Is RSmarkets safe?

Business

License

Is RSmarkets Safe or Scam?

Introduction

RSmarkets is a forex broker that has emerged in the trading landscape since its establishment in 2019. Based in St. Vincent and the Grenadines, RSmarkets positions itself as a platform catering to both novice and experienced traders, offering access to various financial instruments including forex, commodities, and cryptocurrencies. However, with the proliferation of online trading platforms, it is crucial for traders to meticulously evaluate the credibility and safety of such brokers. The potential risks associated with unregulated trading platforms can lead to significant financial losses, making it imperative for traders to conduct thorough research before engaging with any broker.

In this article, we will analyze RSmarkets' safety and legitimacy through a comprehensive investigation. Our assessment will focus on key areas such as regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk evaluation. By synthesizing data from various reputable sources, we aim to provide a balanced perspective on whether RSmarkets is a safe option for traders or if it raises red flags.

Regulation and Legitimacy

The regulatory status of a brokerage is paramount in determining its safety for traders. RSmarkets is registered in St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This raises concerns about the broker's legitimacy and the level of protection it offers to its clients. Below is a summary of RSmarkets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | 25695 BC 2019 | St. Vincent and the Grenadines | Unregulated |

As indicated in the table, RSmarkets operates under a registration that does not equate to a robust regulatory license. The absence of stringent regulatory oversight means that traders may lack recourse in the event of disputes or financial issues. Furthermore, the lack of negative regulatory disclosures is overshadowed by the broker's unregulated status, which inherently carries higher risks. Traders are often advised to prioritize brokers that are regulated by reputable authorities, as these entities are required to adhere to strict standards that safeguard client interests. In summary, the lack of regulation raises significant concerns about whether RSmarkets is safe for trading.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its reliability. RSmarkets was founded in 2019 and claims to be operated by a team of experienced professionals in the forex and trading industry. However, detailed information regarding the management team and their qualifications is scarce. This lack of transparency can be a warning sign for potential clients.

The company's incorporation as an international business in St. Vincent and the Grenadines further complicates its credibility. This location is often associated with offshore brokers that do not offer the same level of investor protection as those regulated in jurisdictions like the European Union or the United States. The absence of clear information about the management and operational practices of RSmarkets can lead to skepticism about its intentions and reliability. Therefore, potential traders should approach this broker with caution, as the lack of transparency about the company's background raises questions about its safety.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer, including fees, spreads, and commissions. RSmarkets presents a competitive trading environment with a minimum deposit requirement of $250 and leverage up to 1:400. However, the overall fee structure is complex and may include various hidden costs.

| Fee Type | RSmarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | High | Low to Medium |

As shown in the table, the spreads for major currency pairs at RSmarkets are slightly higher than the industry average, which could affect trading profitability. Moreover, the broker charges withdrawal fees that can reach up to 10%, which is notably high compared to many competitors. Such fees can significantly erode a trader's capital, especially for those who frequently withdraw funds. Therefore, while RSmarkets does offer some attractive trading conditions, the presence of high withdrawal fees and spreads suggests that traders should carefully consider the overall cost of trading with this broker.

Customer Fund Security

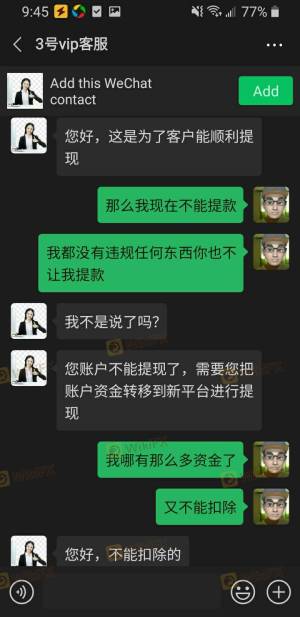

The security of customer funds is a critical aspect of any trading platform. RSmarkets claims to implement measures to safeguard client funds, but the lack of proper regulation raises concerns about the effectiveness of these measures. The broker does not provide clear information regarding fund segregation or investor protection schemes.

In an unregulated environment like that of RSmarkets, traders' funds are at risk, especially in the event of insolvency. Without a regulatory body overseeing the broker's operations, clients may find themselves without recourse should the broker face financial difficulties. Furthermore, there have been reports of withdrawal issues and complaints regarding the inability to access funds, which further emphasizes the need for caution. Consequently, the uncertainty surrounding the safety of customer funds with RSmarkets is a significant red flag that potential traders should not overlook.

