Regarding the legitimacy of Peer FX forex brokers, it provides FCA and WikiBit, .

Is Peer FX safe?

Business

License

Is Peer FX markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Peer Funding Limited

Effective Date:

2016-07-20Email Address of Licensed Institution:

roger.smith@sourced.co, investorteam@sourced.coSharing Status:

No SharingWebsite of Licensed Institution:

www.sourcedcapital.coExpiration Time:

--Address of Licensed Institution:

Capital House 6 Webster Court Carina Park Warrington WA5 8WD UNITED KINGDOMPhone Number of Licensed Institution:

+4403331231330Licensed Institution Certified Documents:

Is Peer FX Safe or a Scam?

Introduction

Peer FX is a peer-to-peer foreign exchange platform that aims to provide users with a low-cost way to exchange currencies by eliminating the bid-ask spread and offering median rates. This innovative approach positions Peer FX within a rapidly evolving sector of the forex market, which has seen a surge in interest from both individual and corporate clients looking to optimize their currency exchange processes. However, as with any financial service, it is crucial for traders to carefully evaluate the legitimacy and safety of their chosen broker. The forex market is rife with scams and unregulated entities, making due diligence essential for safeguarding investments. This article investigates the safety and reliability of Peer FX by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

A key factor in determining whether Peer FX is safe lies in its regulatory status. Regulation is critical as it provides oversight and consumer protection, ensuring that brokers adhere to strict operational standards. In the case of Peer FX, the regulatory landscape is somewhat unclear. The company claims to operate under a peer-to-peer model, which may not always fall under the same stringent regulations as traditional brokers.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight raises concerns about the safety of funds and the potential for fraudulent activities. A well-regulated broker is typically subject to regular audits and must maintain specific standards for capital reserves, which helps protect clients' investments. Peer FX's lack of clear regulatory information suggests that traders should exercise caution. The quality of regulation is paramount; brokers under top-tier regulators, such as the FCA or ASIC, provide greater assurance of operational integrity. Given that Peer FX does not appear to be regulated by any recognized authority, it may not be safe for traders seeking a secure trading environment.

Company Background Investigation

Understanding the companys history and ownership structure is vital in assessing whether Peer FX is safe. Peer FX was founded with the intent to disrupt traditional currency exchange methods by leveraging technology for a more cost-effective solution. However, the specifics of its ownership structure and the backgrounds of its management team are not readily available, which diminishes transparency.

The management team‘s expertise is crucial in navigating the complexities of the forex market and ensuring compliance with financial regulations. A strong team with a proven track record can instill confidence among users. Unfortunately, without publicly available information regarding the team’s qualifications and experience, it is challenging to evaluate the company's credibility. Furthermore, the lack of transparency regarding its operational practices and financial health can be a red flag for potential investors.

Trading Conditions Analysis

When analyzing whether Peer FX is safe, it is essential to understand its trading conditions and cost structure. The platform promotes a low-cost approach to currency exchange, but traders must be aware of any hidden fees that could affect profitability.

| Fee Type | Peer FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0 pips | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

While the elimination of the bid-ask spread is appealing, the absence of detailed information about commissions and overnight fees is concerning. Traders should be wary of any unexpected costs that may arise, as these can significantly impact trading outcomes. Additionally, the lack of a clear commission structure may indicate potential issues with transparency in pricing. It is crucial for traders to have a comprehensive understanding of all costs involved before committing their funds.

Customer Fund Security

The safety of customer funds is a paramount concern when evaluating whether Peer FX is safe. A reliable broker should implement robust measures to protect client funds, including segregated accounts, investor protection schemes, and negative balance protection policies. However, information regarding Peer FX's security measures is limited.

Traders should ask whether Peer FX employs segregated accounts to ensure that client funds are kept separate from company operating funds. This practice is crucial in safeguarding assets in the event of financial difficulties. Additionally, understanding whether the platform participates in any investor compensation schemes can provide further reassurance. Unfortunately, without clear information on these aspects, potential clients may face uncertainty regarding the safety of their investments with Peer FX.

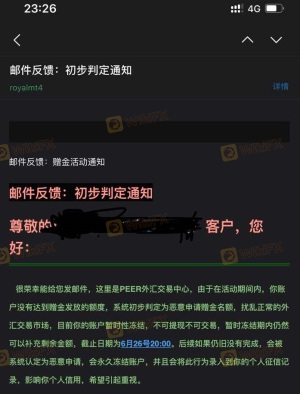

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user experiences can help determine whether Peer FX is safe or if it has a history of complaints. While there are limited reviews available online, anecdotal evidence suggests that users have experienced difficulties with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow responses |

| Customer Support | Medium | Inconsistent |

Common complaints include slow withdrawal processing and inadequate customer support. These issues can significantly affect user satisfaction and trust. For instance, some users reported waiting extended periods for their funds to be released, raising concerns about the platform's liquidity and operational efficiency. A broker's responsiveness to complaints is crucial; effective resolution of issues can enhance trust and credibility among traders.

Platform and Execution

The performance of the trading platform is another critical factor in determining whether Peer FX is safe. A reliable platform should provide stability, ease of use, and efficient order execution. However, there is limited information available regarding the specific features and performance metrics of the Peer FX platform.

Users should be cautious of any signs of platform manipulation, such as frequent slippage or rejected orders, which can indicate underlying issues with order execution. A high rejection rate may suggest that the broker is not adequately managing their liquidity or is engaging in practices that are not trader-friendly. Therefore, it is essential for traders to thoroughly assess the platform's performance through demo accounts or trial periods before committing real funds.

Risk Assessment

In summary, the overall risk of using Peer FX must be carefully evaluated. Traders should consider the following risk categories to determine whether Peer FX is safe for their trading activities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulatory oversight |

| Fund Security Risk | Medium | Unclear safety measures for customer funds |

| Customer Service Risk | High | Numerous complaints regarding support |

| Platform Risk | Medium | Limited information on execution quality |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and consider diversifying their trading activities across multiple platforms. Engaging with regulated brokers with established reputations may also provide a safer alternative.

Conclusion and Recommendations

In conclusion, the investigation into Peer FX raises several concerns regarding its safety and reliability. The absence of regulatory oversight, limited transparency about company operations, and reported customer service issues suggest that potential users should proceed with caution. While the platform's low-cost model is attractive, the lack of clarity surrounding fees and fund security measures can pose significant risks.

For traders considering Peer FX, it is advisable to explore alternative brokers that offer robust regulatory protection, transparent pricing structures, and responsive customer support. Some recommended alternatives include well-regulated platforms such as TransferWise and CurrencyFair, which have established reputations in the peer-to-peer forex market. Ultimately, ensuring the safety of investments should be the top priority for any trader in the forex market.

Is Peer FX a scam, or is it legit?

The latest exposure and evaluation content of Peer FX brokers.

Peer FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Peer FX latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.