Jetvix 2025 Review: Everything You Need to Know

Executive Summary

Jetvix is a new player in the forex brokerage world. This jetvix review shows a broker with good features and serious problems that traders should think about carefully.

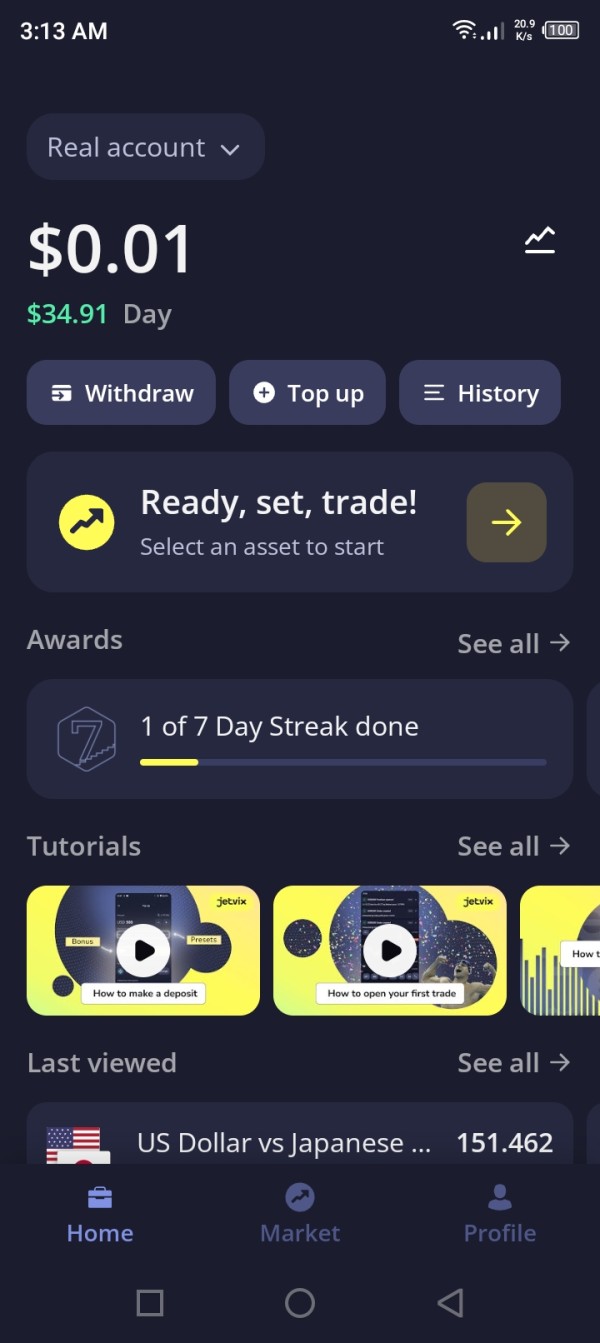

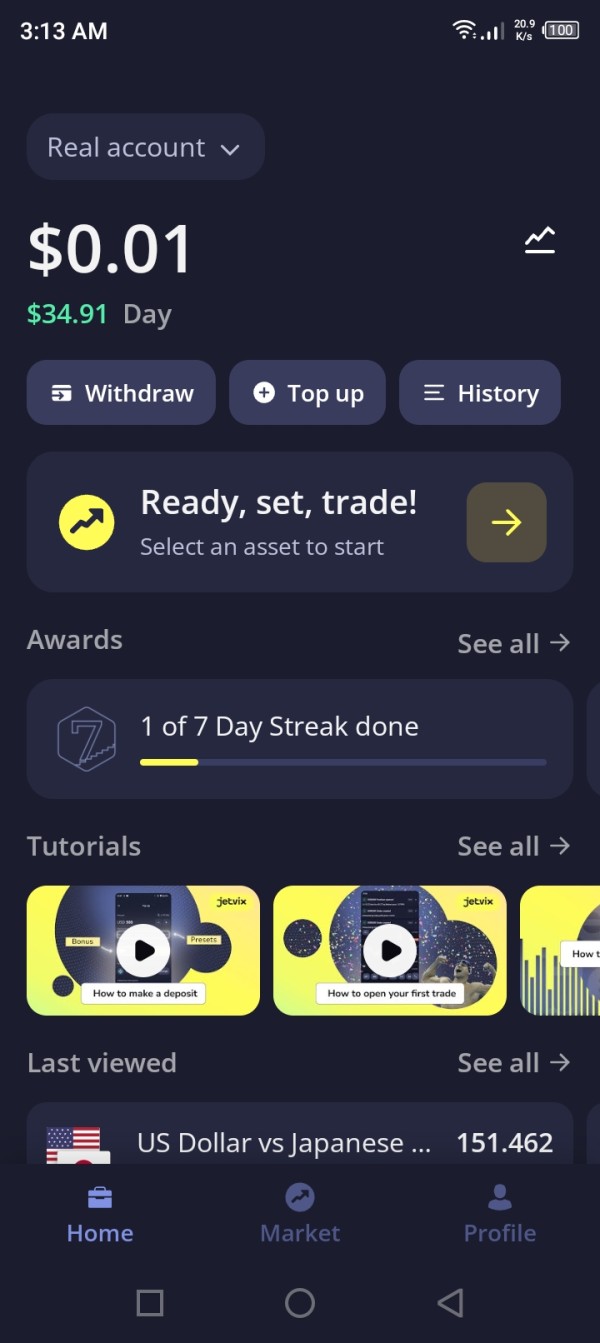

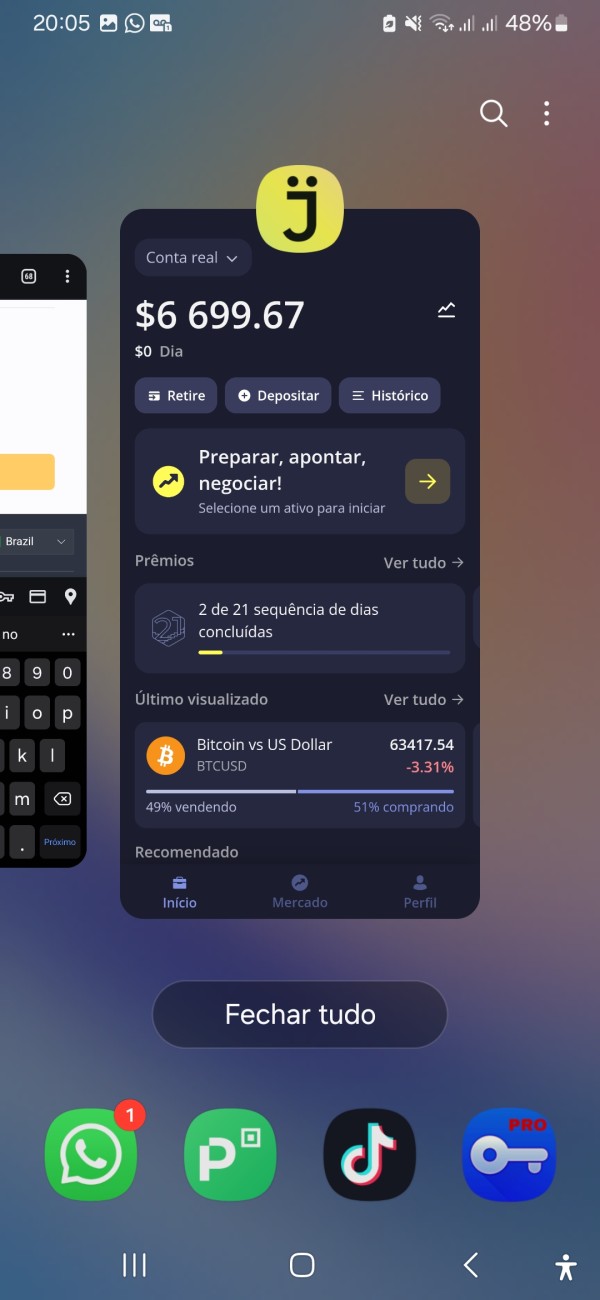

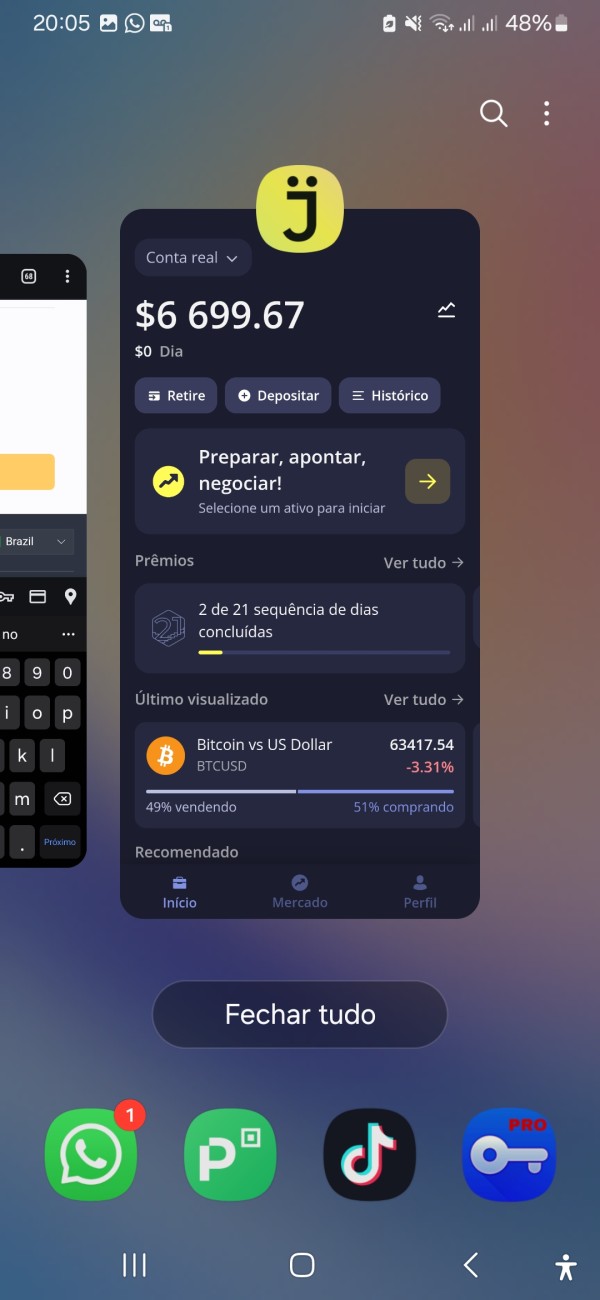

The platform has its own trading terminal and says it serves over 50,000 traders with more than $200 million in trading volume. Jetvix gives access to 140+ trading assets across different markets, which appeals to traders who want variety. Users like how fast and reliable the trading terminal is, with many praising the low spreads and quick order execution.

