Dacland 2025 Review: Everything You Need to Know

Executive Summary

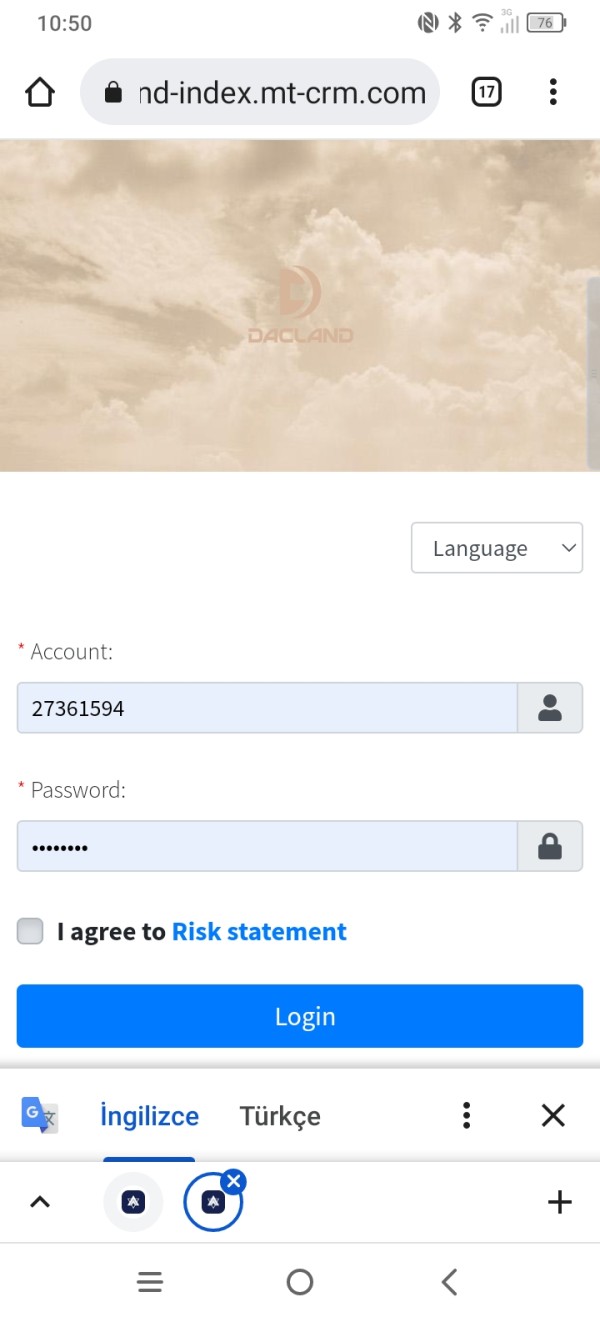

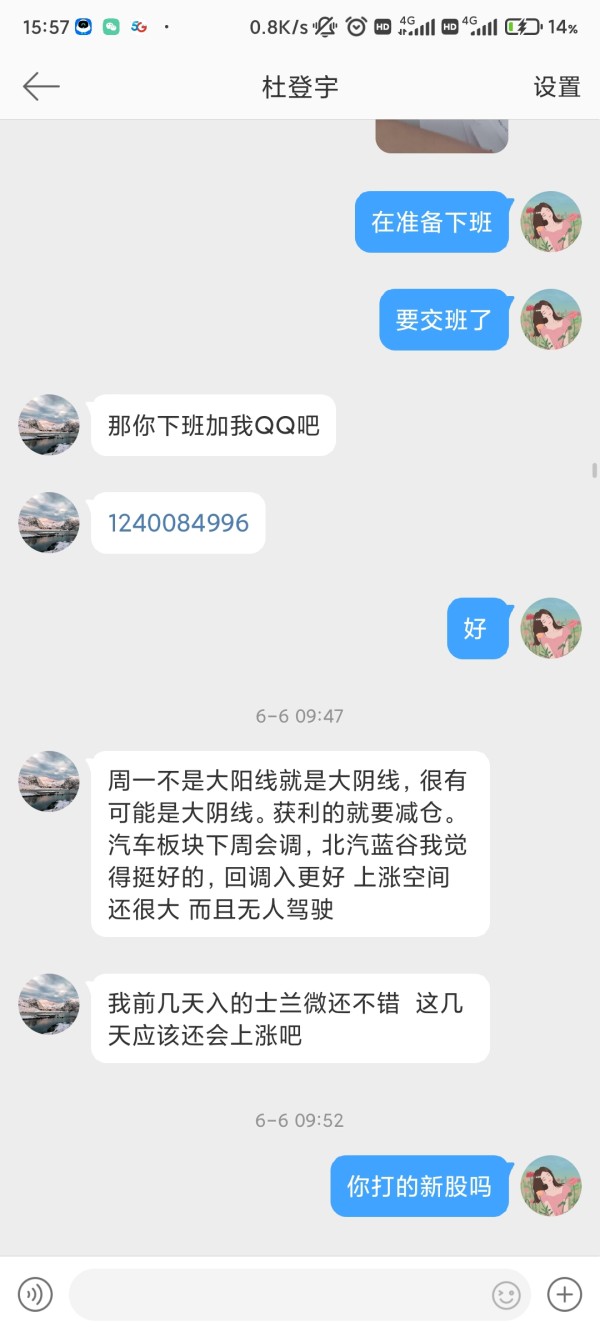

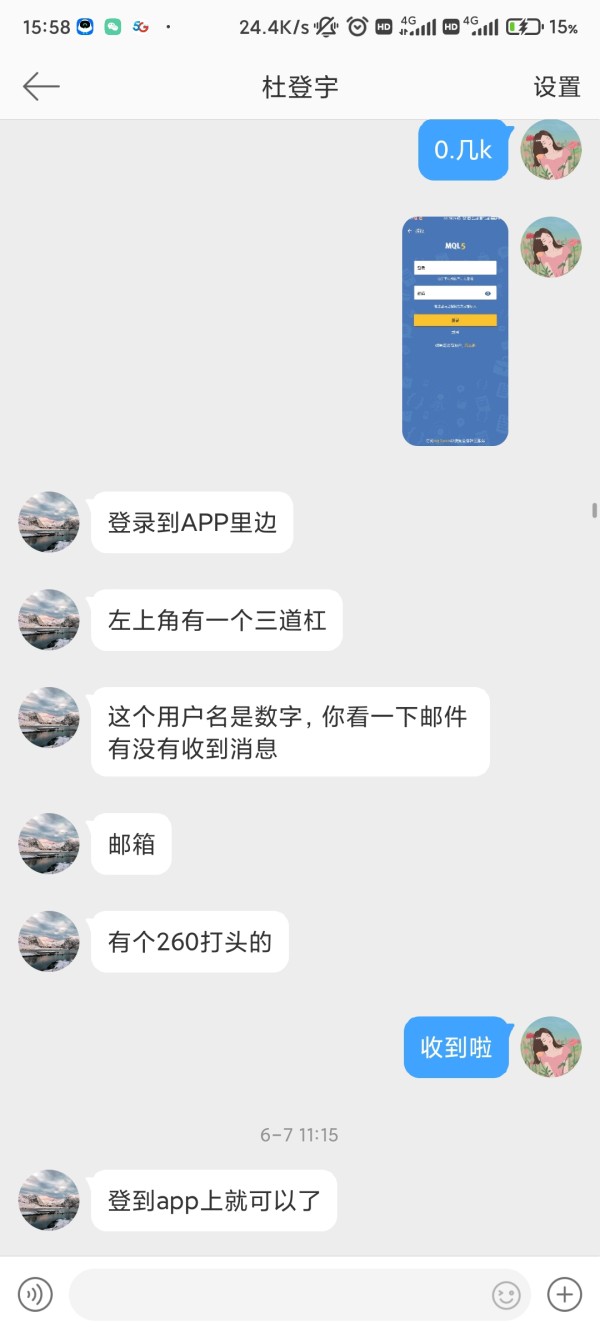

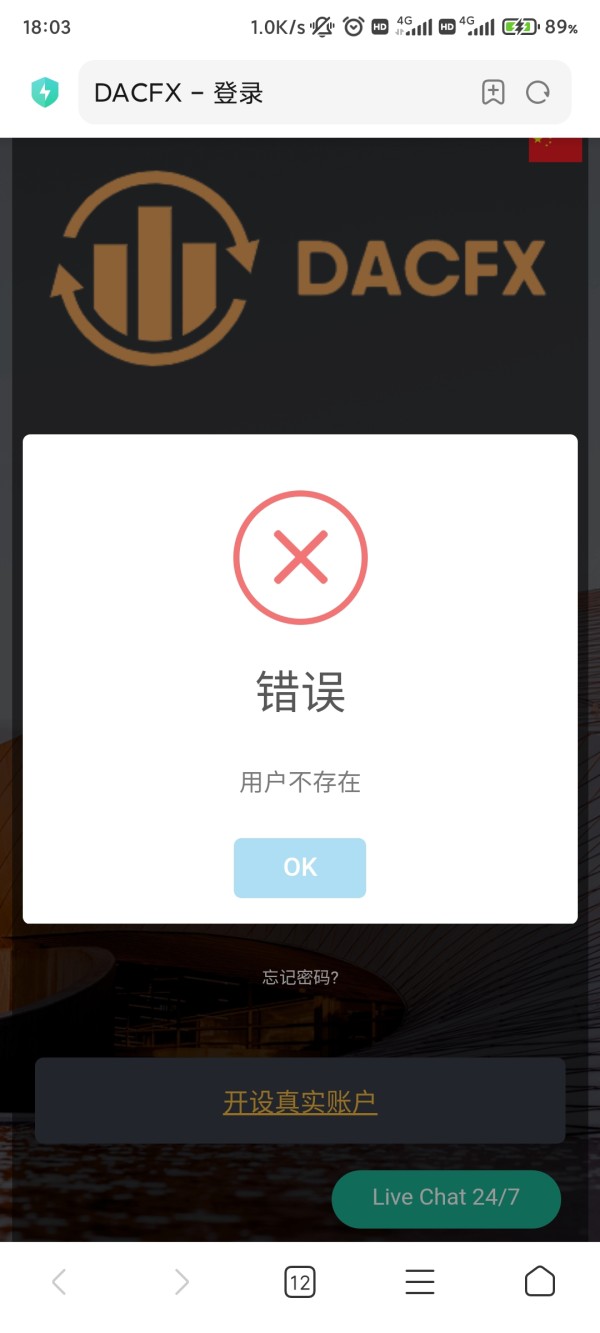

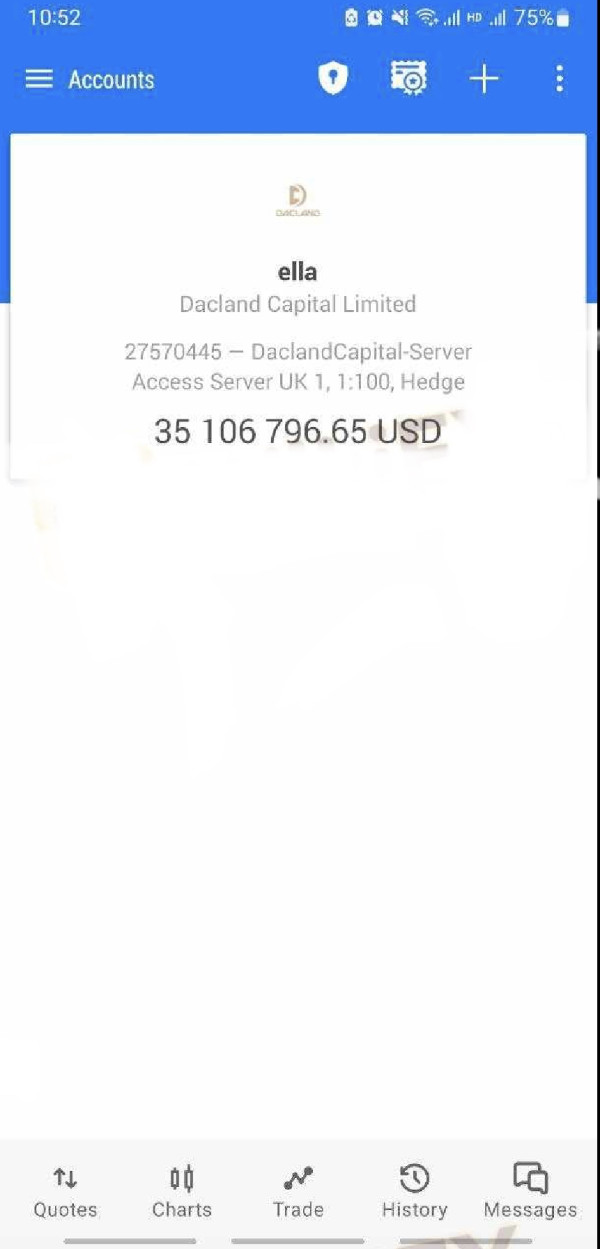

Dacland presents itself as a forex and CFD trading platform. Our comprehensive dacland review reveals significant concerns that potential traders must carefully consider before making any decisions. This broker operates without proper regulatory oversight. The lack of regulation immediately raises red flags regarding trader protection and fund security, which are essential for safe trading. Based on available information and user feedback, Dacland claims to offer MetaTrader 5 platform access and various trading instruments including forex, commodities, and CFDs.

