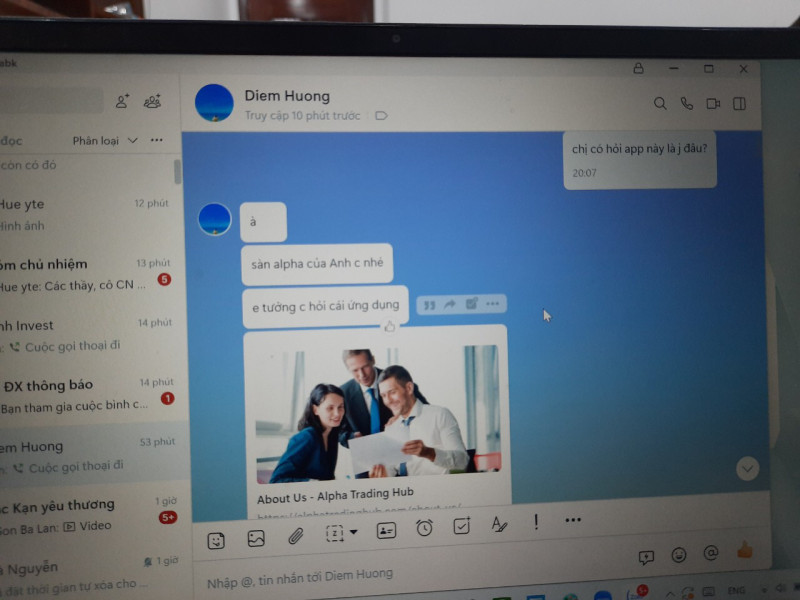

Alpha Trading Hub 2025 Review: Everything You Need to Know

Summary: The Alpha Trading Hub has garnered considerable skepticism within the online trading community, primarily due to its unregulated status and numerous complaints regarding withdrawal issues. While it presents a range of trading instruments and platforms, the overall consensus leans towards caution when considering this broker.

Note: It is essential to recognize that Alpha Trading Hub operates under different jurisdictions, which can significantly impact users' experiences. This review aims to provide a balanced view based on available information for accuracy and fairness.

Rating Overview

We evaluate brokers based on user feedback, expert analyses, and factual data.

Broker Overview

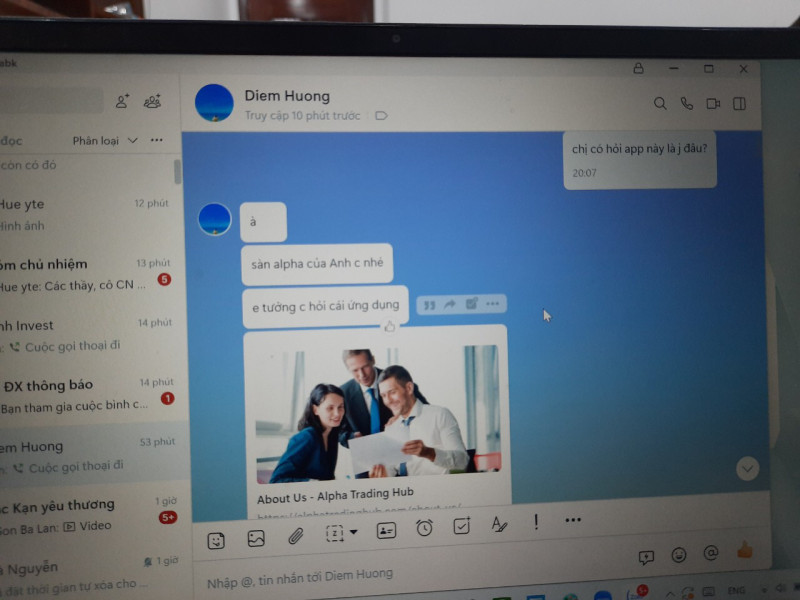

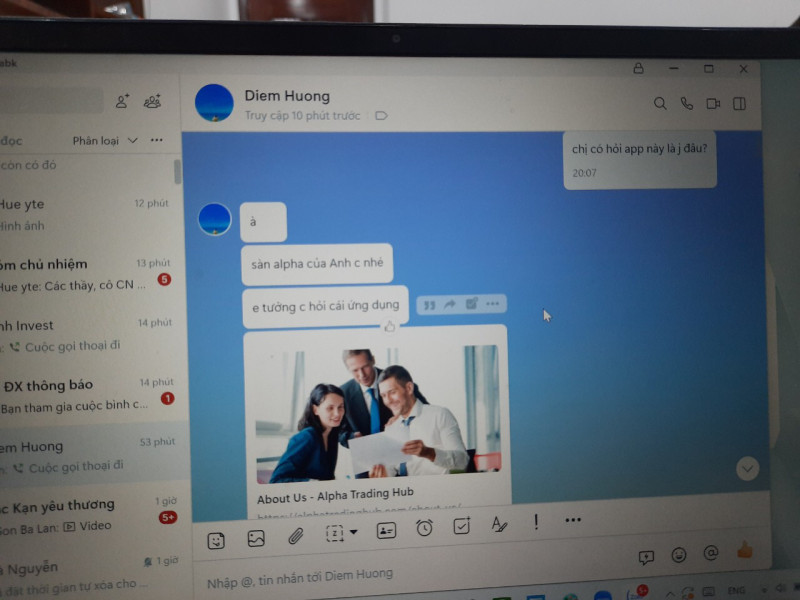

Founded in 2015, Alpha Trading Hub claims to be a global online trading provider offering access to various financial instruments, including forex, CFDs, indices, precious metals, energies, and cryptocurrencies. The broker operates on the MetaTrader 5 platform, which is widely recognized for its advanced trading capabilities. However, it lacks regulation from any major financial authority, with its only license originating from the Mwali International Services Authority, which raises significant concerns regarding its reliability.

Detailed Sections

Regulated Geographic Areas/Regions:

Alpha Trading Hub is primarily registered in Comoros, which is considered an offshore jurisdiction. This lack of robust regulatory oversight is a critical factor for potential traders to consider, as it can lead to increased risks associated with trading.

Deposit/Withdrawal Currencies/Cryptocurrencies:

