Is SovyFX safe?

Business

License

Is SovyFX Safe or Scam?

Introduction

SovyFX is a forex broker that positions itself within the competitive landscape of online trading, particularly focusing on offering contracts for difference (CFDs) across various asset classes. Established in 2017 and based in Australia, SovyFX aims to attract traders with promises of favorable trading conditions and a user-friendly platform. However, the forex market is notorious for its high level of risk and the presence of unregulated brokers, making it essential for traders to conduct thorough due diligence before selecting a trading partner. This article will evaluate whether SovyFX is safe for trading or if it operates as a scam. The assessment will rely on a combination of user reviews, regulatory information, and operational transparency.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Regulatory bodies are vital as they enforce compliance with financial laws, ensuring that brokers operate within established guidelines designed to protect traders. Unfortunately, SovyFX does not hold a license from any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation is alarming, especially in a market where several brokers have been flagged for fraudulent activities. The lack of oversight means that traders have limited recourse should issues arise, such as withdrawal problems or disputes over trading conditions. Furthermore, unregulated brokers, like SovyFX, are often associated with higher risks, including potential scams. The historical compliance of regulated brokers offers a level of assurance that unregulated ones simply cannot provide. Therefore, it is crucial for traders to be cautious and consider the risks associated with trading through SovyFX.

Company Background Investigation

SovyFX was established in 2017, and its operations are based in Australia. However, the companys ownership structure and management team remain opaque, which is a red flag for potential investors. A lack of transparency can often indicate that a company is attempting to hide something, whether it be poor performance, a history of complaints, or even fraudulent practices.

The management team's background is another critical aspect to consider. Effective leadership with a solid track record in the financial sector can inspire confidence in a broker's operations. Unfortunately, detailed information about SovyFX's management is scarce, making it difficult for traders to assess their qualifications and experience. This opacity can lead to skepticism regarding the broker's intentions and capabilities.

In addition, the overall transparency of the company is concerning. There is limited information available regarding its operational practices, financial health, and customer service policies. This lack of information can make it challenging for traders to make informed decisions. Thus, the overall opacity surrounding SovyFX raises significant doubts about its legitimacy and safety for traders.

Trading Conditions Analysis

When evaluating a broker, it's essential to consider the trading conditions it offers, including fees, spreads, and other costs associated with trading. SovyFX claims to provide competitive trading conditions; however, the specifics of these conditions are not well-documented or transparent.

| Fee Type | SovyFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.5 - 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commission structures is a significant concern. Traders should be wary of brokers that do not disclose their fee structures, as hidden fees can erode profits and lead to unexpected losses. Furthermore, the lack of transparency in fees may indicate that the broker is not operating in good faith.

Moreover, any unusual fee policies could signal potential issues. For instance, excessive withdrawal fees, inactivity fees, or other hidden costs can make trading with SovyFX less appealing. Traders should always seek brokers that provide clear and fair fee structures, as this is a key indicator of a broker's integrity.

Client Fund Safety

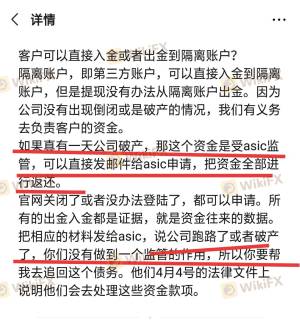

The safety of client funds is paramount when considering whether a broker is safe. SovyFX's lack of regulation raises concerns about its client fund security measures. Regulated brokers are typically required to segregate client funds from their operational funds, providing a layer of protection in case of insolvency. However, without regulatory oversight, it is unclear whether SovyFX implements similar measures.

Additionally, the absence of investor protection schemes, such as compensation funds, further jeopardizes the safety of client funds. If SovyFX were to encounter financial difficulties, clients might find themselves without recourse to recover their investments. Historical issues related to fund security often serve as a warning sign for traders, and any past controversies involving SovyFX could indicate a pattern of mismanagement or fraud.

In summary, the lack of transparency regarding SovyFX's fund safety measures, coupled with its unregulated status, suggests that traders should approach this broker with extreme caution. The potential risks associated with entrusting funds to an unregulated entity are significant, and traders must weigh these risks carefully.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's operations and reliability. Unfortunately, SovyFX has received a considerable number of complaints from users, particularly concerning withdrawal issues. Many clients report being unable to access their funds, with various excuses provided by the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Issues | Medium | Poor |

Common complaints include delayed withdrawals, lack of communication from customer service, and issues with account management. These patterns of complaints are alarming and indicate a potential systemic problem within the company. In particular, the inability to withdraw funds is a significant red flag, as it suggests that the broker may be engaging in practices designed to limit access to client capital.

Additionally, the quality of customer support is often cited as inadequate, with many users reporting long response times and unhelpful assistance. This can exacerbate frustrations, especially for traders facing urgent issues with their accounts. Overall, the negative customer feedback surrounding SovyFX raises serious concerns about its reliability and trustworthiness.

Platform and Execution

The trading platform offered by a broker is a critical factor in a trader's overall experience. SovyFX utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading capabilities. However, the performance and stability of the platform are crucial for successful trading.

Issues related to order execution, such as slippage and requotes, can significantly impact trading outcomes. Traders have reported instances of poor execution quality on SovyFXs platform, which can lead to losses and frustration. Furthermore, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, should be closely scrutinized.

A brokers ability to provide a reliable and efficient trading environment is essential for building trust with clients. If SovyFX fails to deliver on these fronts, it could further diminish its credibility in the eyes of potential traders.

Risk Assessment

Using SovyFX comes with a range of risks that potential traders should consider carefully. The absence of regulation, coupled with numerous complaints regarding fund safety and withdrawal issues, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from regulatory bodies |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | Medium | Poor response to client complaints |

Given the high-risk nature of trading with SovyFX, traders are advised to implement risk mitigation strategies. This may include starting with a small investment, utilizing stop-loss orders, and diversifying trading accounts across multiple brokers to minimize exposure.

Conclusion and Recommendations

In conclusion, the evidence suggests that SovyFX is not a safe trading option. The combination of its unregulated status, numerous customer complaints, and lack of transparency regarding fees and fund safety raises significant red flags. Traders should be particularly cautious when considering this broker, as the risks associated with trading through SovyFX appear to outweigh any potential benefits.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable authorities, offer clear fee structures, and maintain a positive reputation among clients. Some recommended options include brokers like IG, OANDA, and Forex.com, which have established themselves as trustworthy entities in the forex market.

Ultimately, the choice of a trading partner should be made with careful consideration of the associated risks. Is SovyFX safe? Based on the analysis presented, it is prudent for traders to seek safer, more reliable options for their trading needs.

Is SovyFX a scam, or is it legit?

The latest exposure and evaluation content of SovyFX brokers.

SovyFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SovyFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.