CHS Review 1

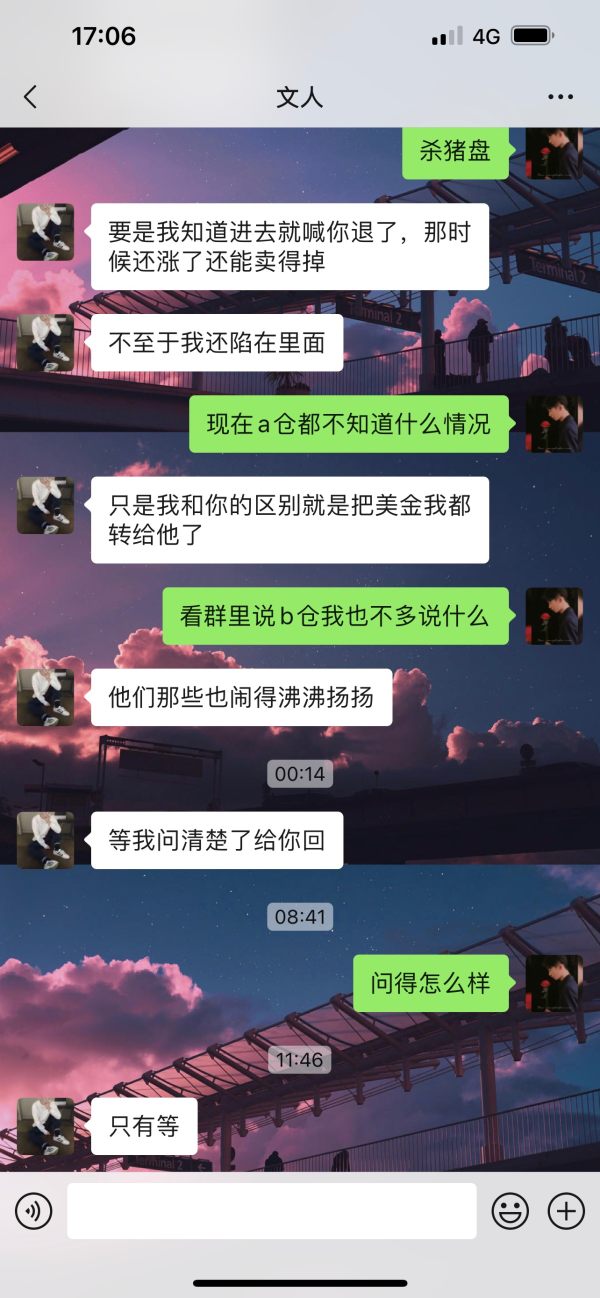

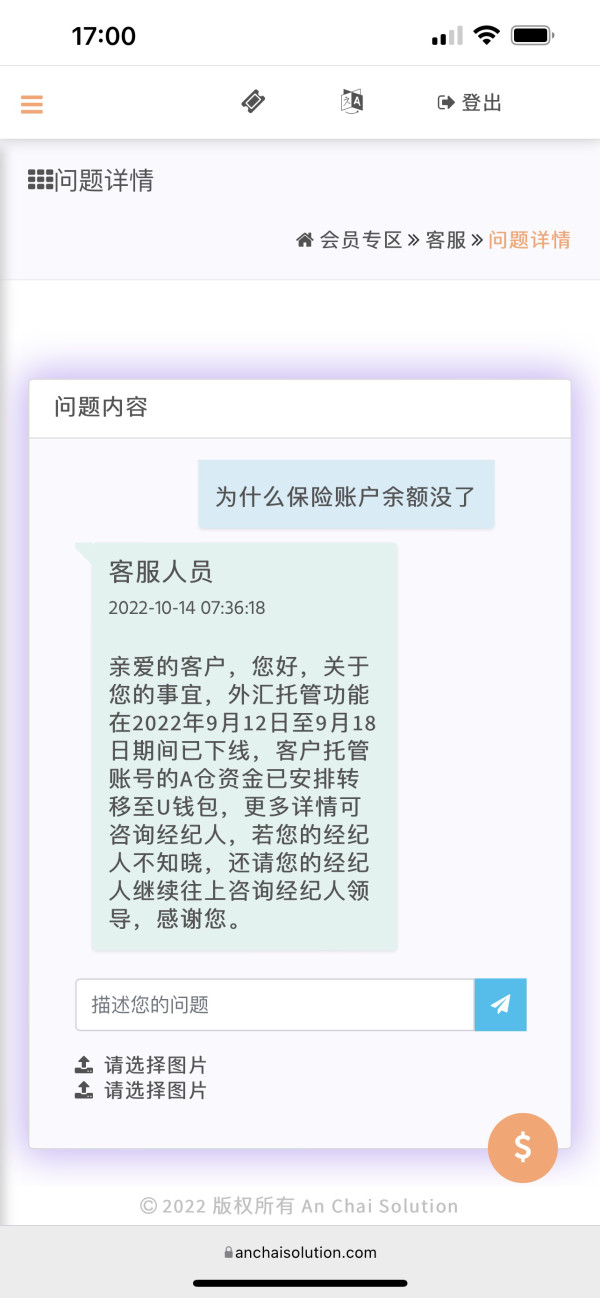

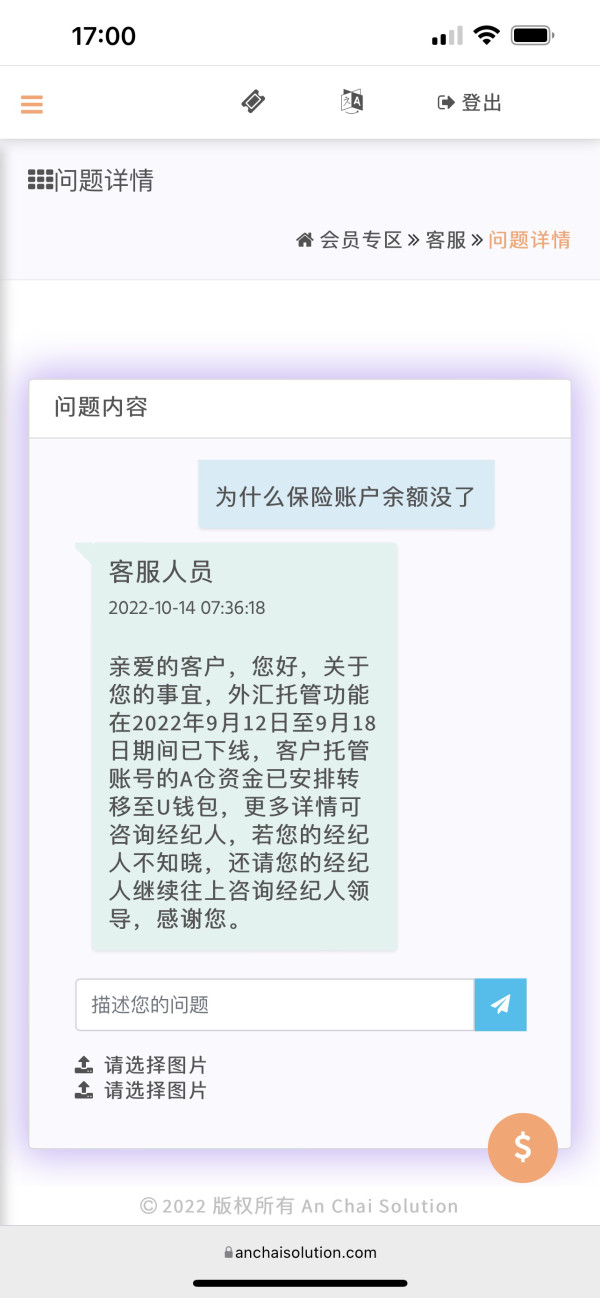

They said that I can withdraw after trading three times. Later, for half a year, they asked me to change the platform for system translation, and the website was still closed, but there was no result

CHS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They said that I can withdraw after trading three times. Later, for half a year, they asked me to change the platform for system translation, and the website was still closed, but there was no result

CHS Hedging stands out as a regulated futures commission merchant. The company provides reliable commodities brokerage services to clients seeking professional risk management solutions. This chs review reveals that the company maintains a solid reputation in the commodities trading sector, backed by over three decades of risk management experience and comprehensive market intelligence support. The firm primarily serves investors and institutions. These clients require sophisticated commodity price risk management strategies.

CHS Hedging operates under the oversight of the Commodity Futures Trading Commission and maintains membership with the National Futures Association. Employee satisfaction data from Glassdoor indicates that 75% of staff members would recommend the company, resulting in a 3 out of 5-star rating. This suggests a generally positive working environment. A good work environment often translates to better client service quality. The company's focus on commodities brokerage makes it particularly suitable for agricultural producers, food processors, energy companies, and institutional investors. These businesses need to hedge against commodity price volatility.

Potential clients should be aware that the company's operations may vary across different regions. The operations are subject to local regulatory requirements and service availability. The regulatory framework under CFTC and NFA primarily governs US operations. International clients should verify applicable regulations in their jurisdiction.