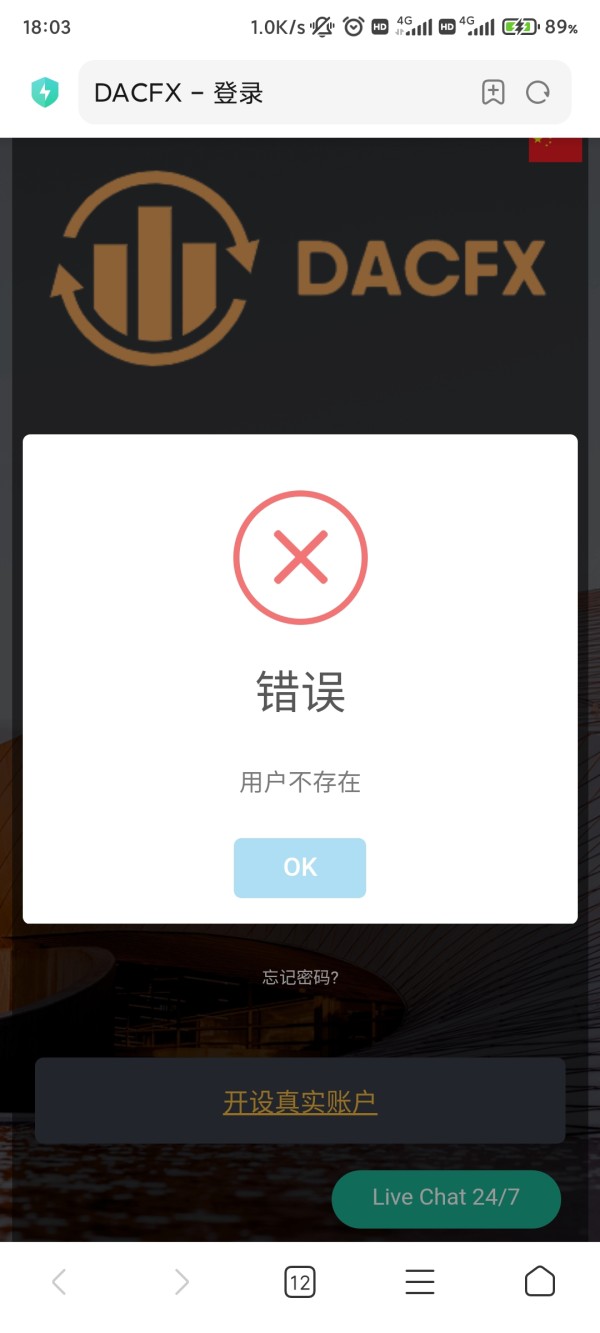

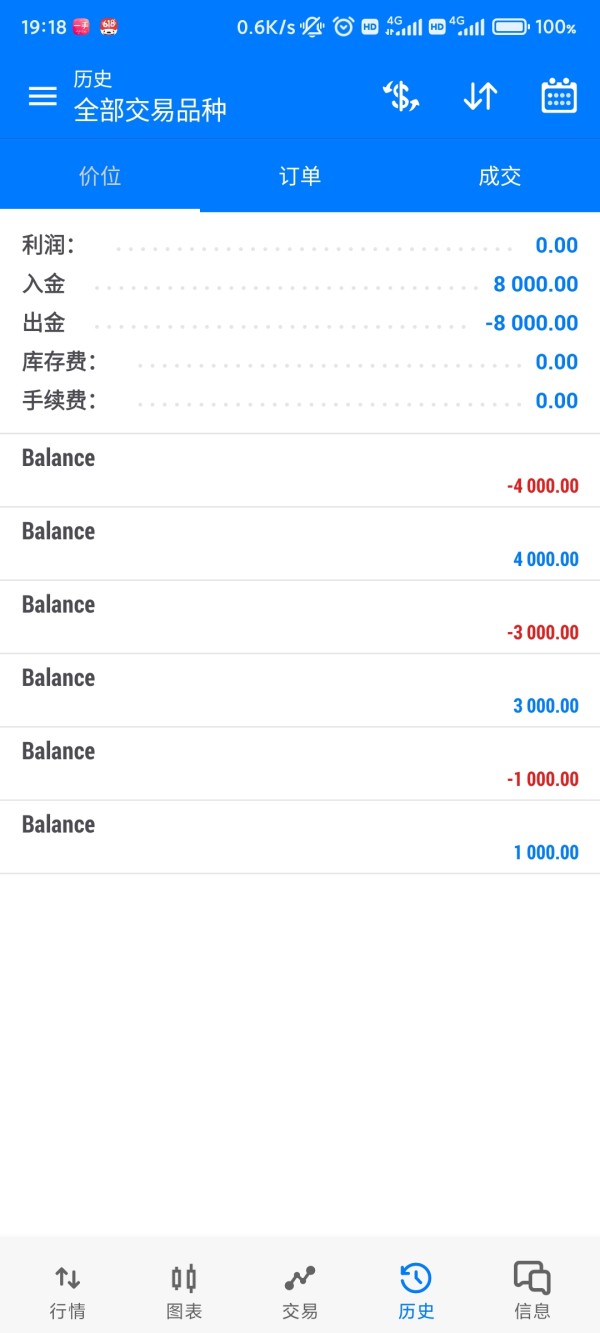

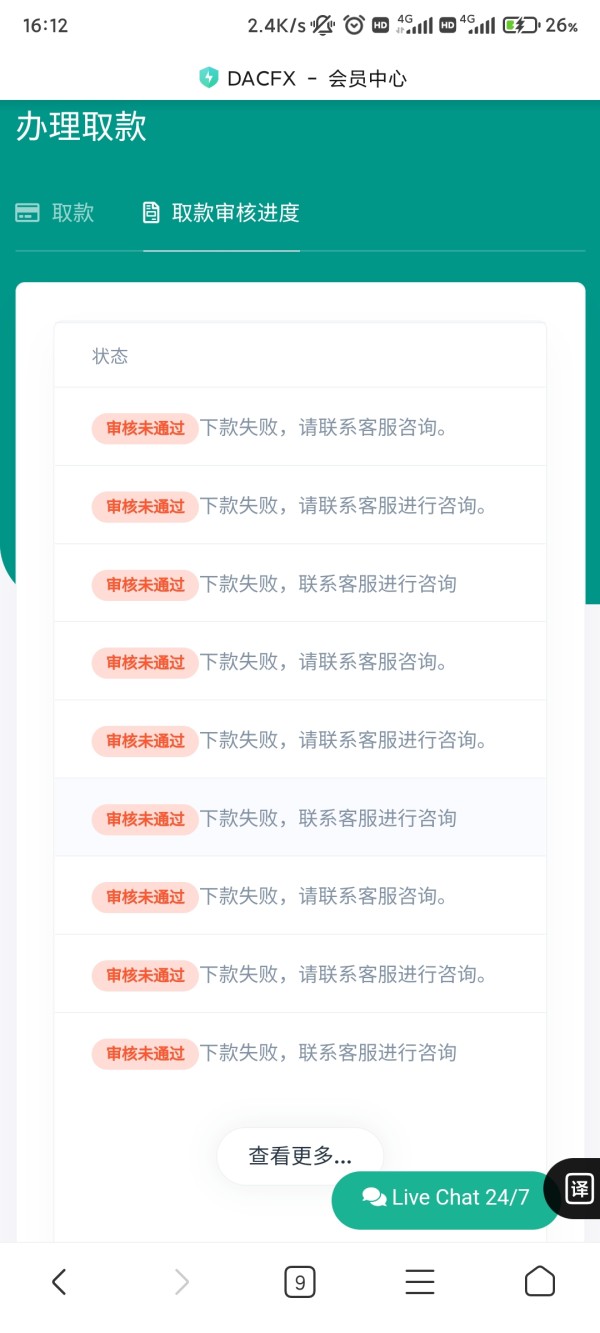

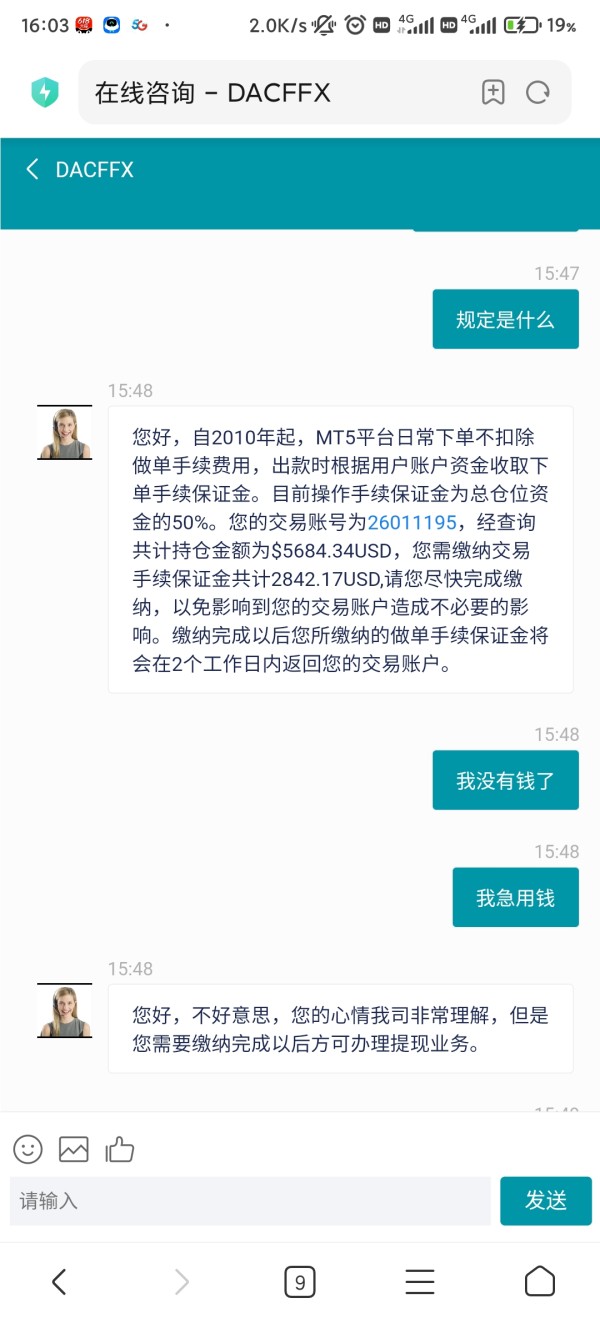

However, multiple reports indicate serious issues with customer service responsiveness and withdrawal processes that cannot be ignored. Users have reported difficulties in retrieving their funds and experiencing delayed responses from the support team, creating frustration and financial stress. While the broker advertises diverse trading tools and modern platform technology, the lack of regulatory compliance overshadows these potential benefits completely. The trading community has expressed mixed reviews, with particular emphasis on concerns about the broker's legitimacy and operational transparency.

This review is essential for traders considering Dacland as their trading partner. It provides crucial insights into the broker's actual performance versus its marketing claims, which often differ significantly. Given the unregulated status and user complaints, extreme caution is advised for anyone considering opening an account with this broker.

Important Notice

Regional Entity Differences: Dacland operates primarily from Australia with a listed address at 2/468 St Kilda Rd, Melbourne, VIC, 3004, Australia. However, the broker lacks proper regulatory authorization from major financial authorities, including ASIC or other internationally recognized regulatory bodies. This absence of regulatory oversight means traders have limited recourse in case of disputes, which can lead to significant financial losses.

