EternalWealth 2025 Review: Everything You Need to Know

Executive Summary

This eternalwealth review gives you a complete look at a broker that has gotten a lot of bad attention from traders. EternalWealth Group says it works under many names like eternalwealthfx, but people have made lots of complaints about not being able to take out their money and other shady business moves. WikiBit monitoring data shows the broker has gotten 14 bad reviews that point out serious problems with how it works.

The broker says it offers forex and CFD trading services but doesn't have real oversight from regulators and no real business location you can check. People who used it keep talking about withdrawal problems, and many traders say they can't get their money back after putting it in. Many review websites have marked EternalWealth as possibly fake, with Trustpilot reviews and other places sharing stories from people who got scammed.

Our research shows that EternalWealth works without proper permission from regulators, which makes it bad for traders who want safe and reliable trading. All the proof we found suggests this broker is very risky for your money and both new and experienced traders should stay away.

Important Notice

This review uses feedback from users and many review sources that we collected by the end of 2024. Our way of checking things includes what users said, searching regulatory databases, and reports from third-party monitors. You should know that we can't verify the regulatory information for this broker, and no real licensing has been confirmed through normal regulatory channels.

The analysis here shows information that anyone can find and what users went through. Since the accusations against EternalWealth are very serious, people thinking about using them should do more research and think about regulated alternatives before putting any money in.

Rating Framework

Broker Overview

EternalWealth Group says it's an online forex and CFD trading provider, but when it started and how its business is set up isn't clear from what we can find. Victim reviews collected by DNB Forex Price Action show the broker claims to work under two different names and websites: eternalwealthfx and other platforms. But research has shown no real business presence or company registration you can verify for these companies.

The broker's business plan seems to focus on getting retail traders through online marketing and offering access to foreign exchange and contract for difference trading. But the lack of clear company information and regulatory oversight makes us seriously question if their operations are real.

WikiBit's monitoring system shows that EternalWealth has built up a lot of bad exposure, with 14 documented cases showing various problems with operations. The broker's online presence includes multiple websites, but whether these platforms are real and working is questionable. Reports say the company claims its trading services include forex pairs and CFD instruments, but specific details about trading conditions, spreads, and how well execution works aren't reliably documented.

This eternalwealth review finds that the broker's operational transparency is way below industry standards, with important information about licensing, company structure, and regulatory compliance notably missing from verified sources.

Regulatory Status: Information we can find shows no verified permission from recognized financial authorities. Normal regulatory database searches haven't found any real licensing information for EternalWealth or its claimed operating companies.

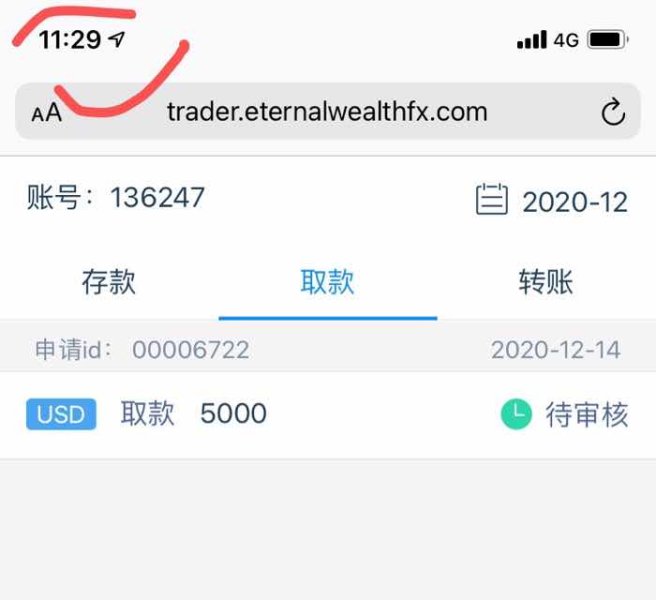

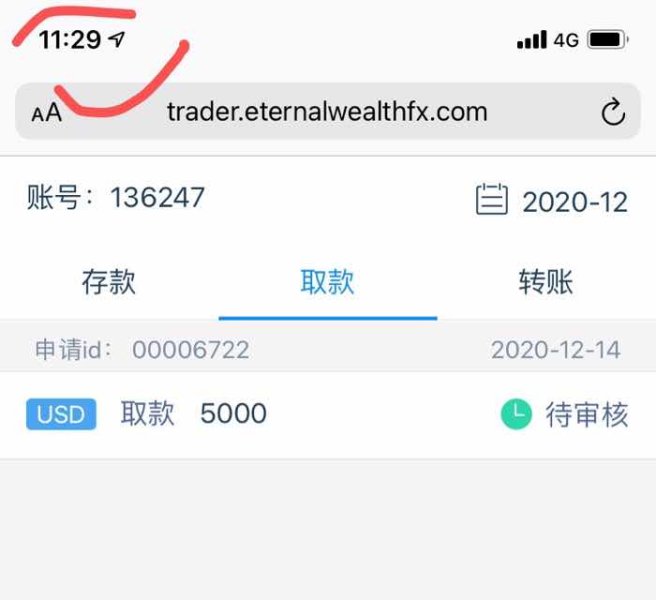

Deposit and Withdrawal Methods: Specific payment processing methods aren't clearly documented in sources we can find. But user complaints consistently point out big difficulties with withdrawal processes, which suggests possible problems with fund management systems.

Minimum Deposit Requirements: Exact minimum deposit amounts aren't specified in available documentation, but user reports suggest the broker accepts various deposit sizes to attract different trader segments.

Promotional Offers: No verified information about bonuses or promotional campaigns is available in current sources, but such offers may be used as marketing tools without proper regulatory disclosure.

Tradeable Assets: According to information we can find, the platform claims to offer forex currency pairs and CFD trading opportunities, but the specific range and quality of available instruments remain unverified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs isn't reliably documented. The absence of transparent pricing information raises concerns about potential hidden fees and unfavorable trading conditions.

Leverage Ratios: Specific leverage offerings aren't detailed in available sources, which is concerning given how important this information is for risk management and regulatory compliance.

Trading Platform Options: The technical specifications and features of the trading platform(s) offered by EternalWealth aren't comprehensively documented in verified sources.