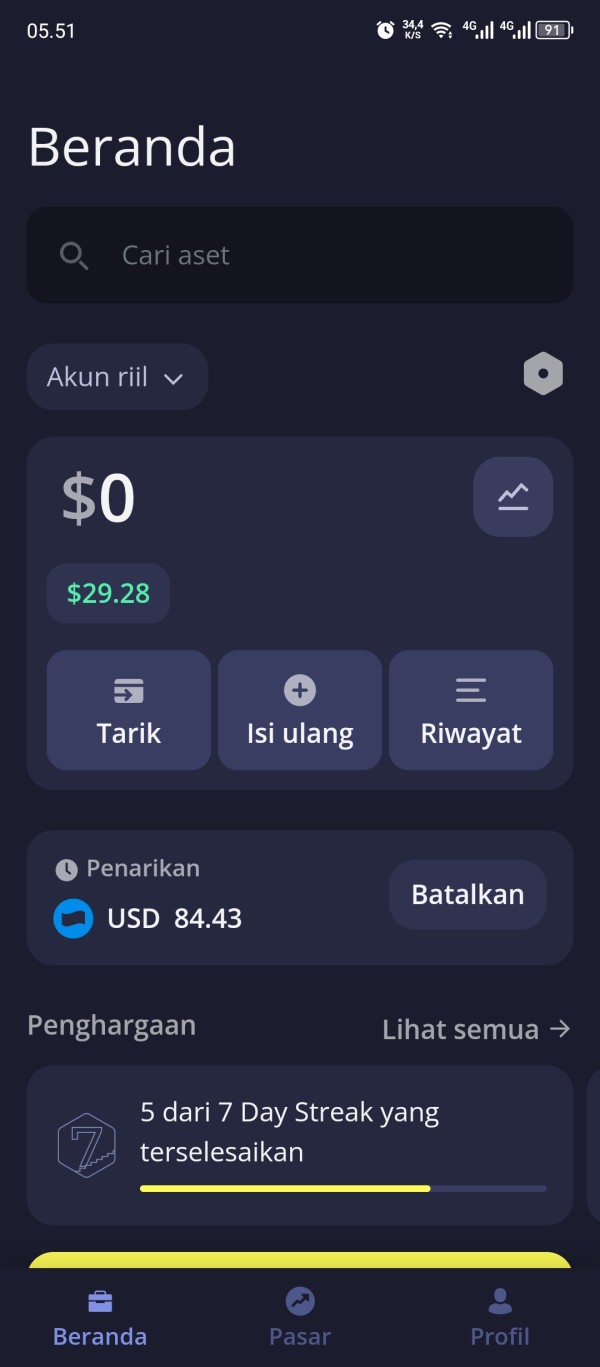

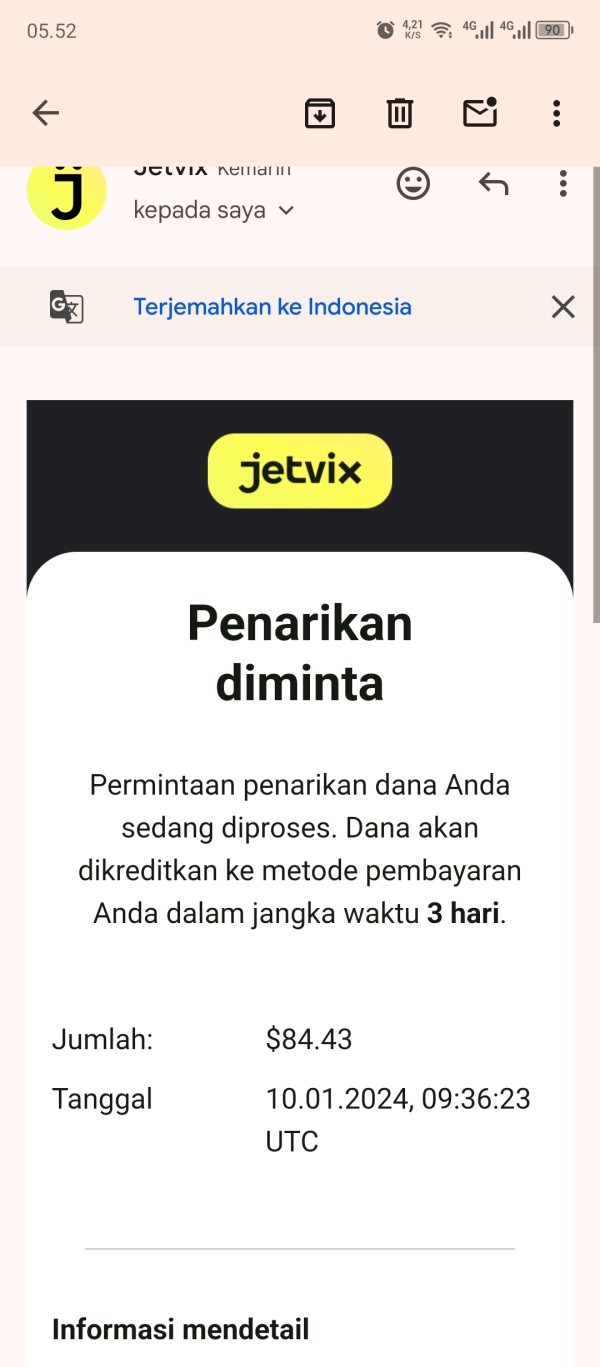

However, our analysis finds big concerns about withdrawal processes and whether you can trust them. Many user complaints point to withdrawal systems that aren't automated and long waiting times to get your money back. With a trust score of 49 and scam risk warnings, Jetvix shows a mixed picture for potential clients.

The broker mainly targets traders who want low spreads and diverse asset choices, especially those comfortable with proprietary trading platforms. While the technical trading experience gets positive reviews, the problems with fund management raise questions about the broker's reliability and customer service standards.