This review is based on publicly available information, regulatory filings, and user feedback compiled from various sources. The analysis aims to provide an objective assessment of CHS Hedging's services. However, potential clients should conduct their own due diligence and consider their specific trading needs before making any decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available materials |

| Tools and Resources | N/A | Specific tools and resources information not mentioned in available sources |

| Customer Service and Support | N/A | Customer service quality information not provided in available materials |

| Trading Experience | N/A | Trading platform and experience details not specified in available information |

| Trustworthiness | 9/10 | CFTC regulation, NFA membership, 75% employee recommendation rate |

| User Experience | N/A | Specific user experience information not detailed in available materials |

CHS Hedging operates as the commodities brokerage subsidiary of CHS Inc. The company brings more than 30 years of specialized experience in risk management services and education to the agricultural and commodities markets. The company has established itself as a significant player in the commodities brokerage space. It focuses primarily on helping clients navigate the complexities of commodity price volatility through comprehensive hedging strategies and market expertise.

The firm's business model centers around providing full-service commodity brokerage services. These services are designed to help clients manage commodity price risk effectively. This approach makes CHS Hedging particularly valuable for agricultural producers, energy companies, food processors, and other businesses whose operations are significantly impacted by commodity price fluctuations. The company's extensive experience in risk management education also positions it as a resource for clients seeking to improve their understanding of commodity markets.

CHS Hedging operates under the supervision of the Commodity Futures Trading Commission and maintains active membership with the National Futures Association. This regulatory framework provides clients with important protections and ensures that the company adheres to industry standards for financial integrity and business conduct. While specific details about trading platforms and asset classes are not extensively detailed in available materials, the company's focus remains firmly rooted in commodity trading and risk management services.

Regulatory Jurisdictions: CHS Hedging operates under United States regulatory oversight. The company is specifically governed by the Commodity Futures Trading Commission and maintains membership with the National Futures Association. This regulatory framework ensures compliance with US commodity trading standards.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. Clients would require direct contact with the company for current options.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in available public information. Potential clients should inquire directly with CHS Hedging for current account opening requirements.

Bonus and Promotions: Information about promotional offers or bonus programs is not mentioned in available materials. This suggests the company may focus on service quality rather than promotional incentives.

Tradeable Assets: The company primarily concentrates on commodity trading. However, specific details about the range of available commodities and markets are not comprehensively listed in public materials.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in available sources. This chs review notes that potential clients should request detailed pricing information directly from the company.

Leverage Ratios: Leverage information is not specified in available materials. This would require direct inquiry with the company.

Platform Options: Specific trading platform details are not mentioned in available public information.

Regional Restrictions: Geographic limitations are not detailed in available materials.

Customer Service Languages: Available customer service languages are not specified in public information.

The evaluation of CHS Hedging's account conditions faces limitations due to insufficient publicly available information about specific account types, features, and requirements. This chs review cannot provide a comprehensive assessment of account variety, minimum deposit requirements, or special account features such as Islamic accounts or institutional-specific offerings. The lack of detailed account information suggests that CHS Hedging may provide customized solutions rather than standardized account packages. This approach is common among specialized commodity brokers.

Potential clients would need to engage directly with the company to understand available options. This is because specific details about the account opening process, verification requirements, or account maintenance fees are not available. This approach may indicate that CHS Hedging tailors its services to individual client needs. The company particularly focuses on institutional and commercial clients who often require customized risk management solutions. The absence of readily available account condition information could be seen as either a limitation for transparency or an indication of personalized service delivery.

Account conditions likely vary significantly based on trading volume, risk management needs, and business relationships. This is especially true for agricultural producers, energy companies, and other commercial entities that typically form CHS Hedging's client base. The company's three decades of experience suggests they have developed sophisticated account structures to meet diverse client requirements. However, specific details remain undisclosed in public materials.

The assessment of CHS Hedging's tools and resources is constrained by limited publicly available information about specific trading tools, analytical resources, or educational materials. While the company emphasizes its extensive risk management experience and market intelligence support, detailed descriptions of available tools, research capabilities, or automated trading support are not specified in accessible materials.

It's reasonable to expect that the company provides specialized tools relevant to commodity trading. Given CHS Hedging's focus on commodity brokerage and risk management, these might include hedging calculators, market analysis, and price risk assessment tools. However, without specific information about the quality, variety, or accessibility of these resources, this review cannot provide a comprehensive evaluation of the company's technological offerings.

The company's emphasis on education and risk management experience suggests that they likely provide substantial support in terms of market intelligence and guidance. However, the specific format, frequency, and depth of such resources remain unclear from available public information. For clients requiring detailed information about available tools and resources, direct contact with CHS Hedging would be necessary to understand current offerings and capabilities.

Evaluating CHS Hedging's customer service and support quality is challenging due to limited publicly available information about service channels, response times, and support quality metrics. While the company's Glassdoor rating shows that 75% of employees would recommend the organization, this internal satisfaction metric may indicate positive workplace culture that could translate to better customer service. However, direct customer service feedback is not available in public materials.

