Regarding the legitimacy of Hong Kong Yoda Capital forex brokers, it provides CYSEC, ASIC and WikiBit, .

Is Hong Kong Yoda Capital safe?

Business

License

Is Hong Kong Yoda Capital markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Royal Financial Trading (Cy) Ltd

Effective Date:

2016-08-10Email Address of Licensed Institution:

Compliance@oneroyal.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.oneroyal.euExpiration Time:

--Address of Licensed Institution:

152 Fragklinou Rousvelt, 3045 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 080 880Licensed Institution Certified Documents:

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Royal Financial Trading Pty Ltd

Effective Date: Change Record

2012-06-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 15 60 MARGARET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Hong Kong Yoda Capital A Scam?

Introduction

Hong Kong Yoda Capital has emerged as a player in the forex market, attracting attention from traders seeking opportunities in currency trading. However, with the rise of online trading platforms, it has become increasingly crucial for traders to evaluate the legitimacy and reliability of brokers before committing their funds. The forex market is rife with risks, and choosing the wrong broker can lead to significant financial losses. This article aims to provide an objective analysis of Hong Kong Yoda Capital, evaluating its regulatory status, company background, trading conditions, customer experience, and overall safety. By utilizing various sources and methodologies, including reviews from industry experts and customer feedback, we will assess whether Hong Kong Yoda Capital is a safe option or a potential scam.

Regulation and Legitimacy

Regulation in the forex industry is vital as it serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Hong Kong Yoda Capital claims to operate under certain regulatory frameworks; however, a closer look reveals some concerning details.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CYSEC | Suspicious Clone | Cyprus | Not Verified |

| ASIC | Suspicious Clone | Australia | Not Verified |

The above table highlights that Hong Kong Yoda Capital is associated with suspicious regulatory licenses from both CYSEC and ASIC, which raises red flags about its legitimacy. A lack of valid regulation means that the broker may not be held accountable for its actions, leaving traders vulnerable to potential fraud or mismanagement of funds. Furthermore, the absence of a robust regulatory framework can contribute to a lack of transparency in operations, making it difficult for traders to trust the broker's practices.

Regulatory Quality and Compliance History

The quality of regulation is a critical factor in assessing a broker's safety. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Securities and Futures Commission (SFC) in Hong Kong enforce strict guidelines to protect investors. However, Hong Kong Yoda Capital's association with suspicious clones raises concerns about its compliance history. Traders should be cautious when dealing with brokers that lack oversight from reputable regulatory authorities, as this often indicates a higher risk of encountering fraudulent practices.

Company Background Investigation

Hong Kong Yoda Capital's company history and ownership structure are essential components in evaluating its trustworthiness. The company has been operating for approximately 2-5 years, a relatively short duration in the financial industry. Limited operational history can often lead to questions regarding the broker's stability and reliability.

The management team behind Hong Kong Yoda Capital is another critical aspect to consider. A well-experienced and transparent management team can instill confidence in potential clients. However, information about the backgrounds and qualifications of the management team at Hong Kong Yoda Capital is scarce, contributing to a perception of opacity. Furthermore, a lack of transparency regarding the company's ownership structure can lead to doubts about its legitimacy and accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders looking to maximize their profitability. Hong Kong Yoda Capital presents various trading options, but an analysis of its fee structure reveals several potential issues.

| Fee Type | Hong Kong Yoda Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | High | Average |

The above table indicates that Hong Kong Yoda Capital may charge higher spreads on major currency pairs compared to industry averages. High trading costs can significantly impact a trader's profitability, particularly for those who engage in frequent trading. Additionally, the lack of clarity surrounding the commission structure raises concerns about hidden fees that could further erode trading profits. Traders should always seek brokers with transparent and competitive fee structures to ensure they are not overpaying for services.

