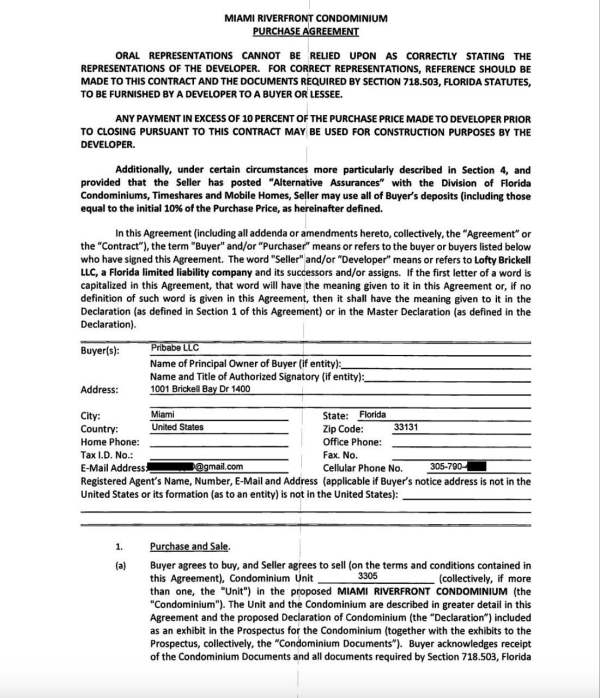

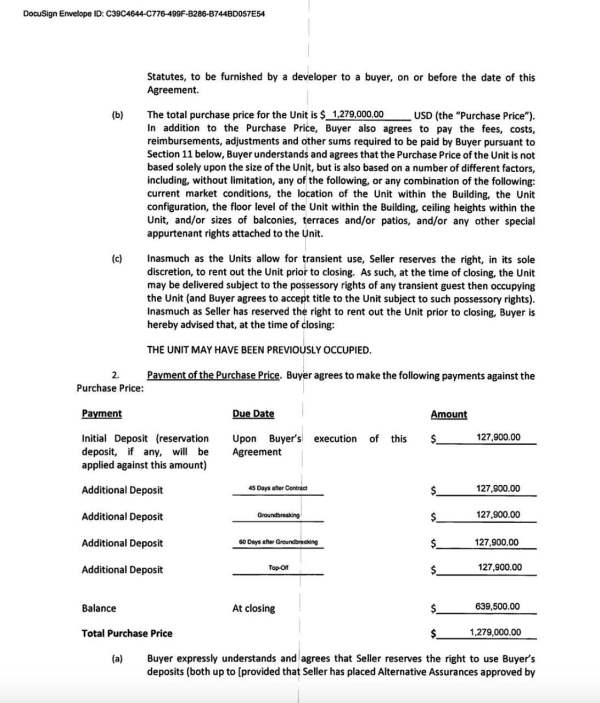

Fxwinning 2025 Review: Everything You Need to Know

Executive Summary

This Fxwinning review shows serious concerns about the broker's safety and legitimacy. Potential traders must think carefully before investing their money with this platform. Based on detailed analysis of user feedback and public information, Fxwinning presents a mixed picture with major red flags.

Trustpilot data shows that Fxwinning has a moderate rating of 3 out of 5 stars from 845 user reviews. This indicates mixed user experiences and moderate satisfaction levels. However, this average rating hides deeper concerns about how the platform operates and follows regulations.

