Gate Invest Markets 2025 Review: Everything You Need to Know

Executive Summary

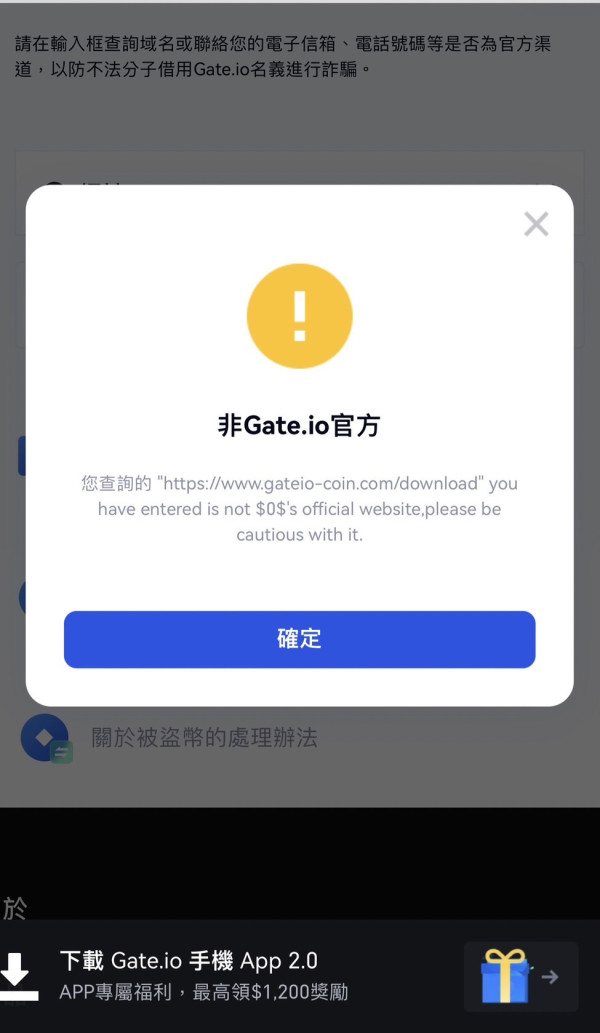

This gate invest markets review gives a neutral assessment of the broker. The main concerns are the lack of clear regulatory information and user complaints about withdrawal issues. Gate Invest Markets has shown significant growth in the cryptocurrency trading sector, positioning itself as a provider of advanced trading platforms for investors who want exposure to both forex and digital assets.

CoinDesk's latest 2025 Exchange Review shows the platform has strong momentum in crypto derivatives trading. Trading volumes reached $264 billion in May 2025, representing nearly 70% growth compared to previous periods. This growth highlights the broker's competitive edge in the rapidly evolving cryptocurrency landscape.

The main target customers are investors interested in diversified trading opportunities across forex and cryptocurrency markets. However, potential clients should be careful given the mixed user feedback, which includes both positive experiences and concerning reports about withdrawal difficulties that may indicate operational challenges.

Important Disclaimer

Users should carefully evaluate the safety and legitimacy of trading conditions across different regions due to limited information about specific regulatory frameworks. This review is based on available user feedback, market analysis, and publicly accessible information. The absence of clear regulatory oversight information raises important considerations for potential clients regarding fund security and dispute resolution mechanisms.

Prospective traders are strongly advised to conduct independent verification of regulatory status and thoroughly understand the terms and conditions before engaging with this platform.