Review Methodology: This evaluation is based on comprehensive analysis of available user feedback, industry reports, and publicly accessible information about Dacland's services. Our assessment incorporates multiple sources to provide a balanced perspective on the broker's performance and reliability.

Rating Framework

Broker Overview

Dacland entered the forex trading market claiming to provide comprehensive trading solutions for retail traders. The company positions itself as a modern broker offering access to global financial markets through advanced trading technology that promises to meet trader needs. According to available information, Dacland focuses on delivering forex, commodity, and CFD trading services to individual investors seeking market exposure.

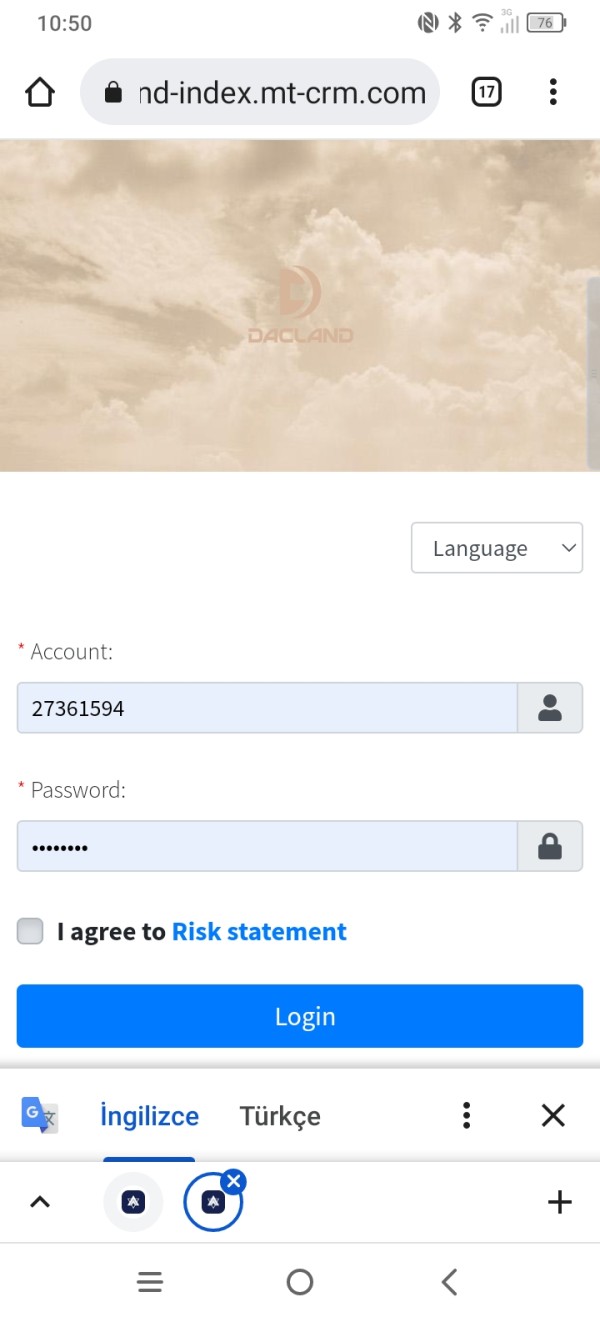

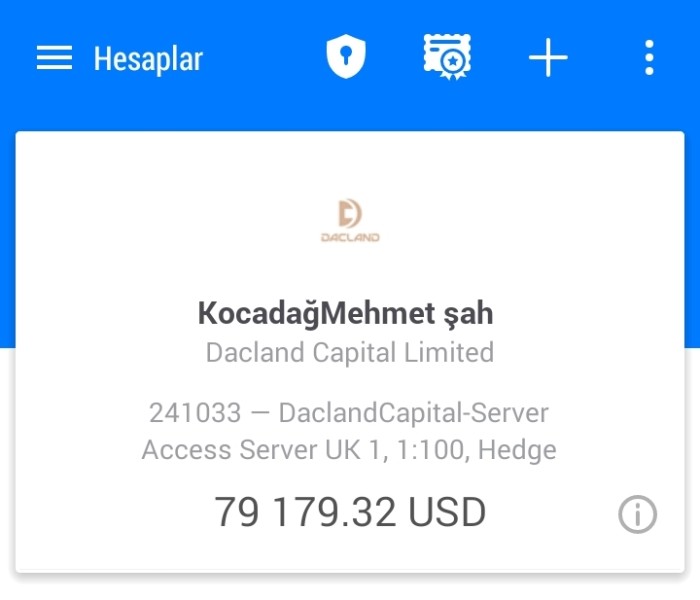

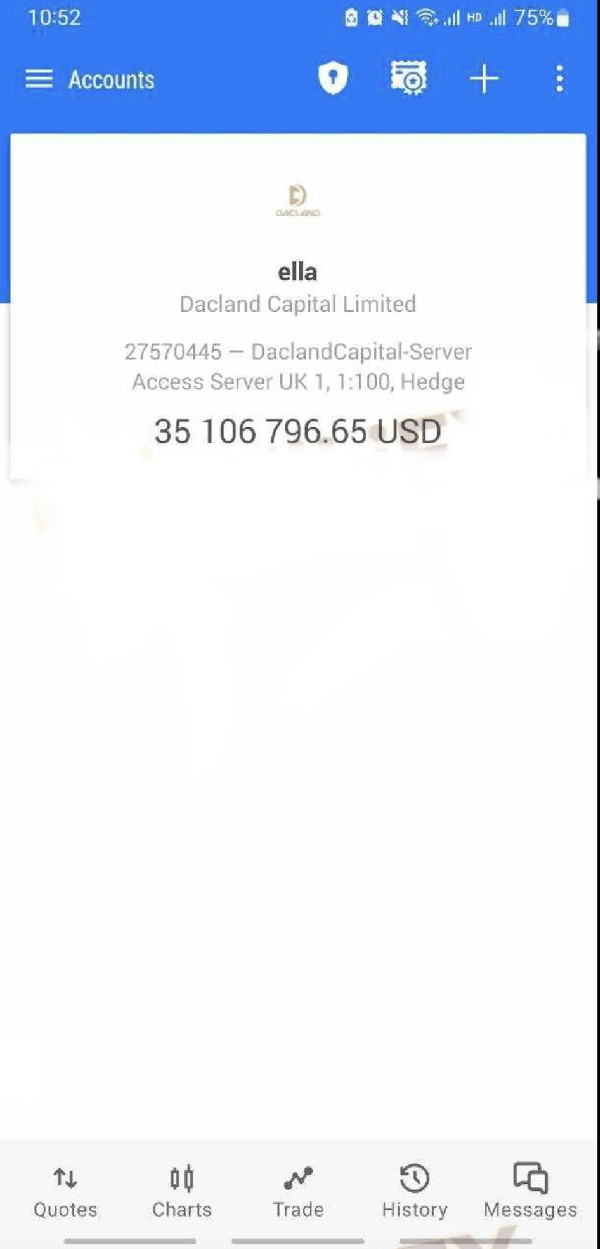

The broker's business model centers around providing MetaTrader 5 platform access. This platform is widely recognized in the trading community for its advanced features and analytical tools that help traders make informed decisions. Dacland markets itself to traders interested in diverse asset classes, promising competitive trading conditions and professional support. However, the reality of their service delivery appears to diverge significantly from these marketing promises.

