Executive Summary

This comprehensive alkem venture partners ltd review provides an in-depth analysis of an unregulated forex broker that has generated mixed feedback from the trading community. The broker has attracted both positive and negative attention from traders worldwide. Alkem Venture Partners Ltd positions itself as a foreign exchange specialist, offering multiple account types and competitive spreads across various trading instruments. Our investigation reveals significant concerns regarding regulatory oversight and withdrawal processes that potential clients must carefully consider.

The broker caters primarily to investors interested in forex trading. It provides access to foreign exchange, precious metals, CFDs, and cryptocurrency markets through web-based trading platforms. While the company offers some attractive features including demo accounts and swap-free options, the absence of clear regulatory authorization and documented user complaints about fund withdrawal issues present notable red flags. These issues have created serious concerns among potential clients.

Based on available information and user feedback analysis, this review aims to present a balanced perspective for traders considering Alkem Venture Partners Ltd as their trading partner. The assessment process involved examining multiple data sources and user testimonials. Our assessment reveals a mixed picture that requires careful consideration of both opportunities and risks associated with this broker.

Important Disclaimer

This review is based on publicly available information and user feedback collected from various sources. The information comes from multiple platforms and trading communities. Due to the unregulated nature of Alkem Venture Partners Ltd, cross-regional trading activities may involve elevated risks that differ significantly from regulated alternatives. Potential clients should be aware that unregulated brokers operate without oversight from established financial authorities, which may impact trader protection and dispute resolution mechanisms.

Our evaluation methodology incorporates user testimonials, available company information, and industry standard comparison metrics. The analysis follows established review protocols used throughout the industry. However, given the limited transparency typical of unregulated entities, some aspects of this assessment rely on third-party reports and user experiences rather than verified regulatory filings.

Rating Overview

Broker Overview

Alkem Venture Partners Ltd operates as an unregulated forex broker registered in China. The company focuses on providing foreign exchange trading services to international clients across multiple regions. According to WikiFX monitoring data, the company has established itself as a specialist in forex trading while expanding its offerings to include multiple asset classes. The broker's business model centers on providing web-based trading access without the regulatory oversight typically associated with licensed financial institutions.

The company's official website serves as the primary gateway for client onboarding and platform access. However, specific details about founding dates and corporate structure remain limited in publicly available documentation. This lack of transparency is characteristic of unregulated brokers and represents a key consideration for potential clients evaluating the platform. Many traders find this information gap concerning when making investment decisions.

Alkem venture partners ltd review data indicates that the broker targets investors seeking exposure to global currency markets, precious metals, and emerging cryptocurrency trading opportunities. The platform offers both live and demo trading environments, suggesting an attempt to accommodate traders at different experience levels. However, the absence of clear regulatory authorization means that client protections and dispute resolution mechanisms may differ significantly from those provided by licensed alternatives. This creates additional risk factors that traders must consider carefully.

The broker's operational focus on web-based trading platforms reflects current industry trends toward accessible, technology-driven trading solutions. This approach allows for broader market reach while potentially reducing operational overhead compared to more traditional brokerage models.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Alkem Venture Partners Ltd operations. This places it in the unregulated broker category with associated risks for client fund protection.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees was not detailed in available sources. This represents a significant transparency gap for potential clients who need clear payment information.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types were not specified in available documentation. This makes it difficult for traders to assess entry barriers and plan their initial investments.

Promotional Offers: Current bonus structures, welcome offers, or ongoing promotional campaigns were not detailed in available sources. This suggests either absence of such programs or limited marketing disclosure practices.

Available Trading Assets: The broker provides access to foreign exchange pairs, precious metals, Contracts for Difference, and cryptocurrency instruments. This offering provides reasonable diversification for multi-asset trading strategies.

Cost Structure: According to available information, Alkem Venture Partners Ltd offers competitive spreads. However, specific commission rates, overnight fees, and additional charges were not detailed in source materials.

Leverage Options: Maximum leverage ratios for different asset classes and account types were not specified in available documentation. This represents another transparency concern for risk management planning purposes.

Platform Selection: The broker provides web-based trading platform access. However, specific platform features, charting capabilities, and analytical tools were not detailed in available sources.

Geographic Restrictions: Information regarding restricted countries or regional limitations was not specified in available documentation. This creates uncertainty for international traders considering the platform.

Customer Service Languages: Supported languages for customer service communication were not detailed in available sources. This may impact international client support quality and accessibility.