Geographic Restrictions: Information about regional limitations or prohibited jurisdictions isn't clearly available, which may indicate non-compliance with international trading regulations.

Customer Support Languages: Available customer service language options aren't specified in current documentation.

This eternalwealth review reveals significant information gaps that would typically be readily available for legitimate, regulated brokers.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions offered by EternalWealth represent one of the most concerning aspects of this broker's operations. Information we can find provides no clear documentation of account types, minimum deposit requirements, or specific terms and conditions governing client accounts. This lack of transparency is particularly troubling given that legitimate brokers typically provide detailed account specifications as part of their regulatory compliance obligations.

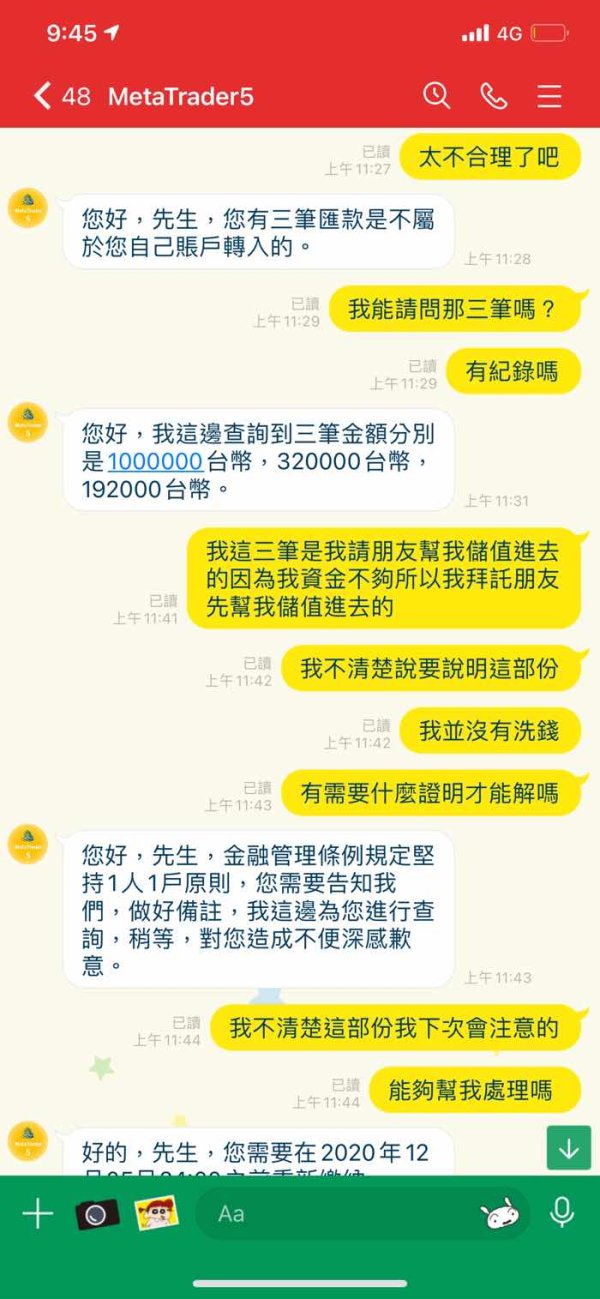

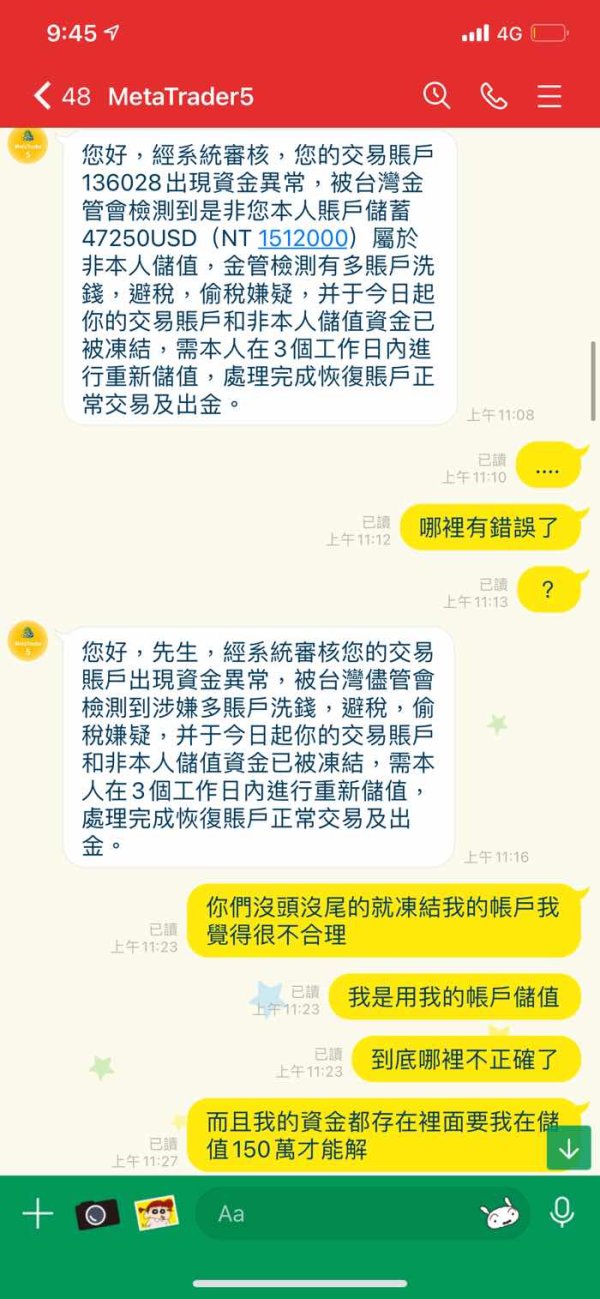

User feedback consistently shows that while account opening may initially appear straightforward, the real problems emerge when clients attempt to access their funds or modify account settings. Reports suggest that the broker may not maintain proper segregated client accounts, which is a fundamental requirement for legitimate financial service providers.