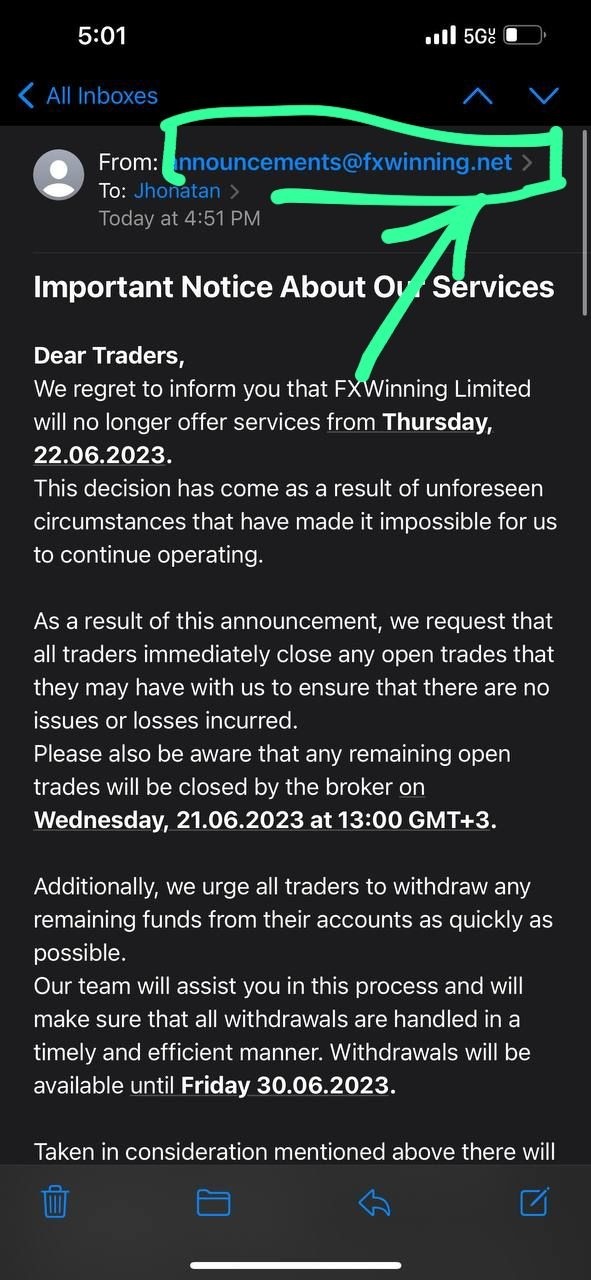

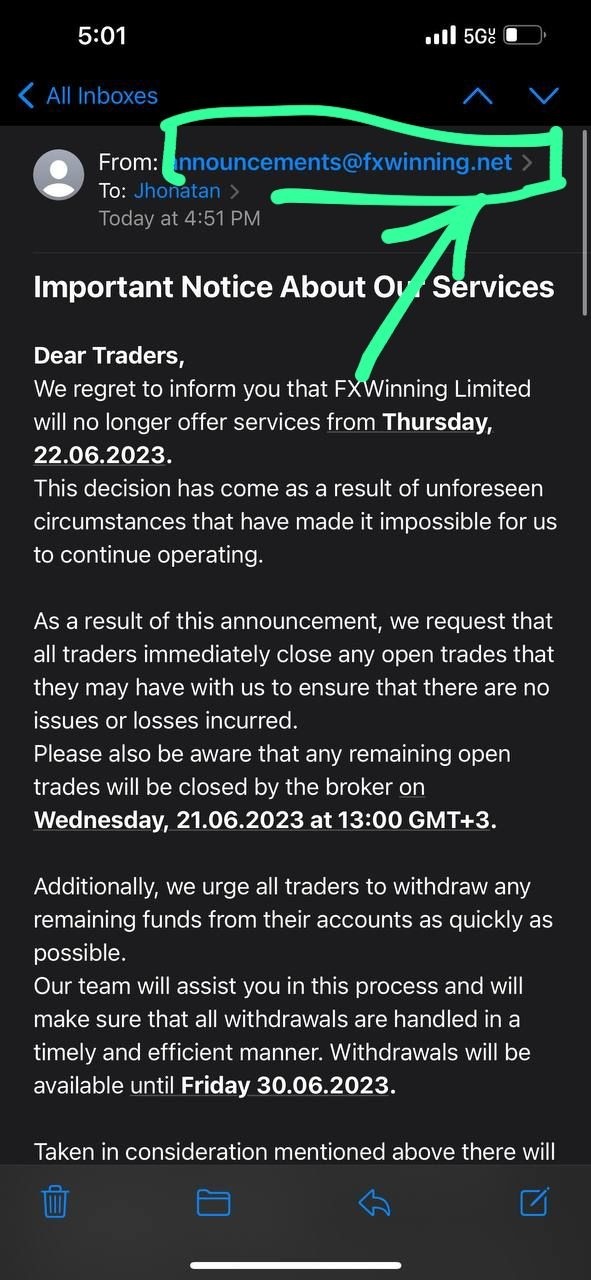

Legal investigators have started looking into this broker. Silver Miller Law is conducting investigations into FxWinning, Ltd. and how they do business. These investigations focus on claims about extremely high returns ranging from 8-15% monthly, which raises serious concerns about whether such claims are real or sustainable.

Fxwinning might appeal to investors who want high returns. However, the combination of legal scrutiny, regulatory uncertainty, and mixed user feedback suggests that potential clients should be extremely careful. The platform lacks clear regulatory information and faces ongoing legal investigations that present major risks outweighing any potential benefits for most traders.

