Fastwin 2025 Review: Everything You Need to Know

Executive Summary

This fastwin review gives you a complete look at Fastwin. Fastwin is a trading platform that has become a moderate trust broker in the forex and financial markets sector. The platform lets users buy and sell various financial assets in what the company calls a fast, efficient, and secure way, based on information from multiple sources.

Fastwin stands out with its maximum leverage of up to 1:500. The platform also offers full mobile trading support through apps for both Android and iOS devices. Fastwin calls itself a modern trading solution that uses user-friendly designs and new features to meet today's traders and investors needs.

The broker mainly targets retail traders who want high leverage opportunities and diverse trading options across multiple asset classes. WikiBit gives Fastwin a user trust score of 55, which puts it in the medium trust category among brokers. The platform has VFSC regulation and is registered to offer trading services across various financial instruments including forex and CFDs.

Fastwin shows competitive spreads starting from 0 and offers substantial leverage options. This review will examine whether the platform delivers on its promises of efficiency and security for modern traders.

Important Notice

Fastwin may operate under different regulatory frameworks across various jurisdictions. Traders should know that regulatory requirements and available services may differ depending on their location. The company's primary registration appears to be in Saint Vincent and the Grenadines, with VFSC oversight, though specific regulatory details may vary by region.

This evaluation is based on publicly available information, user feedback, and industry reports available as of 2024-2025. The assessment uses multiple data sources including regulatory databases, user review platforms, and technical analysis of the broker's offerings. Traders should do their own research and consider their individual circumstances before making trading decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Fastwin emerged in the online trading landscape as a platform designed to streamline the trading experience for retail investors. The broker calls itself a cutting-edge trading platform that lets users buy and sell various financial assets through what it describes as fast, efficient, and secure trading mechanisms, according to available company information. The platform has developed its infrastructure to use user-friendly designs and new features, ensuring it meets the evolving needs of modern traders and investors.

The company operates under the business model of providing forex and Contract for Difference (CFD) trading services to retail clients. Fastwin has registered its operations in Saint Vincent and the Grenadines, operating under VFSC regulatory oversight. This regulatory framework allows the broker to offer its services to international clients while maintaining compliance with applicable financial regulations.

Platform and Service Offerings

Fastwin's trading infrastructure centers around its mobile-first approach. The broker offers dedicated applications for both Android and iOS devices. This mobile accessibility shows the broker's commitment to meeting the demands of contemporary traders who require flexible, on-the-go trading capabilities.

The platform supports trading across multiple asset classes, including foreign exchange pairs and various CFD instruments. Fastwin's service portfolio includes a diverse game selection and trading options, positioning itself to serve traders with varying experience levels and trading preferences. The company's technology infrastructure adapts to use user-friendly designs and new features, ensuring the platform remains current with industry standards and trader expectations. Fastwin emphasizes its commitment to providing seamless access to multiple trading services through its unified platform interface.

Regulatory Jurisdiction and Oversight

Fastwin operates under the regulatory supervision of the VFSC (Vanuatu Financial Services Commission). The broker has its primary registration in Saint Vincent and the Grenadines. This regulatory framework provides basic oversight for the broker's operations, though traders should note that offshore regulation may offer different levels of client protection compared to major financial centers.

