99fx 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive 99fx review examines a relatively new forex broker that has gained recognition in the Arab world, East Asia, and North Africa. The broker faces significant regulatory challenges despite its growing presence. According to WikiFX monitoring, 99fx operates without proper licensing, which significantly impacts its trustworthiness among international traders who value regulatory protection. However, user feedback indicates positive experiences regarding competitive pricing and responsive technical support that helps traders resolve issues quickly.

The broker requires a substantial minimum deposit of $10,000. This positions it primarily for well-capitalized traders who have significant funds available. While 99fx claims to be a leading financial services company in its target regions, the lack of regulatory oversight raises important concerns for potential clients who prioritize safety and security. User reviews highlight the platform's affordability and quick technical assistance. These positives are overshadowed by regulatory deficiencies that create trust issues.

99fx utilizes the cTrader trading platform and appears to focus on serving traders in specific geographical regions. The regulatory requirements may differ from major financial centers in these areas. This 99fx review aims to provide a balanced assessment of the broker's offerings while highlighting both opportunities and risks for potential users who are considering this platform.

Important Notice

This review acknowledges that 99fx operates across different regions with varying regulatory landscapes. This may result in different user experiences and trust levels depending on geographical location where traders are based. The broker's registration in Saint Vincent and the Grenadines, combined with the absence of major regulatory licenses, creates uncertainty about client protection standards that traders typically expect from established brokers.

Our assessment is based on available public information, user feedback from various review platforms, and market research. Given the limited regulatory oversight, potential clients should exercise enhanced due diligence before engaging with this broker to protect their interests.

Scoring Framework

Broker Overview

99fx positions itself as a leading financial services company operating primarily in the Arab world, East Asia, and North Africa regions. The company aims to provide comprehensive forex trading services to clients in these specific geographical markets according to information available on their platform. The broker has established its presence by focusing on regional market needs and preferences that differ from global standards. However, detailed information about its founding date and corporate history remains limited in available documentation that potential clients can review.

The company operates as an online forex broker. It provides access to currency markets through digital trading platforms that connect traders to global markets. While 99fx claims leadership status in its target regions, the broker's actual market share and competitive position require further verification through independent industry analysis that would confirm these claims.

99fx utilizes the cTrader trading platform as its primary trading interface. This platform is known for its advanced charting capabilities and user-friendly design that appeals to both new and experienced traders. However, specific information about available asset classes beyond forex remains unclear in current documentation. The broker's registration in Saint Vincent and the Grenadines places it in a jurisdiction known for lighter regulatory requirements, which explains the absence of major financial authority licenses that traders typically expect from established brokers.

This 99fx review notes that while the broker operates in multiple regions, the lack of comprehensive regulatory oversight may impact client confidence and protection standards.

Regulatory Status: 99fx is registered in Saint Vincent and the Grenadines but lacks licensing from major financial regulators such as FCA, ASIC, or CySEC. This significantly impacts its regulatory standing among international traders.

Deposit and Withdrawal Methods: Specific information about available payment methods for deposits and withdrawals is not detailed in current available documentation.

Minimum Deposit Requirements: The broker requires a substantial minimum deposit of $10,000. This positions it for high-net-worth individuals and experienced traders with significant capital available for trading.

Bonuses and Promotions: Current promotional offers and bonus structures are not specified in available broker information.

Tradeable Assets: While 99fx operates as a forex broker, specific details about available currency pairs and other tradeable instruments are not comprehensively documented.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not explicitly provided. User feedback suggests competitive pricing that attracts traders looking for affordable options.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in current documentation.

Platform Options: The broker utilizes cTrader as its primary trading platform. This platform is known for advanced features and institutional-grade functionality that professional traders appreciate.

Regional Restrictions: Specific geographical limitations and restricted territories are not clearly outlined in available information.

Customer Service Languages: Available customer support languages are not specified in current documentation. The broker's regional focus suggests multilingual capabilities that would serve diverse client bases.

