Is ValorFX safe?

Business

License

Is ValorFX Safe or Scam?

Introduction

ValorFX is a forex broker that positions itself in the crowded market of online trading, offering a range of trading instruments including forex, CFDs, and cryptocurrencies. However, as the forex market grows, so do the number of brokers, making it essential for traders to carefully evaluate the credibility and reliability of these platforms. With numerous reports of scams and fraudulent activities, assessing the safety of a broker like ValorFX becomes crucial for both novice and experienced traders. This article investigates the legitimacy of ValorFX by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

One of the primary factors that determine whether a forex broker is safe to trade with is its regulatory status. Regulation serves as a form of oversight that can protect traders from potential fraud and misconduct. ValorFX claims to operate from Saint Vincent and the Grenadines, a location known for its lenient regulatory environment. However, it lacks any valid licenses from reputable regulatory authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 14806 (revoked) | Vanuatu | Revoked |

The VFSC previously issued a license to ValorFX but revoked it due to concerns regarding the broker's operations and financial stability. This lack of regulatory oversight raises significant red flags regarding the safety of trading with ValorFX. Without proper regulation, traders have little recourse in the event of disputes or fraudulent activities. Therefore, it is crucial to question is ValorFX safe when it operates without the backing of a reputable regulatory body.

Company Background Investigation

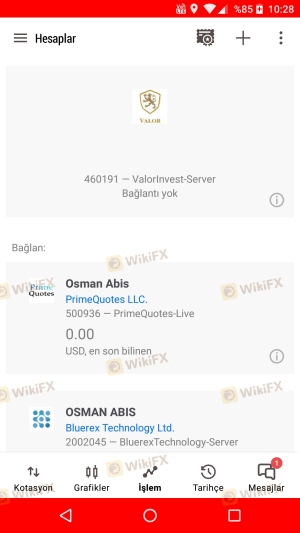

ValorFX was established in 2017 and is owned by Valor Invest LLC. While the company presents itself as a legitimate trading platform, its operational history is marred by a lack of transparency. The management team behind ValorFX remains largely unknown, which raises concerns about their experience and qualifications in the financial industry.

The absence of detailed information regarding the company's ownership structure and management team contributes to a perception of opacity. Moreover, the company's website does not provide comprehensive disclosures about its financial standing or operational practices, making it difficult for potential clients to assess its reliability. This lack of transparency further complicates the question of is ValorFX safe for traders looking to invest their funds.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. ValorFX provides a range of trading accounts with varying spreads and commissions. However, the overall fee structure appears to be less competitive compared to other brokers in the market.

| Fee Type | ValorFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None (Standard) | $5 per lot |

| Overnight Interest Range | High | Low to Medium |

The spreads offered by ValorFX, particularly on major currency pairs, are higher than the industry average, which can eat into traders' profits. Additionally, reports indicate that clients have faced difficulties when trying to withdraw funds, which raises concerns about the broker's overall cost structure and transparency. Given these factors, potential clients should carefully consider whether is ValorFX safe when it comes to trading costs and conditions.

Client Fund Security

The security of client funds is another critical aspect that traders must consider when evaluating a broker. ValorFX claims to implement various measures to protect client funds, but the lack of regulatory oversight raises questions about the effectiveness of these measures.

A key feature that traders should look for is the segregation of client funds. This practice ensures that client deposits are kept separate from the broker's operational funds, providing an additional layer of protection. However, ValorFX has not provided clear information on whether it adheres to this practice. Furthermore, the absence of investor protection schemes, such as those offered by regulated brokers, means that traders are at risk of losing their funds without any recourse.

The historical context of fund security issues with unregulated brokers further complicates the question of is ValorFX safe. Traders should be cautious and consider the potential risks involved in trading with a broker that lacks stringent security measures.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing the reliability of a broker. ValorFX has garnered a mixed reputation online, with numerous complaints filed by clients. Common issues reported include difficulties in withdrawing funds, high spreads, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| High Spreads | Medium | Unresponsive to Complaints |

| Customer Service Delays | Medium | Limited Support |

For instance, one user reported being unable to withdraw their funds after several attempts, leading to frustration and financial loss. Another common complaint highlights the high spreads that ValorFX charges, which can significantly affect profitability. The lack of timely responses from customer service further exacerbates these issues, leading to a negative overall experience for many clients. This pattern of complaints raises serious concerns about whether is ValorFX safe for potential traders.

Platform and Trade Execution

The trading platform's performance and execution quality are critical for a successful trading experience. ValorFX utilizes the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, there have been reports of order execution issues, including slippage and rejections, which can adversely affect trading outcomes.

Additionally, traders have expressed concerns about the platform's stability, with some users experiencing downtime during critical trading periods. Such performance issues can lead to significant financial losses and contribute to the perception that ValorFX may not be a reliable broker. Considering these factors, traders must evaluate whether is ValorFX safe when it comes to platform reliability and execution quality.

Risk Assessment

Engaging with an unregulated broker like ValorFX inherently carries risks. The absence of oversight can lead to potential fraudulent practices, lack of customer protection, and financial instability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of client fund protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Execution Risk | Medium | Issues with order execution |

Given these risks, it is crucial for traders to exercise caution. Those considering trading with ValorFX should take steps to mitigate these risks, such as starting with a small investment and being vigilant about their trading activities.

Conclusion and Recommendations

In conclusion, the evidence suggests that trading with ValorFX may pose significant risks. The lack of regulation, transparency issues, high trading costs, and negative customer experiences raise serious concerns about the broker's legitimacy. Therefore, it is essential for traders to ask themselves is ValorFX safe before committing their funds.

For those seeking a more secure trading environment, it is advisable to consider regulated brokers that offer better protection and more favorable trading conditions. Alternatives such as IC Markets, Pepperstone, and AvaTrade have established reputations and regulatory oversight, making them safer choices for forex trading. Ultimately, traders must prioritize safety and reliability when selecting a broker to ensure a positive trading experience.

Is ValorFX a scam, or is it legit?

The latest exposure and evaluation content of ValorFX brokers.

ValorFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ValorFX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.