The absence of verified information about Islamic accounts, professional trading accounts, or other specialized account types further indicates the broker's failure to meet industry standards. Also, no information is available regarding account protection measures, insurance coverage, or client fund segregation policies.

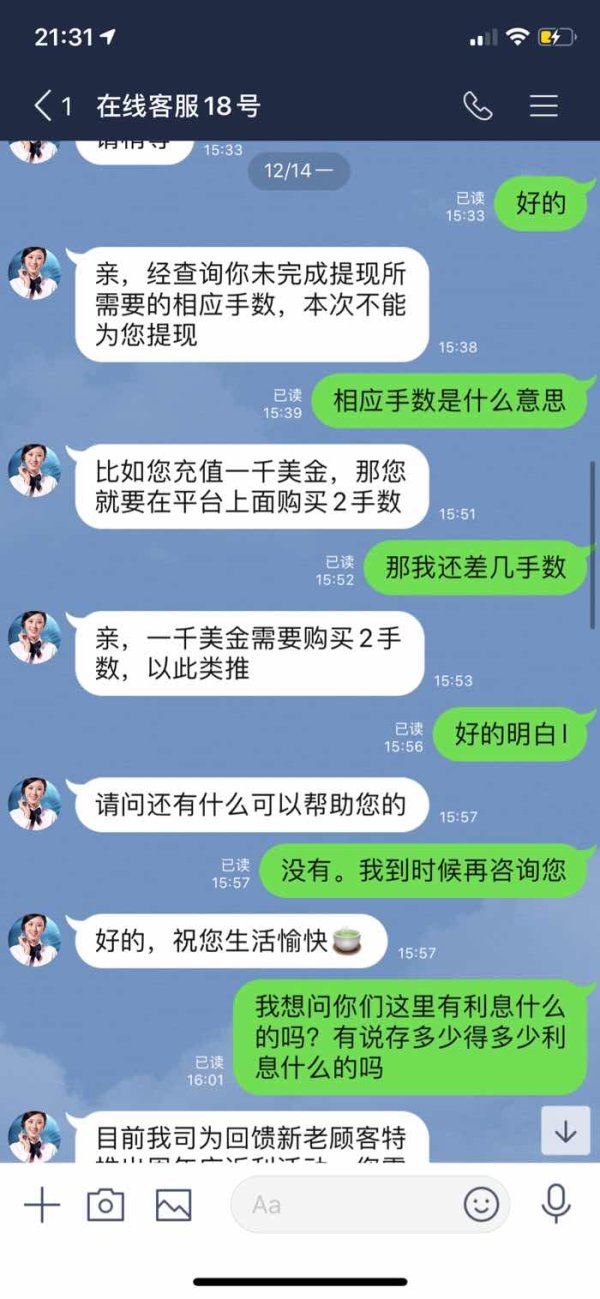

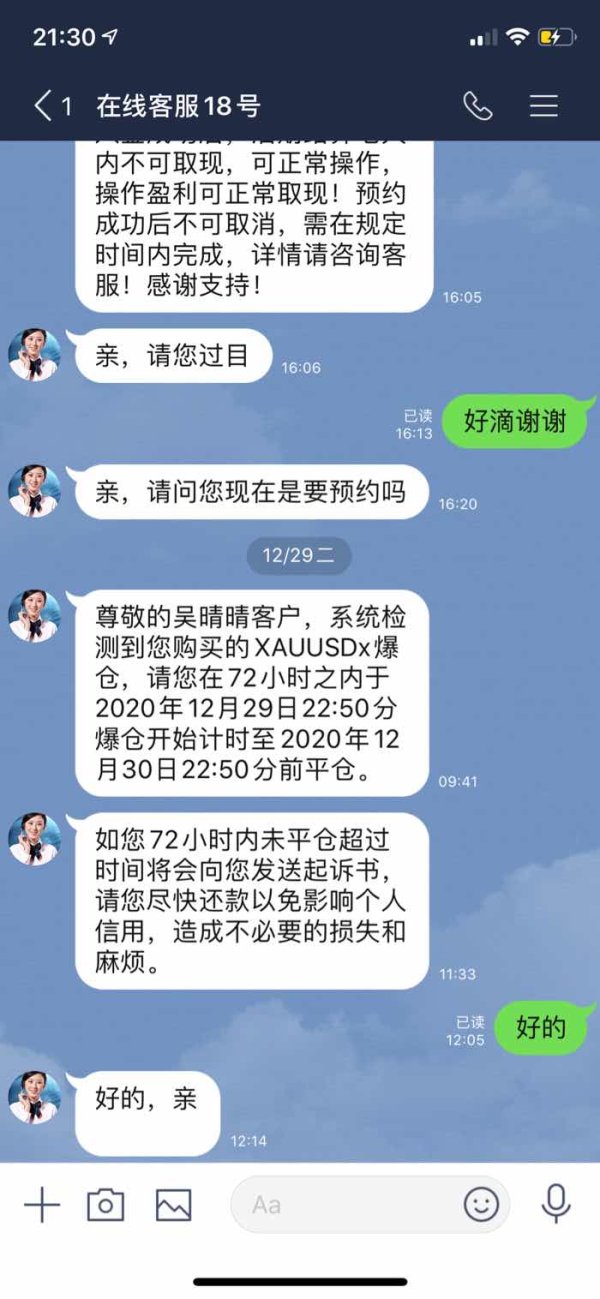

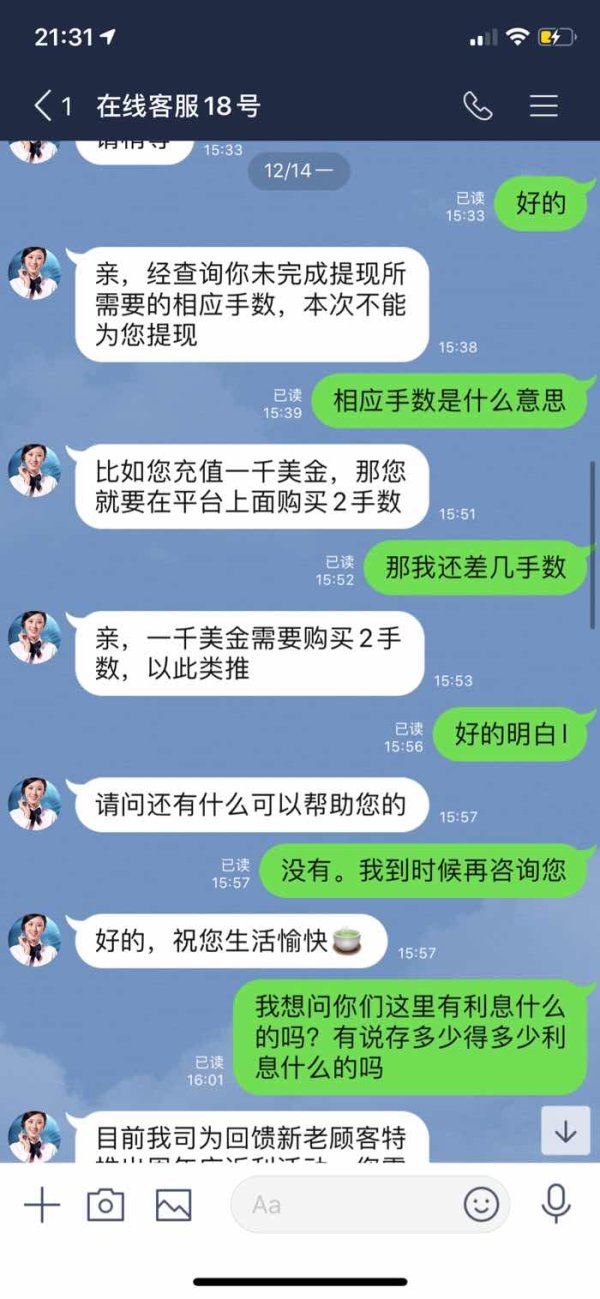

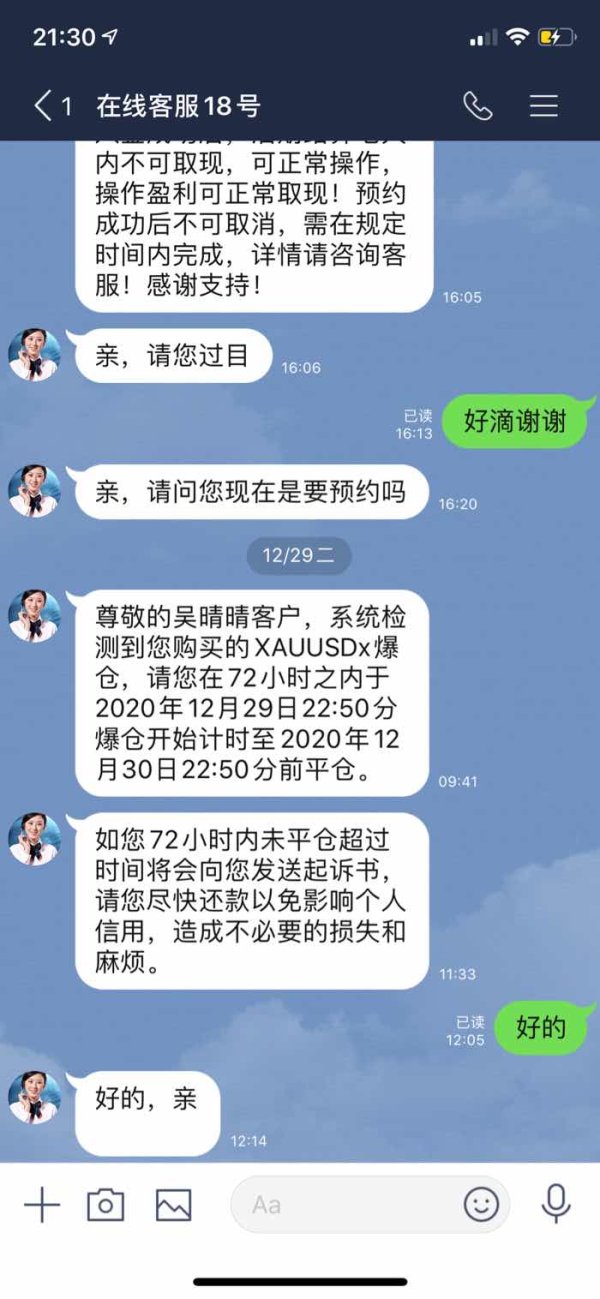

According to victim testimonials compiled in various review sources, many traders discovered that their account terms changed unexpectedly, or that withdrawal conditions were significantly different from what was initially presented. This eternalwealth review finds that the broker's account conditions fail to meet basic transparency and reliability standards expected in the financial services industry.

The trading tools and educational resources allegedly provided by EternalWealth lack proper documentation and verification. Unlike established brokers who typically offer comprehensive suites of analytical tools, charting software, and educational materials, EternalWealth's offerings in this area remain largely unsubstantiated.

Sources we can find don't provide evidence of professional-grade trading tools such as advanced charting packages, technical analysis indicators, economic calendars, or market research reports. The absence of detailed information about platform capabilities suggests either inadequate tool provision or deliberate concealment of platform limitations.

Educational resources, which are crucial for trader development and regulatory compliance in many jurisdictions, appear to be minimal or non-existent. Legitimate brokers typically provide extensive educational libraries, webinars, trading guides, and market analysis to support client success and meet regulatory requirements.

User feedback shows that any tools provided may be unreliable or of poor quality, with some reports suggesting that analytical features may not function as advertised. The lack of third-party integrations with established trading tools and research providers further diminishes the broker's credibility in this area.

Automated trading support, algorithmic trading capabilities, and API access - features commonly offered by reputable brokers - are not documented or verified for EternalWealth's platforms.

