Is WATT AND VOLT safe?

Pros

Cons

Is Watt And Volt Safe or Scam?

Introduction

Watt And Volt is a forex broker that has emerged in the competitive landscape of online trading, primarily targeting clients in Greece and other regions. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is fraught with risks, and the presence of unregulated or poorly regulated brokers can lead to significant financial losses. Therefore, assessing the credibility and safety of Watt And Volt is essential for potential investors. This article employs a comprehensive evaluation framework, drawing insights from multiple sources, to determine whether Watt And Volt is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a pivotal factor in determining its safety. Watt And Volt operates without proper regulatory oversight, which raises significant red flags for potential investors. Below is a summary of the broker's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Greece | Unregulated |

The absence of regulation implies that Watt And Volt is not held accountable to any financial authority, which is a critical aspect of ensuring investor protection. Established regulatory bodies enforce strict compliance standards that brokers must adhere to, including maintaining client funds in segregated accounts and providing clear information about trading conditions. The lack of such oversight for Watt And Volt means that traders may not have recourse in case of disputes or financial misconduct. Historical compliance issues associated with unregulated brokers further exacerbate the risks involved.

Company Background Investigation

Watt And Volt was founded in 2011 and has positioned itself as a provider of various trading services, including forex and contracts for difference (CFDs). However, the company's ownership structure and management team lack transparency, which is a concerning factor for potential clients. While the company claims to have a solid operational history, the absence of detailed disclosures about its founders and key executives raises questions about its legitimacy.

A thorough background check on the management team reveals limited professional experience in the forex industry, which can significantly impact the broker's operational integrity and client trust. Transparency in a broker's operations, including clear information about its ownership and management, is crucial for building confidence among traders. The lack of such transparency at Watt And Volt is a notable concern that potential clients should consider before investing.

Trading Conditions Analysis

Watt And Volt's trading conditions are another critical aspect to evaluate. The broker offers a variety of trading instruments, but the costs associated with trading can significantly impact profitability. Below is a comparison of core trading costs:

| Cost Type | Watt And Volt | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Moderate |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The trading fees at Watt And Volt are reportedly higher than the industry average, which could eat into traders' profits. Furthermore, the absence of a transparent commission structure raises concerns about hidden fees that could be detrimental to traders. High spreads and unclear fee policies are often indicative of brokers that may not prioritize their clients' interests, thus warranting caution when considering this broker.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Watt And Volt's lack of regulatory oversight translates to inadequate measures for safeguarding client deposits. There is no evidence that the broker employs fund segregation practices, which are essential for ensuring that client funds are kept separate from the broker's operational funds. Additionally, the absence of investor protection schemes raises the risk of total loss in the event of broker insolvency.

Historically, unregulated brokers have been associated with various financial scandals, including the misappropriation of client funds. Therefore, potential clients should be extremely cautious when considering depositing funds with Watt And Volt, as the lack of robust security measures could lead to significant financial risks.

Customer Experience and Complaints

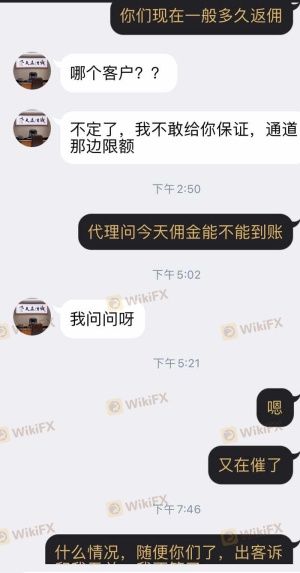

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Watt And Volt indicate a mixed response from clients, with several complaints surfacing regarding withdrawal issues and unresponsive customer service. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

| Fee Transparency | High | Poor |

Many users have reported difficulties in withdrawing their funds, often citing delays and excuses from the broker. This pattern of complaints is concerning, as it suggests a lack of accountability and responsiveness from the broker's management. The overall sentiment among users points to a perception that Watt And Volt may not prioritize customer satisfaction, which is a significant factor to consider when evaluating the broker's safety.

Platform and Execution

The trading platform offered by Watt And Volt is another critical aspect of the trading experience. User reviews suggest that while the platform is functional, it may not provide the level of stability and performance expected from a reputable broker. Concerns have been raised regarding order execution quality, including instances of slippage and rejected orders. These issues can significantly impact trading outcomes and indicate potential manipulation or inefficiencies within the trading system.

Moreover, the absence of advanced trading tools and features commonly found in established platforms raises questions about the broker's commitment to providing a competitive trading environment. Traders should be wary of platforms that do not deliver on performance, as this can lead to frustrating trading experiences and financial losses.

Risk Assessment

Engaging with Watt And Volt presents several risks that potential clients should consider. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Financial Risk | High | Lack of fund security measures may lead to total loss. |

| Operational Risk | Medium | Complaints about execution and withdrawal issues. |

To mitigate these risks, potential clients should consider trading with regulated brokers that offer transparent fee structures, robust security measures, and responsive customer service. It is advisable to conduct thorough research and seek out brokers with strong reputations and positive user feedback.

Conclusion and Recommendations

In conclusion, the investigation into Watt And Volt raises significant concerns regarding its safety and legitimacy. The broker operates without proper regulatory oversight, lacks transparency in its operations, and has received numerous complaints from clients regarding withdrawal issues and customer service. The high trading costs and inadequate security measures further exacerbate the risks associated with this broker.

Given the findings, it is recommended that traders exercise extreme caution when considering Watt And Volt as a trading option. For those seeking safer alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized. These brokers not only offer better security for client funds but also provide a more transparent and reliable trading environment.

In summary, Watt And Volt does not meet the necessary criteria for a safe trading platform, and potential clients should be aware of the associated risks before proceeding.

Is WATT AND VOLT a scam, or is it legit?

The latest exposure and evaluation content of WATT AND VOLT brokers.

WATT AND VOLT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WATT AND VOLT latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.