Is Roctec Futures safe?

Business

License

Is Roctec Futures Safe or Scam?

Introduction

Roctec Futures, a forex broker based in Hong Kong, has garnered attention in the trading community, particularly for its claims of providing access to various financial markets. However, with the rise of online trading platforms, it has become increasingly crucial for traders to evaluate the legitimacy and safety of such brokers. The forex market is rife with both opportunities and risks, making it essential for investors to conduct thorough research before committing their capital. This article aims to provide an objective analysis of Roctec Futures, assessing its credibility through various factors, including regulatory status, company background, trading conditions, and customer experiences.

To conduct this investigation, we analyzed information from multiple sources, including reviews, regulatory databases, and user feedback. Our assessment framework focuses on key areas such as regulation and legality, company background, trading conditions, customer fund security, and overall user experience. By synthesizing this information, we aim to answer the critical question: Is Roctec Futures safe for traders?

Regulation and Legitimacy

The regulatory framework within which a broker operates is fundamental to its legitimacy. Roctec Futures claims to be licensed by the Securities and Futures Commission (SFC) of Hong Kong; however, there are significant concerns regarding the validity of this claim. The broker's license number, AAJ 976, has been flagged as suspicious, and it appears that Roctec operates under a clone license, raising serious doubts about its regulatory compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AAJ 976 | Hong Kong | Suspicious |

The lack of a credible regulatory authority overseeing Roctec's operations means that traders may face heightened risks, including the potential loss of funds without any legal recourse. Regulatory bodies exist to protect investors, and the absence of genuine oversight can expose traders to fraudulent practices. Given these concerns, it is imperative for potential clients to consider whether Roctec Futures is safe for their trading activities.

Company Background Investigation

Roctec Futures, operating under the name Eagle Futures Limited, has been in business for approximately 5 to 10 years. However, the company has faced scrutiny regarding its transparency and ownership structure. There is limited publicly available information about the management team and their professional backgrounds, which raises questions about the broker's credibility.

Transparency is a critical factor in assessing the legitimacy of a broker. A reputable firm typically provides clear information about its ownership, management team, and operational history. In Roctec's case, the lack of detailed disclosures may indicate a reluctance to provide potential clients with the information necessary to make informed decisions. Consequently, this lack of transparency contributes to the overall uncertainty surrounding whether Roctec Futures is safe for traders.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure, including spreads, commissions, and overnight interest rates. Roctec Futures presents various account types with differing minimum deposits and leverage options. However, the specifics of its fee structure have raised eyebrows among industry observers.

| Fee Type | Roctec Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | From 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Roctec are notably higher than the industry average, which could significantly affect trading profitability. Additionally, the absence of a clear commission structure raises questions about potential hidden fees that traders may encounter. These factors contribute to the perception that Roctec Futures may not be safe, particularly for cost-conscious traders.

Customer Fund Security

The safety of customer funds is paramount when assessing a broker's reliability. Roctec Futures claims to implement various security measures to protect client funds; however, detailed information regarding these measures is scarce. The absence of clarity surrounding fund segregation, investor protection, and negative balance protection policies raises concerns about the overall safety of client capital.

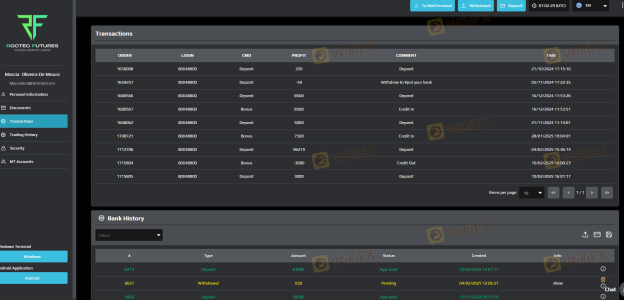

Historical data indicates that Roctec has faced issues with fund security, including reports of difficulties in withdrawing funds. Such incidents can severely undermine trust and confidence in a broker. Therefore, the lack of robust security measures could suggest that Roctec Futures is not safe, especially for traders concerned about the security of their investments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Roctec Futures reveal a pattern of negative experiences, with many users reporting challenges in withdrawing their funds and aggressive tactics from the company to solicit additional deposits.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales | Medium | Poor |

| Lack of Transparency | High | Poor |

Several users have shared their experiences of being unable to withdraw funds, often citing excuses related to hidden fees or additional requirements. These complaints highlight a troubling trend that suggests a lack of professionalism and customer care. In light of these findings, it is reasonable to question whether Roctec Futures is safe for potential investors.

Platform and Execution

The performance of a trading platform is critical for a seamless trading experience. Roctec Futures offers various trading terminals; however, user reviews indicate issues with platform stability and execution quality. Reports of slippage and order rejections have surfaced, raising concerns about the broker's reliability in executing trades.

A platform that frequently experiences technical issues can significantly impact a trader's ability to capitalize on market opportunities. If traders cannot rely on the execution quality, it raises further doubts about whether Roctec Futures is safe to trade with.

Risk Assessment

In summary, the overall risk profile of Roctec Futures appears concerning. The combination of suspicious regulatory status, lack of transparency, high trading costs, and negative customer experiences paints a troubling picture.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone license, no genuine oversight. |

| Fund Security | High | Reports of withdrawal issues and lack of clarity on fund protection policies. |

| Trading Conditions | Medium | Higher-than-average spreads and unclear fee structure. |

| Customer Service | High | Poor response to complaints and customer support issues. |

To mitigate risks, potential traders should exercise extreme caution when considering Roctec Futures. Seeking alternative brokers with established regulatory oversight and positive customer feedback may be prudent.

Conclusion and Recommendations

In conclusion, the evidence suggests that Roctec Futures is not a safe broker for traders. The combination of regulatory concerns, poor customer experiences, and high trading costs raises significant red flags. For those considering trading in the forex market, it is advisable to explore alternative options that offer greater transparency, regulatory compliance, and a solid reputation.

For traders seeking reliable alternatives, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically provide better customer protections and a more transparent trading environment, ensuring that your trading experience is not only profitable but also secure.

Is Roctec Futures a scam, or is it legit?

The latest exposure and evaluation content of Roctec Futures brokers.

Roctec Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Roctec Futures latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.