Rating Framework

Broker Overview

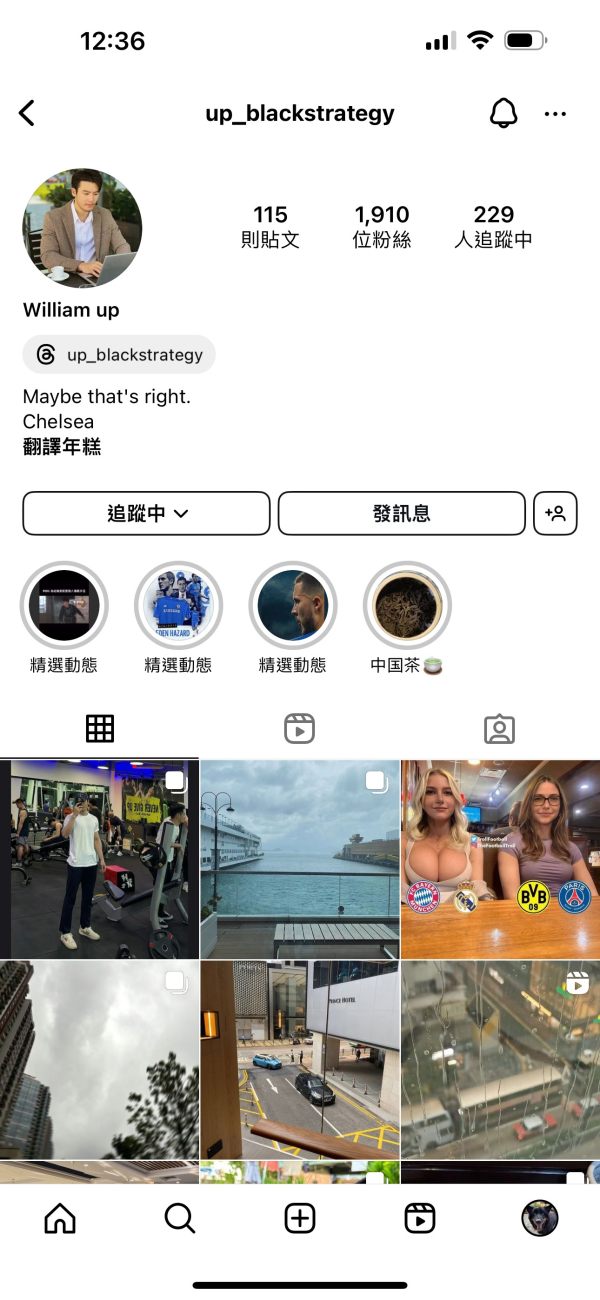

Gate Invest Markets emerged in 2024 as a UK-based financial services provider. The company positions itself to serve investors seeking flexible trading environments across multiple asset classes. Gate Invest Markets has established its operations with a focus on delivering comprehensive trading solutions that encompass both traditional forex markets and the rapidly expanding cryptocurrency sector.

The broker's business model centers on providing Contract for Differences and direct cryptocurrency trading opportunities. This dual approach aims to capture the growing demand from retail and institutional investors who seek exposure to digital assets while maintaining access to conventional forex markets. The platform emphasizes its commitment to technological innovation, offering what it describes as cutting-edge trading infrastructure.

Gate Invest Markets offers multiple account types designed to accommodate varying investor profiles and capital requirements according to available information. The broker's asset coverage includes major forex pairs, cryptocurrency CFDs, and direct digital asset trading. However, specific details regarding platform partnerships, exact regulatory authorization, and comprehensive fee structures remain unclear in publicly available documentation, which presents potential transparency concerns for prospective clients.

Regulatory Status: The available research materials do not provide specific information about regulatory authorization from recognized financial authorities. This raises important questions about oversight and client protection.

Deposit and Withdrawal Methods: Specific payment processing options and associated fees are not detailed in the available documentation. User feedback suggests potential issues with withdrawal processing times.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in the available materials.

Promotional Offers: Information regarding welcome bonuses, trading incentives, or promotional campaigns is not available in the current research materials.

Tradeable Assets: The platform offers CFDs, cryptocurrency trading, and forex instruments. The exact number of available instruments and specific asset coverage remains unspecified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in the available documentation. This makes cost comparison challenging.

Leverage Options: Specific leverage ratios for different asset classes are not mentioned in the research materials.

Platform Selection: The broker describes itself as offering cutting-edge trading technology. Specific platform names, features, or third-party integrations are not detailed.

Geographic Restrictions: Information about restricted jurisdictions or regional limitations is not available.