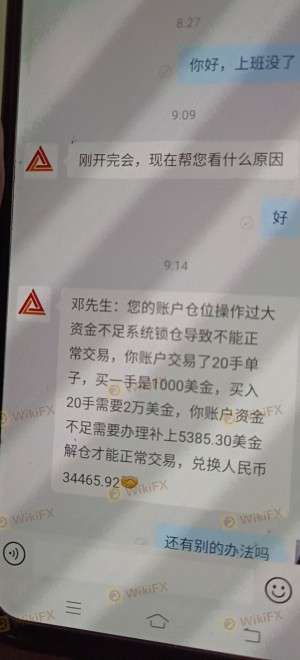

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Hong Kong Yoda Capital's safety measures regarding client funds need thorough examination. It is essential to determine whether the broker employs proper fund segregation, investor protection mechanisms, and negative balance protection policies.

Unfortunately, there is limited information available regarding the specific safety measures implemented by Hong Kong Yoda Capital. The absence of clear details on fund segregation and investor protection raises concerns about the security of client deposits. Furthermore, any historical issues or disputes related to fund safety can significantly affect a broker's reputation. Traders should always prioritize brokers that demonstrate a commitment to safeguarding client funds through robust security measures.

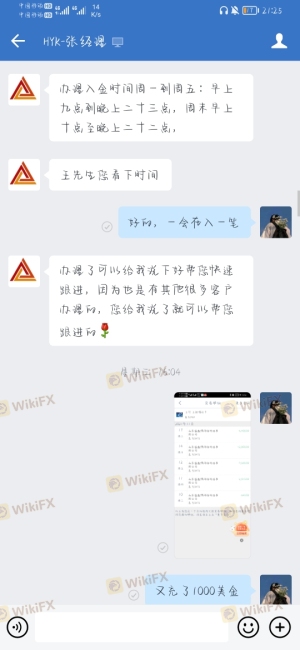

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for understanding a broker's reputation. Hong Kong Yoda Capital has received mixed reviews from clients, with several complaints highlighting significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Unresponsive |

| Customer Service Quality | High | Poor |

The table above indicates that clients frequently report withdrawal issues, which can be a significant red flag for any broker. Complaints about high fees and poor customer service further exacerbate concerns regarding the broker's reliability. One typical case involved a user who was unable to withdraw their funds despite repeated requests, leading to frustration and distrust. Such experiences underline the importance of assessing a broker's responsiveness and commitment to customer service.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. Hong Kong Yoda Capital's platform has been described as unstable, with users reporting issues related to order execution, slippage, and rejections.

A trading platform that frequently malfunctions can lead to missed trading opportunities and financial losses. Instances of slippage during high-volatility periods can further complicate matters, as traders may find themselves executing trades at unfavorable prices. Any signs of platform manipulation should be taken seriously, as they can indicate deeper issues within the broker's operations.

Risk Assessment

Overall, the risks associated with trading through Hong Kong Yoda Capital appear to be significant.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Financial Risk | High | High fees and withdrawal issues can lead to losses. |

| Operational Risk | Medium | Platform instability can impact trading efficiency. |

The above risk assessment highlights the numerous challenges traders may face when dealing with Hong Kong Yoda Capital. To mitigate these risks, traders should exercise caution and consider diversifying their investments across multiple, more reputable brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hong Kong Yoda Capital exhibits several characteristics that warrant caution. The broker's lack of valid regulation, high fees, and poor customer feedback raise significant concerns about its trustworthiness. While it may offer trading opportunities, potential clients should carefully weigh the risks involved.

For traders seeking safer alternatives, it is advisable to consider brokers that are well-regulated by reputable authorities, offer transparent fees, and have a proven track record of positive customer experiences. Brokers such as Interactive Brokers or eToro may provide more reliable trading environments, ensuring greater protection for client funds and improved trading conditions.

In summary, is Hong Kong Yoda Capital safe? The evidence leans towards a cautious approach, and potential clients should thoroughly research and consider more reputable options before proceeding.

Is Hong Kong Yoda Capital a scam, or is it legit?

The latest exposure and evaluation content of Hong Kong Yoda Capital brokers.

Hong Kong Yoda Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hong Kong Yoda Capital latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.