Artsmrkts 2025 Review: Everything You Need to Know

Executive Summary

Artsmrkts is a forex broker registered in Saint Vincent and the Grenadines. It has been operating under SVG FSA registration since 2018. While the company is registered with SVG FSA, this regulatory body does not oversee forex trading activities, which significantly impacts the overall trust rating of this broker. This artsmrkts review reveals that the platform requires a minimum deposit of 500 USD. It offers maximum leverage of 1:300, utilizing the MetaTrader 4 trading platform for its operations.

The broker primarily targets small to medium-sized investors who seek high-leverage trading opportunities. According to Trustpilot reviews, 89% of users have given 5-star ratings. This indicates high user satisfaction levels. However, the lack of comprehensive regulatory oversight remains a significant concern for potential investors. Artsmrkts offers trading in CFDs, Rolling Spot Forex/FX CFDs, futures, and options. The company emphasizes the high-risk nature of these instruments. The platform's headquarters are located in Saint Lucia, specifically at Suite Number 3 at Place Creole - Rodney Bay Gros Islet. It operates under registered number 2023-00238.

Important Notice

Due to Artsmrkts being registered solely in Saint Vincent and the Grenadines, investors should be aware of the limited regulatory protection available. The SVG FSA registration does not provide the same level of oversight and consumer protection typically found with major regulatory bodies like the FCA, ASIC, or CySEC. This review is based on comprehensive analysis of publicly available information, user feedback, and official company documentation. Potential clients should carefully consider the regulatory limitations. They should conduct their own due diligence before engaging with this broker's services.

Rating Framework

Broker Overview

Artsmrkts was established in 2018. It has positioned itself as a forex and CFD trading provider catering primarily to retail investors. The company operates from Saint Lucia, with its registered office at Suite Number 3 at Place Creole - Rodney Bay Gros Islet, Saint Lucia, West Indies. Incorporated under registered number 2023-00238 by the Registrar of International Business Companies, Artsmrkts Limited focuses on providing online trading services to small and medium-sized investors. These investors seek access to leveraged trading opportunities.

The broker operates on a business model that emphasizes high-risk, high-reward trading instruments. According to the company's official documentation, clients should only engage in CFD, Rolling Spot Forex/FX CFD, futures, or options trading if they are prepared to accept a high degree of risk. This transparent approach to risk disclosure suggests the company targets experienced traders. It also targets those willing to accept significant market exposure in pursuit of potentially higher returns.

Artsmrkts utilizes the MetaTrader 4 platform as its primary trading interface. It supports multiple device types for enhanced accessibility. The platform offers trading in various asset classes including CFDs, Rolling Spot Forex/FX CFDs, futures, and options trading. While registered with SVG FSA, the broker operates without the comprehensive regulatory oversight typically associated with major financial centers. Potential clients should carefully consider this when evaluating the platform for their trading needs.

Regulatory Jurisdiction: Artsmrkts is registered in Saint Vincent and the Grenadines under SVG FSA oversight. However, it's crucial to understand that SVG FSA does not regulate forex trading activities. This means the broker operates with minimal regulatory supervision compared to brokers licensed by major regulatory bodies.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available documentation. The company does specify support contact through support@artsmrkts.com for operational inquiries.

Minimum Deposit Requirements: The broker requires a minimum deposit of 500 USD. This positions it in the mid-range category for entry-level requirements, potentially limiting access for smaller retail investors.