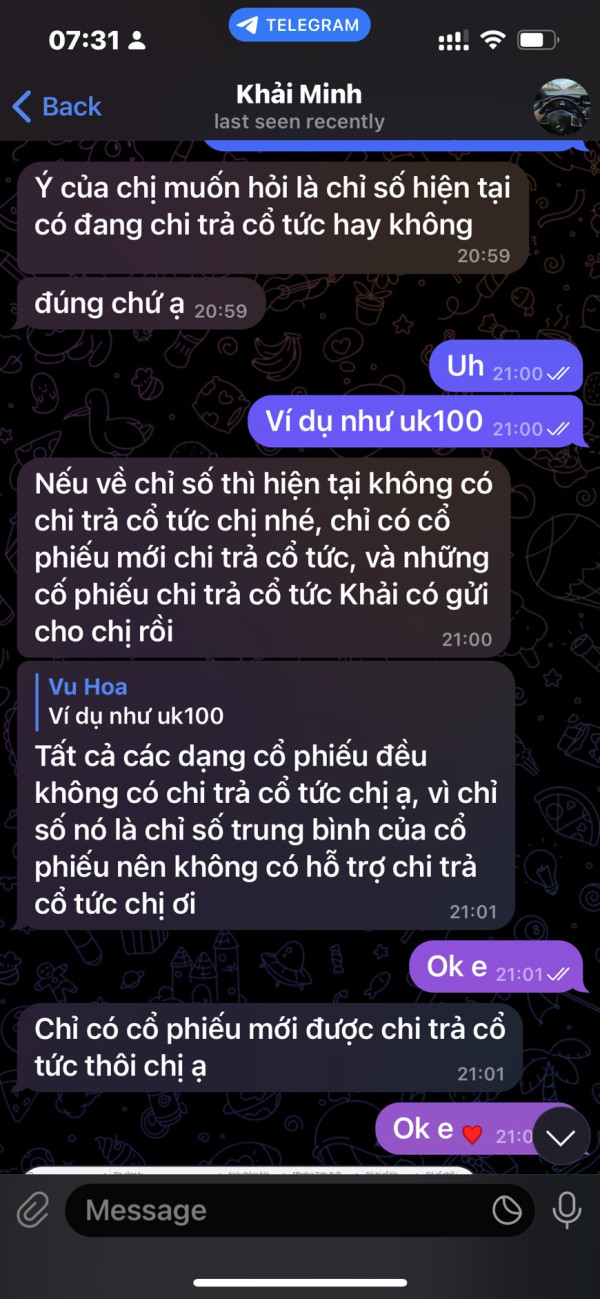

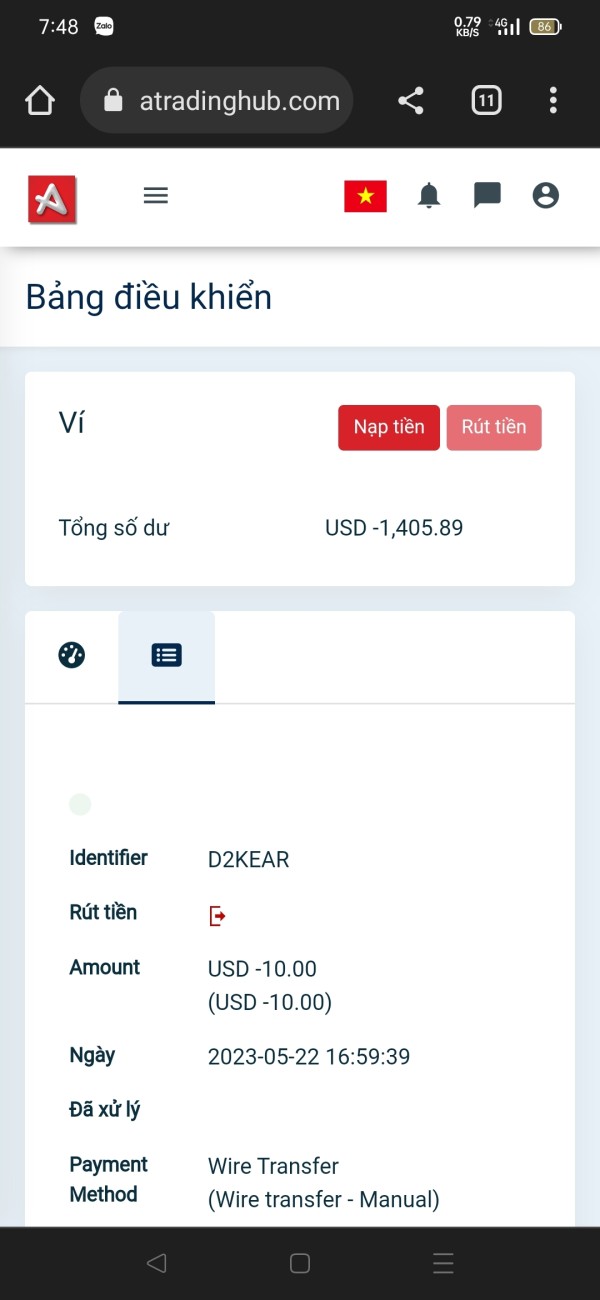

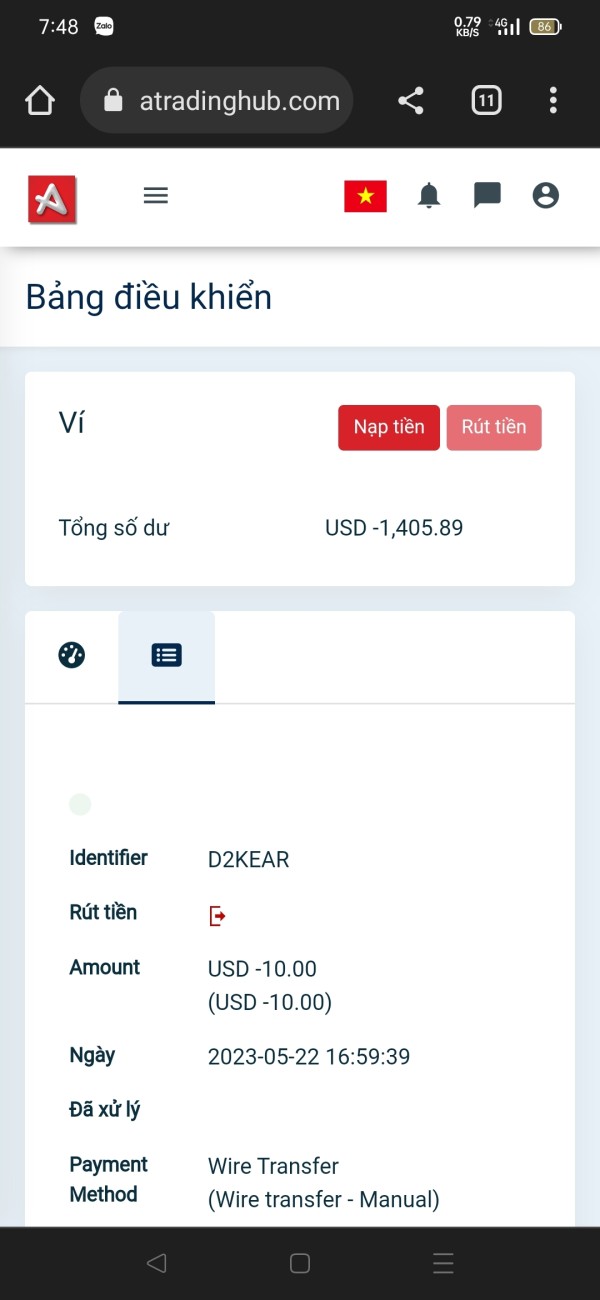

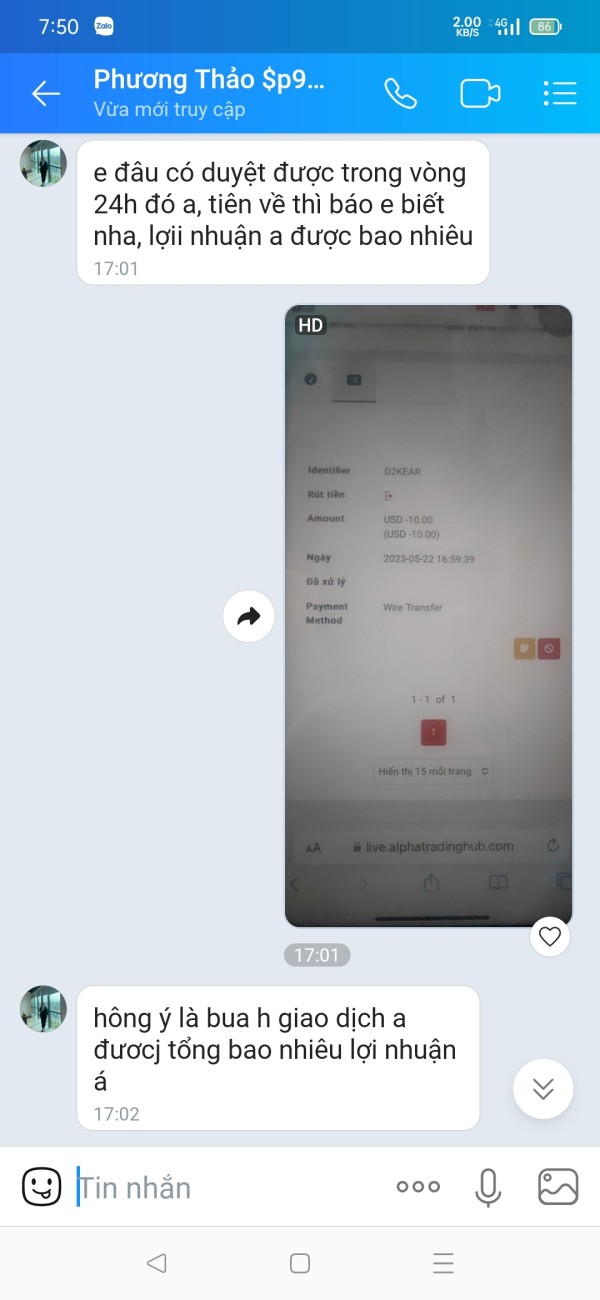

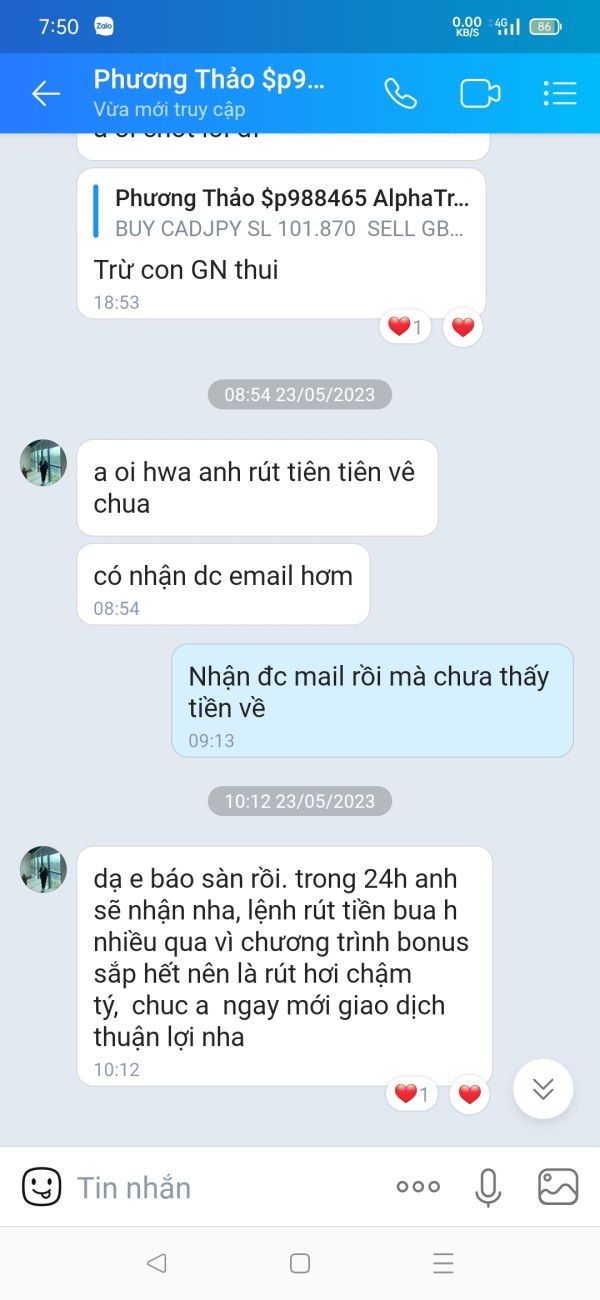

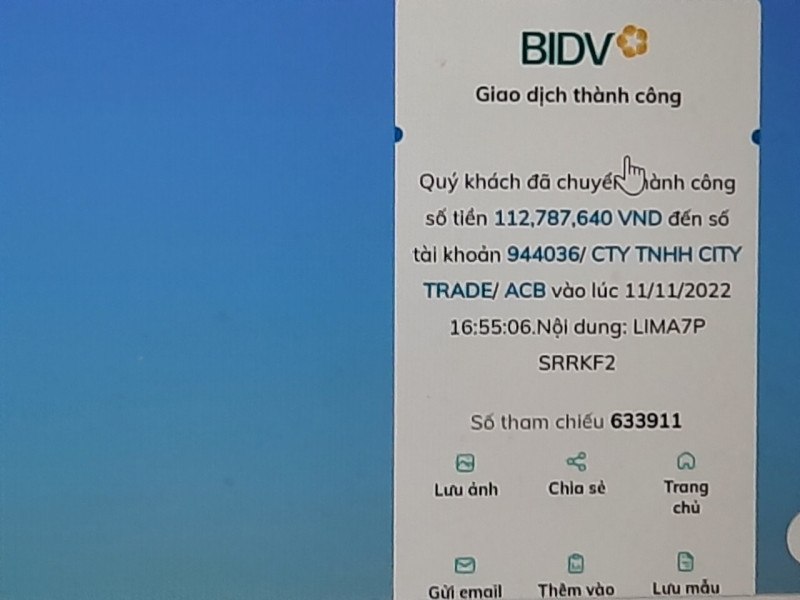

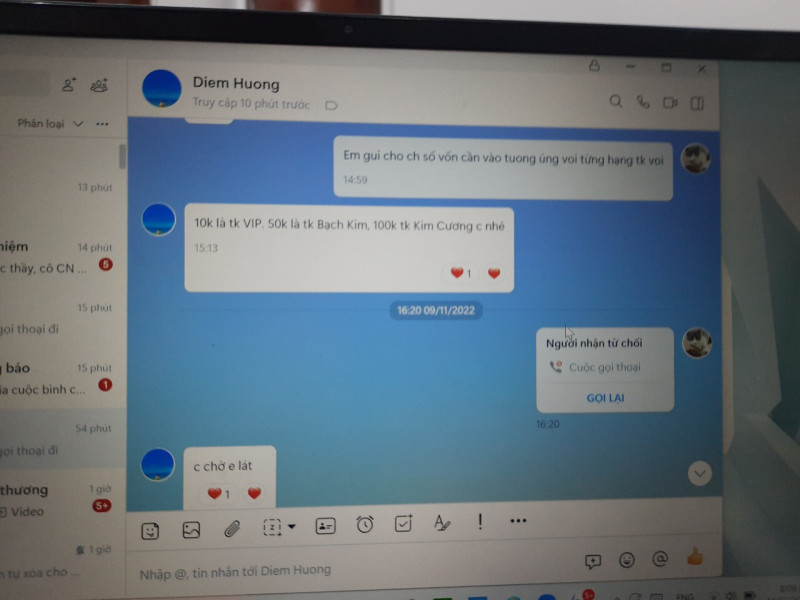

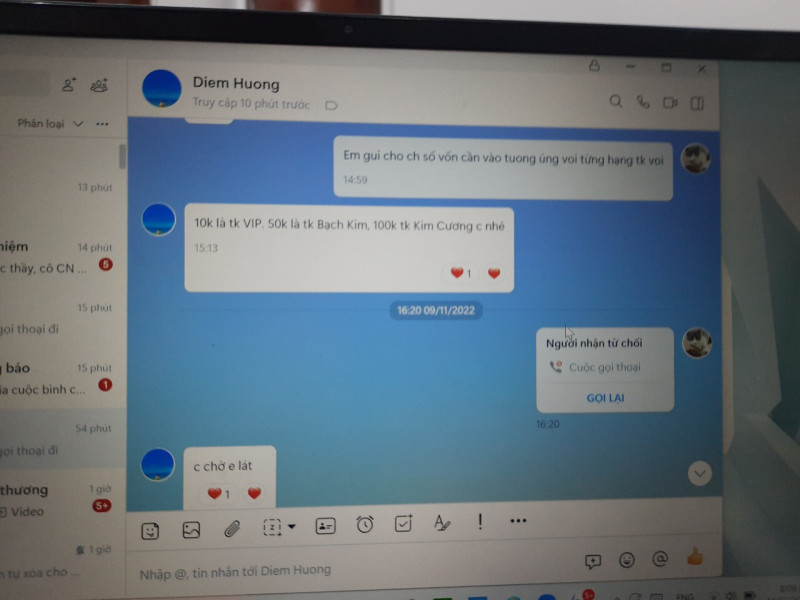

