Is ARTSMRKTS safe?

Software Index

License

Is Artsmrkts Safe or Scam?

Introduction

Artsmrkts is a forex brokerage that positions itself as a competitive player in the ever-evolving foreign exchange market. As a trading platform, it claims to offer a range of services aimed at both novice and experienced traders, including attractive cashback offers and a variety of account types. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and unregulated entities makes it imperative for traders to conduct thorough evaluations of any brokerage before investing their funds. This article aims to investigate the safety and legitimacy of Artsmrkts by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory framework within which a forex broker operates is critical to its legitimacy and safety. Regulatory bodies enforce standards that protect traders and ensure fair practices within the market. Unfortunately, Artsmrkts lacks valid regulatory oversight, which raises significant concerns about its safety.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that Artsmrkts is not held accountable to any governing authority, which increases the risk of fraudulent activities. Traders should be particularly wary of brokers that operate without regulatory oversight, as this can lead to issues such as fund mismanagement and lack of recourse in the event of disputes. The quality of regulation is paramount, and without it, Artsmrkts may not offer the same level of protection that regulated brokers do.

Company Background Investigation

Artsmrkts claims to have been established in 2007, positioning itself as an industry leader in providing forex rebates. However, limited information is available regarding its ownership structure and the backgrounds of its management team. Transparency is a key factor when assessing a broker's reliability.

The lack of detailed information about the company's history, ownership, and operational structure raises red flags about its transparency. A brokerage that does not openly share this information may not be fully committed to ethical trading practices. Furthermore, the absence of a well-defined leadership team with relevant experience can be indicative of potential operational weaknesses.

Trading Conditions Analysis

When evaluating the safety of a forex broker, it is essential to analyze the trading conditions they offer. Artsmrkts promotes itself with competitive spreads and rebates, but the specifics of its fee structure warrant scrutiny.

| Fee Type | Artsmrkts | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The spread offered by Artsmrkts is notably higher than the industry average, which could impact traders' profitability. Additionally, the absence of a commission model may initially seem attractive, but it could be a strategy to offset costs through wider spreads. Traders should be aware of any hidden fees or unexpected charges that could arise during their trading activities.

Client Fund Security

The safety of client funds is a significant concern for any trader. Artsmrkts has not provided clear information regarding its fund security measures. Effective brokers typically implement segregated accounts to ensure that client funds are kept separate from the company's operational funds.

Furthermore, investor protection schemes, such as negative balance protection, are crucial for safeguarding traders against significant losses. Unfortunately, Artsmrkts does not appear to offer these protections, which raises concerns about the safety of client funds. Any historical issues related to fund security could further erode trust in the brokerage.

Customer Experience and Complaints

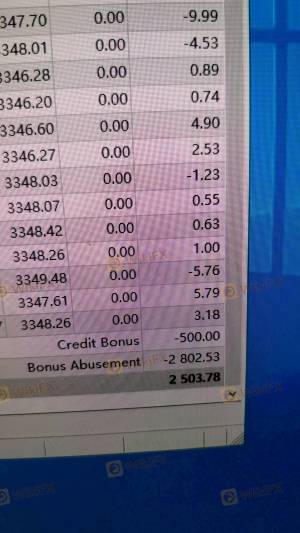

Customer feedback is a valuable indicator of a broker's reliability. Artsmrkts has received mixed reviews from users, with common complaints revolving around slow customer service responses and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Unresponsiveness | Medium | Fair |

Several users have reported significant delays in processing withdrawals, which can be a major red flag. A broker that fails to respond to withdrawal requests in a timely manner may be engaging in unethical practices. Additionally, the quality of customer service is crucial for resolving issues, and Artsmrkts appears to struggle in this area.

Platform and Execution

The trading platform provided by Artsmrkts is another critical aspect to consider. A reliable platform should offer stable performance, fast execution, and a user-friendly interface. However, reports of slippage and order rejections have surfaced, raising questions about the platform's reliability.

Traders have expressed concerns about the execution quality, with some experiencing significant delays during high volatility periods. Such issues can lead to missed trading opportunities and financial losses. Furthermore, any signs of platform manipulation should be taken seriously, as they can indicate a lack of integrity on the part of the broker.

Risk Assessment

Using Artsmrkts presents a range of risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases fraud risk. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Given the high regulatory and fund security risks, traders should approach Artsmrkts with caution. It is advisable to consider alternative brokers that offer robust regulatory frameworks and better client fund protection.

Conclusion and Recommendations

In conclusion, the investigation into Artsmrkts raises significant concerns about its safety and legitimacy. The absence of regulation, combined with a lack of transparency and poor customer feedback, suggests that traders should exercise extreme caution. While the broker offers attractive cashback and competitive spreads, the potential risks outweigh the benefits.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated and have a proven track record of client satisfaction. Ultimately, the question of "Is Artsmrkts safe?" leans towards a cautious "no," and traders should prioritize their safety by opting for more reputable options in the forex market.

Is ARTSMRKTS a scam, or is it legit?

The latest exposure and evaluation content of ARTSMRKTS brokers.

ARTSMRKTS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ARTSMRKTS latest industry rating score is 1.96, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.96 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.