Is JDR SECURITIES safe?

Software Index

License

Is JDR Securities Safe or Scam?

Introduction

JDR Securities is a relatively new player in the forex market, having been established in 2021. The broker offers a range of trading instruments, including over 35 forex currency pairs, commodities, and CFDs, utilizing the popular MetaTrader 4 platform. As the forex market continues to grow, the number of brokers has surged, making it crucial for traders to conduct thorough evaluations before committing their funds. This article aims to assess whether JDR Securities is a safe and legitimate option for traders or if there are red flags that suggest it may be a scam. Our investigation is based on a comprehensive analysis of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy and safety. JDR Securities operates under the auspices of several regulatory bodies, primarily the Australian Securities and Investments Commission (ASIC) and the New Zealand Financial Markets Authority (FMA). However, it is essential to note that JDR Securities is also registered in St. Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 420268 | Australia | Verified |

| FMA | 1005237 | New Zealand | Verified |

| SVG FSA | 26326 | St. Vincent | Not applicable |

The ASIC license indicates a higher level of oversight, as this authority enforces strict financial regulations, including the requirement for brokers to maintain a certain level of capital and provide investor protection schemes. However, the SVG FSA does not regulate forex trading, which raises concerns about the security of funds held by JDR Securities. This mixed regulatory framework suggests that while there are some safeguards in place, potential investors should be cautious, especially given the broker's offshore registration.

Company Background Investigation

JDR Securities is structured as a subsidiary of Royal Financial Trading Pty Ltd, which is regulated by ASIC. The company was founded with the intention of providing a reliable trading environment for both novice and experienced traders. However, being a relatively new entrant, it lacks a long history of performance and reputation in the market.

The management team behind JDR Securities includes individuals with experience in finance and trading, although specific details about their backgrounds are not widely available. This lack of transparency regarding the management's qualifications may raise concerns for potential investors. Furthermore, the company's operational base in St. Vincent adds another layer of opacity, as the jurisdiction is often associated with less stringent regulatory practices.

Trading Conditions Analysis

When evaluating the safety of a broker, it is crucial to analyze the trading conditions they offer. JDR Securities claims to provide competitive spreads and leverage, with a minimum deposit requirement of $0, making it accessible for traders at all levels. However, the fee structure is somewhat ambiguous, and certain fees may apply that are not immediately apparent.

| Fee Type | JDR Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 0.8 - 1.0 pips |

| Commission Model | $7 per lot (for professional accounts) | Varies (typically $0 - $10) |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by JDR Securities are competitive, they are slightly higher than the industry average for major currency pairs. Additionally, the commission on professional accounts may deter some traders, especially those who prefer a commission-free trading model. Overall, while the trading conditions are not the worst, they do not stand out as particularly favorable either.

Client Fund Security

The safety of client funds is paramount when assessing whether JDR Securities is safe. The broker claims to implement measures such as segregated accounts to protect client funds; however, the effectiveness of these measures is questionable given the regulatory environment in which they operate. There is no clear evidence provided by the broker regarding the investor protection mechanisms, such as compensation schemes in case of insolvency.

Furthermore, the lack of negative balance protection raises concerns, especially for traders using high leverage, which can amplify losses. Historical data on JDR Securities does not indicate any significant incidents of fund mismanagement or security breaches, but the potential risks associated with its offshore registration cannot be ignored.

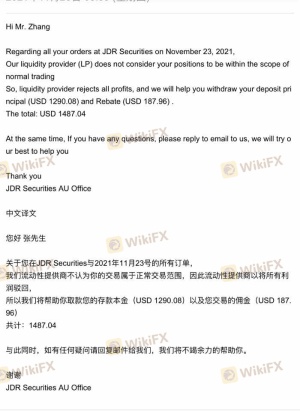

Customer Experience and Complaints

Customer reviews and feedback are essential in gauging the overall experience of traders with JDR Securities. The broker has received mixed reviews, with some users praising the customer service and trading execution, while others have raised concerns about withdrawal processes and responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Verification Issues | Medium | Generally responsive |

| Customer Service Quality | Low | Generally positive |

One common complaint revolves around withdrawal delays, with some traders reporting difficulties in accessing their funds promptly. This issue can significantly impact a trader's perception of safety and reliability. In contrast, many users have praised the platform's ease of use and the quality of customer support, indicating that while there are issues, the overall experience is not entirely negative.

Platform and Trade Execution

The trading platform provided by JDR Securities is MetaTrader 4 (MT4), a widely trusted platform among traders. Users have reported a stable trading environment with minimal downtime, which is crucial for effective trading. However, concerns have been raised regarding potential slippage and order execution quality, particularly during high volatility periods.

The platform does not show significant signs of manipulation, but traders should remain vigilant and monitor their trades closely. The overall user experience on the MT4 platform is generally positive, with many finding it intuitive and easy to navigate.

Risk Assessment

Trading with JDR Securities presents various risks that traders should be aware of. The mixed regulatory environment, potential withdrawal issues, and lack of certain investor protections contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates in a lax regulatory environment |

| Withdrawal Risk | Medium | Reports of delays and difficulties |

| Market Risk | High | High leverage can amplify losses |

To mitigate these risks, traders are advised to use risk management strategies, such as setting stop-loss orders and avoiding over-leveraging their accounts. Additionally, conducting thorough research and possibly starting with a demo account can help traders familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while JDR Securities does offer certain advantages, such as competitive trading conditions and a user-friendly platform, there are significant concerns regarding its regulatory status and client fund safety. The mixed reviews and reports of withdrawal issues suggest that potential investors should approach with caution.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives that offer stronger regulatory oversight and proven track records. Some recommended brokers include those regulated by the FCA or ASIC, which provide robust investor protections and transparency. Overall, while JDR Securities may not be outright fraudulent, the risks associated with trading with them warrant careful consideration and due diligence.

Is JDR SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of JDR SECURITIES brokers.

JDR SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JDR SECURITIES latest industry rating score is 2.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.