Important Notice

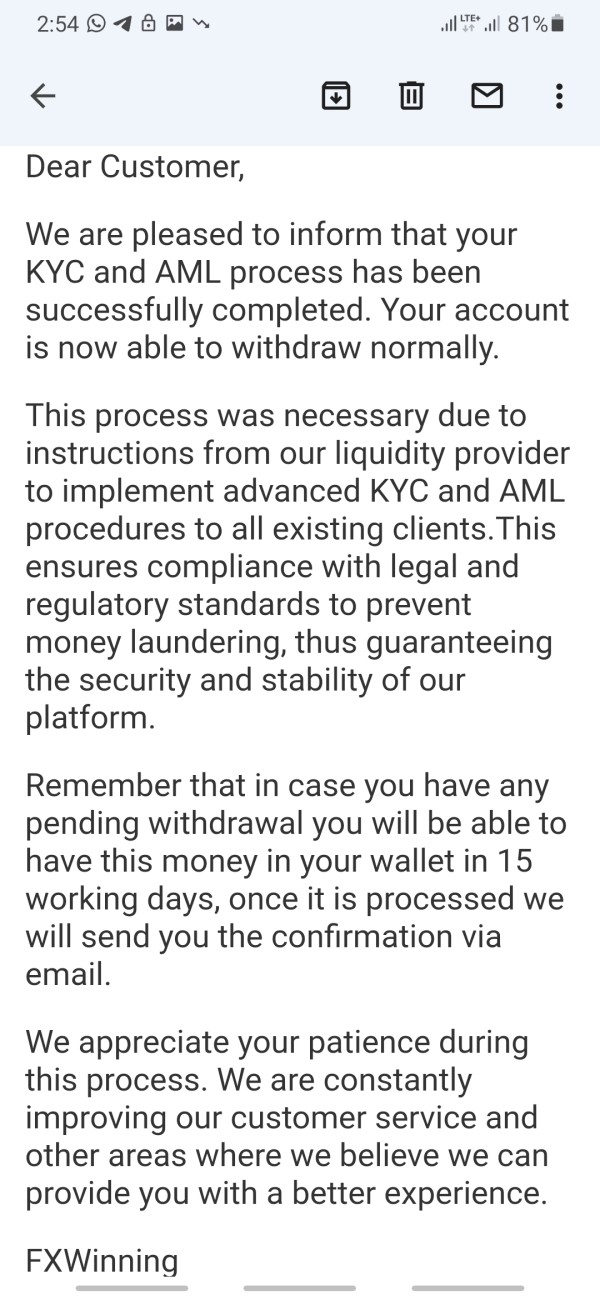

Regional Regulatory Differences: Fxwinning has not clearly disclosed its regulatory status across different areas. This may result in varying legal protections and compliance standards depending on where the user lives. Potential clients should verify the applicable regulatory framework in their specific region before using the platform.

Review Methodology: This evaluation uses publicly available information, user feedback from verified review platforms, legal documentation, and industry reports. Due to limited official disclosure from Fxwinning about their operations, some parts of this review rely on third-party sources and user testimonials.

Rating Framework

Broker Overview

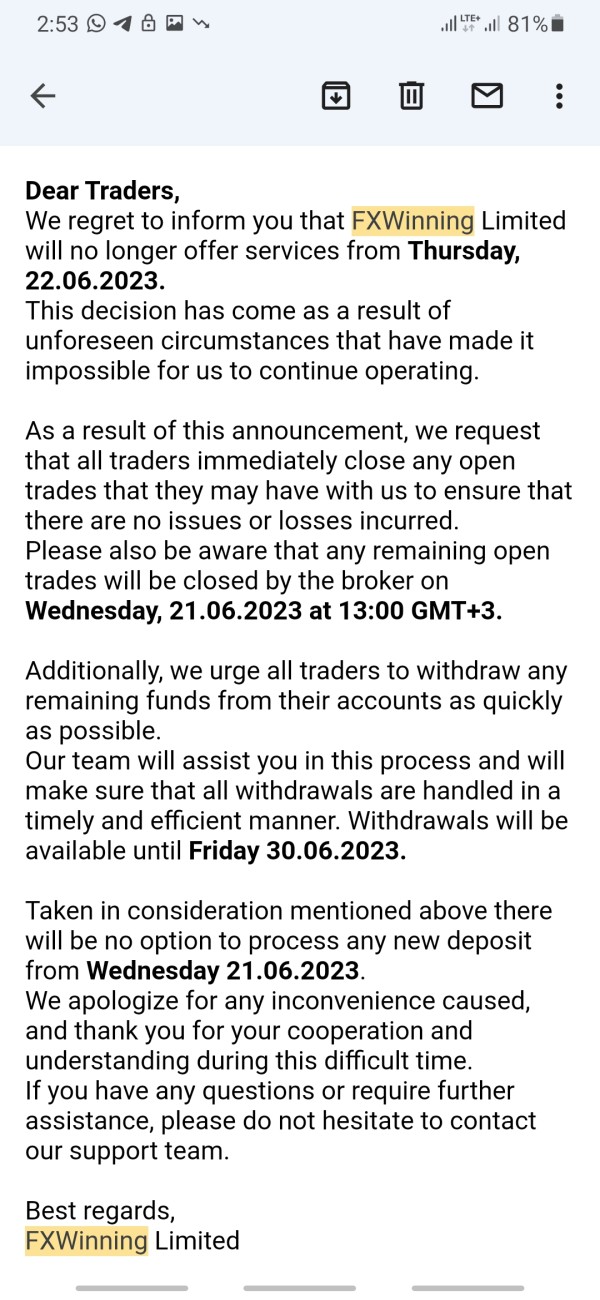

Fxwinning operates as a forex trading platform. However, specific details about when it was established and its founding history remain unclear from available public sources. The company has gained attention mainly through legal proceedings started by Silver Miller Law, which has raised questions about the firm's business practices and how transparent their operations are.