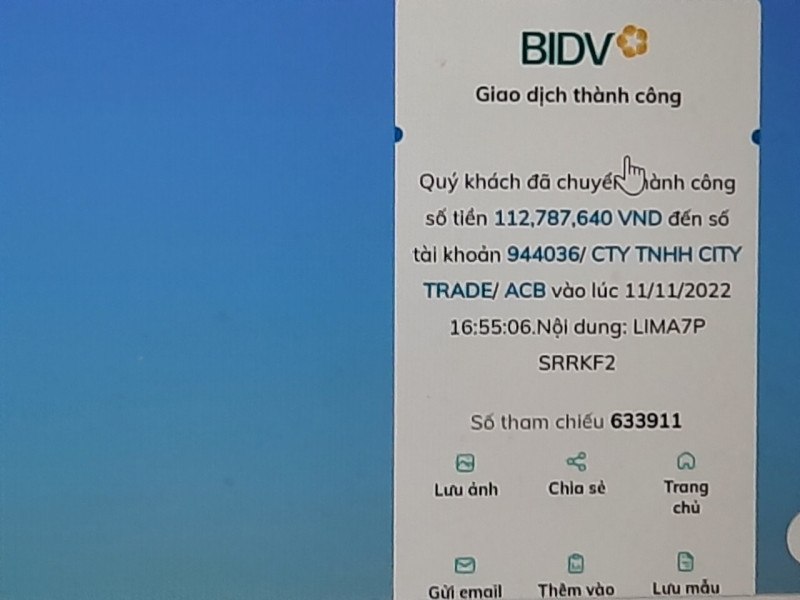

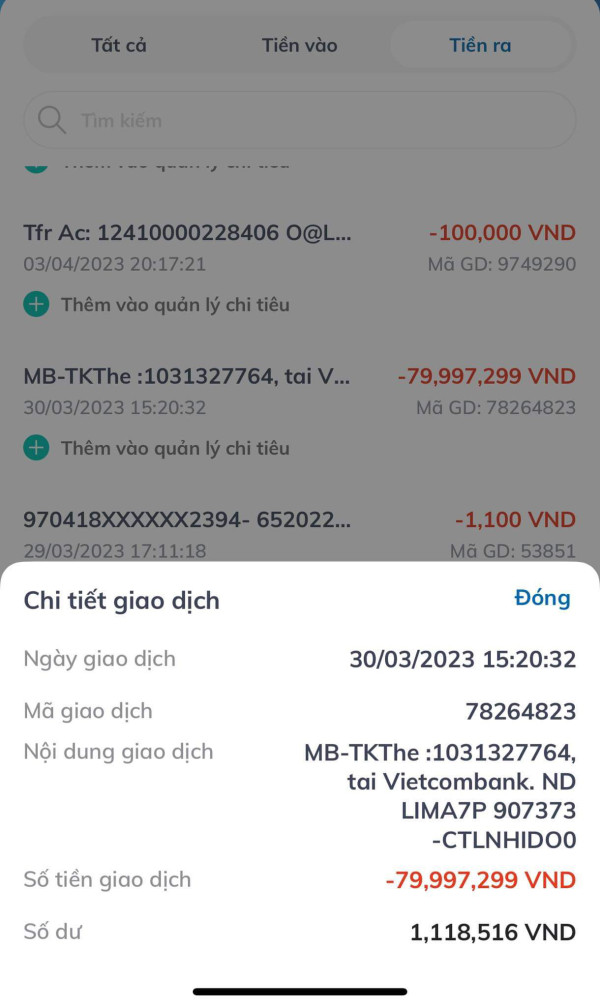

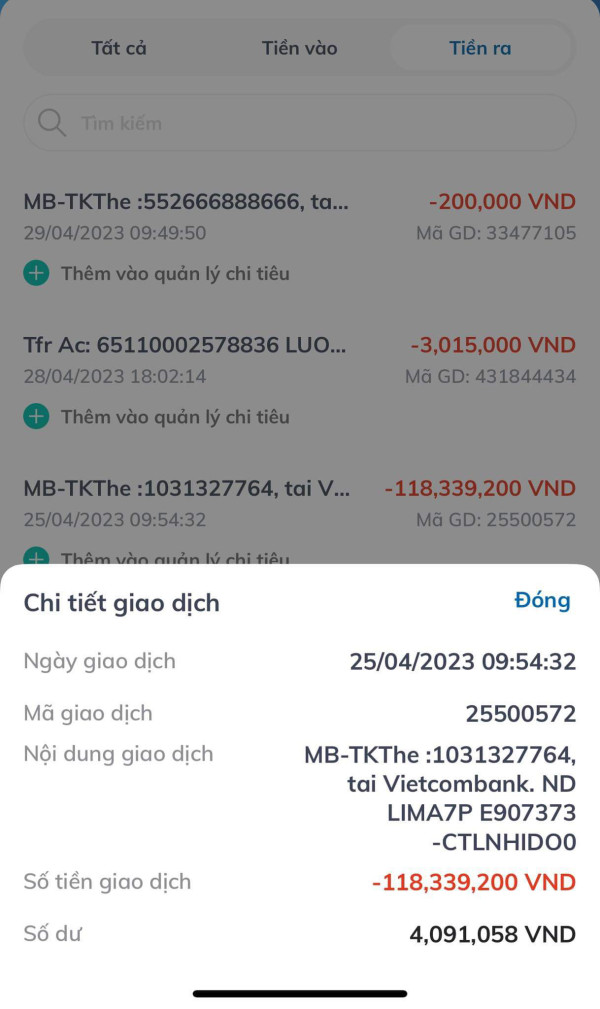

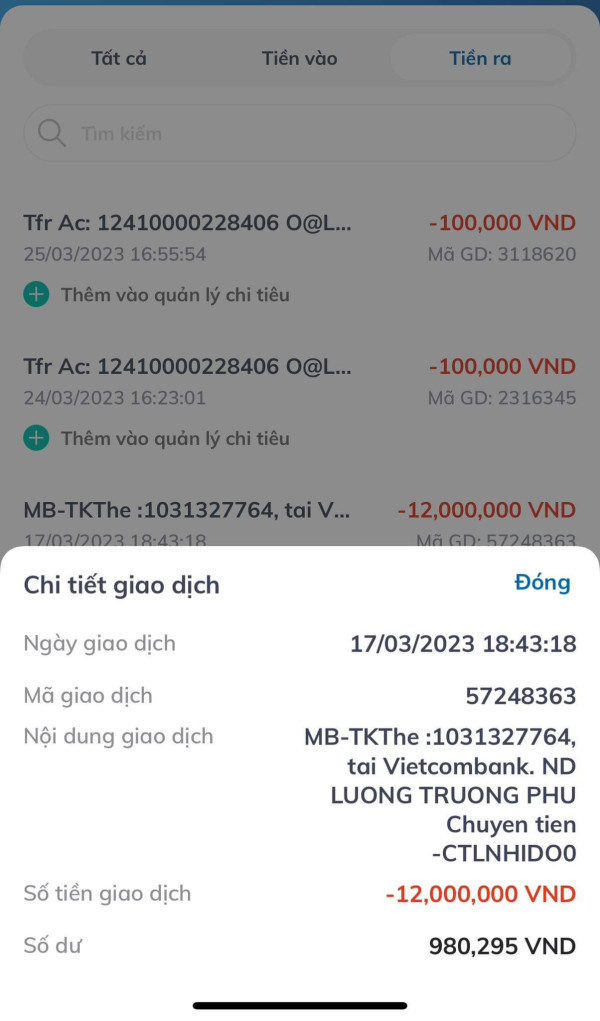

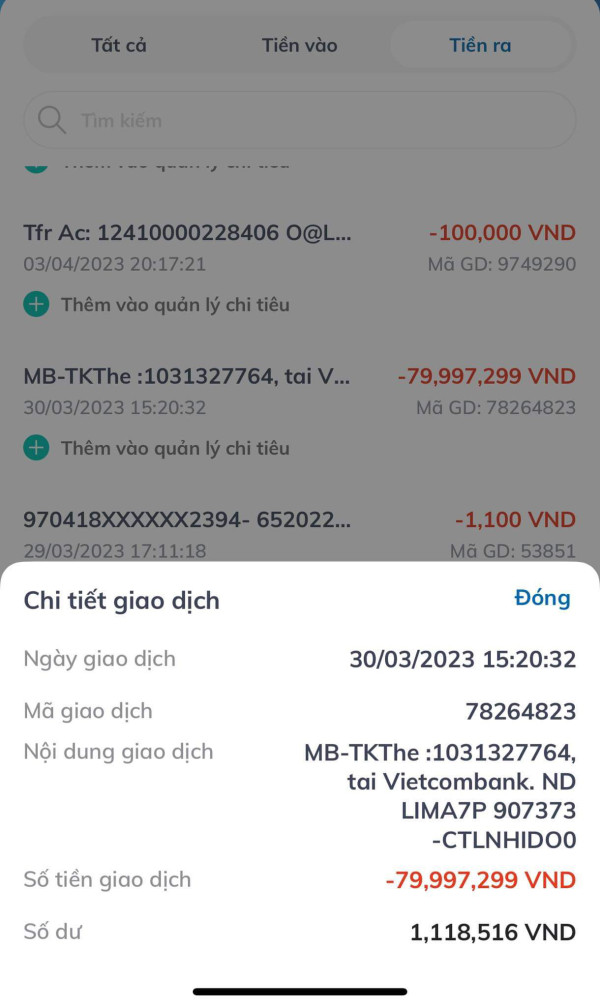

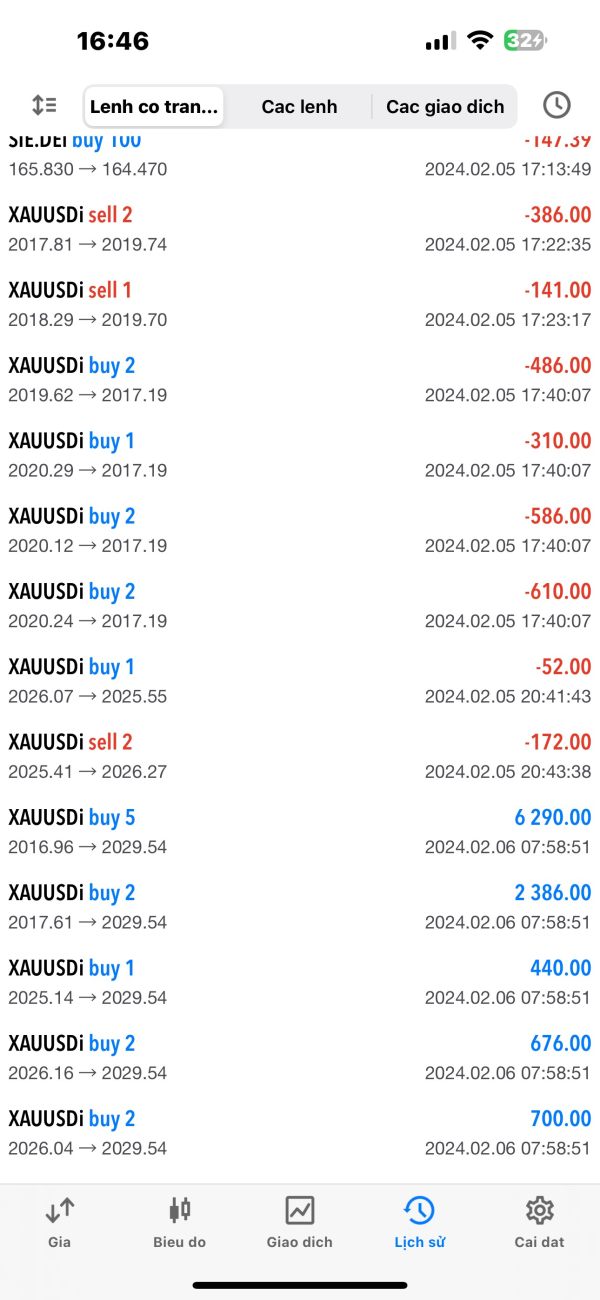

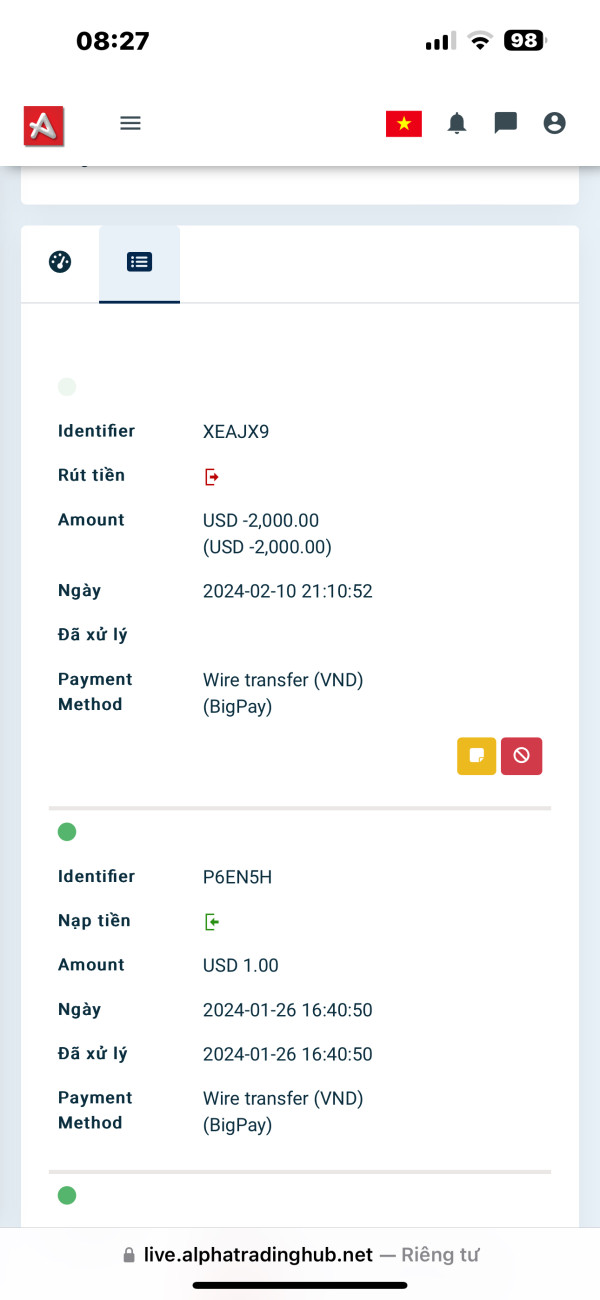

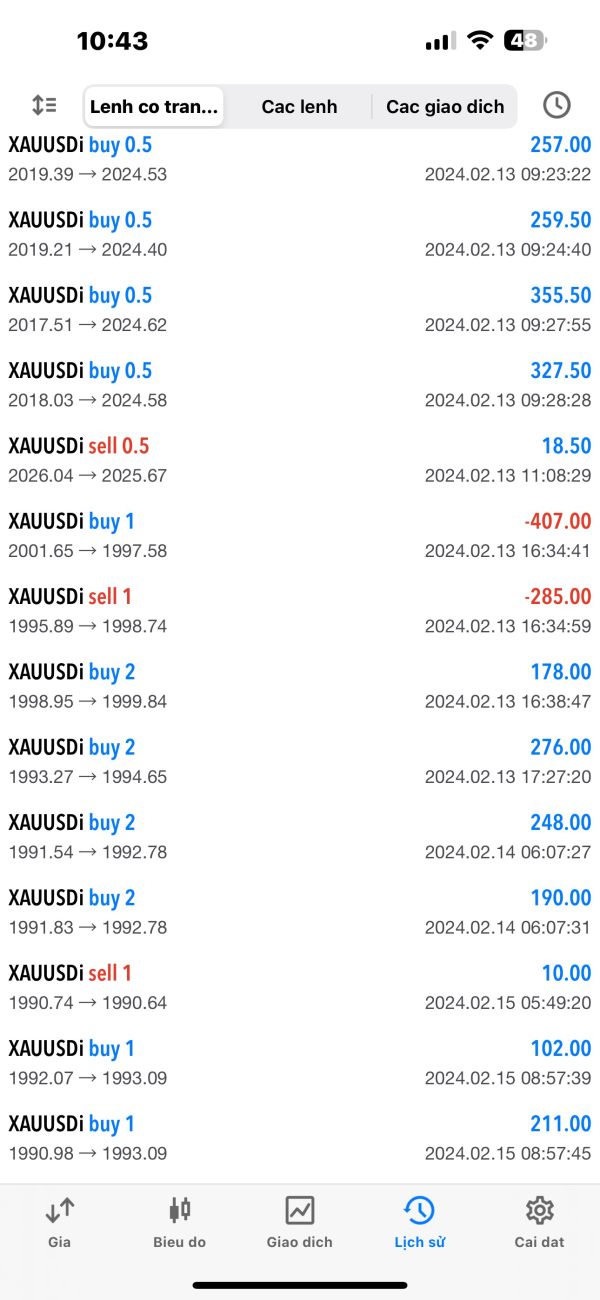