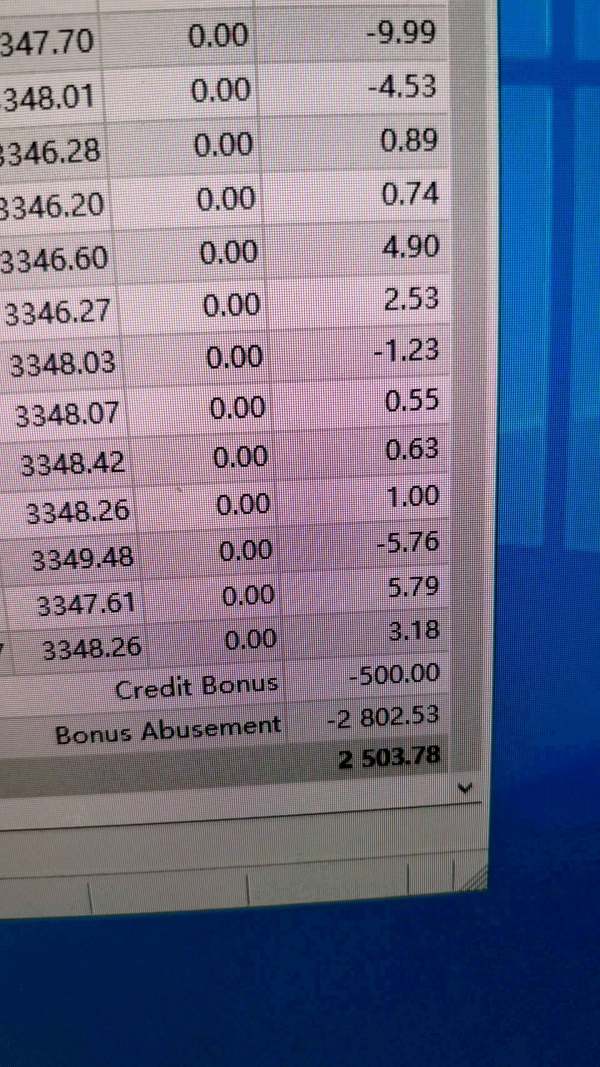

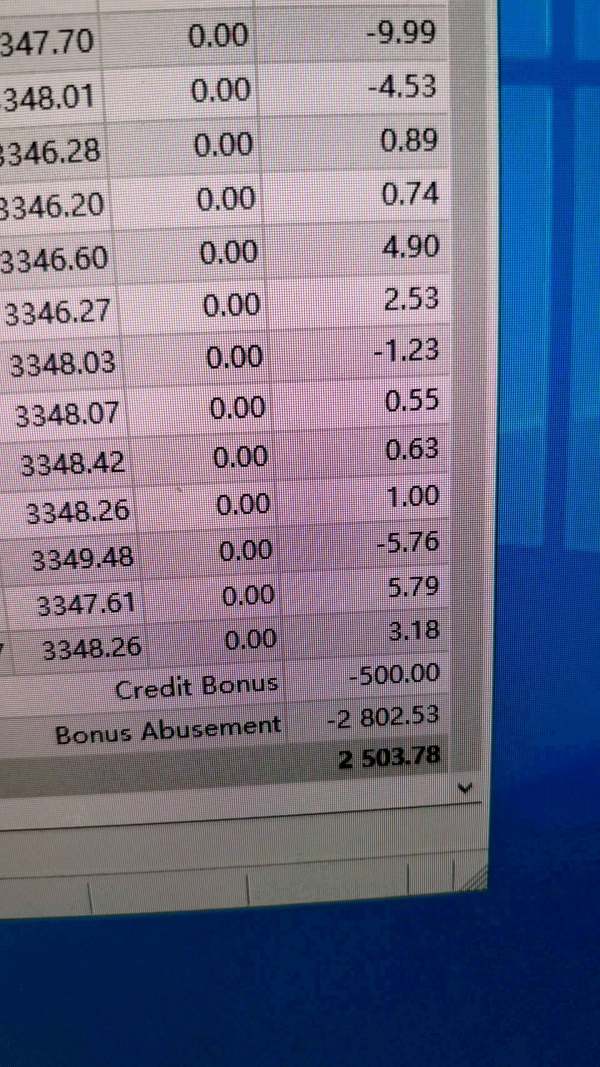

Bonus and Promotional Offers: Available information indicates the company offers welcome bonuses for new account holders. Specific terms and conditions of these promotional offers were not detailed in the reviewed materials.

Tradeable Assets: The platform supports trading in CFDs, Rolling Spot Forex/FX CFDs, futures, and options. The company emphasizes that these instruments carry high risk. They are suitable only for traders prepared to accept significant market exposure.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs was not provided in available documentation. Traders should expect costs associated with high-leverage trading instruments.

Leverage Ratios: Artsmrkts offers maximum leverage of 1:300. This is competitive within the industry and appeals to traders seeking significant market exposure with relatively smaller capital requirements.

Platform Options: The primary trading platform is MetaTrader 4. It supports multiple device types and provides standard charting and analysis tools expected from this widely-used platform.

Geographic Restrictions: Specific information regarding geographic trading restrictions was not detailed in available materials.

Customer Support Languages: Available documentation does not specify the range of languages supported by customer service teams.

This comprehensive artsmrkts review highlights both the opportunities and limitations present with this broker. It particularly focuses on regulatory oversight and transparency of trading conditions.