Customer Service and Support Analysis (2/10)

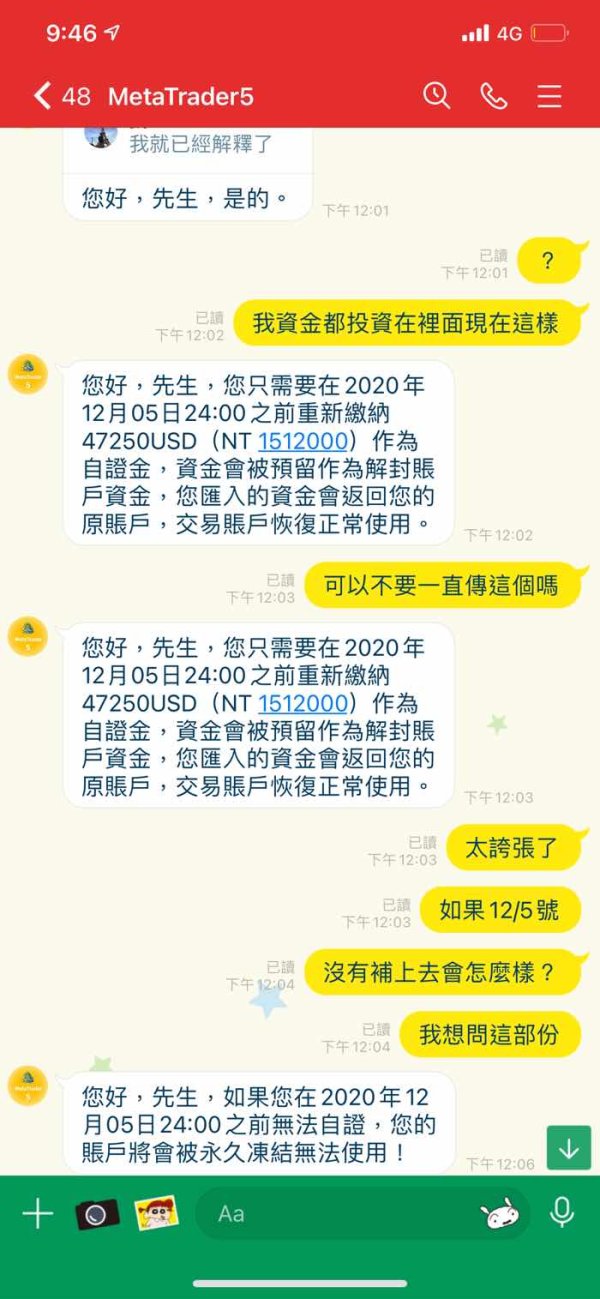

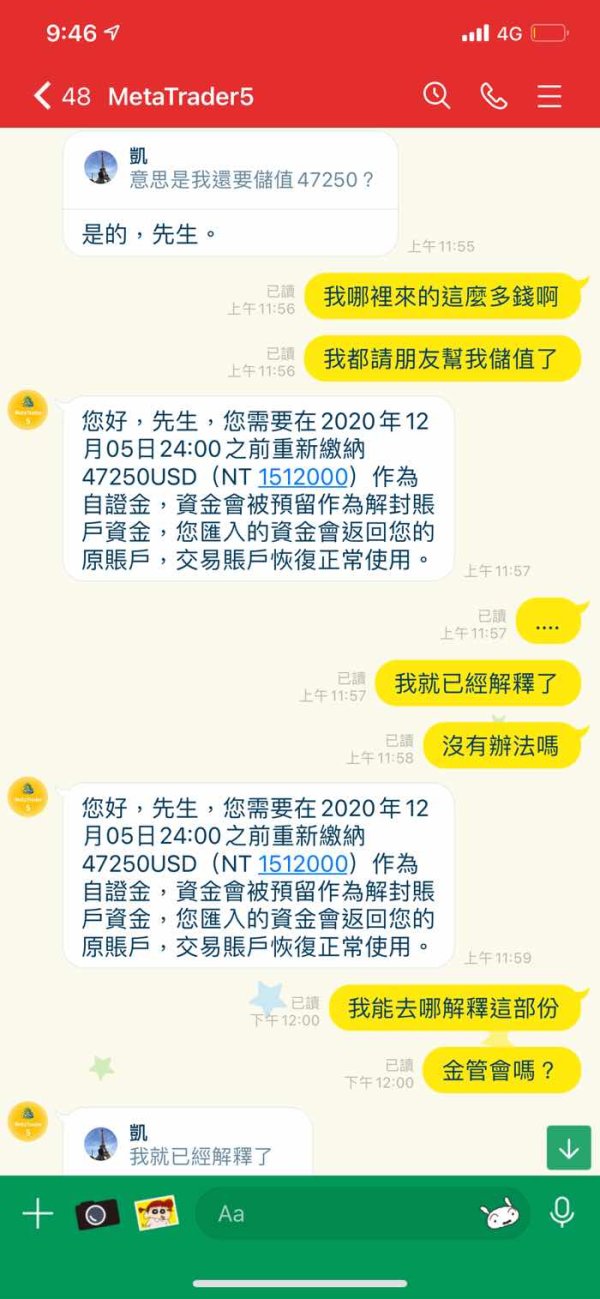

Customer service quality represents another significant weakness in EternalWealth's operations, based on available user testimonials and complaint documentation. Multiple sources show that client support is inadequate, with poor response times and limited problem resolution capabilities.

User reports consistently describe frustrating experiences when attempting to contact customer support, particularly regarding withdrawal issues and account problems. The limited availability of support channels and apparent lack of multilingual support further compound these service deficiencies.