Customer Support Languages: The range of supported languages for customer service is not specified in the available materials.

This gate invest markets review highlights the need for greater transparency in operational details and regulatory compliance information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for Gate Invest Markets reflects significant information gaps that impact the overall assessment. Gate Invest Markets claims to offer multiple account types designed for different investor profiles, but specific details about account tiers, their respective features, and associated benefits remain unclear in available documentation.

The absence of transparent information regarding minimum deposit requirements across different account categories makes it difficult for potential clients to make informed decisions. This lack of clarity extends to account opening procedures, required documentation, and verification timelines. User feedback regarding account conditions is limited, with most available reviews focusing on trading execution and withdrawal experiences rather than account setup and maintenance.

The platform's relatively recent establishment in 2024 means that long-term account performance data and user satisfaction metrics are not yet available for comprehensive evaluation. Without detailed information about special account features such as Islamic accounts, VIP services, or institutional offerings, potential clients cannot adequately assess whether Gate Invest Markets can accommodate their specific trading requirements. This gate invest markets review emphasizes the need for more comprehensive account condition disclosure.

Gate Invest Markets receives a moderate rating for tools and resources. The platform's focus on providing cutting-edge trading technology is emphasized, though specific tool descriptions are limited in available materials. The broker's positioning in the competitive crypto derivatives market, as evidenced by significant trading volume growth, implies the availability of sophisticated trading infrastructure.

However, detailed information about specific analytical tools, charting capabilities, technical indicators, or automated trading support is not readily available in current documentation. Educational resources, market research, and analyst commentary availability remain unclear, which limits the assessment of the platform's commitment to trader development and market insight provision. The absence of detailed information about mobile trading capabilities, API access, or third-party tool integration further constrains the evaluation.

User feedback does not provide substantial insight into the quality and effectiveness of available trading tools. This makes it challenging to assess real-world performance and user satisfaction with the platform's technological offerings. The platform's relative newness means that comprehensive tool testing and user experience data are still developing.