This 99fx review highlights the need for more comprehensive disclosure of trading conditions and operational details.

Account Conditions Analysis

The account structure at 99fx presents a mixed picture for potential traders. The most significant barrier for many traders is the substantial minimum deposit requirement of $10,000, which immediately excludes retail traders with smaller capital bases who want to start with modest investments. This high threshold suggests that 99fx targets institutional clients or high-net-worth individuals rather than the broader retail trading community that typically starts with smaller amounts.

Currently available information does not provide detailed descriptions of different account types, their specific features, or tiered benefits based on deposit levels. This lack of transparency regarding account structures makes it difficult for potential clients to understand what services and conditions they can expect at different investment levels that match their trading goals.

The account opening process details are not comprehensively documented. This leaves questions about verification requirements, documentation needed, and typical approval timeframes that new clients need to plan for. For a broker operating across multiple regions, clear information about account setup procedures would be essential for client confidence and smooth onboarding experiences.

Special account features such as Islamic accounts for Muslim traders are not specifically mentioned in available documentation. This would be particularly relevant given the broker's focus on Arab markets where religious compliance is important. This represents a potential missed opportunity for serving the religious requirements of clients in target markets who need Sharia-compliant trading options.

This 99fx review finds that while the high minimum deposit may ensure serious traders, the lack of detailed account information and options limits the broker's appeal to diverse trading needs.

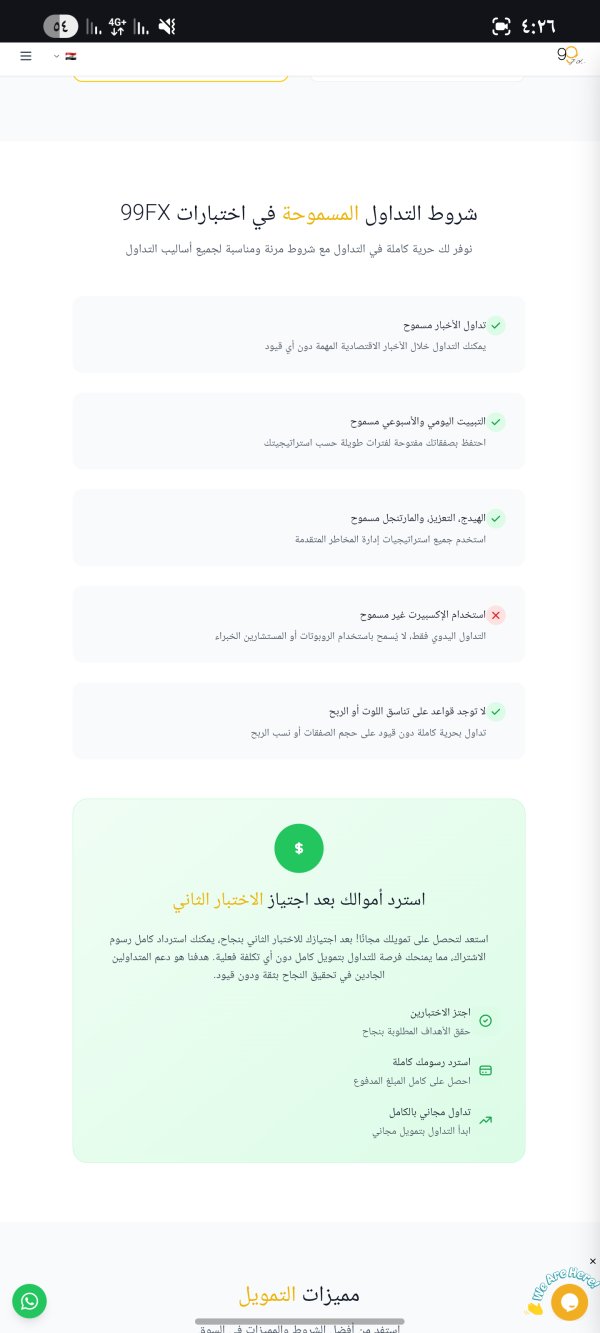

99fx's technological infrastructure centers around the cTrader platform. This platform is generally regarded as a robust trading solution with advanced charting capabilities and algorithmic trading support that professional traders value. However, the broker's offering appears limited when compared to comprehensive service providers who typically offer multiple platform options and extensive additional tools for market analysis.