Based on industry reports and user feedback, Dacland's operational approach lacks the transparency and regulatory compliance expected from legitimate brokers. The company's dacland review profile shows concerning patterns in customer service delivery and fund management practices that raise serious questions about their reliability. Despite claims of modern trading infrastructure, users report fundamental issues with basic broker services including withdrawals and customer support responsiveness.

Regulatory Status: Dacland operates without proper regulatory authorization from recognized financial authorities. This unregulated status poses significant risks to trader funds and limits legal protections available to clients who may face problems.

Deposit and Withdrawal Methods: Specific information about payment methods and processing procedures was not detailed in available sources. This lack of transparency itself raises concerns about the broker's commitment to clear communication.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not clearly specified in available materials. This indicates poor communication of essential trading conditions that traders need to know.

Bonuses and Promotions: No specific promotional offers or bonus structures were identified in the available information.

Tradeable Assets: Dacland claims to offer forex pairs, commodities, and CFDs. These instruments provide access to multiple market sectors for diversified trading strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in the source materials. This represents a significant transparency gap that makes it difficult for traders to calculate their potential costs.

Leverage Ratios: Specific leverage offerings are not clearly documented in available sources.

Platform Options: The broker primarily offers MetaTrader 5 platform access. This platform provides professional-grade trading tools and analytical capabilities that many traders find useful.

Geographic Restrictions: Specific country restrictions are not detailed in available materials.

Customer Support Languages: Language support details are not specified in the available information.

This dacland review reveals significant information gaps that legitimate brokers typically address transparently on their websites and marketing materials.

Detailed Rating Analysis

Account Conditions Analysis

Dacland's account conditions receive a poor rating due to fundamental transparency issues and lack of regulatory protection. The broker fails to provide clear information about account types, minimum deposits, or specific trading conditions that traders need to make informed decisions about their investments. This opacity is particularly concerning given the broker's unregulated status, which already creates additional risks for potential clients.