Account Conditions Analysis

Artsmrkts' account structure appears relatively straightforward. Specific details about different account types were not extensively documented in available materials. The broker's minimum deposit requirement of 500 USD places it in a middle-tier category that may exclude smaller retail investors while remaining accessible to serious traders with moderate capital. This deposit threshold suggests the broker targets clients who are committed to substantial trading activity. It does not target casual market participants.

The account opening process details were not comprehensively outlined in available documentation. The company provides contact information through support@artsmrkts.com for inquiries. The lack of detailed information about specialized account features, such as Islamic accounts for Sharia-compliant trading, represents a transparency gap. Potential clients may find this concerning when comparing options.

When compared to other brokers in the market, the 500 USD minimum deposit is notably higher than many competitors. Many competitors offer account access with deposits as low as 10-50 USD. This higher barrier to entry may limit the broker's appeal to novice traders or those seeking to test the platform with minimal initial investment. The absence of detailed information about account tiers, benefits, or progression structures further complicates the evaluation process for potential clients.

The overall account conditions reflect a broker positioned for more serious traders rather than beginners. The lack of comprehensive documentation about account features and benefits represents a significant limitation in this artsmrkts review. Potential clients should contact the broker directly to obtain detailed information about account structures and associated benefits.

Artsmrkts provides the MetaTrader 4 platform as its primary trading interface. It offers standard charting capabilities, technical analysis tools, and automated trading support that experienced traders expect from this established platform. MetaTrader 4's inclusion suggests the broker recognizes the importance of providing familiar, reliable trading infrastructure. This infrastructure supports both manual and algorithmic trading strategies.

However, available documentation does not detail additional proprietary tools, advanced analytical resources, or comprehensive market research that could differentiate the broker from competitors. The absence of information about economic calendars, market analysis reports, or specialized trading calculators represents a significant gap in the platform's resource offering. This is based on what was presented in available materials.

Educational resources, which are crucial for trader development and platform adoption, were not specifically outlined in the reviewed documentation. This lack of educational content information is concerning for potential clients who value broker-provided learning materials. These clients appreciate webinars or trading guides that can enhance their market understanding and platform utilization.

The platform's support for automated trading through MetaTrader 4 is implied but not explicitly detailed. This leaves questions about the extent of algorithmic trading capabilities, expert advisor support, or custom indicator development. While MetaTrader 4 inherently supports these features, the broker's specific policies and support for automated strategies remain unclear from available information.

Overall, the tools and resources evaluation reveals a basic but functional trading environment centered around MetaTrader 4. The lack of detailed information about additional resources, educational materials, and specialized tools limits the comprehensive assessment of the broker's complete offering.

Customer Service and Support Analysis

Artsmrkts provides customer support primarily through email contact at support@artsmrkts.com. The availability of additional support channels such as telephone support, live chat, or comprehensive help desk services was not detailed in available documentation. This limited information about customer service infrastructure raises questions about the broker's commitment to comprehensive client support and accessibility.

The absence of information regarding response times, service quality metrics, or customer satisfaction data makes it difficult to assess the effectiveness of the support system. For a financial services provider, transparent communication about support availability, response timeframes, and problem resolution processes is typically expected by clients. These clients may need assistance during critical trading situations.

Multi-language support capabilities were not specified in available materials. This could be a significant limitation for international clients who prefer support in their native languages. Similarly, information about customer service operating hours, time zone coverage, or 24/7 availability was not provided. This leaves potential clients uncertain about when support will be accessible.

The lack of detailed information about customer service training, expertise levels, or specialized support for complex trading issues represents another gap in the available documentation. Clients typically expect support representatives to understand platform functionality, trading concepts, and account management procedures thoroughly.

While the provision of an email contact point demonstrates basic support infrastructure, the overall customer service evaluation is limited by insufficient information. This includes information about the breadth, quality, and accessibility of support services. Potential clients should directly inquire about comprehensive support capabilities before committing to the platform.

Trading Experience Analysis

The trading experience evaluation for Artsmrkts is primarily supported by Trustpilot ratings. These ratings show 89% of users providing 5-star reviews, suggesting generally positive client experiences with the platform. However, specific technical performance data regarding platform stability, execution speeds, or order processing quality was not detailed in available documentation. This limits the depth of trading experience assessment.

MetaTrader 4's inclusion as the primary platform suggests users can expect standard functionality. This includes real-time charting, technical analysis capabilities, and order management tools that are characteristic of this established trading platform. However, broker-specific customizations, enhanced features, or performance optimizations were not described in available materials.

