Is Xianglong Guoji safe?

Business

License

Is Xianglong Guoji Safe or Scam?

Introduction

Xianglong Guoji, a forex broker based in Hong Kong, has emerged in the trading landscape, primarily catering to the Chinese market. As the forex market continues to expand in complexity and reach, traders must exercise caution when evaluating brokers to ensure their investments are secure. The importance of assessing a broker's legitimacy cannot be overstated, as it can significantly impact a trader's financial well-being. In this article, we will investigate whether Xianglong Guoji is safe or potentially a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

When evaluating the safety of any forex broker, regulatory oversight is a critical factor. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client funds and maintain market integrity. Unfortunately, Xianglong Guoji appears to lack valid regulatory credentials, which raises significant concerns regarding its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight suggests that Xianglong Guoji operates without the necessary checks and balances. This lack of regulation increases the risk of potential fraud, making it essential for traders to remain vigilant. Furthermore, historical compliance issues have been noted, with reports indicating that clients have faced difficulties withdrawing funds, raising red flags about the broker's operational integrity. In light of these findings, it is crucial for traders to approach Xianglong Guoji with caution.

Company Background Investigation

Xianglong Guoji has been in operation for approximately 2 to 5 years, primarily focused on the Chinese market. However, limited information is available regarding its ownership structure, company history, and management team. The lack of transparency raises questions about the broker's legitimacy and accountability.

The management teams qualifications and experience are vital indicators of a broker's reliability. Unfortunately, there is little publicly available information about the individuals leading Xianglong Guoji, which further complicates the assessment of its safety. A transparent broker typically provides detailed information about its executives and their professional backgrounds, which is not the case here.

Moreover, the company's website lacks comprehensive disclosures regarding its operations, financial health, and business practices. This opacity can be a warning sign for potential investors. Given the combination of limited company history and insufficient information about its management, traders should be cautious when considering Xianglong Guoji as a trading partner.

Trading Conditions Analysis

An assessment of trading conditions is crucial in determining the overall attractiveness of a broker. Xianglong Guoji offers various trading instruments, but its fee structure has raised concerns among users. The broker's fees may not align with industry standards, which could lead to unexpected costs for traders.

| Fee Type | Xianglong Guoji | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Rates | Variable | Fixed |

Reports indicate that traders have encountered high spreads on major currency pairs, which can significantly erode profit margins. Additionally, the commission structure remains ambiguous, leaving traders unsure of the total costs associated with their trades. Such discrepancies can lead to confusion and dissatisfaction among clients, raising further concerns about the broker's trustworthiness.

Overall, the trading conditions at Xianglong Guoji do not appear competitive when compared to reputable brokers in the industry. This lack of favorable trading conditions could be a significant factor contributing to the perception that Xianglong Guoji may not be safe for traders.

Customer Fund Security

The safety of customer funds is a paramount concern for any forex trader. Xianglong Guoji's measures to protect client funds are unclear. A reputable broker typically employs strict fund segregation practices, ensuring that client deposits are held in separate accounts from the company's operational funds. However, the absence of clear information regarding Xianglong Guoji's fund security measures is alarming.

Moreover, there is no mention of investor protection schemes or negative balance protection policies. These safeguards are essential in protecting traders from incurring debts beyond their initial investments. The lack of such measures raises significant concerns about the security of funds held with Xianglong Guoji.

Historical issues have also been reported, with clients alleging difficulties in withdrawing their funds. Such complaints indicate potential operational problems and further erode trust in the broker. In light of these findings, it is crucial for traders to consider the risks associated with entrusting their funds to Xianglong Guoji.

Customer Experience and Complaints

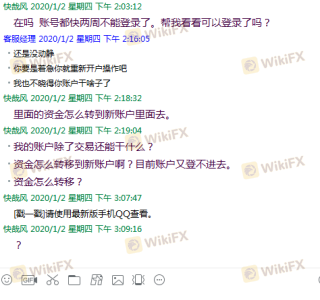

Customer feedback plays a vital role in assessing the reliability of a broker. Reviews and testimonials about Xianglong Guoji have been mixed, with several users expressing dissatisfaction with the service provided. Common complaints include difficulties with fund withdrawals, poor customer support, and high fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inadequate |

| Fee Transparency | High | No Response |

The severity of withdrawal issues reported by clients is particularly concerning, as it suggests that the broker may not prioritize the financial interests of its users. Additionally, the company's slow response to customer inquiries and complaints indicates a lack of commitment to providing quality service.

A few notable case studies highlight these issues. One user reported being unable to withdraw their funds for several months, while another cited a lack of communication from customer service when attempting to resolve a dispute. These experiences paint a troubling picture of the overall customer experience with Xianglong Guoji, leading to further skepticism about its safety.

Platform and Trade Execution

The performance and reliability of a trading platform are critical to a trader's success. Xianglong Guoji offers a trading platform, but reports suggest mixed reviews regarding its stability and execution quality. Users have reported instances of slippage and rejected orders, which can severely impact trading outcomes.

The potential for platform manipulation is also a concern, as traders have raised questions about the integrity of the execution process. A reliable broker should provide transparent information about order execution policies and ensure that trades are executed fairly and efficiently. However, the lack of clarity surrounding these aspects at Xianglong Guoji raises further doubts about its safety.

Risk Assessment

Using Xianglong Guoji presents several risks that traders should be aware of. The absence of regulation, unclear trading conditions, and negative customer experiences contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of clear fund protection measures |

| Customer Support | Medium | Slow response to complaints |

Given these risks, it is advisable for traders to exercise caution when considering Xianglong Guoji as a trading option. Engaging with a broker that lacks regulation and has a questionable reputation can lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the investigation into Xianglong Guoji raises considerable concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with negative customer experiences and unclear trading conditions, suggests that this broker may not be safe for traders.

For those considering forex trading, it is crucial to choose a broker with a solid regulatory framework and positive customer feedback. Reputable alternatives include well-regulated brokers that prioritize transparency, customer support, and fund security. Always perform thorough research before committing to any broker to ensure a safe trading experience.

Is Xianglong Guoji a scam, or is it legit?

The latest exposure and evaluation content of Xianglong Guoji brokers.

Xianglong Guoji Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xianglong Guoji latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.