FxWinning, Ltd. has been investigated regarding its marketing practices. This particularly concerns promises of substantial monthly returns. According to legal documentation, the company allegedly promoted investment opportunities promising returns of 8-15% monthly through cryptocurrency exchanges and forex trading activities. These unusually high return promises have attracted regulatory scrutiny and raised concerns among financial industry observers.

The broker's business model appears to focus on forex trading services. It potentially includes other financial derivatives such as CFDs. However, the lack of comprehensive public information about the company's operational structure, regulatory compliance, and specific service offerings makes it challenging to provide a complete assessment of their business approach. The ongoing legal investigations suggest that potential clients should carefully evaluate the risks associated with the platform's promised returns and overall business practices.

Regulatory Status: Available information does not specify clear regulatory oversight from recognized financial authorities. This presents a significant concern for trader protection and fund security.

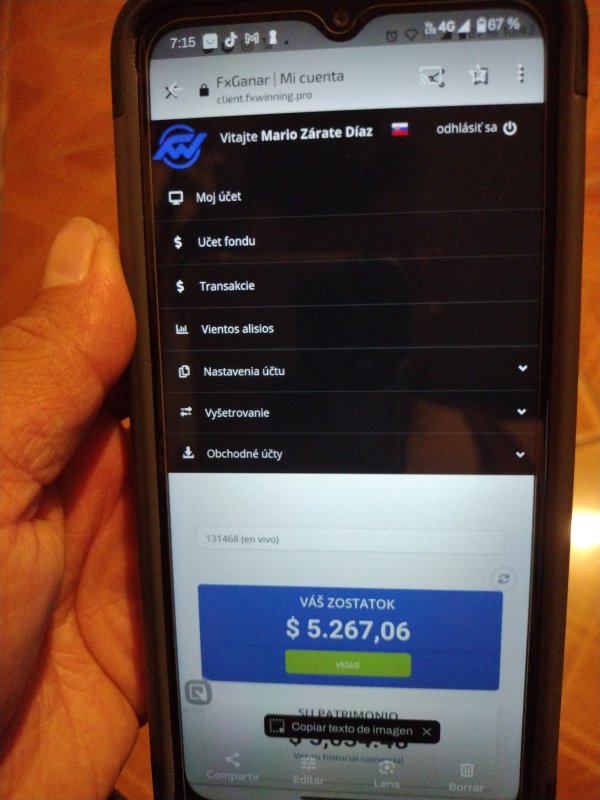

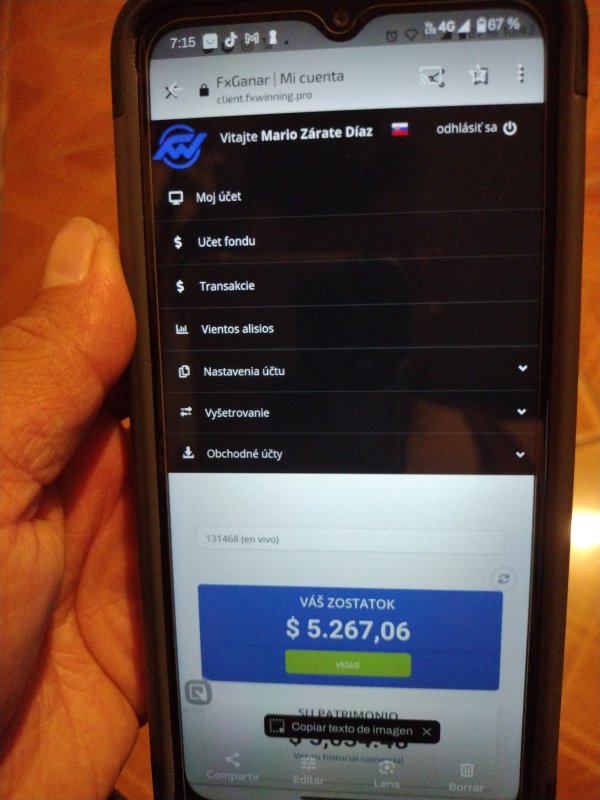

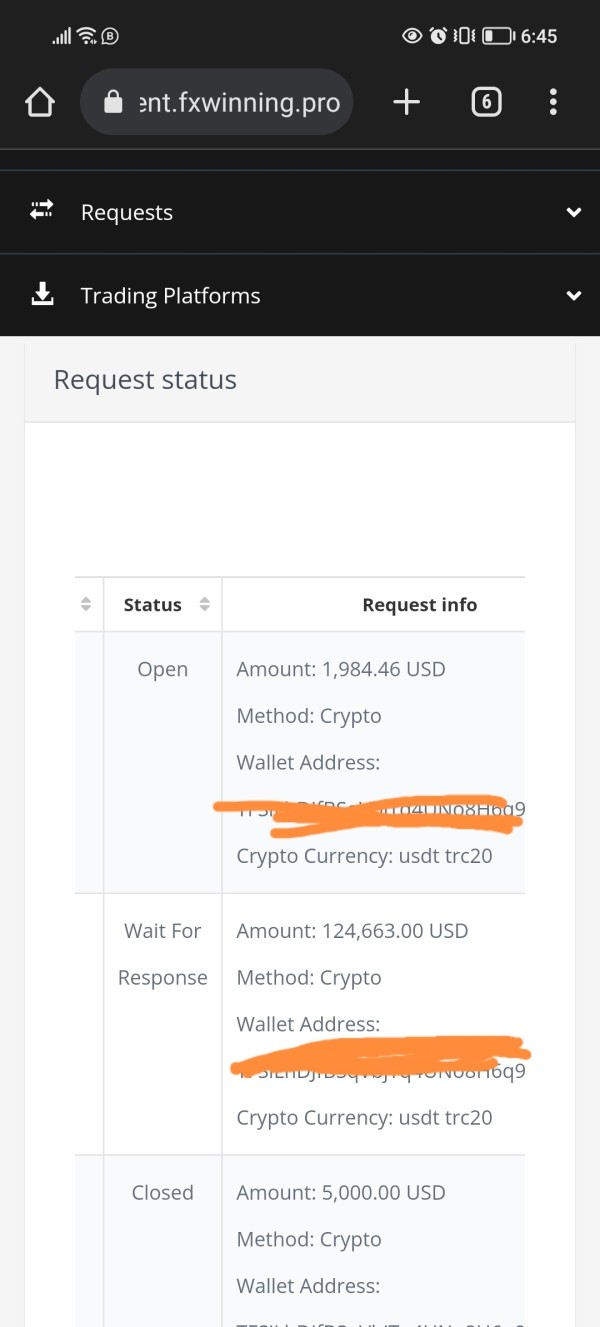

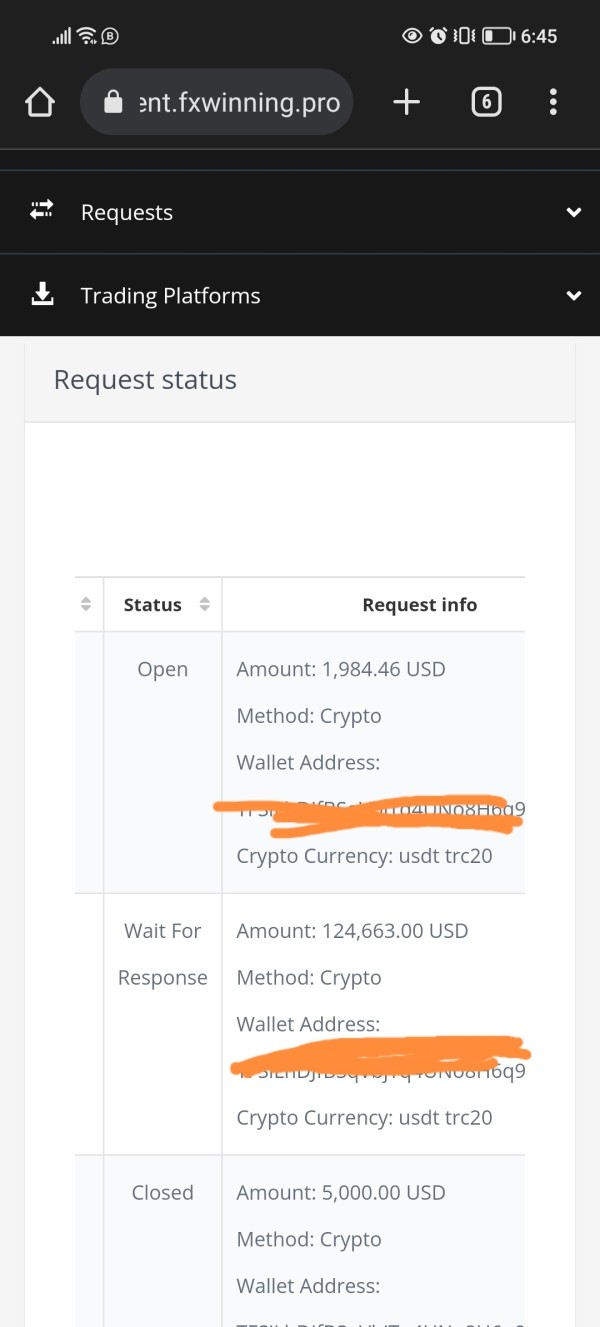

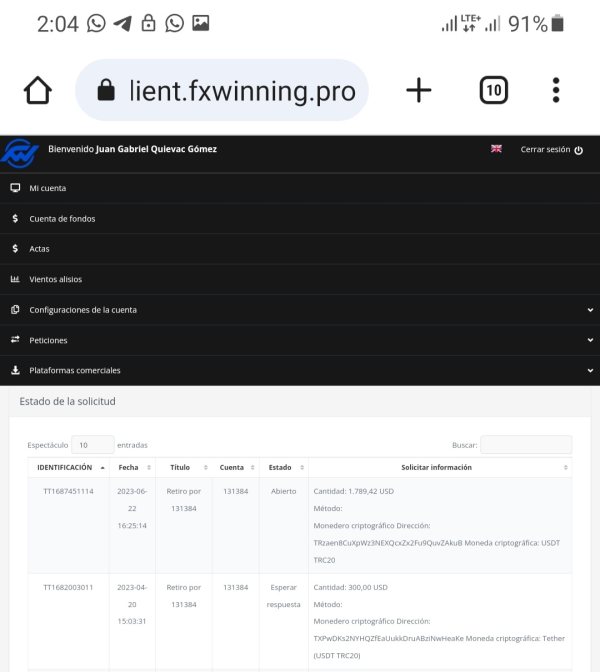

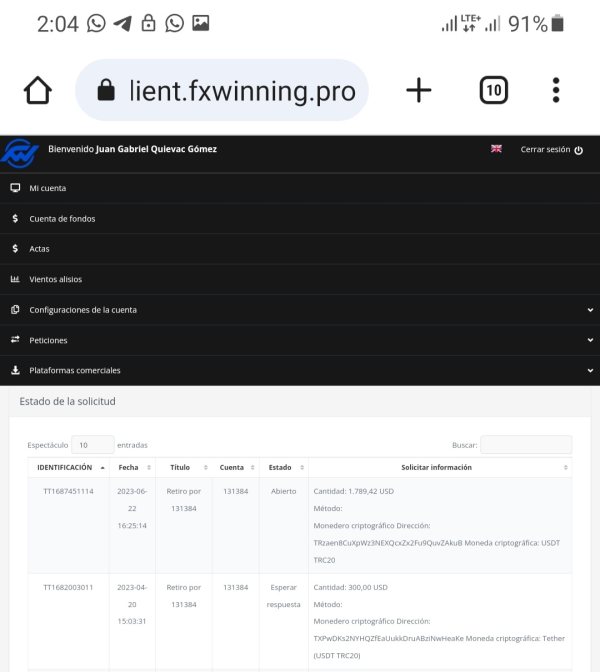

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures has not been disclosed in available public sources.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with Fxwinning is not specified in accessible documentation.

Promotional Offers: While specific bonus structures are not detailed, the legal investigations mention promises of high monthly returns that may constitute promotional activities.

Tradeable Assets: The platform appears to focus on forex trading, with potential inclusion of cryptocurrency-related investments and other financial derivatives. However, the complete asset list remains unclear.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in public sources. This makes it difficult for potential clients to assess the true cost of trading.

Leverage Ratios: Specific leverage offerings have not been disclosed in available materials.

Platform Options: The type of trading platforms offered by Fxwinning has not been clearly specified in accessible sources.

Geographic Restrictions: Information about regional limitations or restricted territories is not available in current documentation.

Customer Support Languages: The range of supported languages for customer service has not been specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