Customer Experience and Complaints

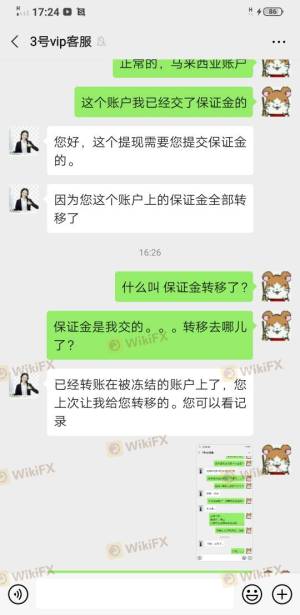

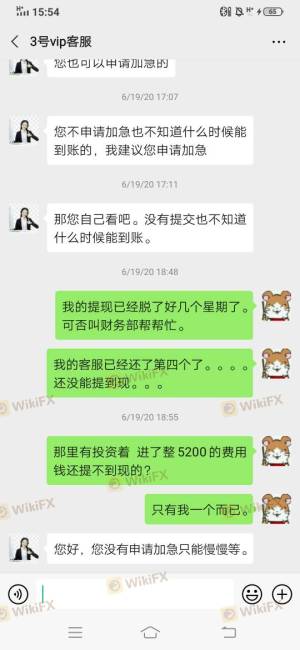

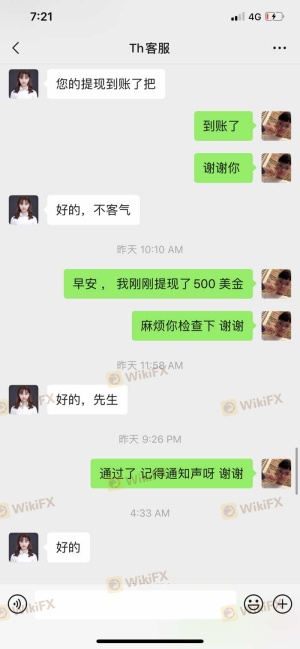

Analyzing customer feedback can provide valuable insights into a broker's reliability. Reviews of RSmarkets reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and customer service responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Moderate |

Many clients have expressed frustration over the inability to withdraw their funds, often citing extended delays and unresponsive customer service. These issues not only highlight potential operational inefficiencies but also raise concerns about the broker's integrity. A particularly alarming case involves a trader who reported being unable to access their funds for over a month, leading to suspicions of fraudulent practices. This pattern of complaints suggests that the customer experience at RSmarkets may not align with the expectations of a reputable broker, further questioning its safety.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. RSmarkets offers the MetaTrader 5 (MT5) platform, which is widely regarded for its functionality and user-friendly interface. However, the execution quality and potential issues such as slippage or order rejections are equally important.

Reports from users indicate mixed experiences with trade execution, with some traders experiencing significant slippage during volatile market conditions. This can be detrimental, particularly for those employing scalping strategies or relying on precise entry and exit points. Additionally, the absence of any evidence suggesting platform manipulation is a positive aspect, but the overall execution quality remains a concern. Therefore, while the platform itself may be robust, the execution issues reported by users raise questions about whether RSmarkets is safe for high-frequency trading.

Risk Assessment

Engaging with RSmarkets entails various risks, primarily stemming from its unregulated status and customer feedback. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated jurisdiction |

| Financial Risk | High | Withdrawal issues reported |

| Execution Risk | Medium | Slippage and order rejections |

Given the high levels of regulatory and financial risks, potential traders should exercise extreme caution. The lack of oversight and the reported issues with withdrawals suggest that engaging with RSmarkets could lead to significant financial loss. To mitigate risks, it is advisable for traders to maintain strict risk management practices and consider utilizing demo accounts before committing real funds.

Conclusion and Recommendations

In conclusion, the investigation into RSmarkets raises several concerns regarding its safety and legitimacy. The broker's unregulated status, coupled with a lack of transparency and numerous customer complaints, suggests that it may not be a reliable choice for traders. The absence of robust regulatory oversight and the reported issues with fund withdrawals are significant red flags that potential clients should consider seriously.

For traders seeking a safer trading environment, it is advisable to explore alternative brokers that are regulated by reputable authorities, such as those in the UK, EU, or Australia. Brokers like eToro, IG, or OANDA offer more robust protections and a better overall trading experience. Ultimately, while RSmarkets may present itself as a viable trading option, the potential risks involved warrant a careful and cautious approach.

Is RSmarkets a scam, or is it legit?

The latest exposure and evaluation content of RSmarkets brokers.

RSmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RSmarkets latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.