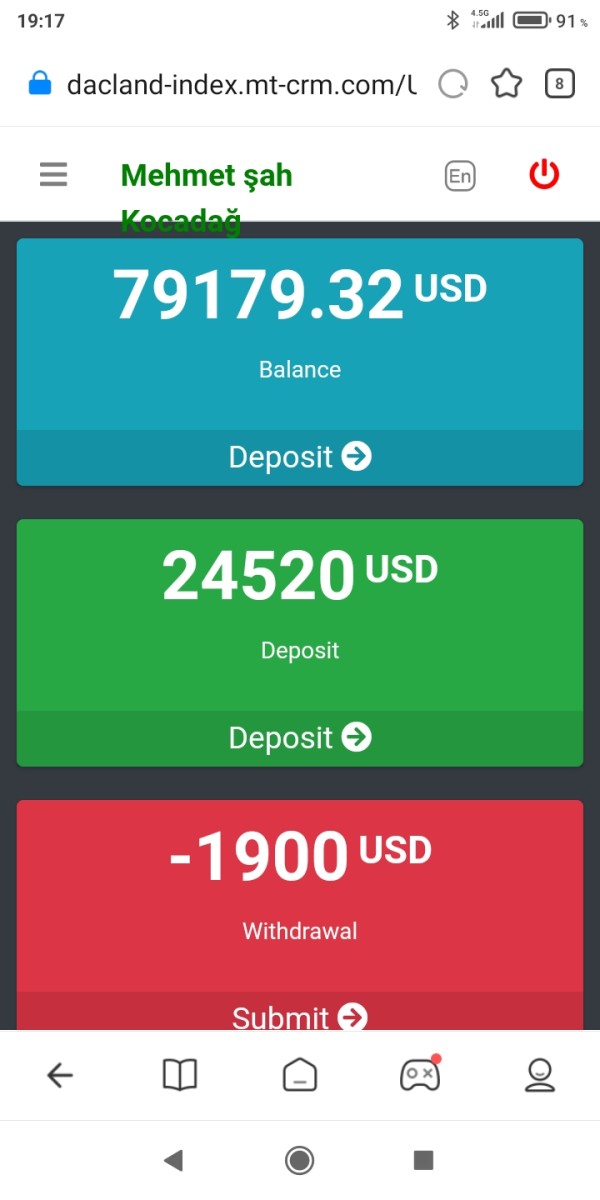

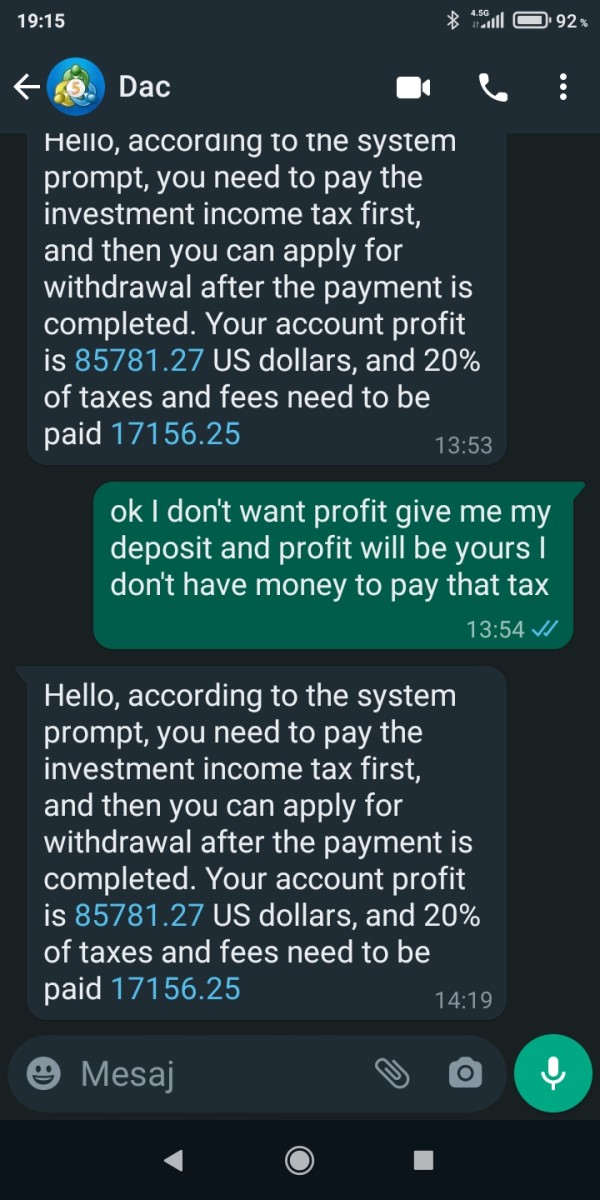

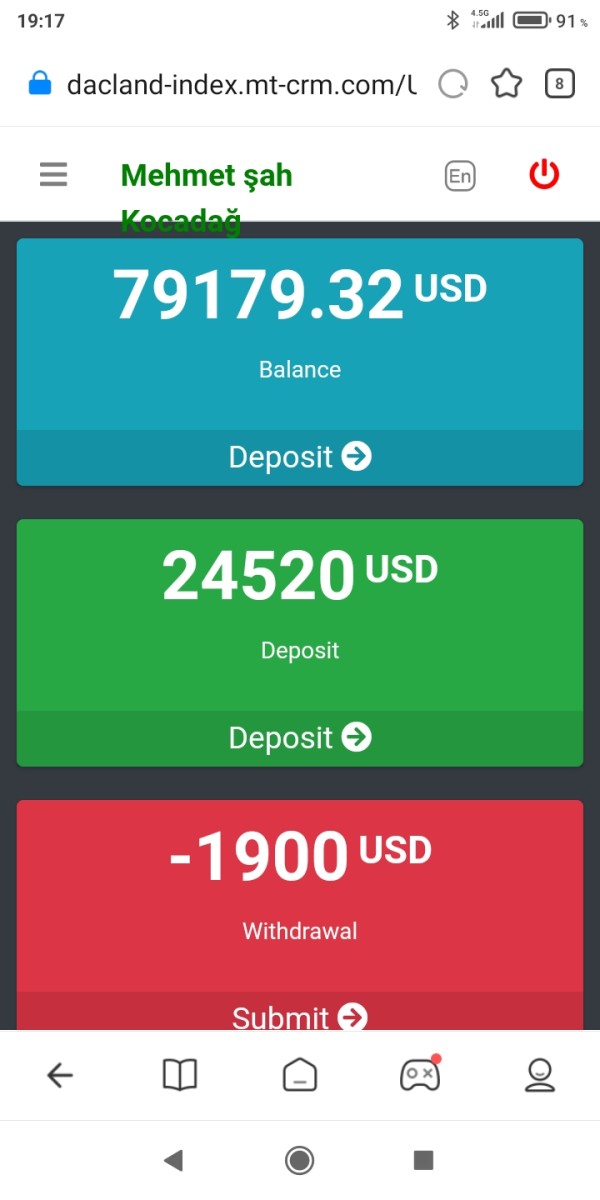

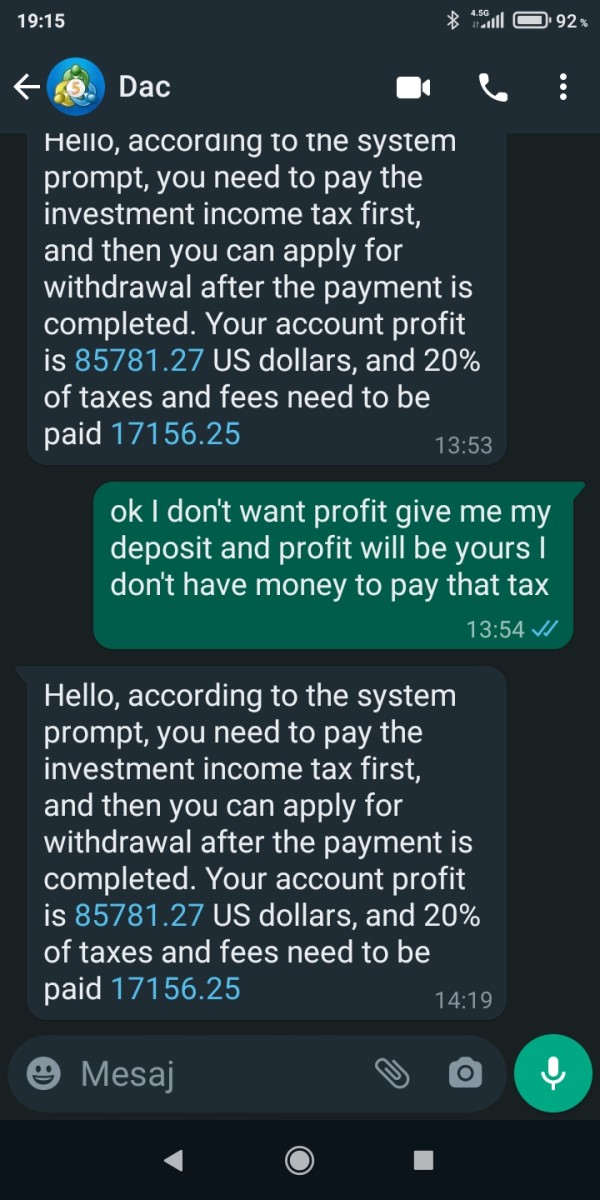

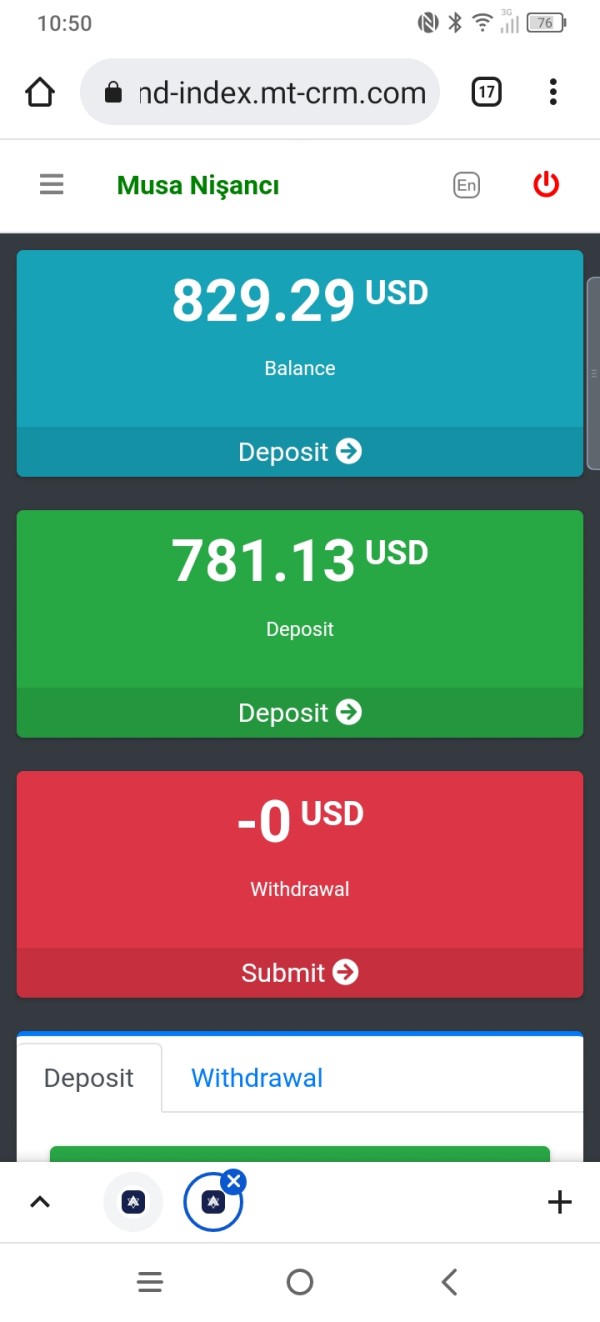

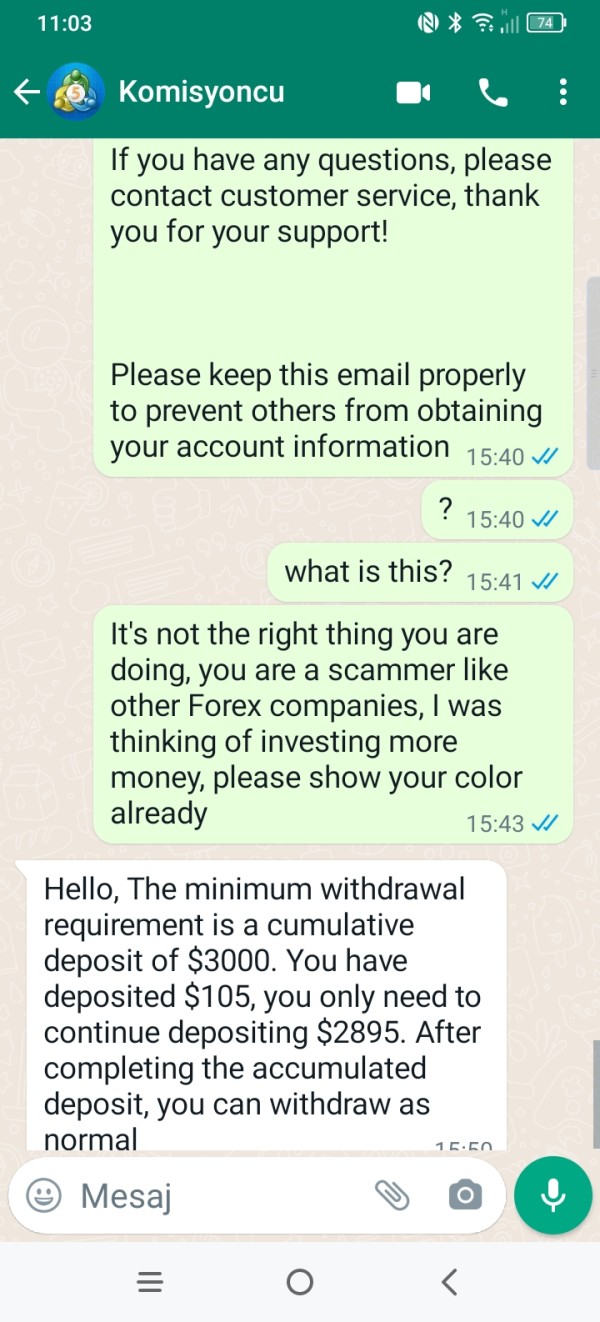

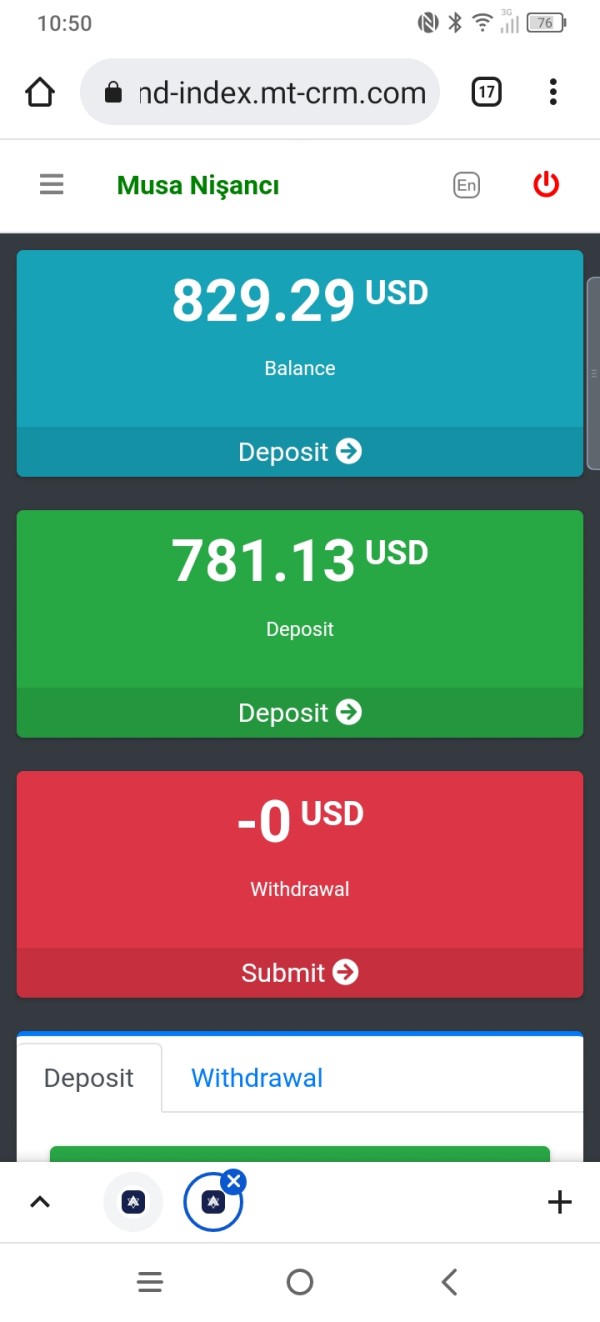

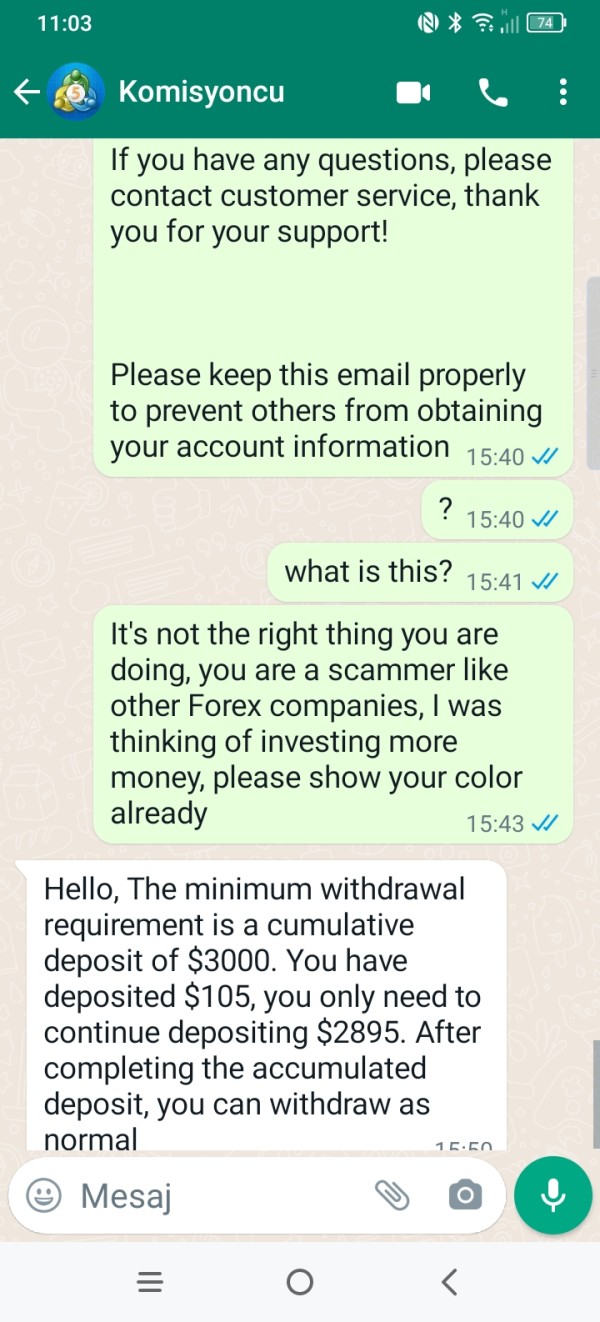

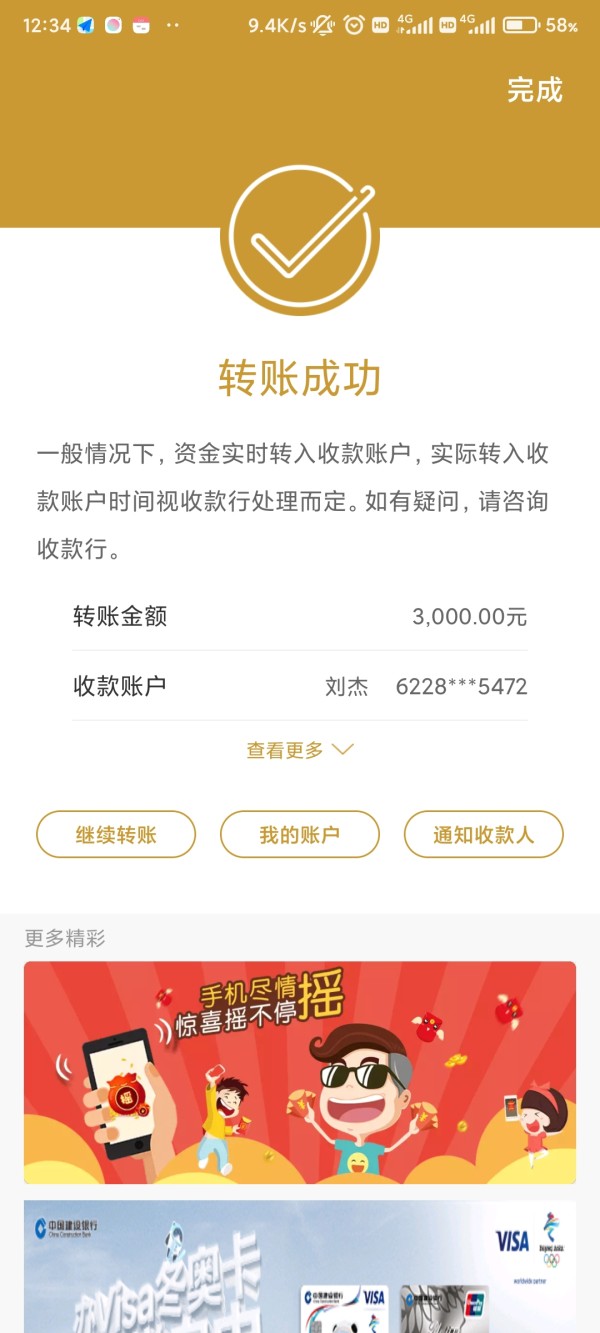

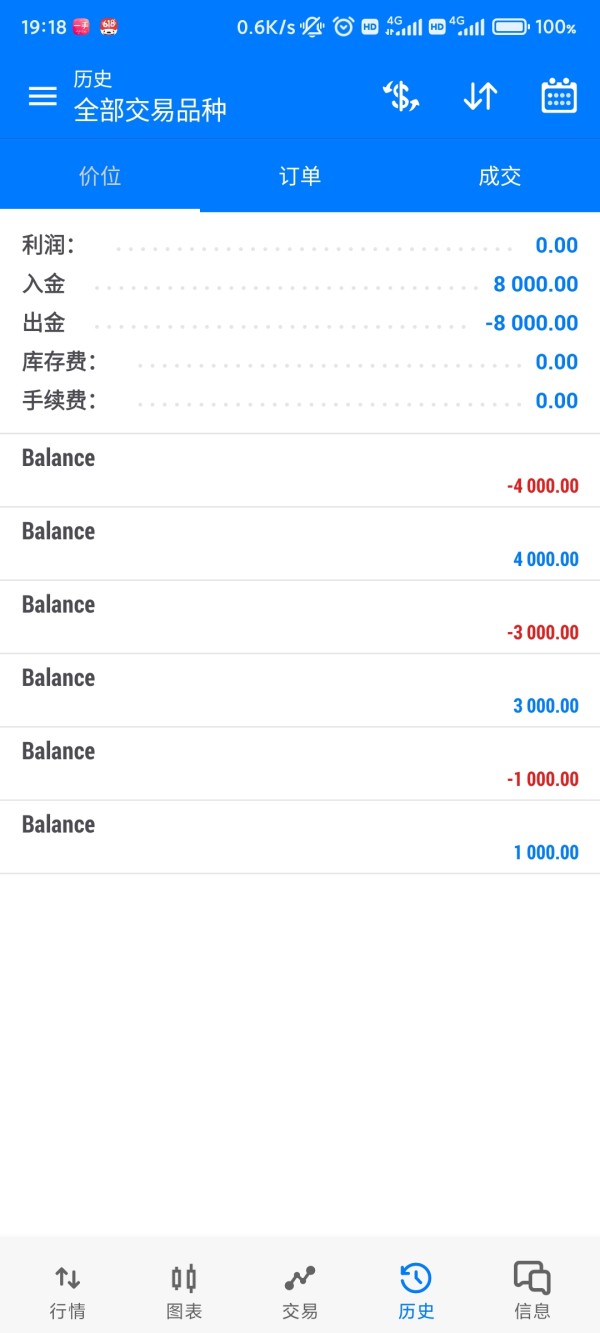

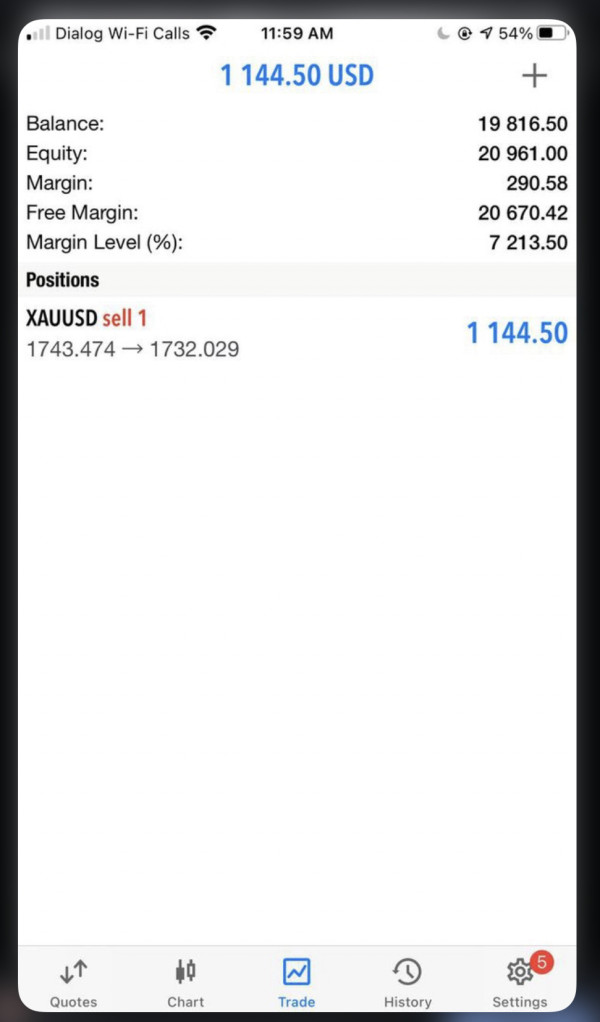

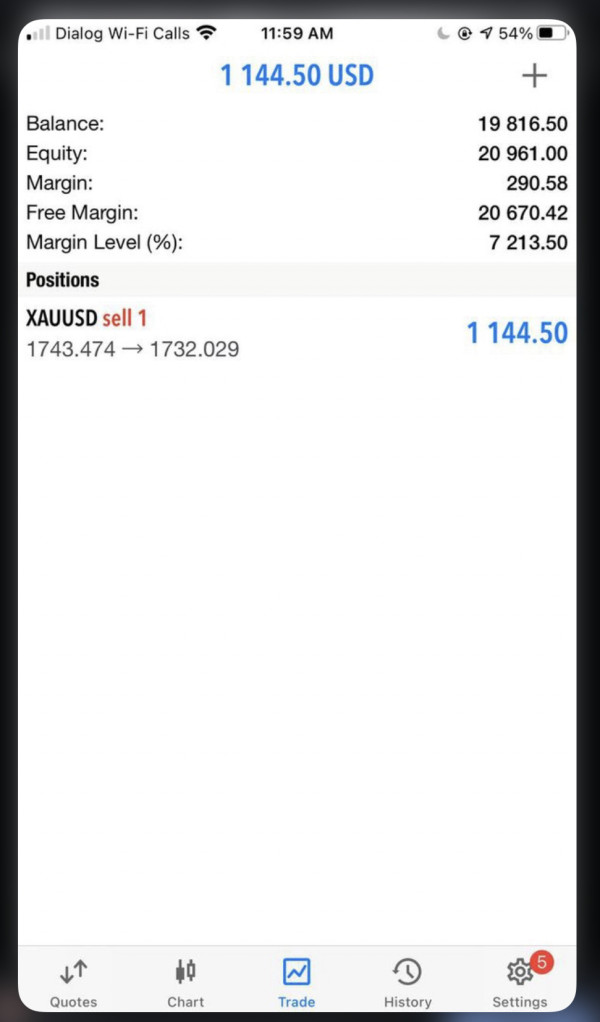

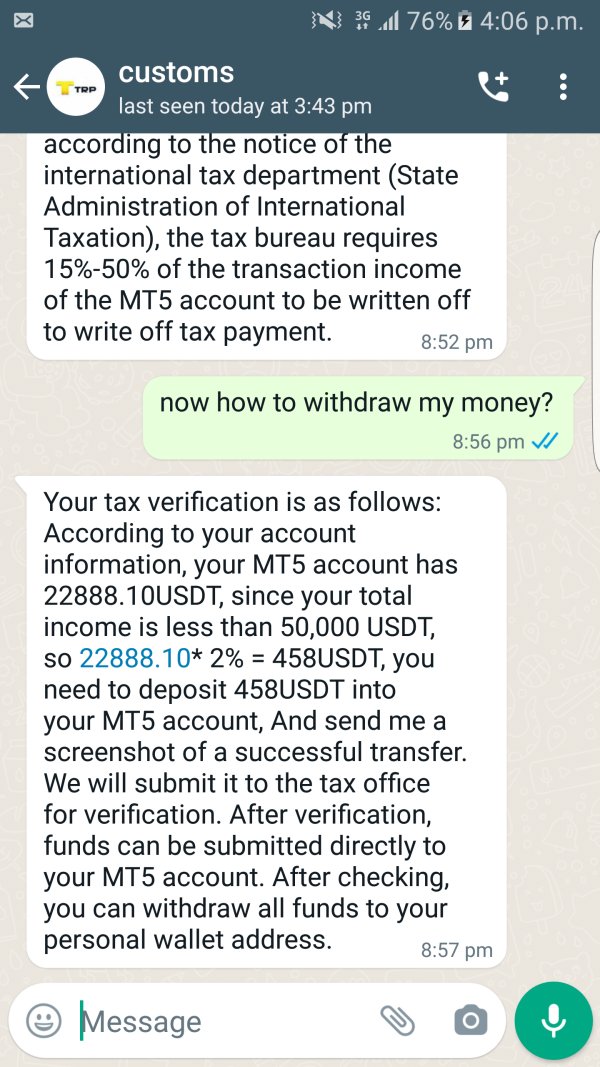

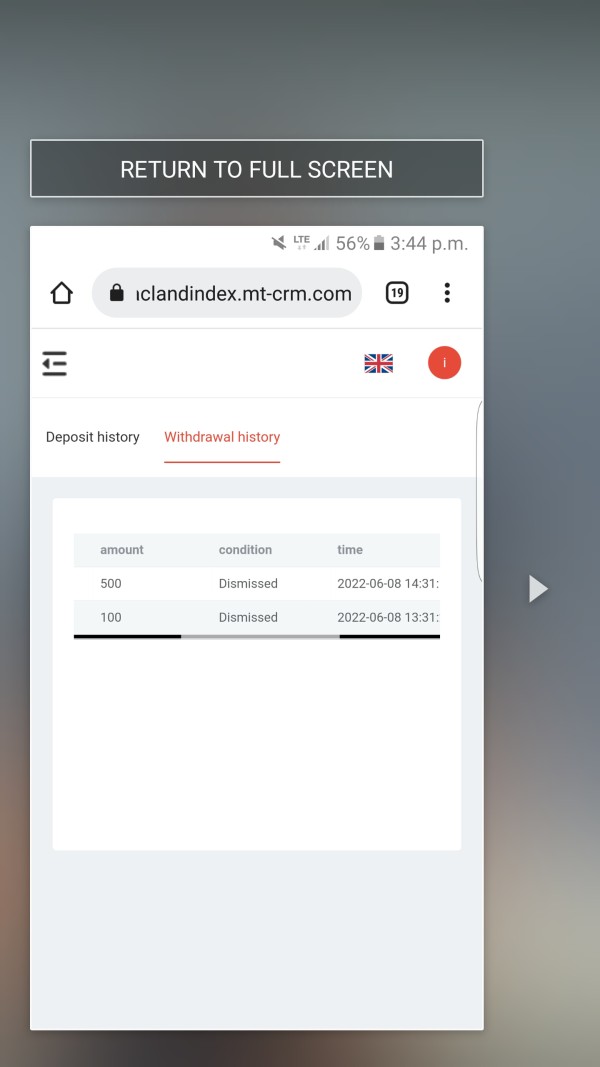

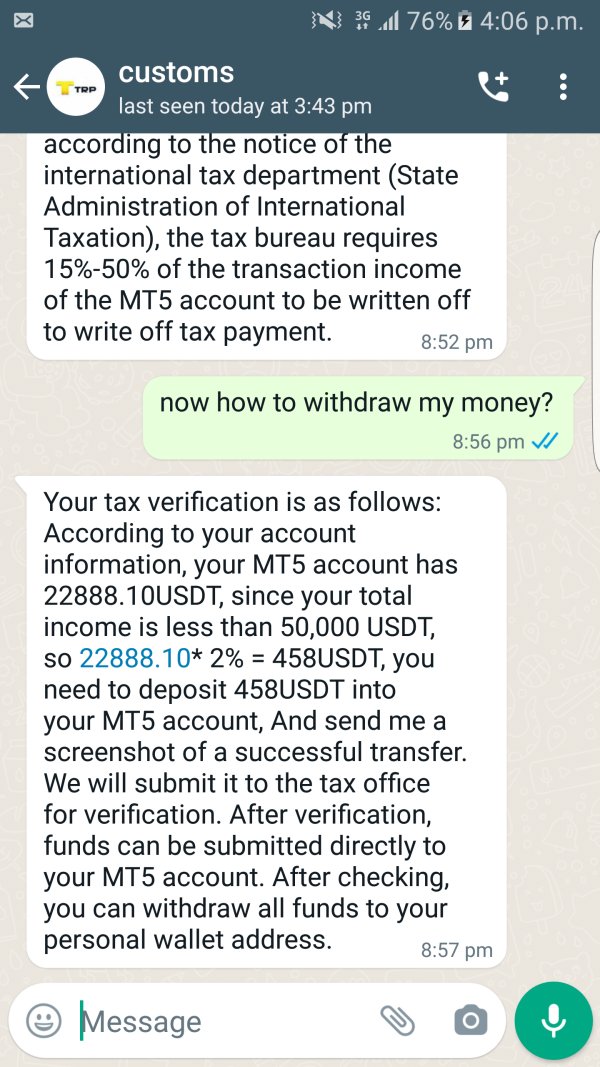

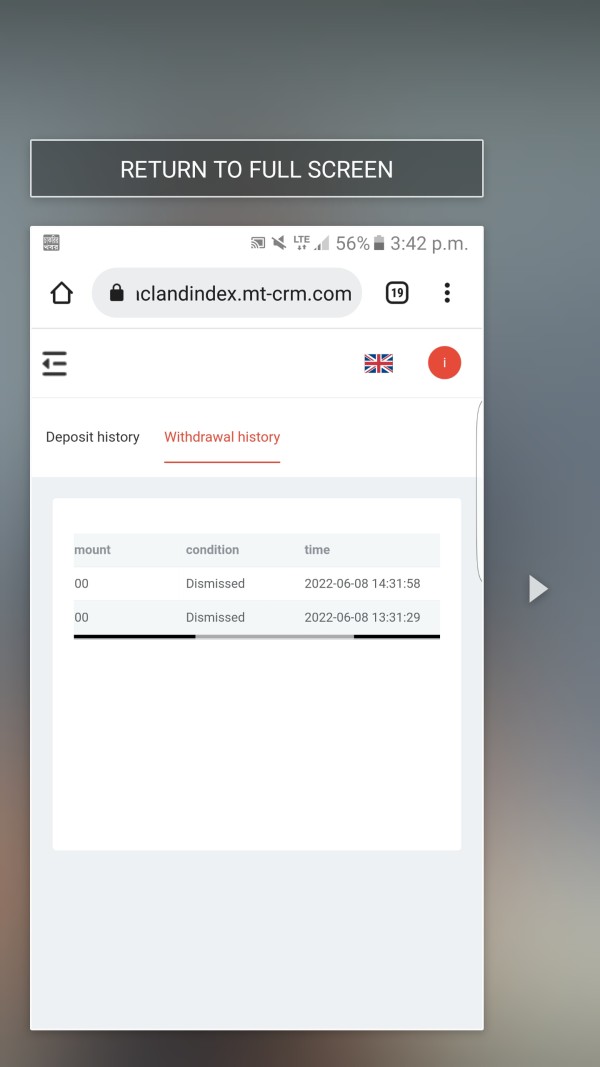

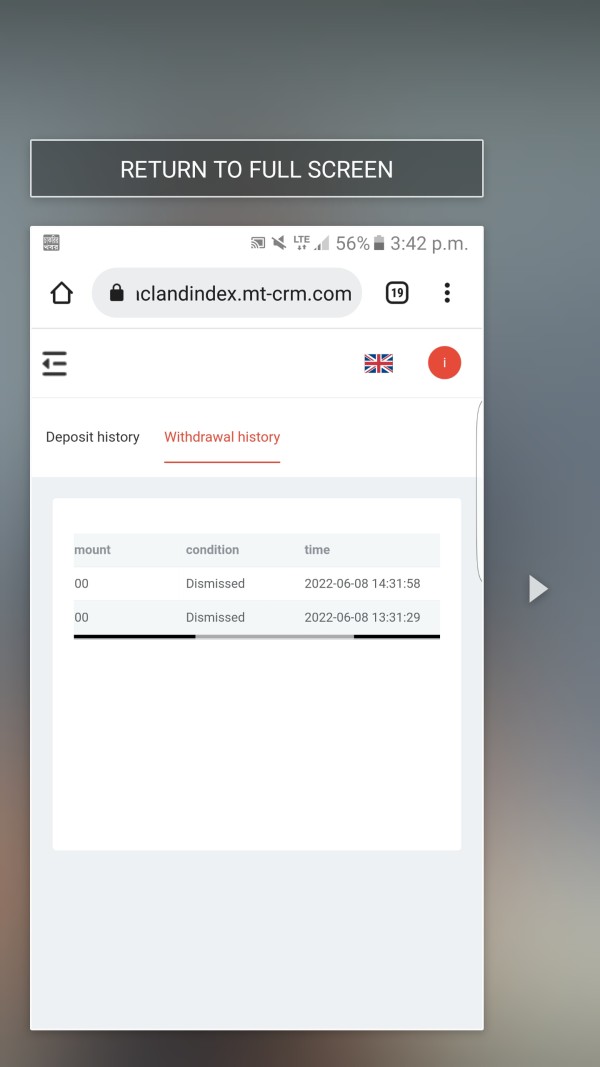

User feedback indicates significant problems with account management, particularly regarding withdrawal procedures that should be straightforward. Multiple reports suggest that clients experience unusual delays and complications when attempting to access their funds, creating stress and financial uncertainty. The absence of clear account terms and conditions creates an environment where traders cannot adequately assess the risks and costs associated with their trading activities.

Compared to regulated brokers that provide detailed account specifications, fee structures, and clear terms of service, Dacland's approach lacks the professionalism and transparency expected in the modern forex industry. The lack of different account tiers or specialized account options further limits the broker's appeal to diverse trading needs that different types of traders may have.

The dacland review feedback consistently highlights concerns about account accessibility and fund security. Several users report difficulties in maintaining normal account operations, which are basic expectations for any trading platform.

Despite significant concerns in other areas, Dacland's tools and resources receive a relatively positive rating due to their MetaTrader 5 platform offering. MT5 is widely regarded as one of the most comprehensive trading platforms available, providing advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors that can help traders implement complex strategies.

The platform offers multiple timeframes, extensive technical indicators, and sophisticated order management features. These tools can meet the needs of both novice and experienced traders who require different levels of functionality. Users can access real-time market data, perform complex technical analysis, and implement various trading strategies through the platform's robust infrastructure.