Customer Service and Support Analysis

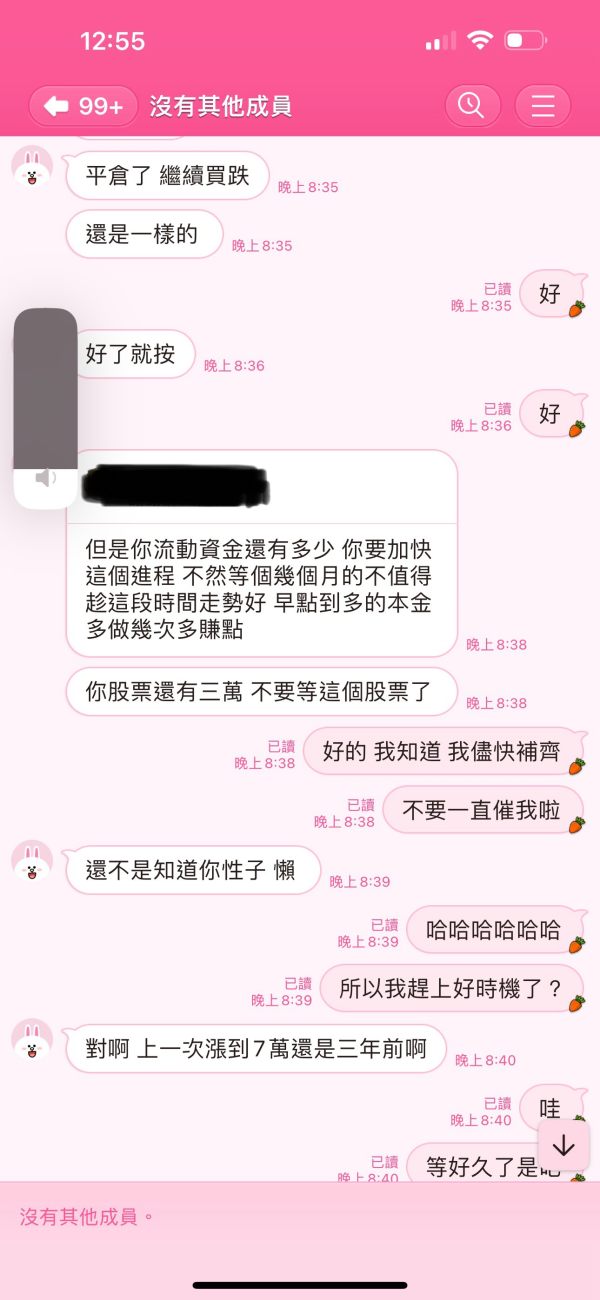

Customer service and support receive a below-average rating primarily due to user complaints regarding withdrawal processing and communication issues. Available user feedback indicates concerns about response times and problem resolution effectiveness, particularly related to fund withdrawal requests.

The lack of detailed information about customer support channels, operating hours, and multilingual support capabilities further impacts this assessment. Without clear documentation of support ticket systems, live chat availability, or phone support options, potential clients cannot adequately evaluate the accessibility and quality of customer assistance. User reports suggesting difficulties with withdrawal processing indicate potential gaps in customer service protocols and communication transparency.

These concerns are particularly significant for a financial services provider, where prompt and effective customer support is essential for maintaining client confidence and regulatory compliance. The absence of publicly available information about customer service training, escalation procedures, or satisfaction metrics makes it difficult to assess whether reported issues represent isolated incidents or systemic service challenges. This aspect of the gate invest markets review highlights the importance of robust customer support infrastructure for broker credibility.

Trading Experience Analysis

The trading experience receives a relatively positive rating based on the absence of significant user complaints regarding platform stability or execution quality. Gate Invest Markets' strong performance in cryptocurrency derivatives trading, as evidenced by substantial volume growth, suggests effective trade execution and platform reliability.

The platform's ability to handle significant trading volumes, reaching $264 billion in May 2025, indicates robust technical infrastructure capable of supporting active trading strategies. This performance metric suggests that the trading environment can accommodate both retail and institutional trading requirements effectively. User feedback does not highlight major issues with order execution, slippage, or platform downtime, which contributes positively to the trading experience assessment.

The broker's focus on cutting-edge technology appears to translate into functional trading capabilities. However, specific performance metrics such as execution speeds and order fill rates are not detailed. The platform's cryptocurrency trading focus aligns with current market trends and trader demand for digital asset exposure.

The lack of detailed information about trading conditions, such as typical spreads, execution models, or advanced order types, limits the comprehensive evaluation of the trading experience. This gate invest markets review acknowledges the positive trading volume performance while noting the need for more detailed trading condition transparency.

