Is IfineFX safe?

Business

License

Is IfineFX A Scam?

Introduction

IfineFX is a forex broker that claims to operate from the UK, positioning itself as a competitive player in the foreign exchange market. However, potential traders must exercise caution when evaluating this broker due to the increasing prevalence of scams in the financial sector. The importance of thorough research cannot be overstated, as the safety of funds and the legitimacy of trading conditions are paramount for successful trading experiences. This article investigates the credibility of IfineFX by analyzing its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory environment is crucial for any forex broker, as it ensures compliance with financial standards and protects traders' interests. IfineFX claims to be based in the UK; however, it lacks any valid licenses from recognized regulatory bodies such as the Financial Conduct Authority (FCA). The absence of regulatory oversight raises significant concerns regarding the safety of traders' funds and the legitimacy of its operations.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Licensed |

The lack of regulation means that IfineFX does not adhere to the strict compliance standards set by the FCA, such as maintaining minimum capital requirements and participating in compensation schemes for traders. This absence of oversight can lead to potential exploitation of traders, making it essential to question whether IfineFX is safe for trading. Without a regulatory framework, traders have no recourse in case of disputes or fund mismanagement, making the broker a risky choice.

Company Background Investigation

IfineFX's company background is shrouded in ambiguity, with little information available regarding its history, ownership, or management team. The broker claims to be operated by Ifine Capital Ltd., but no verifiable records exist to substantiate this claim. The lack of transparency surrounding the company's operational structure raises red flags for potential investors.

The management team's qualifications and experience are also unclear, as there is no publicly available information about their professional backgrounds. This opacity further contributes to concerns about the company's reliability and accountability. In the financial sector, transparency is key, and the inability to provide essential details about its operations makes IfineFX a questionable entity. Therefore, potential traders should carefully consider whether IfineFX is safe to engage with, given its lack of clarity and transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall credibility. IfineFX presents an attractive trading environment with promises of high leverage and low spreads. However, upon closer inspection, these claims appear misleading. The broker advertises spreads as low as 0.2 pips, but actual spreads can reach up to 30 pips, especially on major currency pairs.

| Fee Type | IfineFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Up to 30 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The inconsistency in advertised and actual trading costs suggests that traders may not receive the value they expect. Additionally, the lack of clarity around commission structures and overnight interest rates raises further concerns. Potential traders must weigh these factors and consider whether IfineFX is safe for their trading endeavors.

Customer Fund Security

The security of customer funds is paramount in the forex trading industry. IfineFX does not provide adequate measures to protect traders' investments. The broker does not segregate client funds from its operational accounts, which exposes traders to the risk of losing their deposits in case of financial instability. Furthermore, there is no evidence of negative balance protection, leaving traders vulnerable to losses that exceed their initial investments.

Historically, IfineFX has not been involved in any significant fund security controversies, but the absence of regulatory oversight raises concerns about potential future issues. Without proper safeguards in place, traders must question whether IfineFX is safe for their financial assets.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of IfineFX reveal a pattern of dissatisfaction among users, with common complaints including withdrawal delays, lack of responsive customer service, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Inconsistent |

| Account Management Problems | High | Negligent |

For instance, many traders report significant delays in processing withdrawal requests, which can take weeks or even months. This lack of timely response raises concerns about the broker's operational integrity and customer service quality. Given these issues, potential traders should carefully consider whether IfineFX is safe to trade with, as the overall customer experience suggests a lack of reliability.

Platform and Execution

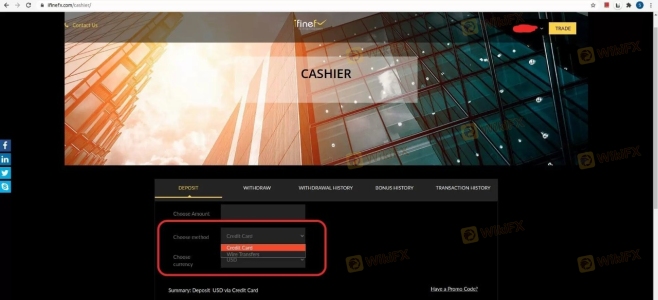

The trading platform's performance is crucial for executing trades efficiently. IfineFX claims to offer the widely-used MetaTrader 4 platform; however, users report difficulties in accessing and utilizing this software. The web-based trading platform provided by IfineFX lacks essential features and stability, leading to poor user experiences.

Moreover, traders have expressed concerns regarding order execution quality, with reports of slippage and high rejection rates. Such issues can significantly impact trading outcomes, making it vital for traders to assess whether IfineFX is safe for their trading activities.

Risk Assessment

Engaging with IfineFX carries several inherent risks that traders must consider. The lack of regulation, high spreads, and questionable customer service contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Poor platform performance and support |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that offer better regulatory protection and customer service. Evaluating the overall risk profile is crucial for determining whether IfineFX is safe for trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that IfineFX exhibits several characteristics typical of a scam broker. The lack of regulation, transparency issues, and poor customer feedback raise significant concerns about its legitimacy and safety. Potential traders should approach IfineFX with caution and consider alternative, regulated brokers to safeguard their investments.

For those seeking reliable trading options, it is advisable to explore brokers regulated by reputable agencies such as the FCA or CySEC, which provide essential protections and a more trustworthy trading environment. Ultimately, ensuring the safety of funds and the quality of trading conditions should be the top priority for any trader considering whether IfineFX is safe to engage with.

Is IfineFX a scam, or is it legit?

The latest exposure and evaluation content of IfineFX brokers.

IfineFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IfineFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.