However, the availability of additional research resources, educational materials, or proprietary analysis tools remains unclear from available information. Many legitimate brokers supplement platform access with market research, economic calendars, and educational content to support trader development and decision-making processes.

The quality of the trading tools ultimately depends on the broker's execution quality and data feed reliability. These are areas where user feedback suggests potential concerns that could impact the overall trading experience.

Customer Service and Support Analysis

Customer service represents one of Dacland's most significant weaknesses, earning a poor rating based on consistent user complaints about responsiveness and problem resolution. Multiple sources indicate that traders experience substantial delays when attempting to contact support representatives, with some reports suggesting inadequate responses to urgent account issues that require immediate attention.

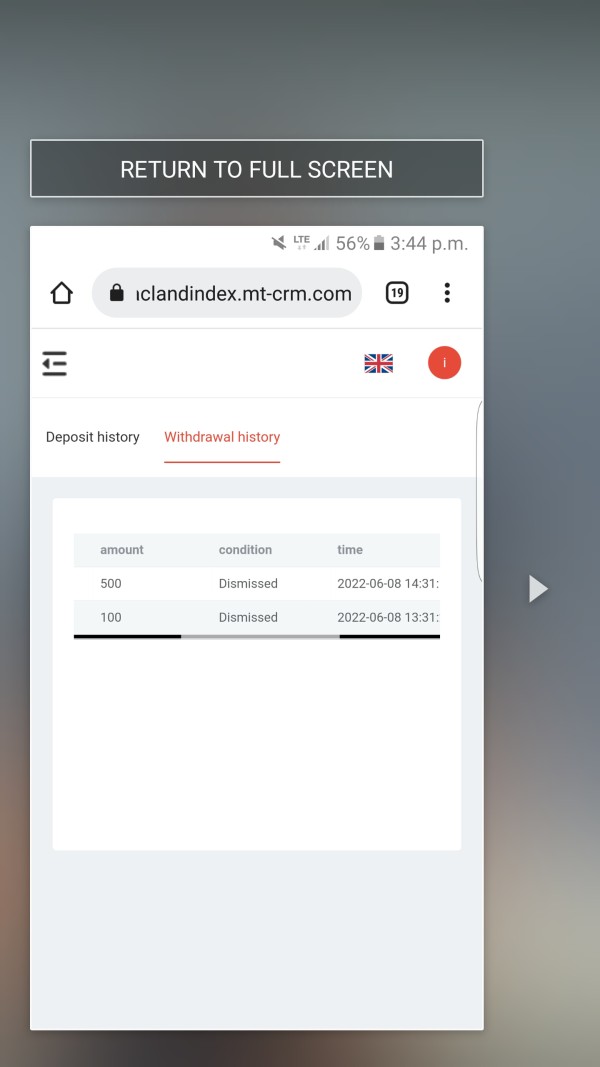

The withdrawal process appears to be particularly problematic for many users. Reports suggest extended delays and unclear communication about fund retrieval procedures, which creates anxiety and financial stress for traders trying to access their own money. This is especially concerning given the broker's unregulated status, as traders have limited external recourse when facing service issues.

Available information does not specify the customer support channels, operating hours, or language capabilities. This further indicates poor communication infrastructure that fails to meet modern customer service standards. Professional brokers typically provide multiple contact methods, clearly defined response times, and comprehensive support documentation.

User feedback consistently emphasizes frustration with the support team's ability to resolve account-related issues efficiently. The combination of poor responsiveness and complex withdrawal procedures creates a concerning pattern that suggests systemic customer service problems rather than isolated incidents.

Trading Experience Analysis

The trading experience with Dacland receives an average rating, primarily supported by the MetaTrader 5 platform's capabilities but undermined by concerns about execution quality and overall service reliability. While MT5 provides excellent technical analysis tools and order management features, the actual trading environment depends heavily on the broker's infrastructure and execution practices that may not meet professional standards.