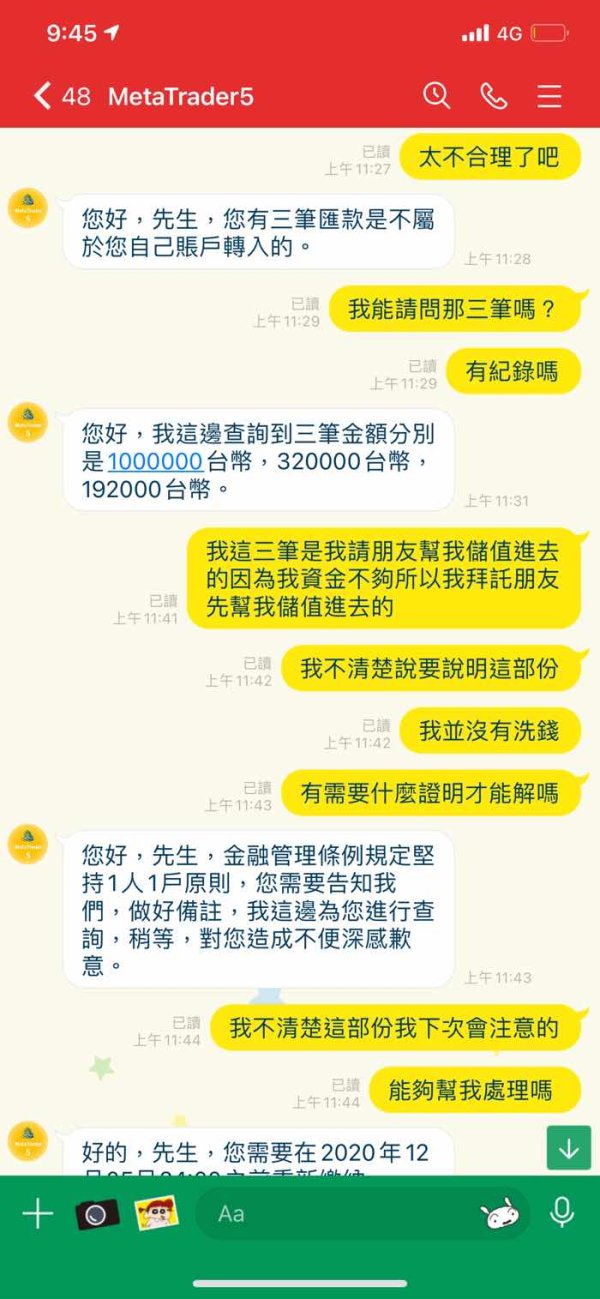

Response time analysis from user feedback suggests that when support is available, representatives often provide generic responses that fail to address specific client concerns. More concerning are reports showing that support communication may cease entirely when clients raise serious questions about fund access or account irregularities.

The absence of verified contact information, physical office locations, or regulatory complaint procedures shows that EternalWealth may not maintain proper customer service infrastructure. This lack of accessible, reliable support represents a significant risk factor for potential clients.

Documentation suggests that support staff may lack proper training or authority to resolve account issues, leading to prolonged resolution times and client frustration. The overall customer service experience appears to fall well below industry standards for professional financial service providers.

Trading Experience Analysis (1/10)

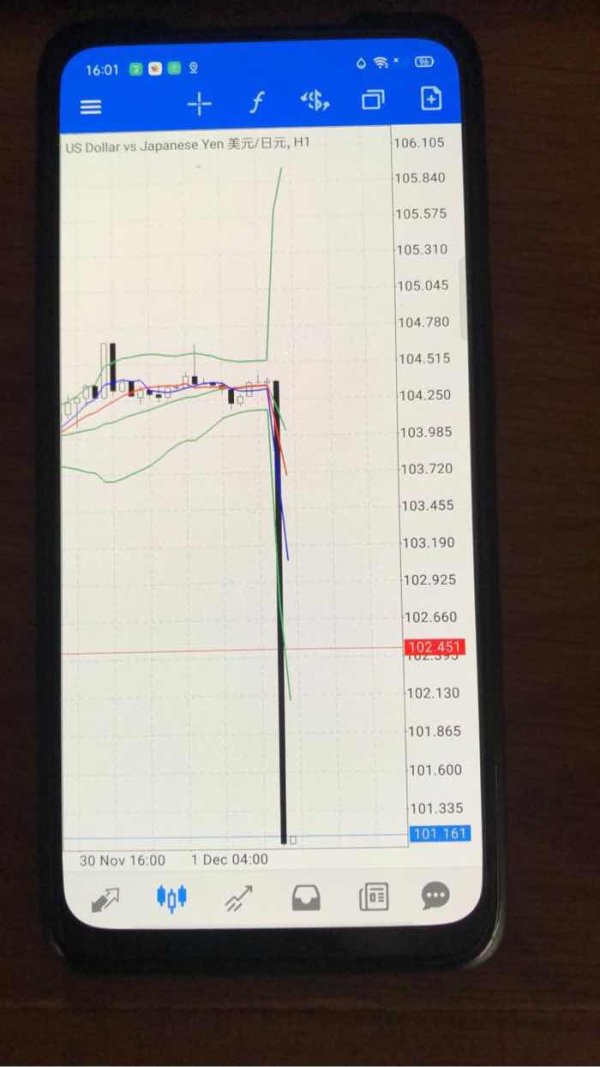

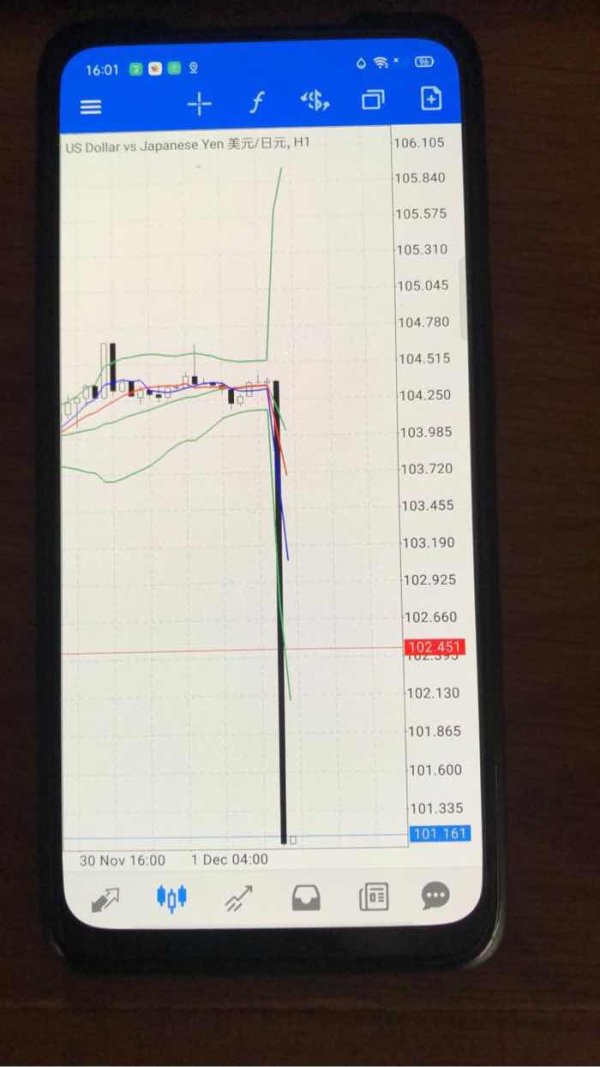

The trading experience provided by EternalWealth has been consistently criticized in user reports and review documentation. Multiple sources show significant problems with platform stability, order execution, and overall trading environment quality that make this broker unsuitable for serious trading activities.