Important Disclaimers

Regional Variations: Jetvix does not give clear regulatory information in available materials, meaning investor protections may vary a lot across different areas. Potential clients should check local regulatory status and legal protections before using the platform.

Review Methodology: This evaluation uses user feedback analysis, market observations, and industry standard assessments. Due to limited official disclosure from Jetvix about regulatory status and operational details, some parts of this review rely heavily on user-reported experiences and publicly available information.

Rating Framework

Broker Overview

Jetvix operates as a global financial technology platform, though specific founding details and company history remain unclear from available sources. The company says it serves over 50,000 traders and handles more than $200 million in trading volume, which suggests big operations despite being relatively new to the market.

The broker's business model focuses on providing complete trading services through its own platform, emphasizing technology innovation and user experience. Jetvix positions itself as a modern alternative to traditional brokers, focusing on competitive spreads and diverse asset access rather than extensive educational resources or premium research offerings.

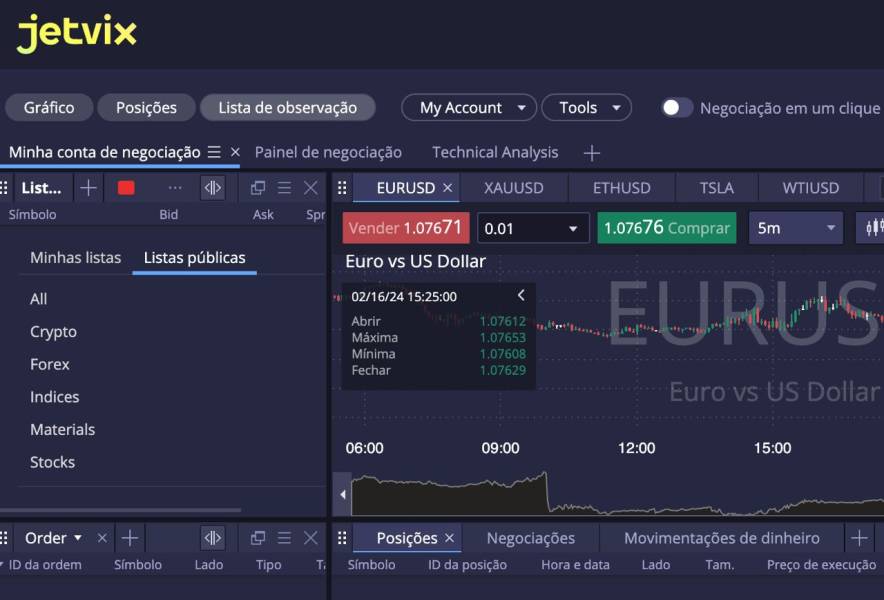

According to available information, Jetvix offers access to 140+ trading instruments across multiple asset classes including forex pairs and CFDs. The platform operates mainly through its custom-built trading terminal, which users report as fast and reliable for order execution. However, this jetvix review notes the absence of popular third-party platforms like MetaTrader 4 or 5, which may limit appeal for traders who prefer familiar interfaces.

The regulatory status remains a big concern, as available materials do not clearly identify specific supervisory authorities or compliance frameworks. This regulatory uncertainty raises questions about investor protection measures and dispute resolution mechanisms available to clients.

Regulatory Oversight: Available documentation does not specify particular regulatory authorities overseeing Jetvix operations, creating uncertainty about compliance standards and investor protections.

Deposit and Withdrawal Methods: Specific payment options and processing procedures are not detailed in accessible materials, though user feedback indicates challenges with withdrawal automation.

Minimum Deposit Requirements: Entry-level funding requirements are not clearly specified in available broker information.

Promotional Offerings: Current bonus structures and promotional campaigns are not detailed in accessible materials.

Available Trading Assets: Jetvix provides access to 140+ trading instruments across multiple categories, including major and minor forex pairs, along with various CFD products covering different markets.

Cost Structure: The broker advertises low spreads as a primary competitive advantage, though specific spread ranges and commission details are not thoroughly documented. Users report satisfaction with competitive pricing, but complete fee schedules remain unclear.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Selection: Trading occurs exclusively through Jetvix's proprietary terminal, featuring integrated technical analysis tools and customizable interface options.