This alkem venture partners ltd review reveals significant information gaps that potential clients should consider when evaluating the broker's suitability for their trading requirements.

Account Conditions Analysis

Alkem Venture Partners Ltd offers multiple account types designed to accommodate different trading preferences and religious requirements. The variety includes options that cater to diverse trader needs across multiple markets. The availability of demo accounts provides potential clients with risk-free platform exploration opportunities, while swap-free options cater to traders requiring Islamic-compliant trading conditions. However, the lack of detailed information regarding minimum deposit requirements makes it challenging for prospective clients to assess entry barriers and plan their initial investment accordingly.

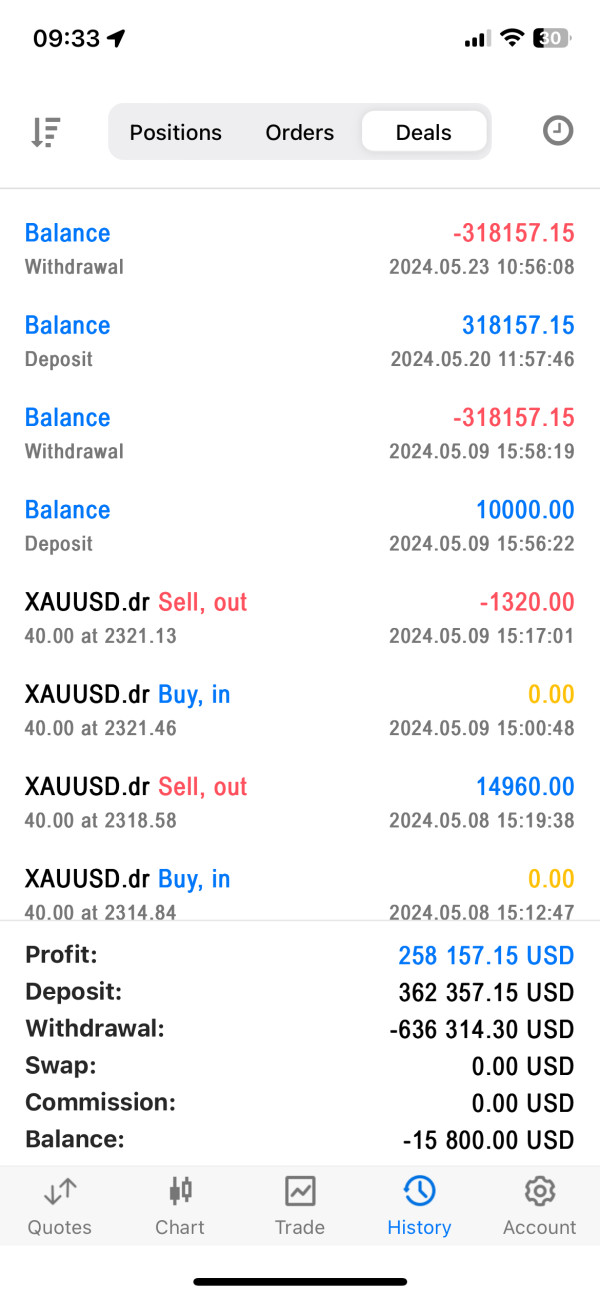

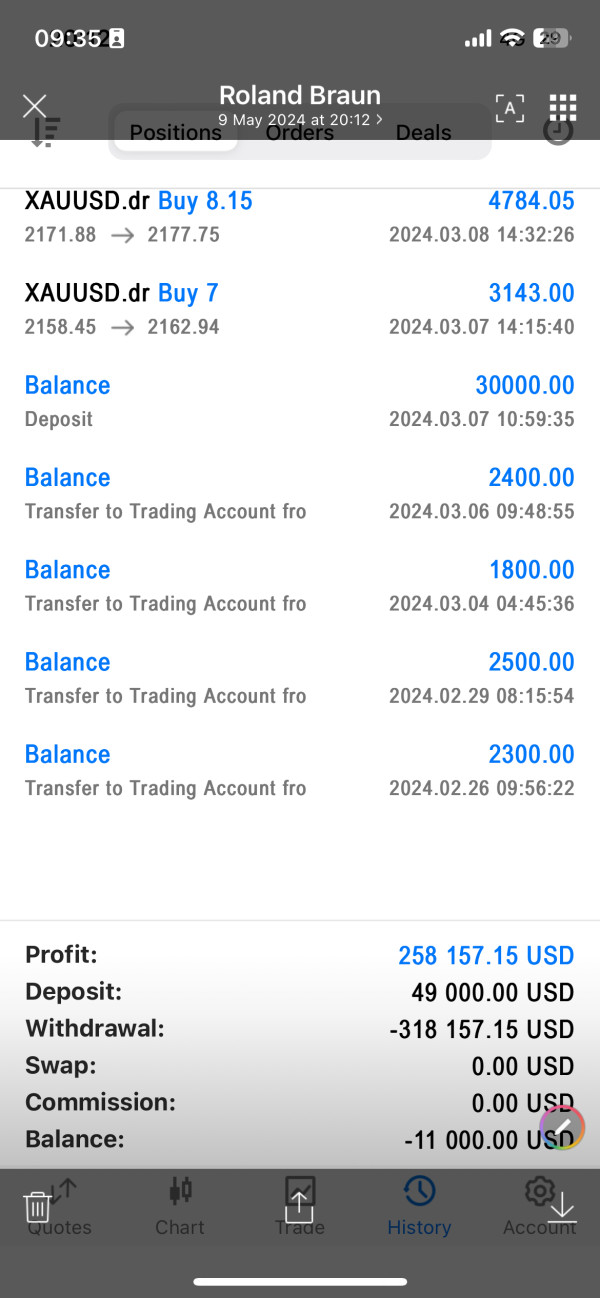

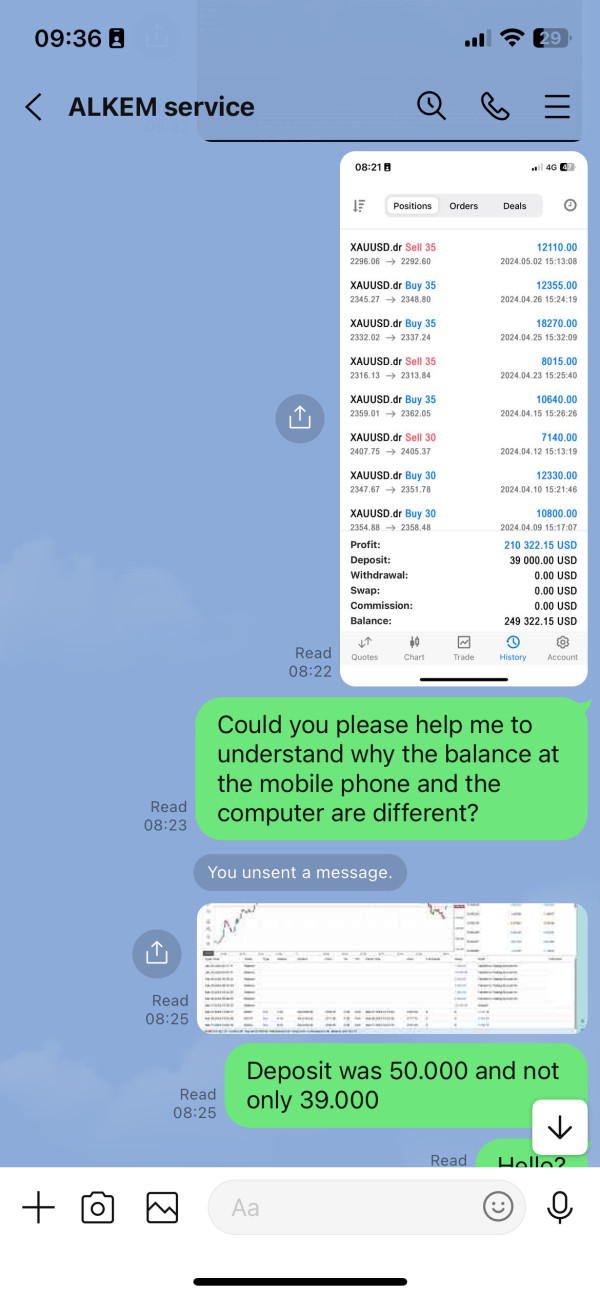

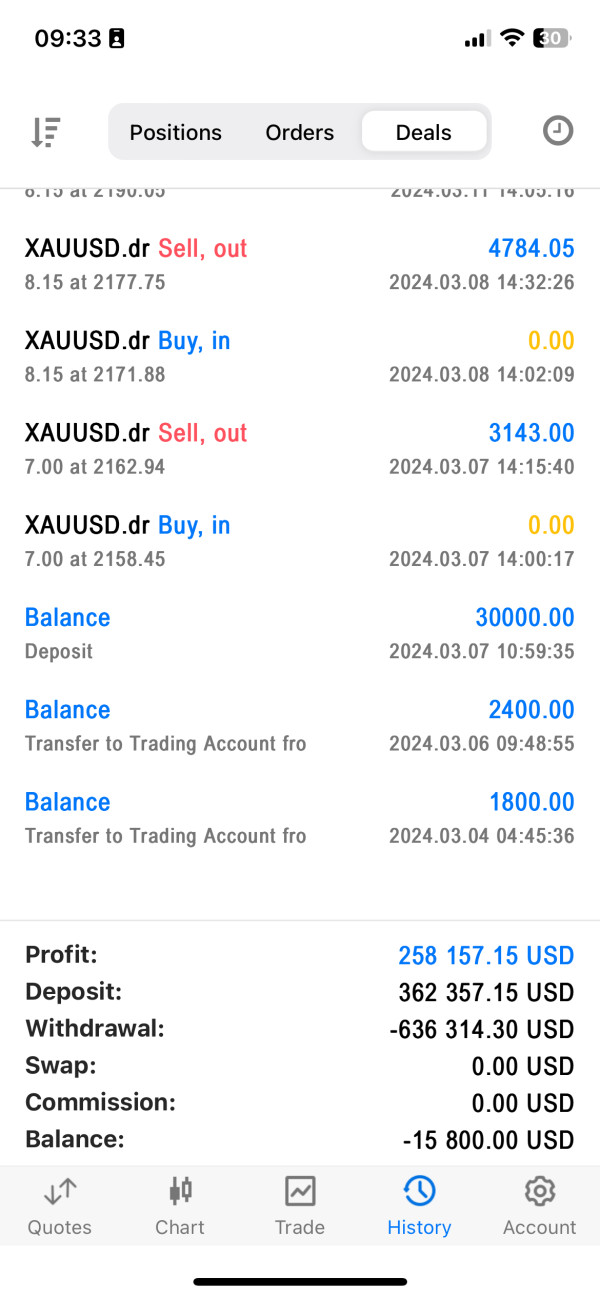

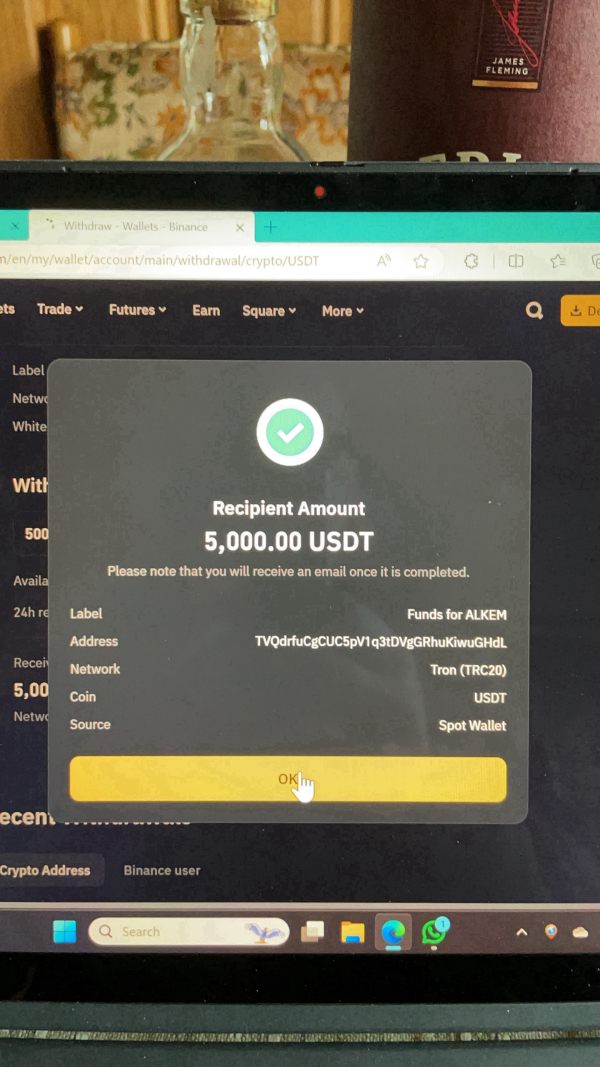