User feedback provides mixed signals about the actual trading experience on the platform. Some positive comments about platform functionality are balanced against concerns about order execution and pricing transparency that can significantly impact trading results. The lack of detailed information about execution speeds, slippage rates, and pricing models makes it difficult for traders to assess the quality of the trading environment.

Platform stability and reliability are crucial factors for successful trading in fast-moving markets. Available information does not provide sufficient detail about Dacland's technical infrastructure or performance metrics that traders need to evaluate. Professional traders require consistent platform access and reliable order execution, areas where the broker's performance remains unclear.

The mobile trading experience and additional platform features are not well documented in available sources. This suggests potential limitations in the comprehensive trading experience that modern traders expect from their brokers.

Trust and Security Analysis

Trust and security receive the lowest possible rating due to Dacland's unregulated status and concerning user feedback about fund safety. The absence of regulatory oversight from recognized authorities like ASIC, FCA, or CySEC means that traders have minimal protection for their deposited funds and limited recourse in case of disputes that may arise.

Multiple sources have flagged Dacland as a potentially problematic broker. Some reports suggest possible fraudulent activities that could put trader funds at serious risk. The lack of proper licensing and regulatory compliance creates an environment where trader funds are not protected by standard industry safeguards such as segregated accounts or compensation schemes.

The broker's transparency regarding company ownership, financial stability, and operational procedures is severely lacking. Legitimate brokers typically provide detailed company information, regulatory documentation, and clear fund protection policies to build client confidence and demonstrate their commitment to ethical business practices.

User reports about withdrawal difficulties and poor customer service responsiveness further erode confidence in the broker's trustworthiness. The combination of regulatory absence and negative user experiences creates a high-risk environment that experienced traders typically avoid.

User Experience Analysis

The overall user experience with Dacland rates below average due to a combination of platform positives and significant service negatives. While users may appreciate certain aspects of the MetaTrader 5 platform, the overall experience is severely impacted by customer service issues and withdrawal complications that create ongoing frustration.