Geographic Restrictions: Specific jurisdictional limitations are not clearly outlined in accessible materials.

Customer Support Languages: Available language options for customer service are not specified in current documentation.

This jetvix review emphasizes the need for potential clients to directly contact the broker for detailed information on these crucial operational aspects.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions evaluation for Jetvix reveals significant information gaps that impact the overall assessment. Available materials do not provide clear details about account tier structures, minimum deposit requirements, or specific features that make various account types different. This lack of transparency makes it difficult for potential traders to understand entry requirements and account progression opportunities.

The absence of detailed account specifications in publicly available information suggests either limited marketing disclosure or a simplified account structure. While some brokers offer multiple account tiers with varying features and requirements, Jetvix appears to operate with less complex account categorization, though specific details remain unclear.

User feedback does not extensively address account opening procedures or verification processes, making it challenging to assess the efficiency and user-friendliness of initial setup requirements. The lack of complete account condition information represents a significant limitation for traders seeking detailed operational understanding before committing to the platform.

Without clear information about account minimums, maintenance requirements, or tier-specific benefits, potential clients cannot effectively compare Jetvix account conditions against industry standards or competitor offerings. This jetvix review recommends direct broker contact for detailed account specification clarification.

Jetvix shows strength in its proprietary trading platform development, offering users access to custom-built terminal software with integrated technical analysis capabilities. User feedback consistently highlights satisfaction with the platform's speed and reliability, suggesting robust technical infrastructure supporting trading operations.

The broker's charting terminal provides technical analysis functionality, allowing traders to conduct market research and analysis within the platform environment. This integrated approach eliminates the need for external charting software for basic technical analysis requirements, streamlining the trading workflow for many users.

However, available information does not detail complete educational resources, research publications, or advanced analytical tools that many established brokers provide. The focus appears to be on core trading functionality rather than extensive educational or research support, which may limit appeal for traders seeking complete learning resources.

The proprietary platform approach offers customization capabilities that users report as beneficial for personalizing trading environments. While this provides flexibility, it also means traders cannot access familiar third-party platforms like MetaTrader, which some may prefer based on previous experience and available plugins or expert advisors.

Customer Service and Support Analysis (Score: 4/10)