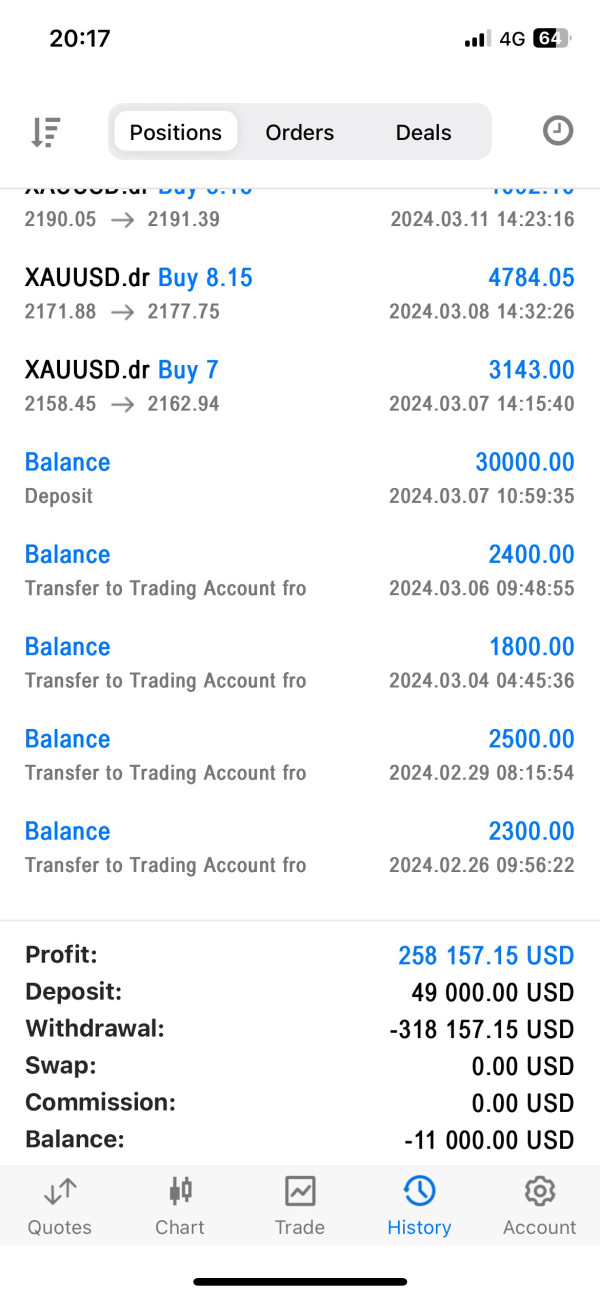

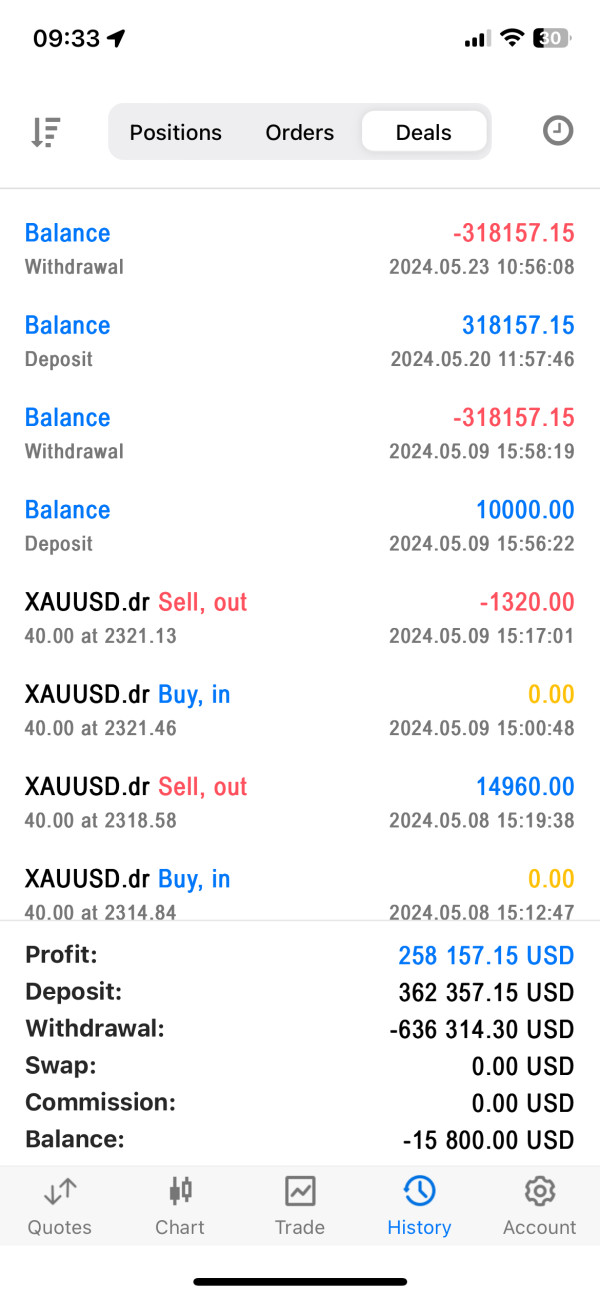

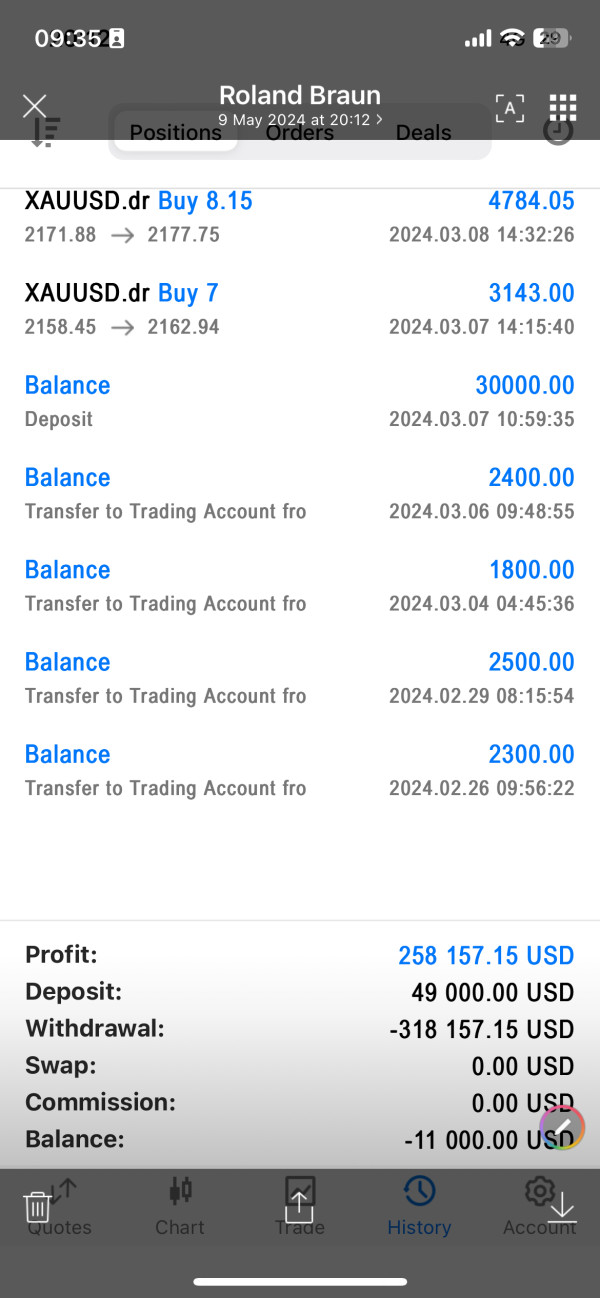

The account opening process details were not specified in available sources. User feedback suggests potential complications may arise during the account lifecycle, particularly regarding fund withdrawal procedures. According to WikiFX monitoring data, at least one user reported significant difficulties withdrawing funds from their account, stating "I cannot withdraw any money from my account." This concerning feedback indicates potential issues with account management and client fund accessibility that could affect other users.

The absence of clear information about account maintenance fees, inactivity charges, or other ongoing costs represents a transparency gap that could impact long-term trading economics. Additionally, specific details about account verification requirements, documentation needs, and approval timeframes were not available in source materials. These missing details create uncertainty for traders who need clear information about account setup processes.

Special account features beyond the mentioned swap-free options were not detailed. This leaves questions about whether the broker offers additional services such as managed accounts, copy trading, or premium account tiers with enhanced features. The competitive spread offering mentioned in available sources suggests potentially favorable trading conditions, though without specific numerical data, direct comparison with regulated alternatives remains difficult.

