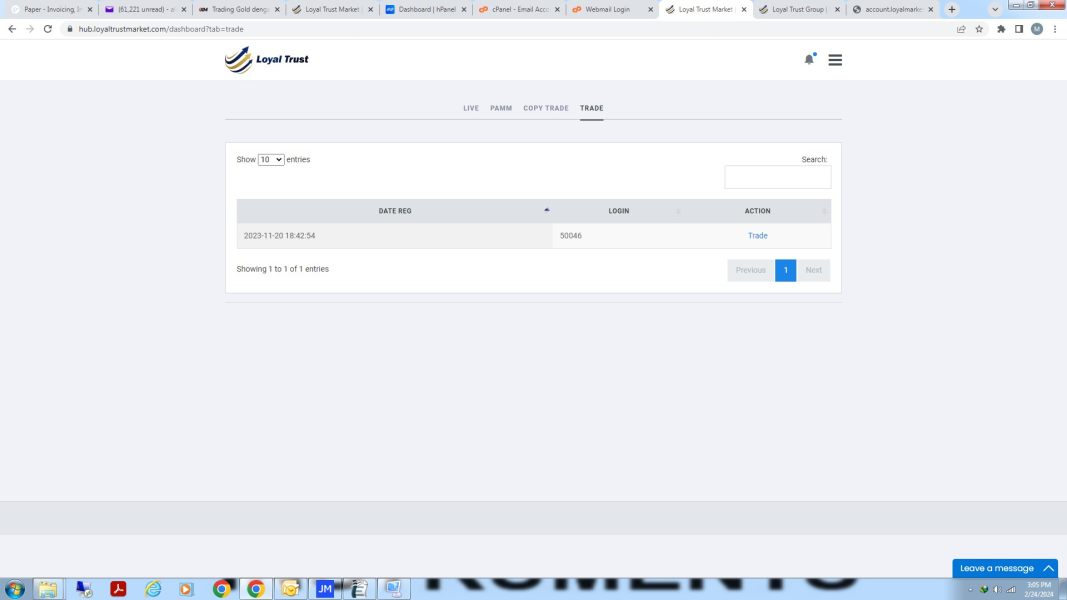

Tradable Asset Categories

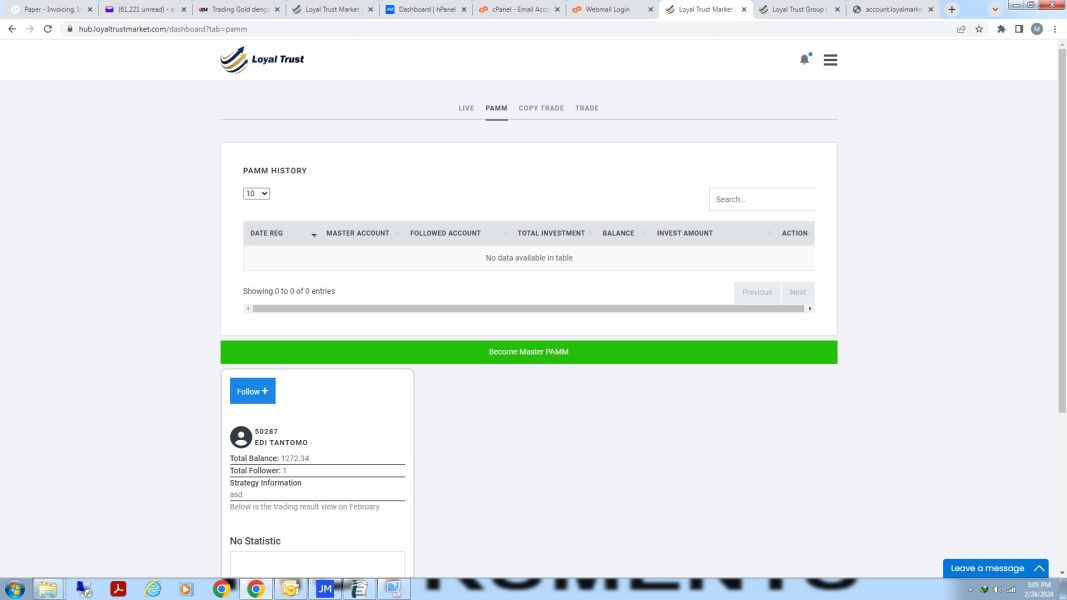

Traders can access a wide range of asset classes, including forex, shares, commodities, and indices. This variety may appeal to those looking to diversify their portfolios.