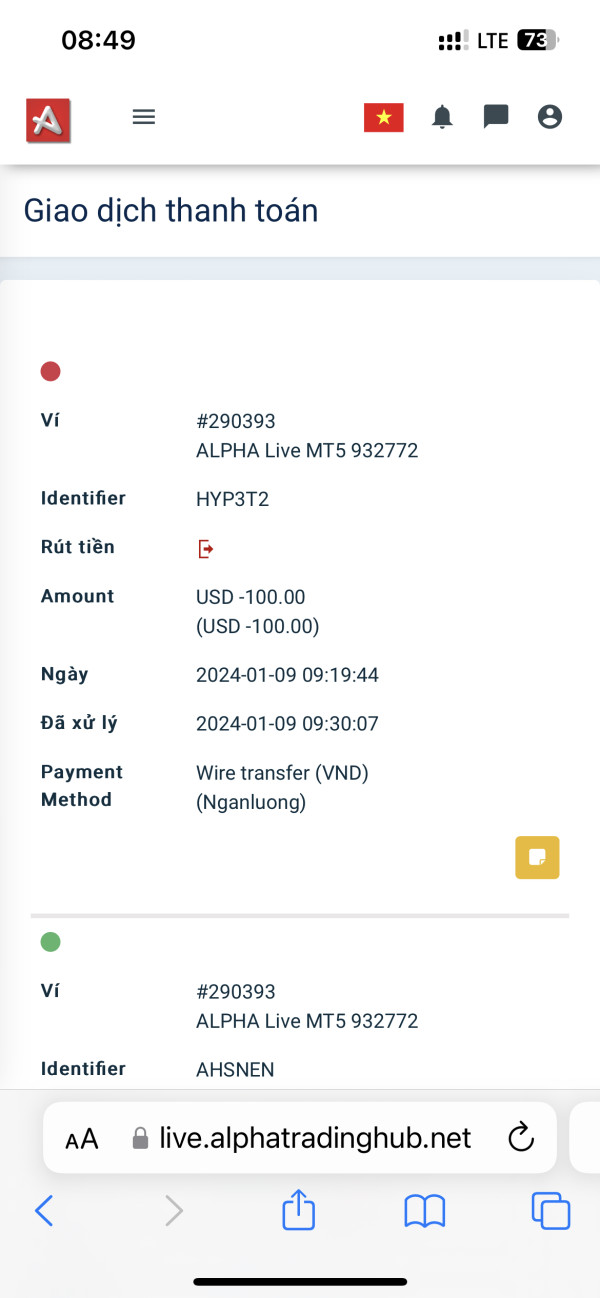

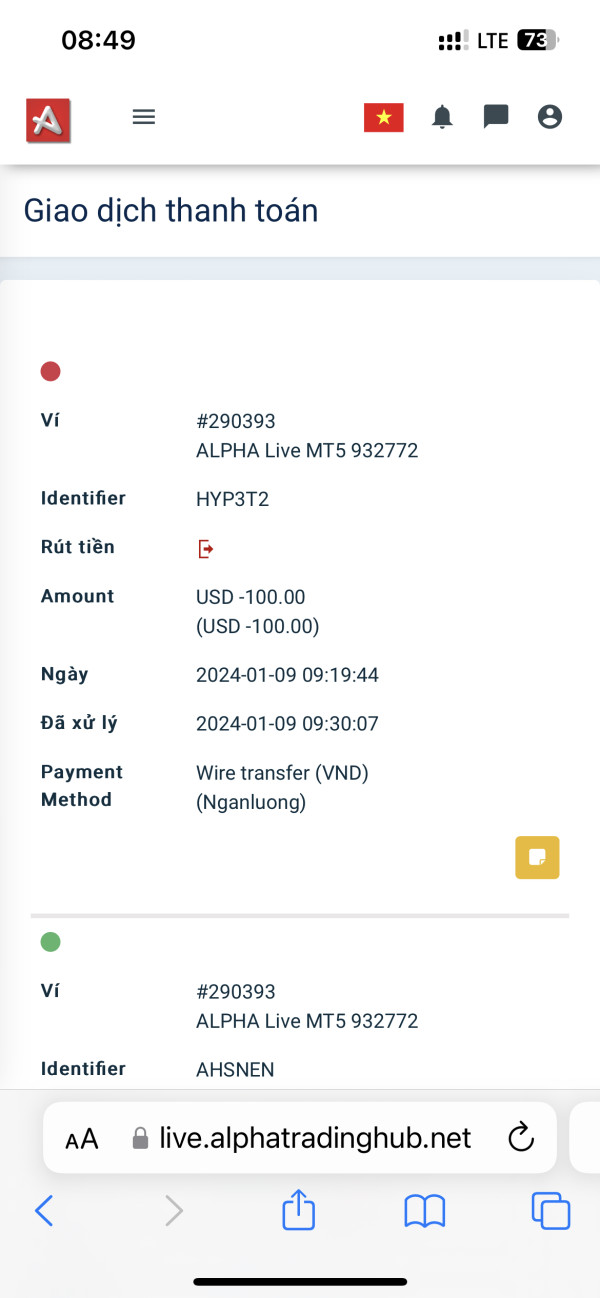

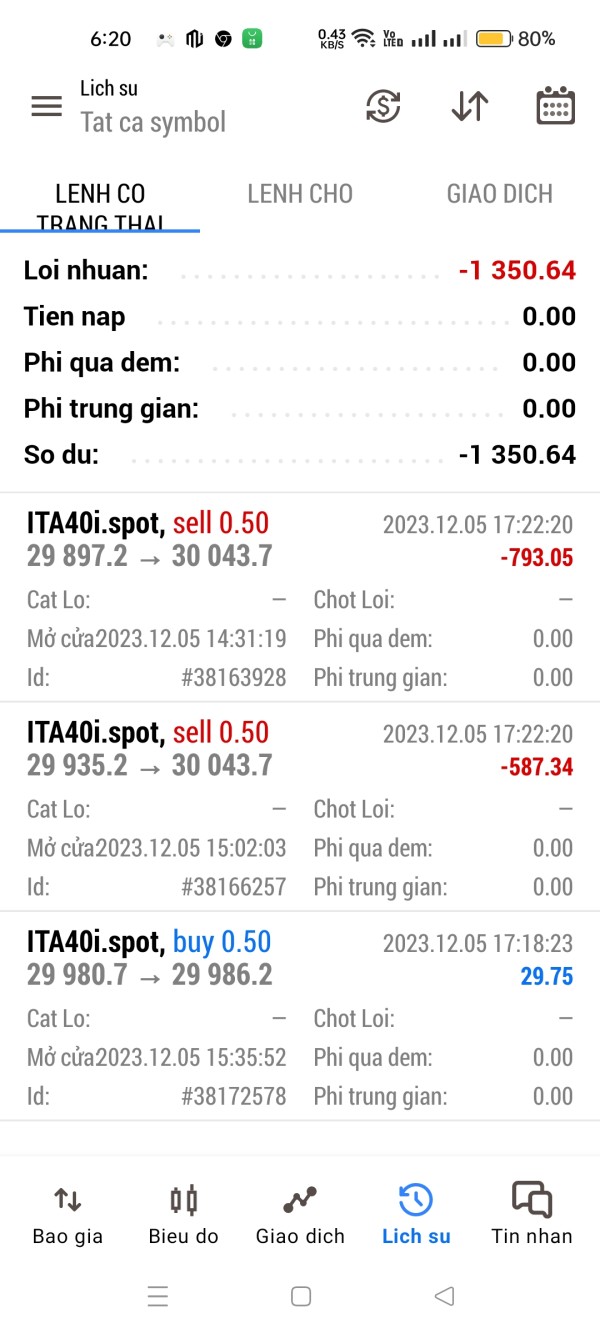

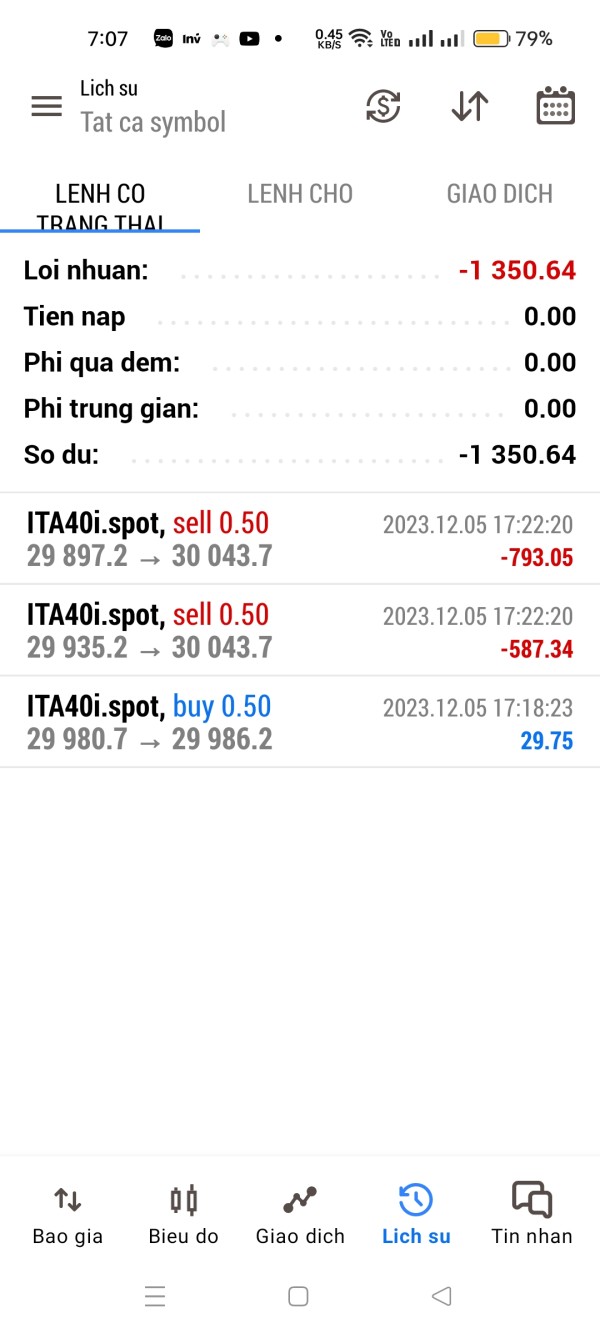

The broker accepts various currencies, including USD, EUR, GBP, THB, IDR, and VND. However, users have reported issues when attempting to