The absence of detailed information about customer service hours, available communication channels, multilingual support, or response time commitments makes it difficult to assess the company's support infrastructure comprehensively. For a specialized commodity broker serving commercial clients, customer service quality is typically crucial. Clients often require timely support for time-sensitive trading decisions and risk management strategies.

It's likely that the company provides dedicated support tailored to these sophisticated users' needs. Given CHS Hedging's focus on serving agricultural producers, energy companies, and institutional clients, this specialized approach makes sense. However, without specific customer feedback or detailed service level information, potential clients would need to inquire directly about support availability, expertise levels, and service standards. This direct inquiry would help them make informed decisions about the adequacy of customer service for their specific requirements.

The evaluation of CHS Hedging's trading experience is limited by the lack of specific information about platform stability, execution speed, order execution quality, and mobile trading capabilities in available public materials. This chs review cannot provide detailed insights into the technical aspects of the trading environment, platform functionality, or user interface design based on current information sources.

Trading experience factors such as real-time market data accuracy, execution speed during volatile market conditions, and platform reliability during peak trading hours are crucial considerations. For a commodity-focused brokerage, these elements are particularly important. However, without specific user feedback about platform performance, execution quality, or technical issues, it's challenging to assess how well CHS Hedging's trading infrastructure meets client expectations.

The company's three decades of experience in commodity markets suggests they have developed robust systems to handle commodity trading requirements. However, specific details about platform features, mobile accessibility, order types, and trading tools remain undisclosed in available materials. Potential clients interested in understanding the trading experience would need to request platform demonstrations or trial access. This would allow them to evaluate the technical capabilities and user experience firsthand.

CHS Hedging demonstrates strong trustworthiness credentials through its regulatory status with the Commodity Futures Trading Commission and membership in the National Futures Association. These regulatory relationships provide important oversight and client protection measures that are essential for commodity trading operations. The CFTC's supervision ensures compliance with federal commodity trading regulations. Meanwhile, NFA membership adds an additional layer of industry self-regulation and ethical standards.

The company's 75% employee recommendation rate, while not directly related to client trust, suggests positive internal culture and operational stability that often correlates with reliable client service. This internal satisfaction metric, combined with the company's three decades of operation in the commodity brokerage space, indicates organizational stability and continuity. Clients can rely upon this stability for long-term business relationships.

Specific information about fund security measures, segregated account policies, insurance coverage, or transparency initiatives is not detailed in available materials. While regulatory oversight provides fundamental protections, additional details about the company's specific risk management practices, financial strength, and client fund protection measures would enhance the trustworthiness assessment. The absence of reported negative events or regulatory actions in available information suggests a clean operational record. However, comprehensive due diligence would require direct verification of regulatory standing and financial stability.

User experience evaluation for CHS Hedging is primarily informed by the employee satisfaction data showing that 75% of staff would recommend the company, resulting in a 3 out of 5-star Glassdoor rating. While this internal metric doesn't directly reflect client experience, it provides insights into organizational culture and operational satisfaction that may influence service delivery quality.

The company's target user base consists primarily of agricultural producers, energy companies, food processors, and institutional investors who require sophisticated commodity risk management services. For these commercial clients, user experience factors likely focus more on service quality, expertise, and relationship management rather than consumer-oriented features like user interface design or simplified onboarding processes.

This review cannot provide comprehensive insights into the actual user experience. Without specific information about the registration process, verification procedures, platform usability, or common client feedback, a thorough assessment is not possible. The specialized nature of commodity brokerage services suggests that CHS Hedging's user experience is likely tailored to professional users who prioritize functionality, reliability, and expert support over consumer-friendly features. Potential clients would need to engage directly with the company to evaluate whether the user experience aligns with their specific business requirements and operational preferences.

CHS Hedging presents itself as a well-established and regulated commodity brokerage firm with over 30 years of specialized experience in risk management services. The company's regulatory standing with the CFTC and NFA membership provides important credibility and client protection measures that are essential for commodity trading operations. The positive employee satisfaction metrics suggest organizational stability and operational quality. These factors may translate to reliable client service.

This broker appears most suitable for agricultural producers, energy companies, food processors, and institutional investors who require specialized commodity trading services and sophisticated risk management strategies. The company's focus on commercial clients and emphasis on education and market intelligence support makes it particularly appropriate for businesses whose operations are significantly impacted by commodity price volatility.

The main limitation identified in this evaluation is the lack of publicly available information about specific trading conditions, tools, platforms, and service details. While this may indicate a personalized service approach common among specialized commercial brokers, potential clients should conduct thorough due diligence and direct communication with CHS Hedging. This communication will help them understand current offerings, terms, and capabilities before making trading decisions.

FX Broker Capital Trading Markets Review