Is S&J Future Limited safe?

Business

License

Is S&J Future Limited A Scam?

Introduction

S&J Future Limited, a forex broker based in Hong Kong, has been gaining attention in the trading community. Established in 2021, it offers a platform for trading various financial instruments, including forex and cryptocurrencies. However, as the forex market continues to attract both seasoned traders and novices, the importance of evaluating the legitimacy and safety of brokers cannot be overstated. Traders need to ensure that their funds are secure and that they are dealing with a reputable entity. This article aims to provide a thorough investigation into S&J Future Limited's regulatory status, company background, trading conditions, customer experiences, and overall safety. The analysis is based on a comprehensive review of available online resources, including user feedback, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its credibility. S&J Future Limited operates without any recognized regulatory oversight, which raises significant concerns regarding its legitimacy. The absence of regulation means that the broker is not subject to the stringent rules and standards typically imposed by financial authorities, leaving traders vulnerable to potential risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework means that there is no governing body to oversee the broker's operations or protect traders in case of disputes. This is particularly alarming given the number of complaints from users regarding withdrawal issues and alleged scams. Without regulatory oversight, S&J Future Limited's operations remain shrouded in uncertainty, prompting traders to exercise extreme caution. The history of compliance is non-existent, further emphasizing the risks associated with trading through this broker.

Company Background Investigation

S&J Future Limited was incorporated in Hong Kong on August 3, 2021. The company has been operational for a little over two years, but the lack of transparency regarding its ownership and management raises questions. There is limited information available about the company's founders or the management team, which is a common red flag in the forex industry. A reputable broker typically provides detailed information about its leadership and operational structure, allowing traders to assess their expertise and experience.

The company's website, which is currently down, adds to the concerns about its transparency and reliability. Users have reported difficulties accessing services, which is a significant issue for a trading platform that needs to be consistently operational. The absence of clear communication channels and an accessible website further diminishes trust in S&J Future Limited. Overall, the companys lack of transparency and the absence of a clear ownership structure contribute to the perception that S&J Future Limited may not be a safe choice for traders.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions it offers are paramount. S&J Future Limited provides access to forex and cryptocurrency trading with a maximum leverage of 1:400, which can be enticing for traders looking to maximize their potential returns. However, such high leverage also significantly increases the risk of substantial losses, especially for inexperienced traders.

The fee structure of S&J Future Limited is somewhat opaque, with reports indicating variable spreads and no clear commission structure. This lack of clarity can lead to unexpected costs for traders, making it difficult to gauge the overall cost of trading with this broker.

| Fee Type | S&J Future Limited | Industry Average |

|---|---|---|

| Spread on Major Pairs | Starting from 0.1 pips | 1-2 pips |

| Commission Model | Not specified | $3-$5 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

The absence of a clearly defined fee structure and the presence of high leverage may suggest that S&J Future Limited is not entirely transparent in its trading practices. This can lead to a negative trading experience and potential financial losses for users. Traders should be wary of brokers with unclear fee policies, as these can often mask higher costs that can eat into profits.

Client Fund Security

The security of client funds is a critical consideration for any trader. S&J Future Limited does not appear to have any robust measures in place to protect client deposits. There are no indications of segregated accounts or investor protection schemes, which are standard practices among regulated brokers. This lack of financial safeguards increases the risk of losing funds in the event of the brokers insolvency.