withdraw funds, with many claiming their requests were either denied or delayed significantly.

Minimum Deposit:

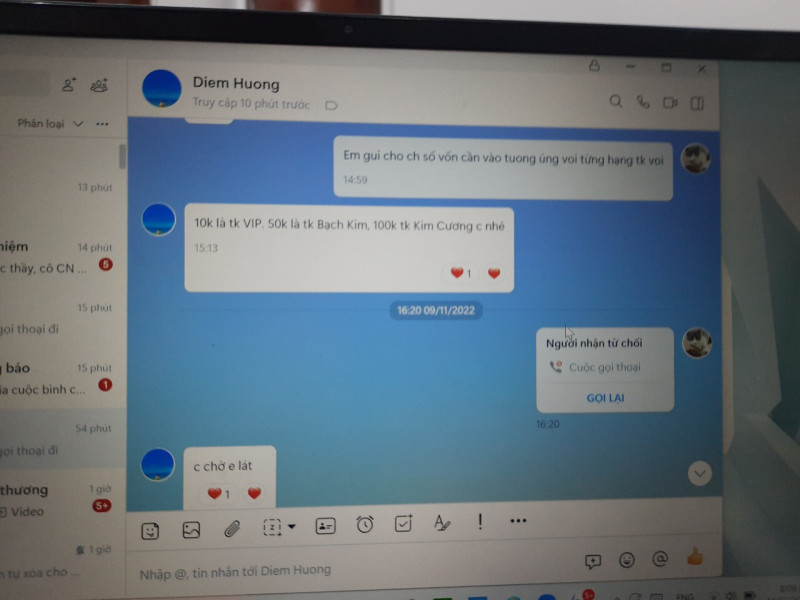

To open an account with Alpha Trading Hub, a minimum deposit of $500 is required for the standard account. This amount increases for VIP accounts, which require $5,000 and $20,000 for VIP 1 and VIP 2, respectively.

Bonuses/Promotions:

Alpha Trading Hub offers promotional trading bonuses, but these have been criticized for being misleading. For instance, a bonus that claims to allow trading for a limited time often comes with strings attached that prevent withdrawals.

Tradeable Asset Classes:

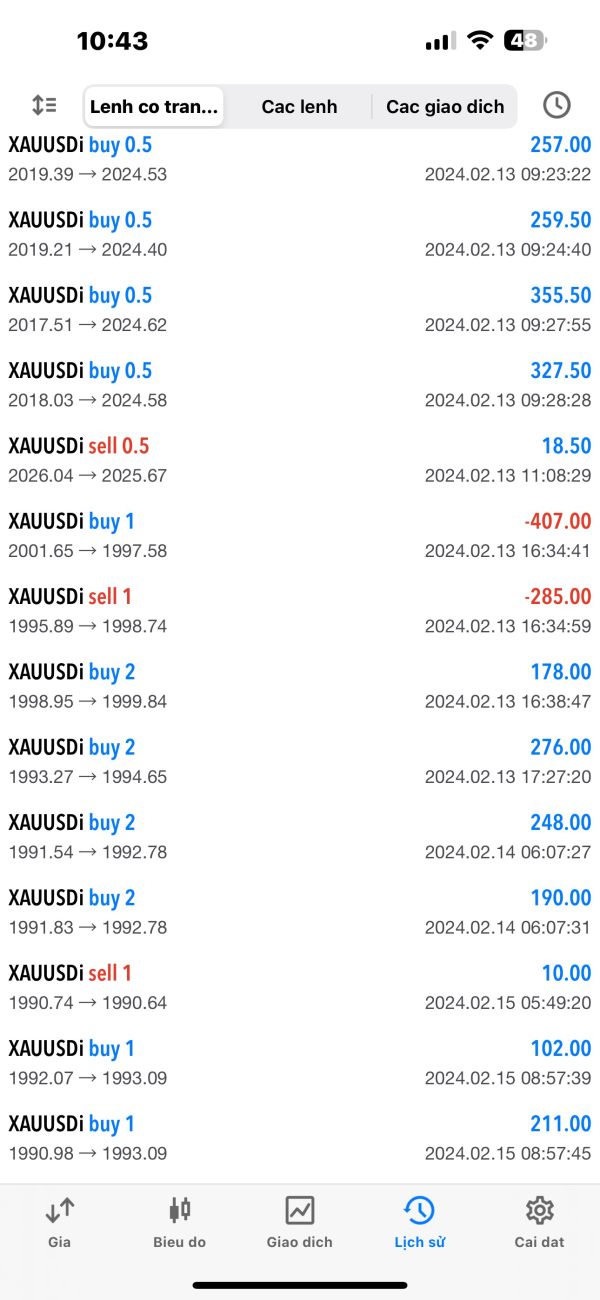

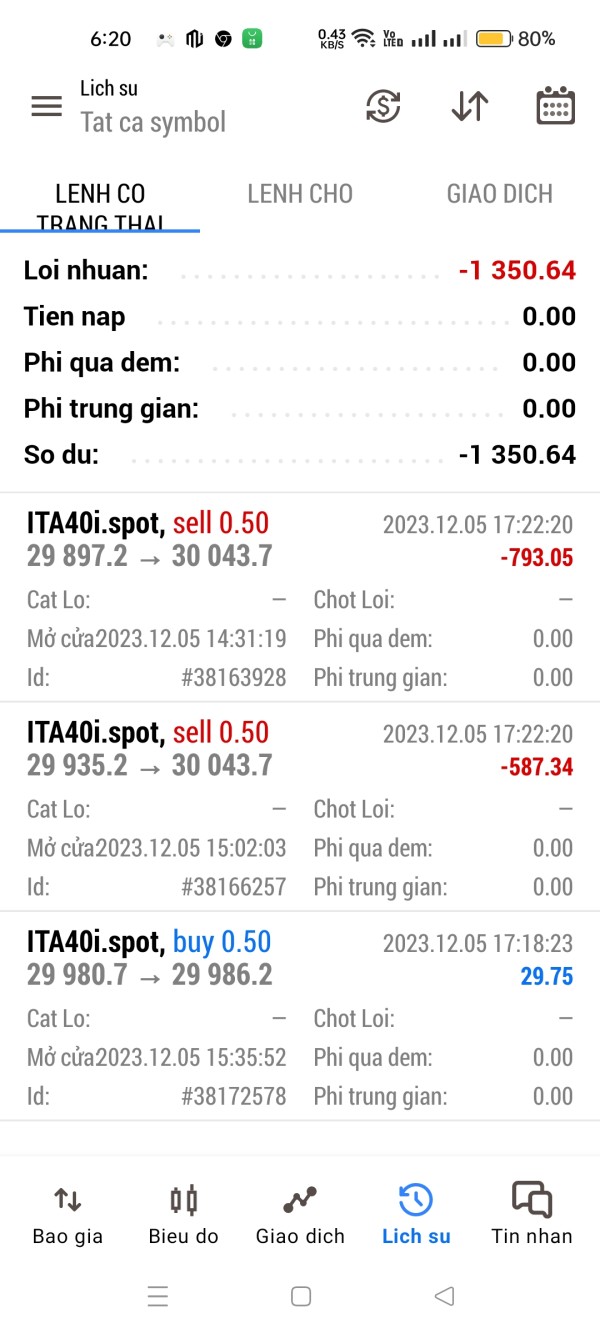

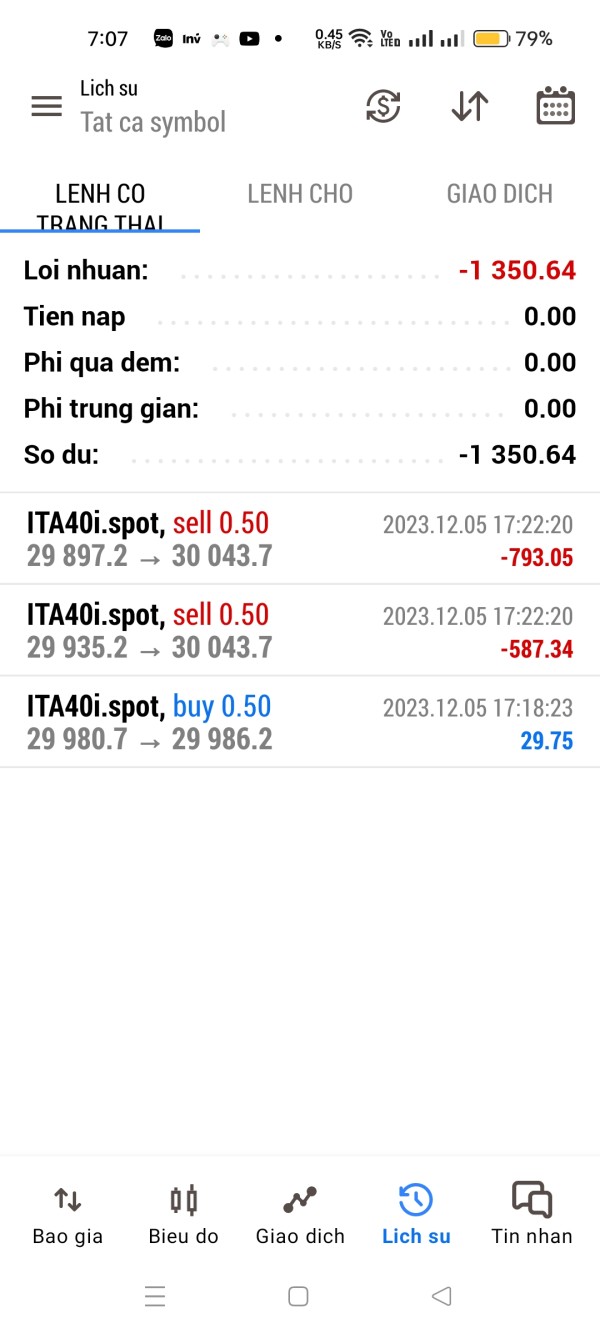

The broker provides access to a wide range of asset classes, including over 40 forex pairs, commodities like gold and silver, indices, and cryptocurrencies. This diversity can be appealing to traders looking for various investment opportunities.

Costs (Spreads, Fees, Commissions):

The spreads at Alpha Trading Hub are relatively higher for standard accounts, starting at 1.4 pips, while VIP accounts can enjoy lower spreads starting from 0.1 pips. However, users have reported additional fees that are not always clearly disclosed.

Leverage:

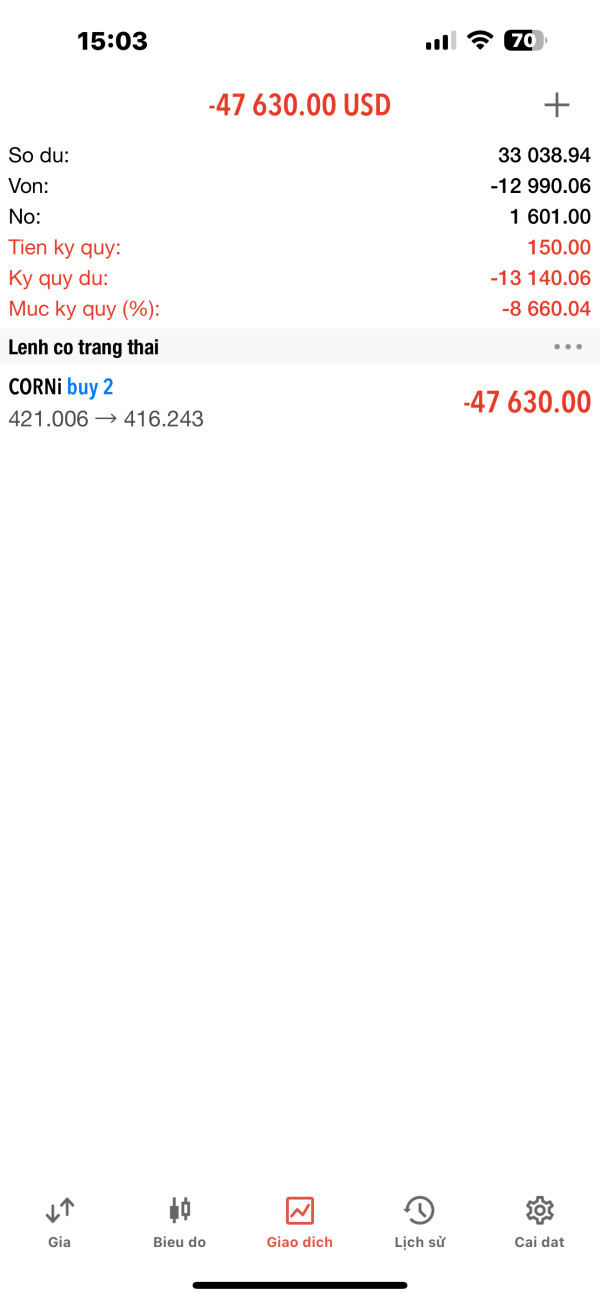

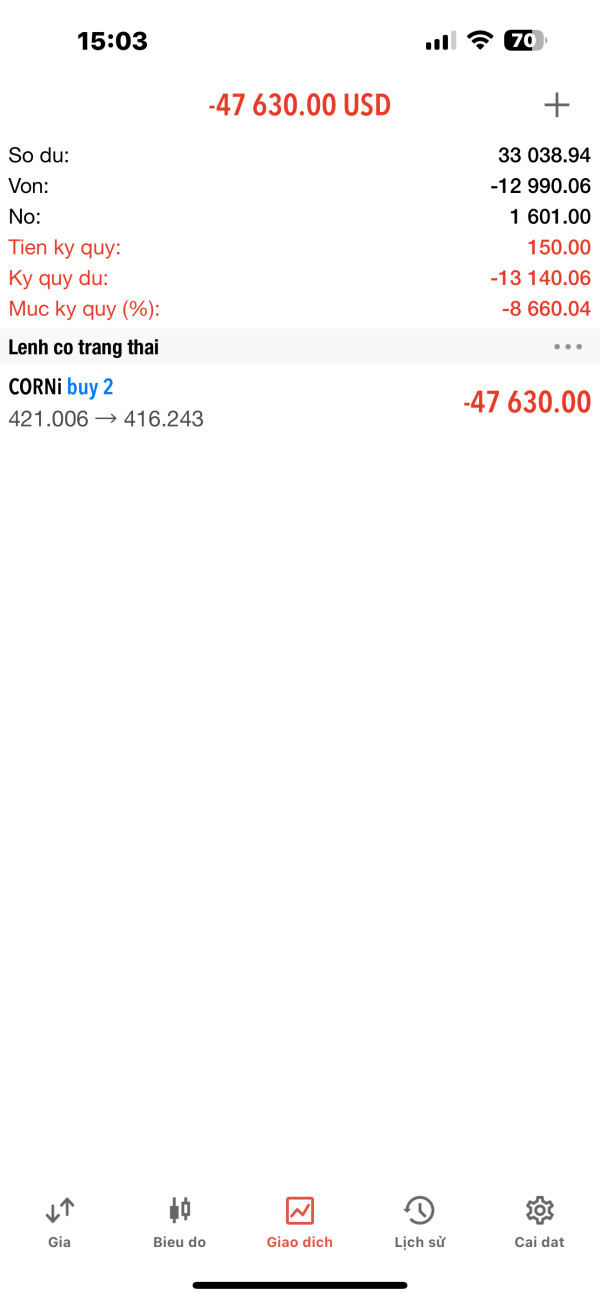

The maximum leverage offered is up to 1:500, which can amplify both potential profits and losses. This high leverage is a double-edged sword, especially for inexperienced traders who may not fully understand the risks involved.

Allowed Trading Platforms:

Alpha Trading Hub primarily uses the MetaTrader 5 platform, which is known for its advanced trading features. Additionally, a web trader platform is available, allowing for trading from any device with internet access.

Restricted Regions:

The broker does not accept clients from several countries, including the USA, Canada, Japan, and Australia, which may limit its appeal to a global trading audience.

Available Customer Service Languages:

Customer support is available in multiple languages, including English, Chinese, Indonesian, and Vietnamese. However, the quality of customer service has received criticism, with many users reporting unresponsive support.

Rating Overview (Revisited)

Detailed Breakdown

Account Conditions:

The account conditions at Alpha Trading Hub are somewhat standard, with three account types available. However, the minimum deposit requirement may be high for some traders, and the withdrawal issues reported by users are concerning.

Tools and Resources:

While the broker provides access to a range of trading tools and educational resources, the overall effectiveness of these tools is questionable, especially given the lack of regulatory oversight.

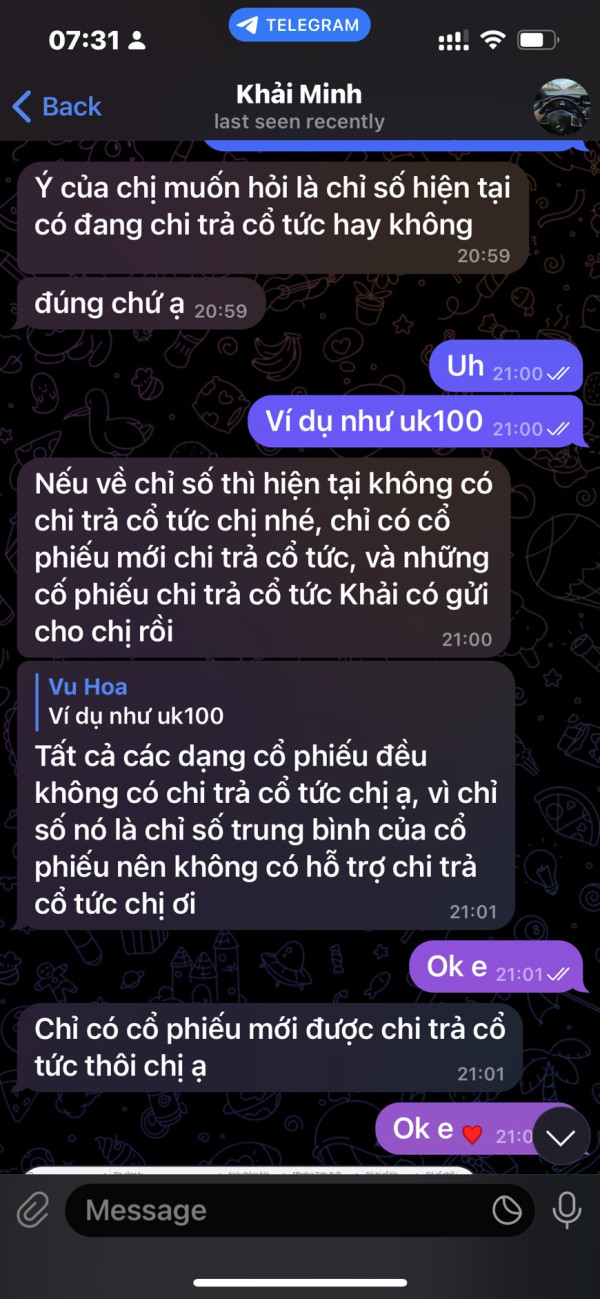

Customer Service and Support:

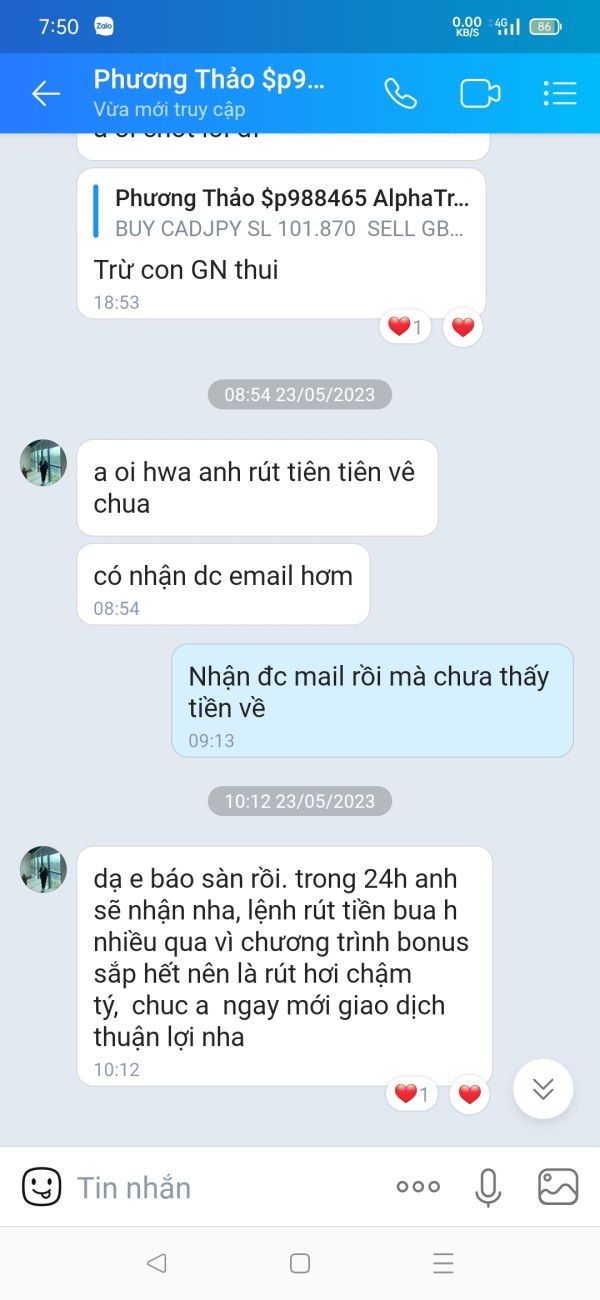

Customer service has been a significant pain point for many users. Complaints often highlight long response times and inadequate support when issues arise, particularly concerning withdrawals.

Trading Setup (Experience):

The trading experience on the MetaTrader 5 platform is generally positive, with many users appreciating its features. However, the overall trading experience is marred by trust issues due to the broker's unregulated status.

Trustworthiness:

The trustworthiness of Alpha Trading Hub is low, as indicated by numerous complaints regarding withdrawal processes and lack of regulatory oversight. This is a critical factor for traders to consider before investing.

User Experience:

User experiences vary, but a significant number of negative reviews highlight issues with withdrawal and customer service, suggesting a common theme of dissatisfaction among traders.

In conclusion, while Alpha Trading Hub presents itself as a comprehensive trading platform with various offerings, the lack of regulation and numerous user complaints raise serious concerns. Potential traders should proceed with caution and consider more reputable alternatives.