Regarding the legitimacy of Million Tinkle forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Million Tinkle safe?

Business

License

Is Million Tinkle markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

聯福金號有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港上環孖沙街12-18號金銀商業大廈602室Phone Number of Licensed Institution:

31666120Licensed Institution Certified Documents:

Is Million Tinkle Safe or Scam?

Introduction

Million Tinkle is a forex broker that positions itself within the competitive landscape of online trading, primarily focusing on attracting retail traders looking for opportunities in the foreign exchange market. However, the rise of online trading has also led to an increase in fraudulent activities, making it imperative for traders to carefully evaluate the legitimacy and safety of their chosen brokers. The potential for scams in the forex market is significant, as many unregulated entities can operate without oversight, putting traders' funds at risk. This article aims to provide an objective assessment of Million Tinkle, examining its regulatory status, company background, trading conditions, customer safety, and client experiences. The investigation is based on a comprehensive review of multiple sources, including user feedback, regulatory information, and expert analyses.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy and the safety of clients' funds. Million Tinkle claims to operate under the auspices of the Chinese Gold & Silver Exchange Society (CGSE). However, the lack of a more widely recognized regulatory authority raises red flags about its operations. Below is a summary of the regulatory information available for Million Tinkle:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society (CGSE) | 136 | Hong Kong | Suspicious |

The CGSE is not considered a robust regulatory body compared to others like the FCA or ASIC, which enforce strict compliance measures. Additionally, there have been numerous complaints about Million Tinkle's operations, including reports of clients being unable to withdraw their funds. This history of complaints and the broker's unregulated status raise serious concerns about the safety of trading with Million Tinkle. Without proper oversight, clients are left vulnerable to potential fraud and mismanagement of funds.

Company Background Investigation

Million Tinkle was established in 2017 and is based in Hong Kong. However, its ownership structure is unclear, as the company does not disclose specific details about its management team or operational history. This lack of transparency is concerning, especially for potential investors who rely on a broker's reputation and credibility. The absence of an identifiable management team with relevant experience in financial services further complicates the assessment of Million Tinkle's trustworthiness.

Moreover, the company has been associated with a series of negative reviews and complaints from users, indicating a troubling pattern of customer dissatisfaction. A broker's credibility is often tied to its transparency and the professionalism of its leadership. In this case, the lack of clear information about Million Tinkle's management raises questions about its operational integrity and commitment to client service.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is essential for assessing its competitiveness and fairness. Million Tinkle has not provided comprehensive information regarding its fee structure, which is a critical aspect for traders. Below is a comparison of core trading costs that are typically expected in the industry:

| Fee Type | Million Tinkle | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not Disclosed | 1-2 pips |

| Commission Structure | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The absence of detailed information on fees and commissions is alarming. Brokers typically provide this information upfront to ensure transparency and build trust with their clients. The lack of clarity regarding trading costs at Million Tinkle may indicate potential hidden fees or unfavorable trading conditions, making it essential for traders to exercise caution. Without a clear understanding of the costs involved, traders may find themselves facing unexpected expenses that could erode their profits.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Million Tinkle's approach to fund security is a significant concern, as there is little information available regarding their policies on fund segregation, investor protection, and negative balance protection. In a well-regulated environment, brokers are typically required to keep client funds in separate accounts to safeguard them from operational risks. However, the lack of regulatory oversight for Million Tinkle raises questions about whether such measures are in place.

Historically, there have been reports of clients facing difficulties withdrawing their funds, which further emphasizes the potential risks associated with trading on this platform. If a broker does not have robust safety measures in place, clients may find themselves at risk of losing their investments without recourse. Therefore, it is crucial for traders to assess the safety protocols of Million Tinkle before proceeding with any investments.

Customer Experience and Complaints

Analyzing customer feedback is an essential part of evaluating a broker's reputation. Many users have reported negative experiences with Million Tinkle, particularly concerning withdrawal issues and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

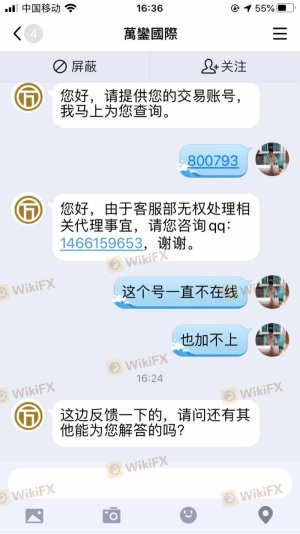

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Account Blocking | High | Poor |

One notable case involved a user who reported being unable to withdraw their funds after several attempts, leading to significant frustration and financial loss. The lack of effective communication from the company's support team exacerbated the situation, leaving the client feeling abandoned. Such experiences highlight the potential risks of trading with Million Tinkle and suggest a pattern of inadequate customer service.

Platform and Execution Quality

The trading platform provided by a broker plays a crucial role in the overall trading experience. Million Tinkle utilizes the MetaTrader 4 (MT4) platform, which is widely recognized for its user-friendly interface and robust features. However, user reviews indicate that the platform may suffer from stability issues, including lagging performance and execution delays. These problems can significantly impact a trader's ability to execute trades effectively and may lead to missed opportunities.

Furthermore, there are concerns about the quality of order execution, with some users reporting instances of slippage and rejected orders. Such issues can be detrimental to a trader's success, especially in a fast-moving market where timely execution is critical. If traders suspect any manipulation or irregularities in trade execution, it raises serious concerns about the integrity of the trading environment offered by Million Tinkle.

Risk Assessment

Using Million Tinkle presents several risks that traders should be aware of before engaging with the broker. Below is a summary of the key risk areas associated with this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation increases the risk of fraud. |

| Fund Security Risk | High | Insufficient information on fund protection measures. |

| Customer Service Risk | Medium | Poor responsiveness to client issues and complaints. |

To mitigate these risks, traders should consider conducting thorough research and due diligence before investing with Million Tinkle. It is advisable to keep investment amounts low and to withdraw profits regularly to minimize exposure to potential issues.

Conclusion and Recommendations

In summary, the evidence presented raises significant concerns about the legitimacy and safety of trading with Million Tinkle. The lack of robust regulation, unclear fee structures, and numerous customer complaints point to a broker that may not be trustworthy. Additionally, the reported difficulties in fund withdrawals and the overall transparency issues suggest that traders should exercise extreme caution.

For traders considering their options, it may be prudent to seek alternatives that offer a higher level of regulatory oversight, transparency, and customer support. Brokers such as IG, OANDA, and Forex.com are generally regarded as safer choices, with established reputations and comprehensive regulatory frameworks.

In light of the findings, it is recommended that potential clients avoid engaging with Million Tinkle until substantial improvements in its operational practices and regulatory compliance are made.

Is Million Tinkle a scam, or is it legit?

The latest exposure and evaluation content of Million Tinkle brokers.

Million Tinkle Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Million Tinkle latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.