User testimonials frequently mention platform connectivity issues, unexpected system downtime, and order execution problems that can result in trading losses. These technical difficulties appear to be systemic rather than isolated incidents, suggesting fundamental infrastructure inadequacies.

Execution quality reports show potential issues with slippage, requotes, and delayed order processing that can significantly impact trading outcomes. The lack of transparent execution statistics or third-party verification of trading conditions raises additional concerns about the fairness of the trading environment.

Mobile trading capabilities, which are essential for modern traders, appear to be limited or problematic based on available user feedback. The absence of detailed platform specifications or demo account access makes it difficult for potential clients to properly evaluate the trading environment before committing funds.

Market access and instrument availability may be more limited than advertised, with some users reporting unexpected restrictions on certain trading pairs or instruments. The overall trading experience appears to be compromised by technical limitations and operational deficiencies that make this eternalwealth review particularly concerning for potential clients.

Trust and Reliability Analysis (1/10)

Trust and reliability represent the most critical deficiencies in EternalWealth's operations. The complete absence of verified regulatory authorization from recognized financial authorities immediately disqualifies this broker from consideration by risk-conscious traders seeking legitimate trading partners.

Regulatory database searches through major financial authorities have yielded no evidence of proper licensing or oversight for EternalWealth or its claimed operating entities. This regulatory vacuum means that clients have no official recourse or protection in case of disputes or operational failures.

The broker's claimed operation under multiple names and websites raises additional red flags about corporate transparency and business legitimacy. Legitimate financial service providers typically maintain clear, consistent corporate identities with verifiable registration and licensing information.

Fund security measures, including client money segregation, insurance coverage, and audit procedures, are not documented or verified. This absence of basic financial safeguards represents an unacceptable risk for client funds and violates fundamental industry standards.

Industry reputation analysis reveals predominantly negative assessments from multiple review sources and monitoring organizations. The accumulation of exposure reports and scam allegations creates a pattern that strongly suggests this broker should be avoided by all potential clients.

User Experience Analysis (2/10)

Overall user satisfaction with EternalWealth appears to be extremely low based on available testimonials and review documentation. The consensus among user reports shows widespread dissatisfaction with multiple aspects of the broker's services and operations.

Interface design and platform usability receive consistent criticism from users who report confusing navigation, poor functionality, and technical limitations that impede effective trading. The lack of intuitive design elements and user-friendly features suggests inadequate platform development and testing.

Account registration and verification processes may initially appear straightforward, but users frequently report complications and delays that become apparent only after initial deposits are made. This pattern suggests potentially deceptive onboarding practices designed to secure client funds quickly.