This alkem venture partners ltd review indicates that while basic account variety exists, the lack of transparency regarding terms, conditions, and user experience issues warrant careful consideration before account opening.

The broker's web-based trading platform approach reflects modern industry trends toward accessible, browser-based trading solutions that eliminate software download requirements. This modern approach appeals to traders who prefer convenience and accessibility. This platform choice potentially offers advantages in terms of cross-device compatibility and immediate access, though specific technical capabilities, charting features, and analytical tools were not detailed in available documentation. The lack of detailed platform information makes it difficult for traders to assess whether the tools meet their specific needs.

Asset class diversity represents a notable strength, with foreign exchange, precious metals, CFDs, and cryptocurrency options providing traders with multi-market exposure opportunities. This range suggests the platform may accommodate various trading strategies and portfolio diversification needs, though specific instrument counts and market depth information were not available in source materials. Traders seeking comprehensive market access may find this diversity appealing despite other concerns.

Research and analysis resources that might support trading decisions were not specified in available information. This represents a potential service gap for traders who rely on fundamental analysis, technical indicators, or market commentary. Educational resources, tutorials, or training materials that could benefit novice traders were similarly not mentioned in source documentation. The absence of educational support may disadvantage newer traders who need guidance.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, or social trading features, was not detailed in available sources. These omissions may impact traders who rely on systematic trading approaches or wish to leverage community-based trading strategies. Advanced traders often require these features for their trading systems.

The absence of detailed platform feature descriptions makes it difficult to assess whether the trading environment includes essential tools such as advanced order types, risk management features, or real-time market data quality. Mobile trading capabilities, which have become increasingly important for active traders, were not specifically addressed in available information.

Customer Service and Support Analysis

User feedback regarding customer service quality raises significant concerns about Alkem Venture Partners Ltd's support capabilities. The feedback comes from multiple sources and indicates systemic issues. The documented complaint about withdrawal difficulties suggests potential inadequacies in problem resolution processes and client communication effectiveness. When users report being unable to access their funds, it indicates either systematic issues with withdrawal procedures or insufficient customer service intervention to resolve legitimate requests.

Specific customer service channels, including phone support, email response systems, live chat availability, or support ticket systems, were not detailed in available sources. This information gap makes it difficult for potential clients to understand how they might seek assistance when needed or what response times they could expect for various types of inquiries. Clear communication channels are essential for effective broker-client relationships.

Response time expectations for different types of support requests were not specified. The existence of unresolved withdrawal complaints suggests that resolution timeframes may not meet user expectations. The quality of support interactions, including staff expertise, problem-solving capabilities, and follow-up procedures, cannot be adequately assessed based on available information. These factors significantly impact overall user satisfaction and trust.

Multi-language support availability was not mentioned in source materials. This could impact international clients who prefer assistance in their native languages. Given the broker's apparent international focus, language support capabilities represent an important service consideration that remains unclear. Effective communication becomes even more critical when dealing with financial matters.

Customer service operating hours, weekend availability, and holiday coverage were not specified in available documentation. These operational details significantly impact user experience, particularly for active traders who may require assistance outside standard business hours or during market volatility events.

Trading Experience Analysis

Platform stability and execution speed represent critical factors for trading success. These technical aspects determine the quality of the overall trading experience. Yet specific performance metrics were not available in source documentation. User feedback provides limited insight into actual trading conditions, though the absence of widespread complaints about execution quality suggests the platform may provide acceptable order processing capabilities under normal market conditions.

Order execution quality, including fill rates, slippage characteristics, and rejection frequencies, was not detailed in available sources. These technical performance aspects significantly impact trading profitability, particularly for strategies that rely on precise entry and exit timing or operate during high-volatility market periods. Traders need reliable execution to implement their strategies effectively.

Platform functionality completeness, including available order types, risk management tools, and analytical capabilities, was not comprehensively described in source materials. The web-based platform approach suggests modern interface design, though specific feature sets and usability characteristics remain unclear based on available information. Modern traders expect comprehensive functionality from their trading platforms.

Mobile trading experience details were not provided in source documentation. The absence of mobile trading information is concerning given the increasing importance of mobile platform capabilities for contemporary traders. The ability to monitor positions, execute trades, and manage risk from mobile devices has become essential for many trading strategies. This represents a significant information gap for potential users.