Order execution quality, including information about slippage rates, requote frequency, or execution speed benchmarks, was not provided in the reviewed documentation. These technical performance metrics are crucial for traders who require reliable, fast execution for their strategies. This is particularly important in volatile market conditions.

The mobile trading experience details were not specifically outlined. MetaTrader 4 typically includes mobile applications. However, the quality of mobile implementation, feature completeness, or user interface optimization for mobile devices remains unclear from available information.

Trading environment factors such as spread stability, liquidity provision, or market depth information were not detailed in available materials. While user ratings suggest satisfaction, the absence of specific technical performance data limits the comprehensive evaluation. This affects the assessment of actual trading experience quality that clients can expect from the platform.

Trust and Regulation Analysis

Artsmrkts operates under registration with SVG FSA. This stands for Saint Vincent and the Grenadines Financial Services Authority. However, this regulatory body does not oversee forex trading activities. This regulatory limitation significantly impacts the broker's trust rating as clients lack the comprehensive consumer protections typically associated with major regulatory jurisdictions. These jurisdictions include the UK's FCA, Australia's ASIC, or Cyprus's CySEC.

The absence of robust regulatory oversight means that standard investor protection measures may not be enforced to the same standards expected from fully regulated brokers. These measures include segregated client funds, compensation schemes, or mandatory financial reporting. This regulatory gap represents a substantial risk factor that potential clients must carefully consider when evaluating the platform.

Information regarding specific fund safety measures, client money segregation policies, or insurance coverage was not detailed in available documentation. The lack of transparency about financial safeguards and asset protection mechanisms further compounds the trust concerns. These concerns arise from limited regulatory oversight.

The company's incorporation under registered number 2023-00238 in Saint Lucia provides basic corporate structure. It does not address the regulatory supervision gap that affects client protection and operational oversight. The absence of information about third-party audits, financial reporting, or compliance monitoring represents additional transparency limitations.

Industry recognition, awards, or positive regulatory assessments were not mentioned in available materials. No information was provided about the company's handling of complaints or regulatory issues. The overall trust evaluation reflects significant concerns about regulatory protection and transparency. Potential clients should carefully weigh these concerns against other platform factors.

User Experience Analysis

User satisfaction data from Trustpilot shows exceptionally positive feedback. 89% of reviewers provide 5-star ratings and 11% give 4-star ratings, resulting in no negative ratings in the available sample. This overwhelmingly positive user sentiment suggests that clients who engage with the platform generally report satisfactory experiences. The specific aspects driving this satisfaction were not detailed in available reviews.

The platform's interface design, ease of navigation, and overall usability were not comprehensively described in available documentation. The use of MetaTrader 4 suggests users can expect familiar functionality if they have previous experience with this widely-adopted platform. However, broker-specific interface customizations or user experience enhancements remain unclear.

Account registration and verification processes were not detailed in available materials. This leaves questions about the complexity, time requirements, or documentation needed for account setup. Streamlined onboarding processes are typically important factors in overall user experience. This is particularly true for new clients unfamiliar with the platform.

Fund management operations were not specifically addressed in available documentation. This includes deposit and withdrawal experiences, processing times, or user interface quality for financial transactions. These operational aspects significantly impact user satisfaction and platform adoption rates.

The target user profile appears to include small to medium-sized investors seeking high-leverage trading opportunities. Specific user demographics or trading patterns were not detailed. The high user satisfaction ratings suggest the platform successfully serves its intended audience. This is despite limitations in available information about specific user experience features and improvements.

Conclusion

This comprehensive artsmrkts review reveals a forex broker that presents both opportunities and significant limitations for potential clients. Artsmrkts operates as a Saint Vincent and the Grenadines-registered broker offering MetaTrader 4-based trading with competitive leverage up to 1:300. The lack of effective regulatory oversight represents a substantial concern for risk-conscious investors.

The broker appears most suitable for experienced small to medium-sized investors who are comfortable with high-leverage trading. These investors understand the implications of limited regulatory protection. The exceptionally positive user ratings suggest that clients who engage with the platform generally report satisfactory experiences. This should be weighed against the regulatory limitations.

Key advantages include competitive leverage ratios, positive user feedback, and the familiar MetaTrader 4 platform. Significant disadvantages encompass weak regulatory oversight, relatively high minimum deposits, and limited transparency about trading conditions and platform features. Potential clients should carefully consider these factors. They should conduct thorough due diligence before engaging with this broker's services.