User feedback reveals a pattern of frustration with basic broker services, particularly account management and fund access procedures that should work smoothly. These fundamental operational issues overshadow any positive aspects of the trading platform itself, creating an overall negative user experience. The registration and account verification processes are not well documented, suggesting potential complications for new users attempting to establish trading accounts.

Professional brokers typically provide clear onboarding procedures and transparent account setup requirements that make the process straightforward. Common user complaints focus on communication difficulties, delayed responses to inquiries, and complications with fund withdrawals that should be routine transactions. These issues indicate systemic problems with the broker's operational approach rather than isolated service incidents.

The user experience could be significantly improved through better customer service, increased transparency, and proper regulatory compliance. However, these fundamental changes would require major operational improvements that may not be forthcoming.

Conclusion

This comprehensive dacland review reveals a broker with significant operational and regulatory concerns that outweigh any potential benefits from their platform offerings. While Dacland provides access to the respected MetaTrader 5 platform and claims to offer diverse trading instruments, the fundamental issues with regulatory compliance, customer service, and fund security create substantial risks for potential traders that cannot be ignored.

The broker may appeal to traders seeking MT5 platform access for its advanced features. However, the unregulated status and concerning user feedback make it unsuitable for most retail traders who need reliable service and fund protection. The combination of withdrawal difficulties, poor customer service responsiveness, and lack of regulatory protection creates an environment where trader funds and trading activities face unnecessary risks.

Recommendation: Experienced traders should consider regulated alternatives that provide proper fund protection, transparent operations, and reliable customer service. The risks associated with Dacland's unregulated status and operational issues significantly outweigh the potential benefits of their trading platform access, making it a poor choice for serious traders.