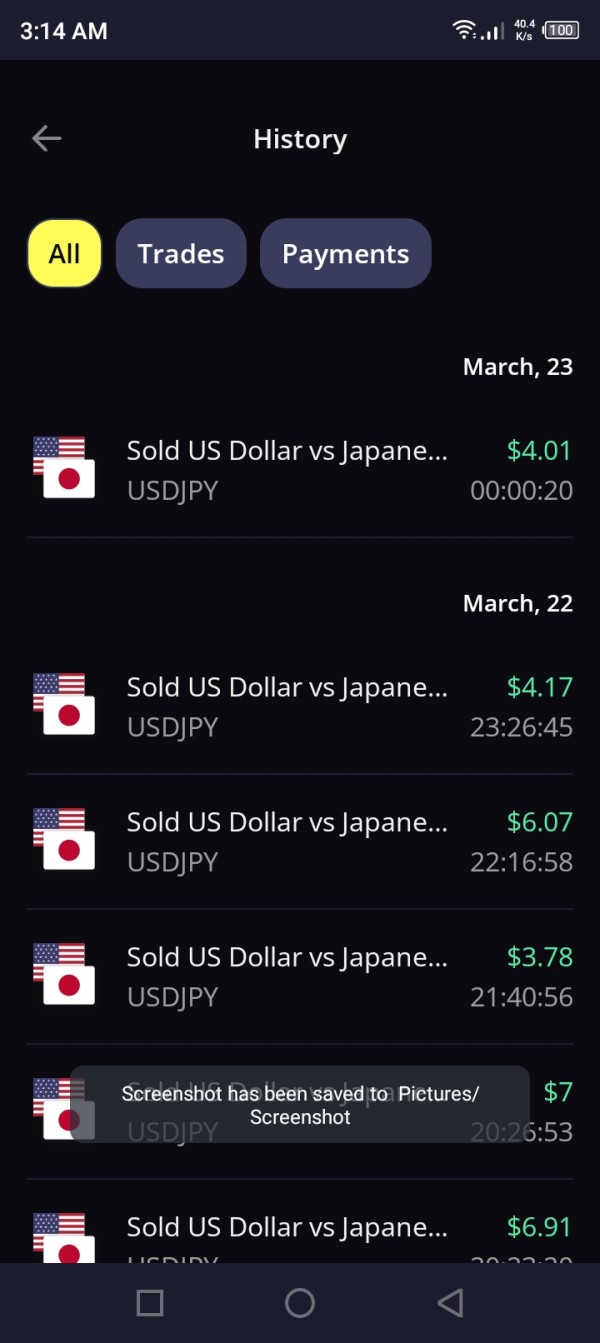

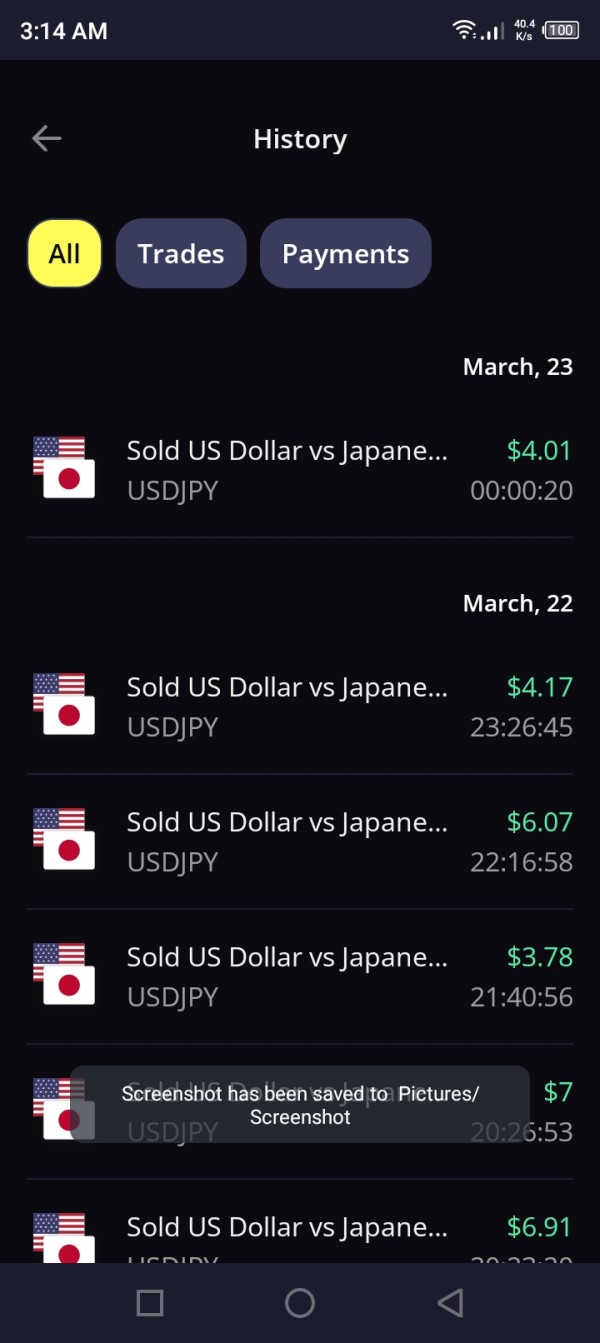

Customer service represents a significant weakness in the Jetvix offering, with multiple user complaints highlighting systematic issues with support responsiveness and withdrawal processing. User feedback consistently reports extended waiting times for withdrawal requests and non-automated fund transfer systems, creating frustration and operational delays.

The withdrawal system complaints suggest manual processing requirements that contribute to delays and user dissatisfaction. In an industry where automated, efficient fund management is standard, these reported delays represent a substantial competitive disadvantage and operational concern for potential clients.

Available information does not specify customer support channels, availability hours, or language support options, making it difficult to assess the complete support infrastructure. The lack of detailed support information, combined with negative user feedback about service responsiveness, suggests limited investment in customer service operations.

Response time issues reported by users indicate potential understaffing or inefficient support processes that impact user experience. For traders requiring prompt assistance with technical issues or account problems, these service limitations represent significant operational risks that should be carefully considered.