Trust and Security Analysis

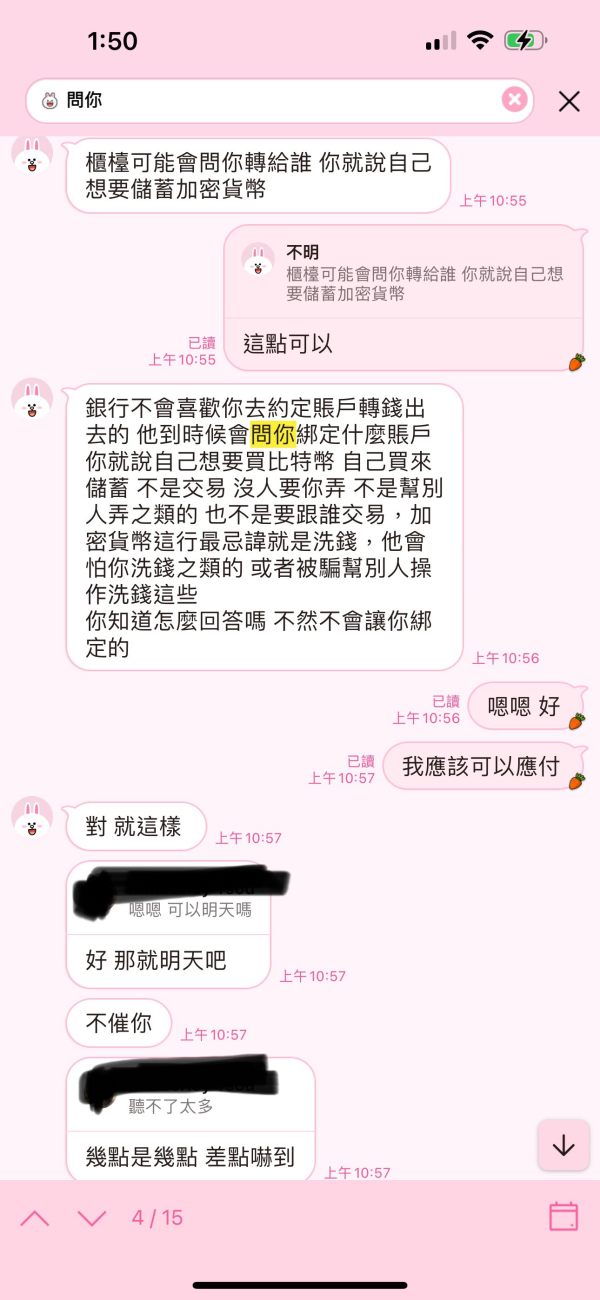

Trust and security receive the lowest rating in this evaluation due to critical concerns about regulatory transparency and user withdrawal experiences. The absence of clear regulatory authorization information from recognized financial authorities raises fundamental questions about client fund protection and operational oversight.

User reports of withdrawal difficulties represent significant red flags for potential clients, as reliable fund access is a cornerstone of broker trustworthiness. These concerns are compounded by the lack of detailed information about client fund segregation, deposit insurance, or dispute resolution mechanisms. The platform's recent establishment in 2024 means that long-term operational track record and regulatory compliance history are not available for assessment.

Without established regulatory relationships or transparent compliance reporting, potential clients cannot adequately evaluate the security of their investments. The absence of third-party security audits, fund protection schemes, or regulatory oversight creates substantial uncertainty about the platform's ability to protect client interests. These factors combine to create significant trust concerns that potential clients must carefully consider before engaging with the platform.

User Experience Analysis

User experience receives an average rating reflecting mixed feedback and limited comprehensive user satisfaction data. Some users report satisfactory trading experiences, but withdrawal-related complaints significantly impact overall user satisfaction metrics.

The platform interface and usability information is not detailed in available materials, making it difficult to assess the quality of user interaction design and navigation efficiency. Registration and account verification processes are not clearly documented, which may create uncertainty for prospective clients. User feedback indicates that while trading functionality appears adequate, administrative processes such as fund withdrawal may present challenges that negatively impact the overall user experience.

The lack of comprehensive user testimonials or satisfaction surveys limits the depth of this assessment. The broker's focus on cryptocurrency trading may appeal to users seeking digital asset exposure, but the absence of detailed platform demonstrations or user interface previews makes it challenging to evaluate ease of use and feature accessibility. This gate invest markets review emphasizes the importance of transparent user experience documentation for informed decision-making.

Conclusion

Gate Invest Markets demonstrates strong performance in cryptocurrency derivatives trading, evidenced by significant volume growth and competitive positioning in the digital asset market. However, this gate invest markets review concludes with a neutral overall assessment due to critical concerns about regulatory transparency and user withdrawal experiences.

The platform may appeal to investors seeking exposure to both forex and cryptocurrency markets, particularly those interested in the growing crypto derivatives sector. The lack of clear regulatory oversight and user reports of withdrawal difficulties create substantial risk considerations that potential clients must carefully evaluate. The primary advantages include diverse trading product offerings and demonstrated growth in the cryptocurrency sector, while significant disadvantages encompass regulatory uncertainty and customer service challenges.

Prospective clients should conduct thorough due diligence and consider these factors carefully before making investment decisions.