Is JYJ TRADER safe?

Business

License

Is JYJ Trader Safe or a Scam?

Introduction

JYJ Trader is a forex broker that claims to operate out of Australia, offering a range of trading instruments including stocks, indices, commodities, and currencies. In the ever-evolving forex market, traders must be cautious when selecting a broker, as the risk of scams and unregulated activities is significant. This article aims to provide an objective analysis of JYJ Trader, exploring its regulatory status, company background, trading conditions, client safety measures, and user experiences. Our investigation is based on a thorough review of available online resources, user feedback, and regulatory databases to determine whether JYJ Trader is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in assessing its legitimacy. A regulated broker is subject to oversight by financial authorities, which can provide a level of security for traders. Unfortunately, JYJ Trader appears to be an unregulated entity. There is no valid regulatory information available about the broker, which raises significant concerns about its operational legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that JYJ Trader is not held accountable to any governing body, making it difficult for traders to seek recourse in case of disputes or issues. Furthermore, the lack of historical compliance records raises additional red flags. Without a regulatory framework, traders are advised to exercise extreme caution and consider the risks involved in trading with JYJ Trader.

Company Background Investigation

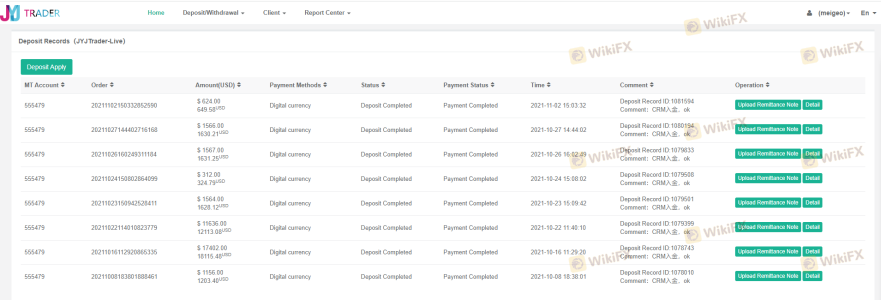

JYJ Trader Limited, the company behind JYJ Trader, has minimal public information available regarding its history and ownership structure. The company was incorporated in March 2021, but it has since been dissolved as of August 2022, leading to questions about its operational continuity and stability. The lack of transparency regarding the management team and their professional backgrounds further complicates the assessment of the broker's credibility.

While some online sources suggest that JYJ Trader is linked to previous scams, including those associated with other brokerage names, the evidence is largely anecdotal. Nevertheless, the company's failure to provide clear and accessible information about its operations and ownership raises concerns about its reliability and commitment to ethical trading practices.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. JYJ Trader claims to offer competitive trading conditions, including low spreads and high leverage options. However, the absence of detailed information regarding fees and commissions is alarming.

| Fee Type | JYJ Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency in trading costs can lead to unexpected charges, which is a common tactic used by fraudulent brokers to exploit unsuspecting traders. Given the high leverage offered by JYJ Trader (up to 1:500), inexperienced traders may find themselves at risk of significant losses. It is crucial to evaluate these conditions carefully before committing any funds to JYJ Trader.

Client Fund Safety

Client fund safety is a primary concern for any trader. JYJ Trader has not provided sufficient information regarding its measures for protecting client funds. There are no indications of segregated accounts, which are typically used by regulated brokers to ensure that client funds are kept separate from the broker's operational funds.

Moreover, there is no mention of investor protection schemes or negative balance protection policies, which are essential features for safeguarding traders against potential losses that exceed their deposits. The absence of these safety measures heightens the risk associated with trading on the JYJ Trader platform, making it imperative for potential clients to consider these factors seriously.

Customer Experience and Complaints

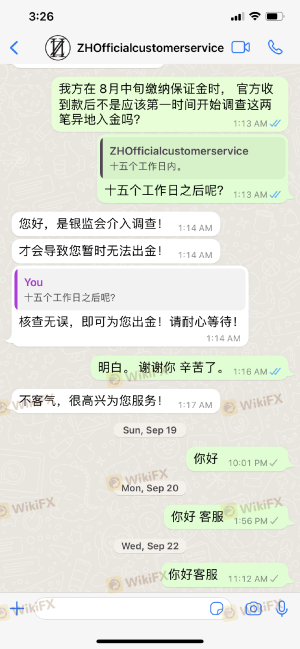

Analyzing customer feedback is vital in assessing the overall reliability of a broker. Numerous complaints have been reported regarding JYJ Trader, primarily focused on withdrawal issues and customer service responsiveness. Many users have expressed frustration over the inability to access their funds after making deposits, a common pattern with scam brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

In particular, users have reported being asked to pay additional fees before they could withdraw their funds, a tactic often employed by fraudulent brokers to retain client money. These patterns of complaints suggest that JYJ Trader may not be a safe option for traders seeking a reliable and trustworthy trading environment.

Platform and Trade Execution

The performance of a trading platform is critical for a successful trading experience. JYJ Trader utilizes the widely-used MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. However, user experiences regarding platform stability and trade execution quality have been mixed.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Additionally, there are concerns about potential platform manipulation, as some users have reported discrepancies between the market price and the price at which their orders were executed. These issues raise further questions about the integrity and reliability of the JYJ Trader platform.

Risk Assessment

Using JYJ Trader comes with a variety of risks that potential traders should be aware of. The lack of regulation, transparency, and client fund safety measures collectively contribute to a high-risk trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with JYJ Trader. It may be prudent to start with a demo account or to limit initial investments until a clearer understanding of the broker's practices is established.

Conclusion and Recommendations

In summary, the evidence gathered raises significant concerns about whether JYJ Trader is safe or a scam. The lack of regulation, transparency, and client safety measures, coupled with numerous complaints from users, suggests that traders should approach this broker with extreme caution.

For traders seeking reliable options, it is advisable to consider regulated brokers with a proven track record of ethical practices and positive client feedback. Alternatives may include well-known brokers that offer robust regulatory oversight, transparent trading conditions, and comprehensive client support. Ultimately, the decision to trade with JYJ Trader should be made with careful consideration of the associated risks and potential for loss.

Is JYJ TRADER a scam, or is it legit?

The latest exposure and evaluation content of JYJ TRADER brokers.

JYJ TRADER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JYJ TRADER latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.