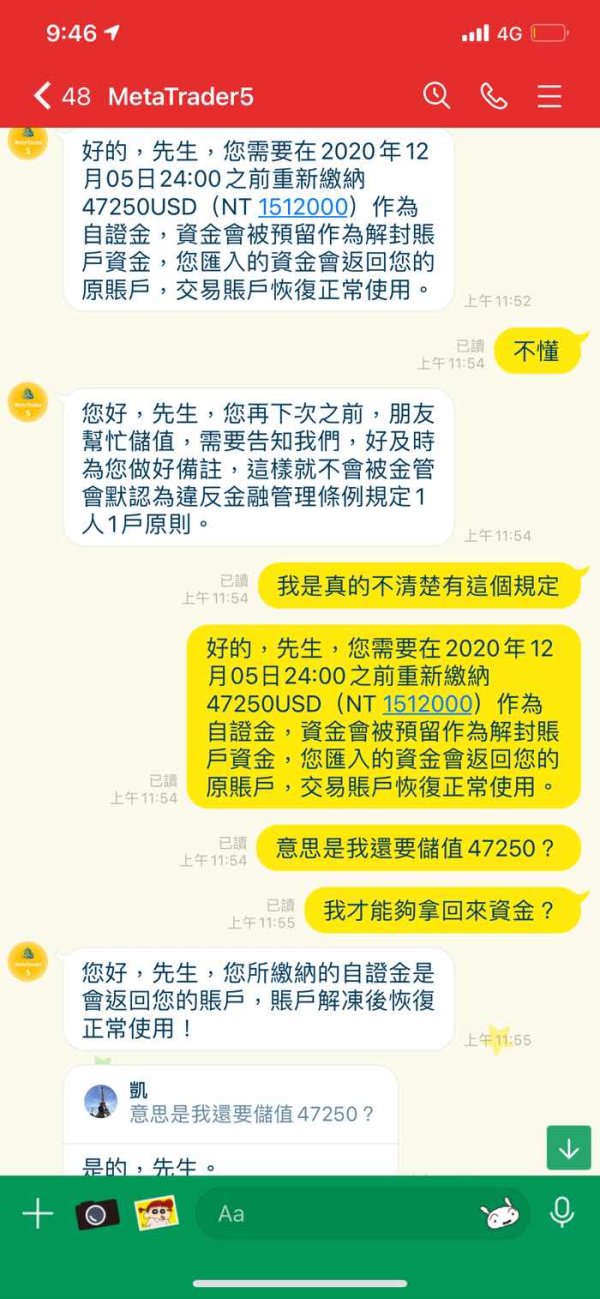

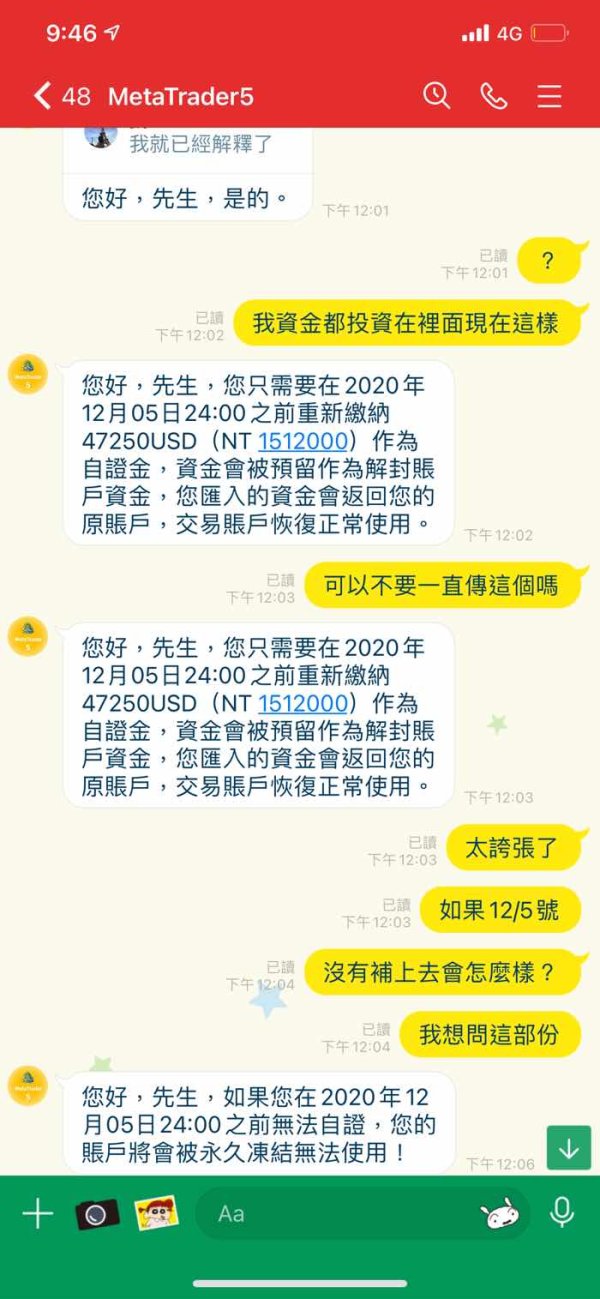

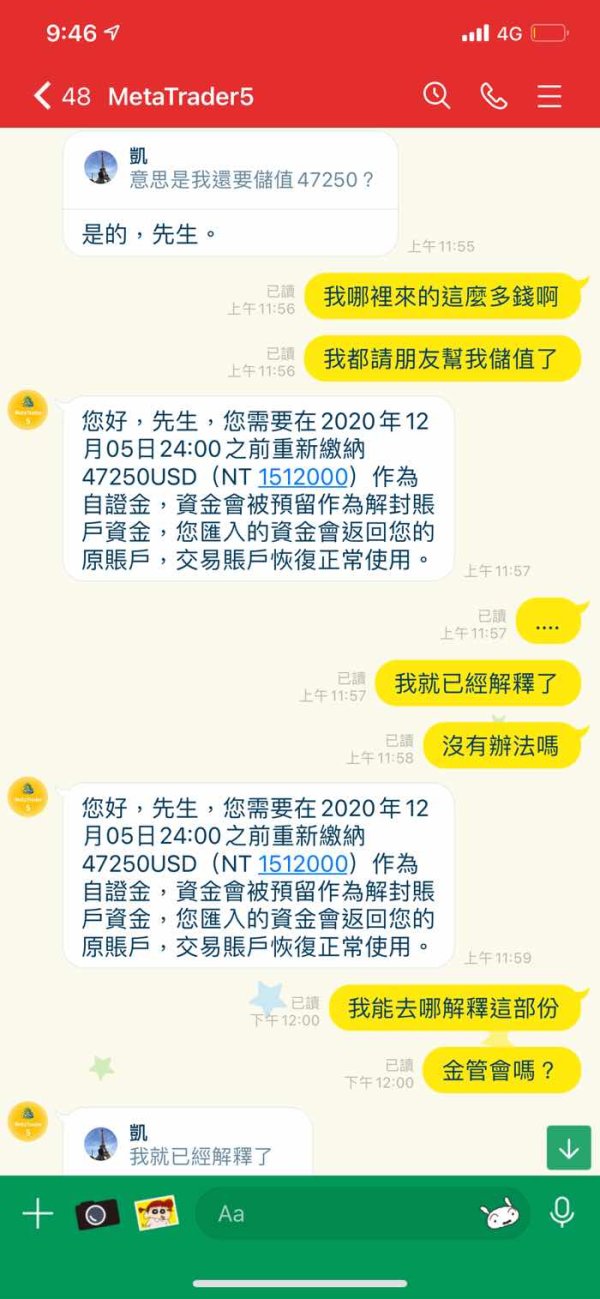

Fund management experiences represent the most serious user complaints, with withdrawal difficulties being the predominant concern across multiple review sources. The inability to access deposited funds represents a fundamental failure of basic broker obligations to clients.

Common user complaints center on communication difficulties, platform limitations, and most critically, fund access problems that suggest potential fraud. The pattern of negative experiences shows systematic operational failures rather than isolated service issues.

User demographic analysis suggests that EternalWealth is unsuitable for all trader categories, from beginners seeking reliable learning environments to experienced traders requiring professional-grade services and regulatory protection.

Conclusion

This comprehensive eternalwealth review reveals a broker with significant operational deficiencies and serious red flags that make it unsuitable for any legitimate trading activity. The overwhelming evidence of withdrawal difficulties, lack of regulatory oversight, and consistently negative user experiences creates a clear pattern of concerning business practices.

EternalWealth cannot be recommended to any category of trader, whether novice or experienced, due to the fundamental absence of regulatory protection and the documented history of client fund access problems. The broker's failure to maintain transparent operations, provide reliable customer service, or demonstrate legitimate business registration represents unacceptable risks for potential clients.

The primary disadvantages include complete lack of regulatory authorization, widespread withdrawal difficulties, poor customer service, questionable platform reliability, and absence of verifiable corporate presence. No significant advantages have been identified that would offset these critical deficiencies. Traders seeking legitimate forex and CFD trading opportunities should focus exclusively on properly regulated brokers with verified track records and transparent operations.