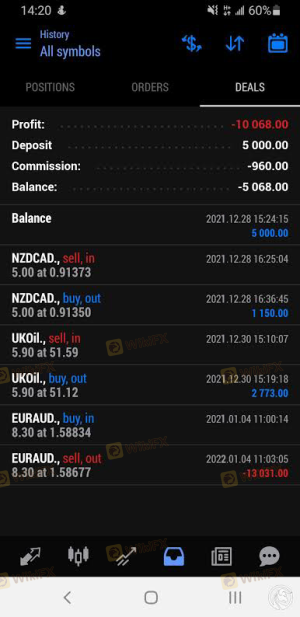

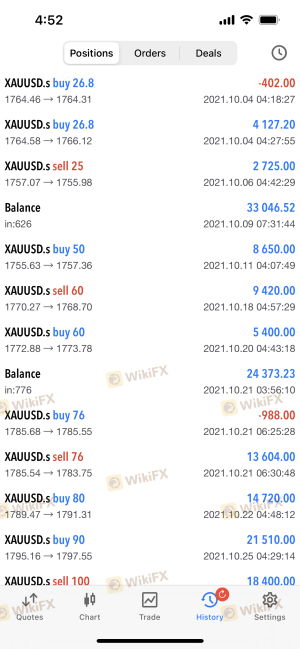

Moreover, historical complaints from users indicate issues with fund withdrawals, further highlighting potential vulnerabilities in S&J Future Limited's operational integrity. The absence of negative balance protection also poses a risk, as traders could find themselves liable for losses exceeding their initial investment. Given these factors, it is clear that S&J Future Limited does not prioritize client fund security, making it a risky choice for traders.

Customer Experience and Complaints

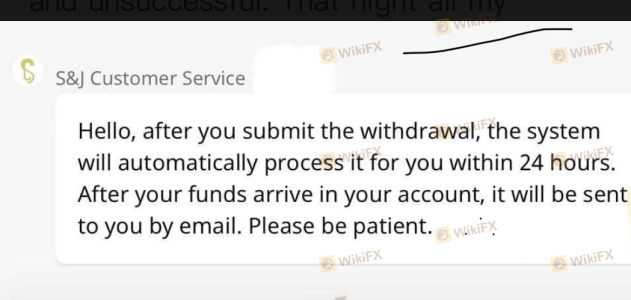

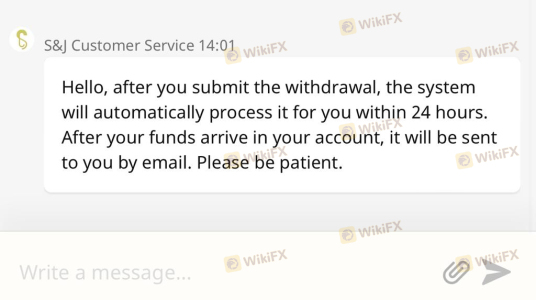

Customer feedback is an invaluable resource when assessing a broker's reliability. Unfortunately, S&J Future Limited has garnered a significant number of negative reviews from users. Common complaints include withdrawal issues, lack of responsive customer support, and allegations of fraudulent practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Alleged Fraud | High | No response |

Many users have reported being unable to withdraw their funds after making deposits, which is a serious red flag. Additionally, the quality of customer service has been criticized, with many users stating that their queries went unanswered or were met with vague responses. Notably, some users have shared harrowing experiences of losing significant amounts of money, leading to distress and financial hardship. These patterns of complaints strongly suggest that S&J Future Limited may not be a trustworthy broker.

Platform and Execution

The trading platform offered by S&J Future Limited is based on the widely used MetaTrader 4 (MT4) software. While MT4 is known for its reliability and user-friendly interface, the overall performance of the platform has been called into question by users. Reports of execution delays, slippage, and order rejections have surfaced, indicating potential issues with the broker's execution quality.

Traders have expressed concerns about the reliability of S&J Future Limited's platform, with some alleging that they experienced manipulation during high-volatility trading periods. Such practices, if true, could severely undermine the integrity of the trading environment and lead to significant financial losses for traders.

Risk Assessment

Trading with S&J Future Limited involves various risks that traders should be aware of. The absence of regulation, unclear fee structures, and numerous user complaints contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection |

| Execution Risk | Medium | Reports of slippage and delays |

To mitigate these risks, traders should conduct thorough research before engaging with S&J Future Limited. It is advisable to start with a demo account, if available, and to avoid depositing large sums until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that S&J Future Limited raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, poor customer feedback, and issues related to fund security point towards a potentially risky trading environment. Traders should be particularly cautious and consider alternative brokers that are regulated and have a proven track record of reliable service.

If you are a trader seeking a safer environment for your investments, it is recommended to explore brokers that are regulated by reputable authorities, such as those listed by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers typically provide better protection for client funds and a more transparent trading experience. Always prioritize safety and conduct thorough due diligence before engaging with any forex broker, especially one like S&J Future Limited, which has raised numerous red flags in the trading community.

Is S&J Future Limited a scam, or is it legit?

The latest exposure and evaluation content of S&J Future Limited brokers.

S&J Future Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

S&J Future Limited latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.