The absence of detailed information about research and analysis resources represents a significant gap in the broker's service portfolio. Modern traders expect access to market analysis, economic calendars, trading signals, and educational content to support their trading decisions and improve their performance. The current documentation does not indicate whether 99fx provides these essential resources that help traders make informed decisions.

Educational resources are not mentioned in available broker information. These resources are crucial for trader development and retention in competitive markets. Given the broker's regional focus, localized educational content in relevant languages would be particularly valuable for building client relationships and supporting trader success in diverse cultural contexts.

Automated trading support capabilities are not specifically highlighted or promoted by the broker. These features are potentially available through cTrader's algorithmic trading features that allow systematic trading approaches. This represents a missed opportunity to attract traders interested in systematic trading approaches who want to automate their strategies.

User feedback regarding technical support responsiveness is positive. This suggests that while the tool portfolio may be limited, the broker does provide adequate technical assistance when needed to resolve platform issues. However, the overall tools and resources offering appears basic compared to full-service brokers who provide comprehensive trading ecosystems.

Customer Service and Support Analysis

Customer service represents one of 99fx's stronger areas based on available user feedback. Traders have specifically noted that technical support responds quickly to inquiries and issues, which is crucial for maintaining trading operations and resolving platform-related problems promptly when time-sensitive situations arise. However, detailed information about customer service infrastructure is limited in current documentation.

Available documentation does not specify the channels through which clients can reach support. These channels typically include phone, live chat, email, or help desk systems that provide multiple contact options. For a broker serving multiple regions, comprehensive communication options would be essential for effective client service that meets diverse preferences and urgent needs.

Response time quality appears to be a strength based on user testimonials. Specific service level agreements or guaranteed response times are not documented in available materials. The positive feedback suggests that when clients do reach support, they receive timely and effective assistance that resolves their concerns satisfactorily.

Multilingual support capabilities are not explicitly detailed. This is surprising given the broker's stated focus on Arab world, East Asian, and North African markets where multiple languages are spoken. Effective service in local languages would be essential for building strong client relationships in these diverse regions that have different cultural and linguistic preferences.

Operating hours for customer support are not specified in available documentation. This leaves questions about availability during different market sessions and time zones that affect global trading activities. Given the global nature of forex markets and the broker's multi-regional focus, 24-hour or extended support coverage would be expected to serve clients across different time zones effectively.

The positive user feedback on support responsiveness provides some confidence in the broker's commitment to client service.

Trading Experience Analysis

User feedback regarding the trading experience at 99fx is generally positive, particularly concerning pricing competitiveness. Traders have noted that the broker offers attractive pricing conditions that help reduce trading costs and improve profitability potential. However, specific spread ranges and commission structures are not detailed in available documentation that would allow for precise cost comparisons.

Platform stability and execution speed are crucial factors for forex trading success. While users report satisfactory trading experiences, detailed performance metrics such as average execution speeds, slippage statistics, or uptime records are not publicly available for independent verification. The use of cTrader as the primary platform does provide confidence in underlying technology quality that supports reliable trading operations.

The cTrader platform offers comprehensive functionality including advanced charting, multiple order types, and algorithmic trading capabilities. However, 99fx's specific implementation and any customizations or limitations are not detailed in current documentation that would help traders understand platform capabilities. This information would be valuable for traders who want to understand exactly what features are available for their trading strategies.

Mobile trading capabilities are not specifically addressed in available information. These capabilities are essential for modern traders who need market access while away from their desks during important market movements. Given that cTrader typically offers mobile applications, this functionality is likely available but not prominently promoted in the broker's marketing materials.