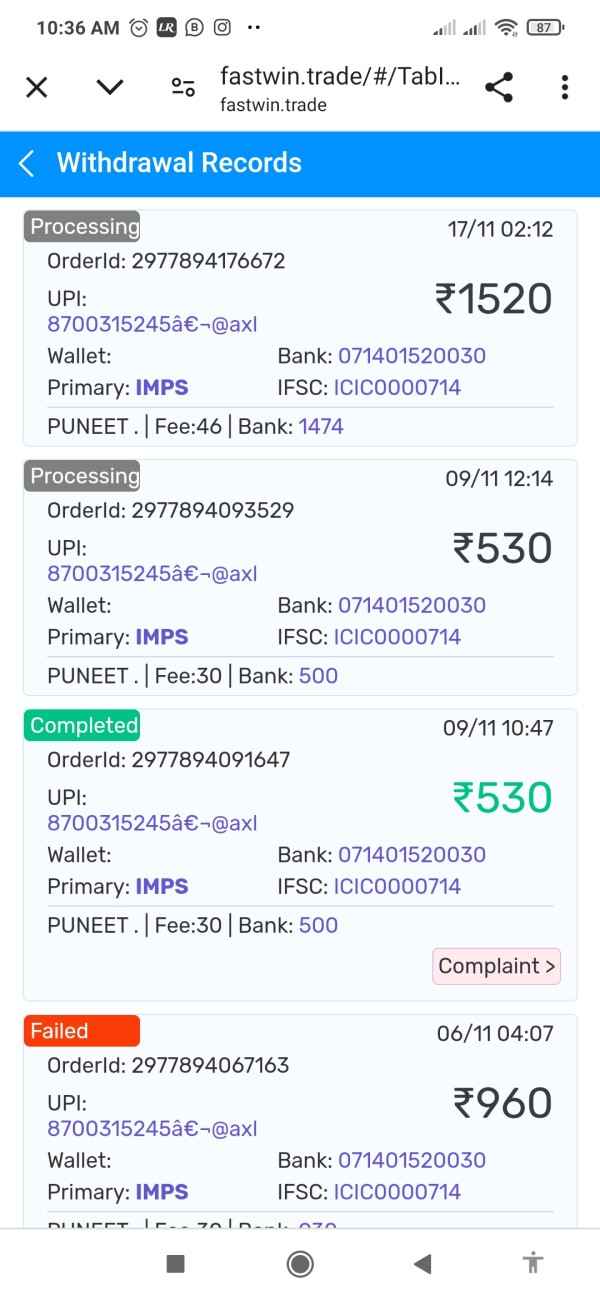

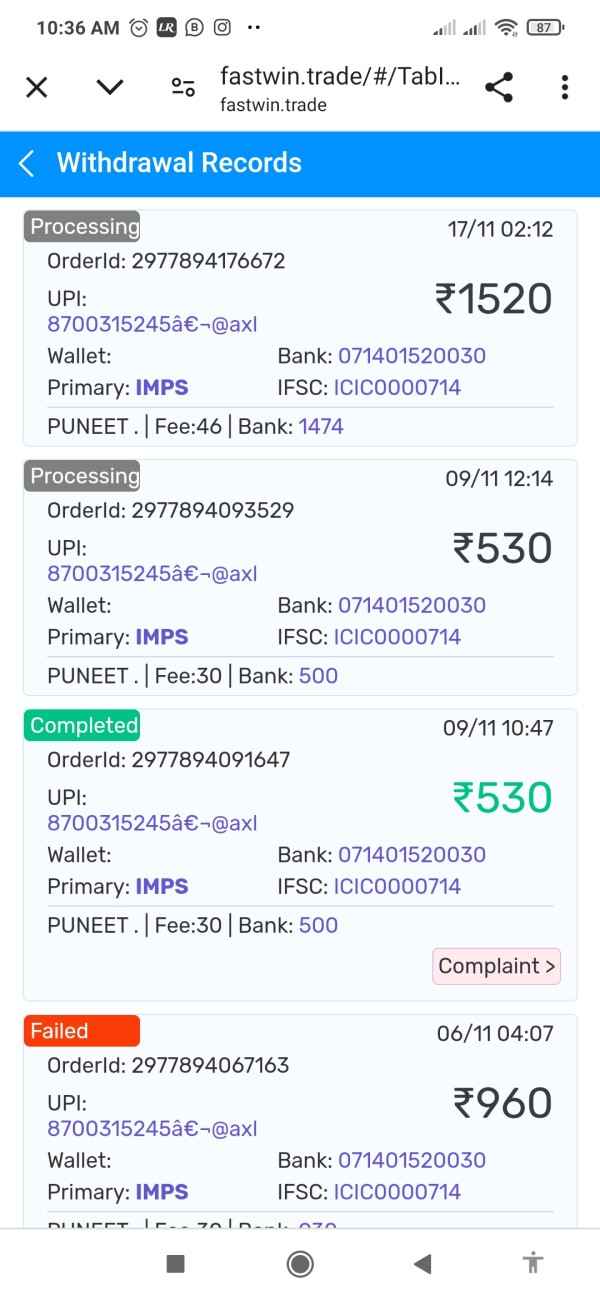

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods was not detailed in available source materials. Traders interested in Fastwin's banking options should contact the broker directly for complete information about supported payment methods, processing times, and any associated fees.

Minimum Deposit Requirements

The minimum deposit requirement for opening trading accounts with Fastwin was not specified in available documentation. Prospective clients should verify current minimum deposit amounts directly with the broker.