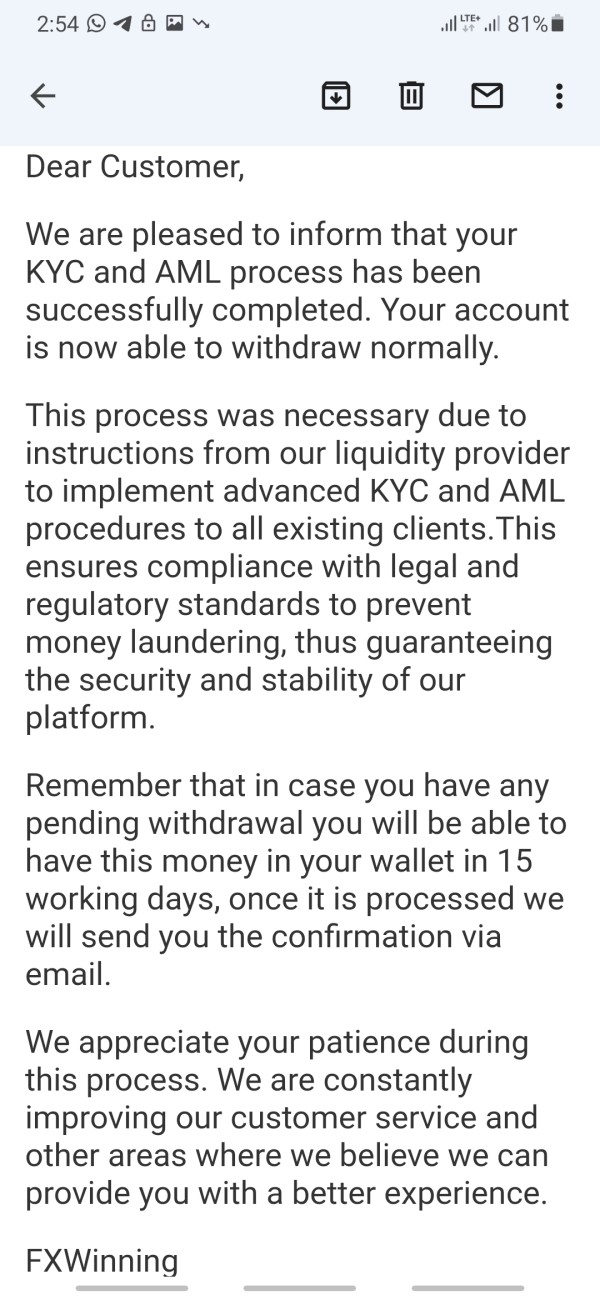

The account conditions evaluation for this Fxwinning review reveals significant information gaps that raise concerns about transparency. Without clear disclosure of account types, minimum balance requirements, or specific terms and conditions, potential traders face uncertainty about what to expect when opening an account with the platform. The absence of detailed account information in publicly available sources suggests either limited operational transparency or restricted access to essential trading information.

Professional forex brokers typically provide comprehensive account specifications. These include various account tiers, minimum deposit requirements, and specific terms of service. The lack of such information from Fxwinning makes it difficult for traders to make informed decisions about account suitability. User feedback regarding account opening processes and account management experiences is limited in available review sources.

This information void prevents a thorough assessment of how the platform handles client onboarding, account verification procedures, and ongoing account maintenance. The legal investigations mentioned in various sources focus more on return promises than operational account management, leaving questions about day-to-day account functionality unanswered.

The evaluation of trading tools and educational resources represents one of the weakest aspects of this Fxwinning review. Available information provides no substantial details about the analytical tools, research resources, or educational materials offered to traders on the platform. Professional forex trading typically requires access to comprehensive market analysis tools, real-time data feeds, technical indicators, and educational resources to support informed trading decisions.

The absence of information about such tools suggests either limited platform capabilities or inadequate disclosure of available resources. This lack of transparency particularly concerns traders who rely on sophisticated analysis tools for their trading strategies. Educational resources play a crucial role in trader development, especially for newcomers to forex markets.

The unavailability of information about educational materials, webinars, market analysis, or trading guides indicates potential limitations in supporting trader development. Without proper educational support, traders may face increased risks and reduced chances of trading success. Automated trading support and algorithmic trading capabilities have not been documented in available sources, which limits the platform's appeal to traders seeking advanced trading automation features.

Customer Service and Support Analysis (4/10)

Customer service evaluation in this Fxwinning review shows mixed results based on limited available feedback. The Trustpilot rating of 3 out of 5 stars suggests moderate satisfaction levels, though specific details about customer service quality remain unclear from available sources. The absence of detailed information about customer support channels, response times, and service availability hours makes it difficult to assess the platform's commitment to client support.

Professional forex brokers typically offer multiple contact methods including live chat, email support, and phone assistance with clearly defined operating hours and response time commitments. User feedback analysis from available sources does not provide sufficient detail about problem resolution effectiveness or customer service representative expertise. The legal investigations surrounding the platform may impact customer service operations, though specific effects on day-to-day support quality cannot be determined from available information.

Multilingual support capabilities have not been documented, which may limit accessibility for international clients. The geographic scope of customer service operations remains unclear, potentially affecting support quality for clients in different time zones.

Trading Experience Analysis (3/10)

The trading experience assessment in this Fxwinning review faces significant limitations due to insufficient data about platform performance, execution quality, and overall trading environment. Without comprehensive user feedback about actual trading conditions, it becomes challenging to evaluate the platform's effectiveness for active trading. Platform stability and execution speed are critical factors for successful forex trading, yet available sources provide no substantial information about these technical aspects.

Professional trading requires reliable platform performance, especially during high-volatility market conditions when execution delays can result in significant losses. Order execution quality, including slippage rates and order fill accuracy, has not been documented in available user feedback or independent testing reports. These factors significantly impact trading profitability and overall user satisfaction, making their absence from available information particularly concerning.

Mobile trading capabilities and cross-device synchronization have not been addressed in available sources. This limits assessment of the platform's accessibility for traders who require flexibility in their trading approach. Modern forex trading increasingly relies on mobile access, making this information gap particularly relevant for potential users.

Trust and Safety Analysis (2/10)

The trust and safety evaluation represents the most concerning aspect of this Fxwinning review, with multiple red flags raising serious questions about the platform's reliability and legitimacy. The ongoing legal investigations by Silver Miller Law into FxWinning, Ltd. and its business practices constitute a significant warning sign for potential investors. Regulatory compliance remains unclear, with no evidence of oversight from recognized financial authorities such as the FCA, ASIC, or CySEC.

