Regarding the legitimacy of PRUTON FUTURES forex brokers, it provides BAPPEBTI and WikiBit, .

Is PRUTON FUTURES safe?

Business

License

Is PRUTON FUTURES markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. PRUTON MEGA BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

compliance@pruton-futures.comSharing Status:

No SharingWebsite of Licensed Institution:

www.pruton-futures.comExpiration Time:

--Address of Licensed Institution:

Menara STandard CharTered LanTai 32, Jl. ProF. DR. SaTrio Kav. 164, JakarTa 12930Phone Number of Licensed Institution:

02125532708Licensed Institution Certified Documents:

Is Pruton Futures A Scam?

Introduction

Pruton Futures is an Indonesian-based forex broker that claims to provide a comprehensive trading platform for retail traders. Established with a vision to offer competitive trading conditions and a transparent service, Pruton Futures aims to position itself as a significant player in the forex market. However, traders must exercise caution when evaluating forex brokers, as the industry is fraught with scams and unregulated entities. The safety and security of investments are paramount, and it is essential to thoroughly investigate a broker's legitimacy before committing any funds. This article utilizes a comprehensive evaluation framework, drawing on multiple sources, to assess whether Pruton Futures is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Pruton Futures operates without robust regulatory oversight, which raises significant concerns about its safety for traders. Currently, there is no valid regulatory information available for Pruton Futures, and it has been reported to have a history of complaints regarding its operations. The table below summarizes the key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that traders have limited recourse should issues arise, such as withdrawal problems or disputes over trades. Regulatory bodies are crucial as they impose standards that protect traders, ensuring that brokers adhere to ethical practices. Without such oversight, the risk of fraud and malpractice significantly increases. Reports suggest that Pruton Futures has received numerous complaints, indicating a troubling pattern that could suggest it is not a safe trading environment.

Company Background Investigation

Pruton Futures claims to have a professional management team and a commitment to transparency; however, there are substantial gaps in the information available about its corporate structure and history. The company was established in 2017, but detailed insights into its ownership and operational history remain scarce. This lack of transparency can be alarming for potential investors.

The management team's qualifications and experience in the financial sector are crucial indicators of a broker's reliability. Unfortunately, there is limited information available regarding the backgrounds of key personnel at Pruton Futures. This absence of data can be a red flag, as reputable brokers typically provide detailed bios of their management teams to instill confidence in their operations. Furthermore, the company's failure to disclose significant information about its operations raises questions about its commitment to transparency and accountability.

Trading Conditions Analysis

An essential aspect of evaluating any broker is understanding its trading conditions, including fees, spreads, and commissions. Pruton Futures offers a trading environment that may not be competitive compared to other brokers. The following table summarizes the core trading costs associated with Pruton Futures:

| Fee Type | Pruton Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The spread of 3 pips for major currency pairs is considerably higher than the industry average, potentially eroding traders' profits. Additionally, the lack of clarity regarding commissions and overnight interest rates makes it difficult for traders to assess the total cost of trading. This lack of transparency in fees could be indicative of a broker that is not fully committed to fair trading practices, further questioning the safety of Pruton Futures.

Client Fund Security

Client fund security is paramount when evaluating the safety of a forex broker. Pruton Futures claims to implement measures to protect client funds; however, the absence of a regulatory framework raises significant concerns. The broker does not provide clear information regarding segregated accounts, investor protection schemes, or negative balance protection policies.

Without these essential safety measures, traders face the risk of losing their entire investment without any legal recourse. Historical complaints have indicated issues with fund withdrawals, suggesting that Pruton Futures may not prioritize the security of its clients funds. This situation underscores the importance of understanding how a broker safeguards client assets and whether it adheres to industry best practices.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Pruton Futures reveal a troubling pattern of complaints, particularly concerning withdrawal issues and poor customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Lack of Transparency | High | No Response |

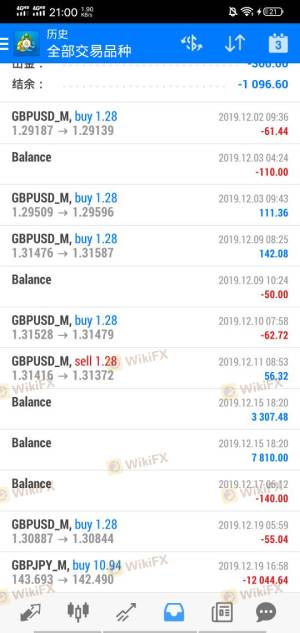

Many users have reported difficulties in withdrawing their funds, with some claiming that their requests have gone unanswered for extended periods. This pattern raises alarms regarding the broker's operational integrity and its commitment to customer service. In one notable case, a trader reported being unable to access their funds for several months, leading to significant frustration and financial loss. Such experiences highlight the potential risks associated with trading through Pruton Futures and suggest that it may not be a safe option for traders.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. Pruton Futures utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, reports indicate potential issues with order execution, including slippage and high rejection rates.

Traders have expressed concerns about the reliability of trade execution, with some suggesting that the platform may not operate as intended during volatile market conditions. This raises questions about the broker's operational capabilities and whether it can provide a fair trading environment. If traders experience significant slippage or rejected orders, it can severely impact their trading outcomes, further emphasizing the need for caution when considering Pruton Futures.

Risk Assessment

Evaluating the overall risk of trading with Pruton Futures is essential for prospective clients. The following risk assessment summarizes the key risks associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety | High | Lack of protection measures |

| Customer Support | Medium | Poor response to complaints |

| Trading Conditions | Medium | High spreads and unclear fees |

Given the high level of regulatory risk and concerns about fund safety, trading with Pruton Futures poses significant risks. Traders should approach this broker with extreme caution and consider alternative options that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pruton Futures may not be a safe trading option for forex traders. The lack of regulation, high trading costs, and numerous complaints regarding fund withdrawals and customer support raise substantial red flags.

Traders should remain vigilant and consider alternative brokers that are well-regulated and have a proven track record of reliability. For those seeking safer trading environments, reputable options include brokers that are regulated by recognized authorities and offer transparent trading conditions. Overall, it is crucial for traders to conduct thorough research and exercise caution in their trading endeavors, particularly when considering brokers like Pruton Futures.

Is PRUTON FUTURES a scam, or is it legit?

The latest exposure and evaluation content of PRUTON FUTURES brokers.

PRUTON FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRUTON FUTURES latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.