Promotional Offers and Bonuses

Details about specific bonus promotions or incentive programs were not outlined in the source materials reviewed. Traders should ask Fastwin directly about any current promotional offerings.

Available Trading Assets

Fastwin provides access to multiple financial asset classes, including foreign exchange (forex) pairs and Contracts for Difference (CFDs). The platform emphasizes its diverse selection of trading instruments, though specific details about the number of available currency pairs, indices, commodities, or other CFD instruments were not fully detailed in available materials.

Cost Structure and Fees

The broker advertises competitive spreads starting from 0. This suggests a potentially low-cost trading environment for clients. However, complete information about commission structures, overnight financing charges, and other potential trading costs was not detailed in the available source materials.

Leverage Ratios

Fastwin offers maximum leverage of up to 1:500. This represents a significant leverage option for retail traders. This high leverage ratio may appeal to traders seeking to maximize their position sizes, though it also increases potential risk exposure.

Platform Selection and Technology

The broker supports mobile trading through dedicated applications available for Android and iOS devices. However, specific information about desktop trading platforms, web-based trading interfaces, or third-party platform integration was not detailed in available materials.

Geographic Restrictions

Specific information about geographic restrictions or country limitations was not provided in the source materials reviewed for this fastwin review.

Customer Support Languages

Details about supported customer service languages were not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Fastwin's account conditions present a mixed picture based on available information. The broker offers maximum leverage of up to 1:500, which represents one of the more generous leverage ratios available in the retail trading market. This high leverage option can be particularly attractive to traders seeking to maximize their position sizes with limited capital, though it correspondingly increases risk exposure.

The platform advertises spreads starting from 0. This suggests competitive pricing for at least some trading instruments. However, the lack of detailed information about specific account types, their individual characteristics, and associated features limits a complete assessment of the broker's account offerings.

The absence of clear information about minimum deposit requirements makes it difficult for potential clients to understand the accessibility threshold for different account tiers. Account opening procedures and verification processes were not detailed in available materials, leaving questions about the efficiency and requirements of the client onboarding experience. Additionally, information about specialized account features such as Islamic accounts for Muslim traders, professional accounts for qualified investors, or other account variations was not available for review.

The overall account conditions receive a moderate rating due to the attractive leverage and spread offerings. However, the lack of complete information about account structures, minimum deposits, and specific features prevents a higher assessment in this fastwin review.

The availability of trading tools and educational resources represents an area where Fastwin's offerings are not fully documented in available materials. The broker provides mobile applications for both Android and iOS platforms, indicating some level of technological infrastructure, but detailed information about specific trading tools, analytical resources, and educational materials was not extensively available for review.

The platform's emphasis on user-friendly design and new features suggests some attention to tool development. Without specific details about charting capabilities, technical analysis tools, economic calendars, or market research resources, it's challenging to assess the depth and quality of the broker's analytical offerings. Modern traders typically expect complete charting packages, real-time market data, and analytical tools to support their trading decisions.

Educational resources, which are crucial for developing trader skills and market understanding, were not detailed in the available source materials. The absence of information about webinars, tutorials, market analysis, or educational content libraries limits the assessment of Fastwin's commitment to client education and development.

Automated trading support, including Expert Advisor compatibility or algorithmic trading features, was not mentioned in available documentation. This represents a potential limitation for traders interested in systematic trading approaches or automated strategies.

Customer Service and Support Analysis (Score: 5/10)

Customer service capabilities represent a critical component of any trading platform. Specific information about Fastwin's support infrastructure was not fully detailed in available materials. The absence of clear information about customer service channels, including whether the broker offers phone support, live chat, email assistance, or other contact methods, makes it difficult to assess the accessibility and convenience of client support.

Response time commitments, which are crucial for traders who may need urgent assistance during market hours, were not specified in available documentation. The quality of customer service, including the expertise level of support staff and their ability to resolve trading-related issues efficiently, could not be evaluated based on available information.

Multi-language support capabilities, which are important for international brokers serving diverse client bases, were not detailed in the source materials reviewed. Given Fastwin's international positioning, the availability of support in multiple languages would be expected, but confirmation of specific language offerings was not available.

Customer service operating hours, including whether support is available during major trading sessions or offers 24/7 assistance, were not specified in available materials. This information gap limits traders' ability to assess whether support availability aligns with their trading schedules and time zones.