User satisfaction with the overall trading environment appears positive based on feedback about pricing and general experience. However, the limited availability of detailed trading conditions and performance data makes it difficult to provide a comprehensive assessment of the trading experience quality that potential clients can rely on.

This 99fx review notes that while user feedback is encouraging, more transparency about trading conditions and platform performance would strengthen the broker's credibility.

Trustworthiness Analysis

Trustworthiness represents the most significant concern for 99fx, primarily due to the absence of regulatory licensing from major financial authorities. The broker's registration in Saint Vincent and the Grenadines provides minimal regulatory oversight compared to jurisdictions with stringent financial regulations that protect client interests through comprehensive oversight mechanisms. WikiFX has assigned a low rating of 1 point to 99fx, which reflects serious concerns about the broker's regulatory status and overall reliability in the trading community.

This rating significantly impacts the broker's credibility among informed traders who prioritize regulatory protection. Specific information about client fund protection measures, such as segregated accounts or deposit insurance, is not detailed in available documentation that would reassure potential clients. These protections are standard among regulated brokers and their absence raises important questions about client fund security during normal operations and potential crisis situations.

Company transparency regarding ownership, management, and operational details is limited. This further compounds trust concerns among traders who want to know who they are dealing with. Established brokers typically provide comprehensive corporate information to build client confidence and meet regulatory requirements that demonstrate accountability and professional standards.

The absence of information about negative event handling, dispute resolution procedures, or regulatory compliance history makes it difficult to assess how the broker manages client concerns. These procedures are important when regulatory issues arise and clients need protection. User concerns about safety and security, as reflected in available feedback, align with the regulatory deficiencies identified through independent analysis that highlights systemic trust issues.

While some users report positive experiences, the underlying trust issues remain unresolved.

User Experience Analysis

Overall user satisfaction with 99fx presents a mixed picture, with positive feedback about pricing and technical support offset by underlying concerns about security and trustworthiness. Users appreciate the competitive pricing structure and responsive technical assistance, which are important operational factors for daily trading activities that affect profitability and user satisfaction. Interface design and platform usability benefit from the cTrader platform's generally well-regarded user experience that provides intuitive navigation and comprehensive functionality.

However, specific customizations or limitations implemented by 99fx are not detailed in available documentation. Registration and account verification processes are not comprehensively described, leaving questions about the efficiency and requirements of onboarding new clients who want to start trading quickly. Clear, streamlined processes are essential for positive initial user experiences that create good first impressions and encourage long-term relationships.

Fund management experiences are not detailed in current documentation. These include deposit and withdrawal processes, timeframes, and potential restrictions that significantly impact user convenience. These operational aspects significantly impact overall user satisfaction and confidence in the broker's ability to handle client funds professionally and efficiently.

Common user complaints center around security concerns and trustworthiness issues rather than platform functionality or service quality. This pattern suggests that while the broker's operational capabilities may be adequate, fundamental confidence issues limit user satisfaction and long-term client retention. The combination of positive operational feedback with underlying security concerns creates a complex user experience profile that reflects the broker's mixed strengths and weaknesses in different areas.

Conclusion

This 99fx review reveals a broker with notable operational strengths overshadowed by significant regulatory and trust concerns. While users report positive experiences with competitive pricing and responsive technical support, the absence of proper regulatory licensing creates substantial risks that cannot be overlooked by prudent traders who prioritize safety and regulatory protection. 99fx appears most suitable for well-capitalized traders who prioritize pricing and are comfortable with higher risk profiles associated with unregulated brokers that operate without comprehensive oversight.

The $10,000 minimum deposit requirement further limits the broker's accessibility to serious traders with substantial capital. The broker's main advantages include competitive pricing structures and quick technical support response times that help traders operate efficiently. However, these benefits are significantly outweighed by the lack of regulatory oversight, limited transparency, and resulting trust deficiencies that create substantial risks for client funds and trading operations in various market conditions.