Is Xinbaojinhao safe?

Business

License

Is Xinbaojinhao Safe or Scam?

Introduction

Xinbaojinhao is an online forex broker that has recently gained attention in the trading community. Positioned as a platform for both novice and experienced traders, it offers a variety of trading instruments, including currency pairs, commodities, and indices. Given the volatile nature of the forex market and the prevalence of scams, traders must exercise caution when selecting a broker. This article aims to provide a comprehensive evaluation of Xinbaojinhao, assessing its legitimacy and safety for potential investors. The investigation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk factors.

Regulation and Legitimacy

Regulatory oversight is crucial in determining the safety of any forex broker. A well-regulated broker is generally more trustworthy, as they are subject to strict compliance standards that protect traders' interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Currently, Xinbaojinhao lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns regarding its legitimacy. Without a regulatory framework, traders may find it challenging to seek recourse in cases of disputes or fund recovery. The broker's operational practices and adherence to industry standards remain unverified, making it difficult to ascertain its credibility.

The quality of regulation is paramount; brokers under stringent regulatory bodies such as the FCA or ASIC are typically more trustworthy. In contrast, Xinbaojinhao's lack of oversight suggests that it may not adhere to the same standards, potentially exposing traders to higher risks. Past compliance issues, if any, remain undisclosed, further complicating the assessment of its safety.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for evaluating its reliability. Xinbaojinhao was established in recent years, and while it claims to have a robust operational framework, specific details about its founding and growth trajectory remain scarce. The lack of transparency regarding its ownership structure raises questions about accountability and governance.

The management teams background plays a significant role in the broker's credibility. Unfortunately, information regarding the qualifications and experience of Xinbaojinhao's leadership is not readily available. A strong management team with a proven track record in the financial industry is typically indicative of a reliable broker. However, the absence of such information about Xinbaojinhao makes it difficult to assess its professionalism and commitment to ethical trading practices.

Furthermore, the company's transparency regarding its operations and financial performance is crucial. A reliable broker should provide regular updates and disclosures to its clients. Xinbaojinhao's apparent lack of such information could be a red flag for potential investors. Overall, the company's opaque background does not instill confidence in its operations or safety.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Xinbaojinhao presents a variety of trading instruments, but the overall fee structure and conditions are essential to evaluate its competitiveness in the market.

| Fee Type | Xinbaojinhao | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The lack of clear information regarding spreads, commissions, and overnight interest rates raises concerns about transparency. Traders often rely on competitive spreads and low commissions to optimize their trading strategies. If Xinbaojinhao's fees are significantly higher than the industry average, it may deter potential clients. Furthermore, any unusual or hidden fees could be indicative of a broker's attempts to capitalize on unsuspecting traders.

The absence of a well-defined fee structure can lead to confusion and mistrust among clients, as they may encounter unexpected charges during their trading experience. This lack of clarity is a critical factor to consider when evaluating whether Xinbaojinhao is safe or a potential scam.

Client Funds Security

The safety of client funds is a primary concern for any trader. A trustworthy broker should implement robust measures to protect investors' capital. Xinbaojinhao's security protocols regarding fund management and segregation remain unclear.

Investors typically expect brokers to maintain client funds in segregated accounts, ensuring that their money is protected in case of the broker's insolvency. Additionally, investor protection schemes, such as negative balance protection, are essential in safeguarding traders from excessive losses. However, Xinbaojinhao has not provided sufficient information on its fund security measures, which raises concerns about the safety of client investments.

In the past, brokers lacking adequate security measures have faced significant issues, including fund mismanagement and loss of client assets. Without a transparent disclosure of its security policies, traders may find themselves at risk, questioning whether they can trust Xinbaojinhao with their capital.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user experiences can provide insight into the overall quality of service offered by Xinbaojinhao.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow to respond |

| Misleading Information | High | No resolution |

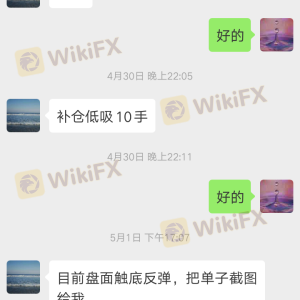

Common complaints against Xinbaojinhao include difficulties with fund withdrawals and inadequate customer support. Many users have reported experiencing delays or unresponsiveness when attempting to withdraw their funds, which is a significant red flag for any broker. A broker that does not facilitate timely withdrawals may be perceived as operating unethically.

Additionally, the quality of customer service is crucial for a positive trading experience. If clients encounter issues and receive slow or unhelpful responses, it can lead to frustration and distrust. The severity of complaints against Xinbaojinhao suggests that potential traders should proceed with caution.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. Traders expect a stable and user-friendly platform that allows for seamless order execution. Xinbaojinhao's platform performance, however, has not been thoroughly evaluated in the available data.

Factors such as order execution speed, slippage, and rejection rates are essential to consider. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. If the platform shows signs of manipulation or inconsistencies in execution, it could indicate deeper issues within the brokerage.

A reliable trading platform should provide transparent information regarding its operational performance. Without such transparency, traders may question whether Xinbaojinhao is safe or if it poses risks related to trade execution.

Risk Assessment

Utilizing Xinbaojinhao involves several risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight. |

| Fund Security | High | Lack of transparency on fund protection. |

| Customer Support | Medium | Reports of slow response times. |

| Platform Performance | High | Issues with execution and reliability. |

The combination of high regulatory risk, fund security concerns, and platform performance issues suggests that trading with Xinbaojinhao carries significant risk. Traders should consider these factors carefully and may want to explore alternative options that offer stronger protections and a more transparent trading environment.

Conclusion and Recommendations

In conclusion, the investigation into Xinbaojinhao reveals several concerning aspects that suggest it may not be a safe option for traders. The lack of regulatory oversight, transparency regarding trading conditions, and reports of customer complaints raise significant red flags.

Traders are advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability. Some reputable alternatives include brokers regulated by the FCA or ASIC, which typically offer better protections for client funds and more transparent trading conditions.

Ultimately, the decision to trade with Xinbaojinhao should be made with careful consideration of the risks involved. The evidence suggests that potential clients may want to look elsewhere for a safer trading experience.

Is Xinbaojinhao a scam, or is it legit?

The latest exposure and evaluation content of Xinbaojinhao brokers.

Xinbaojinhao Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xinbaojinhao latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.