Trading Experience Analysis (Score: 6/10)

Fastwin's trading experience centers around its mobile-first approach. The broker confirms availability of applications for both Android and iOS devices. This mobile accessibility represents a positive aspect of the platform's offering, recognizing the importance of flexible trading access in today's market environment.

The emphasis on user-friendly design and new features suggests some attention to user experience optimization. However, complete information about platform stability, execution speed, and overall trading performance was not available in the source materials reviewed. These technical aspects are crucial for evaluating the quality of the trading experience, as they directly impact traders' ability to execute strategies effectively and manage positions efficiently.

Order execution quality, including information about slippage rates, requote frequency, and fill rates, was not detailed in available documentation. These execution metrics are fundamental to assessing whether a broker can deliver the trading environment necessary for successful trading outcomes.

Platform functionality completeness, including the availability of advanced order types, risk management tools, and trading features, could not be fully evaluated based on available information. While mobile app availability is confirmed, the depth and sophistication of trading features within these applications remain unclear. The trading environment's characteristics, including spread stability during volatile market conditions and liquidity provision, were not detailed in available materials, limiting the assessment of the overall trading experience quality in this fastwin review.

Trust and Reliability Analysis (Score: 5/10)

Fastwin's trust and reliability assessment reveals a moderate trust profile based on available information. The broker operates under VFSC regulation from Saint Vincent and the Grenadines, which provides basic regulatory oversight but may not offer the same level of client protection as regulation from major financial centers like the UK's FCA, Australia's ASIC, or Cyprus' CySEC.

WikiBit's user trust score of 55 places Fastwin in the medium trust category. This indicates that while the broker maintains basic operational standards, there may be areas for improvement in building stronger client confidence. This moderate trust rating suggests that while the broker is operational and serving clients, it has not yet achieved the higher trust levels associated with more established or extensively regulated brokers.

Information about specific fund safety measures, such as segregated client account policies, deposit insurance coverage, or investor compensation schemes, was not detailed in available source materials. These safety mechanisms are crucial for client protection and represent important factors in assessing broker reliability.

Company transparency about ownership, financial statements, and operational details was not fully available for review. Greater transparency in these areas typically contributes to higher trust ratings and client confidence. The handling of any negative events, regulatory actions, or client disputes was not documented in available materials, making it difficult to assess the broker's track record in managing challenging situations or regulatory compliance issues.

User Experience Analysis (Score: 5/10)

The overall user experience assessment for Fastwin is limited by the lack of complete user feedback and detailed platform information in available materials. The broker targets retail traders seeking high leverage and diversified trading options, but specific user satisfaction metrics and detailed experience reports were not extensively available for review.

Interface design and usability information, crucial factors in determining user experience quality, were not detailed beyond general mentions of user-friendly design principles. Modern traders expect intuitive interfaces, efficient navigation, and responsive design across devices, but specific assessments of these characteristics were not available.

The registration and account verification process efficiency, which significantly impacts initial user experience, was not detailed in available source materials. Streamlined onboarding processes are increasingly important for broker competitiveness, but Fastwin's specific procedures and timeframes could not be evaluated.

Fund operation experiences, including deposit and withdrawal convenience, processing speeds, and associated costs, were not documented in available materials. These operational aspects significantly impact ongoing user satisfaction and platform usability. Common user complaints or frequently reported issues were not identified in the source materials reviewed, limiting the ability to assess potential pain points or areas where user experience might fall short of expectations.

Similarly, positive user feedback highlighting platform strengths was not extensively available for inclusion in this analysis.

Conclusion

This complete fastwin review reveals a trading platform that occupies a moderate position in the broker landscape. Fastwin offers certain attractive features while facing limitations in information transparency and documented user experience. The platform presents itself as a cutting-edge trading solution with competitive offerings including maximum leverage of 1:500 and spreads starting from 0, supported by mobile applications for both Android and iOS devices.

The broker appears most suitable for retail traders seeking high leverage opportunities and multi-asset trading capabilities, particularly those who prioritize mobile trading accessibility. However, the limited availability of detailed information about account structures, complete trading tools, and customer service infrastructure suggests that traders should conduct thorough research before committing to the platform.

The main advantages identified include competitive spread offerings and substantial leverage options. The primary limitations center around insufficient detailed information about account conditions, customer service capabilities, and complete platform features. Prospective clients should consider these factors carefully and may benefit from direct contact with the broker to obtain more detailed information about services and conditions.