This regulatory vacuum leaves traders without the protections typically associated with licensed forex brokers, including segregated client funds, dispute resolution mechanisms, and compensation schemes. The allegations regarding promises of 8-15% monthly returns raise serious concerns about the sustainability and legitimacy of the business model. Such exceptionally high return promises are typically associated with high-risk investment schemes and may indicate practices that are inconsistent with legitimate forex trading operations.

Company transparency issues are evident in the limited availability of operational information, regulatory status, and clear business model documentation. Legitimate forex brokers typically provide comprehensive disclosure about their operations, regulatory compliance, and risk factors associated with their services.

User Experience Analysis (3/10)

User experience evaluation in this Fxwinning review indicates moderate satisfaction levels based on the available Trustpilot rating of 3 out of 5 stars from 845 reviews. However, this rating should be interpreted cautiously given the legal concerns and regulatory uncertainty surrounding the platform. The overall user satisfaction level suggests mixed experiences, with some users apparently finding value in the platform while others may have encountered issues.

However, the specific nature of user complaints or positive feedback is not detailed in available sources, limiting the depth of user experience analysis. Interface design and platform usability have not been comprehensively reviewed in available user feedback, making it difficult to assess the platform's ease of use for both novice and experienced traders. User-friendly design is crucial for effective trading, particularly for newcomers to forex markets.

Registration and account verification processes have not been thoroughly documented in user reviews. However, the legal investigations suggest that the onboarding process may involve promises of high returns that potential users should carefully evaluate.

Conclusion

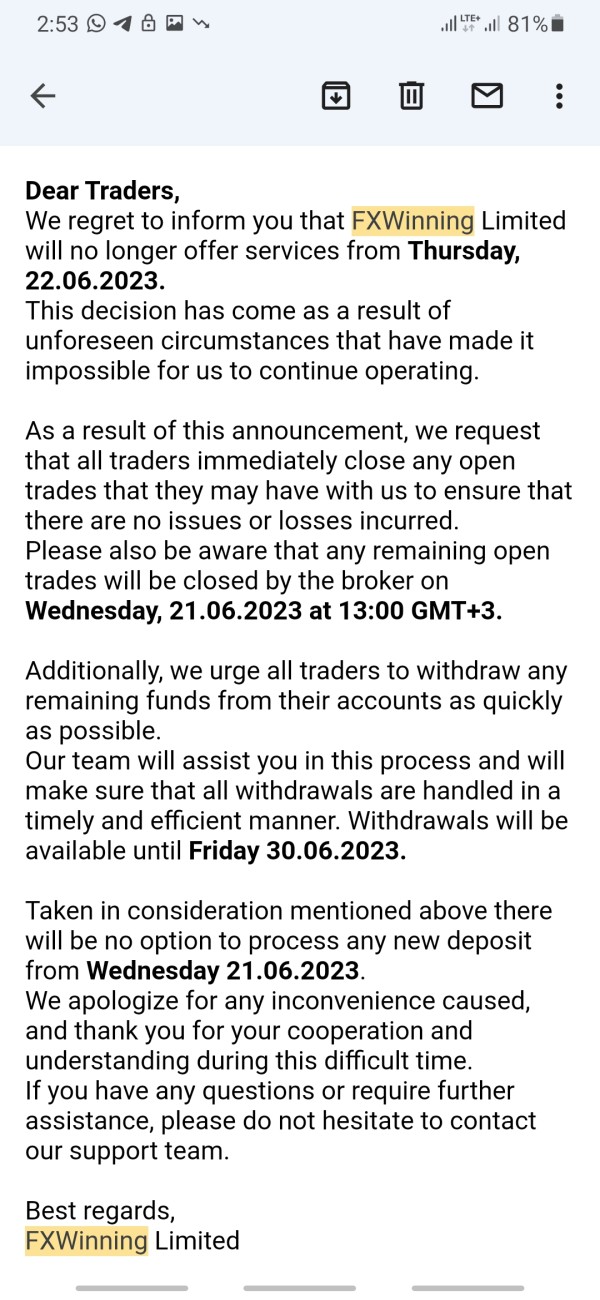

This comprehensive Fxwinning review reveals significant concerns that potential traders must carefully consider before engaging with the platform. The combination of legal investigations, regulatory uncertainty, and limited operational transparency presents substantial risks that outweigh potential benefits for most investors. The broker may appeal to high-risk tolerance investors attracted by promises of exceptional returns, but the legal scrutiny and lack of clear regulatory oversight make it unsuitable for traders seeking secure and compliant trading environments.

The ongoing investigations by Silver Miller Law particularly highlight concerns about the sustainability and legitimacy of the platform's business model. Key Advantages: Limited positive aspects include a moderate user base as evidenced by Trustpilot reviews, though even this should be viewed cautiously given the surrounding controversies.

Major Disadvantages: Significant concerns include ongoing legal investigations, unclear regulatory status, lack of operational transparency, and promises of unsustainable returns that raise red flags about the platform's legitimacy and long-term viability.