Trading Experience Analysis (Score: 6/10)

The core trading experience on Jetvix receives generally positive user feedback, particularly regarding platform speed and order execution reliability. Users consistently report satisfaction with the trading terminal's performance, indicating robust technical infrastructure supporting real-time trading operations.

Low spreads represent a significant competitive advantage that users acknowledge and appreciate. The competitive pricing structure appeals to cost-conscious traders seeking to minimize transaction costs, particularly for high-frequency trading strategies where spread costs add up significantly over time.

The proprietary platform offers customization options that enhance user experience by allowing interface personalization according to individual preferences and trading styles. This flexibility supports various trading approaches and helps users optimize their workspace for maximum efficiency.

However, the trading experience is significantly impacted by withdrawal processing issues that affect overall user satisfaction. While the actual trading functionality receives praise, the inability to efficiently access funds creates anxiety and operational challenges that diminish the positive trading experience.

This jetvix review notes that technical trading capabilities appear solid, but operational support systems require substantial improvement to match the platform's technical performance standards.

Trust and Safety Analysis (Score: 4/10)

Trust and safety represent major concerns for Jetvix, with a trust score of 49 indicating significant reliability questions and existing scam risk warnings that potential clients must carefully consider. The absence of clear regulatory information in available materials creates uncertainty about investor protection measures and dispute resolution mechanisms.

Without specific regulatory oversight details, clients cannot verify compliance with established financial services standards or understand available recourse options in case of disputes. This regulatory uncertainty represents a substantial risk factor that distinguishes Jetvix from well-regulated competitors with clear supervisory oversight.

The scam risk warnings associated with the broker suggest industry concerns about operational practices or business model sustainability. While these warnings do not constitute definitive fraud accusations, they indicate elevated risk levels that require careful consideration by potential clients.

User complaints about withdrawal difficulties contribute to trust concerns, as fund access represents a fundamental broker reliability indicator. When users report systematic withdrawal delays or processing issues, it raises questions about financial management practices and operational integrity that impact overall trustworthiness assessments.

User Experience Analysis (Score: 5/10)

Overall user experience with Jetvix presents a mixed picture, with strong technical platform performance offset by significant operational challenges. The 5-star user rating indicates general satisfaction among active users, though this positive feedback is tempered by specific complaints about fund management processes.

Platform usability receives positive reviews, with users appreciating the intuitive interface design and customization capabilities. The proprietary terminal appears to successfully balance functionality with ease of use, making it accessible to traders with varying experience levels while providing sufficient tools for advanced analysis.

The registration and account verification processes are not extensively documented in user feedback, suggesting either streamlined procedures or limited user discussion of initial setup experiences. Without detailed user reports about onboarding experiences, it's difficult to assess the efficiency and user-friendliness of initial account establishment.

Fund management represents the primary user experience weakness, with withdrawal system complaints significantly impacting overall satisfaction. Users seeking reliable, efficient access to their funds may find the reported delays and manual processing requirements unacceptable for their trading needs.

The target user profile appears to be traders prioritizing low spreads and diverse asset access over complete support services and regulatory assurance. For users comfortable with these trade-offs, Jetvix may provide acceptable value, though the operational limitations require careful consideration.

Conclusion

This complete jetvix review reveals a broker with significant technical capabilities undermined by operational weaknesses and trust concerns. While the proprietary trading platform shows solid performance and competitive spreads attract cost-conscious traders, systematic issues with customer service and fund management create substantial user experience challenges.

Jetvix appears most suitable for experienced traders comfortable with regulatory uncertainty who prioritize low trading costs and platform performance over complete support services. The 140+ available trading assets and competitive pricing structure offer value for diversification-focused strategies, but operational limitations require careful risk assessment.

The primary advantages include fast, reliable trading terminal performance and competitive spread offerings that appeal to active traders. However, significant disadvantages include withdrawal system delays, limited customer service responsiveness, regulatory uncertainty, and overall trust concerns that may outweigh technical benefits for many potential clients.

Prospective users should thoroughly evaluate their risk tolerance and operational requirements before engaging with Jetvix, particularly considering the withdrawal processing challenges and trust score concerns highlighted throughout this analysis.