Costs (Spreads, Fees, Commissions)

Spreads and commissions are not transparently disclosed, which is a common concern among users. According to sources, the trading costs may not be competitive compared to regulated brokers.

Leverage

The broker offers high leverage options, which can be appealing but also increases risk exposure. Users should exercise caution when trading with high leverage.

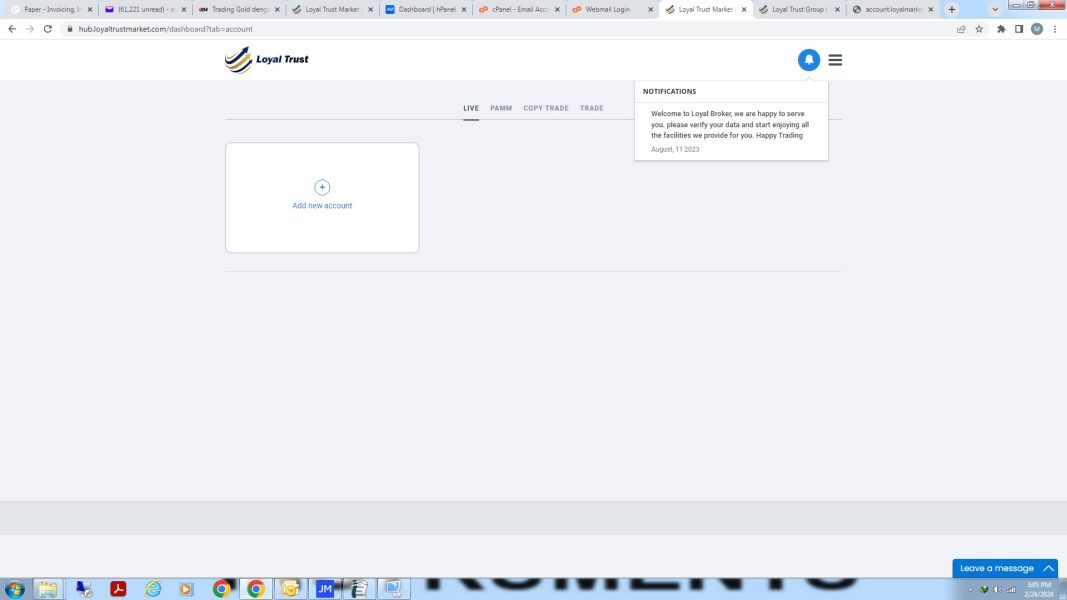

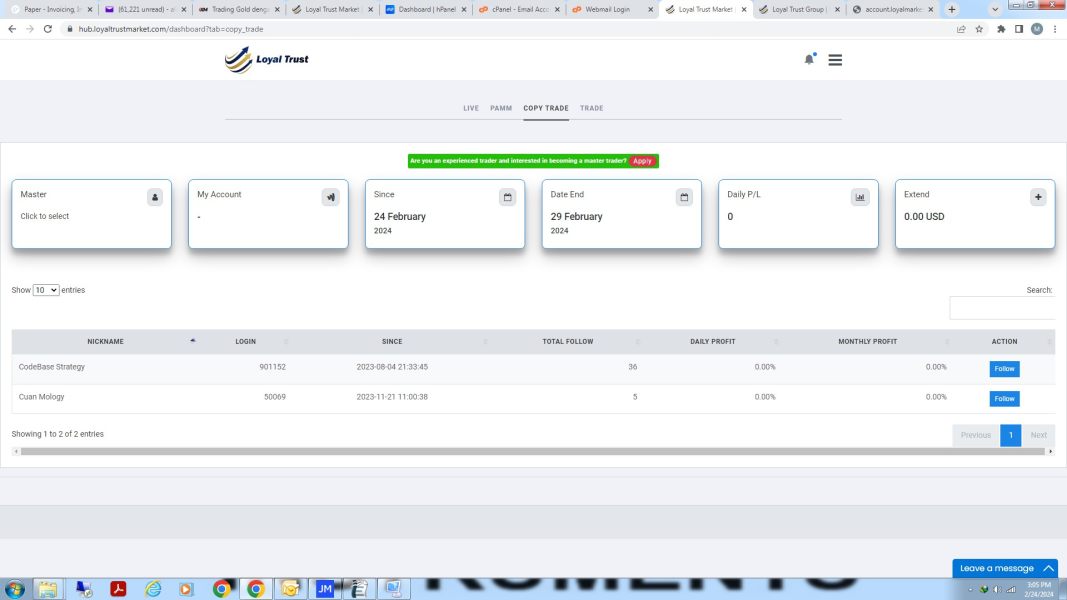

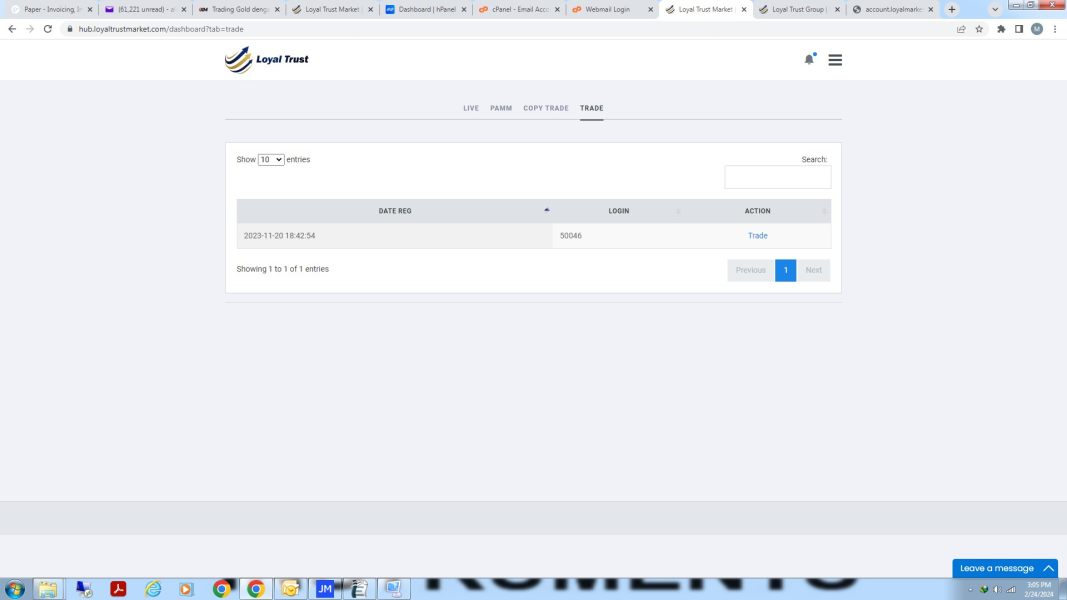

Loyal Trust Market utilizes the popular MetaTrader 4 and MetaTrader 5 platforms, providing a user-friendly interface for trading. However, the lack of regulatory oversight raises concerns about the integrity of the trading environment.

Restricted Regions

The broker does not provide clear information on restricted regions, which may lead to confusion for international traders.

Available Customer Service Languages

Customer service options are limited, with reports indicating that support is slow and unresponsive. This lack of effective communication can be a significant drawback for users in need of assistance.

Rating Breakdown

Account Conditions

The account conditions receive a low rating of 4 due to the absence of regulatory backing and unclear trading terms. The minimum deposit may attract users, but the risks involved are significant.

With a score of 5, the broker provides access to essential trading tools, but the lack of educational resources and market analysis limits its value for traders seeking comprehensive support.

Customer Service and Support

Customer service is rated poorly at 3, with reports of slow response times and limited support options. This can be particularly frustrating for users needing immediate assistance.

Trading Setup (Experience)

The trading experience is rated at 5, mainly due to the availability of popular trading platforms. However, the overall environment remains questionable due to the lack of regulation.

Trustworthiness

Trustworthiness is rated at a low 2, reflecting concerns about the broker's unregulated status and negative user reviews regarding fund withdrawals and customer service.

User Experience

User experience receives a rating of 4, with mixed reviews highlighting both positive trading experiences and significant concerns about customer support and withdrawal issues.

In conclusion, while Loyal Trust Market may offer attractive trading conditions in terms of account setup and available instruments, the significant lack of regulation and mixed user experiences raise serious concerns. Potential investors should proceed with caution and consider alternative regulated brokers for safer trading opportunities.