Trading environment characteristics, including the mentioned competitive spreads, suggest potentially favorable cost conditions. However, without specific spread data or commission structures, direct comparison with alternative brokers remains challenging. The overall alkem venture partners ltd review indicates mixed user experiences that warrant careful consideration of individual trading requirements and risk tolerance levels.

Trust and Security Analysis

The unregulated status of Alkem Venture Partners Ltd represents the most significant trust and security concern for potential clients. This status creates fundamental risks that regulated brokers do not present. Operating without oversight from established financial regulatory authorities means that standard client protection mechanisms, including segregated fund requirements, compensation schemes, and dispute resolution procedures, may not be available or enforceable. This absence of regulatory oversight significantly increases risk exposure for traders.

Fund safety measures, including client money segregation, bank deposit protection, or insurance coverage, were not specified in available documentation. This absence of clear fund protection information is particularly concerning given user reports of withdrawal difficulties, as it suggests potential risks to client capital accessibility and security. Traders need assurance that their funds are properly protected and accessible when needed.

Corporate transparency regarding company ownership, management structure, financial statements, or operational history was not evident in available sources. This lack of transparency is characteristic of unregulated brokers but represents a significant disadvantage compared to licensed alternatives that must provide regular regulatory disclosures. Transparency builds trust and allows clients to make informed decisions about their broker relationships.

Industry reputation indicators, such as regulatory awards, industry recognition, or third-party certifications, were not mentioned in available information. The absence of such credentials further emphasizes the trust challenges associated with unregulated broker relationships. Established brokers typically accumulate various forms of industry recognition over time.

Negative event handling capabilities cannot be adequately assessed based on available information. The existence of unresolved user complaints suggests potential deficiencies in dispute resolution processes. The combination of regulatory absence and user complaints creates a concerning trust profile that requires careful risk assessment by potential clients.

User Experience Analysis

Overall user satisfaction appears mixed based on available feedback. The feedback comes from various sources and presents a complex picture. WikiFX data indicates a combination of positive, neutral, and negative reviews alongside exposure complaints. This balanced but concerning feedback pattern suggests that while some users may find acceptable service, significant issues exist that impact overall satisfaction levels.

Interface design and usability characteristics of the web-based platform were not detailed in available sources. The browser-based approach suggests modern design principles may be employed. However, without specific user interface descriptions or navigation feedback, platform usability assessment remains incomplete. User interface quality significantly impacts daily trading activities and overall satisfaction.

Registration and verification process convenience was not described in available documentation. User complaints about fund access suggest that account management procedures may present challenges for some clients. The efficiency and transparency of onboarding processes represent important user experience factors that remain unclear. Smooth account setup processes are essential for positive initial user experiences.

Fund operation experience represents a critical concern based on available user feedback. The documented complaint about withdrawal inability indicates serious deficiencies in fund management processes that significantly impact user experience and trust. Such issues can transform otherwise acceptable trading experiences into highly problematic relationships. Fund accessibility forms the foundation of any successful broker-client relationship.

Common user complaints appear focused on fund accessibility issues. These represent among the most serious concerns possible in broker relationships. The ability to deposit and withdraw funds reliably forms the foundation of any successful trading relationship, making these complaints particularly significant for potential clients considering the platform. These issues should be carefully considered by anyone evaluating this broker.

User profile analysis suggests the broker may attract investors interested in forex trading opportunities. However, the mixed feedback and withdrawal concerns indicate that experienced traders with higher risk tolerance may be better suited to navigate potential challenges associated with this unregulated broker relationship.

Conclusion

This comprehensive alkem venture partners ltd review reveals a mixed picture that requires careful consideration by potential clients. The analysis has examined multiple aspects of the broker's operations and user feedback. While the broker offers some attractive features including multiple account types, competitive spreads, and diverse asset class access, significant concerns regarding regulatory oversight and fund accessibility create substantial risk factors that cannot be overlooked. These concerns represent fundamental issues that affect the broker-client relationship.

The broker appears most suitable for experienced traders who understand the risks associated with unregulated broker relationships and have sufficient risk tolerance to manage potential fund access complications. Less experienced traders or those requiring strong regulatory protections may find better alternatives among licensed brokers with established oversight mechanisms. The choice ultimately depends on individual risk tolerance and trading experience levels.

Key advantages include account variety and competitive trading conditions, while primary disadvantages center on regulatory absence, transparency limitations, and documented user complaints regarding fund withdrawal processes. The combination of these factors suggests that while trading opportunities may exist, they come with elevated risks that require careful assessment and ongoing monitoring.