Is Pro Emini safe?

Business

License

Is Pro Emini Safe or a Scam?

Introduction

Pro Emini is a futures and commodity brokerage that positions itself as a discount trading platform catering to high-volume traders. With claims of low commission rates and access to a variety of trading markets, it has attracted attention from both novice and experienced traders. However, the importance of thoroughly evaluating any forex broker cannot be overstated. Traders are often vulnerable to scams and unreliable platforms, making it crucial to assess the legitimacy and safety of a broker before committing funds. This article will investigate whether Pro Emini is safe or if it exhibits signs of being a scam by reviewing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Pro Emini operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. Regulation is vital in the financial industry as it ensures that brokers adhere to strict guidelines designed to protect traders. Without proper oversight, traders may face increased risks, including the potential for fraud.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not verified |

The absence of regulatory status for Pro Emini highlights a critical red flag for potential clients. While the company claims to provide excellent service and low fees, the lack of regulatory oversight means there is no governing body to hold them accountable. This situation can lead to issues such as withdrawal delays, unfair trading practices, and a general lack of transparency.

Company Background Investigation

Pro Emini has been in operation for approximately 2 to 5 years, according to various sources. However, the details regarding its ownership and management team are sparse. The lack of transparency about who runs the company is concerning, as it makes it difficult for traders to trust the broker. A reputable company typically provides detailed information about its management team, including their professional backgrounds and expertise in the trading industry.

The absence of such information raises questions about the company's commitment to transparency and accountability. Without knowing who is behind the platform, potential clients may find it challenging to assess the broker's credibility. This lack of clarity is particularly alarming when considering the potential risks of trading with an unregulated entity.

Trading Conditions Analysis

Pro Emini advertises a competitive fee structure, boasting commission rates as low as $0.49 per trade. However, not all clients qualify for this rate, and those requiring broker assistance may face higher fees. Understanding the complete fee structure is essential for traders to evaluate the overall cost of trading with Pro Emini.

| Fee Type | Pro Emini | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | $0.49 + fees | $5-10 per trade |

| Overnight Interest Range | Variable | 0.5%-3% |

While low commission rates can be appealing, it is essential to scrutinize any additional fees that may apply. Traders should be cautious of hidden costs that could significantly impact their trading profitability. Furthermore, the variability in spreads and overnight interest rates suggests that costs may fluctuate, potentially leading to unexpected expenses.

Client Funds Security

The security of client funds is a paramount concern for any trader. Pro Emini's lack of regulatory oversight raises questions about its fund protection measures. A reputable broker typically employs strict measures to safeguard client funds, including segregating client accounts and offering investor protection schemes.

Unfortunately, Pro Emini does not provide sufficient information regarding its fund security policies. This lack of clarity could expose traders to significant risks, including the possibility of losing their investments. Additionally, any historical incidents of fund safety issues or disputes could further complicate the trustworthiness of the broker.

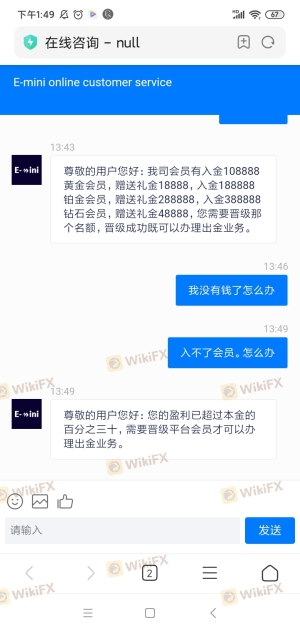

Customer Experience and Complaints

Customer feedback on Pro Emini reveals a mixed bag of experiences. While some users report positive interactions, others have raised concerns about withdrawal delays and unresponsive customer service. Understanding the common complaint patterns can provide valuable insights into the broker's reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Unclear Fee Structure | High | Minimal clarity |

Typical complaints include issues with withdrawing funds and a lack of clarity regarding fees. The severity of these complaints suggests that traders may face challenges when dealing with Pro Emini. The company's slow response to complaints can exacerbate these issues, leading to frustration among clients.

Platform and Trade Execution

The trading platform offered by Pro Emini is critical to the overall trading experience. Traders expect a reliable and efficient platform that allows for seamless order execution. However, concerns about order execution quality, slippage, and potential manipulation have been raised.

A thorough evaluation of the platform's performance and user experience is essential. If there are indications of frequent slippage or rejected orders, it could signal deeper issues within the broker's operational framework. Such problems can significantly impact trading outcomes and raise questions about the broker's integrity.

Risk Assessment

The overall risk of using Pro Emini is compounded by its lack of regulation, transparency issues, and mixed customer feedback. These factors contribute to a higher risk profile for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Security | High | Insufficient protection measures |

| Customer Service | Medium | Inconsistent responsiveness |

To mitigate these risks, traders should consider using alternative brokers with established regulatory oversight, transparent fee structures, and positive customer reviews. Researching and comparing options before committing funds is crucial for protecting investments.

Conclusion and Recommendations

In conclusion, the investigation into Pro Emini reveals several concerning factors that suggest it may not be a safe trading platform. The absence of regulatory oversight, unclear company information, and mixed customer feedback raise significant red flags. While some traders may have had positive experiences, the risks associated with trading through Pro Emini cannot be overlooked.

For traders seeking safety and reliability, it is advisable to consider alternative brokers that are regulated and have a proven track record of customer satisfaction. Brokers with transparent fee structures, robust fund protection policies, and responsive customer service should be prioritized. Ultimately, due diligence is essential for ensuring a secure trading experience in the forex market.

Is Pro Emini a scam, or is it legit?

The latest exposure and evaluation content of Pro Emini brokers.

Pro Emini Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pro Emini latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.