Is Lido Isle Advisors safe?

Business

License

Is Lido Isle Advisors Safe or Scam?

Introduction

Lido Isle Advisors is an investment firm that has positioned itself within the managed futures sector, aiming to provide tailored investment strategies to individual and institutional investors. Given the complexities and risks associated with the forex market, it is crucial for traders to conduct thorough evaluations of any brokerage or investment firm before engaging in trading activities. This scrutiny is essential not only to protect their investments but also to ensure compliance with regulatory standards that safeguard investor interests.

In this article, we will delve into the safety and legitimacy of Lido Isle Advisors by assessing its regulatory status, company background, trading conditions, customer experiences, and more. Our evaluation methodology is based on a comprehensive review of available data, including regulatory filings, customer feedback, and industry standards.

Regulation and Legitimacy

The regulatory status of any investment firm is a critical indicator of its legitimacy and operational integrity. Lido Isle Advisors operates in a space that is often scrutinized due to the high potential for fraudulent activities. According to multiple sources, Lido Isle Advisors is unregulated, which raises significant concerns regarding the safety of funds and the firm's accountability.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Lido Isle Advisors is not subject to the oversight of any financial authority, leaving clients without the protections typically afforded by regulated entities. This lack of oversight can lead to potential abuses, such as misappropriation of funds or failure to adhere to industry standards. Furthermore, the unregulated status indicates that there are no legal repercussions for the firm should it choose to engage in unethical practices, making it imperative for potential clients to exercise caution.

Company Background Investigation

Lido Isle Advisors was established with the goal of helping clients maximize returns while managing risks through diverse portfolios. However, the firm's history and ownership structure are not well-documented, which raises questions about its transparency. The management team lacks publicly available credentials and experience, further adding to the uncertainty surrounding the firm's operations.

The company's website offers limited information about its founding members and their qualifications, a critical aspect that potential investors should consider. Transparency is vital in the financial industry; a lack of clear information about who is managing investments can be a red flag for potential scams. Without a robust background and a clear ownership structure, it is difficult for investors to ascertain whether Lido Isle Advisors operates with integrity.

Trading Conditions Analysis

When evaluating the trading conditions offered by Lido Isle Advisors, one must consider the fee structure and any unusual charges that may apply. The firm advertises various trading options, but the specifics regarding spreads, commissions, and overnight interest rates remain vague.

| Fee Type | Lido Isle Advisors | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information on trading costs can be concerning. Traders should be wary of hidden fees that could significantly impact their overall profitability. Moreover, the absence of industry-standard practices in fee disclosure further complicates the decision-making process for potential clients.

Customer Funds Security

The security of client funds is paramount when assessing any investment firm. Unfortunately, Lido Isle Advisors has been reported to lack adequate measures for safeguarding client assets. There is no information available regarding fund segregation, investor protection schemes, or negative balance protection policies.

Given that the firm is unregulated, clients are at a heightened risk of losing their investments without any recourse. Historical complaints regarding withdrawal difficulties and fund accessibility further exacerbate concerns about the safety of client funds. Investors must understand that, without proper regulatory oversight, their money may not be secure.

Customer Experience and Complaints

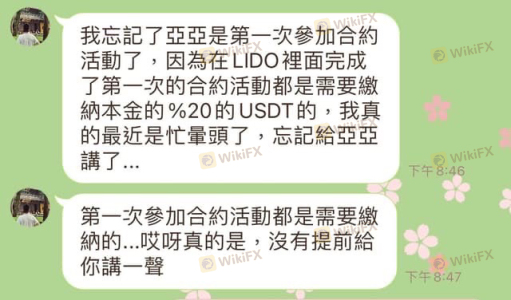

Customer feedback is a valuable resource when evaluating the reliability of an investment firm. Lido Isle Advisors has received mixed reviews, with many clients expressing dissatisfaction regarding their experiences. Common complaints include difficulties in withdrawing funds, lack of communication from customer service, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Communication Problems | Medium | Poor |

| Aggressive Sales Tactics | High | Poor |

In one typical case, a client reported significant challenges when attempting to withdraw their funds, with the firm employing various tactics to delay the process. Such experiences highlight the potential risks associated with trading through Lido Isle Advisors and raise concerns about whether the firm prioritizes client welfare.

Platform and Trade Execution

The performance of the trading platform is another critical factor to consider. Lido Isle Advisors offers a platform that may not meet the stability or execution quality expected by traders. Reports of slippage and order rejections have been noted, which can severely affect trading outcomes.

Traders should be cautious of platforms that do not provide reliable execution, as this can lead to unexpected losses. Moreover, any signs of platform manipulation or unfair trading practices should be thoroughly investigated before committing funds.

Risk Assessment

Engaging with Lido Isle Advisors presents several risks that potential clients must consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Lack of fund protection and withdrawal issues. |

| Operational Risk | Medium | Platform reliability and execution quality concerns. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence, seek out regulated alternatives, and consider using established platforms with proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Lido Isle Advisors is not a safe investment option. The firm's unregulated status, lack of transparency, and numerous customer complaints indicate a high level of risk for potential investors. Individuals considering trading with Lido Isle Advisors should proceed with extreme caution, as there are significant indicators of potential fraud or mismanagement.

For traders seeking safer alternatives, it is recommended to explore regulated firms with strong reputations and transparent operations. Always prioritize platforms that offer clear information about their regulatory status, fee structures, and customer support to ensure a secure trading experience.

Is Lido Isle Advisors a scam, or is it legit?

The latest exposure and evaluation content of Lido Isle Advisors brokers.

Lido Isle Advisors Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lido Isle Advisors latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.